Cell-based Assays Market Size and Growth 2025 to 2034

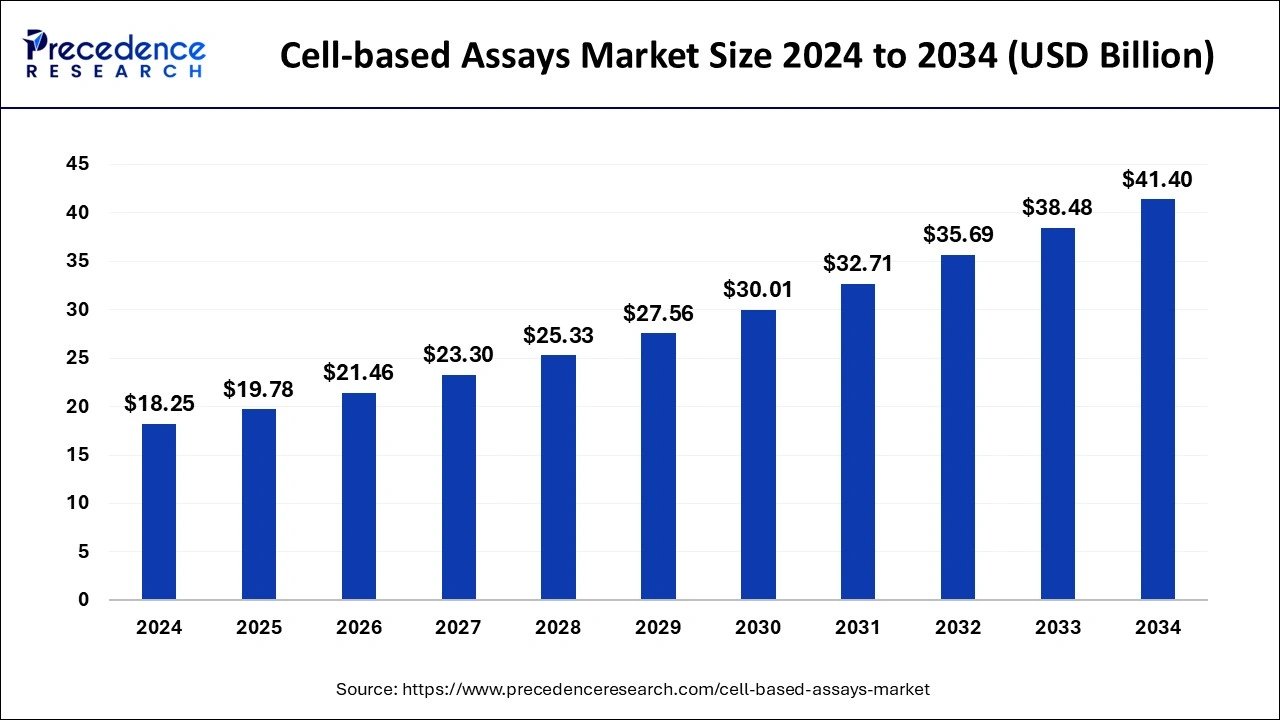

The global cell-based assays market size was valued at USD 18.25 billion in 2024 and is anticipated to reach around USD 41.40 billion by 2034, growing at a CAGR of 8.54% from 2025 to 2034.

Cell-based Assays Market Key Takeaways

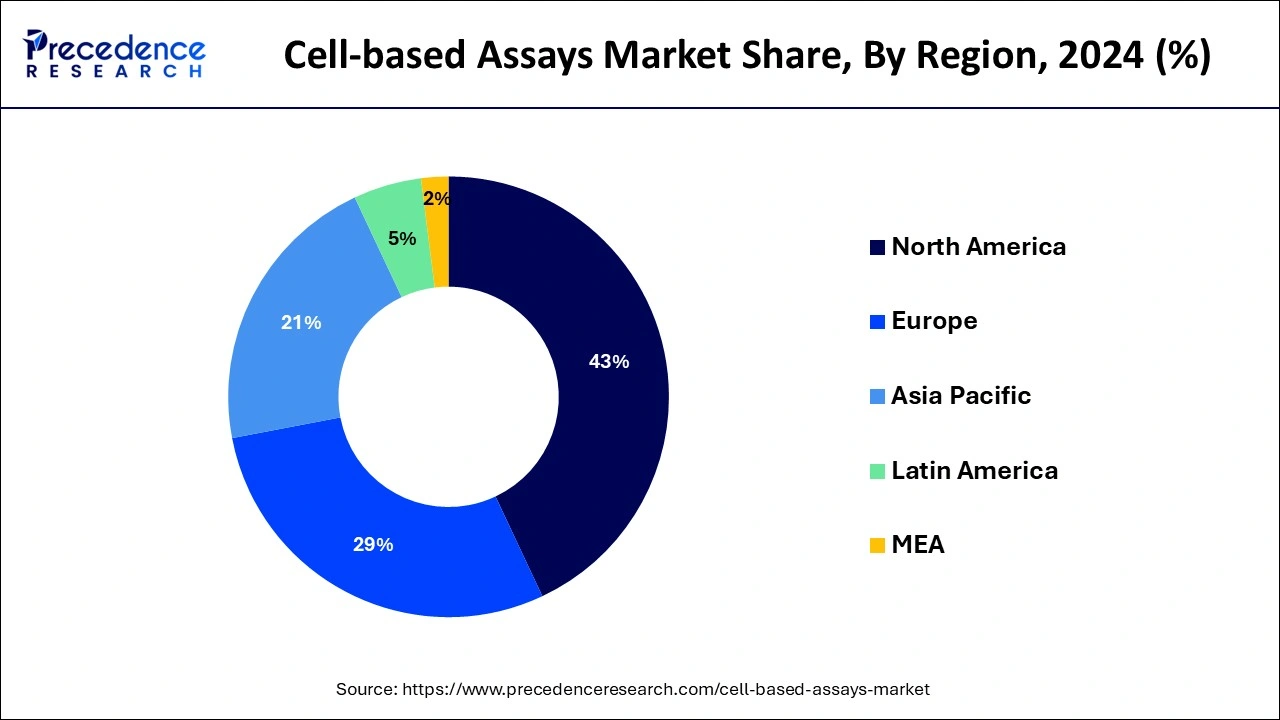

- North America generated more than 43% of the revenue share in 2024.

- By Products & Services, the assay kits products & services segment recorded more than 40% of revenue share in 2024.

- By Technology, the high-throughput screening segment is expected to expand at the fastest CAGR from 2025 to 2034.

- By Application, the drug discovery segment contributed more than 41% of revenue share in 2024.

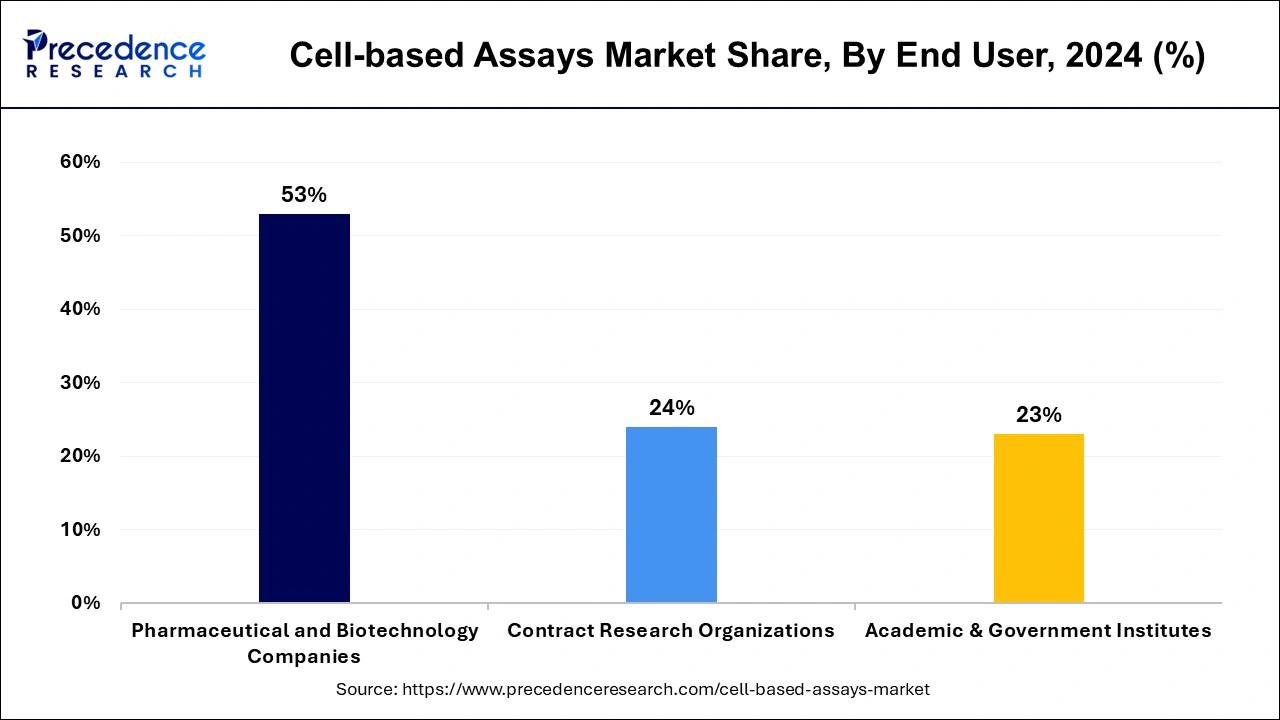

- By End-use, the biotechnology and pharmaceutical companies segment captured more than 53% of revenue share in 2024.

U.S.Cell-based Assays Market Size and Growth 2025 to 2034

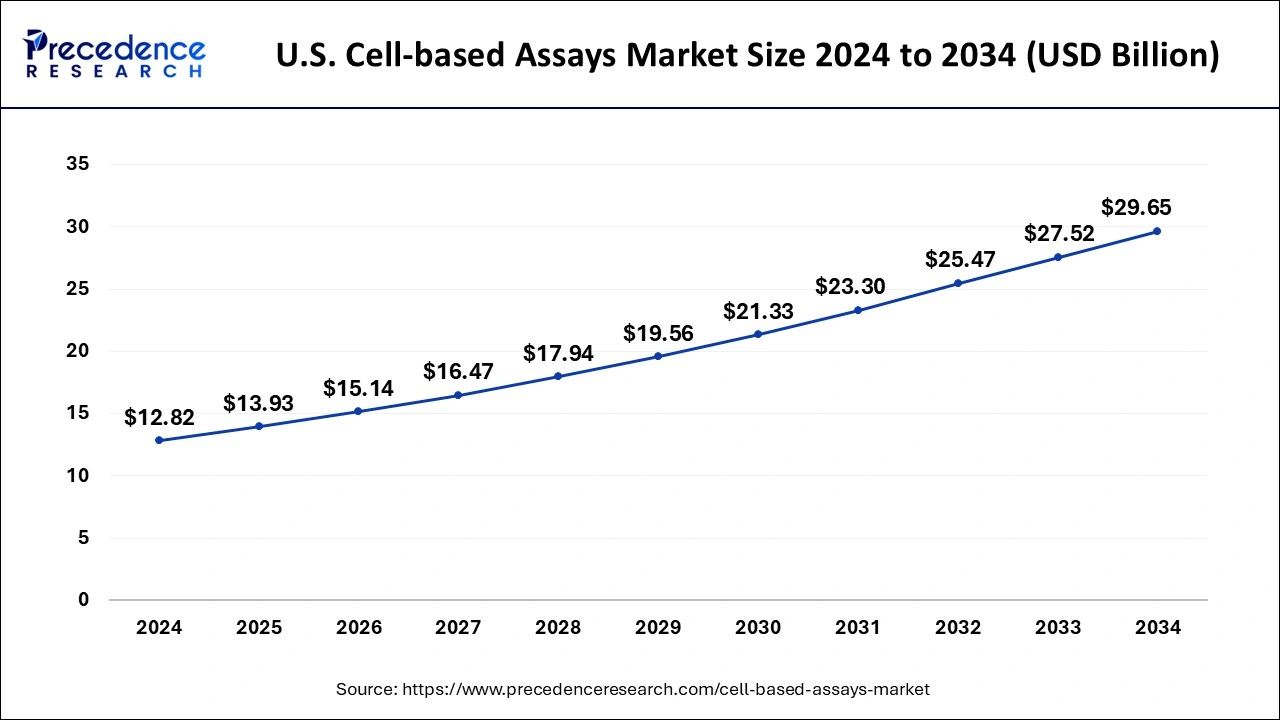

The U.S. cell-based assays market size reached USD 12.82 billion in 2024 and is anticipated to be worth around USD 29.65 billion by 2034, poised to grow at a CAGR of 8.75% from 2025 to 2034.

North America accounted for the larger market share during the forecast period.The increasing prevalence of chronic diseases such as cancer, cardiovascular, cancer, diabetes, neurological disorders, osteoarthritis, diabetes and others, sophisticated healthcare infrastructure, presence of prominent market players, increasing R&D investment, and high adoption of cell-based assays is expected to drive the demand for cell-based assays for newer drug discoveries, making it a crucial factor for the growth of the market in the region. In addition, several market players are focusing on partnerships or strategic collaborations for the development of cell-based assays in the region.

For instance, in March 2022, headquartered in the United States, a pioneer and rapidly growing company in offering advanced solutions and technical support to life science sector, Promega Corporation announced a strategic business activity with FUJIFILM Cellular Dynamics Inc in order to advance novel assay systems for novel drug discovery. Under the collaboration, the companies aim to develop novel assays to detect and monitor cellular biology that reflects cells behavior in the human body.

On the other hand, the Asia Pacific is expected to witness the fastest growth during the forecast period.The Asia Pacific region has witnessed a surge in research and development activities in the field of life sciences and biotechnology. Governments, academic institutions, and private organizations are investing in research infrastructure and promoting collaborations. This has led to the expansion of cell-based assay research, driving the market's growth.

The Asia Pacific region is experiencing an increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes. Cell-based assays play a crucial role in understanding disease mechanisms, identifying potential therapeutic targets, and testing drug efficacy. The need for effective diagnostics and personalized medicine approaches drives the adoption of cell-based assays in the region.

Europe is expected to remain another lucrative marketplace for cell-based assay market players. Europe's cell-based assay market is driven by factors such as increasing research activities, a well-established pharmaceutical industry, the prevalence of chronic diseases, technological advancements, supportive government initiatives, presence of major market players and the adoption of personalized medicine approaches. As these trends continue, the market is expected to expand further in the region.

Cell-based Assays Market Overview

The cell-based assays market plays around the production and services related to cell-based assays. The global cell-based assays market carries a wide range of reagents, consumables, instruments, and services used in conducting cell-based assays for research, drug discovery, and toxicity testing applications. The market includes both the products and services provided by manufacturers, as well as the contract research organizations (CROs) and academic research institutions that utilize cell-based assays for their research.

The cell-based assay is a technique widely used to study the characteristics and responses of cells in a controlled laboratory setting. These assays involve the use of live cells, either in culture or derived from organisms, to investigate various cellular processes, such as cell viability, proliferation, apoptosis, gene expression, protein production, signaling pathways, and drug responses. Cell-based assays provide valuable insights into cellular biology, disease mechanisms, drug discovery, and toxicity testing.

Cell-based assays are crucial in evaluating the toxicity of chemicals, drugs, or environmental agents. Assays like cell viability assays, apoptosis assays, or cell cycle analysis can help assess the adverse effects of compounds on cellular health and function.

Cell-based Assays Market Growth Factors

The global cell-based assays market is expected to witness significant growth during the forecast period owing to the rising focus on drug development globally. Cell-based assays play a critical role in early-stage drug discovery by enabling the evaluation of compound efficacy, toxicity, and safety profiles. The continuous need for new drugs and the expanding pharmaceutical and biotechnology industries fuel the demand for cell-based assays.

Growing emphasis on personalized medicine, rising government investments in research and developments, and expansion of pharmaceutical and biotechnology industries are a few growth factors that collectively contribute to expanding the cell-based assay market. The market is highly competitive, with critical players offering a wide range of products and services, including reagents, assay kits, instruments, and contract research services. Continued innovation, product development, strategic collaborations, and the increasing adoption of cell-based assays across various research fields are expected to drive the growth of the market in the coming years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.78 Billion |

| Market Size by 2034 | USD 41.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | By Type, By Products & Services, By Application, By Technology, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of the chronic disorder

The rising prevalence of chronic disorders acts as a significant driver for the cell-based assays market due to the need for understanding, treatment, and management of these disorders. Chronic disorders such as cardiovascular diseases, diabetes, cancer and neurodegenerative diseases require a deeper understanding of their underlying mechanisms. Cell-based assays provide a precise tool for studying disease pathology, identifying key cellular targets, and investigating disease progression. Cell-based assays allow researchers to mimic disease conditions in vitro and assess cellular responses to various stimuli or treatments. The rising prevalence of chronic disorders fuels the demand for cell-based assays as researchers seek to gain insights into disease mechanisms.

Cell-based assays even play a crucial role in drug discovery and development processes, enabling the screening of compounds, identification of potential drug candidates, and evaluation of their efficacy and safety profiles. With the increasing prevalence of chronic disorders, the demand for cell-based assays in drug discovery rises, as researchers strive to find novel therapeutic options.

Restraints

Restrictions on reagent use

The restrictions on reagent use are projected to hamper the growth of the global cell-based assay market. In addition, the high instrument costs are likely to limit the expansion of the global cell-based assay market during the forecast period. Some cell-based assays require specific reagents, such as antibodies, growth factors, cytokines, or fluorescent dyes, to detect and measure cellular responses. These specialized reagents may be subject to restrictions due to intellectual property rights, licensing agreements, or limited commercial availability. If researchers or assay developers face challenges in accessing these critical reagents, it can impede the progress and adoption of certain cell-based assays.

Opportunities

Deployment of 3D cell culture practices

3D cell culture models provide a more relevant environment. The opportunities for the market are available in leveraging 3D cell culture models to enhance the predictive power and reliability of cell-based assays. 3D cell culture models offer the potential to create disease-specific microenvironments, allowing researchers to study disease mechanisms and develop better models for drug discovery and development. These models can be tailored to replicate specific disease conditions, such as cancer, neurodegenerative disorders, or organ-specific diseases. By integrating 3D cell culture with cell-based assays, researchers can gain insights into disease pathogenesis, identify therapeutic targets, and evaluate personalized treatment strategies.

Product Insights

The assay kits products & services segment is expected to expand at a robust growth rate during the forecast period owing to its utility in numerous biopharmaceutical applications. These kits are used to study various aspects of cellular behavior such as cell cycle progression, migration, and invasion, as well as to determine the content of key cell components that are frequently used to monitor the health of cells in culture and their response to different stimuli.

Technology Insights

Based on the technology, the global cell-based assay market is segmented into automated handling, flow cytometry, label-free detection, high-throughput screening, and others.

The high-throughput screening segment of the technology is predicted to grow at the most significant rate. High throughput screening technology is widely used in drug discovery processes that boost the speed of cellular and biochemical events. High-throughput screening technology offers cost-effective screening approaches. By screening large compound libraries in a single experiment, researchers can optimize resource utilization, including reagents, consumables, and laboratory equipment. High-throughput screening reduces the need for individual compound testing, minimizing costs associated with labor, time, and materials.

Application Insights

The drug discovery segment is expected to dominate the market over the forecast period owing to the increasing investment by biopharmaceutical companies in R&D activities, the increasing number of CROs providing drug discovery services, the introduction of new drugs, rising incidence of chronic diseases, such as cancer, cardiovascular disorders, diabetes, and others is boosting the demand for cell-based assays for the development newer drug discoveries.

Cell-based assays evaluate a drug's effectiveness in a cellular environment, which is important for comprehending how a drug behaves in a biological system and for aligning readouts with a biomarker that can be translated. Several phases of drug development employ cell-based assays. Prior to testing a medication candidate on live animals or in later stages of clinical trials, specific cell-based in vitro experiments must be completed. The biological activity of the test substances naturally becomes the main focus of drug discovery.

Throughout the drug development process, a cell-based assay can also be used to evaluate the "potency" of drug products. For the initial "hit discovery" to find a medicine with verified activity against a biological target, cell-based tests can be performed. Information on complex biology, extensive screening libraries, and cutting-edge drug screening platforms are all necessary for this stage of drug discovery.

End User Insights

The biotechnology and pharmaceutical companies segment held the largest share of the market in 2024; the segment is expected to sustain its dominance during the forecast period. Cell-based assays are commonly used by multiple pharmaceutical companies as well as biotechnology companies. In recent years, the biotechnology and pharmaceutical sectors have witnessed immense growth, a significant factor in the segment's growth.

The contract research organizations (CROs) segment is expected to be the most attractive segment during the forecast period. CROs use cell-based assays for high-throughput screening of small molecule libraries or compound collections. By employing automated systems and robotic platforms, they can test thousands of compounds against specific cellular targets or disease models. Cell-based assays enable efficient and rapid screening, identifying potential drug candidates for further development.

Cell-based assays enable CROs to provide efficient, cost-effective, and high-quality services to their clients, facilitating the advancement of pharmaceutical and biotechnological research.

Cell-based Assays MarketCompanies

- Danaher Corporation

- Lonza Group AG

- Promega Corporation

- F. Hoffmann-La Roche AG

- Charles River Laboratories International, Inc.

- Menarini Silicon Biosystems, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Macrogen Inc

- DiscoverX Corporation

- Corning Inc.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Perkinelmer, Inc.

- Biognosys

- Cell Signaling Technology, Inc.

- Lebermuth, Inc.

- Eurofins DiscoverX Products

- AAT Bioquest, Inc.

- GE Healthcare

- Beckman Coulter,Inc.

Recent Developments

- In February 2021, Selvital announced the launch of its new cell-based assay platform with phenotypic features that could be utilized in drug discovery. The newly launched platform aims to be utilized to analyze compounds with therapeutic potential in various areas such as neuroinflammatory and fibrotic diseases. According to the company, the new platform for cell-based assay will complement the company's drug discovery services along with a new method in an effective and rapid manner.

- In November 2021, a prominent leader in liquid biopsy and other associated services, Menarini Silicon Biosystems announced the launch of its laboratory developed test, Cellsearch in order to assist the enumeration from the whole blood. Along with the commercial launch of the new platform, the company has stated that the platform has achieved certification from the Centers for Medicare and Medicaid Services.

- In August 2022, a globally prominent player in the biotechnology industry, LifeNet Health LifeSciences announced the launch of an advanced cell-based assay service platform. The company has launched the new service under the acquisition activity of IONTOX. The new service associated with cell-based assays offers vitro screening options and alternatives for animal testing in a more effective way.

Segments Covered in the Report:

By Type

- Cell Viability Assay

- Cytotoxicity Assay

- Cell Death Assay

- Cell Proliferation Assay

- Others

By Products & Services

- Reagents

- Assay Kits

- Cell Growth Assays

- Reporter Gene Assays

- Cell Death Assays

- Second Messenger Assays

- Microplates

- Probes & Labels

- Instruments & Software

- Cell Lines

- Primary Cell Lines

- Stem Cell Lines

- Immortalized Cell Lines

By Application

- Basic Research

- Drug Discovery

- Other Applications

By Technology

- Automated Handling

- Flow Cytometry

- Label-free Detection

- High-throughput Screening

- Others

By End-use

- Pharmaceutical and Biotechnology Companies

- Academic & Government Institutes

- Contract Research Organizations

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting