Microarray Market Size and Forecast 2025 to 2034

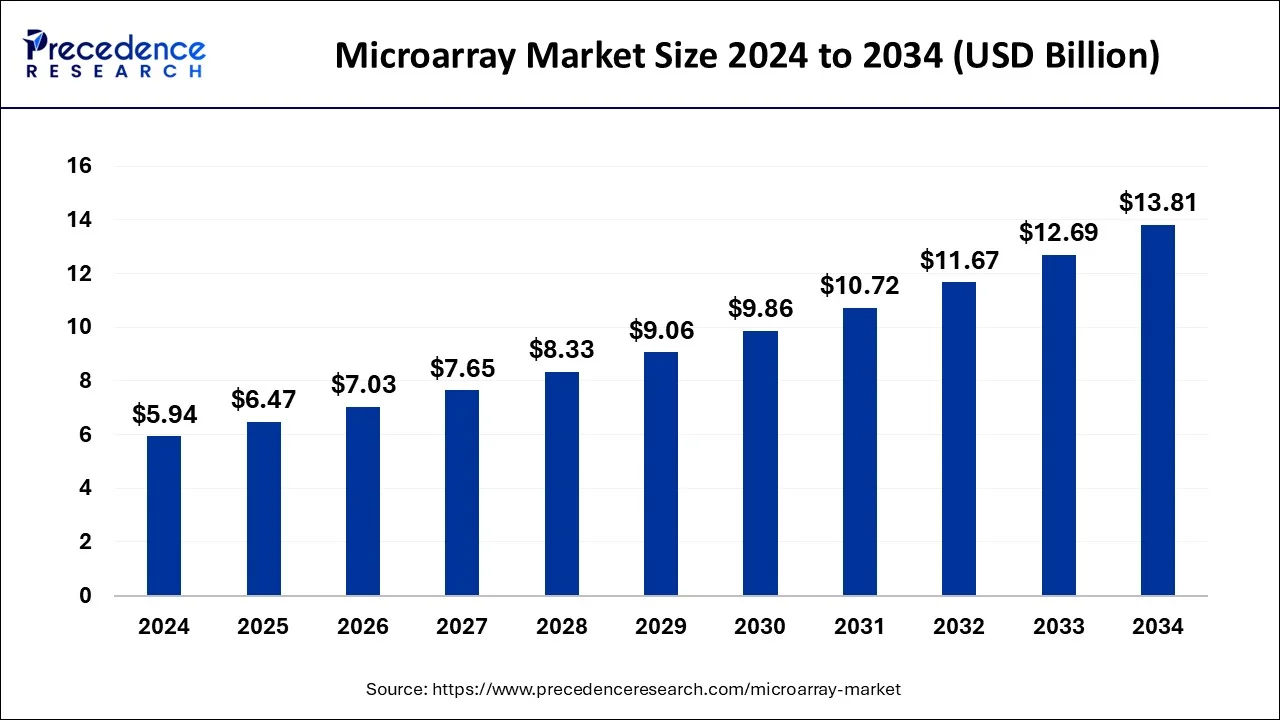

The global microarray market size was for USD 5.94 billion in 2024, and is expected to reach around USD 13.81 billion by 2034, expanding at a CAGR of 8.8% from 2025 to 2034. The microarray market is driven by the growing incidence of cancer worldwide and developments in bioinformatics.

Microarray Market Key Takeaways

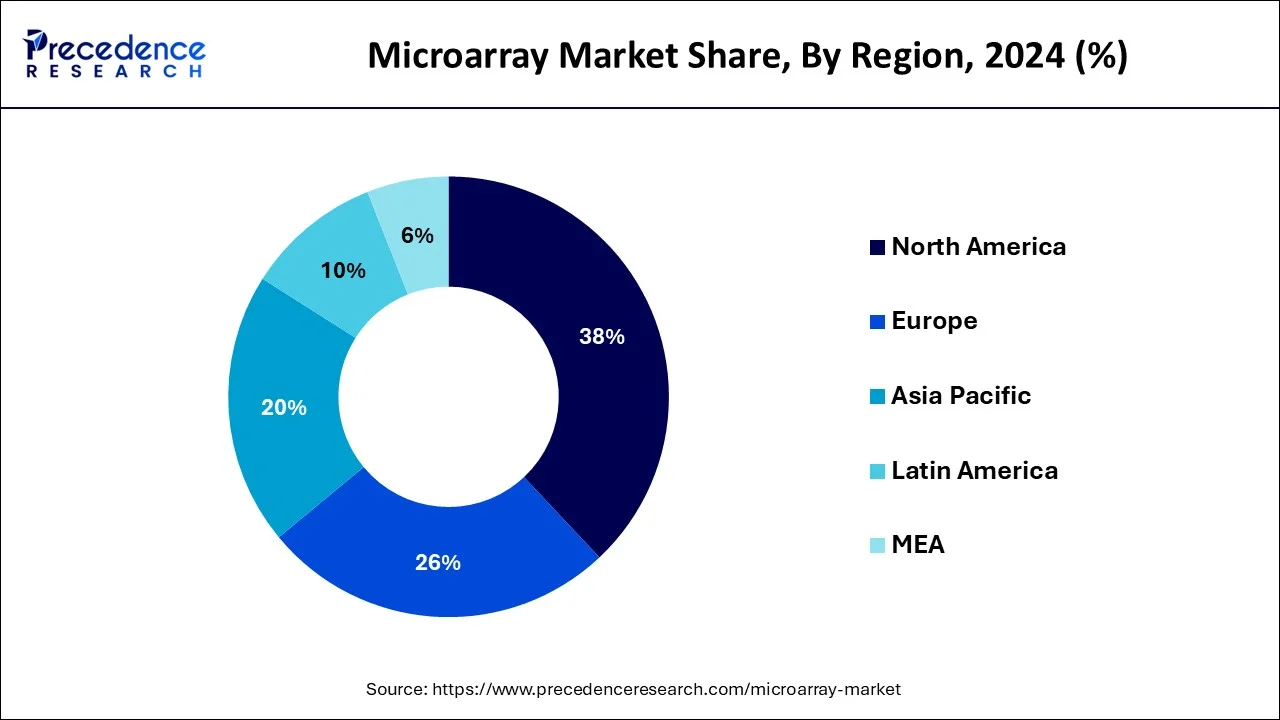

- North America led the global market with the highest market share in 2024.

- By Product, the consumables segment has held the largest revenue share in 2024.

- By Type, the DNA microarrays segment has held the highest market share in 2024.

- By Application, the research segment dominated the global market in 2024.

- By End User, the Research & Academic segment has held the highest market share in 2024.

How is AI helping the microarray industry?

Microarrays can evaluate the expression of thousands of genes to detect changes in expression between different biological states. The biotechnology industry relies deliberately on data storage, analysis, filtering, and sharing. Biotechnology firms and various healthcare organizations around the world already maintain huge databases. Drug manufacturing, chemical analysis of multiple compounds, sequencing of DNA and RNA, enzyme studies, and other similar biological processes require strong support from AI software solutions to move faster and reduce manual errors. AI and ML techniques are used to examine microarray data to gain insights into biological processes. Machine learning tools can automate the analysis of microarray data to identify gene expression patterns.

U.S. Microarray Market Size and Growth 2025 to 2034

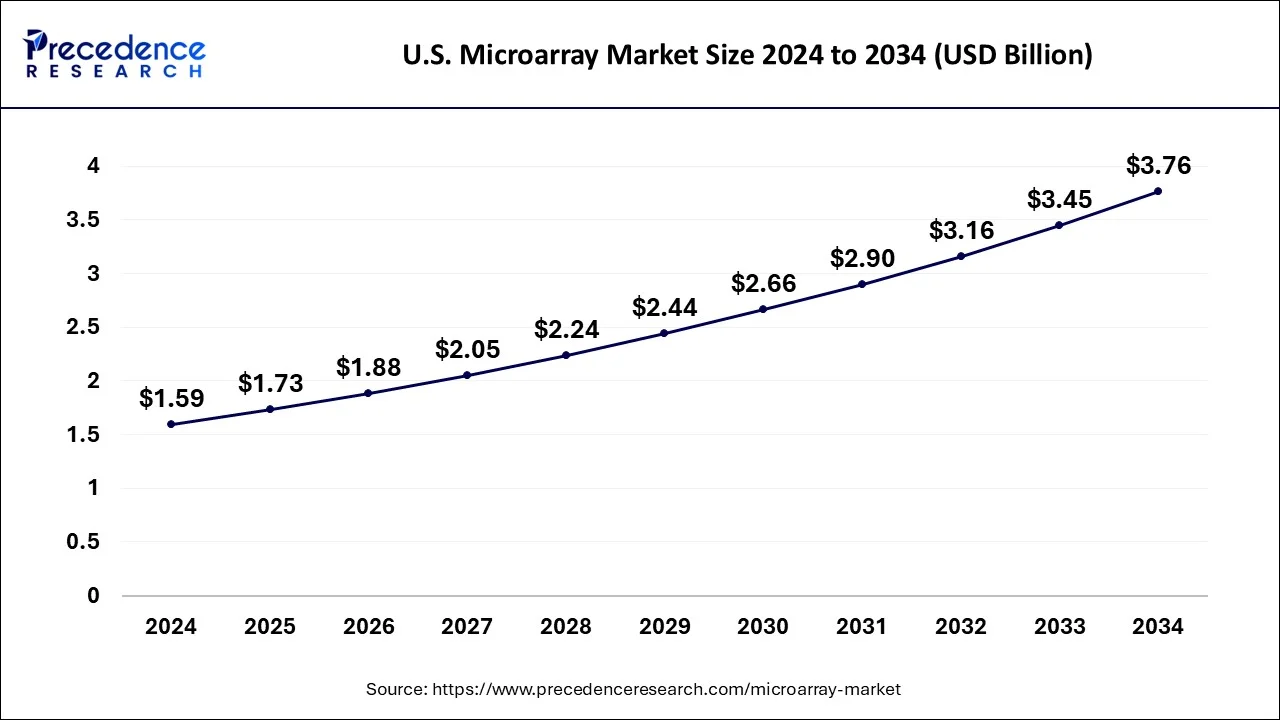

The U.S. microarray market size was estimated at USD 1.59 billion in 2024 and is predicted to be worth around USD 3.76 billion by 2034, at a CAGR of 9% from 2025 to 2034.

North America held the dominating position in the microarray market. North America, particularly the United States, is a global hub for research and development in the life sciences and biotechnology sectors. The region is home to numerous renowned research institutions, universities, and biotechnology companies driving advancements in genomics. The robust biotechnology and pharmaceutical industry in North America is a major consumer of microarray technologies. These industries leverage microarrays for various applications, including drug discovery, personalized medicine, and biomarker identification. Prestigious academic and research institutions in North America actively contribute to genomics and molecular biology research. The adoption of microarray technologies is high in academic research, fueling the demand for microarray products and services.

Asia Pacific is the fastest-growing microarray market during the forecast period. It is expanding quickly due to developments in biotechnology, genomics, and personalized medicine. Drug discovery, disease diagnostics, and research are a few fields that use microarray technology more and more since it simultaneously examines thousands of genes. The need for microarray-based solutions in disease screening and biomarker identification is boosted by the rising incidence of cancer and the increased emphasis on precision medicine.

Market Overview

In molecular biology and genetics, a microarray is an effective tool for examining gene expression, finding mutations, and researching many facets of genomics. It comprises several microscopic dots arranged in an array to hold molecules such as proteins, RNA, DNA, or other substances. This arrangement enables researchers to test thousands of gene expression levels simultaneously. Microarray technological advancements have resulted in better sensitivity, lower prices, and higher throughput.

Extracting valuable insights from microarray studies has become dependent on integrating bioinformatics tools for data analysis. Continuous attempts to improve microarray technologies through research and development define the industry. Emerging technologies like next-generation sequencing (NGS), which provides more excellent resolution and a more comprehensive range of applications, compete with microarrays.

Microarrays are essential tools for basic science and clinical applications that help us understand diseases and create tailored therapies. The microarray industry is widespread, with significant contributions from North America, Europe, and the Asia-Pacific area coming in second and third, respectively. Technological advances, healthcare infrastructure, and research funding are some elements that impact market growth. Expanding uses in personalized health and pharmacogenomics. There is a growing need for research and diagnostics for high-throughput technology.

Microarray Market Major Trends

Microarrays have transformed the approach to gene expression profiling. Related to prior approaches, microarrays have vividly high throughput and are lesser cumbersome. Microarrays are established as a practice for large-scale DNA sequencing and mapping. However, altering the backing surface from a permeable membrane to a dense surface afforded substantial improvements by growing reaction kinetics and dropping background noise. The expertise for microarrays is incessantly evolving. The commonly used arrays are separated into two main categories that comprise oligonucleotide and complementary or spotted DNA (cDNA) microarrays. The commercial oligonucleotide staging has gained acceptance over spotted cDNA microarrays as prices have fallen to the stage where commercial microarrays are the more used platform. DNA microarray delivers a quantitative and panoramic overview of a sample's appearance output. The power is vast as biological developments generally result from the synchronized interaction of numerous genes.

Microarray technology is principally used in genome sequencing and mapping applications. Nevertheless, in the past decade, this technology is extensively being used in the judgment of genetic and infectious ailments, pharmacogenomics research, forensic applications, drug discovery, cancer diagnostics, and agriculture. Furthermore, the microarray technology is also employed in immunology study such as the researchon the relation between gene expression and phenotype, variation and activation of immune cells, parameter of immune responses, immunological pharmacology, and examination of the molecular mechanisms of allergy. In the current field of genomics, conventional gene-by-gene approach is not satisfactory to meet the demand of handling information produced from mapping the compound biology of the human genome. Thus, there is a need to surge the global interpretation of examining the magnitude of info with microarrays.

Microarray Market Growth Factors

- In genomics research, microarrays are essential tools that enable researchers to concurrently examine and comprehend the expression patterns of thousands of genes.

- Microarray technologies have been fueled by the rising incidence of genetic illnesses and the demand for effective, high-throughput techniques for genetic investigation.

- Microarrays are extensively utilized for drug discovery and development in the biotechnology and pharmaceutical industries.

- The use of microarrays in various fields is facilitated by their capacity to examine gene expression and pinpoint possible therapeutic targets.

- Continuous technical developments in microarray platforms, such as enhanced automation, data analysis, and probe design, increase the accuracy and efficiency of microarray studies and propel market expansion.

- Microarrays are helpful in clinical diagnostics because they make it possible to identify genetic variants linked to specific disorders. Growth in the market is supported by the need for diagnostic tools that offer comprehensive genetic information.

- The creation and uptake of microarray technologies are financially supported by public and private sector funding in genomic research projects.

- The desire for technology like microarrays that can provide extensive genetic information is driven by the movement toward personalized medicine, where therapies are customized based on an individual's genetic composition.

- By promoting the creation of new applications and technologies, partnerships between academic institutions, biotechnology firms, and diagnostic labs help to expand the microarray business.

Future of Microarray

The microarray technologies encompass a high multiplexing capability and are extensively used for sensing diverse β-lactamase genes existing in a sole strain. This ability can help clinicians in guiding antimicrobial treatment. Microarray technology is demonstrating to be one of the main developments in the recent past that have driven biological research into post-genomic era.

Market Scope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.8% |

| Market Size in 2024 | USD 5.94 Billion |

| Market Size in 2025 | USD 6.47 Billion |

| Market Size by 2034 | USD 13.81 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, End User |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Driver

Drug Discovery and Development

Due to microarray technology, thousands of genes can measure their expression levels in a single experiment. This knowledge aids in comprehending how genes are controlled and how their expression varies in response to various circumstances, such as illnesses. Microarrays are valuable instruments for locating biomarkers linked to particular diseases. Molecular signs known as biomarkers are helpful for illness diagnosis, prognostication, and treatment efficacy tracking. They analyze gene expression patterns in both standard and sick tissues, which helps identify and confirm possible therapeutic targets. Researchers can use this information to identify genes that could be targeted for therapeutic intervention and that could be implicated in the disease process.

Restraint

Limited dynamic range

Microarrays may need help to quantify low levels of gene expression accurately. This presents particular challenges when examining genes with low expression levels or samples with insufficient RNA. On the other hand, at high gene expression levels, microarrays might become saturated. This implies that information in the upper range may be lost due to inaccurate quantification of highly high expression levels. The detection of low gene expression levels may be impacted by background noise. This noise has several possible origins, including cross-hybridization and non-specific probe binding.

Opportunity

Agricultural biotechnology

Using scientific methods and instruments, such as genetic engineering and molecular biology, to increase and improve agricultural output is known as agricultural biotechnology. This topic includes a wide range of applications, including the production of genetically modified organisms (GMOs) with desired features, pest and disease resistance, and agricultural improvement. Gene expression patterns linked to desired characteristics like enhanced yield, pest resistance, and drought resistance can be investigated using microarrays. Microarrays facilitate the creation of crops with increased resilience by assisting in identifying genes linked to resistance to pests and diseases. Microarrays shed light on the roles played by various crops' genes, which advances the field of functional genomics.

Product Insights

The consumable segment holds the largest share of the microarray market. The goods that are frequently used and exhausted throughout microarray studies are referred to as consumables in the microarray market. In molecular biology and genomics, microarrays are very effective instruments that enable researchers to simultaneously examine hundreds of genes or other biomolecules' expression levels. Consumables are vital to the regular functioning of the technology and play a significant part in the day-to-day operations of microarray research. Usually constructed of glass or other materials, they have a grid or array of places where biological substances, including proteins or DNA, can be stuck to be analyzed.

Various reagents are utilized in microarray research, including buffers, labelling kits, and detecting reagents. These compounds support target molecule synthesis, tagging, and detection on the microarray. By making it easier for nucleic acid probes to hybridize with complementary sequences on microarrays, these solutions enable the identification of specific genetic sequences. It is essential to wash away loose or non-specifically bound compounds after hybridization. Wash buffers facilitate this by preserving ideal washing conditions. Although instruments are more appropriately classified as equipment, consumables are pins and needles that must be replaced regularly in microarray printers.

Type Insights

DNA microarrays hold the largest share in the microarray market. One of the primary uses for DNA microarrays is this. By examining the expression levels of hundreds of genes in a biological sample using microarrays, researchers can get insight into the various circumstances in which genes are regulated. Variations in the DNA sequence are evaluated in genotyping investigations using DNA microarrays. Understanding genetic variations, researching the relationship between genetic variants and diseases, and examining polymorphisms depend on this. comparative genomic hybridization microarrays are designed to detect chromosomal imbalances and copy number abnormalities in DNA. This application holds special significance in the field of cancer research, as genetic modifications can have a substantial impact on the onset and advancement of the disease.

Drug development is aided by DNA microarrays, which provide insights into how medicines affect gene expression. This data helps determine possible therapeutic targets and evaluate the effectiveness of medications. The use of DNA microarrays for diagnostics has been investigated, including the discovery of genetic markers linked to a number of disorders. However, there have been difficulties in using microarrays for diagnostic purposes, and next-generation sequencing and other technologies have become more prevalent in clinical diagnostics. DNA microarrays have a sizable customer base of academic and research institutes. Researchers use microarrays to perform transcriptomics, genomics, and other studies.

Application Insights

Research applications segment hold the largest share in the microarray market. In genomics research, microarrays are widely used to examine genetic variants, analyze gene expression profiles, and comprehend gene regulation. Genotyping, comparative genomic hybridization (CGH), and gene expression profiling are some examples of applications. Examining the entire collection of RNA transcripts that the genome produces under particular circumstances is known as the transcriptome investigation. Transcriptomics relies heavily on microarrays since they make it possible to simultaneously measure hundreds of genes' expression levels. In epigenetics research, DNA methylation patterns, histone modifications, and other epigenetic alterations are investigated using microarray technology. With the aid of epigenetic microarrays, scientists can better comprehend the regulation of gene expression variations outside the genetic code.

Protein expression levels, post-translational changes, and protein-protein interactions are all studied using protein microarrays. Researchers use protein microarrays to discover possible therapeutic targets and provide insight into cellular signaling cascades. The study of gene and product function across the genome is known as functional genomics. Microarrays are used to evaluate the impacts of gene knockdown or overexpression to help identify the roles of genes. The identification of putative disease-related biomarkers through the use of microarrays is essential for the creation of focused therapeutics and diagnostic instruments. Researchers use microarrays to examine how individual reactions to medications are influenced by genetic variations.

End User Insights

Research and academic Institutes hold the largest share in the microarray market. Gene expression investigations are undertaken using microarrays, which are essential tools in scientific and academic settings. Using microarrays, researchers may examine hundreds of genes' expression levels at once, providing a thorough understanding of cellular functions. Microarrays are widely employed in genomic research in academic institutions to investigate the genetic basis of different illnesses, find markers for disease, and examine genetic variants. Research institutions commonly use microarrays to find putative illness biomarkers as they make it possible to analyse many genes at once, which helps identify the genetic components of disease. Microarrays are widely used at academic institutions for cancer research. They support research into the gene expression patterns of cancer cells, the identification of cancer subtypes, and the identification of possible treatment targets.

Microarrays are proper research instruments for the investigation of epigenetic changes. Researchers use microarrays to study histone alterations, DNA methylation patterns, and other epigenetic elements that affect gene regulation. In academic settings, microarrays are utilized for teaching objectives. Microarray experiments are helpful for teaching and demonstrating different molecular biology techniques, experimental design, and data analysis to researchers and students. The development of high-density microarrays and next-generation sequencing technologies, among other advancements in microarray technology, has dramatically improved the capacity of academic institutions and research groups conducting genomics and molecular biology investigations.

Microarray Market Companies

- Illumina, Inc.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Merck & Co., Inc.

- PerkinElmer, Inc.

- Arrayit Corporation

- Bio-Rad Laboratories

- GE Healthcare

- Molecular Devices, LLC

- Affymetrix

Recent Developments

- In August 2024, Illumina Inc. declared it has expanded its oncology menu for NovaSeq X Series customers. These assays enable labs to confidently expand oncology testing research of tissue and liquid biopsy samples with new transformative sequencing economics, faster sequencing run times, and broader batch sizes on the NovaSeq X Series for the first time.

- In May 2024, Thermo Fisher Scientific Inc. declared that the Applied Biosystems Chromosomal Analysis Suite Dx software and Applied Biosystems CytoScan Dx Assay now comply with In Vitro Diagnostic Regulations in the European Union. These compliance updates will enable cytogenetics testing laboratories to adapt to cutting-edge medical device safety and efficacy frameworks and conformity assessments.

- In August 2023, the Applied Biosystems CytoScan HD Accel array, an innovative chromosomal microarray designed to improve cytogenetic research lab productivity, efficiency, and profitability with an industry-leading two-day turnaround time, was introduced by Thermo Fisher Scientific, Inc. The human genome was analyzed via the Applied Biosystems CytoScan HD Accel array.

- In January 2023, during JP Morgan Healthcare Conference Week 2023, Complete Genomics Inc., a division of MGI Tech Co., Ltd., debuted its complete sequencing systems today at Biotech Showcase. Chief Scientific Officer Rade Drmanac, launched a ‘free three-month trial' program and a ‘reagent rental leasing' scheme to allow customers to test the goods' dependability and quality before purchasing.

Major Market Segments Covered

By Product

- Consumables

- Software & Services

- Instruments

By Type

- DNA Microarrays

- Protein Microarrays

- Other Microarrays

By Application

- Agriculture

- Research Applications

- Drug Discovery

- Diseases Diagnostics

- Other Applications

By End User

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Other End Users

- Others

By Geography

- North America

-

- U.S.

- Canada

-

- Europe

-

- Germany

- France

- United Kingdom

- Rest of Europe

-

- Asia Pacific

-

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

-

- Latin America

-

- Brazil

- Rest of Latin America

-

- Middle East & Africa (MEA)

-

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

-

Get a Sample

Get a Sample

Table Of Content

Table Of Content