What is the Protein Engineering Market Size?

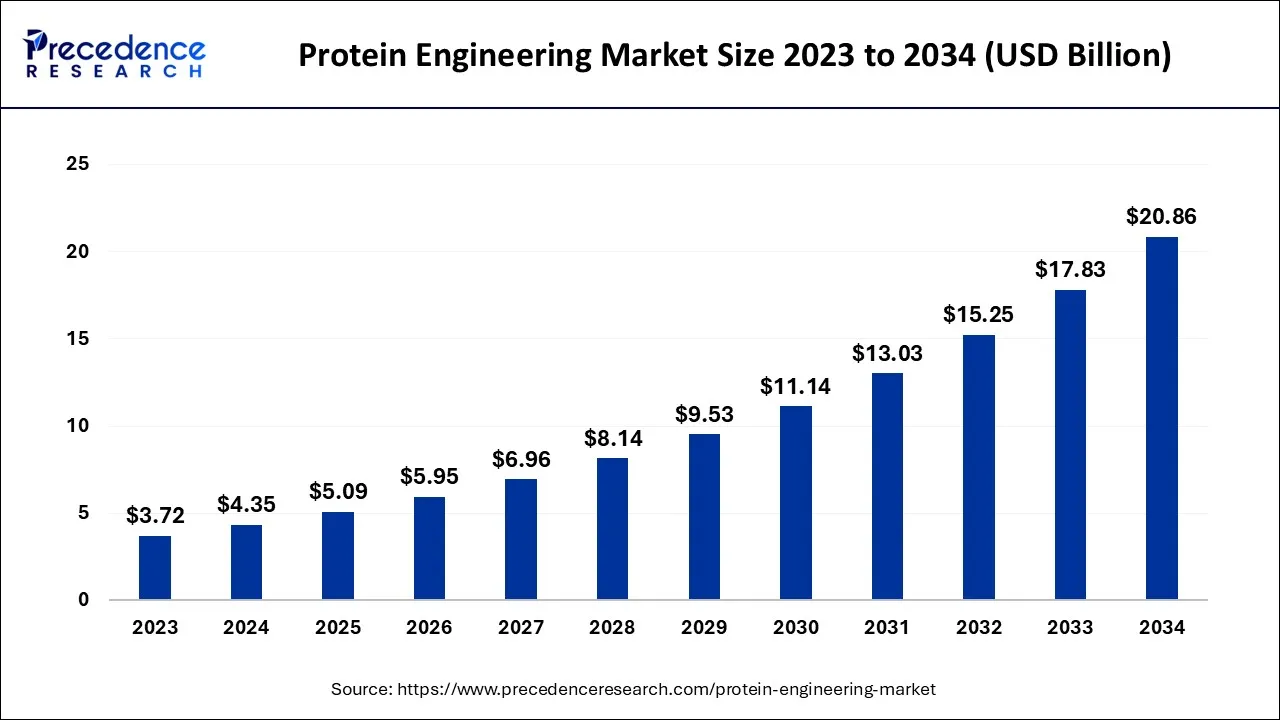

The global protein engineering market size was estimated at USD 5.09 billion in 2025 and is predicted to increase from USD 5.95 billion in 2026 to approximately USD 23.59 billion by 2035, expanding at a CAGR of 16.57% from 2026 to 2035.

Protein Engineering Market Key Takeaways

- In terms of revenue, the market is valued at 5.09 billion in 2025.

- It is projected to reach 23.59billion by 2035.

- The market is expected to grow at a CAGR of 16.57% from 2026 to 2035.

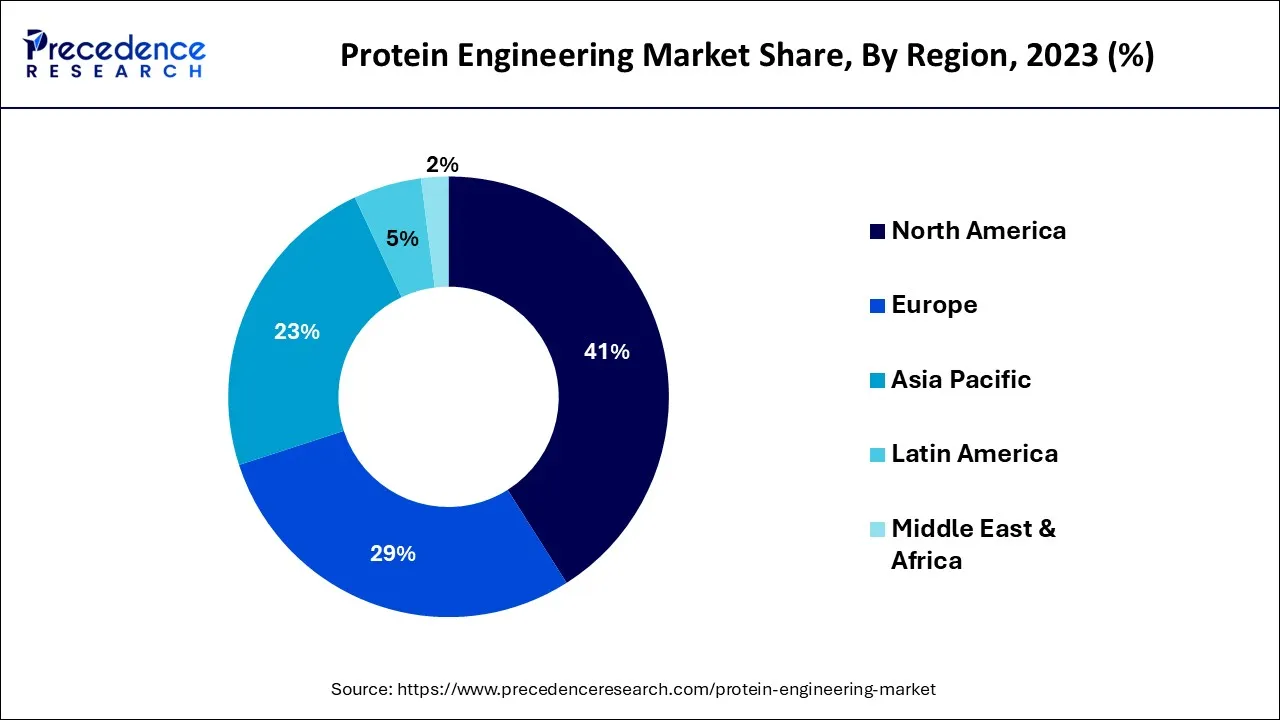

- North America dominated the global market with the largest market share of 41% in 2025.

- By Product, the instruments segment captured the maximum market share in 2025.

- By Technology, the rational protein design segment recorded the biggest market share in 2025.

- By Protein type, the monoclonal antibodies segment contributed to the largest market share in 2025.

- By End-user, the pharmaceutical & biotechnology companies segment generated the major market share of 43% in 2025.

Market Overview

Protein engineering is modifying or creating new ones with specific desired properties using genetic engineering techniques. The globalproteinengineering market has grown steadily in recent years, driven by the increasing demand for protein-based drugs, the need for more efficient and sustainable industrial processes, and the development of novel protein-based products with unique properties.

How is AI Influencing the Protein Engineering Industry?

AI is fundamentally changing the protein engineering industry by shifting the paradigm from slow, trial-and-error, computational design, wet-lab experiments to data-driven. AI prioritizes the most promising candidates for lab testing, dramatically decreasing the costly and time-intensive "trial-and-error" screening procedures. AI engineers engineer enzymes with improved thermostability and raised catalytic activity for use in harsh industrial environments, like chemical manufacturing and sustainable agriculture.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.09 Billion |

| Market Size in 2026 | USD 5.95 Billion |

| Market Size by 2035 | USD 23.59 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 16.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Protein Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, andthe Middle East & Africa |

Market Dynamics

Driver

Growing demand for protein-based drugs and therapeutics

The growing demand for protein-based drugs is crucial for the protein engineering market. Protein-based drugs, known as biologics, are increasingly used to treat various diseases, including cancer, autoimmune disorders, and rare genetic disorders. Compared to traditional small-molecule drugs, protein-based drugs have several advantages. They are often more selective and have fewer side effects, as they are designed to interact with specific targets in the body.

Additionally, protein-based drugs are less likely to be metabolized by the liver, which can improve their efficacy and reduce the risk of toxicity. As a result of these advantages, the global market for protein-based drugs has grown significantly. Several factors drive this growth, including the increasing prevalence of chronic diseases, ageing populations, and rising healthcare spending. In particular, the growing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is driving demand for new and more effective treatments.

Adoption of personalized medicine

Personalized medicine refers to customizing medical treatment to an individual's genetic makeup or other unique characteristics, such as age, gender, and lifestyle factors. Protein engineering plays a crucial role in developing personalized medicine by enabling the creation of proteins tailored to specific patient needs.

For instance, cancer treatment often involves monoclonal antibodies targeting specific cancer cells while leaving healthy cells unharmed. Protein engineering is used to create monoclonal antibodies that are more potent and selective, improving their effectiveness and reducing side effects. Doctors enhance patient outcomes and reduce healthcare costs by developing personalized cancer treatments tailored to an individual's unique genetic profile.

The demand for protein engineering is increasing as the healthcare industry shifts towards personalized medicine. This drives growth in the protein engineering market as companies invest in research and development to create new and innovative protein-based therapeutics customized for individual patients.

Restraint

High cost of development

Protein engineering involves complex and time-consuming designing, synthesizing, and testing proteins with specific properties. This process requires significant investment in research and development, a significant barrier to entry for smaller companies and startups. In addition to the direct costs of research and development, indirect costs are associated with bringing protein-based products to market.

For instance, regulatory approval for new protein-based drugs is lengthy and expensive, involving multiple clinical trials and extensive safety testing. The high development costs associated with protein engineering limits competition in the market, as smaller companies and startup do not have the resources to invest in research and development. This leads to a concentration of market power among larger companies, limiting innovation and increasing consumer prices.

Opportunity

Advancements in gene editing and synthetic biology

Gene editing and synthetic biology technologies enable researchers to manipulate and reprogram the genetic code of cells, which can lead to the creation of novel proteins with unique properties. One promising area of research is using CRISPR/Cas9 gene editing technology to modify the genes that code for specific proteins.

By selectively editing these genes, researchers can create proteins with new or improved functions, such as increased stability, enhanced specificity, or improved activity. Synthetic biology also offers new opportunities for protein engineering. Synthetic biology involves designing and constructing new biological systems using DNA and other biological components. Researchers use synthetic biology techniques to create or modify existing proteins to perform specific functions.

For instance, researchers have used synthetic biology to engineer proteins that detect and respond to environmental stimuli, such as temperature changes or specific chemicals. These proteins could have various applications, from environmental monitoring to drug delivery. Therefore, gene editing and synthetic biology advancements are expected to drive innovation in the protein engineering market and create new and improved protein-based products with a wide range of applications in healthcare, agriculture, and industry.

Segment Insights

Product Insights

Based on product, the protein engineering market is segmented into Instruments, reagents, and software & services. In 2025, the instruments segment accounted for the largest market share. The segment's growth is due to the increasing demand for protein engineering tools and technologies in various applications such as drug discovery, biomanufacturing and biotechnology research. Advances in protein engineering techniques have led to the development of new instruments that perform more complex and precise functions.

For instance, advancements in chromatography systems have led to the development of new protein purification methods, improving the efficiency and yield of protein production. Similarly, new electrophoresis systems have enabled researchers to separate and analyze proteins more accurately and quickly. Furthermore, the increasing number of research and development activities in the biotechnology and pharmaceutical industries and the growing demand for personalized medicine are driving the need for more sophisticated instruments for protein engineering.

Technology Insights

Based on technology, the market is segmented into rational protein design, directed evolution, hybrid approach, de novo protein design, and others. In 2024, the rational protein design segment accounted for the highest market share. rational protein design is used in various applications, including drug discovery, enzyme engineering, and biocatalysis. For instance, rational protein design has been used to engineer enzymes for industrial processes, such as the production of biofuels or chemicals, as well as for medical applications, such as developing enzyme therapies for rare genetic disorders. As the field of protein engineering continues to evolve and advance, the rational protein design segment is expected to grow, driven by ongoing research and development activities and increasing demand for more specialized and effective protein-based therapeutics and industrial enzymes.

Protein Type Insights

Based on the protein type, the protein engineering market is segmented into Insulin, monoclonal antibodies, Vaccines, Colony Stimulating Factors, Coagulation Factors, and Other Proteins. In 2024, the monoclonal antibodies segment accounted for the highest market share. Monoclonal antibodies (mAbs) are laboratory-produced molecules that mimic the immune system's ability to recognize and neutralize harmful pathogens or abnormal cells. They are highly specific to their targets and are engineered to have a variety of functions.

The growth of this segment is due to several factors, including the increased understanding of the molecular mechanisms of diseases and the development of new technologies that enable the production of highly specific and effective monoclonal antibodies. The monoclonal antibodies segment is proliferating owing to a wide range of therapeutic applications for these molecules. Monoclonal antibodies are designed to target specific cells or proteins involved in disease processes, making them an attractive option for treating various cancers, autoimmune disorders, and other diseases.

Increasing demand for personalized medicine is also expected to drive segment growth. Monoclonal antibodies are engineered to target specific patient populations based on their genetic profiles or other factors, allowing for more precise and effective treatments. Moreover, the development of new technologies for the production of monoclonal antibodies has contributed to the growth of this market segment. Advances in genetic engineering and protein expression systems have made producing large quantities of highly specific monoclonal antibodies easier and more cost-effective, making them more accessible to patients.

End-User Insights

Based on the end user, the protein engineering market is segmented into Academic Research Institutes, Contract Research Organizations, and pharmaceutical & biotechnology companies. In 2025, the pharmaceutical & biotechnology companies segment held a significant market share of about 43%. This is due to major players in the protein engineering market developing and manufacturing drugs and biologics that use protein engineering technology. These companies typically have significant resources and expertise in drug discovery and development.

They conduct research or collaborate with academic research institutes or CROs to advance their understanding and develop new products. These companies invest in acquiring or licensing technology from other companies to enhance their capabilities in protein engineering. Therefore, pharmaceutical and biotechnology companies play a critical role in driving growth and innovation in the protein engineering market.

Regional Insights

What is the U.S. Protein Engineering Market Size?

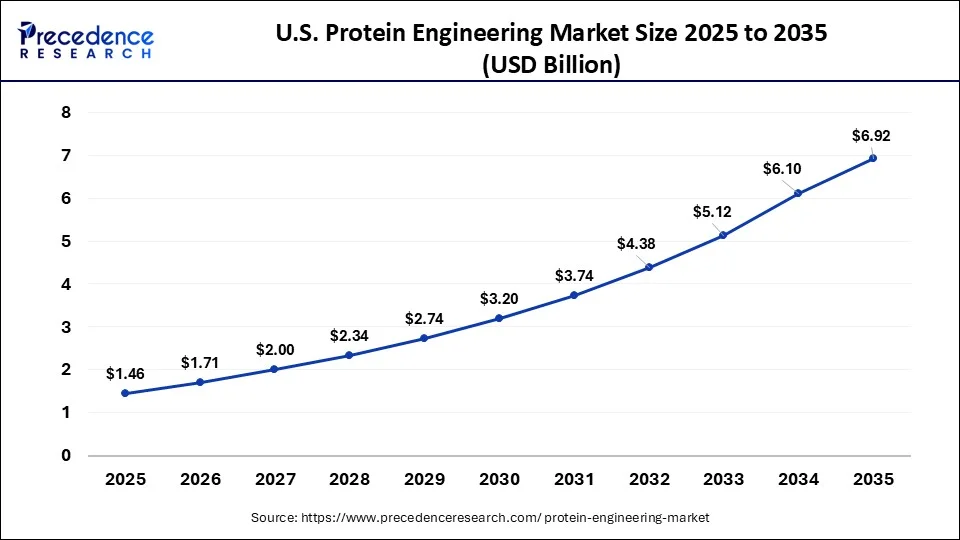

The U.S. protein engineering market size was exhibited at USD 1.46 billion in 2025 and is projected to be worth around USD 6.92 billion by 2035, growing at a CAGR of 16.84% from 2026 to 2035.

In 2025, North America dominated the market holding the highest market share of about 41% owing to many biopharmaceutical and biotechnology companies and academic and research institutes specializing in protein engineering. The United States is the largest market in North America, and it is expected to continue its dominance in the coming years.

The country has a well-established biopharmaceutical industry and a strong research base, which have contributed to the growth of the protein engineering market. Furthermore, the U.S. government has increased funding for research and development in the biotechnology field, which is expected to drive the growth of the protein engineering market in the region.

Value Chain Analysis for the Protein Engineering Market

- R&D: It aims to design, optimize, and even produce novel proteins and enzymes using techniques such as directed evolution, rational design, and AI-driven modeling.

Key Players:Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, GenScript - Clinical Trials and Regulatory Approvals: They serve as the foundational mechanism for validating safety, efficacy, and quality in the protein engineering market, changing theoretical designs into commercially viable biopharmaceuticals.

Key Players: Merck KGaA, Agilent Technologies, Danaher Corporation - Formulation and Final Dosage Preparation: It is a vital, science-driven process that stabilizes engineered proteins (like antibodies, enzymes, and vaccines) to ensure they remain active, stable, and even safe during manufacturing, storage, and administration.

Key Players: Lonza Group AG, Thermo Fisher Scientific Inc., Merck KGaA

Protein Engineering Market Companies

- PerkinElmer, Inc.: PerkinElmer, Inc. provides a comprehensive suite of instruments, reagents, and even services for the protein engineering market, aiming on streamlining workflows from discovery to characterization. Their solutions mainly support biopharmaceutical research, aiming on monoclonal antibodies, enzymes, and even vaccine development.

- Waters Corp.: Waters Corporation offers a comprehensive suite of analytical instruments, specialized chemistries, and software aimed at enabling protein engineering, characterization, and therapeutic development. Their offerings aim on high-performance liquid chromatography along with mass spectrometry to determine protein structure, post-translational modifications, and stability.

- Bio-Rad Laboratories: Bio-Rad Laboratories provides a comprehensive suite of tools for the protein engineering market, aiming on antibody discovery, protein analysis, and even high-throughput screening.

- Merck KGaA: Merck KGaA provides a comprehensive portfolio for the protein engineering market, thus spanning the entire workflow from gene synthesis to antibody production, purification, and analytical characterization. Their offerings are programmed to support both research-scale and GMP-scale biopharmaceutical manufacturing.

Other Major Key Players

- Amgen, Inc.

- Agilent Technologies

- Bruker Cor.

- Thermo Fisher Scientific, Inc.

- Danaher Corp.

- GenScript Biotech Corp.

Recent Developments

- In Jan 2022,Amgen and Generate Biomedicines announced a research collaboration agreement to discover and create protein therapeutics for five clinical targets across several therapeutic areas and multiple modalities.

- In December 2021,Insightful Science, the software company enabling the cloud for scientific discovery, announced that it had completed the transaction to acquire Protein Metrics, Inc., which is a leading provider of biopharmaceutical protein characterization and proteomics analysis software. The acquisition expands the Company's R&D value chain to widen the biopharmaceutical protein analysis arena, unblocking data analysis bottlenecks currently associated with large-scale protein studies.

- In October 2020, Agilent Technologies announced the launch of its new Agilent Seahorse XFp Analyzer, a tool for measuring metabolic activity in live cells that can be used in protein engineering research.

Segments Covered in the Report

By Product

- Instruments

- Reagents

- Software & Services

By Technology

- Rational Protein Design

- Directed Evolution

- Hybrid Approach

- De Novo Protein Design

- Others

By Protein Type

- Insulin

- Monoclonal Antibodies

- Vaccines

- Colony Stimulating Factor

- Coagulation Factors

- Other Proteins

By End-User

- Academic Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting