What is the Genotyping MarketSize?

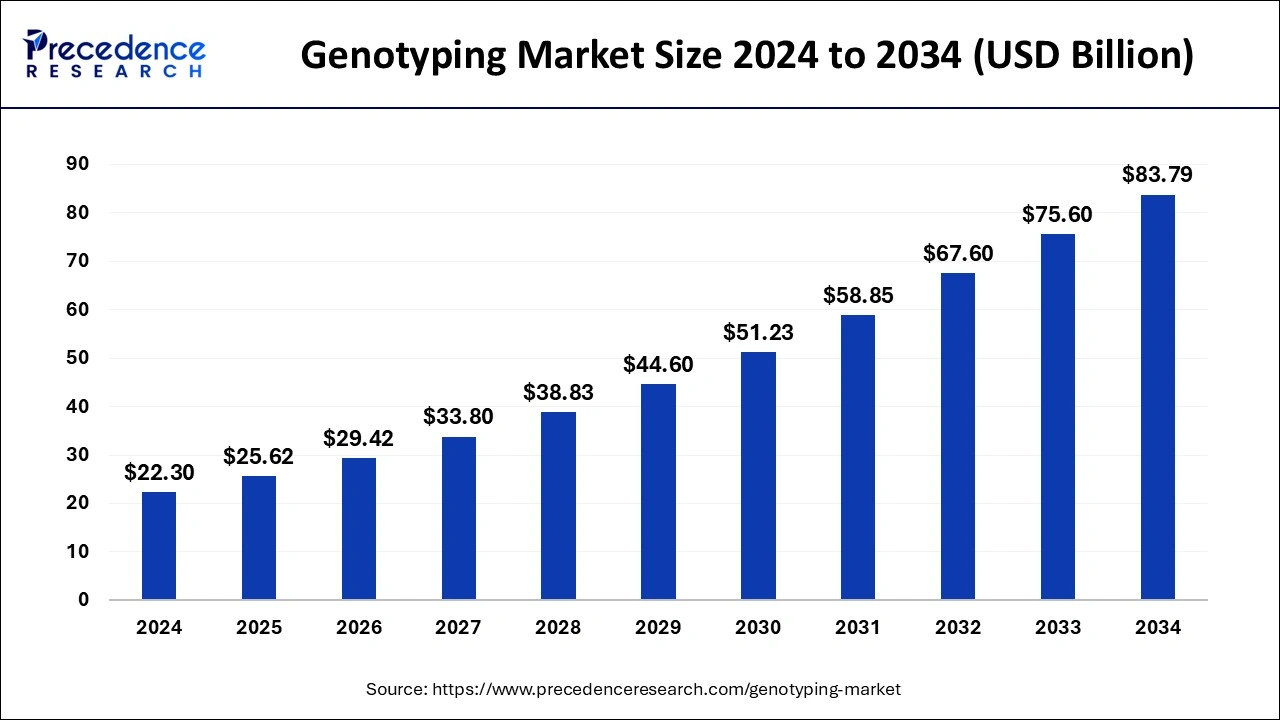

The global genotyping market size is calculated at USD 25.62 billion in 2025 and is predicted to increase from USD 29.42 billion in 2026 to approximately USD 91.85 billion by 2035, expanding at a CAGR of 13.62% from 2026 to 2035.

The genotyping market has grown because genotyping at birth can verify paternity and correct errors. Acknowledging parental errors before registration can prevent future problems and screenings.

Genotyping Market Key Takeaways

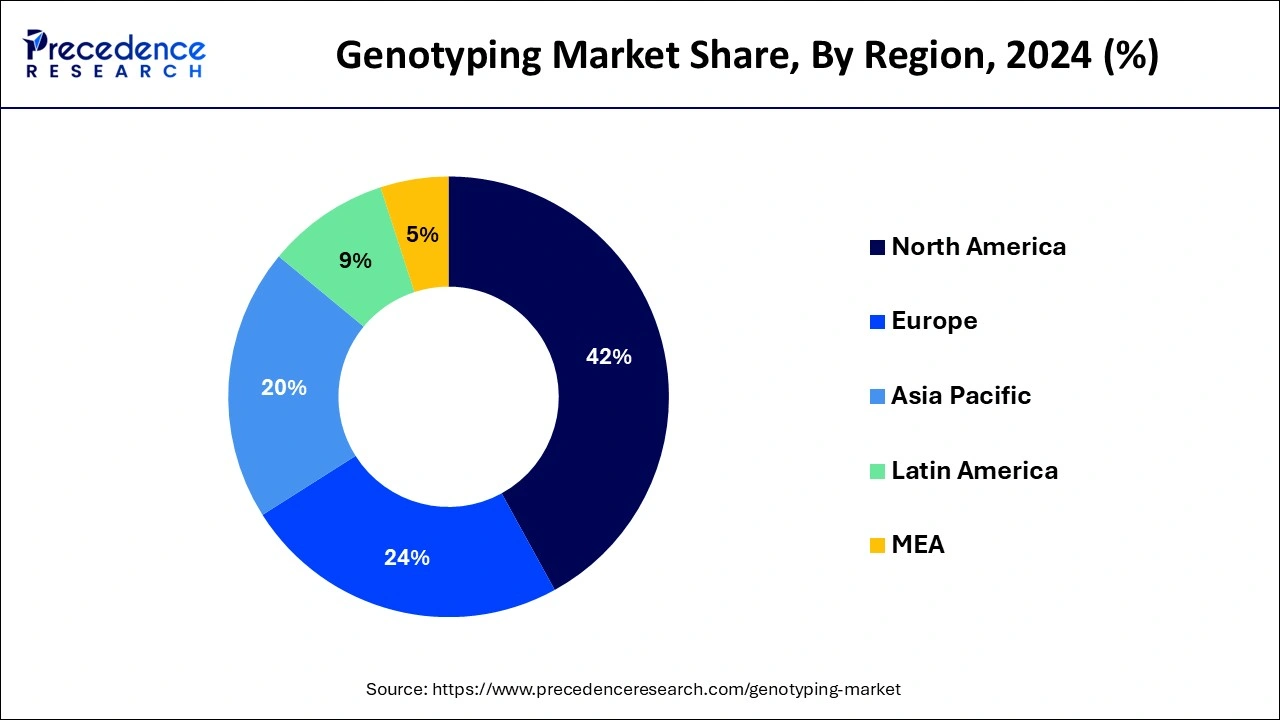

- North America contributed more than 40.13% of the revenue share in 2025.

- Europe region is expected to expand at the fastest CAGR from 2026 to 2035.

- By Product, the reagents & kits segment generated more than 62% of the revenue share in 2025.

- By Application, the pharmacogenomics segment is predicted to dominate the market from 2026 to 2035.

- By Application, the diagnostics and personalized medicine segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By Technology, the PCR segment is predicted to grow at a remarkable CAGR of 12% from 2026 to 2035.

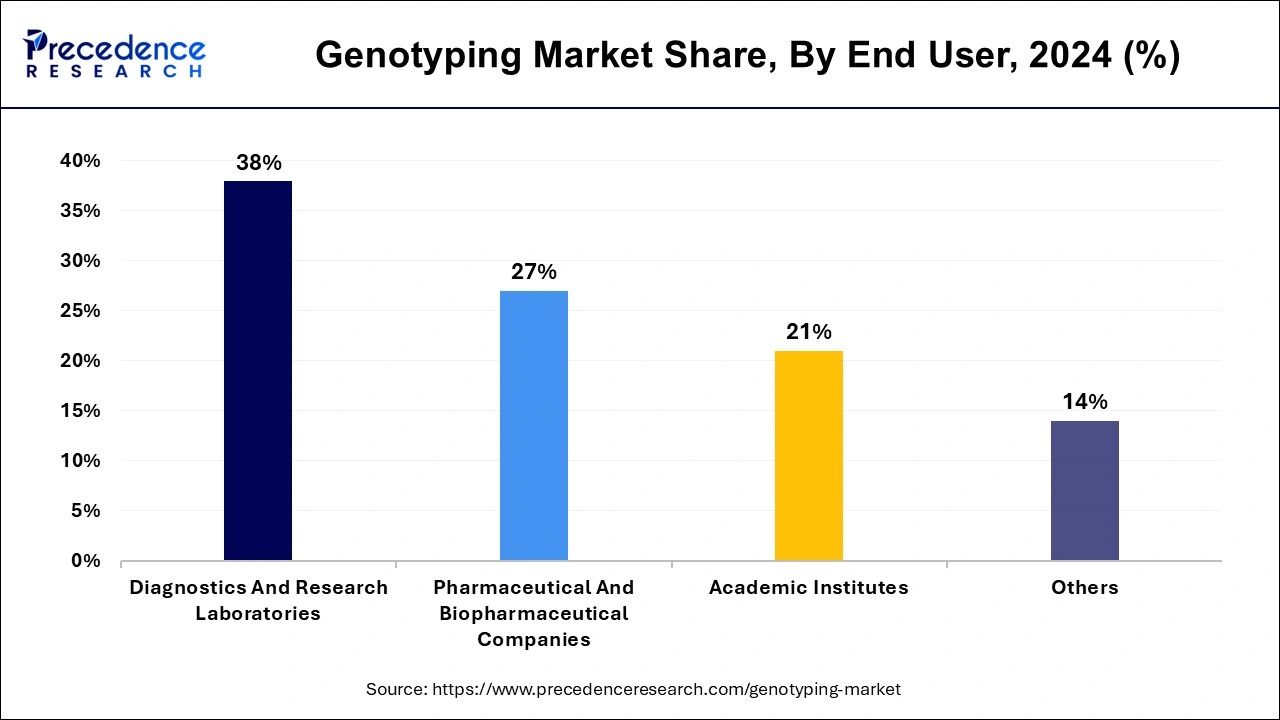

- By End User, the diagnostics and research laboratories segment accounted for more than 37.60% of revenue share in 2025.

Market Overview

The global genotyping market revolves around the product, services and technologies associated with genotyping. Services and products offered by the global genotyping market are further used in multiple fields, including medical research, drug development, agriculture and consumer genetic testing.

Genotype is the heritable information that is carried by all living organisms. Genotyping allows the identification of genetic variants. Genotyping refers to the technology that helps detect small genetic differences which lead to major changes in phenotype, it includes both physical differences that make us different as well as pathological changes. By comparing a DNA sequence to that of another sample or a reference sequence, genotyping detects variations in genetic complement. It identifies minor changes in genetic sequence within populations such as SNPs. SNPs are single base-pair variations in DNA that occur at particular areas in the genome.

Made up of double helix structure, the human genome carries nucleotide base pairs. They can explain features such as eye colour and inherited diseases like cystic fibrosis and sickle cell anaemia, as well as serve as indicators of risk of developing complex common diseases such as Alzheimer's disease and diabetes. By forecasting an individual's risk of contracting specific diseases or developing targeted therapies based on the genetics of the disease, SNP genotyping can speed up the era of personalized medicine. As Single-nucleotide polymorphisms (SNPs) are also linked with individual therapeutic responses, SNP-based assays may be useful in determining the most appropriate course of treatment.

Impact of Artificial Intelligence (AI) on the Genotyping Market

Artificial Intelligence (AI) promises to solve problems by performing the task of calculating phenotypes and correlating them with genotypes. Collaboration between biomedical and cognitive scientists to describe early successes and look ahead. AI techniques have been used to extract information about the structural components of genomic sequences that affect cellular transcriptional processes. In particular, deep learning methods have been used to predict the specificity of DNA and RNA binding proteins. The AI approach scans DNA and RNA for motifs and identifies protein promoter regions that alter binding properties based on changes in single nucleotide polymorphisms, deletions, or insertions. AI, when combined with phenomic information, can improve disease detection in the state when used to identify drivers. AI technology for decision support will improve early detection and improve medical decisions. It will also improve phenotype identification from images, identify new genotypes and phenotypes, and thus support the development of the genotyping market.

For Instance,

- In February 2024, Tempus, a leader in AI and precision medicine, announced the integration of its signature Tempus One technology into its Lens data analytics platform. Tempus One's AI-enabled technology will advance the development of AI to provide researchers with the tools they need to define Tempus' elusive, multidimensional data collection, create patient groups, interrogate patient populations, and more.

Genotyping Market Growth Factors

- Genotyping helps uncover hidden secrets in DNA. It is essential for research and medical diagnostics and is even used in agriculture to combat challenges such as climate change and hunger, which has led to the growth of this cause growth of the genotyping market.

- Genotyping methods are simpler and more cost-effective than traditional phenotyping techniques. Since an individual's genotype is not expected to change over time, most genotyping applications only need to be performed once in an individual's lifetime, which has led to the growth of the genotyping market.

- Genotyping involves the analysis of genetic variants such as single nucleotide changes, nucleotide substitutions, and large-scale DNA mutations to better understand disease etiology, traits, and drug responses at the molecular level, which has led to the growth of the genotyping market.

- Genotyping methods can identify novel polymorphisms/mutations that other genotyping methods cannot detect, which has led to the growth of the genotyping market.

Market Outlook

- Industry Growth Overview: The genotyping industry is experiencing a steady growth pattern as more precision medicines are being adopted, sequencing costs are decreasing, the number of clinical diagnostics is on the rise, and there is an increase in funding for genomic research from pharmaceutical companies and academic institutions.

- Sustainability Trends: Sustainability efforts are focused on reducing the amount of plastic used in consumables, creating reusable lab supplies, developing energy-efficient instruments, and using eco-friendly reagents; these initiatives attempt to align genotyping processes with green laboratory practices and conformity to regulatory standards.

- Global Expansion: Emerging economies continue to build genomics infrastructure through public-private partnerships; they are working on creating national genome programs; and they are growing access to quality healthcare, all resulting in increased global adoption of genotyping technologies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 13.62% |

| Market Size in 2025 | USD 25.62 Billion |

| Market Size in 2026 | USD 29.42 Billion |

| Market Size by 2035 | USD 91.85 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 To 2035 |

| Segments Covered | Product, Application, Technology, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Decreasing prices of DNA sequencing due to technological developments

Advancements in technology such as next-generation sequencing (NGS) has reduced the entire costs of DNA sequencing and lowered the overall cost of genomic and genotyping projects. Technological improvements have enabled miniaturization, automation and helped in decreasing the overall total costs. Such technological advancements have boosted the chances of accuracy in sequencing along with the boosted speed in the sequencing procedures.

These factors have expanded the uses of DNA sequencing and permitted clinicians to focus on decision making processes such as choosing and prioritizing therapeutic targets through several genotyping studies. It has also increased the use of sequencing, PCR, capillary electrophoresis, and microarrays in areas such as clinical research and drug development.

Restraints

High-cost equipment for genotyping is restraining the market growth

The high cost of genotyping is expected to restrain the genotyping market growth. Genotyping equipment is expensive as it has advanced features. The installation and maintenance costs of this equipment are considerably high. As a result, advanced technology such as NGS technology has slowed adoption in many middle and lower-income countries.

Opportunities

Increasing government support in genotyping research

The rising government support in genotyping research is expected to offer a set of opportunities for the global genotyping market. Several governments across the globe are focused on implementing numerous initiatives to support research institutions that focus on personalized medicine. For instance, in September 2018, the National Institutes of Health granted $28.6 million to the ‘All of Us Research Program' for the establishment of three genome centers across the United States which will be dedicated to precision medicine research.

Furthermore, the strategic initiatives undertaken by prominent players are expected to accelerate the market's growth. For instance, in September 2022, a leader in DNA sequencing technologies, Illumina announced the launch of the NovaSeq X Series, new production-scale sequencers. The recent launch platform from Illumina aims to boost the limits of genomic medicine by making it faster, more sustainable, and more powerful. This new technology by the company can generate more than 20,000 genomes per year.

Segment Insights

Product Insights

On the basis of products & services, the global genotyping market is segmented into instruments, reagents & kits, software & services, and genotyping services. The reagents & kits segment is expected to expand at a robust growth rate during the forecast period owing to the rising increasing genotyping testing, increasing R&D investments, and increasing adoption of reagents & kits for genotyping in pharmaceuticals and diagnostic centers. On the other hand, the software & services segment is projected to expand at a rapid rate due extensive adoption of software-based services by academic and research institutions.

Application Insights

Based on the application, the global genotyping market is segmented into pharmacogenomics, diagnostics and personalized medicine, agricultural biotechnology, animal genetics, and others. The pharmacogenomics segment is expected to dominate the market over the forecast period. Pharmacogenomics is an example of the field of precision medicine, which tends to customize treatment to an individual person or to a group of people. Pharmacogenomics examines how the individual's DNA affects and how the individual reacts to drugs. Pharmacogenomics can help an individual to know in advance whether a drug is beneficial and safe for an individual to take or not. In addition, prominent market players are offering solutions for pharmacogenomics studies.

On the other hand, the diagnostics and personalized medicine segment is growing at a significant CAGR during the forecast period due to the wide adoption of genotyping products for research activities and the rising demand for the diagnosis of genetic disorders. Personalized medicine involves the combination of molecular, genetic, and environmental variability in the existing method for the proper management of disorders or illnesses.

Technology Insights

Based on the technology, the global genotyping market is segmented into Polymerase Chain Reaction (PCR), capillary electrophoresis, microarrays, sequencing, matrix-assisted laser desorption/ionization-time of flight (Maldi-TOF) mass spectroscopy, and others. The Polymerase Chain Reaction (PCR) segment is expected to grow at a significant rate during the forecast period owing to the increasing number of CROs, growing demand for advanced diagnostic techniques, and growing prevalence of genetic disorders. Genotyping allows researchers to examine large structural variations in DNA to small genetic changes in DNA like single nucleotide polymorphisms (SNPs). Real-time PCR offers a high throughput solution for genotyping using molecular probes for rapid and accurate results.

On the other hand, the sequencing segment is anticipated to expand at a rapid rate owing to its ability to detect low expression & differentially expressed genes than any other methods. Genotyping by sequencing is a genetic screening method for discovering SNPs and performing genotyping studies.

End User Insights

Based on the end user, the global genotyping market is segmented into pharmaceutical and biopharmaceutical companies, diagnostics and research laboratories, academic institutes, and others. The diagnostics and research laboratories segment is expected to capture a significant market share over the forecast period due to the increasing use of genotyping products for research, the growing demand for the diagnosis of genetic disorders, and the increasing incidence of cancer rises the demand for diagnostic tests are projected to boost the market.

On the other hand, the biopharmaceutical and pharmaceutical companies segment is expected to expand at a robust growth rate in the coming years owing to the increasing number of biopharmaceutical and pharmaceutical companies. Companies actively use pharmacogenomics to develop innovative drugs. The increasing need for pharmacogenomics in the drug development process and FDA suggestions to include pharmacogenomics studies and genotyping in the drug discovery process.

Regional Insights

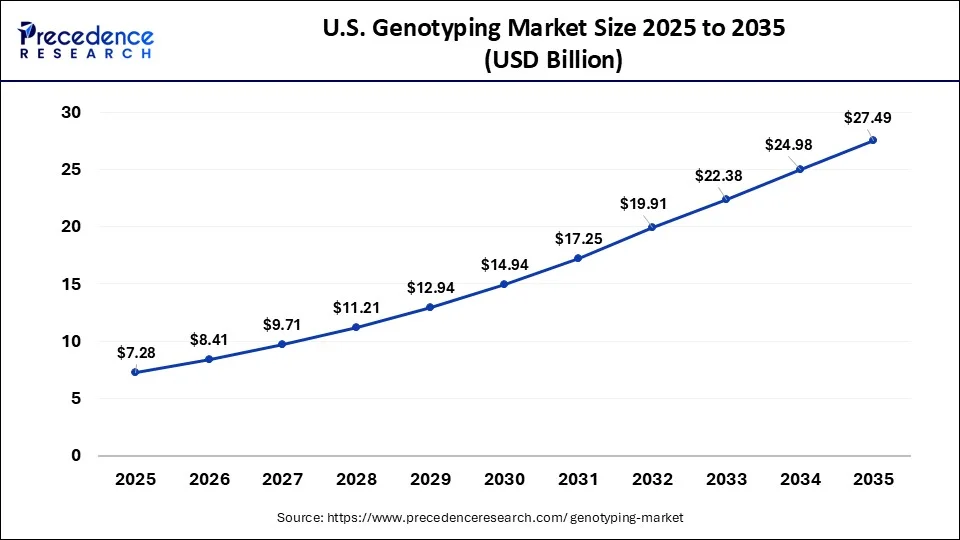

What is the U.S. Genotyping Market Size?

The U.S. genotyping market size was evaluated at USD 7.28 billion in 2025 and is projected to be worth around USD 27.49 billion by 2035, growing at a CAGR of 14.21% from 2026 to 2035.

North America accounted for the largest market share in 2025. The region is expected to maintain its dominance owing to the advancements in the healthcare infrastructure, the presence of prominent market players such as Illumina Inc., Thermo Fisher Scientific Inc. Agilent Technologies, and others, growing adoption of technologically advanced products, increasing government funding, and rising prevalence of chronic diseases in the region. For instance, As per the National Center for Chronic Disease Prevention and Health Promotion, 6 out of 10 Americans live with at least one chronic disease. Genotyping techniques are used for the early diagnosis and treatment of chronic disorders.

On the other hand, the Europe market is expected to grow at a significant CAGR during the forecast perioddue to the rapid growth of the pharma and biopharma companies, technological advancements, and an increase in research and development activities in the region. Furthermore, the Asia Pacific market is projected to register a considerable CAGR during the forecast period owing to the increase in government investment, increasing research projects, and the rise in the number ofclinical trialsbeing performed in the region.

Genomic Integration Driven by Precision Healthcare in Europe

The UK is one of Europe's leading countries in terms of regulatory frameworks to support precision medicine and genomics, and it has well-established and sophisticated healthcare systems. As the number of new uses of genotyping continues to grow (for example, genotyping for oncology and genetic testing for rare diseases), demand for precision medicine and genomics will continue to grow in Europe.

Germany is rapidly expanding due to the strong biotech investment in the area, as well as the tremendous number of clinical research networks.

Genomic Development and Expansion in Latin America

Latin American countries are beginning to adopt genotyping on a broader scale for use as a forensic tool, as well as for agricultural genomics, academic research, etc. The adoption of genotyping at this level is supported by improvements in laboratory infrastructure and increased international partnerships.

Brazil is experiencing the greatest growth in terms of public health genomics programs and biotech start-ups, and it is planned to continue to be a leading driver of growth in the region.

Middle East and Africa (MEA): Infrastructure for Genomic Medicine

In the MEA region, there are gradual increases in the adoption of genotyping due to national healthcare reform programs, the use of population genetics studies, and the establishment of partnerships with global genomics companies, particularly in urban areas.

Value Chain Analysis of the Genotyping Market

- Raw Materials & Reagent Development: Includes producing enzymes, primers, probes, microarrays, and sequencing reagents (which impact assay sensitivity & accuracy).

Key Players: Thermo Fisher Scientific, Merck KGaA, and Agilent Technologies. - Instrumentation & Platform Manufacturing: Genotyping/DNA analysis platforms, such as PCR systems, microarray scanners, capillary electrophoresis equipment, and next-generation sequencing (NGS) systems, are the technology backbone of the market.

Key Players: Illumina, Bio-Rad Laboratories, and QIAGEN. - Data Analysis, Software & End-User Services: Covers bioinformatics software, cloud-based analytics, and interpretation services used by hospitals, research laboratories, CROs, and pharmaceutical companies.

Key Players: Roche, BGI Genomics, and PerkinElmer.

Genotyping MarketCompanies

- Illumina Inc

- Thermo Fisher Scientific Inc.

- Qiagen Inc.

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Danaher Corporation

- Agilent Technologies

- Eurofins Scientific Inc.

- GE Healthcare Inc.

- Bio-Rad Laboratories Inc.

- Pacific Biosciences of California

Recent Developments

- In September 2023, Bio-Rad Laboratories, a global leader in life sciences and analytical products, announced the PTC Tempo 48/48 and PTC Tempo 384 thermal cyclers designed to support PCR application research, basic and translational field development, and quality control.

- In January 2024, Genotyping technology could detect Covid variants faster and cheaper than ever before, according to research from the University of East Anglia and the UK Health Security Agency. A new study published shows that the technology can detect new mutations about a week faster than whole genome sequencing techniques.

- In August 2024, The Kerala government is investigating the use of advanced DNA sequencing technology to help identify 52 dissociated samples from victims of the Wayanad landslides victims.

Segments Covered in the Report

By Product

- Instruments

- Sequencers & Amplifiers

- Analyzers

- Reagents & Kits

- Software and Services

- Genotyping Services

By Application

- Pharmacogenomics

- Diagnostics and Personalized Medicine

- Agricultural Biotechnology

- Animal Genetics

- Others

By Technology

- PCR

- Real-time PCR

- Digital PCR

- Capillary Electrophoresis

- Amplified Fragment Length Polymorphism

- Restriction Fragment Length Polymorphism

- Single-Strand Conformation Polymorphism

- Microarrays

- DNA Microarrays

- Peptide Microarrays

- Others

- Sequencing

- Next Generation Sequencing

- Pyro Sequencing

- Sanger Sequencing

- Matrix-Assisted Laser Desorption/Ionization-Time of Flight (Maldi-TOF) Mass Spectroscopy

- Others

By End User

- Pharmaceutical And Biopharmaceutical Companies

- Diagnostics And Research Laboratories

- Academic Institutes

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting