Protein Expression Market Size and Forecast 2025 to 2034

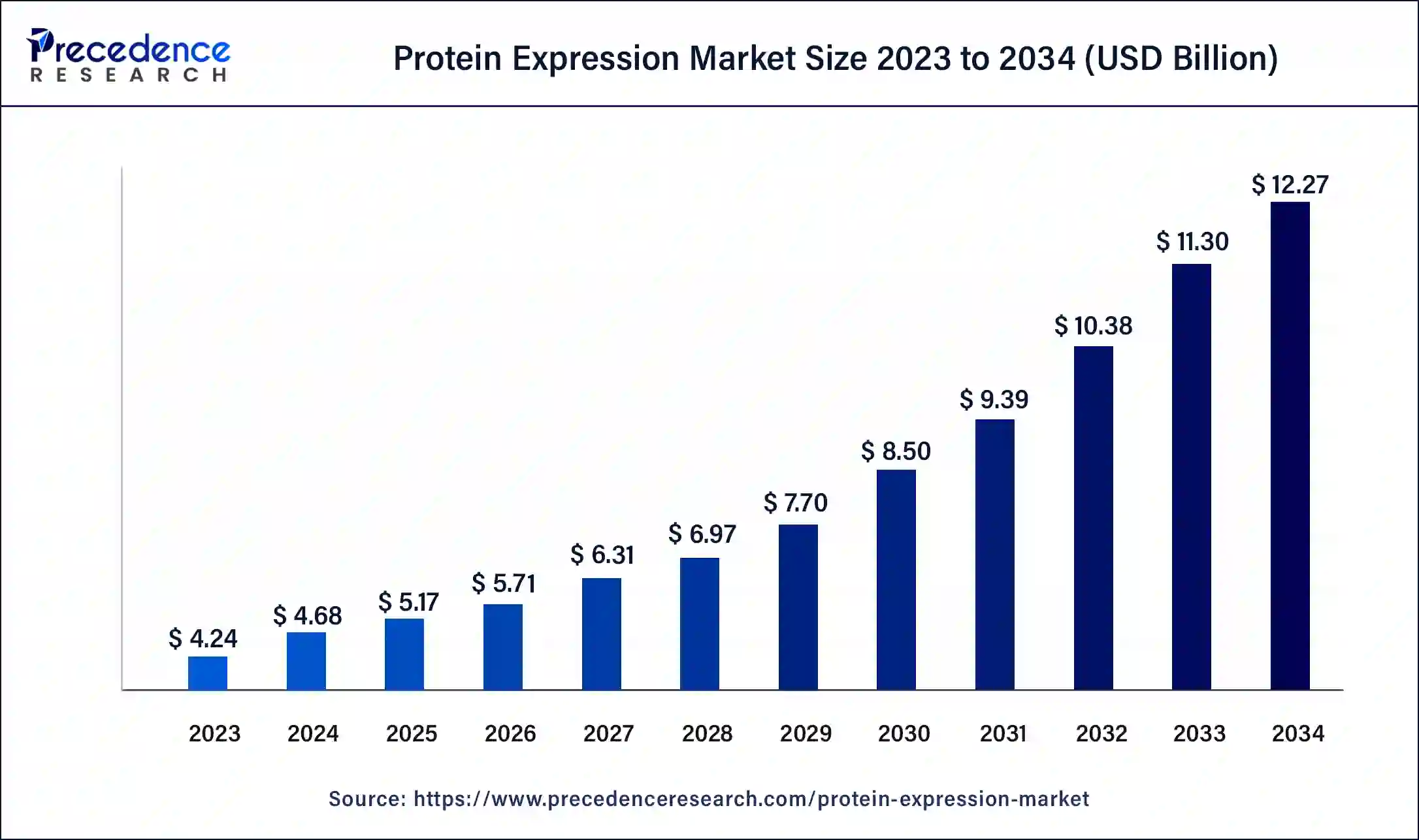

The global protein expression market size accounted for USD 4.68 billion in 2024 and is predicted to reach around USD 12.27 billion by 2034, growing at a solid CAGR of 10.45% from 2025 to 2034. The North America protein expression market size reached USD 1.95 billion in 2023.

Protein expression refers to the process by which a cell's genetic instructions are used to synthesize proteins. This process involves the transcription of DNA into messenger RNA (mRNA) and the subsequent translation of mRNA into a specific protein sequence.

Protein Expression Market Key Takeaways

- By expression system, the prokaryotic expression systems segment held a 43.70% market share in 2024. The dominance is because it is generally simpler to manage and serves important study purposes.

- By expression system, the eukaryotic expression systems are expected to grow at the highest CAGR of 9.10% over the forecast period. The growth of the segment can be credited to the growing demand for cell-based therapies and biologics.

- By product type, the reagents segment dominated the market with a 48.50% share in 2024. Reagents are essential components in protein expression, as they play a crucial role in ensuring the correct folding and conformation of the protein of interest.

- By product type, the services segment is expected to grow at the highest CAGR of 9.40% over the forecast period. The expansion is ascribed to the growing outsourcing of protein production and expression by pharmaceutical and biotech firms.

- By application, the therapeutic development segment held a 41.60% market share in 2024 and is expected to grow at the highest CAGR of 8.90% over the forecast period. The dominance and growth of the segment is due to their adaptability; they provide a more effective course of therapy.

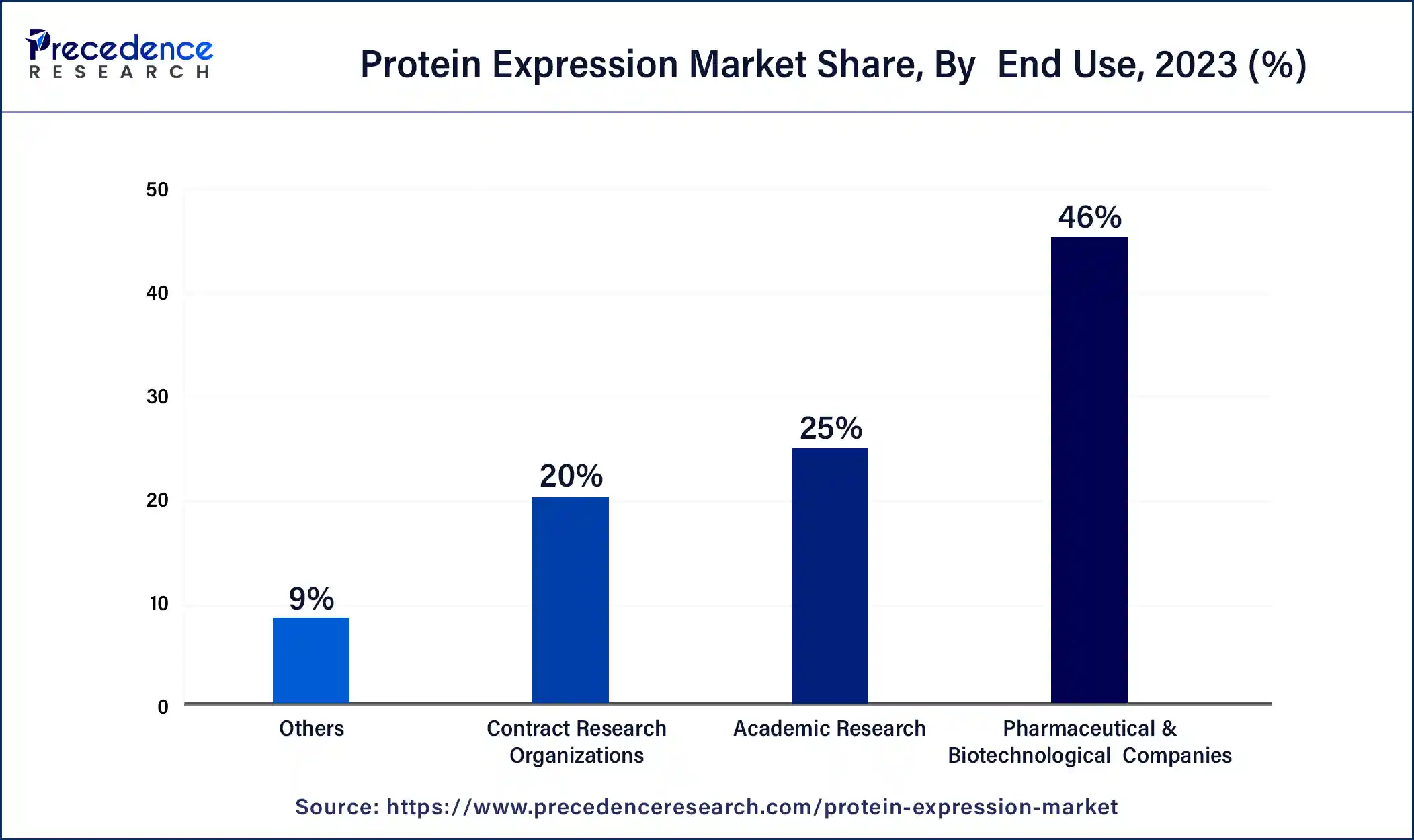

- By end-user, the pharmaceutical & biotechnology companies segment led the market with 45.20% share in 2024. The dominance of the segment is due to the extensive use of cultured cells for the creation of therapeutics and customized medications.

- By end-user, the CMOs and CDMOs segment is expected to grow at the highest CAGR of 9.20% in 2024. The dominance of the segment can be driven by growing demand for specialized production capabilities and the surge in biologics and biosimilars.

- By expression method, the stable expression segment held a 33.50% market share in 2024. The dominance of the segment is owed to the development of novel expression systems coupled with the surge in collaborations among stakeholders.

- By expression method, the cell-free protein synthesis segment is expected to grow at the highest CAGR of 10.10% in 2024. The dominance of the segment is due to increased R&D in proteomics and genomics and the surge in demand for targeted therapies.

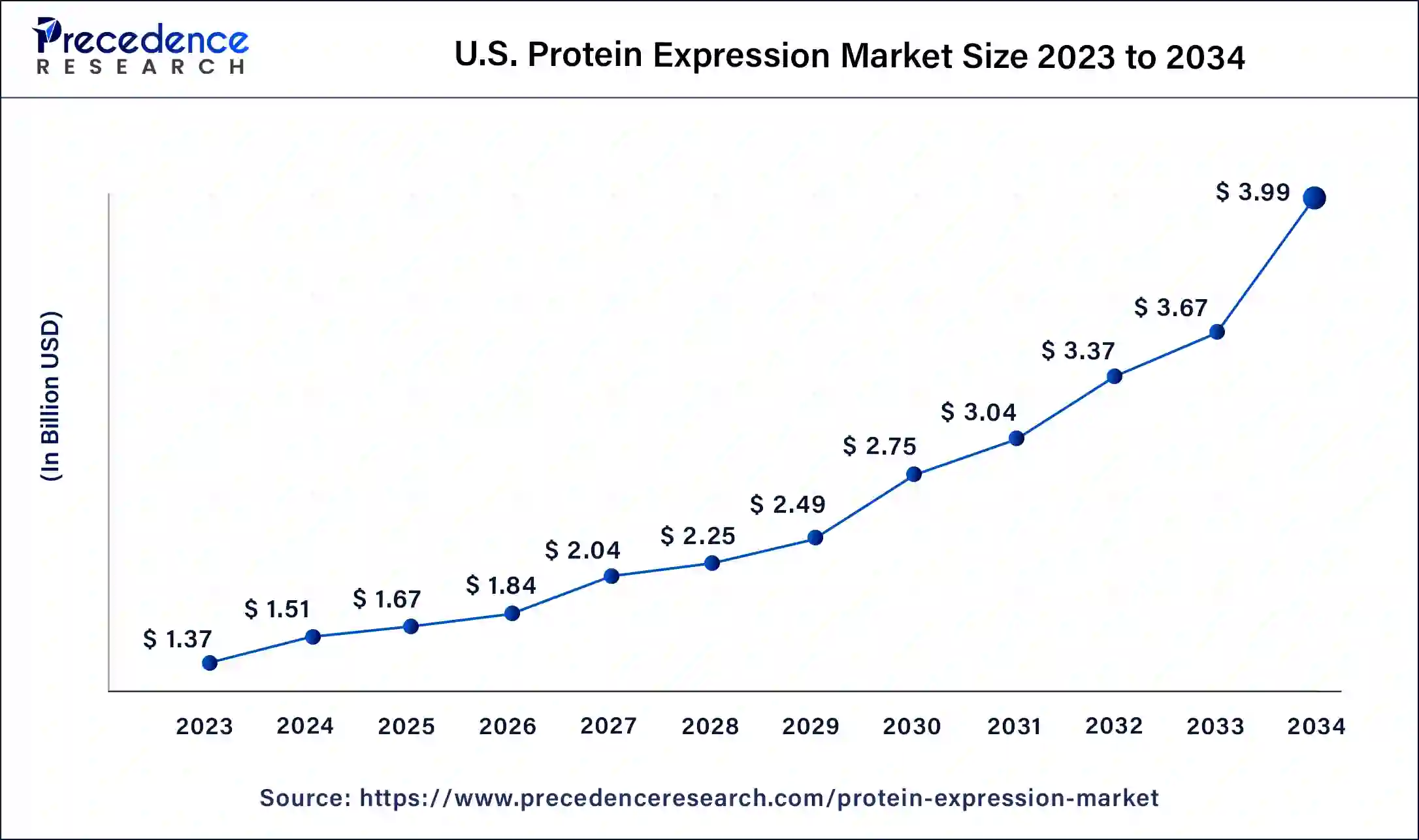

U.S Protein Expression Market Size and Growth 2025 to 2034

The U.S. protein expression market size was valued at USD 1.37 billion in 2023 and is expected to be worth around USD 3.99 billion by 2034, at a remarkable CAGR of 10.20% from 2025 to 2034.

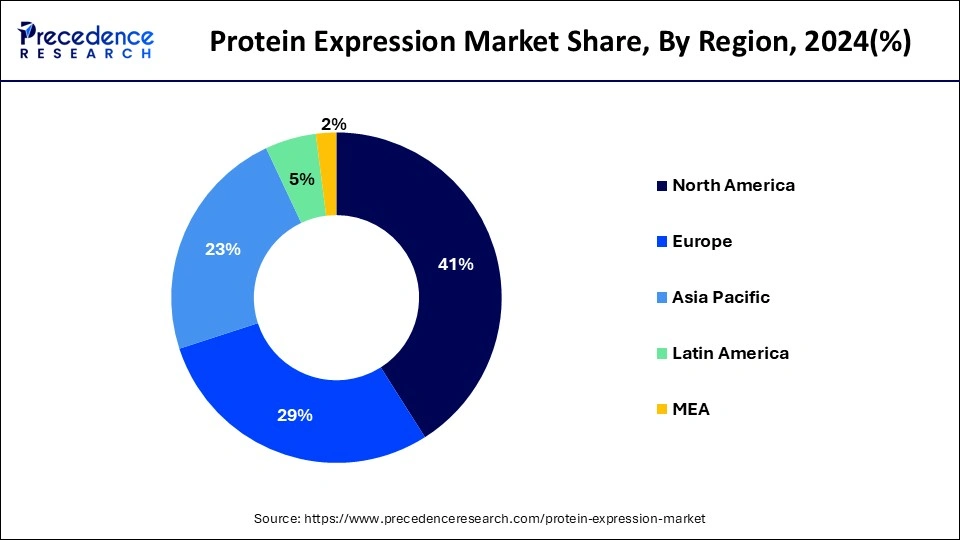

North America has captured more than 41% of revenue share in 2023. North America was in charge. This Significant market share can be attributed to the presence of significant businesses in the region, increasing R&D spending, and strong biosimilarplatforms. It has been noted that one of the most important tactics used in the North American area is collaboration between businesses and academic organizations.

The market in Asia Pacific is expected to expand at the fastest growth rate over the projection period due to the rising use of protein expression in various applications. Additionally, the rising emphasis on proteomics and genomics research, as well as rising academic institution efforts to develop novel protein therapeutics, boosts the market in the region.

In addition, the protein expression market is witnessing significant growth across all regions due to increasing demand for biologics, growing R&D investments, and the rising prevalence of chronic diseases. As a result, key players in the market are expanding their presence in emerging economies to tap into the growing opportunities.

Market Overview

Protein expression refers to the process by which a cell's genetic instructions synthesize proteins. This process involves the transcription of DNA into messenger RNA (mRNA) and subsequent mRNA translation into a specific protein sequence. Protein expression has a wide range of applications. It is used to develop recombinant proteins, which are used in drug discovery and developing novel compounds.

Protein Expression Market Growth Factors

A significant development driver of the market is expected to be the rising significance of protein-based therapeutics in contemporary medicine and the growing expenditure by biopharmaceutical firms in R&D. For instance, Merck and Orna Therapeutics worked together to invent, create, and market a number of projects in August 2022, including creating RNA technology for protein therapeutics. The deal included a $150 million investment from Merck.

Due to the increasing demand for customized therapeutics and the quickly expanding R&D activities that support protein expression, the worldwide market is anticipated to develop. Protein engineering and the synthetic building of recombinant proteins are the driving forces behind the development of protein therapeutics. The development of personalized medical treatments is becoming more and more feasible thanks to technological progress. It is expected that strategic collaborations between businesses and academic institutions to create cutting-edge technologies will support the market's upward trend. For instance, scientists from the University of California, Berkeley and the Novartis Institutes for Biomedical Research worked together to create and market a platform for protein stabilization to spur innovation in treatments for cancer and hereditary diseases. Vicinitas Therapeutics was established by the academics in July 2022 with series A financing of USD 65 million.

It is anticipated that operating companies will use protein expression more frequently as a result of accelerated product releases and the construction of powerful networks. For instance, the introduction of Abevmy (bevacizumab) in Canada was revealed by Biocon Biologics Ltd. and Viatris Inc. in May 2022. Viatris is offering the medication as its fourth copycat for cancer in Canada. Viatris Canada unveiled the Hulio copycat for inflammatory chronic diseases in February 2021. As a result, a key driver of market expansion is the rising regularity of product creation that results from the expression of the target protein.

The market for protein translation systems is growing as instances of diseases like cancer, cardiovascular disease, and genetic abnormalities increase. Insulin is one protein-based medicine that has incredible effectiveness in treating a variety of diseases.

Businesses are also funding research into protein expression technologies like baculovirus expression systems (used in insect cells), transient expression (used in mammalian cells), and steady expression. Protein therapeutics have a low risk of side effects due to their high level of efficacy, which is considerably fueling the market's expansion.

The development of genetic engineering, which has created a plethora of new pathways and possibilities for large-scale protein expression and separation, is another factor that is propelling the global market for transient protein expression.

- Evolution of synthetic biology- New tools in synthetic biology allow for customizable protein architecture and efficient expression systems, which lead to scalable production and reproducible protein quality for therapeutic and industrial applications.

- Growing biotechnology market- The increased usage of biologic medications, such as monoclonal antibodies and vaccines, is driving a growing need for alternative expression technologies to improve upper hand efficiency and quality.

- Increase in personalized medicine- Personalized medicine, such as treatment of specific individuals based on genetic profiles, leads to demand for innovative expression systems to help manufacture targeted therapeutics in small batches.

- Spread of cell-free expression systems- Cell-free protein synthesis is gaining popularity due to its rapid prototyping and flexibility advantages, serving as a viable replacement source for the manufacture of toxic proteins or hard-to-synthesize proteins.

- Automation and AI- Automation and artificial intelligence are being implemented to modify protein expression workflows to prevent human error and expedite research, and track the development timeline.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.27 Billion |

| Market Size in 2025 | USD 5.17 Billion |

| Market Size in 2024 | USD 4.68 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.12% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Expression System, Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising interest in protein biologics

Biologics are used to address the majority of chronic conditions, including cancer, autoimmune disorders, and other severe illnesses. Vaccines, blood and blood components, and modified medicinal proteins are examples of biologics. The FDA authorized 50 new medicines in 2021. One-of-a-kind antibodies, pegylated proteins, hormones, and enzymes made up the other 14 of these biologics, all of which needed protein translation. Additionally, evusheld (co-package of tagevimab with cilgavimab) was approved as a prophylactic or the prevention of the infection. Other mAbs, such as tocilizumab, sotrovimab, and the co-administration of bamlanivimab and etesevimab, had gotten EUA for COVID1 therapy (mild to moderate). By 2022, the FDA is expected to approve several of these medications. The industry is expanding as a result of the rising demand for goods and services related to protein translation.

- In June 2024, Syngene International Ltd., a global contract research, development, and manufacturing organization (CRDMO), launched a protein production platform for rapid production. The platform utilizes a cell line and transposon-based technology licensed by ExcellGene, a Switzerland-based biotech service provider.

Challenges

Undesired post-translational modifications as well as purification

Crude proteins are created during the protein translation process. These are removed and refined once more. Expression and processing of proteins are frequently difficult processes because of the inherent intricacy of proteins in general. Proteins have pleats and are intricate structures. So a protein's structural or sequence characteristics may have an effect on the output and durability of the protein products. For instance, target proteins frequently associate with the plasma membrane when transmembrane regions or GPl-anchor sequences are present, which compromises protein output. The host cells may experience unanticipated physiological changes as a result of the overexpression and buildup of the target protein, which could lead to the creation of misfolded proteins and protein degradation by the host proteases. These present a development obstacle for the protein expression industry.

Opportunitie

Emergence of microfluidics

The protein expression market has seen tremendous growth in recent years, driven by increasing demand for biopharmaceuticals and advancements in technology. One of the emerging trends in the market is the use of microfluidics technology for protein expression. Microfluidics is the science and technology of manipulating fluids in microscale devices. It allows for precise control over small amounts of fluids, which is ideal for protein expression. Microfluidic devices can create small channels and chambers that provide an environment for protein expression, allowing for rapid and efficient screening of different conditions. The results showed that DBM screening is a powerful tool for enhancing cell factories for the production and release of foreign proteins.

The degree of protein translation and phosphorylation at the single-cell level is also evaluated using a cutting-edge tool known as the Microfluidic Antibody Capture (MAC) gadget. The emergence of microfluidics technology in protein expression presents a significant opportunity for biopharmaceutical manufacturers. It has the potential to revolutionize the way proteins are produced, enabling faster, more efficient, and more cost-effective protein expression. As the technology continues to develop and improve, it is expected to play an increasingly important role in the protein expression market.

- In May 2024, Takara Bio USA, Inc. launched the Lenti-X Transduction Sponge, a first-to-market dissolvable microfluidic transduction enhancer that innovates in vitro lentivirus-mediated gene delivery techniques. The Lenti-X Transduction Sponge has the ability to achieve high transduction efficiency in any cell type, enabling downstream research applications in the gene and cell therapy space.

Expression System Insights

The prokaryotic expression systems segment held a 43.70% market share in 2024. The dominance is because it is generally simpler to manage and serves important study purposes. Due to its advantageous traits, including its ability to produce large quantities of recombinant proteins quickly and inexpensively, the market segment is expected to keep its place during the forecast period.

The eukaryotic expression systems are expected to grow at the highest CAGR of 9.10% over the forecast period. The growth of the segment can be credited to the growing demand for cell-based therapies and biologics, along with the innovations in transfection efficiency and scalability. Also, government funding for genomics and proteomics research is playing a vital role in fuelling the segment expansion.

Product Type Insights

The reagents segment dominated the market with a 48.50% share in 2024. Reagents are essential components in protein expression, as they play a crucial role in ensuring the correct folding and conformation of the protein of interest. The increasing demand for research in the field of proteomics and genomics, coupled with the growth of the biopharmaceutical and biotechnology industries, is driving the demand for reagents in the protein expression market.

The services segment is expected to grow at the highest CAGR of 9.40% over the forecast period. The expansion is ascribed to the growing outsourcing of protein production and expression by pharmaceutical and biotech firms to antibody production companies to support the development of customized assays and the finding of therapeutic antibodies. Similarly, many companies are using strategic efforts to increase their market share.

Application Insights

The therapeutic development segment held a 41.60% market share in 2024 and is expected to grow at the highest CAGR of 8.90% over the forecast period. The dominance and growth of the segment is due to their adaptability; they provide a more effective course of therapy and have a low likelihood of adverse effects. Additionally, it can serve as a substitute therapy when a gene defect prevents the body from producing enough effective proteins. Furthermore, the therapeutic segment's growth is driven by the increasing adoption of protein-based therapeutics, which offer several benefits over traditional medications, such as better specificity, fewer side effects, and improved efficacy.

End Use Insights

The pharmaceutical & biotechnology companies segment led the market with 45.20% share in 2024. The dominance of the segment is due to the extensive use of cultured cells for the creation of therapeutics and customized medications. The sector is also fuelled by the pharmaceutical industry's expanding creative use of proteins. The businesses combine already-existing proteins with genetic variations and entirely new protein designs to produce better value in therapeutics and protein stability.

The CMOs and CDMOs segment is expected to grow at the highest CAGR of 9.20% in 2024. The dominance of the segment can be driven by growing demand for specialized production capabilities and the surge in biologics and biosimilars. Moreover, innovations in pharmaceutical technologies, with the increasing emphasis on personalized medicine, can impact segment growth.

Expression Method Insights

The stable expression segment held a 33.50% market share in 2024. The dominance of the segment is owed to the development of novel expression systems coupled with the surge in collaborations among stakeholders. In addition, growing demand for protein-based therapeutics and the growth of cell-free expression systems are leading the segment's growth soon.

The cell-free protein synthesis segment is expected to grow at the highest CAGR of 10.10% in 2024. The dominance of the segment is due to increased R&D in proteomics and genomics and the surge in demand for targeted therapies. Furthermore, cell-free protein synthesis enables more rapid and individualized production of therapeutics specific to individual patient genetic profiles, which is a crucial aspect in precision medicine.

Protein Expression Market Companies

- Agilent Technologies Inc.

- Bio-Rad Technologies

- Thermo Fisher Scientific Inc.

- Merck KGA

- Takara Bio Inc.

- New England Biolabs Inc.

- Oxford Expression Technologies Ltd

- Promega Corporation

- Qiagen NV

- Sigma-Aldrich Corporation.

Recent Developments

- In March 2025, GreenLab and Shiru joined forces to commercialize and scale sustainable protein production using GreenLab's proprietary corn expression system. This collaboration marks a significant milestone in creating sustainable ingredients that nourish billions without exhausting the planet's resources.

- In June 2024, Syngene International Ltd., a contract research, development, and manufacturing organisation (CRDMO), launched its protein production platform. The new platform expands protein production, enabling preclinical, clinical development, and product launches, reducing time to market as per the company's report.

- In October 2024, Celltheon today announced the commercial launch of its CHO-K1-based OmniCHO™ Transient Expression Kit, a breakthrough technology poised to transform preclinical drug development. The kit's versatility is demonstrated by its ability to express both easy and difficult-to-express proteins, including challenging fusion proteins, antigens, and bispecifics, making it a valuable tool for a wide range of research applications.

- In June 2024, Daicel Arbor Biosciences announced the release of the next generation of its myTXTL kits for cell-free protein expression, designed to simplify and accelerate antibody discovery and protein engineering. These powerful new kits include the myTXTL Pro Kit and the myTXTL Antibody/DS Kit, providing researchers with versatile tools to enhance the throughput of their protein expression platforms.

- In July 2022, Beijing Luzhu Biotechnology and Maxvax Biotechnology raised funds for their vaccine R&D projects. Maxvax secured about USD 74 million from Series B funding to finance a number of clinical trials in its vaccine development program.

- In February 2022, Thermo Fisher Scientific opened its bioprocessing manufacturing plant in Millersburg, Pennsylvania, to produce essential components for the creation of new and current biologics and vaccines, including COVID-19.

Segments Covered in the Report

By Expression System

- Prokaryotic Expression Systems

- E. coli Expression Systems

- Other Bacterial Systems

- Eukaryotic Expression Systems

- Yeast Expression Systems (Pichia pastoris, Saccharomyces cerevisiae)

- Insect Cell Systems (Baculovirus)

- Mammalian Cell Systems (e.g., CHO, HEK293)

- Plant-based Systems

- Cell-free Expression Systems

By Product Type

- Reagents

- Expression Vectors

- Competent Cells

- Enzymes

- Buffers & Media

- Antibiotics & Selective Agents

- Instruments

- Cell Disruption Systems

- Protein Purification Systems

- Chromatography Systems

- Services

- Custom Protein Expression Services

- Cell Line Development

- Protein Purification Services

- Contract Research and Manufacturing (CRAMS)

By Application

- Therapeutic Development

- Monoclonal Antibodies

- Vaccines

- Hormones & Growth Factors

- Enzymes

- Industrial Applications

- Enzymes for Food Processing

- Enzymes for Detergents

- Biofuels & Biocatalysis

- Research Applications

- Functional Genomics

- Structural Biology

- Protein-Protein Interaction Studies

By End-use

- Pharmaceutical & Biotechnological Companies

- Academic Research Institutes

- Contract Research Organizations

- CMOs and CDMOs

- Diagnostic Laboratories

By Expression Method/Technology

- Stable Expression

- Transient Expression

- Cell-free Protein Synthesis

- Inducible Expression Systems

- Constitutive Expression Systems

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting