What is the Genotyping Assays Market Size?

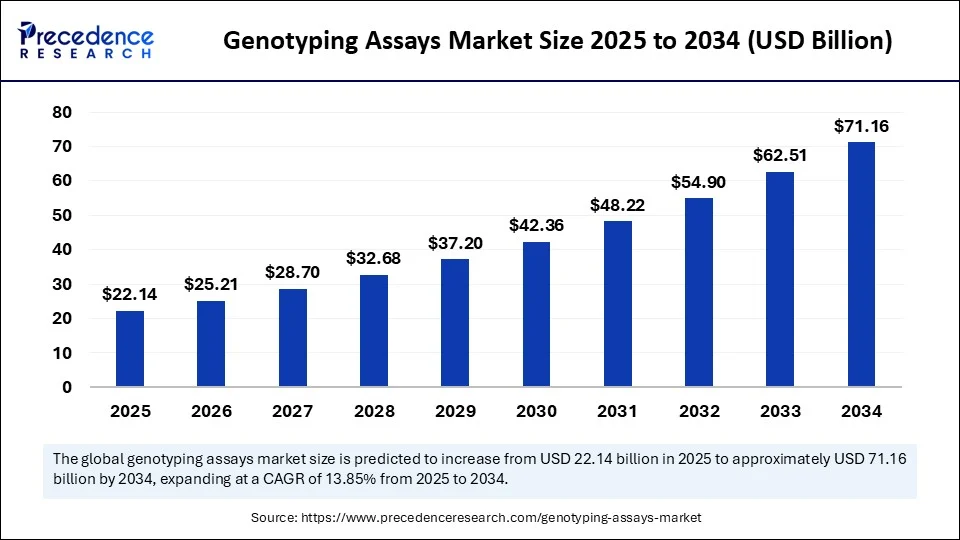

The global genotyping assays market size is accounted at USD 22.14 billion in 2025 and predicted to increase from USD 25.21 billion in 2026 to approximately USD 71.16 billion by 2034, representing a CAGR of 13.85% from 2025 to 2034.The growth of the genotyping assays market is driven by rising demand for personalized medicine, increasing prevalence of genetic disorders, advancements in genomics technologies, and expanding applications in drug development.

Genotyping Assays Market Key Takeaways

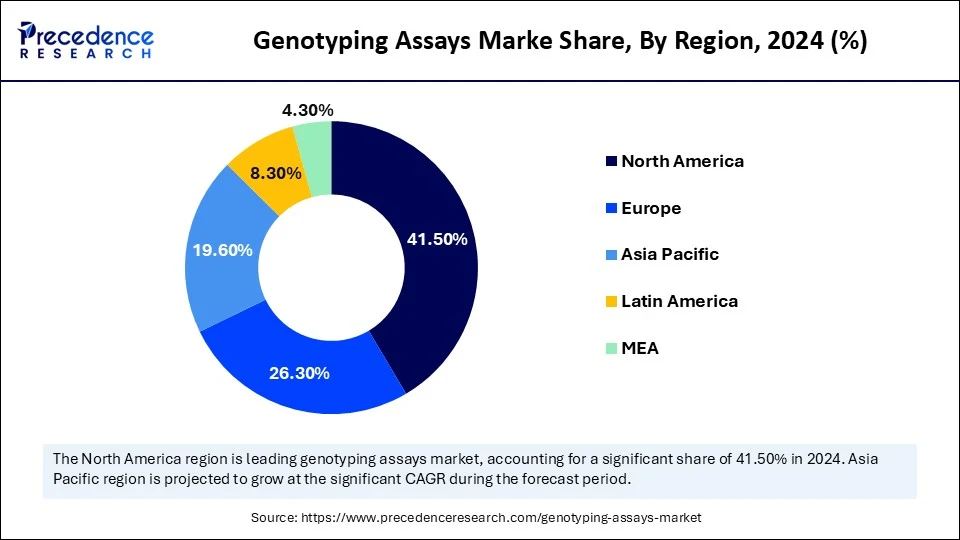

- North America dominated the global genotyping assays market with the largest market share of 41.5% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecast years.

- By technology, the polymerase chain reaction (PCR) segment captured the biggest market share of 32.8% in 2024.

- By technology, the next-generation sequencing (NGS) segment is expected to show rapid growth over the forecast period.

- By product, the reagents & kits segment contributed the highest market share of 48.2% in 2024.

- By product, the software & services segment is expected to show considerable growth over the forecast period.

- By application, the diagnostics (oncology) segment held the biggest market share of 29.6% in 2024.

- By application, the pharmacogenomics segment is anticipated to show considerable growth over the forecast period.

- By end-user, the pharmaceutical & biopharmaceutical companies segment generated the major market share of 34.4% in 2024.

- By end-user, the contract research organizations segment is anticipated to show considerable growth over the forecast period.

- By application, the DNA amplification segment accounted for significant market share of 27.9% in 2024.

- By application, the data analysis & interpretation segment is anticipated to show considerable growth over the forecast period.

Genotyping Assays: Advancing Personalized Medicine and Research

The genotyping assays market refers to the global ecosystem of technologies, instruments, reagents, and services used to analyze genetic variations such as single-nucleotide polymorphisms (SNPs), insertions, deletions, and copy number variations (CNVs) within DNA. Genotyping assays are critical in research, diagnostics, pharmacogenomics, agriculture, and personalized medicine, facilitating disease association studies, drug response prediction, and trait selection. These assays leverage multiple technologies, including PCR, microarrays, sequencing, and mass spectrometry, to enable high-throughput and high-accuracy genetic profiling.

The growing prevalence of genetic disorders and the rapid advancement of genomic research are key drivers in the market. The rising demand for biomarker discovery and precision medicine, along with increasing collaborations between public and private entities that foster innovation and improve access, is also accelerating market growth. The diverse applications of this technology are expanding the scope of genotyping solutions across various industries.

How is AI Integration Transforming the Genotyping Assays Market?

Artificial intelligence is revolutionizing the market for genotyping assays by enabling fast, accurate, and scalable interpretation of genomic data. AI-powered tools improve the precision of genotype calling, reduce human error, and uncover hidden patterns in data. This leads to more accurate and earlier diagnoses, supports the development of tailored therapeutic plans, and enhances biomarker discovery. AI also facilitates effective quality control, automates data curation, and optimizes real-time decision-making and workflows in both research and clinical applications.

Market Outlook

- Industry Growth Overview:

The genotyping assays market is growing, driven by the growing prevalence of genetic diseases, advances in personalized medicine and drug development, and the increasing use of genotyping in agriculture and livestock. The demand for tailored treatments and disease risk assessments is a major growth factor. - Global Expansion:

The genotyping assays market is experiencing global expansion, as methodological progressions such as next-generation sequencing (NGS) and the increasing use of genotyping in medicine, agriculture, and drug development. North America dominated the market as Strong government funding, leading biotechnology firms, and increasing demand for precision medicine and diagnostics contribute to its market leadership. - Major investors:

Major investors in the genotyping assays market include a mix of large corporations that capitalize strategically in the space, as well as specialized venture capital and investment firms focused on life sciences and biotechnology. It contributes to Warburg Pincus, OrbiMed, Casdin Capital, and Illumina Ventures

What Factors are Boosting the Growth of the Genotyping Assays Market?

- Advances in Genomic Research: Advancements in genomics and sequencing technology have made the process more affordable and accurate. This has accelerated the research into gene functions, leading to a wider and more comprehensive use of genotyping tests in personal care medicine, drug research, and disease understanding.

- Demand for Biomarker Discovery: The demand for genetic biomarkers in targeted therapies and early pathology identification is rapidly increasing. These biomarkers are crucial in precision medicine and the development of specific medical products, as the application of these tests is essential for product validation.

- Public-Private Partnerships: Strategic collaborations between government agencies, research institutes, and biotech firms are driving innovation in genotyping. These alliances will enhance the pace of technology development through increased funding and knowledge sharing, making genotyping services more accessible globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 71.16 Billion |

| Market Size in 2026 | USD 25.21 Billion |

| Market Size in 2025 | USD 22.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product, Application, End User, Workflow Stage, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Personalized Medicine

There is an increasing need to generate customized medicine, which is a key driver of the genotyping assays market because personalized medicine is dependent on the knowledge of individual genomics to deliver a customized medical treatment. Personalized medicine refers to a field that aims at delivering treatment depending on the individual genetic configuration of a patient, and this involves the significance of determining genetic differences that affect the reaction of drugs, illness risk, and therapeutic efficiency. Moreover, Genomic science continues to advance and, with increasingly significant financial support from the general populace and the marketplace, genotyping is becoming more economic and within reach. Such trends are contributing to its evolution into wide use in clinical and research programs, which further supports personalized medicine as a guiding power behind the growth of genotyping assays.

Restraint

Complexity of Data Interpretation Disrupts Target

One of the key challenges in the genotyping assays market is the complexity of interpreting large-scale genomic data. The comprehensive and complex datasets generated by genotyping assays require specialized analytical software and statistical expertise for interpretation. This necessitates highly trained professionals such as geneticists, bioinformaticians, data scientists, and advanced computational infrastructure. Additionally, integrating and interpreting multi-omic data further complicates the process. These factors can hinder the widespread use of genotyping assays, especially in decentralized or underfunded healthcare settings, making data complexity a significant barrier to market expansion.

Opportunity

Integration of Genotyping Assay in Clinical Diagnostics

Genotyping is increasingly utilized in oncology to identify tumor-specific genetic anomalies, such as drug resistance, which allows for personalized cancer treatment. Pharmacogenomics is also growing, enabling safer and more effective medication choices by analyzing individual responses to drugs based on their genes. As healthcare systems adopt precision medicine, the clinical application of genotyping tests is expected to expand with broader reimbursement across various areas, including cancer, cardiovascular diseases, and genetic disorders. This integration enhances healthcare efficiency through improved clinical decision-making and patient outcomes.

Technology Insights

Why Did the Polymerase Chain Reaction (PCR) Segment Lead the Genotyping Assays Market in 2024?

The PCR segment led the market while holding a 32.8% share in 2024. The speed and accuracy of genetic analysis have been significantly increased by technological advancements, such as real-time PCR (qPCR) and reverse transcriptase PCR. PCR is now crucial in personalized medicine, infectious disease diagnostics, forensics, and prenatal genetic screening. Its ability to accurately amplify tiny DNA quantities has made it essential in clinical and research settings. Technological advancements in PCR instruments and reagents have also increased their use, decreasing reaction times, enhancing sensitivity, and automating workflows in diagnostic labs.

The next-generation sequencing (NGS) segment is expected to grow at a significant CAGR over the forecast period. This is mainly due to the ability of NGS to simultaneously sequence millions of DNA fragments, enabling the discovery of a wide range of genetic variations, including rare mutations and complex structural changes. This has led to its integration in general diagnostics, particularly in oncology, where it is used for tumor mapping to guide treatment. Furthermore, increased automation, speed, and accuracy in sequencing methods enhance protocol efficiency and data accuracy. The global trend of increased investment in genomic research and the growing demand for precision medicine further drive the adoption of NGS.

Product Insights

How Does the Reagents & Kits Segment Contribute the Largest Revenue Share in 2024?

The reagents & kits segment held a 48.2% share of the genotyping assays market in 2024. These tools are essential for detecting genetic variants by comparing target DNA sequences with reference sequences to identify loci and mutations. Standardized kits are crucial in clinical diagnostics, research, pharmacogenomics, and agriculture due to their precision and reproducibility. The availability of customized reagents for various genotyping platforms, including PCR-based assays and sequencing instruments, ensures maximized performance and minimized errors. The growth of this segment is driven by the increasing demand for high-throughput and accurate genotyping, as well as the expanding use of these assays in personalized medicine and large-scale genomic projects.

The software & services segment is expected to grow at the highest CAGR in the upcoming period due to the increasing interest in data management and advanced analytics within the genomic research and diagnostics. Genotyping assays generate complex and extensive datasets, necessitating the rapid development of bioinformatics platforms, data visualization programs, and interpretation software. These software tools enable researchers and clinicians to analyze raw data, detect genetic variations more quickly and accurately, and extract clinically useful information more efficiently. Furthermore, the use of cloud-based platforms is increasing due to their scalability and ability to facilitate collaborative studies. The software and services segment is becoming a crucial enabler as genotyping assays become more widely adopted in both clinical and non-clinical applications.

Application Insights

What Made Diagnostics the Dominant Segment in the Genotyping Assays Market in 2024?

The diagnostics (oncology) segment led the market while holding a 29.6% share in 2024. Genotyping tests are crucial for diagnosing mutations and changes in cancer/tumor-related genes, enabling the detection of hereditary cancers and specific tumor markers. These tests facilitate early diagnosis, guide targeted treatment choices, and indicate treatment responses by highlighting tumor evolution at the molecular level. The ability to study tumor DNA with high accuracy allows clinicians to personalize treatments, leading to better outcomes and fewer side effects. Continuous improvements in genotyping platforms, along with increased regulatory acceptance and healthcare reimbursement, are driving the expansion of these tests in clinical settings.

The pharmacogenomics segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing demand for personalized medicine and safer, more effective drug treatments. Pharmacogenomics utilizes genetic variation to predict individual responses to medication, and genotyping assays are crucial in determining this variation. Clinicians use genotyping to determine the appropriate drug and dose, predicting how a drug is metabolized, its effectiveness, and potential side effects, thus improving therapeutic outcomes. This is particularly beneficial in treating chronic diseases such as cardiovascular diseases, mental health disorders, and cancer, where treatment responses can vary significantly.

As more people recognize the clinical and economic benefits of pharmacogenomics, genetic testing is being integrated into regular healthcare by more providers. This trend is further supported by the growth of regulatory frameworks and governmental programs that favor personalized medicine.

End-User Insights

How Does the Pharmaceutical & Biopharmaceutical Companies Segment Dominate the Market in 2024?

The pharmaceutical & biopharmaceutical companies segment dominated the genotyping assays market with a 34.4% share in 2024. The dominance of this segment is attributed to the increased emphasis on personalized healthcare, biomarker identification, and precise drug development. These companies extensively utilize genotyping technologies to understand genetic variations influencing drug responses, thereby facilitating the creation of more targeted and effective medications. Genotyping tests are valuable throughout drug development, assisting in identifying potential drug targets, categorizing patient groups, monitoring clinical trial results, and ensuring drug safety. Integrating pharmacogenomics into R&D will help pharmaceutical companies minimize trial-and-error in prescriptions and enhance clinical trial efficiency. As genomics investments increase and collaborations between pharmaceutical companies and research institutions strengthen, genotyping is becoming a crucial process in drug discovery.

The contract research organizations (CROs) segment is expected to grow at the highest CAGR in the upcoming period. This growth is fueled by the increasing demand for outsourcing services from pharmaceutical and biotechnology companies and academic institutions, as they are seeking cost-effective and expert-driven services. Specialized services offered by CROs encompass genotyping assay development, large-scale sample processing, data analysis, and regulatory services, establishing them as crucial partners in the drug development and clinical research lifecycle.

With the increasing complexity of genomic research, numerous organizations depend on CROs for access to advanced genotyping systems, highly trained personnel, and the ability to scale operations without maintaining in-house resources. Additionally, CROs contribute to accelerating the timeline for clinical trials through high-throughput genetic screening, patient sub-classification, and pharmacogenomic testing.

Application Insights

Why Did the DNA Amplification Segment Lead the Genotyping Assays Market?

The DNA amplification segment led the market while holding a 27.9% share in 2024. It is extremely important to make any DNA samples ready to be examined genetically in the next step. Among genotyping methods, PCR (Polymerase Chain Reaction) is the most prevalent due to its high accuracy, speed, and cost-effectiveness. DNA amplification, particularly via PCR, is fundamental, enabling researchers and clinicians to increase the quantity of DNA needed for study. This technique is vital in diagnostics, forensic testing, and biomedical research. The market's growth is further supported by the consolidation of research and forensic laboratories, driven by government funding and private sector investment.

The data analysis & interpretation segment is expected to grow at a significant CAGR over the forecast period. Data analysis is crucial for identifying significant genetic variants, determining disease associations, and guiding clinical decision-making. This segment includes software platforms that facilitate data processing, variant calling, quality control, and visualization, transforming complex genetic data into actionable insights. The increasing integration of artificial intelligence and machine learning algorithms is enhancing the speed, accuracy, and predictive capabilities of these platforms. As healthcare providers and the research community increasingly focus on personalized and precision medicine, robust data analysis software is becoming a central focus of genotyping processes.

Regional Insights

U.S. Genotyping Assays Market Size and Growth 2025 to 2034

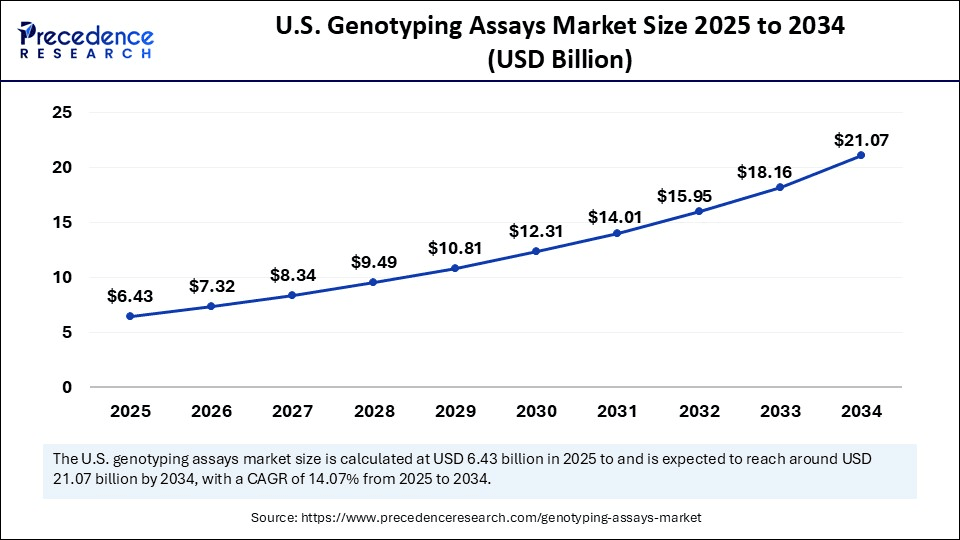

The U.S. genotyping assays market size is exhibited at USD 6.43 billion in 2025 and is projected to be worth around USD 21.07 billion by 2034, growing at a CAGR of 14.07% from 2025 to 2034.

What Made North America the Dominant Region in the Genotyping Assays Market in 2024?

North America dominated the market with the highest market share of 41.5% in 2024. The dominance of the region stems from its advanced healthcare sector, early adoption of cutting-edge technologies, and the presence of major biotechnology and pharmaceutical companies. This dominance is also supported by high healthcare awareness, substantial per capita health spending, and a proactive approach to precision medicine. Government funding further facilitates the adoption of genetic testing and personalized healthcare, driving market growth. Moreover, there is a high prevalence of chronic diseases in the region, necessitating the use of genotyping assays for early disease detection, risk assessment, and tailored treatment.

U.S. Genomics Market Leadership

The U.S. is a major contributor to the North American genotyping assays market, supported by a robust ecosystem of leading bio-pharmaceutical companies, sequencing service providers, and genomics-based start-ups. Genetic testing is widely used in the U.S. healthcare system for disease management and drug development, especially in oncology and pharmacogenomics. Technologically advanced diagnostic laboratories and a skilled workforce of geneticists and bioinformaticians further boost the market.

What Makes Asia Pacific the Fastest-Growing Region in the Genotyping Assays Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by expanding healthcare infrastructure, increased research in genetic diseases, and rising investments in biotechnology and life sciences R&D. The demand for advanced medical diagnostic tools, including genotyping assays, is growing rapidly as countries modernize their healthcare systems and expand personalized medicine. Government and public investments in genomic research, clinical trials, and the integration of genetic testing into mainstream healthcare further support the growth of the market.

Healthy China" Drives Biotech Genomics Boom

China is a major player in the market. This is mainly due to strong government support for biotechnology, rising healthcare expenditures, and a rapid expansion of the genomics sector. The positive environment for genotyping adoption in recent years stems from national programs such as the Healthy China 2030 plan and substantial investments in precision medicine research. Genetic testing facilities have increased across the country, with more local firms and research centers engaged in sequencing and genomic diagnostics. Additionally, with increasing consumer awareness regarding genetic health, the demand for preventive care and personalized medicine is also on the rise.

What are the Key Trends in the European Genotyping Assays Market?

The European genotyping assays market is projected to experience significant growth in the coming years, fueled by the increasing emphasis on personalized treatments, the presence of major academic and research centers, and a more developed healthcare infrastructure. Various European countries are integrating genomic technology into their medical systems for early disease detection, pharmacogenomics, and other genetic screening programs. The application of genomics research and cross-border collaborative programs also benefits from public funding, which fosters innovation and supports genotyping assays.

U.K.: Genomic Medicine Powerhouse Driving Innovation Forward

The U.K. is a key market player due to its policies on genomic medicine and precision healthcare. It has a well-regulated environment, with the Medicines and Healthcare Products Regulatory Agency (MHRA) overseeing the safety and effectiveness of genetic testing technologies. Furthermore, the collaboration between biotech, the public sector, and universities fosters a vibrant ecosystem for genotyping innovation. The increasing application of genetic testing in oncology, rare diseases, and reproduction is also accelerating its adoption.

South America: Increasing Government support

South America is significantly growing in the market as noteworthy interest and activity in genotyping research, primarily due to its unique and complex population admixture, which offers a valuable resource for specific genetic research. Initiatives such as the Latin American Genomics Consortium (LAGC) and the Genetics of Latin American Diversity (GLAD) project are aggressively working to harmonize data.

Brazil: High Prevalence of Genetic Disorders

In Brazil, wide-ranging genetic diversity is distinct from populations in various regions and is underrepresented in worldwide genomic databases, which have a bias towards European disparities. Academic and private sectors' partnership in research, with major local players such as Mendelics and DASA Genomics leading in providing solutions.

MEA: Rising Awareness and Demand for Personalized Medicine

MEA is significantly increasing in the market as this type of technology provides highly reliable, reproducible, and affordable data for investigating hundreds of thousands of recognized genetic variants concurrently. Several MEA countries, particularly the GCC nations such as Saudi Arabia, UAE, and Qatar, have launched national genome programs and are spending heavily in medical infrastructure.

South Africa: Technological Advancements

In South Africa, a growing awareness of the advantages of genetic testing among both the public and medical care professionals. The acceptance of progressive technologies such as next-generation sequencing (NGS) and polymerase chain reaction (PCR)-based assays is growing due to their effectiveness and precision in identifying genetic variations, driving the growth of the market.

Value Chain Analysis – Genotyping Assays Market

- R&D

The R&D process for genotyping assays generally contributes a structured workflow of target identification, assay design, optimization, and severe validation

Key Players: Illumina Inc., and Thermo Fisher Scientific Inc - Clinical Trial

Genotyping assays are integrated into the healthcare trial process, primarily in the areas of patient selection and stratification, evaluating drug effectiveness and safety, and conducting retrospective analyses.

Key Players: Agilent Technologies and QIAGEN - Patient Services

The patient services processes included in genotyping assays involve a series of steps that connect the patient and their healthcare provider with the testing laboratory.

Key Players: F. Hoffmann-La Roche Ltd.

Top Vendors in the Genotyping Assays Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Thermo Fisher Scientific |

United States |

End-to-end services |

It provides an inclusive portfolio of genotyping solutions for SNP, indel, and CNV analysis that support all stages of the workflow. |

|

Illumina Inc. |

United States |

Market leadership and innovation |

Illumina sequencing and array technologies drive development in life science research, translational and consumer genomics, and molecular diagnostics. |

|

Bio-Rad Laboratories Inc. |

United States |

Technological leadership |

In January 2025, Bio-Rad launched Vericheck ddPCR Empty-Full Capsid Kit for Serotypes 2 and 8 for precise AAV vector quality assessment in gene therapy with unmatched sensitivity and accuracy. |

|

Agilent Technologies |

United States |

Financial robustness |

It strengthens its leadership across genetic testing and microfluidics. |

|

QIAGEN |

Venlo, Netherlands |

Growing molecular diagnostics |

QIAGEN will develop a multimodal panel using next-generation sequencing (NGS) technology for detecting clinically relevant gene alterations |

Recent Developments

- In November 2024, BD Company launched the BD Onclarity HPV assay, a game changer in cervical cancer protection. The assay received FDA approval and involved prolonged genotyping, which classified the HPVs according to their risk levels. Such accuracy would allow precise follow-up care where high-risk HPV 16 or 18 genotypes could undergo colposcopy directly. (Source: https://www.contemporaryobgyn.net)

- In May 2023, Illumina released Illumina Connected Insights, a new cloud-delivered software that enables tertiary analysis of clinical next-generation sequencing data. This software assists in genomic profiling of advanced tumors and whole-genome sequencing in rare diseases. (Source: https://www.illumina.com)

- In January 2023, Thermo Fisher Scientific reported the introduction of the CE-IVD marked Applied Biosystems TaqPath Seq HIV-1 Genotyping Kit. The test base of the kit is Sanger's sequencing-based assay, testing positive HIV samples to identify genetic variations that resist well-known antiretroviral medications.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Technology

- Polymerase Chain Reaction (PCR)

- Real-Time PCR

- Digital PCR

- Others

- Microarray

- Next-Generation Sequencing (NGS)

- Mass Spectrometry

- Electrophoresis

- MALDI-TOF

- Others

By Product

- Instruments

- Reagents & Kits

- Software & Services

- Data Analysis Software

- Genotyping Services

By Application

- Pharmacogenomics

- Diagnostics

- Oncology

- Infectious Diseases

- Others

- Animal Genetics

- Agricultural Biotechnology

- Research (Academic & Clinical)

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic Laboratories

- Academic & Research Institutions

- Contract Research Organizations (CROs)

- Others

By Workflow Stage

- Sample Preparation

- DNA Amplification

- Genotyping/Detection

- Data Analysis & Interpretation

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting