What is Infectious Respiratory Disease Diagnostics Market Size?

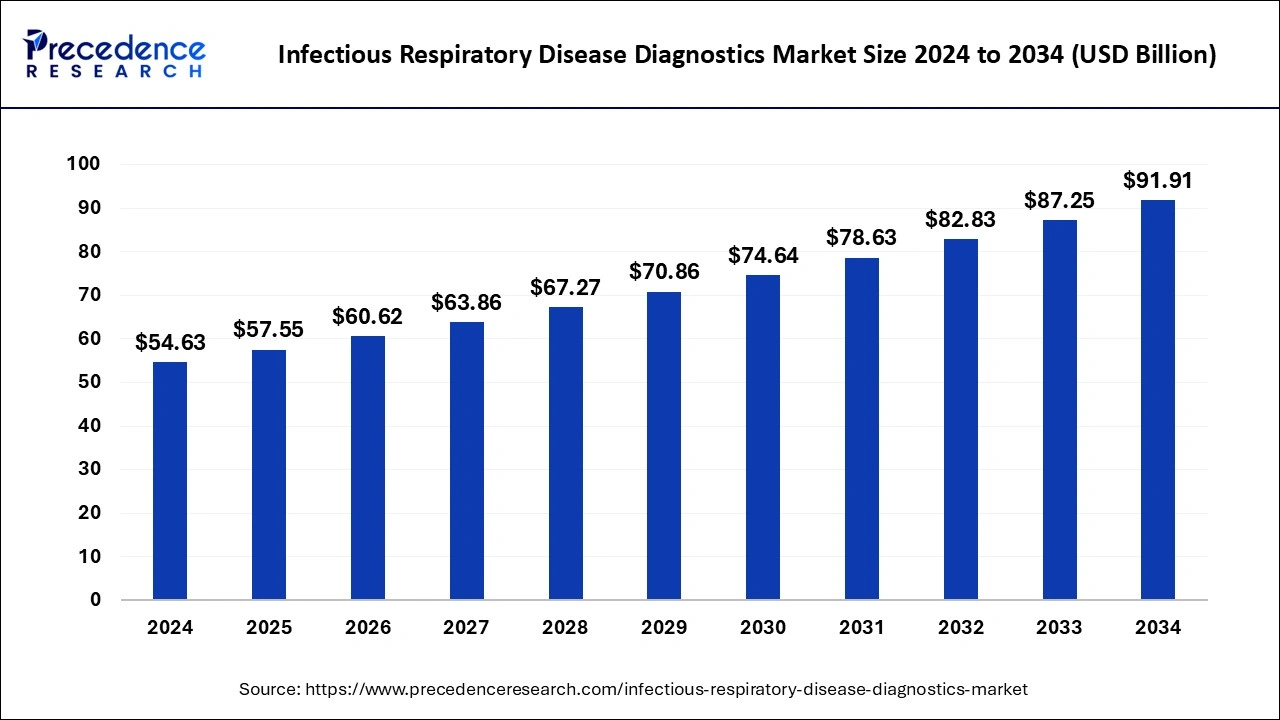

The global infectious respiratory disease diagnostics market size is estimated at USD 57.55 billion in 2025 and is anticipated to reach around USD 91.91 billion by 2034, expanding at a CAGR of 5.34% from 2025 to 2034. The increased adoption of point-of-care testing is the key factor driving growth of the global infectious respiratory disease diagnostics market. The rising government initiatives and funding for infectious disease diagnostics are expected to fuel the market growth in the forecast period.

Market Highlights

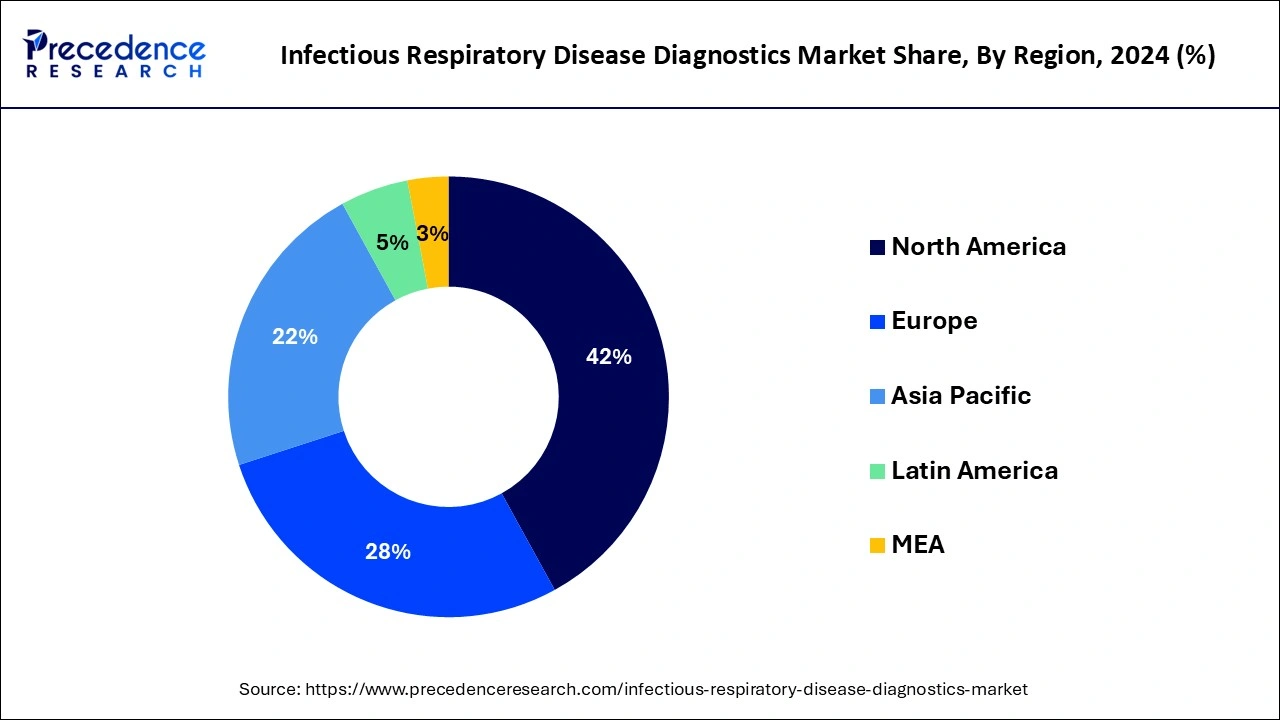

- North America led the global infectious respiratory disease diagnostics market with the largest market share of 42% in 2024.

- By product type, the consumables segment has held a major market share of 64% in 2024.

- By sample type, the nasopharyngeal swabs segment contributed the highest market share of 35% in 2024.

- By sample type, the saliva segment is anticipated to grow at a solid CAGR of 6.22% during the projected period.

- By technology, the molecular diagnostics segment accounted for the biggest market share of 67% in 2024.

- By technology, the immunoassays segment is projected to grow at the fastest CAGR over the projected period.

Market Overview

The infectious respiratory disease diagnostics market operates within the healthcare sector, primarily focusing on the diagnosis and treatment of respiratory infections. This market includes a diverse array of diagnostic techniques, including molecular assays, immunoassays, and imaging methods, all aimed at identifying the causative pathogens behind respiratory ailments, encompassing both viral and bacterial infections.

It plays a pivotal role in early disease detection, guiding effective treatment strategies, and monitoring the prevalence of respiratory diseases, with particular relevance during outbreaks like influenza and the COVID-19 pandemic. The market is characterized by continual technological advancements and a constant emphasis on delivering rapid, accurate, and accessible diagnostic solutions.

Integration of AI in Disease Diagnostics

The leverage of cutting-edge technologies like Artificial Intelligence, Machine Learning, and IoT in the healthcare sector is working to dramatically transform the expenditure. The ability of AI to analyze broad amounts of data & provide early detection of infectious respiratory diseases has generated its popularity in diagnostic applications & devices. Additionally, the requirement of personalized medicines has been a success shot thanks to the AI. The real-time surveillance and outbreak detection ability of AI has been a major reason for its leverage in infectious respiratory disease diagnostics.

Infectious Respiratory Disease Diagnostics Market Growth Factors

- A significant trend within this market is the rapid adoption of molecular diagnostics, notably PCR-based tests. These advanced molecular tests offer exceptional sensitivity and specificity when it comes to identifying respiratory pathogens, providing healthcare professionals with invaluable diagnostic accuracy.

- The infectious respiratory disease diagnostics market thrives on a multitude of driving forces. These include the escalating prevalence of respiratory infections, the indispensable requirement for swift and precise diagnostics during disease outbreaks, and an amplified recognition of the criticality of early disease detection.

- Additionally, the surging global levels of air pollution and lifestyle factors like smoking are substantial contributors to the mounting incidence of respiratory diseases. These factors collectively fuel the demand for respiratory diagnostics, making them pivotal in addressing the healthcare challenges posed by respiratory ailments.

Infectious Respiratory Disease Diagnostics Market Outlook

- Industry Growth Overview: The market is set for strong expansion from 2025 to 2034, fueled by the increasing global incidence of respiratory infections, the demand for rapid diagnostics following COVID-19, and a preference for convenient testing. Technological innovations and government health initiatives also drive market growth.

- Development of Multiplex Testing Panels: A major trend is the development of multiplex testing panels to detect multiple pathogens simultaneously. The expansion of at-home testing solutions that integrate with telehealth platforms is on the rise. CRISPR-based diagnostics also offer a rapid, low-cost testing alternative.

- Global Expansion: The market is expanding worldwide, with significant opportunities in emerging regions. This growth is fueled by increasing healthcare investments and a high burden of infectious diseases. Emerging regions offer immense opportunities due to the rapid expansion of healthcare infrastructure.

- Major Investors: Large corporations such as Abbott Laboratories, F. Hoffmann-La Roche AG, and Thermo Fisher Scientific Inc. are primary investors. Venture capital firms and public-private partnerships also drive investment in cutting-edge diagnostics.

- Startup Ecosystem: The startup ecosystem in the market is emerging, focusing on disruptive innovations. Startups like Sherlock Biosciences are pioneering CRISPR-based diagnostics. Others, such as Haystack Analytics, are developing next-generation analytics and genomic sequencing platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 57.55 Billion |

| Market Size in 2026 | USD 60.62 Billion |

| Market Size by 2034 | USD 91.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.34% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Sample Type, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of respiratory infections and timely outbreak response

The surging prevalence of respiratory infections, including viral and bacterial diseases, significantly surges the demand for diagnostic solutions within the infectious respiratory disease diagnostics market. As the global population faces a heightened risk of respiratory ailments, healthcare providers and individuals increasingly rely on precise and rapid diagnostic tools to identify these infections swiftly. This escalating demand underscores the critical role of diagnostics in timely disease detection, allowing for prompt treatment and containment measures, particularly during outbreaks like influenza and the COVID-19 pandemic.

Moreover, timely outbreak response is a compelling catalyst for surging market demand in the infectious respiratory disease diagnostics market. During infectious disease outbreaks, rapid and accurate diagnostics are paramount to effectively identify and manage cases, contain the spread of pathogens, and safeguard public health. The urgency of outbreak situations underscores the essential role of advanced respiratory diagnostics in providing swift results, guiding treatment decisions, and enabling proactive measures, leading to an increased demand for these diagnostic tools and technologies.

Restraints

Regulatory challenges and resource constraints

Regulatory challenges serve as a significant restraint on the market demand for infectious respiratory disease diagnostics. Stringent regulatory approval processes and compliance requirements can prolong the time it takes to develop and introduce new diagnostic tests and technologies. This delay can impede timely responses to outbreaks and limit the availability of innovative solutions. Moreover, the complexity of navigating regulatory hurdles can deter smaller companies from entering the market, reducing competition and potentially limiting the range of available diagnostic options.

Moreover, resource constraints significantly hinder market demand in the infectious respiratory disease diagnostics market. In resource-limited settings, access to advanced diagnostic technologies and skilled healthcare professionals is limited. This scarcity of resources impedes the widespread adoption of respiratory diagnostics, creating disparities in healthcare delivery. Patients in underserved regions may face delays in diagnosis and treatment, leading to adverse health outcomes and increased disease transmission. Bridging this resource gap is crucial to ensure equitable access to respiratory diagnostics and address the challenges posed by infectious respiratory diseases effectively.

Opportunities

Point-of-care testing and continuous innovation

Point-of-care testing is a pivotal driver of market demand in the infectious respiratory disease diagnostics market. These rapid and on-site diagnostic tests offer the advantage of providing quick and accurate results at the patient's bedside, reducing the time to diagnosis and enabling immediate treatment decisions. This is especially critical during infectious disease outbreaks and in remote or resource-limited settings where access to centralized laboratories is limited.

The convenience and speed of point-of-care testing enhance the adoption of respiratory diagnostics, contributing significantly to market growth. Moreover, continuous innovation serves as a compelling driver for surging market demand within the infectious respiratory disease diagnostics market. Ongoing research and development efforts aimed at enhancing diagnostic technologies, improving sensitivity and specificity, and introducing novel testing methodologies create a climate of constant improvement.

This not only bolsters the accuracy and efficiency of respiratory diagnostics but also fuels healthcare providers' confidence in adopting advanced solutions. As a result, the market experiences a heightened demand for cutting-edge respiratory diagnostic tools, driving growth and improving patient care.

Segment Insights

Sample Type Insights

The nasopharyngeal swabs segment contributed the highest market share of 35% in 2024. Nasopharyngeal swabs, a commonly used sample type in the infectious respiratory disease diagnostics market, involve collecting secretions from the upper part of the throat and nasal passages. Trends indicate a growing preference for this sample type due to its reliability in detecting respiratory pathogens like COVID-19. Additionally, innovations in swab designs and transport media have improved the quality of sample collection and preservation, enhancing diagnostic accuracy. Nasopharyngeal swabs are expected to remain a key sample type in respiratory disease diagnostics, especially during infectious disease outbreaks.

The saliva segment is anticipated to grow at a solid CAGR of 6.22% during the projected period. Saliva samples in the infectious respiratory disease diagnostics market refer to the use of saliva as a non-invasive specimen for detecting respiratory infections. A significant trend is the growing interest in saliva-based tests, especially during the COVID-19 pandemic. Saliva sampling offers advantages like ease of collection, reduced exposure risk for healthcare workers, and suitability for mass testing. Emerging research and diagnostic developments are focusing on optimizing saliva-based assays for respiratory infections, making it a promising and convenient sample type for disease detection.

Technology Insights

The molecular diagnostics segment accounted for the biggest market share of 67% in 2024. Molecular diagnostics, a key technology in the infectious respiratory disease diagnostics market, involves the detection of respiratory pathogens through the analysis of genetic material. This method has witnessed a growing trend towards rapid and highly sensitive Polymerase Chain Reaction (PCR)-based tests, allowing for the swift identification of viral and bacterial infections.

Moreover, advancements in multiplex assays enable the simultaneous detection of multiple pathogens, enhancing diagnostic efficiency. The integration of molecular diagnostics with artificial intelligence for data analysis further refines accuracy, making it a pivotal technology in respiratory disease diagnostics.

The immunoassays segment is projected to grow at the fastest CAGR over the projected period. Immunoassays, a prominent technology in the infectious respiratory disease diagnostics market, are biochemical tests that detect the presence of specific antibodies or antigens in a patient's sample. Recent trends indicate a growing preference for multiplex immunoassays, allowing the simultaneous detection of multiple respiratory pathogens in a single test, improving diagnostic efficiency. Moreover, advancements in assay design, such as lateral flow assays and chemiluminescent immunoassays, enhance sensitivity and reduce turnaround times, aligning with the market's demand for rapid and accurate respiratory disease diagnostics.

Application Insights

The application of COVID-19 diagnostics within the infectious respiratory disease diagnostics market has been transformative. The pandemic led to an unprecedented demand for respiratory diagnostics specifically tailored to detect the SARS-CoV-2 virus. This prompted the development of rapid antigen tests, PCR assays, and serological tests, setting new trends in diagnostic speed and accuracy. The COVID-19 application also drove innovations in remote testing and home-based collection kits, reflecting the market's adaptability to emerging needs during a global health crisis. These trends are reshaping the landscape of infectious respiratory disease diagnostics.

The Influenza segment is anticipated to expand at the fastest rate over the projected period. Influenza, a highly contagious respiratory infection caused by influenza viruses, is a pivotal application area in the infectious respiratory disease diagnostics market. Trends in influenza diagnostics include the development of rapid molecular assays for early detection, a shift towards point-of-care testing to enable quick intervention, and continuous surveillance to monitor influenza strains and predict outbreaks. The market's focus on timely and accurate influenza diagnosis aligns with the broader goal of enhancing public health preparedness in the face of respiratory infectious diseases.

Regional Insights

U.S. Infectious Respiratory Disease Diagnostics Market Size and Growth 2025 to 2034

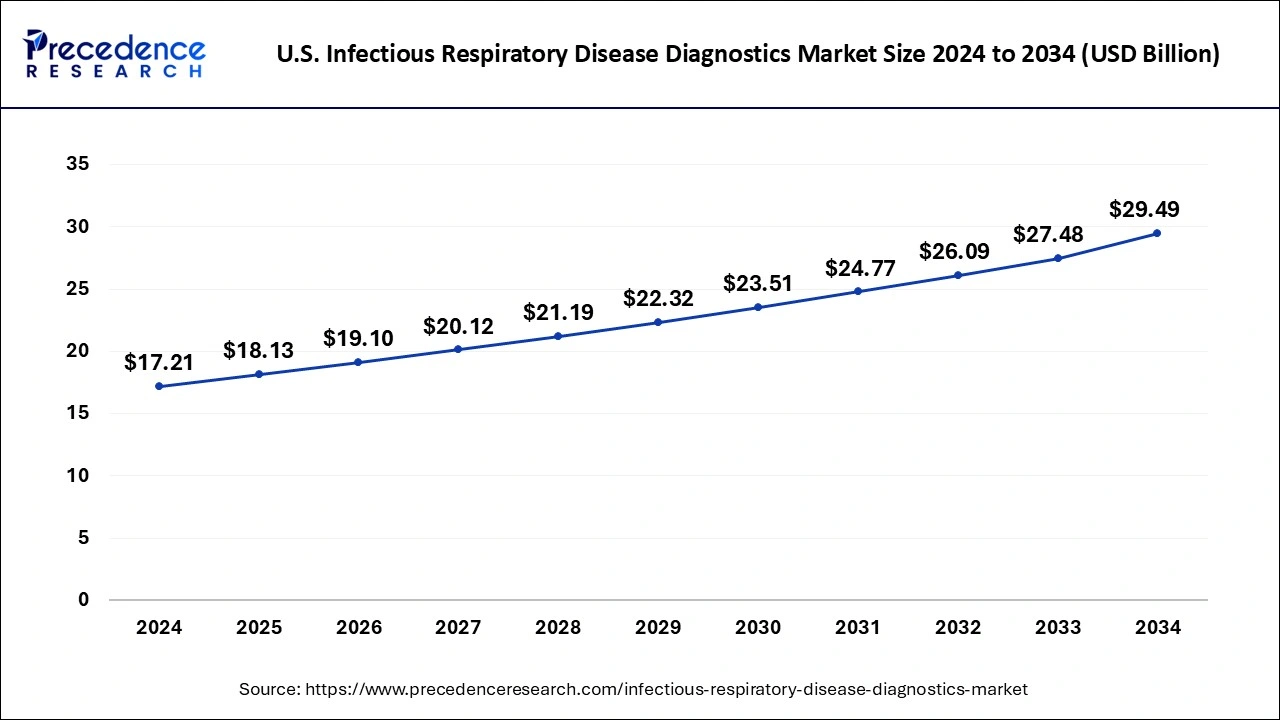

The U.S. infectious respiratory disease diagnostics market size is evaluated at USD 18.13 billion in 2025 and is predicted to be worth around USD 29.49 billion by 2034, rising at a CAGR of 5.53% from 2025 to 2034.

U.S. Infectious Respiratory Disease Diagnostics Market Trends

The U.S. leads the infectious respiratory disease diagnostics market due to its emphasis on technological innovation, advanced R&D, and regulatory leadership. The U.S. excels at developing rapid, sophisticated molecular diagnostics and point-of-care solutions, supported by a strong healthcare infrastructure that enables quick adoption of new testing methods for diseases like COVID-19, influenza, and RSV.

North America led the global infectious respiratory disease diagnostics market with the largest market share of 42% in 2024.The growing preference for multiplex diagnostic tests that can detect multiple pathogens simultaneously is becoming more common in North America. These tests save time, reduce costs, and are more efficient in diagnosing co-infections that can occur with respiratory illnesses like COVID-19, flu, and pneumonia. The growth of personalized medicine is a significant trend in the respiratory disease diagnostics market. Precision medicine involves tailoring healthcare treatments based on individual genetic profiles, and diagnostics play a crucial role in identifying the appropriate treatments. This trend is expected to gain momentum in North America as technologies evolve.

What Makes Asia Pacific the Fastest-Growing Region in the Infectious Respiratory Disease Diagnostics Market?

Asia Pacific is the fastest-growing region in the market, driven by a high disease burden, a large population, and increasing healthcare investments. The region focuses on the rapid adoption of advanced technologies like PCR and point-of-care testing to improve accessibility and accuracy, positioning itself for substantial growth, particularly in key markets like China and India, where affordable diagnostics are a focus, creating substantial demand for effective and accessible testing.

India Infectious Respiratory Disease Diagnostics Market Trends

India is an emerging market, driven by the need to expand accessibility and affordability of diagnostics for its large population. While relying on global technology, India focuses on local innovation, developing cost-effective testing solutions and expanding laboratory infrastructure to address a high burden of respiratory diseases and meet national public health goals.

How is Europe Contributing to the Infectious Respiratory Disease Diagnostics Market?

Europe is growing at a notable rate in the market. The market in Europe is characterized by advanced healthcare infrastructure and high awareness of disease prevention and control. The market is primarily driven by strong public health initiatives, robust focus on rapid, accurate point-of-care testing, and significant R&D in molecular diagnostics. Major players invest heavily in multiplex PCR assays and integrated diagnostic systems to meet stringent quality standards and enhance testing efficiency in clinical settings.

Germany Infectious Respiratory Disease Diagnostics Market Trends

Germany maintains a leading role in the market, fueled by its globally recognized healthcare system and a strong emphasis on top-quality medical engineering and laboratory medicine. The country serves as a hub for R&D in in vitro diagnostics and decentralized testing solutions, with widespread adoption of advanced molecular and immunoassay technologies and the presence of global leaders like QIAGEN. It also demonstrates a commitment to robust public health surveillance and fosters innovation.

How is Latin America Emerging in the Infectious Respiratory Disease Diagnostics Market?

Latin America plays a unique role in the global infectious respiratory disease diagnostics market, fueled by increasing government investments in public health, the expansion of primary care facilities, and growing awareness of communicable diseases. The market is propelled by the growing adoption of rapid diagnostic tests and the expansion of national laboratory networks, with a focus on improving accessibility and reducing the burden on central hospitals, particularly during seasonal outbreaks.

Brazil Infectious Respiratory Disease Diagnostics Market Trends

Brazil is leading the market in Latin America, driven by significant investments in healthcare infrastructure and the need to manage endemic respiratory illnesses and emerging public health crises. A growing focus on surveillance and the use of advanced diagnostics to manage diseases such as tuberculosis and various influenza strains is driving market growth, supported by local initiatives aimed at technological development and disease control.

What Potentiates the Market in the Middle East & Africa?

The infectious respiratory disease diagnostics market in the Middle East & Africa is fueled by rapid improvements in healthcare infrastructure, increasing health expenditure, and a strong emphasis on pandemic preparedness and control. The demand is strong for reliable, rapid diagnostic solutions to manage infectious disease outbreaks, driven by significant investments in smart city projects that integrate robust health surveillance systems.

UAE Infectious Respiratory Disease Diagnostics Market Trends

The UAE plays a vital role in the infectious respiratory disease diagnostics market because of its ambitious technological goals and smart health initiatives. The country is making significant investments in high-speed, futuristic diagnostic labs and advanced health screening programs. As a regional center for technology and innovation, it attracts investment in data centers and state-of-the-art healthcare facilities, speeding up the adoption of innovative diagnostic solutions to protect public health.

Value Chain Analysis

- Research & Development (R&D)

This focuses on developing new diagnostic technologies like PCR, CRISPR, and multiplex panels to detect multiple pathogens quickly.

Key Players: Roche Diagnostics, Abbott, Cepheid, bioMérieux, and Sherlock Biosciences. - Manufacturing and Production

Involves producing assays, kits, reagents, instruments, and consumables like swabs, with recent post-pandemic overcapacity for certain items.

Key Players: Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, and Danaher Corporation. - Clinical Testing and Regulatory Approval

Products require rigorous clinical testing and clearance from regulatory bodies such as the FDA and EMA; accelerated approvals.

Key Players: Abbott Laboratories, Roche Diagnostics, Danaher Corporation, and Thermo Fisher Scientific. - Distribution and Supply Chain Management

Ensures efficient delivery of products to end-users, with supply chains adapting to support new POC, OTC, and telehealth channels.

Key Players: Cardinal Health, McKesson Corporation, Owens & Minor, Henry Schein, and Medline Industries. - Data & Network Integration

An emerging stage leveraging software, informatics, and AI to manage and analyze data for public health surveillance and seamless integration with electronic health records.

Key Players: Oracle Corporation, Microsoft Corporation, and Amazon Web Services.

Infectious Respiratory Disease Diagnostics Market Companies

- Roche: Offers high-throughput cobas systems and rapid cobas Liat for PCR testing.

- Abbott: Leader in rapid POC testing with the instrument-based ID NOW and antigen BinaxNOW tests.

- Thermo Fisher: Provides a wide range of lab instruments and consumables for advanced PCR and sequencing.

- Danaher (Cepheid): Innovator in automated, rapid molecular diagnostics via its GeneXpert systems.

- BD: Focuses on sample collection, lab automation, and scalable molecular diagnostics instruments.

Other Key Players

- Siemens Healthineers AG

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Hologic, Inc.

- Luminex Corporation

- Quidel Corporation

- Meridian Bioscience, Inc.

- BioMérieux SA

- Hain Lifescience GmbH

- GenMark Diagnostics, Inc.

Recent Developments

- In September 2024, Roche introduced its cobas Respiratory flex test, which is the first to use the company's novel and proprietary TAGS (Temperature-Activated Generation of Signal) technology.

- In April 2024, Owlstone Medical, the global leader in Breath Biopsy applications in early disease detection and precision medicine, secured funding of a $5 million equity investment to advance Owlstone's Breath Biopsy platform and $1.5 million in grant funding to develop breath-based diagnostics and identify breath biomarkers for tuberculosis (TB) and HIV from the Bill & Melinda Gates Foundation.

Segments Covered in the Report

By Product Type

- Instruments

- Consumables

- Services

By Sample Type

- Saliva

- Nasopharyngeal Swabs (NPS)

- Anterior Nasal Region

- Blood

- Others

By Application

- COVID-19

- Influenza

- RSV (Respiratory Syncytial Virus)

- Tuberculosis

- Streptococcus Testing

- Other

By Technology

- Immunoassay

- Molecular Diagnostics

- Microbiology

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content