What is the In-vitro Diagnostics Enzymes Market Size?

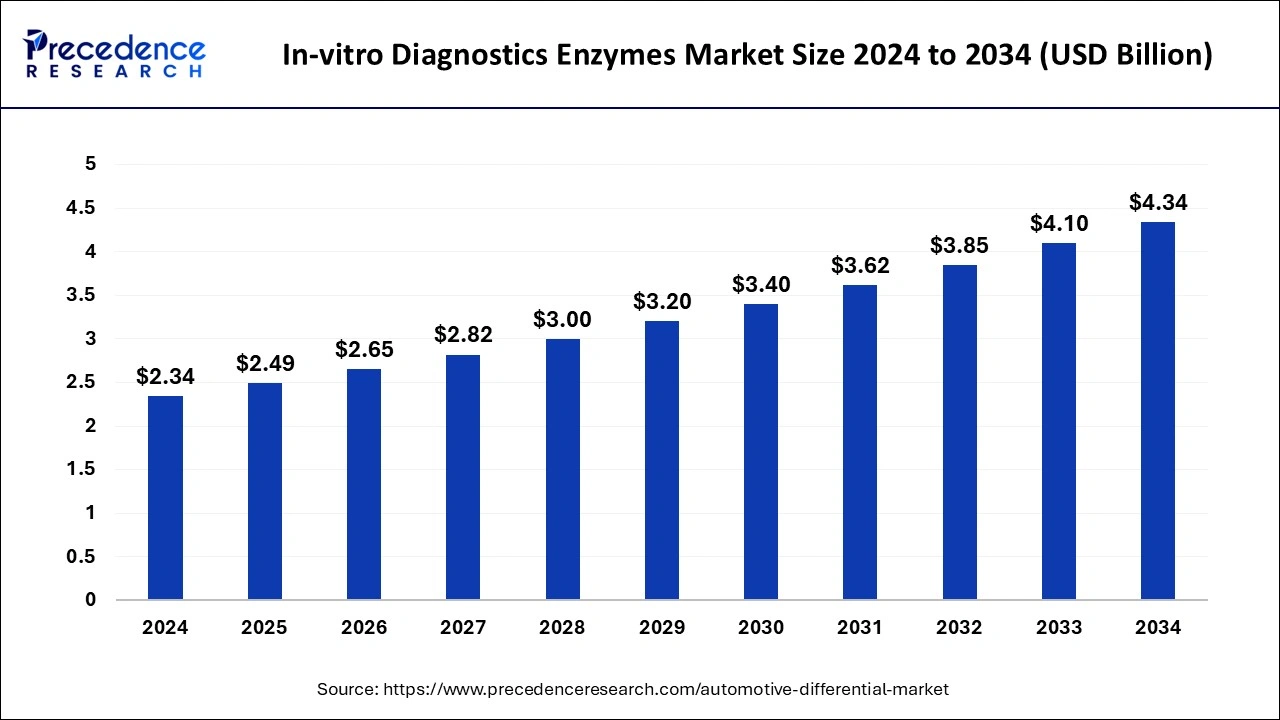

The global in-vitro diagnostics enzymes market size is estimated at USD 2.49 billion in 2025 and is predicted to increase from USD 2.65 billion in 2026 to approximately USD 4.34 billion by 2034, expanding at a CAGR of 6.37% from 2025 to 2034.

In-vitro Diagnostics Enzymes MarketKey Takeaways

- The global in-vitro diagnostics enzymes market was valued at USD 2.34 billion in 2024.

- It is projected to reach USD 4.34 billion by 2034.

- The in-vitro diagnostics enzymes market is expected to grow at a CAGR of 6.37% from 2025 to 2034.

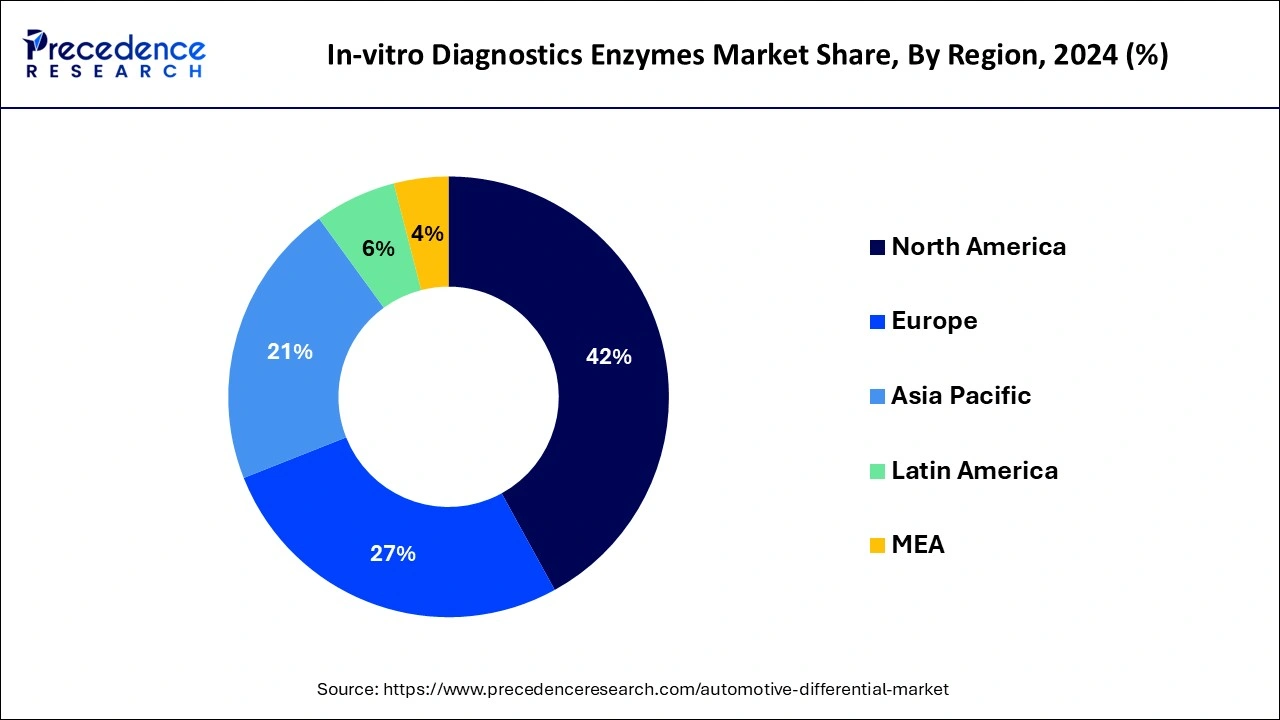

- North America dominated the in-vitro diagnostics enzymes market in 2024 with a revenue share of 42%.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By enzyme type, the polymerase and transcriptase segment has captured a market share of 37% in 2024.

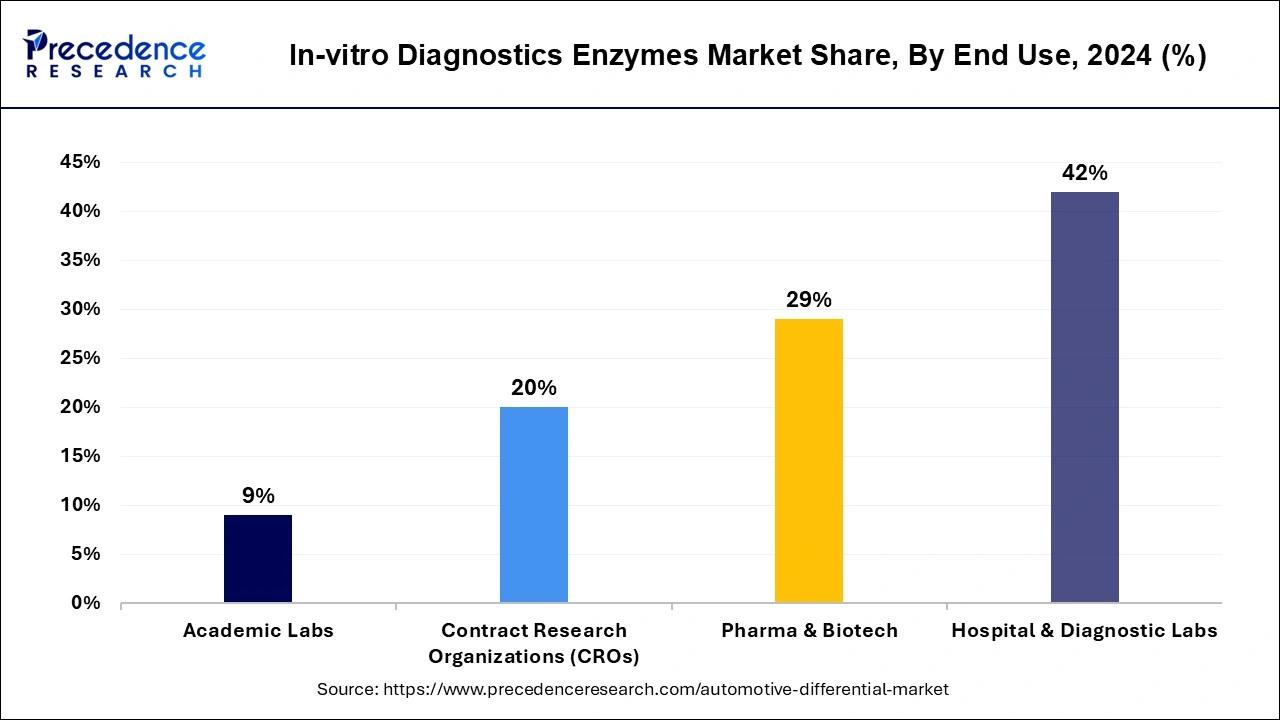

- By end-user, the hospitals and diagnostic segment has held a market share of over 42% in 2024.

- By technology, the histology assays segment has accounted market share of 44% in 2024.

- By disease, the infectious disease segment dominated the market in 2024.

In-Vitro Diagnostics Enzymes Market Outlook

Industry Growth Overview:

Between 2025 and 2034, the IVD enzymes industry is expected to experience rapid growth, as clinical laboratories increasingly adopt enzyme-dependent molecular and immunodiagnostic platforms. The use of point-of-care systems, which rely on enzyme-based signal amplification, is expanding, particularly in emerging economies, further fueling market growth. Overall, the industry is shifting from bulk enzymology toward application-specific formulations for next-generation diagnostic platforms.

Technological Advancements:

Advanced protein engineering platforms are reshaping the market by enabling the development of enzymes with greater sensitivity and enhanced tolerance to extreme conditions like high temperatures or low sample volumes. Molecular tests, including PCR, qPCR, and LAMP, are being quickly scaled up using recombinant systems based on fungal, bacterial, and optimized mammalian expressions. The integration of AI is expected to create new detection capabilities with unmatched accuracy.

Global Expansion:

Global enzyme suppliers are strategically expanding manufacturing footprints to enhance supply chain resilience and reduce production costs for large-scale diagnostic reagent supply. South Korea, China, and India are becoming the new focus for fermentation capacity expansion due to strong biotech clusters and low operating costs. Additionally, Amicogen, Advanced Enzymes Technologies Ltd., and other companies have opened new plants to meet the growing demand for molecular testing consumables worldwide.

Major Investors:

Major investors in the market include global healthcare companies like Thermo Fisher Scientific, Roche, Siemens Healthineers, and Abbott Laboratories. These companies contribute by investing in advanced enzyme-based diagnostic platforms, driving technological innovation, expanding product portfolios, and increasing access to enzyme-driven molecular and immunodiagnostic solutions across both developed and emerging markets.

Innovation Startup Ecosystem:

The IVD enzyme innovation ecosystem is growing rapidly, driven by advances in directed evolution and synthetic biology, which enable tailored catalytic performance. Startups are developing ultra-stabilized enzymes for rapid molecular amplification, enabling faster diagnostics in resource-limited settings. Additionally, smaller companies are developing novel enzymes, such as reverse transcriptases, exonucleases, ligases, and polymerases, to enable high-speed, low-volume applications in microfluidics and handheld diagnostic systems.

Market Overview

The in-vitro diagnostics enzymes market focuses on using enzymes in laboratory tests to detect, measure, and confirm the presence of specific analytes and disease diagnosis and monitoring. The market is continuously growing due to the growing adoption of enzyme-based diagnostic tests in biotechnology. There are new developments and innovations and increasing investments by key players in research & development in biotechnology to develop new products. Technological advancements are also increasing the market opportunities. Companies are developing diagnostic kits, identifying and analyzing spike proteins, and developing new enzyme-based treatment methods.

In-vitro Diagnostics Enzymes MarketGrowth Factors

- Governments around the world are recognizing the importance of diagnostics in healthcare and are providing support in the form of approvals and funding. This not only helps in the development of new diagnostic tools but also encourages companies to innovate and improve their products.

- The COVID-19 pandemic has highlighted the need for rapid and reliable diagnostic tests. Companies are developing novel and rapid diagnostic kits, including those that use enzymes to detect the virus quickly.

- The field of in-vitro diagnostics is constantly evolving, with new technologies and methods being developed. This includes the use of enzymes, which can offer more precise and sensitive diagnostic capabilities. These advancements are driving the growth of the in-vitro diagnostics enzymes market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Market Size in 2025 | USD 2.49 Billion |

| Market Size in 2026 | USD 2.65 Billion |

| Market Size by 2034 | USD 4.34 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Enzyme Type, By Disease Type, By Technology Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The increasing geriatric population and chronic diseases

The increasing number of chronic diseases in the geriatric population is driving the growth of the in-vitro diagnostics enzymes market. The elderly population is more commonly diagnosed with chronic and infectious diseases, and as people age, they are more likely to develop health conditions that require proper regular monitoring and testing. There is a high demand for in-vitro diagnostics enzymes to test these chronic diseases early. The prevalence of chronic diseases will increase more in the future due to changing lifestyles, eating habits, pollution, genetic modification, lack of physical activities, and so on.

Restraint

Government regulations

Government regulations can be a big restraint on the In-vitro diagnostics enzymes market. Many enzymes are difficult to purify or are found in rare species. In many cases, the diagnostic procedures or tests need human-based enzymes, which are produced using recombinant DNA technology in laboratories. All these factors lead to strict government regulations which hinders the processes and takes a lot of time for approval and other formalities.

Opportunity

Technological inventions and increased investments

Advancements in biotechnology and molecular diagnostics are making it easier to use enzymes to detect diseases such as diabetes and cancer. These diseases can be diagnosed more quickly and accurately. Also, the use of AI and automation in diagnostic procedures is making these tests more efficient and reliable. All these advancements are not only improving the quality of diagnostics but also making them more accessible and cost-effective.

The ongoing investments in research and technology are also introducing more effective and automated diagnostic solutions, which is driving the market growth. The combination of new technologies and more investment is creating a lot of opportunities for the In-vitro diagnostics enzymes market.

Enzyme Insights

The polymerase and transcriptase segment dominated the In-vitro diagnostics enzymes market in 2024. Polymerase (PCR) is a laboratory technique to amplify DNA or RNA. The PCR technique is also used in different disciplines, such as medicine and biology, medical diagnostics, molecular biology research, and more. One of the advantages is PCR's high fidelity, which gives precision in detecting mutations or low-abundance genes. Enzymes like DNA polymerase, RNA polymerase, ligase, and reverse transcriptase are involved in the PCR technique, which increases market growth.

The proteases segment is expected to grow at a CAGR of 8.1% during the forecast period. This is because proteases are super helpful in breaking down proteins, which is a key step in many diagnostic tests. Proteases are needed during enzyme-linked immunosorbent assay testing, amino acid detection, protein sequencing, and many other processes.

Disease Insights

The infectious disease segment dominated the in-vitro diagnostics enzymes market in 2024. Infectious diseases are disorders spread by bacteria, fungi, viruses, and parasites. They can be passed from one person to another or spread by eating contaminated food, water, or soil. HIV, flu, strep throat, measles, and COVID-19 are examples of infectious diseases. These diseases are growing, and in-vitro diagnostics enzymes are needed to test them, which leads to market growth.

The oncology segment is expected to grow in the in-vitro diagnostics enzymes market during the forecast period. Oncology focuses on cancer diagnosis, treatment, and prevention. In-vitro diagnostics enzymes are used to diagnose cancer. Cancer has become one of the major causes of death across the world and needs continuous attention from researchers and healthcare professionals. Many tests, including PCR, ELISA, RNA sequencing, and DNA sequencing, are done in oncology, which need enzymes.

Technology Insights

The histology assays segment dominated the in-vitro diagnostics enzymes market in 2024. Histology assays help in medical diagnosis. This technology allows the visualization of tissue structure and characteristic changes. This technology enhances processes and provides effective patient outcomes. This technique improves workflow, such as remote access and flexible work schedules, and also reduces time, which means providing fast access to samples. Due to these benefits, this segment is significantly growing in the market.

The molecular diagnostics segment is expected to grow in the in-vitro diagnostics enzymes market during the forecast period. This technique allows for the early detection of any disease. Molecular diagnostics are used in fields such as infectious disease, cancer, and congenital abnormalities. This molecular diagnostic takes less time, and molecular laboratories can efficiently purify nucleic acid for testing. This technology is growing continuously.

End-user Insights

The hospitals and diagnostic segment dominated the in-vitro diagnostics enzymes market in 2024 with a revenue share of 42%. It involves biotech companies, pharma, hospitals, diagnostic labs, contract research organizations, and others. The in-vitro diagnostic enzymes are used in a wide range of diagnostic tests such as tissue analyses, blood test, and molecular diagnostics. Increasing infectious and chronic disease needs advanced diagnostic abilities. Pharma and biotech companies rely heavily on these enzymes. Pharmaceutical companies are responsible for large scale production of these enzymes while biotechnology field is the most prominent field which uses the enzymes.

The academic segment is expected to grow at a CAGR of 9% during the forecast period. This includes research institutes, small diagnostic centers, and government agencies that use IVD enzymes for testing and a variety of purposes. The use of enzymes in these small diagnostic centers and research institutes is increasing, which leads to market growth.

Regional Analysis

North America dominated the in-vitro diagnostics enzymes market in 2025

North America dominated the in-vitro diagnostics enzymes market in 2025 due to a robust healthcare system that supports the development and use of in-vitro diagnostics. This includes hospitals, labs, and other healthcare facilities that are well-equipped to handle diagnostic procedures. North America also has technological advancements in in-vitro diagnostics. This includes the development of new diagnostic kits and systems that are improving the accuracy and efficiency of disease detection; there's a growing awareness about the importance of early detection of diseases, especially viral diseases like COVID-19. This awareness is driving the demand for in-vitro diagnostics.

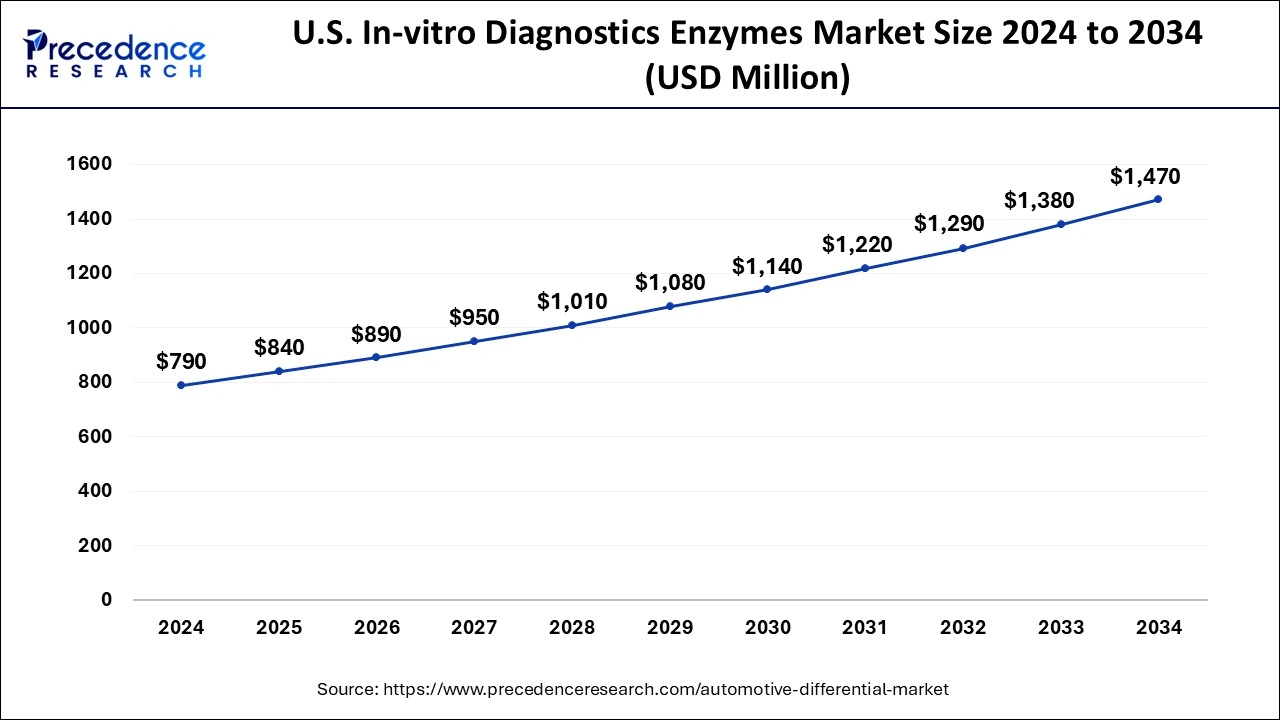

U.S. In-Vitro Diagnostics Enzymes Market Analysis

The U.S. in-vitro diagnostics enzymes market size is estimated at USD 840 million in 2025 and is projected to surpass around USD 1,470 million by 2034 at a CAGR of 6.41% from 2025 to 2034.

The U.S. is a major contributor to the in-vitro diagnostics enzymes market due to its strong healthcare infrastructure, advanced research capabilities, and high demand for diagnostic solutions. Leading companies like Thermo Fisher Scientific, Abbott Laboratories, and Roche have established significant operations in the U.S., driving innovation and adoption of enzyme-based diagnostics. Additionally, the country's focus on personalized medicine, precision diagnostics, and large-scale healthcare networks fuels the continued growth of the IVD enzyme market.

What Potentiates the Growth of the In-Vitro Diagnostics Enzymes Market in Asia Pacific?

Asia Pacific is expected to grow during the forecast period because of the increasing prevalence of chronic diseases, the growing demand for early and accurate diagnosis, and the rise in healthcare expenditure. Countries like China, Japan, and India are particularly notable for their contributions to the market's growth. These countries have large populations and are experiencing a significant increase in the incidence of chronic diseases, creating a huge demand for diagnostic tests. In the Asia Pacific region, Japan holds the largest share of the market due to the adoption of advanced technology and increased chronic conditions, which leads to market growth.

China In-Vitro Diagnostics Enzymes Market Analysis

China holds the largest share of the market in Asia Pacific, fueled by its strong biomanufacturing industry and rapid growth in homegrown diagnostic kit production. Heavy investment in regional biotech parks supports high levels of manufacturing and research, while the expanding export market enhances China's strategic role as a primary supplier of enzymes across the region. China's increasing focus on self-sufficiency in diagnostic kit production is driving a surge in demand for IVD enzymes, with domestic manufacturers scaling up production to meet both local and international needs.

Why is Europe Considered a Significant Region in the Market?

Europe is expected to grow significantly in the coming period due to strict diagnostic quality standards and increasing adoption of engineered enzymes in molecular and immunodiagnostic workflows. The region's strong focus on accurate diagnostics and early disease detection likely accelerates demand for high-performance polymerases and detection enzymes. Additionally, expanded clinical validation programs for oncology and infectious disease panels are predicted to boost enzyme adoption. Moreover, the regional market growth is likely to be sustained by the introduction of CE-marked IVD platforms in emerging Eastern European markets.

Germany In-Vitro Diagnostics Enzymes Market Analysis

Germany leads the European market because of its strong industrial cluster focused on enzyme engineering and high-precision bioprocessing. Local diagnostic companies and OEM suppliers also rely on high-quality enzymes for PCR kits, immunoassays, and clinical chemistry analyzers. Furthermore, Germany has opportunities to strengthen its control over the European market through export-focused production.

What Factors Support the Growth of the Market in Latin America?

Latin America is expected to experience steady growth driven by rising use of enzyme-based diagnostics in national health programs. Increased investment in diagnostic facilities, especially in metropolitan medical centers, is likely to improve enzyme utilization in clinical chemistry instruments and molecular platforms. Higher demand for point-of-care diagnostics in remote areas is expected to further penetrate the market.

Brazil In-Vitro Diagnostics Enzymes Market Analysis

Brazil leads the Latin American market due to the growing use of enzyme-based molecular diagnostics in both public and private healthcare. Universities and research institutions in the country are increasingly partnering with international biotech companies to develop enzyme-optimized tests. Modernization trends in the diagnostic sectors of urban hospitals are likely to continue to grow.

How is the Opportunistic Rise of the Middle East and Africa in the In-Vitro Diagnostics Enzymes Market?

The Middle East and Africa (MEA) region offers substantial growth opportunities in the market, fueled by increasing adoption of molecular and immunodiagnostic technologies in leading healthcare centers. Investments in high-tech hospital laboratories in countries such as Saudi Arabia, the UAE, and South Africa are driving demand for enzyme-based diagnostics. Additionally, the growing emphasis on rapid diagnostics in underserved areas is expected to further support the use of enzymes in decentralized, smaller-scale testing applications.

Saudi Arabia In-Vitro Diagnostics Enzymes Market Analysis

Saudi Arabia leads the market in the Middle East and Africa, driven by its advanced hospital laboratories and rapid adoption of high-complexity diagnostic technologies. National healthcare transformation programs are expected to expand molecular testing capabilities, supported by enzyme-based amplification systems. Additionally, increased distribution partnerships with international diagnostic manufacturers are improving access to high-quality enzyme preparations across the country.

In-Vitro Diagnostics Enzymes Market Value Chain Analysis

Raw Material Sourcing

The value chain begins with sourcing high-grade biological raw materials, including microbial strains, recombinant DNA constructs, fermentation media, stabilizers, and purification reagents required for enzyme production. These materials determine enzyme purity, activity, and diagnostic reliability.

Key Players: Merck KGaA, American Laboratories, Amano Enzyme Inc., Advanced Enzymes Technologies Ltd.

Enzyme Development & Fermentation

Selected microbial or recombinant hosts undergo controlled fermentation and bioprocessing to produce diagnostic enzymes with high activity and batch consistency. This stage includes strain engineering, expression optimization, and early-stage scaling.

Key Players: Dyadic International, Codexis Inc., Amicogen, Biocatalysts Ltd.

Purification & Formulation

Crude enzyme extracts are purified using chromatographic and filtration techniques, then formulated into stable, assay-ready products with required buffers, stabilizers, and preservative systems to maintain activity under diagnostic assay conditions.

Key Players: Biocatalysts Ltd., Amano Enzyme Inc., American Laboratories, Merck KGaA.

Diagnostic Kit Integration

Purified enzymes are incorporated into IVD kits, including PCR assays, immunoassays, clinical chemistry reagents, point-of-care test strips, and biosensors. This stage involves strict quality control, activity validation, and functional testing within diagnostic workflows.

Key Players: F. Hoffmann-La Roche Ltd., BBI Solutions, Affymetrix (Thermo Fisher Scientific), Merck KGaA.

Packaging & Regulatory Compliance

IVD enzymes and kits undergo final packaging with labeling, stability documentation, and lot-release certifications. Although avoiding WHO/CDC/NIH-type agencies in your sources, companies still align with IVD regulatory standards (ISO 13485, CLSI specifications, CE Mark compliance).

Key Players: Roche Diagnostics, BBI Solutions, Merck KGaA.

Distribution to Diagnostics Manufacturers & Clinical Labs

Finished enzyme products and ready-to-use diagnostic kits are supplied to global diagnostics companies, clinical laboratories, point-of-care device manufacturers, and biotech developers. Efficient distribution ensures temperature-controlled logistics and reliable global supply.

Key Players: Roche Diagnostics, Merck KGaA, Thermo Fisher (via Affymetrix), BBI Solutions.

In-vitro Diagnostics Enzymes Market Companies

- Biocatalysts Ltd. (UK)

A specialist in custom enzyme development, Biocatalysts provides tailored diagnostic-grade enzymes optimized for assay performance and stability. - Amicogen (South Korea)

Amicogen supplies high-purity recombinant enzymes widely used in diagnostic kits, molecular assays, and bioprocess applications. - Dyadic International (U.S.)

Dyadic leverages its C1 fungal expression platform to produce cost-efficient, high-yield recombinant enzymes for diagnostics and biotechnology. - BBI Solutions (UK)

BBI Solutions offers a comprehensive portfolio of diagnostic enzymes, such as glucose oxidase and alkaline phosphatase, used in clinical assays and point-of-care tests. - Affymetrix (U.S.)

Now part of Thermo Fisher Scientific, Affymetrix supports the diagnostics sector with enzyme-driven genomic and microarray technologies for molecular testing. - American Laboratories (U.S.)

American Laboratories provides specialty biological enzymes and proteins essential for the development of immunodiagnostic and clinical chemistry assays. - Merck KGaA (Germany)

Merck delivers high-purity enzymes for PCR, molecular diagnostics, and biochemical assays through its extensive life-science solutions portfolio. - Codexis, Inc. (U.S.)

Codexis develops engineered high-performance enzymes using its CodeEvolver platform to enhance diagnostic assay precision and efficiency. - F. Hoffmann-La Roche Ltd. (Switzerland)

Roche supplies assay-critical enzymes integrated into its clinical diagnostics systems, molecular platforms, and reagent kits. - Amano Enzyme Inc. (Japan)

Amano Enzyme manufactures specialty microbial enzymes used in biochemical assays, clinical analyzers, and diagnostic reagent formulations. - Advanced Enzymes Technologies Ltd. (India)

Advanced Enzymes provides a range of microbial and recombinant enzymes utilized in diagnostic industries for substrate breakdown and signal generation.

Recent Developments

- In June 2023, GenWorks Health, a Bengaluru-based startup, launched an IVD test for malaria and dengue. This test includes rapid card test kits.

- In September 2023, NeoDX Biotech lab launched an IVD kit for detecting autoimmune disorders. It's a real-time PCR- a technology-based kit to improve healthcare service and enhance testing abilities.

Segments Covered in the Report

By Enzyme Type

- Proteases

- Polymerase & Transcriptase

- Ribonuclease

- Others

BY Disease Type

- Infectious Disease

- COVID-19 Testing

- Hepatitis

- HIV

- Others

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune diseases

- Others

By Technology Type

- Histology Assays

- Molecular Diagnostics

- PCR Assays

- NGS Assays

- Others

- Clinical Chemistry

By End-use

- Pharma & Biotech

- Hospital & Diagnostic Labs

- Contract Research Organizations (CROs)

- Academic Labs

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting