What is the Protein Sequencing Market Size?

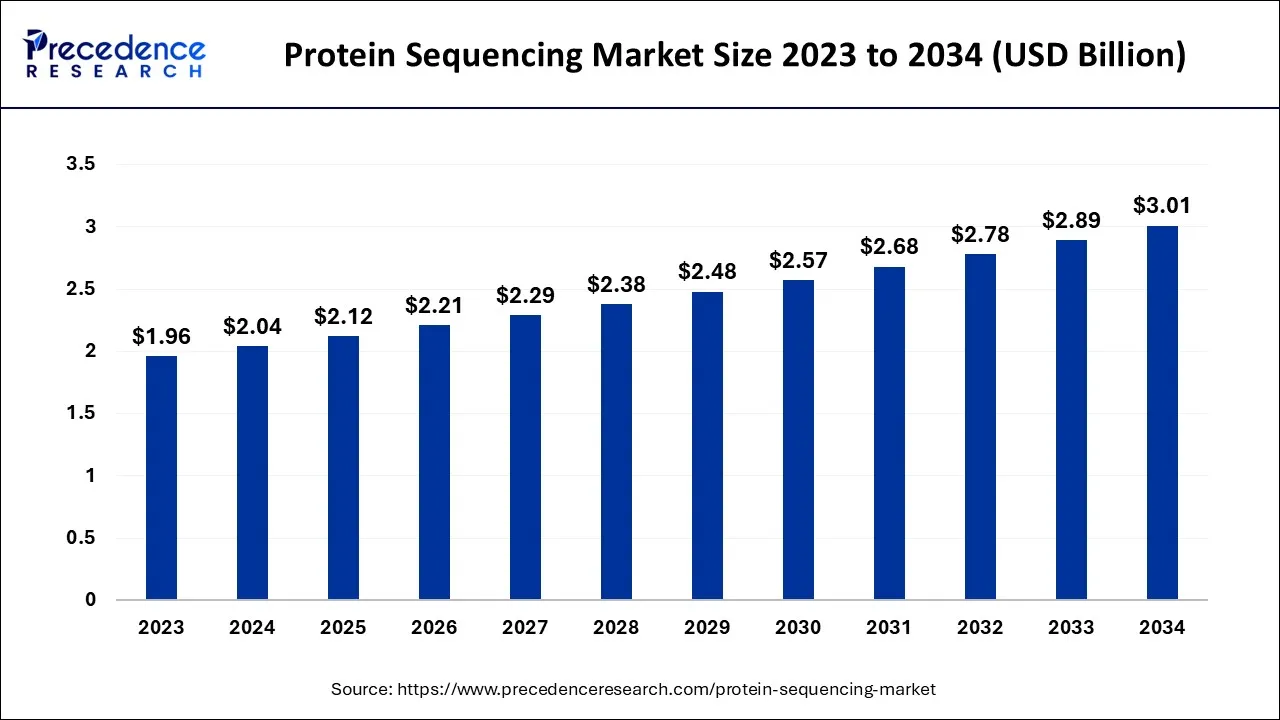

The global protein sequencing market size is expected to be valued at USD 2.12 billion in 2025 and is predicted to increase from USD 2.21 billion in 2026 to approximately USD 3.94 billion by 2035, expanding at a CAGR of 3.97% over the forecast period 2026 to 2035.

Protein Sequencing Market Key Takeaways

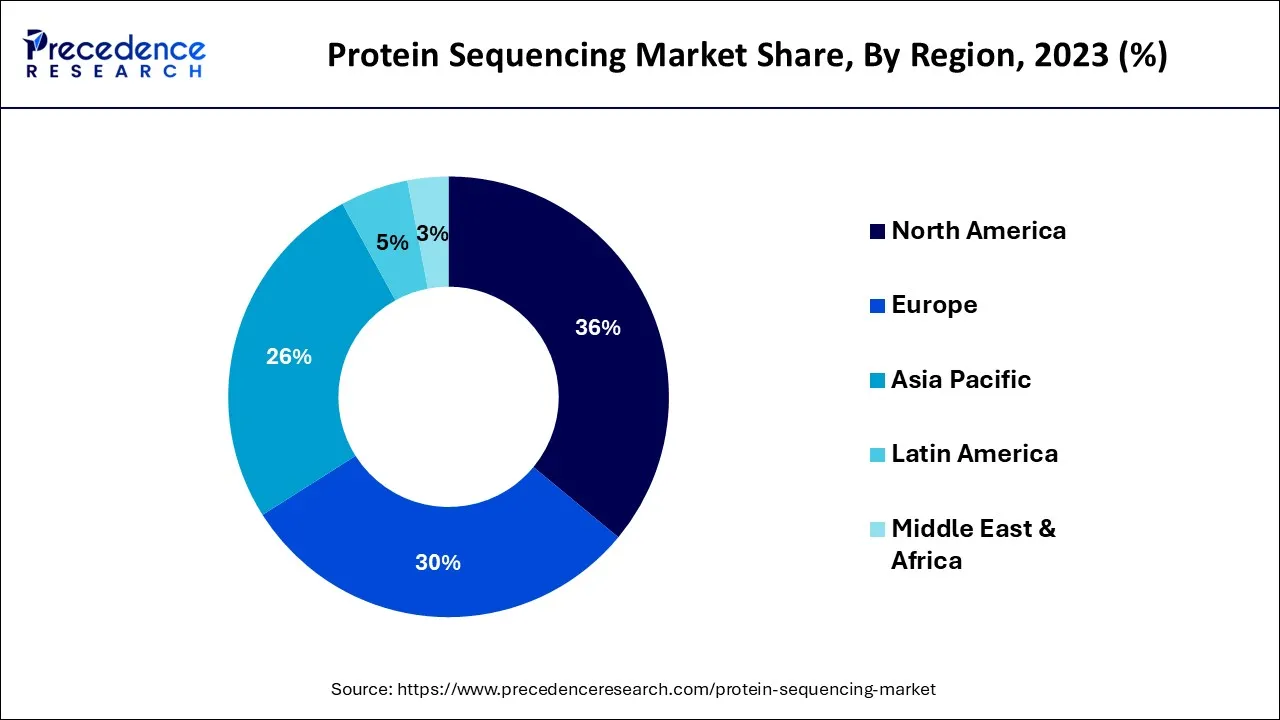

- North America led the global market with the highest market share of 36% in 2025.

- By products and services, the segment of protein sequencing products was the market leader in 2025, with a market share of more than 81%.

- By application, the biotherapeutics market had the greatest market share of around 56% in 2025. This can be ascribed to pharmaceutical corporations' growing involvement in the creation of biotherapeutics.

- By end-use, the academic institutes and research centers segment generated more than 46% of revenue share in 2025 and the pharmaceutical and biotechnology firms' segment will likely develop at the fastest rate during the forecast period.

Protein Sequencing Technology: Advancing Molecular Insight for Diagnostics, Drug Discovery, and Precision Medicine

Protein sequencing is a systematic method of determining a protein or peptide's sequence of amino acids in its entirety or part. This might assist in determining the identity of the protein or characterize any post-translational changes it has undergone. A protein can typically be identified using databases of protein sequences created from the conceptual translation of genes using only partial sequencing of the protein (one or more sequence tags). Edman degradation and Mass spectrometry utilizing a protein sequencer are the primary direct protein sequencing methods.

Scientists and academic institutions are delving into the world of proteins, which are big, complex molecules necessary for the structure, function, and control of organs and tissues in the body, to completely comprehend the molecular foundations of health and disease and modify sequencing techniques.

For instance, in 2022, scientist's team at Arizona State University's Biodesign Center for Molecular Design and Biomimetics worked on an ambitious project to create new techniques for sequencing individual protein molecules quickly, precisely, and precisely inexpensively.

This type of single-molecule protein sequencing can transform diagnostic medicine by identifying cancer protein biomarkers and other lethal diseases, enabling earlier and more precise diagnoses, and expanding the understanding of the functions of healthy cells.

Similarly, the University of Texas researchers developed tools like DNA sequencing to comprehend proteins. Fluorosequencing is a patented process that provides thorough and quick information about thousands of proteins. To market their invention, the technology's creators established a new firm called Erisyion Inc. Applications of the technology comprises Parkinson's disease diagnosis and detection, immuno oncology treatment protein identification for immune-oncology, drug development, camouflage system detection, and industrial biology.

How is AI Impacting the Protein Sequencing Market?

Artificial intelligence (AI) is transforming the protein sequencing market by significantly improving data analysis speed, accuracy, and overall efficiency. AI-based algorithms are widely used to interpret complex mass spectrometry data, enabling faster peptide identification and more precise protein characterization. These tools also help correct errors, identify post-translational modifications, and predict protein structures, enhancing the reliability of sequencing results.

Beyond analysis, AI plays a key role in drug discovery and precision medicine by mining proteomics data alongside genomics and clinical datasets to uncover new biomarkers and therapeutic targets. Additionally, AI supports workflow optimization by improving sample preparation, result validation, throughput, and cost efficiency, making protein sequencing more scalable and commercially viable.

Protein Sequencing Market Growth Factors

The growth of the protein sequencing market will likely be supported by strategic measures taken by academic institutions to alter protein sequencing methods. Due to progress in biomedical research and rapidly expanding R&D activities that enable protein expression, the global industry is growing. Discovering biomarkers for diagnosing diseases such as cancer is made simpler by protein sequencing, and additionally, it deepens the understanding of how healthy cells function.

The protein sequencing industry is primarily driven by the biotechnology and pharmaceutical industries' growing focus on target-based drug development initiatives in various developed and emerging markets. Recent developments in de novo peptide-sequencing techniques and analytical procedures have created new business opportunities with the use of neural networks. One example is the development of mass spectrometer technology. Furthermore, improvements in single-molecule fluorescent devices and nanopore sensors allow for detecting certain peptide residues. Proteomics research funding is increasing in developed and developing countries, helping the market grow. The market for protein sequencing is expanding rapidly due to the increase in demand for protein biomarkers in the drug development process.

Protein sequencing will likely increase as recombinant antibodies are increasingly used to treat cancer, rheumatoid arthritis, and other pathological illnesses. Since personalized medicine and vaccination are new applications in the industry, the rising demand for these services will likely be crucial in the market's growth.

Protein Sequencing Market Outlook

- Industry Growth Overview: The protein sequencing market is growing steadily due to the increasing demand for proteomics in drug discovery, biomarker identification, and precision medicine. The use of mass spectrometry, bioinformatics, and high-throughput sequencing technologies is also driving the market.

- Global Expansion: The market is growing worldwide due to increasing demand for precision medicine, biomarker discovery, and advanced proteomics research, supported by technological advancements such as mass spectrometry and AI-driven data analysis. Emerging regions offer strong opportunities through expanding biotech research, rising healthcare investments, growing pharmaceutical manufacturing, and improving research infrastructure, particularly in Asia-Pacific, Latin America, and the Middle East.

- Major Investors: Major investors include Thermo Fisher Scientific and Bruker Corporation, which are interested in advanced mass spectrometry platforms and proteomics solutions. Still, Agilent Technologies and Danaher Corporation are also working on an integrated protein analysis and sequencing workflow.

- Startup Ecosystem: Quantum-Si and Nautilus Biotechnology are startups that are building next-generation, label-free, and single-molecule protein sequencing technologies. The data analysis powered by AI is used by other emerging companies to enhance the scalability and accuracy of sequencing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.12 Billion |

| Market Size in 2026 | USD 2.21 Billion |

| Market Size by 2035 | USD 3.94 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.97% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product & Service, By Application and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing emphasis on target-based drug development

The market is driven primarily by biotechnology and pharmaceutical businesses in developing and established countries, focusing on target-based drug development activities. However, De novo peptide sequencing technologies and analytical approaches using neural network models have recently developed new business potential. A prime example is the advancement of the mass spectrometer.

Increase in funding for proteomics research

A significant driver of the market growth for academic institutions and research centers is a boost in funding for proteomics research from both public and private institutions. Because they lack the necessary infrastructure, have few samples, and cannot buy necessary protein sequencing supplies, these institutions rely on protein sequencing businesses for proteomic analysis.

Restraint

High infrastructure and equipment costs

The high cost of equipment and infrastructure, including mass spectrometers, may be a barrier to the market's expansion. The need for more suitable technological know-how and laboratory infrastructure in various regions can also hinder the market's growth. Mass spectrometry is a strong technique for protein sequencing. However, it needs specialized and costly equipment and experienced personnel to run and maintain it. This can make it challenging for smaller enterprises or research organizations with limited resources to penetrate and thrive in the market. Other expenditures related to protein sequencing, like reagents and consumables, are additional to the cost of the equipment. These expenses can quickly build up, especially when performing sophisticated experiments or sequencing many proteins.

Opportunities

Rising research and development activities across the globe

The protein engineering sector is expected to grow in the market due to increased protein engineering research activities and funding for producing various protein-based products. The government's increased assistance for establishing innovative sequencing infrastructure in research institutions and businesses' rising R&D expenditures are contributing to the expansion of the protein sequencing market. Proteomic research receives more governmental and private funding, contributing to the market's growth.

For example, the National Institute of General Medical Sciences granted the Upstate Medical University professor more than USD 1.5 million in October 2022 for merging protein and DNA engineering. The researcher is developing a few choice protein switches with robust biological activities and employing DNA engineering to activate those activities using RNA or DNA sequences of choice, like coronavirus or cytomegalovirus.

Segment Insights

Service and Product Insights

With a market share of more than 80.0%, the segment of protein sequencing products was the market leader in 2023. The sub-segment of mass spectrometry instruments in the instruments segment had the greatest share in 2021. Several bio-analytical tools have been used in the past few years to examine peptides and proteins in proteomics. Mass spectrometry has emerged as a promising technology for calculating the molecular masses of peptides, proteins, and sequences for proteomics research.

Additionally, the lower instrument prices have favorably affected the market expansion. More affordable financing methods, such as leasing the equipment, have enabled researchers to use the technology as cheaply as possible.

During the forecast period, it is likely that the segment for protein sequencing services will expand profitably. A growing number of research facilities and academic institutions charge researchers a small fee to use their labs and equipment, ranging from USD 8 per hour to USD 300 per hour.

Additionally, several businesses are creating innovative technologies that make protein sequencing easier for service providers. For instance, NVIDIA Corporation stated in September 2022 that it would integrate its cloud service NeMo LLM with BioNeMO, which gives academics access to pre-trained chemical and biology language models. These services support research interaction and modify data and proteins for various uses, such as drug discovery.

Application Insights

In 2023, the biotherapeutics market had the greatest share. This can be ascribed to pharmaceutical corporations' growing involvement in the creation of biotherapeutics. The core of bio-therapeutics for curing many diseases is thought to be recombinant therapeutic proteins, particularly monoclonal antibodies. One hundred monoclonal antibodies had received FDA approval as of May 2021.

Similarly, more strategic activities from industry participants in biotherapeutics will likely boost market expansion. For instance, Generate Biomedicines announced in November 2021 that it would raise USD 370 million in a Series B round of funding to assist in creating a drug generation platform. The goal is to comprehend how proteins' genetic code affects their functionality.

End-User Insights

The majority of the market in 2023 belonged to research centers and academic institutes, and it is a significant source of market revenue. The institutes are performing extensive research and development to create protein sequencing technologies. For instance, the University of Texas researchers announced the creation of a workable method for single-molecule protein sequencing in January 2022. Therefore, it is likely that technological developments in protein sequencing methods will accelerate market expansion.

The pharmaceutical and biotechnology firms segment will likely develop fastest during the forecast period. Finding new drugs and developing existing ones is connected to using protein sequencing, particularly mass spectrometry, in the pharmaceutical industry. As a result, the segment is expanding due to the rising need for drug components and biomolecule analysis. The sophisticated mass spectrometry instruments provide high throughput and an ideal testing environment. As a result, these end users show an increased need for such innovations.

Regional Insights

What is the U.S. Protein Sequencing Market Size?

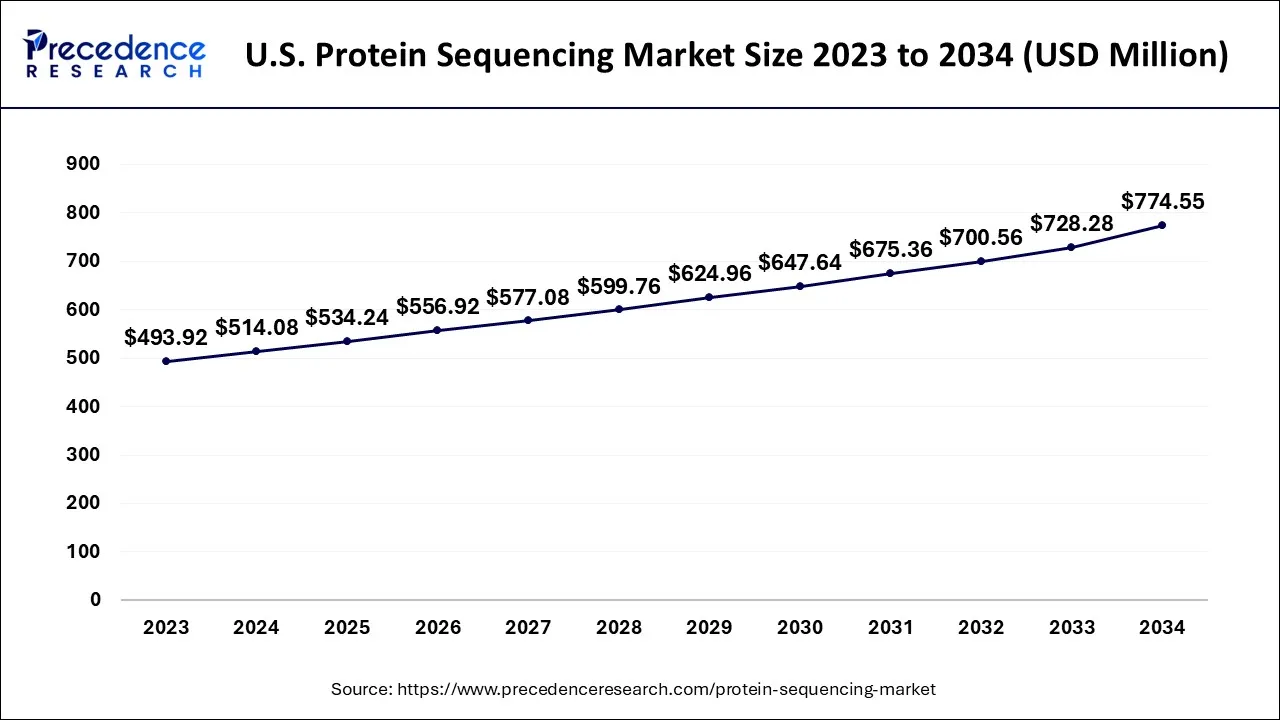

The U.S. protein sequencing market size is exhibited at USD 534.24 million in 2025 and is projected to beprotein sequencing market worth around USD 808.45 million by 2035, growing at a CAGR of 4.23% from 2026 to 2035.

North America is expected to hold the dominating share of the protein sequencing market during the forecast period owing to the rising technical breakthroughs and the availability of superior healthcare infrastructure in the region. In addition, the rising governmental support in the form of funding for proteomics research is observed to boost the growth of protein sequencing market.

U.S. Market Trends

The U.S. protein sequencing market is growing due to increasing demand for precision medicine, advanced diagnostics, and drug discovery. Increased funding for proteomics research and the presence of leading biotechnology firms and academic institutions are accelerating innovation in the market. Additionally, growing focus on early disease detection and biomarker identification and rapid adoption of next-generation sequencing technologies are further driving market expansion.

Furthermore, during the forecast period, market growth will likely be accelerated by business activities carried out by major players in North America. For instance, the platinum protein sequencing system started shipping commercially in January 2023.

Based in the United States, Quantum-Si gave business updates at the 41st Annual Conference of J.P. Morgan Healthcare. To co-develop sample preparation kits for research workflows of protein sequencing with Platinum, the business teamed up with Aviva Systems Biology, an antibody, protein, and immunoassay reagent product supplier.

What Potentiates the Asia Pacific Protein Sequencing Market?

In the upcoming years, the Asia Pacific protein sequencing market will likely represent a large portion of the target market's value. During the forecast period, China will likely see the target market's fastest growth rate. India is another significant market for protein sequencing. Moreover, the emerging expenditures for research and development activities in major pharmaceutical and biotechnology companies are expected to fuel the market's growth in India.

India Market Trends

India is emerging as a major player in the market within Asia Pacific, owing to increasing investment in biotechnology research, academic collaborations, and pharmaceutical R&D. Growing focus on drug development, biosimilars, and personalized medicine, along with government support for life sciences research and improving laboratory infrastructure, is boosting the adoption of advanced protein sequencing technologies across research institutes and biopharma companies.

What Makes Europe a Significant Region in the Protein Sequencing Market?

Europe is expected to grow at a significant CAGR over the forecast period due to strong funding for life science and proteomics research and rising adoption of advanced analytical technologies. Increasing pharmaceutical innovation, active academic–industry collaborations, and supportive regulatory frameworks are accelerating protein sequencing applications in drug discovery, precision medicine, and clinical research across the region.

UK Market Trends

The UK protein sequencing market is growing due to strong government funding for life sciences, advanced academic research capabilities, and expanding biotech and pharmaceutical sectors. Rising demand for precision medicine, early disease detection, and proteomics-driven drug discovery, along with collaborations between universities and industry players, is accelerating market growth in the country.

Why is the MEA Protein Sequencing Market Gaining Momentum?

The Middle East & Africa protein sequencing market is growing due to increased initiatives in medical research and healthcare advancements. Gulf nations like Saudi Arabia, the UAE, and Qatar are enhancing genomics and proteomics initiatives as national precision medicine programs. The growth of academic research centers and the establishment of partnerships with major pharmaceutical and biotechnology firms around the region are driving the need to use advanced protein sequencing instruments.

Growing focus on infectious disease research and public health surveillance is driving the adoption of proteomics across Africa. International research funding and capacity-building initiatives are improving access to advanced protein sequencing technologies, while the gradual integration of AI-based bioinformatics solutions is helping address skills gaps and data complexity, supporting continued market growth in the Middle East & Africa region.

How is the Opportunistic Rise of Latin America in the Protein Sequencing Market?

Latin America is expanding steadily due to growing pharmaceutical R&D capabilities and increased investment in proteomics research. Countries such as Brazil, Mexico, and Chile are strengthening life science infrastructure and adopting advanced analytical techniques to support drug discovery and translational research. Rising academic collaborations and regional research networks are further driving demand for protein sequencing instruments and services.

Growing interest in biomarker discovery for oncology, metabolic, and infectious diseases is boosting market growth. Support from government funding agencies and international research organizations is enhancing local expertise and laboratory capacity, while improved access to affordable sequencing technologies and AI-based data analysis tools is positioning Latin America as an emerging and dynamic protein sequencing market.

Protein Sequencing Market Companies

- Shimadzu Corporation: Provides advanced mass spectrometry and analytical instruments supporting protein identification, sequencing, and quantitative proteomics for pharmaceutical, clinical, and academic research applications.

- Charles River Laboratories: Offers integrated proteomics, bioanalysis, and drug discovery services, supporting pharmaceutical and biotechnology companies from early research through preclinical and regulatory development stages.

- Selvita S.A.: Delivers contract research services including proteomics, biomarker discovery, and bioanalytical studies to accelerate drug discovery and translational research for global life science clients.

- Proteome Factory AG: Specializes in protein sequencing, mass spectrometry-based proteomics, and structural protein analysis services for academic institutions, diagnostics developers, and biotechnology companies.

- Bioinformatics Solutions Inc.: Develops software platforms and analytical tools for proteomics data processing, protein identification, and systems biology, enabling efficient interpretation of complex biological datasets.

- Creative Proteomics: Provides comprehensive proteomics services, including protein sequencing, quantitative proteomics, PTM analysis, and bioinformatics support for life science and biomedical research.

- Bruker Corporation: Supplies high-performance mass spectrometry, NMR, and proteomics solutions enabling advanced protein characterization, structural biology, and multi-omics research across pharmaceutical and academic sectors.

- Alphalyse Inc.: Offers specialized protein sequencing, peptide mapping, and structural analysis services using Edman degradation and mass spectrometry for biopharmaceutical and research applications.

Other Major Key Players

- Thermo Fisher Scientific Inc.

- Nihon Kohden Corporation

- Agilent Technologies Inc.

- Rapid Novor Inc.

Recent Developments

- In January 2025, Quantum-Si introduced the Platinum Pro, a next-generation benchtop protein sequencer designed to improve proteomics research. The system offers a larger touchscreen and a Pro Mode that supports customized applications, with commercial shipments beginning in Q1 2025 through Avantor across the U.S. and Canada.

(Source: ir.quantum-si.com - In January 2025, UK Biobank initiated the largest-ever proteomics project, examining around 5,400 proteins from 600,000 samples. Supported by 14 biopharmaceutical partners, the study integrates proteomic, genetic, and imaging data to advance AI-driven disease prediction research.

(Source: www.ukbiobank.ac.uk - The NIH granted over $200 millionin 2022 to support pioneering biomedical research initiatives across four different study categories. The award categories include "the impact of fracking on pregnancy and conception", "the neural basis of social bias and association using the female songbird as a model", "how brain mechanisms influence memory performance', "health among African Americans across the United States", "tissue regeneration using the uterus as a model", "new model organism to lead in the development of an HIV vaccine" and "a mixed methods examination of skin tone".

- Researchers from Poland, the Netherlands, the United States, Switzerland, Israel, France, Italy, Spain, Luxembourg, Germany, and Canada collaborated on a study on single-molecule protein sequencing technology that was released in June 2021. The scientists claimed that advancements in protein sequencing methods would make it possible to examine proteins at the single-cell level, even for proteins with low abundances. Therefore, whole proteome sequencing would likely create an array of possibilities in medical diagnostics.

- In May 2022, Amphista Therapeutics and Bristol Myers Squibb partnered to discover and create small-molecule protein degraders. An exclusive license for the product's production and marketing will likely go to Bristol Myers Squibb.

- In January 2022, Amgen and Generate Biomedicines collaborated to find and advance protein-based therapies in numerous fields. The partnership is estimated to be worth approximately USD 1.9 billion.

- According to a study published in September 2022, 97,437 COVID-19 protein sequences were run to look for non-synonymous mutations in 26 different sequences. The result was beneficial for the whole market.

- According to research released in February 2022, de novo antibody sequencing using mass spectrometry methods is possible for various complex clinical samples from endogenous sources, such as serum. Therefore, such research will likely enhance the market's applications in therapeutics.

Segments Covered in the Report

By Product & Service

- Protein Sequencing Products

- Reagents & Consumables

- Instruments

- Mass Spectrometry Instruments

- Edman Degradation Sequencers

- Software

- Protein Sequencing Services

By Application

- Bio-therapeutics

- Genetic Engineering

- Others

By End-user

- Academic Institutes & Research Centres

- Pharmaceutical & Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting