What is the Single Nucleotide Polymorphism (SNP) Genotyping Market Size?

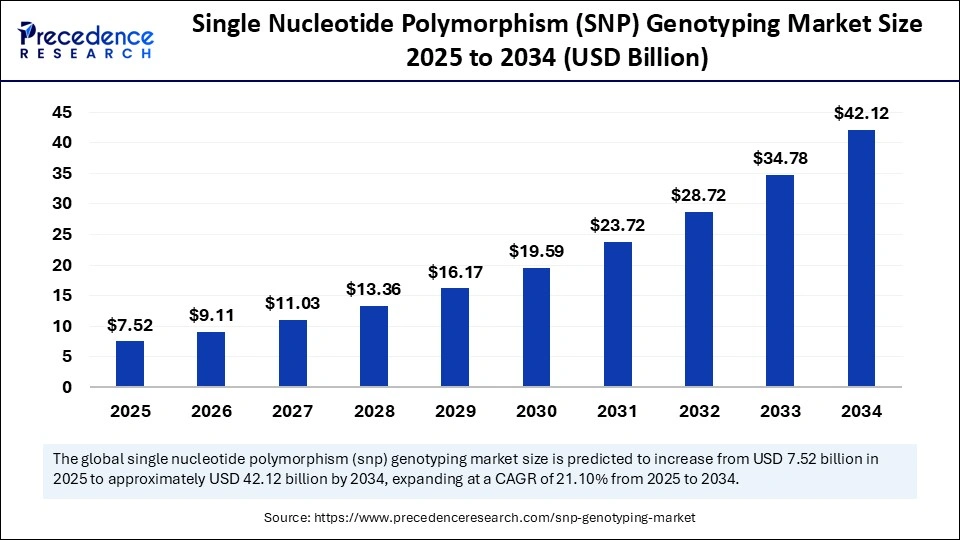

The global single nucleotide polymorphism (SNP) genotyping market size accounted for USD 7.52 billion in 2025 and is predicted to increase from USD 9.11 billion in 2026 to approximately USD 42.12 billion by 2034, expanding at a CAGR of 21.10% from 2025 to 2034. The market is rapidly expanding due to advancements in genomic technology, the rise in fatal and chronic diseases, the expansion of SNP genotyping applications, and substantial government funding for R&D in the pharma and biotech sectors worldwide.

Market Highlights

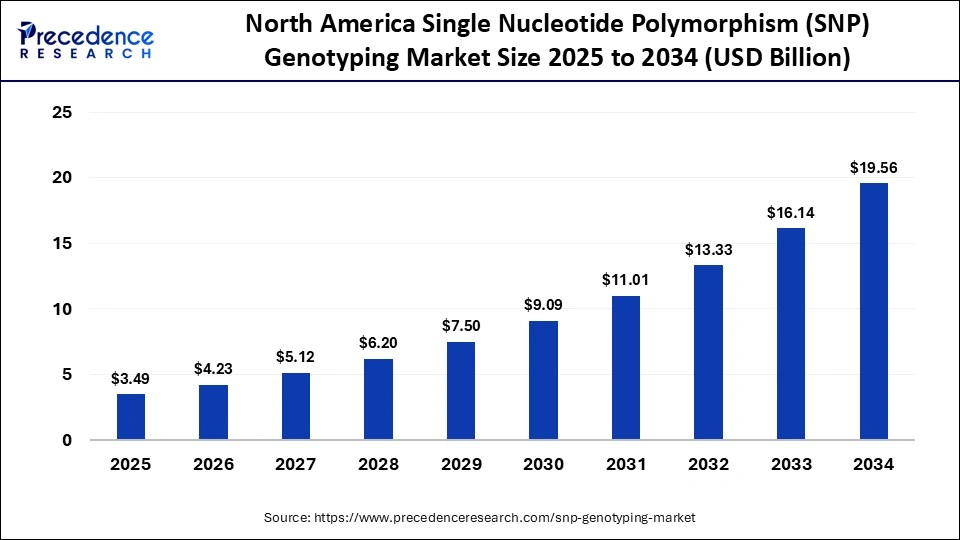

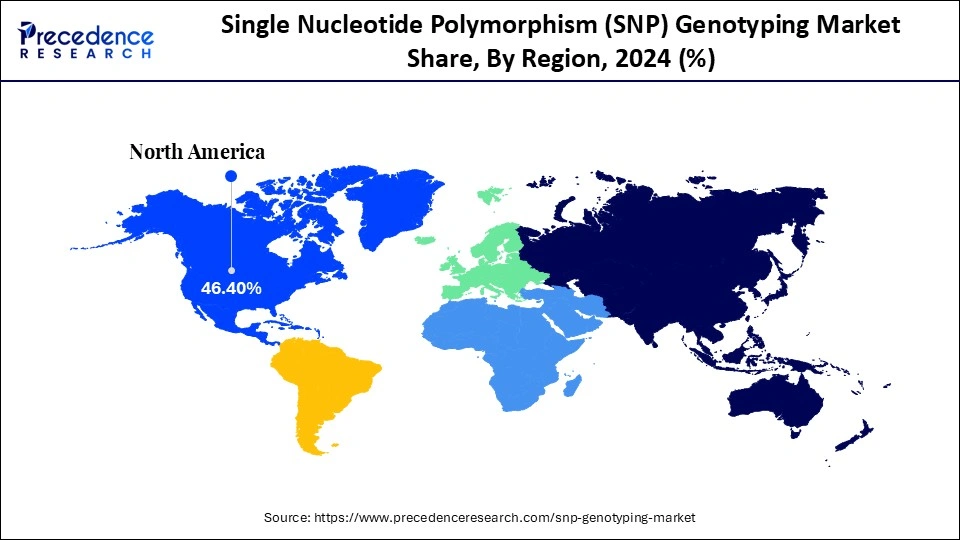

- North America accounted for the largest market share of 46.4% in 2024.

- The Asia Pacific is expected to witness the highest CAGR from 2025 to 2034.

- By technology, the PCR-based genotyping segment held the largest market share of 40.4% in 2024.

- By technology, the next-generation sequencing-based genotyping segment is growing at a solid CAGR from 2025 to 2034.

- By product/component, the instruments segment held the major market share of 61.4% in 2024.

- By product, the software & services segment is expected to grow the highest CAGR of 13.2% from 2025 to 2034.

- By application, the pharmaceuticals & pharmacogenomics segment contributed the highest market share of 38.4% in 2024.

- By application, the genetic testing/diagnostics segment is growing at a strong CAGR of 12.8% from 2025 to 2034.

- By end user, the pharmaceutical & biotechnology companies segment captured the biggest market share of 51.5% in 2024.

- By end user, the contract research organizations (CROs) / service providers segment is expected to expand at a notable CAGR of 12.5% from 2025 to 2034.

Single Nucleotide Polymorphism (SNP) Genotyping Market Means

The Single Nucleotide Polymorphism (SNP) Genotyping Market refers to the ecosystem of technologies, instruments, reagents, software, and services used to identify and analyse individual base-pair variations (SNPs) in DNA across populations, organisms, and disease states.

These technologies enable high-throughput genotyping for clinical diagnostics, pharmacogenomics, agricultural biotechnology, and research applications, supporting precision medicine, biomarker discovery, and trait selection in crops & livestock. The market covers hardware platforms (arrays, PCR, NGS), consumables, bioinformatics tools, and associated services.

AI Shifts in Single Nucleotide Polymorphism (SNP) Genotyping Market

The integration of AI will be revolutionary in the SNP Genotyping market, enabling more accurate and efficient variant calling from large genomic datasets and accelerating research while supporting personalized medicine. Models like ML and deep learning help identify disease-linked SNPs and predict disease risk prior to treatment, further accelerating drug development.

With the help of suboptimal DNA samples and streamlined processes, AI optimizes genotyping and makes complex genetic processes more accessible, enabling more accurate analysis. This will help tailor medical treatments to the type of disease and improve outcomes, and reduce mortality rates.

Single Nucleotide Polymorphism (SNP) Genotyping Market Outlook

The market is significantly expanding due to the rising prevalence of chronic diseases such as cardiovascular and cancer, the growing adoption of personalized medicine, and ongoing technological advancements, including next-generation sequencing, ML, and AI integration.

The major investment in the market comes from large institutional investors, venture capital funds, and government initiatives to develop the healthcare sector. Major investors like Thermo Fisher Scientific and Danaher are active in the market, acquiring innovative start-ups and providing funding to internal R&D, which will help expand their product portfolios and technological capabilities.

The start-up ecosystem of the single nucleotide polymorphism genotyping market is highly active and vibrant, while focusing on niche technological areas and innovative applications. Many start-ups are concentrated in major biotech hubs like Seattle, Cambridge, and Beijing. Start-ups are entering new areas such as AI-powered genetic interpretation, novel sequencing platforms, and tailored diagnostics and therapeutic services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.52 Billion |

| Market Size in 2026 | USD 9.11 Billion |

| Market Size by 2034 | USD 42.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 21.10% |

| Dominating Region | North america |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product/Component, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Single Nucleotide Polymorphism (SNP) Genotyping Market Segmental Insights

Technology Insights

The PCR-based genotyping segment held the largest share, 40.4%, in the single nucleotide polymorphism (SNP) genotyping market in 2024. The segment is dominant due to the technology ability to identify specific genetic variations, such as SNPs, in DNA samples. The technology is cost-effective and flexible for targeted studies. Its ideal for processing large samples.

The next-generation sequencing-based genotyping segment is expected to witness the highest CAGR of 13.5% for single nucleotide polymorphism (SNP) genotyping over the foreseeable period. The segment is growing due to lower costs and more detailed genomic data compared to traditional methods, making it highly applicable for comprehensive genomic profiling.

Microarrays / Gene Chips

The segment is notably growing due to its high-throughput capacity, cost-effective results, precise identification of common variants, and streamlined workflow. The technology delivers rapid results even with small DNA or RNA samples, a major benefit when dealing with limited samples.

Mass Spectrometry / MALDI-TOF

The segments growth can be related to its speed, cost-effectiveness, and precise output as it directly measures the mass of single-base extended primers without complex fluorescent signals. It is specifically suited for detecting multiple SNPs simultaneously and is highly amenable to automation.

Product Insights

The instruments segment held the largest share, 61.4%, in the single nucleotide polymorphism (SNP) genotyping market in 2024, due to its high initial and maintenance costs of the advanced equipment needed for large-scale genetic analysis. A wide range of applications in research and diagnostics found it highly beneficial, as they need to process large datasets for cutting-edge research and diagnostics.

The software & services segment is expected to witness the fastest CAGR of 13.2% during the forecast period, driven by the large volume of data generated by complex, modern genotyping technologies, which require sophisticated analysis to yield insights.

Reagents & Kits

The segment is growing notably because it offers benefits such as enhanced efficiency, output, reliability, and reproducibility compared to in-house methods and products. Its ready-to-use nature makes it easy to handle and eliminates the need for separate reagent preparation.

Application Insights

The pharmaceuticals & pharmacogenomics segment is leading the market with a 38.4% share in 2024, driven by the crucial role of SNP genotyping in the development of personalized medicines. This offers better prediction of drug response, improved detection of genetic variations, and reduced trial-and-error use of drugs. The pharmaceutical industry is driven by continuous drug development and the creation of targeted drug therapies for fatal diseases.

The genetic testing/diagnostics segment is expected to witness the fastest CAGR of 12.8% during the foreseeable period. The segment is growing due to the increasing shift towards personalized medicine, innovations like NSG, microarray tools, and the increasing cases of genetic disorders, cancer, and various chronic conditions that need personalized therapy with early diagnosis.

Agricultural Biotechnology

The segment is notably growing due to the offerings of single nucleotide polymorphism genotyping in agricultural biotechnology, including accelerating crop improvement, disease resistance, and genetic diversity analysis, as well as cost-effective methods such as arrays and next-generation sequencing. SNP data enables breeders to select for expected traits more effectively with marker-assisted selection.

End User Insights

The pharmaceutical & biotechnology companies segment held the largest market share of 51.5% in 2024. The segment is dominating due to its crucial role in drug discovery and development, especially for personalized medicines and pharmacogenomics. Also, the U.S. FDA encourages the use of pharmacogenomics and genotyping for drug development and discovery, which pushes the pharmaceutical and biotechnology sectors to adopt SNP genotyping more widely.

The contract research organizations (CROs) / service providers segment is expected to witness the highest CAGR of 12.5% during the forecasted period due to the growing shift towards outsourcing the R&D activities of pharma and biotech companies to minimize cost and fuel drug development timelines.

Agricultural / Livestock Genomics Firms

The segment is growing rapidly due to the key benefits of SNP genotyping, such as accelerated breeding phases, higher selection accuracy, and greater intensity for specific traits like milk production, disease resistance, growth rate, and stress tolerance, leading to greater genetic gain and higher productivity.

Single Nucleotide Polymorphism (SNP) Genotyping Market Regional Insights

The North America single nucleotide polymorphism (SNP) genotyping market size is estimated at USD 3.49 billion in 2025 and is projected to reach approximately USD 19.56 billion by 2034, with a 21.11% CAGR from 2025 to 2034.

What Factors Made North America a Dominant Region in the Single Nucleotide Polymorphism (SNP) Genotyping Market?

North America held the largest market share of 46.4% in the single nucleotide polymorphism (SNP) genotyping market in 2024, driven by a combination of factors, including strong healthcare infrastructure, robust research and development investments, and advanced diagnostics and therapeutic technologies. The presence of leading players in the biopharmaceutical sector drives significant demand for genotyping in drug discovery, clinical trials, and other applications.

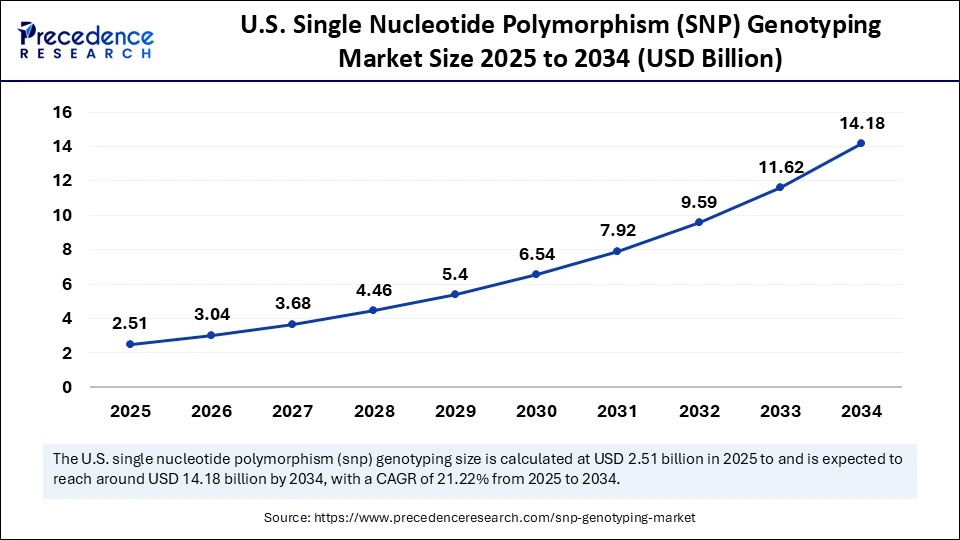

The U.S. single nucleotide polymorphism (SNP) genotyping market size is calculated at USD 2.51 billion in 2025 and is expected to reach nearly USD 14.18 billion in 2034, accelerating at a strong CAGR of 21.22% between 2025 and 2034.

U.S. Single Nucleotide Polymorphism (SNP) Genotyping Market Trends

The regions growth can be attributed to rapid expansion driven by chronic diseases, the rise of personalized medicine, and expanding applications in sectors such as cancer research and pharmacogenomics. SNP genotyping is now widely accepted in the U.S., especially for diagnostic research, animal/plant breeding, and forensic testing. Also, next-gen sequencing is becoming the dominant technology in the region.

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The region is expanding due to the increasing awareness and demand for personalized medicine, targeted therapies for chronic and genetic diseases, and genetic diseases. Also, the rapid expansion of pharmaceutical and biotech companies in leading countries such as China, Japan, and India. The region has a large population base, offering a vast genetic pool for genomic studies and significant unexplored market potential.

China Single Nucleotide Polymorphism (SNP) Genotyping Market

China is heavily investing in genomics research, driving demand for SNP genotyping tools and services. Also, government initiatives are helping develop diagnostics and therapeutics for chronic and fatal diseases, further promoting the large-scale adoption of SNP genotyping. Chinas large population and unmet medical needs create a significant opportunity for the expansion of personalized medicine based on genetic testing.

Europe single nucleotide polymorphism genotyping market is expanding due to the increasing demand for genetic analysis in clinical and research settings, government support for genomic research and innovation in sectors like bioinformatics and multiplexing arrays to make the technology highly accessible to masses. A strong emphasis on genomic research to find out genetic variants related to the various diseases is again fueling the market growth in the region.

Germany Single Nucleotide Polymorphism (SNP) Genotyping Market

The single nucleotide polymorphism (SNP) genotyping market in Germany is experiencing steady growth, driven by advances in genomic research and the growing adoption of precision medicine. Strong government support for biotechnology and healthcare innovation is also contributing to market expansion. Key players in the country are focusing on developing efficient, high-throughput genotyping technologies to enhance research accuracy and reduce costs.

The Middle East & Africa single nucleotide polymorphism (SNP) genotyping market is expanding due to increased investments in healthcare and biotechnology, growing demand for advanced diagnostics, and the adoption of technologies such as next-generation sequencing and high-throughput platforms. Beyond diagnostic applications, SNP genotyping is primarily used in agriculture to improve healthy crops and in the livestock industry.

Saudi Arabia Single Nucleotide Polymorphism (SNP) Genotyping Market

Saudi Arabia is emerging as a leading market for single nucleotide polymorphism (SNP) genotyping in the Middle East. The country strong government initiatives, such as the Saudi Human Genome Program, are driving advancements in genetic research and personalized medicine. Increasing investments in healthcare infrastructure and partnerships with global biotechnology firms are further accelerating the adoption of SNP genotyping technologies across the region.

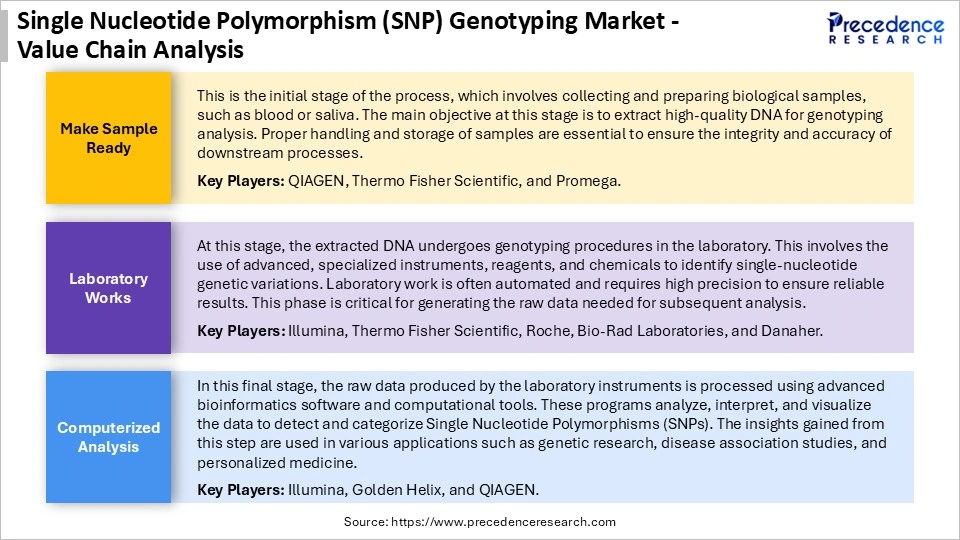

Single Nucleotide Polymorphism (SNP) Genotyping Market Value Chain

Single Nucleotide Polymorphism (SNP) Genotyping Market Companies

Corporate Information

- Headquarters: Santa Clara, California, United States

- Year Founded: 1999

- Ownership Type: Publicly Traded (NYSE: A)

History and Background

Agilent Technologies, Inc. was established in 1999 as a spin-off from Hewlett-Packard, focusing on life sciences, diagnostics, and applied chemical markets. Over the past two decades, Agilent has become a leading global provider of analytical instruments, genomic technologies, and laboratory software solutions supporting pharmaceutical, clinical, and biotechnology research.

In the Single Nucleotide Polymorphism (SNP) Genotyping Market, Agilent Technologies provides advanced tools and platforms for genetic variation analysis, microarray technology, and next-generation sequencing (NGS) data interpretation. Its SNP genotyping solutions are widely used in biomedical research, pharmacogenomics, and disease association studies, enabling high-throughput, accurate detection of genetic polymorphisms.

Key Milestones / Timeline

- 1999: Founded as a life sciences and chemical analysis company following Hewlett-Packards restructuring

- 2005: Expanded genomics capabilities with microarray technology portfolio

- 2012: Acquired Halo Genomics to strengthen targeted resequencing and SNP assay development

- 2018: Introduced SureSelectXT HS system for targeted SNP genotyping and variant detection

- 2024: Released updated bioinformatics software suite integrating AI-based SNP interpretation

Business Overview

Agilent Technologies operates as a leading provider of analytical and genomic solutions for research and diagnostics. In SNP genotyping, the company offers comprehensive systems that combine sample preparation, microarrays, sequencing, and bioinformatics tools. Its platforms support genome-wide association studies (GWAS), precision medicine applications, and population-scale genotyping initiatives.

Business Segments / Divisions

- Life Sciences and Applied Markets

- Diagnostics and Genomics

- Agilent CrossLab (Services and Consumables)

Geographic Presence

Agilent serves customers in over 100 countries, with major facilities in the United States, China, Singapore, and the United Kingdom.

Key Offerings

- Agilent SureSelect Target Enrichment Platform for SNP and variant detection

- Agilent Microarray Technology for high-throughput SNP genotyping

- SureDesign Software for customized genotyping assays

- Bioinformatics tools for SNP calling and data visualization

Financial Overview

Agilent Technologies reports annual revenues of approximately $6.8 billion USD, with its Diagnostics and Genomics Group accounting for a growing portion driven by genomic research demand.

Key Developments and Strategic Initiatives

- April 2023: Expanded SureSelect product line with improved accuracy for low-frequency SNP detection

- October 2023: Partnered with biopharma companies for SNP genotyping in drug response studies

- May 2024: Launched AI-assisted SNP calling pipeline integrated into Agilents bioinformatics suite

- January 2025: Introduced SNP genotyping workflow automation for population-scale studies

Partnerships & Collaborations

- Collaborations with global genomics research institutions for large-scale SNP mapping

- Partnerships with pharmaceutical firms for pharmacogenomic applications

- Alliances with sequencing technology providers for workflow integration

Product Launches / Innovations

- SureSelectXT HS SNP Genotyping System (2023)

- AI-driven SNP Analysis Software (2024)

- Automated Microarray Workflow for GWAS (2025)

Technological Capabilities / R&D Focus

- Core technologies: Microarrays, hybrid capture sequencing, targeted enrichment, and AI-driven bioinformatics

- Research Infrastructure: R&D centers in California, Singapore, and Shanghai

- Innovation focus: Precision SNP detection, scalable genotyping platforms, and data integration tools

Competitive Positioning

- Strengths: Established genomics expertise, broad platform compatibility, and strong R&D pipeline

- Differentiators: Integration of sequencing and microarray technologies for comprehensive SNP analysis

SWOT Analysis

- Strengths: Strong brand reputation, innovation-driven portfolio, and robust customer base

- Weaknesses: High equipment cost may limit adoption by smaller research labs

- Opportunities: Expansion in precision medicine and pharmacogenomics

- Threats: Growing competition from Illumina and Thermo Fisher Scientific in genotyping platforms

Recent News and Updates

- March 2024: Agilent launched automated SNP discovery software with integrated data visualization

- July 2024: Partnered with genomics consortium for population-scale variant mapping

- January 2025: Introduced a cloud-based storage solution for SNP genotyping datasets

Corporate Information

- Headquarters: Basel, Switzerland

- Year Founded: 1896

- Ownership Type: Publicly Traded (SIX: ROG)

History and Background

Founded in 1896, F. Hoffmann-La Roche AG is a global pioneer in pharmaceuticals and diagnostics. Its diagnostics division, Roche Diagnostics, is one of the largest in the world, specializing in molecular biology, genomics, and personalized healthcare solutions. Roches commitment to advancing genetic and molecular testing has established it as a key innovator in precision medicine and clinical genomics.

In the Single Nucleotide Polymorphism (SNP) Genotyping Market, Roche Diagnostics offers a wide range of solutions, including real-time PCR assays, sequencing reagents, and microarray systems. These technologies enable accurate identification of genetic variants associated with inherited diseases, cancer risk, and drug response, supporting both research and clinical diagnostics.

Key Milestones / Timeline

- 1896: Founded in Basel, Switzerland

- 1991: Introduced PCR-based diagnostics through collaboration with Cetus Corporation

- 2007: Expanded genomics capabilities through acquisition of NimbleGen Systems (microarrays)

- 2015: Enhanced next-generation sequencing portfolio through partnerships with academic institutions

- 2024: Released an integrated digital PCR and SNP genotyping solution for clinical research applications

Business Overview

Roche Diagnostics provides high-precision analytical tools and molecular systems for research and clinical use. Its SNP genotyping platforms focus on improving diagnostic accuracy, reproducibility, and throughput, offering tailored solutions for pharmacogenomics, oncology, and population genetics.

Business Segments / Divisions

- Diagnostics (Core Lab, Molecular, Tissue Diagnostics, Point-of-Care)

- Pharmaceuticals

- Roche Information Solutions

Geographic Presence

Roche Diagnostics operates in more than 100 countries with major manufacturing and R&D facilities in Switzerland, Germany, and the United States.

Key Offerings

- LightCycler Real-Time PCR Systems for SNP detection and genotyping

- NimbleGen Microarrays for genome-wide SNP analysis

- Digital PCR and sequencing platforms for targeted variant detection

- Bioinformatics tools for genotyping data management and interpretation

Financial Overview

Roche Diagnostics reports annual revenues exceeding CHF 14 billion (approximately $15.5 billion USD), with significant contributions from molecular and genetic diagnostics.

Key Developments and Strategic Initiatives

- March 2023: Released new LightCycler platform optimized for high-throughput SNP genotyping

- September 2023: Introduced a cloud-based analytics suite for large-scale genomic data interpretation

- May 2024: Launched digital PCR-based SNP detection system for oncology and rare disease research

- January 2025: Announced global collaboration for pharmacogenomic SNP testing in personalized medicine

Partnerships & Collaborations

- Collaborations with universities and genomics institutes for precision SNP mapping

- Partnerships with biopharma firms for companion diagnostic development

- Strategic alliances with cloud technology providers for genomic data integration

Product Launches / Innovations

- LightCycler 480 II SNP Genotyping Kit (2023)

- Digital PCR SNP Detection Platform (2024)

- NimbleGen Advanced Microarray Suite (2025)

Technological Capabilities / R&D Focus

- Core technologies: PCR-based detection, microarray analysis, and molecular data interpretation

- Research Infrastructure: R&D centers in Basel, Penzberg, and Indianapolis

- Innovation focus: Clinical-grade genotyping, automation, and integration of molecular workflows

Competitive Positioning

- Strengths: Established diagnostics expertise, clinical reliability, and integrated digital infrastructure

- Differentiators: Combination of PCR precision and high-throughput array technologies

SWOT Analysis

- Strengths: Strong global footprint, diversified genomics portfolio, and regulatory experience

- Weaknesses: High capital requirements for advanced platforms

- Opportunities: Expanding use of SNP genotyping in oncology and personalized therapy

- Threats: Competitive pressure from faster and lower-cost sequencing-based solutions

Recent News and Updates

- April 2024: Roche introduced an advanced SNP analysis workflow compatible with clinical genomics labs

- August 2024: Partnered with a global health consortium for population-wide genetic screening

- January 2025: Announced release of AI-based bioinformatics engine for SNP interpretation in clinical diagnostics

Other Key Players in the Market for Single Nucleotide Polymorphism (SNP) Genotyping

- QIAGEN N.V.: QIAGEN delivers advanced sample preparation, PCR, and genotyping kits designed for SNP analysis. Its platforms, such as QIAseq and Rotor-Gene Q, enable high-precision detection of genetic variants for research and clinical applications in oncology, pharmacogenomics, and infectious disease.

- Bio-Rad Laboratories, Inc.: Bio-Rad provides SNP genotyping assays and instrumentation, including droplet digital PCR (ddPCR) and real-time PCR platforms. The company genotyping technologies are widely used in biomarker validation, agricultural genetics, and molecular diagnostics.

- Danaher Corporation: Danaher, through subsidiaries such as Cepheid and Beckman Coulter, offers genomic analysis systems and reagents used in SNP genotyping. Its technologies support precision medicine, genomic research, and high-throughput screening for genetic variation.

- Beckman Coulter, Inc.: Beckman Coulter provides high-performance liquid handling and analytical systems that support SNP genotyping workflows. Its automated platforms improve accuracy and efficiency in sample preparation, genotyping, and data analysis for research and diagnostics.

- Luminex Corporation: Luminex offers multiplex genotyping solutions using xMAP technology, enabling simultaneous analysis of multiple SNPs in a single reaction. The companys assays are used in pharmacogenomics, genetic research, and clinical diagnostics for complex trait analysis.

- PerkinElmer, Inc.: PerkinElmer provides molecular biology instruments and reagents for SNP genotyping, including PCR-based assays and genotyping arrays. Its genomic solutions are used across agriculture, human health, and environmental studies for genetic variation detection.

- Fluidigm Corporation: Fluidigm delivers microfluidic-based SNP genotyping systems designed for high-throughput genetic screening. Its IFC (Integrated Fluidic Circuit) technology enables efficient, cost-effective genotyping and variant analysis across large sample sets.

- Affymetrix (now part of Thermo Fisher Scientific): Affymetrix, integrated under Thermo Fisher, provides high-density SNP genotyping arrays and genomic analysis tools. Its platforms are widely used for population genetics, disease association studies, and precision medicine applications.

- Sequenom, Inc.: Sequenom, now incorporated into Laboratory Corporation of America (Labcorp), developed mass spectrometry-based genotyping solutions such as the MassARRAY system. The technology remains widely recognized for its accuracy in SNP and mutation analysis.

- Oxford Nanopore Technologies, Inc.: Oxford Nanopore offers long-read sequencing technology capable of detecting SNPs and structural variants in real time. Its portable and high-throughput sequencing platforms enable comprehensive genomic variation analysis for research and clinical applications.

- Promega Corporation: Promega provides molecular biology reagents and genotyping tools, including PCR and DNA quantification kits suitable for SNP detection. The companys solutions are used in genetic identification, forensic analysis, and biomedical research.

Recent Developments

- In January 2024, Thermo Fisher Scientific introduced a Pangenome array. It supports population-scale disease research in the field of pharmacogenomics. It is currently the only research solution that combines four assays into a single test.(Source: https://www.businesswire.com)

- In October 2025, Roche presents significant advancements for its sequencing with the help of expansion technology (SBX). It also holds a new GUINNESS world record at the ASHG conference in 2025.(Source: https://www.roche.com)

Single Nucleotide Polymorphism (SNP) Genotyping MarketSegments Covered in the Report

By Technology

- PCR-based Genotyping

- Microarrays/Gene Chips

- Mass Spectrometry/MALDI-TOF

- Other Technologies (Capillary Electrophoresis, Pyrosequencing)

By Product/Component

- Instruments

- Reagents & Kits

- Software & Bioinformatics Services

By Application

- Pharmaceuticals & Pharmacogenomics

- Diagnostic Research

- Agricultural Biotechnology

- Breeding & Animal Livestock

- Other Applications

By End-User

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories/Clinical Labs

- Academic & Research Institutes

- Agricultural/Livestock Genomics Firms

- Contract Research Organizations (CROs)/Service Providers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting