Dental Laboratories Market Size and Forecast 2025 to 2034

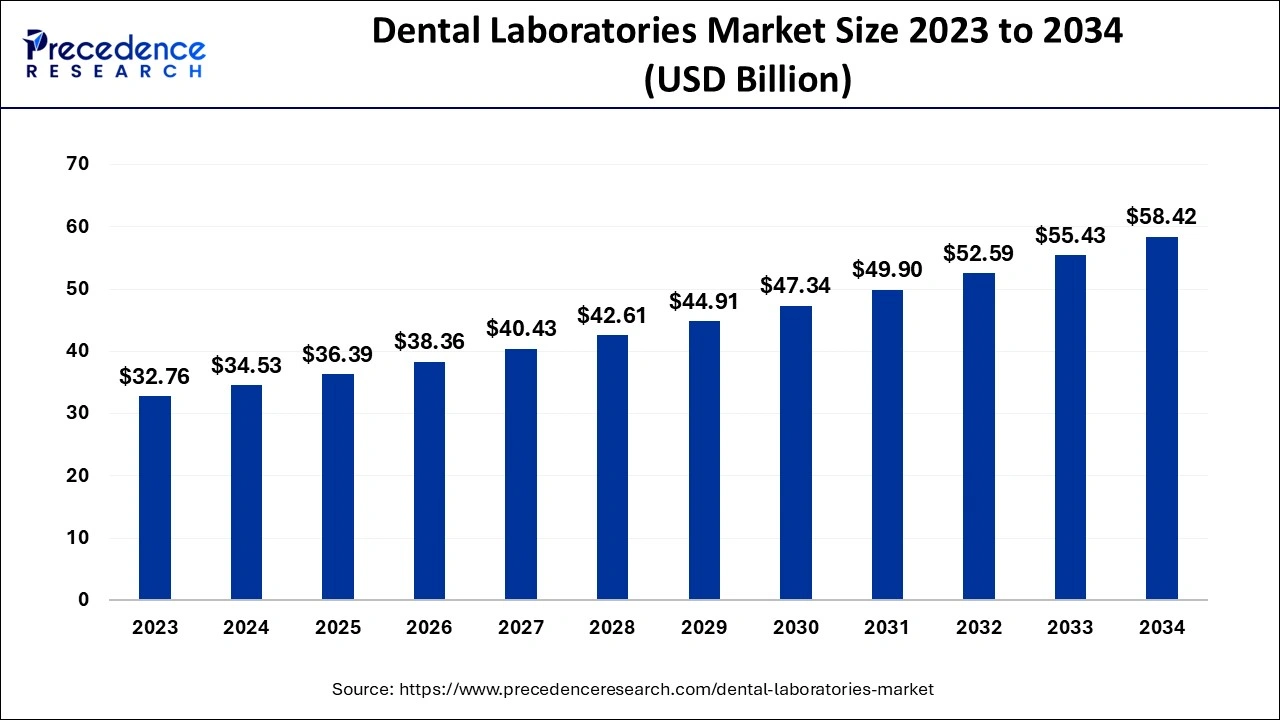

The global dental laboratories market size was estimated at USD 34.53 billion in 2024 and is predicted to increase from USD 36.39 billion in 2025 to approximately USD 58.42billion by 2034, expanding at a CAGR of5.40% from 2025 to 2034.

Dental Laboratories Market Key Takeaways

- In terms of revenue, the global dental laboratories market was valued at USD 34.53 billion in 2024.

- It is projected to reach USD 58.42 billion by 2034.

- The market is expected to grow at a CAGR of 5.40% from 2025 to 2034.

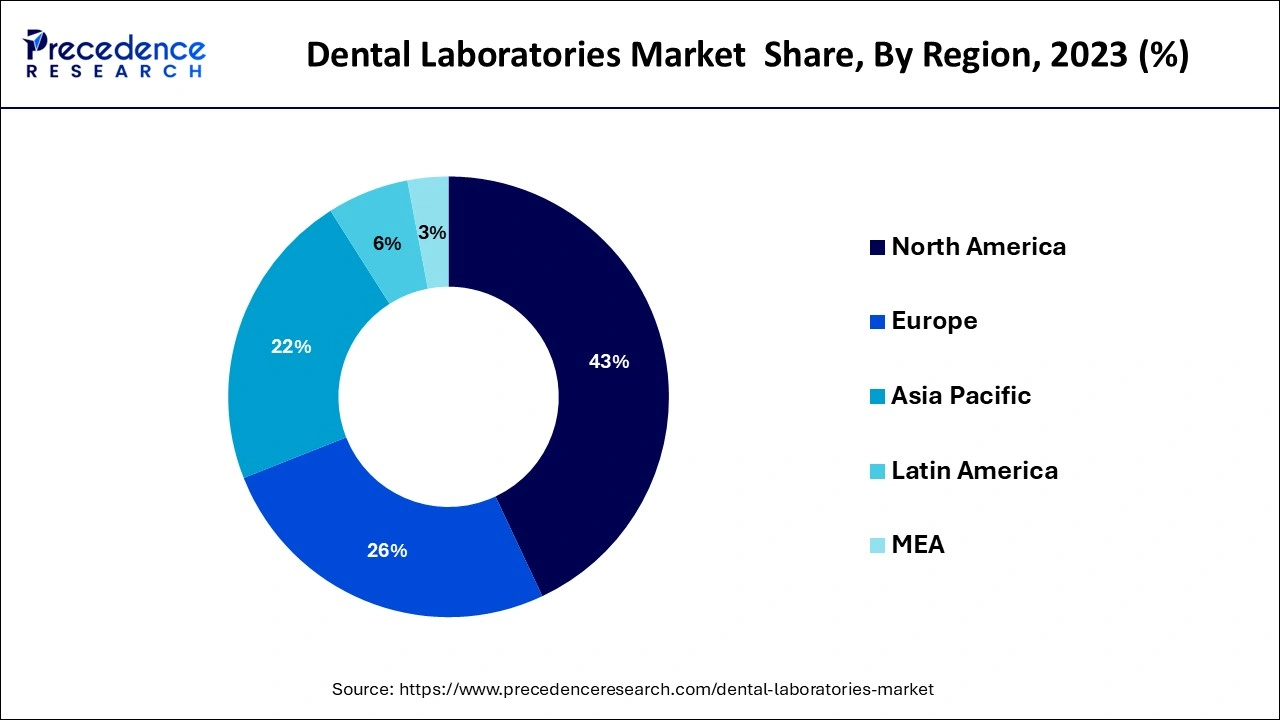

- North America dominated the dental laboratories market with the largest market share of 43% in 2024.

- By product, the oral care segment dominated the market in 2024

- By equipment, the systems and parts segment led the market in 2024.

- By material, the metal ceramics segment dominated the market in 2024

- By prosthetic, the crowns segment led the market in 2024.

U.S. Dental Laboratories Market Size and Growth 2024 to 2034

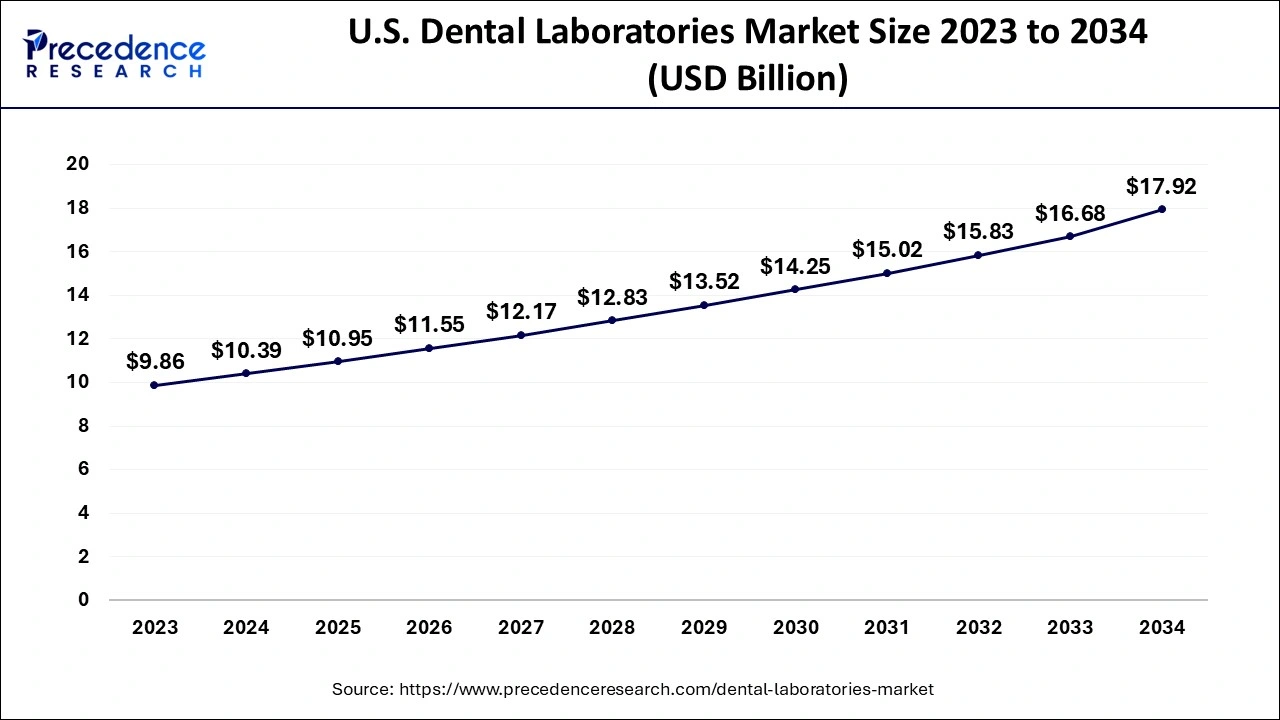

The U.S. dental laboratories market size is evaluated at USD 10.39 billion in 2024 and is predicted to be worth around USD 17.92 billion by 2034, rising at a CAGR of 5.60% from 2025 to 2034.

North America dominated the foam market in 2024, owing to factors such as the stronger insurance coverage and advanced healthcare infrastructure. Furthermore, the regional countries like the United States and Canada have seen under heavy in spending for cosmetic dental care, which has led to regional growth in recent years. Also, having a higher number of dental laboratories and greater infrastructure for dental care, the region is likely to create lucrative opportunities in the upcoming years.

United States

The United States maintained its dominance in the foam market, owing to access to modern dental technology and greater patient awareness in the current period. Moreover, the dental professionals and scientists in the United States have seen under a heavy investment in minimal dental therapies, which can lead the industry growth in the coming years. furthermore, the dental practitioners are also observed in creating collaboration with dental lab practitioners for greater treatment and research in recent years

Asia Pacific

The Asia Pacific region is also expected to have the highest CAGR during the forecast period. The Asia Pacific market is expected to show good growth as there is an aging population, increasing disposable income, and increasing awareness regarding the available treatments and other larger untapped opportunities. Moreover, there is an increasing awareness regarding oral hygiene; this region provides a lower cost of dental laboratory work, which is expected to drive the market during the forecast period.

China

China is expected to capture a major share of the market, akin to Segment Insights, owing to the enlarged and technologically advanced healthcare settings. Also, the country is seen under the heavy healthcare and cosmetic dentistry spending, which can create significant industry opportunities during the forecast period. Also, the factors such as the social media influence and urbanization is likely to contribute heavily to the future industry growth in the region as per the future industry expectations.

Market Overview

Rapid technological advancements in dental laboratories and the use of different types of implant materials have increased the demand for surgeries. Advanced implants with technological developments have led to painless and easy healing procedures. 3D imaging of dental implant bridges or crowns has facilitated the planning of complicated procedures. There are growing investments in equipment and strict regulations for consumer safety in this industry.

The increasing awareness about oral health care amongst the people and the efforts by the government in order to reimburse dental treatment are the major driving factors of the dental laboratories market. Many celebrities and social media influencers have triggered the need for aesthetic appeal in order to have a perfect smile, and many people are seeking orthodontic treatments, which help boost the market.

The rapid growth of the geriatric population has also led to the growth of dental laboratories for many customized solutions. There is an increasing popularity of cosmetic dentistry, which is driving the growth of the dental laboratories market. The designing and manufacturing of various products like caps, bridges, crowns, and all the other essential appliances in order to protect and straighten the teeth are expected to drive the market during the forecast period.

Advanced CAD/CAM systems are utilized for the high-quality development and manufacturing of products used in dentistry clinics; however, only a few laboratories can afford these systems due to their high cost and heavy maintenance. Due to a lack of financial resources, dentists and dental laboratories in poor countries do not prefer to install such high-priced equipment. Due to rising demand, this will be a significant factor slowing the market development.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 34.53 Billion |

| Market Size in 2025 | USD 36.39 Billion |

| Market Size by 2034 | USD 58.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Equipment, Material, Prosthetic Type, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rapid technological advancements in dental laboratories and the use of different types of implant materials have increased the demand for surgeries. Advanced implants with technological developments have led to painless and easy healing procedures. 3D imaging of dental implant bridges or crowns has facilitated the planning of complicated procedures. There are growing investments in equipment and strict regulations for consumer safety in this industry. The increasing awareness about oral health care amongst the people and the efforts by the government in order to reimburse for dental treatment are the major driving factors of the dental laboratories market. Many celebrities and social media influencers have triggered the need for aesthetic appeal in order to have a perfect smile and many people are seeking orthodontic treatments which help to boost the market. The rapid growth of the geriatric population has also led to the growth of dental laboratories for many customized solutions. There is increasing popularity of cosmetic dentistry which is driving the growth of the dental laboratories market. The designing and manufacturing of various products like the caps bridge crowns and all the other essential appliances in order to protect and straighten the teeth are expected to drive the market during the forecast period.

Advanced CAD/CAM systems are utilized for the high-quality development and manufacturing of products used in dentistry clinics; however, only a few laboratories can afford these systems due to their high cost and heavy maintenance. Due to a lack of financial resources, dentists and dental laboratories in poor countries do not prefer to install such high-priced equipment. Due to rising demand, this will be a significant factor slowing the market development.

Cosmetic dentistry is one of the most rapidly increasing areas of the dental profession. With rising disposable earnings, people willing to undergo costly cosmetic operations have increased, especially among elder people. Cosmetic dentistry is becoming more popular in both emerging as well as developed countries, owing to changing lifestyles and a growing emphasis on dental aesthetics. Which is driving up demand for operations like implants, crowns, bonding, bridges, orthodontic therapy, inlays, on-lays, and veneers. This increased demand for cosmetic dentistry operations, with rising disposable incomes, will propel the growth of the dental laboratories industry to new heights in the future years.

Opportunity

The digital dentistry practices and development of personalized prosthetics are likely to create favorable conditions for long-term business planning in the coming years. Also, the dental professionals can benefit from consumer demand, like precision dental restoration and accurate treatment options from this integration. Also, by producing the aligners, crowns, bridges, and crown accommodations to meet customized and personalized patients' needs, the manufacturer is likely to gain major industry share in the coming years.

Restraint

The high cost of equipment and skilled professionals' shortage is likely to prevent firms from capitalizing on emerging opportunities during the forecast period. Also, several dental laboratories are seen struggling to afford CAD/CAM milling systems, software licenses, and 3D printing due to the higher cost in recent years. Furthermore, the shortage of trained dental technicians is another concern facing the dental laboratories in developing countries.

Product Insights

The oral care segment has the largest share about 29% in 2023. It had good revenue till the last year due to increased awareness regarding oral hygiene and adoption of various techniques the market is expected to grow during the forecast period. The restorative segment is also expected to have a good revenue share during the forecast period. There are advanced and improved restorations that are fueling the market growth due to technological advancements in areas like digital radiography, caries diagnosis, CAD/CAM implant dentistry, and intraoral imaging.

Various dental devices are used to treat the misalignment of the teeth. These dental devices are fabricated especially for the treatment of various dental conditions. The use of this device is for the correction of the jaws and the teeth that are positioned improperly are also expected to see a growth during the study period. In the restorative segment, various appliances are used by placing gentle pressure on the jaws and the teeth which are helped to move teeth and retrain the muscles all of these techniques are expected to see good progress during the analysis.

Equipment Insights

The systems and parts segment is expected to have the largest market share, 37.5% in terms of revenue during the forecast period. The systems and parts segment will dominate the market due to various supporting equipment which is required to carry out the dental laboratory procedures. Various equipment is milling equipment, furnaces, scanners, and articulators which are extremely essential for traditional dental technicians.

The dental laser segment is also expected to grow during the forecast period it shall have the fastest CAGR of 8.7% during the forecast period. The dental laser segment is expected to grow due to the use of computers in this industry as computer-aided design, laser sintering, and laser welding. In dental diagnostics and various dental surgical procedures, dental lasers have a wide range of use. The use of dental lasers provides many benefits like regeneration of bones and ligament issues reduced surgery discomforts and minimal bleeding.

Material Insights

Based on materials, the market is categorized into metal-ceramics, traditional all-ceramics, CAD/CAM materials, plastics, and metals. The metal ceramics segment has the highest market share 46% in 2024. Due to its superior biocompatibility as compared to ceramics and other indirect restorative materials, as well as its strength, durability, and resistance to fracture, these qualities make the demand for the metal market sector have a higher market share than ceramics. Moreover, plastic composite dental sets are used in the new age of technology.

The CAD/CAM materials segment is expected to grow at a notable rate during the predicted timeframe because they enable faster, more precise, and highly aesthetic restorations. Unlike traditional manual techniques, CAD/CAM-compatible materials such as zirconia, lithium disilicate, and hybrid ceramics are optimized for digital milling and 3D printing

Prosthetic Type

Based on prosthetic type, the market is categorized into bridges, crowns, veneers, dentures, and clear aligners. The crowns segment has the largest share in the prosthetic type market. Crowns accounted for the market share of around 42% in 2023. The increasing toothless population and increasing geriatric population are increasing the demand for the dental laboratories market.

The clear aligners segment is expected to grow at a notable rate during the predicted timeframe, because of rising patient preference for discreet, comfortable, and non-invasive orthodontic treatment. Unlike traditional metal braces, aligners are nearly invisible and can be removed during eating, offering convenience.

Dental Laboratories Companies

- Envista

- Dentsply Sirona

- A-dec Inc.

- Institut Straumann AG

- GC Corporation

- Mitsui Chemicals, Inc.

- 3M

- Dental Services Group

- Zimmer Biomet

- Ultradent Products, Inc.

- Danaher

Recent Developments

- In 2025, the Amrita School of Dentistry introduced a digital dentistry center. The newly launched center is known as the state-of-the-art digital dentistry center, which includes an advanced CAD/CAM laboratory, as per the published report. (Source: https://www.amrita.edu)

Segments Covered in the Report

By Product

- Restorative

- Orthodontic

- Endodontic

- Oral care

- Implants

By Equipment

- Dental Lasers

- Systems and Parts

- Laboratory Machines

- Dental Radiology Equipment

- 3D Printing Systems

- Milling Equipment

- Furnaces

- Dental Scanners

By Material

- Metal-Ceramics

- Traditional All-Ceramics

- CAD/CAM Materials

- Plastics

- Metals

By Prosthetic Type

- Bridges

- Crowns

- Veneers

- Dentures

- Clear Aligners

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting