Prostate Cancer Diagnostics Market Size and Forecast 2025 to 2034

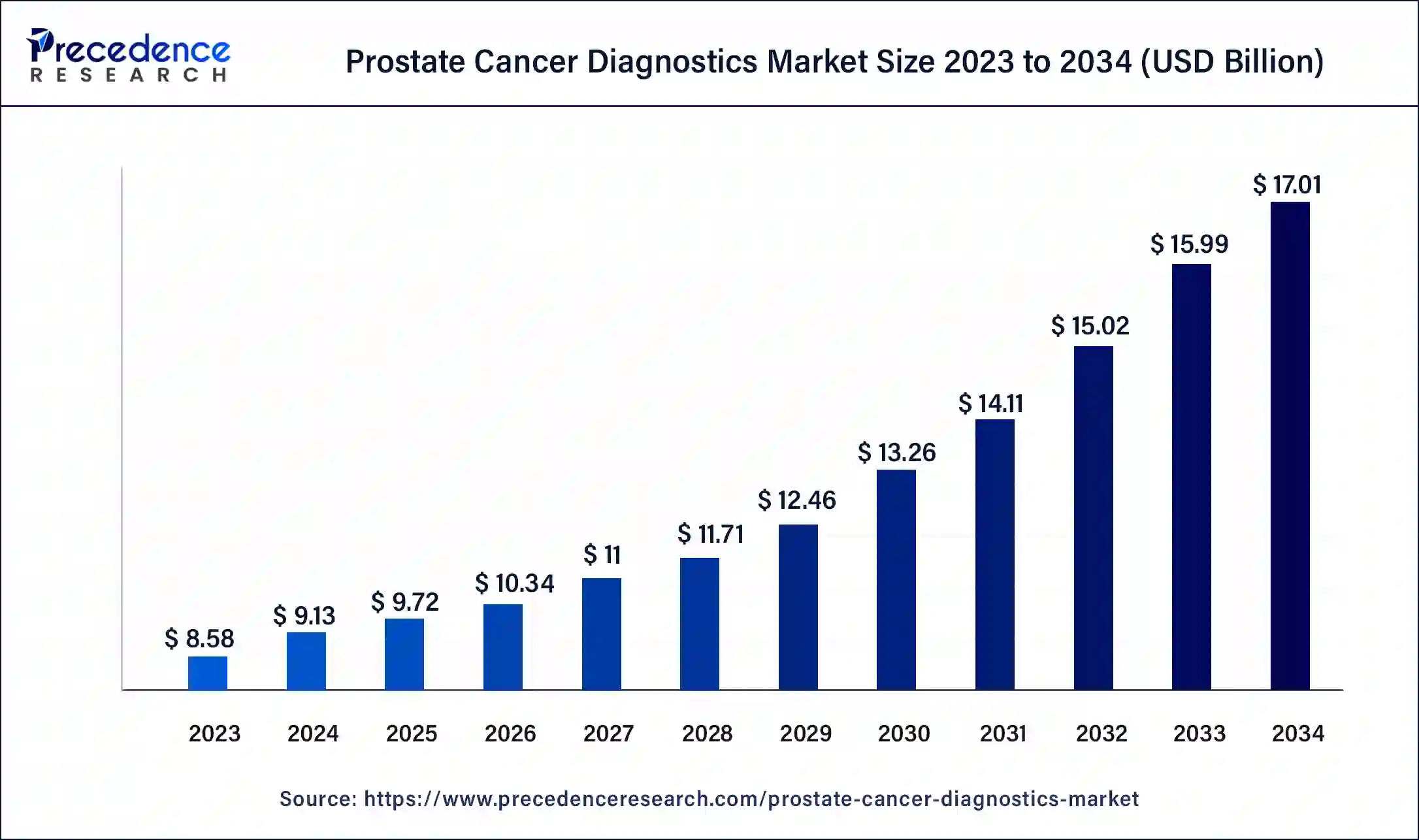

The global prostate cancer diagnostics market size was estimated at USD9.13 billion in 2024 and is predicted to increase from USD 9.72 billion in 2025 to approximately USD 17.01 billion by 2034, expanding at a CAGR of 6.42% from 2025 to 2034. The increasing cases of transitional cell (or urothelial) cancer across the world are driving the growth of the prostate cancer diagnostics market.

Prostate Cancer Diagnostics Market Key Takeaways

- In terms of revenue, the global prostate cancer diagnostics market was valued at USD 9.13 billion in 2024.

- It is projected to reach USD 17.01 billion by 2034.

- The market is expected to grow at a CAGR of 6.42% from 2025 to 2034.

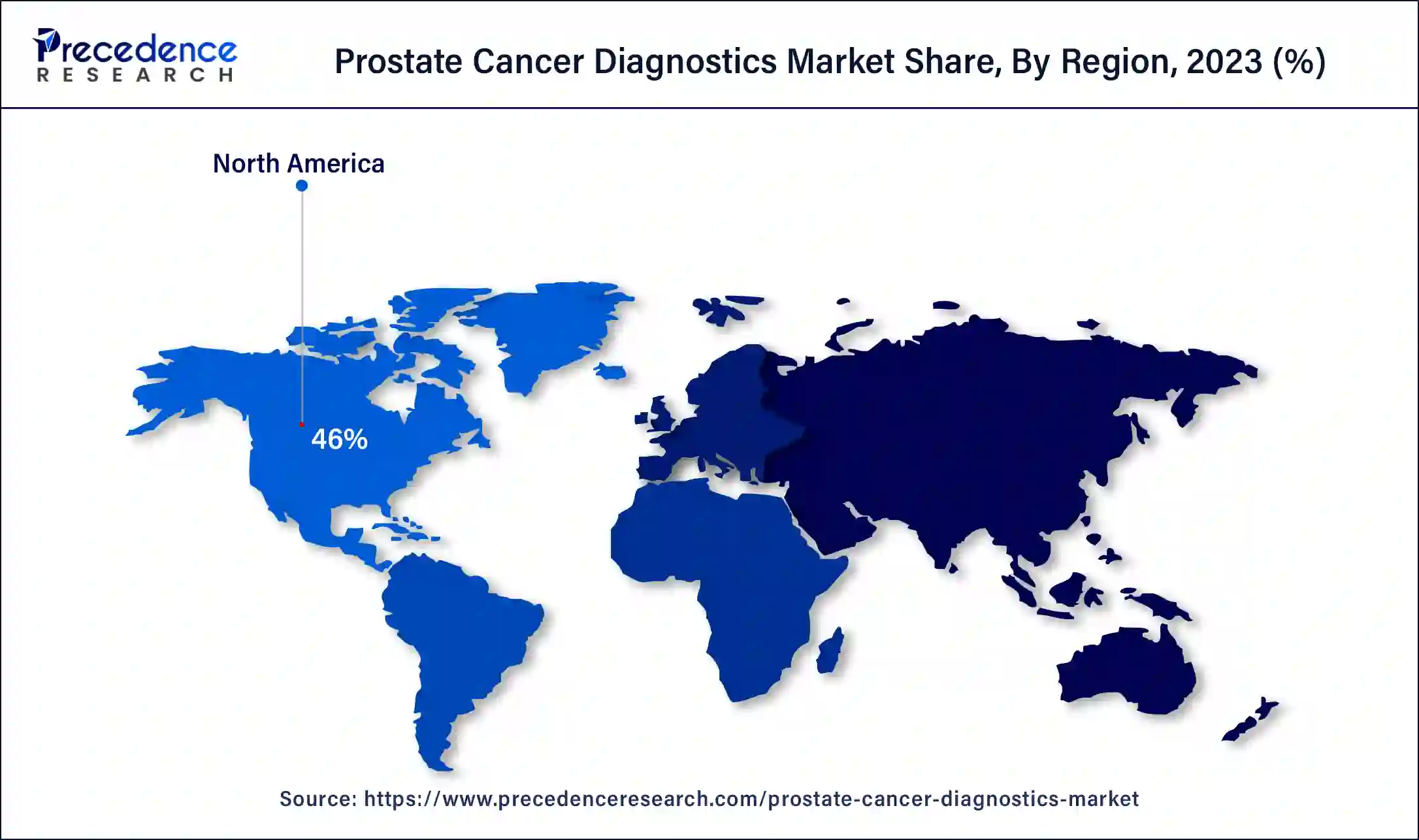

- North America dominated the prostate cancer diagnostics market with the largest market share of 46% in 2024.

- Asia Pacific is expected to attain the fastest rate of growth during the forecast period.

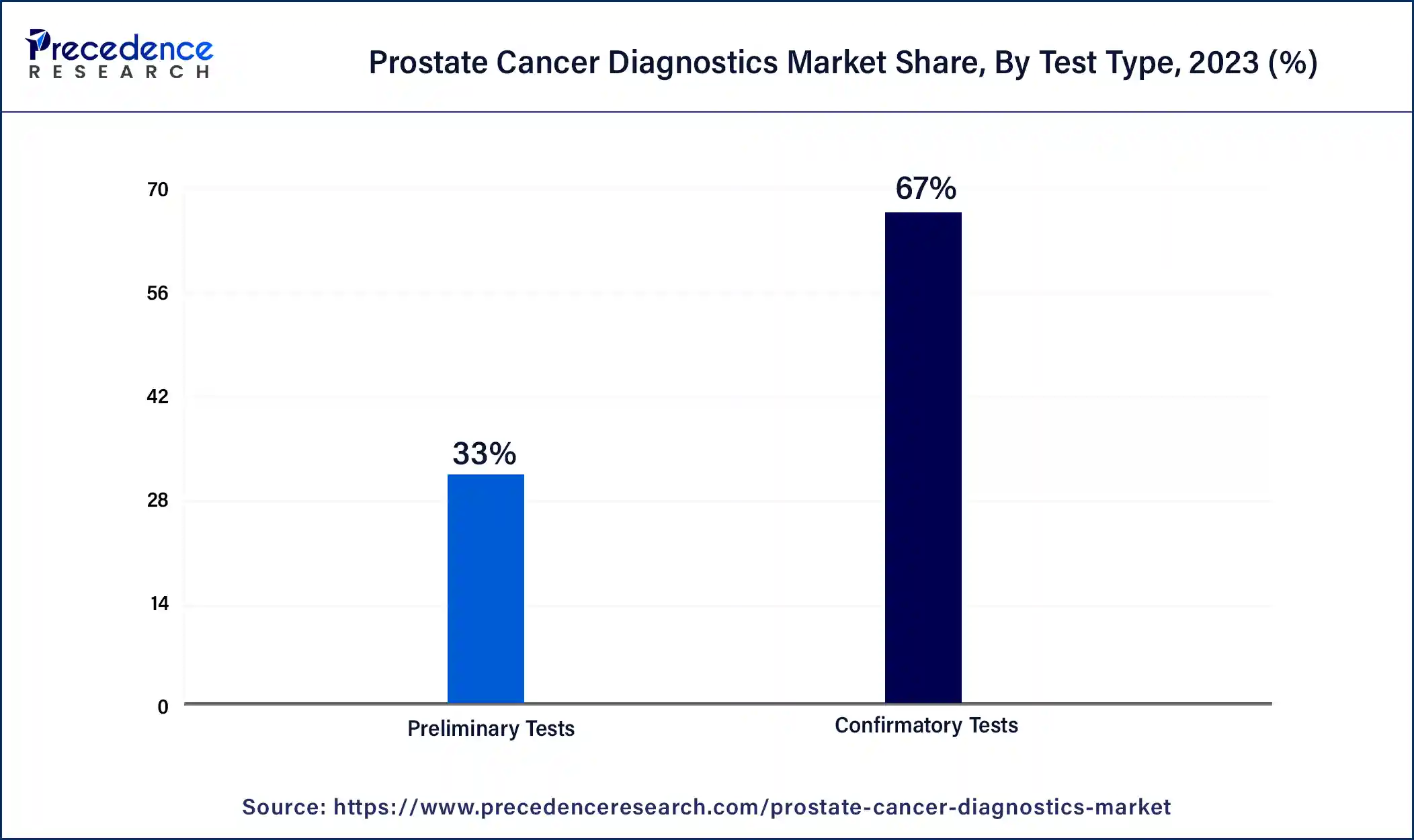

- By test type, the confirmatory tests segment held the largest market share of 67% in 2024.

- By test type, the preliminary tests segment is expected to grow with a significant CAGR during the forecast period.

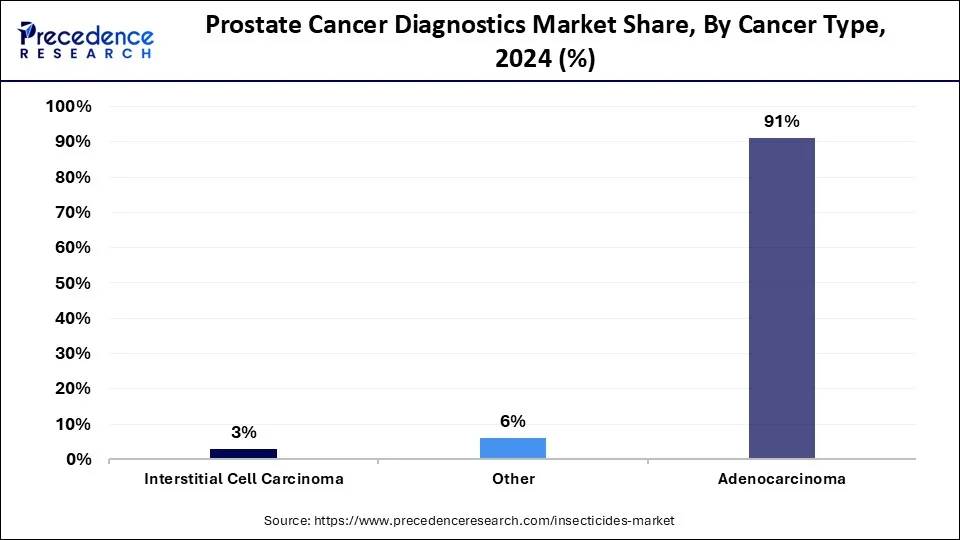

- By type, the adenocarcinoma segment has contributed the biggest market share of 91% in 2024.

- By type, the interstitial cell carcinoma segment is estimated to exhibit a significant growth rate during the forecast period.

- By end-use, the outpatient facilities segment dominated the market in 2024.

- By end-use, the hospitals segment is expected to grow at a significant rate during the forecast period.

How is AI shaping the Prostate Cancer Diagnostics Industry?

Advancements in AI play an important role in the development of the prostate cancer diagnostics market. Nowadays, diagnostic tool companies have started integrating AI into their systems for diagnosing prostate cancer. AI can help in the detection of lesions in early stages, precise risk stratification, aggressiveness of cancer, and others, along with enhancing the accuracy of diagnosis. Thus, the ongoing integration of AI in prostate cancer diagnosis is shaping the prostate cancer diagnostics industry in a positive manner.

- In March 2024, GE HealthCare launched Prostate Volume Assist. Prostate Volume Assist is an AI-enabled software that helps in prostate imaging for detecting prostate cancers.

U.S. Prostate Cancer Diagnostics Market Size and Growth 2025 to 2034

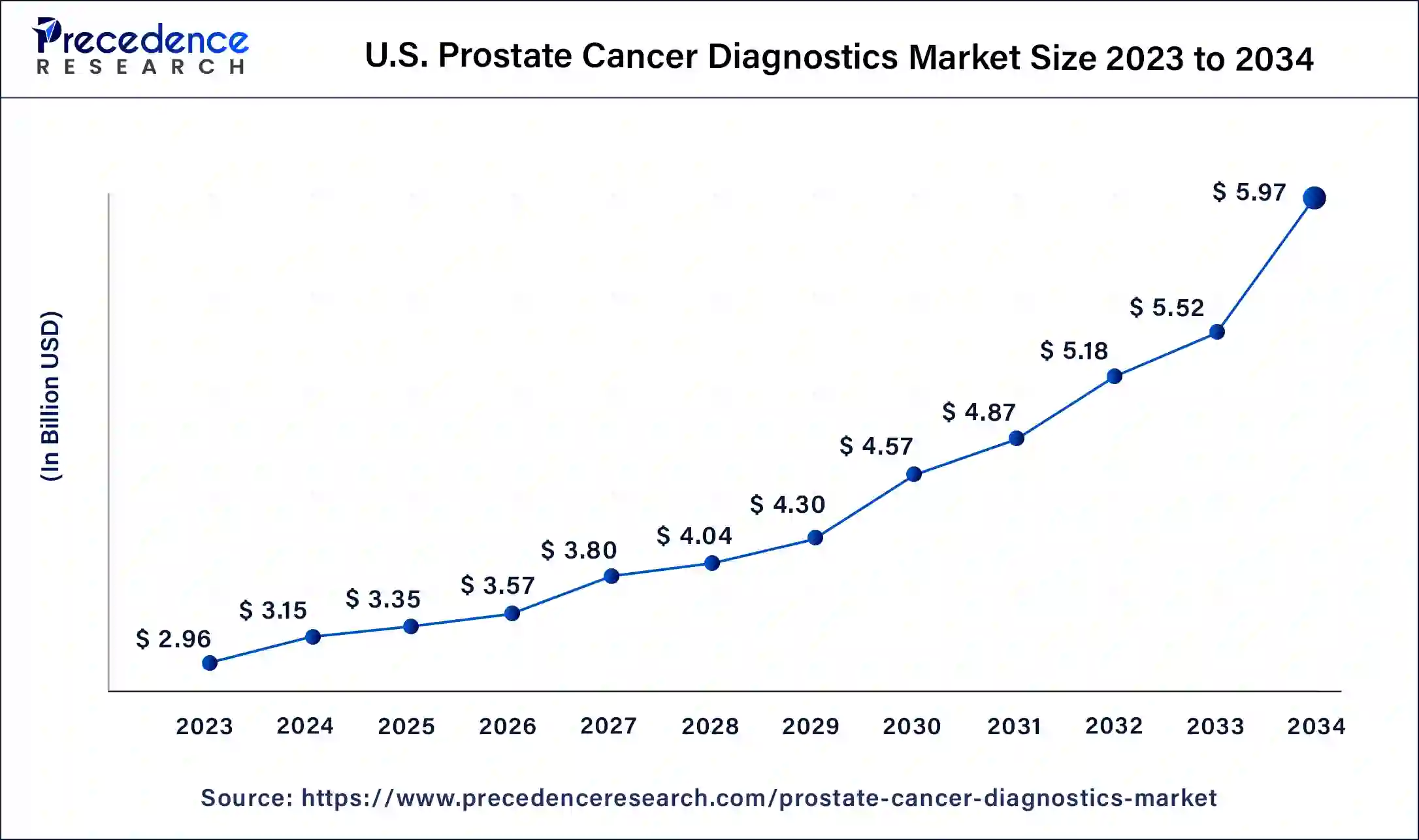

The U.S. prostate cancer diagnostics market size was exhibited at USD 3.15 billion in 2024 and is projected to be worth around USD 5.97 billion by 2034, poised to grow at a CAGR of 6.60% from 2025 to 2034.

North America held the highest market share of 46% in 2024. The growth of the market in this region is mainly driven by the rising advancements in the healthcare sector along with increasing investment by the government in countries such as the U.S. and Canada for developing the cancer diagnosis and treatment sector.

- In August 2024, the U.S. government announced to invest around US$ 9 million for improving access to cancer screening in 18 HRSA-funded health centers.

The growing developments in artificial intelligence technology, along with the increasing number of outpatient facilities related to prostate cancer diagnosis, have driven the market growth. Also, the rising cases of prostate cancer in the U.S. and Canada have increased the demand for diagnosis methodologies associated with it, thereby driving the market growth to some extent.

Moreover, the presence of several local market players in prostate cancer diagnostics, such as Pfizer Inc., Myriad Genetics, Inc., Hologic Inc., and some others, are constantly engaged in the development of high-quality prostate cancer diagnostics tools and adopting several strategies such as partnerships, acquisitions, launches, and business expansions, which in turn drives the growth of the prostate cancer diagnostics market in this region.

- In May 2022, Myriad Genetics launched a comprehensive suite. This comprehensive suite finds numerous applications in the detection of prostate cancers.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The rising development in the prostate cancer industry by private and public entities, along with the growing investment by the government for opening new cancer hospitals in countries such as India, China, Japan, South Korea, and some others, is expected to drive the market growth to some extent. Moreover, the increasing geriatric population in Japan that is prone to prostate cancer has increased the demand for prostate cancer diagnostics, thereby driving the market growth. Additionally, the rise in the number of research activities associated with prostate cancer diagnostics is likely to boost the market growth to some extent.

Furthermore, various local companies in prostate cancer diagnostics, such as Chugai, Telix Pharmaceuticals, Sinotau Pharmaceutical Group, and others, are developing advanced prostate cancer diagnostics tools and systems across the Asia Pacific region, which is expected to drive the growth of the prostate cancer diagnostics market in this region.

- In November 2023, the government of Assam in India announced that it would invest Rs 135 crores in the Assam Cancer Care Foundation to develop ten new cancer hospitals in the state.

- According to World Data Atlas, the rate of geriatric population (65 years and above) in Japan was 30.1 % of the total population in 2023.

- In October 2023, Sinotau Pharmaceutical Group announced a partnership with Blue Earth Diagnostics Ltd. This partnership is done to launch Flotufolastat (18F) Injection for prostate cancer diagnosis in China.

Market Overview

The prostate cancer diagnostics market is one of the most important industries in the healthcare sector. This industry deals in the development and distribution of prostate cancer diagnostics methodologies for detecting prostate cancer across the world. This industry comprises various tests that mainly include preliminary tests and confirmatory tests. These tests are performed for the detection of several types of prostate cancers, such as adenocarcinoma, interstitial cell carcinoma, and some others. There are several end-users of this industry, mainly including hospitals, home care, outpatient facilities, research & manufacturing, and some others. This market is expected to grow significantly with the growth in the clinical diagnostics industry.

- According to the annual report of Lantheus Holdings published in March 2024, PYLARIFY's revenue in the U.S. during 2023 was more than US$ 150 million in the year 2023. PYLARIFY is the leading prostate-specific membrane antigen (“PSMA”) PET imaging test for diagnosis of prostate cancer.

Prostate Cancer Diagnostics Market Growth Factors

- Growing developments related to the healthcare industry have led to prostate cancer diagnostics market growth.

- The rise in the number of government initiatives related to screening of prostate cancer across the globe.

- The ongoing developments in the diagnostics tools related to prostate imaging.

- The application of Pca3 tests for the detection of prostate cancer antigen 3 (PCA3) gene is growing.

- There are growing investments from public and private sector entities to develop the prostate cancer diagnostics industry.

- The advancements in technologies related to the diagnosis of cancer impact industrial growth positively.

- The increase in the number of biomarker research studies has accelerated the market in a positive way.

- The growing adoption of PSA test for detection of interstitial cell carcinoma.

- The rise in the number of campaigns related to screening of prostate cancer in men.

- The increasing demand for home-based testing kits for prostate cancers boosts the market growth.

- The growing number of diagnostics centers around the world has driven the growth of the prostate cancer diagnostics market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 17.01 Billion |

| Market Size in 2025 | USD 9.72 Billion |

| Market Size in 2024 | USD 9.13 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

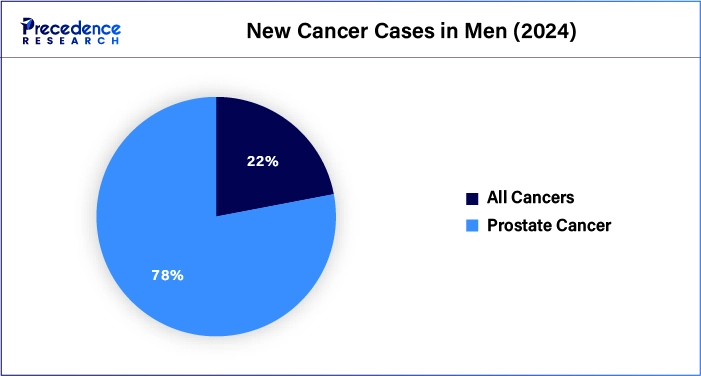

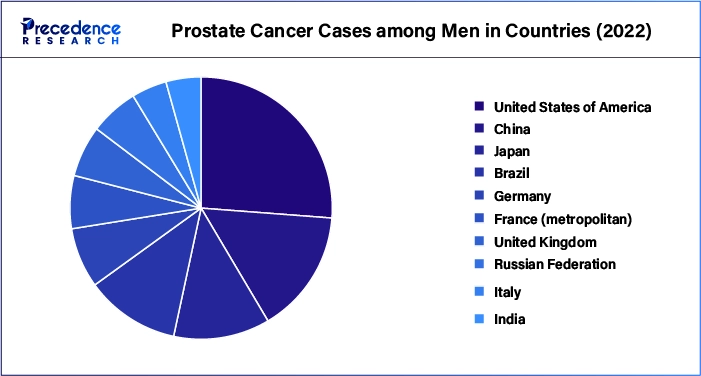

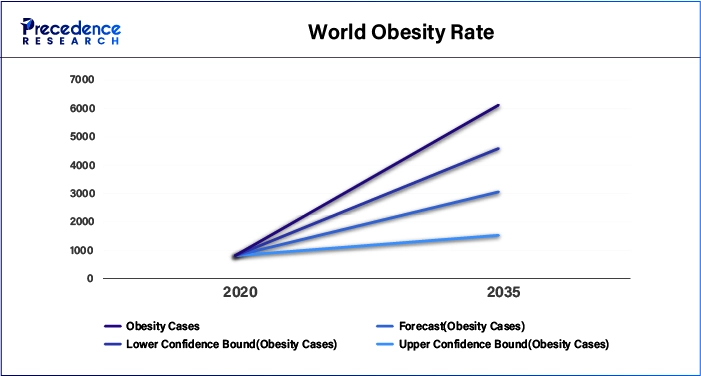

Rising incidences of prostate cancer among men

The cases of prostate cancer in men have been increasing rapidly across the world. The rising incidences of prostate cancer are mainly due to several factors such as age, diet, obesity, ethnicity, chemical exposure, genetics, prostatitis, vasectomy, and some others. Thus, with the increasing prevalence of prostate cancer, the demand for prostate cancer diagnosis increases, thereby driving the growth of the prostate cancer diagnostics market during the forecast period.

- According to a report published by World Cancer Research Fund International, the prevalence rate of prostate cancer among men in France was the highest at 82.3% in 2022.

Restraint

High cost of diagnosis along with a lower number of positive trials

The prostate cancer diagnostics industry has gained prominent attention with the rising cases of adenocarcinoma and small cell carcinoma around the world. Although there are several advantages of prostate cancer diagnostics tools, there are various problems in this industry. Firstly, the diagnosis of prostate cancer is relatively higher as compared to the diagnosis of other types of cancers. Secondly, most of the clinical trials associated with prostate cancer diagnosis come with a lower success rate. Thus, the high diagnosis cost associated with prostate cancer, along with the lower success rate of clinical trials, is expected to restrain the growth of the prostate cancer diagnostics market during the forecast period.

Opportunity

Developments associated with the MPS2 test to change the future

Diagnostics centers around the world are using different types of diagnostics methodologies for the detection of prostate cancer. Nowadays, the research and development activities associated with the MPS2 test are growing rapidly to avoid unnecessary biopsies and other testing for detecting prostate cancer. Thus, advancements in MPS2 tests associated with prostate cancer diagnosis are expected to create ample opportunities for the market players in the upcoming future.

- In February 2023, Lynx Dx, Inc. launched MyProstateScore 2.0, an MPS2-based prostate cancer screening test that provides accurate results to guide clinical decisions.

Top Hospitals Associated with Prostate Cancer Diagnoses (U.S.)

- University Hospital

- Moffitt Cancer Center Magnolia Campus

- Mayo Clinic Hospital - Saint Marys Campus

- Hartford Hospital

- Parkview Regional Medical Center

- Cleveland Clinic Main Campus

- University Hospital

- Stanford Hospital - 300 Pasteur Dr

- William P Clements Jr University Hospital

- Memorial Sloan Kettering Cancer Center

- Test Type Insights

Test Type Insights

The confirmatory tests segment dominated the market with the highest market share of 67% in 2024. The rising incidence of small cell prostate cancer and neuroendocrine tumors among men has driven market growth. Also, the rising application of the PCA3 test in detecting various types of prostate cancer is likely to boost the market growth to some extent. Moreover, the growing adoption of transrectal ultrasound systems for creating video images of the prostate gland is expected to drive the growth of the prostate cancer diagnostics market during the forecast period.

- In April 2024, Best Nomos launched Sonalis. Sonalis is a transrectal ultrasound system that finds several applications in the detection of prostate cancer in men.

The preliminary segment is estimated to exhibit a significant growth rate during the forecast period. The rising prevalence of squamous cell carcinoma and adenocarcinoma across the world has increased the demand for preliminary tests associated with prostate cancer, thereby driving market growth. Also, the growing adoption of PSA (prostate-specific antigen) tests for screening prostate cancer will likely boost the market growth to some extent. Moreover, the increasing application of free PSA tests for detecting early stages of prostate cancer is expected to propel the growth of the prostate cancer diagnostics market during the forecast period.

- In May 2024, Oxford BioDynamics announced a partnership with Goodbody Clinic to launch a PSA test in the U.K. to screen prostate cancer.

Type Insights

The adenocarcinoma segment accounted for a major market share of 91% in 2024. The increasing cases of adenocarcinoma among people across the world have boosted the market growth. Also, the rising incidences of acinar adenocarcinoma and ductal adenocarcinoma in men have increased the demand for diagnostics methodologies associated with it, thereby driving the market growth to some extent. Moreover, the growing application of positron emission tomography (PET) scan andmagnetic resonance imaging (MRI) for the detection of adenocarcinoma is expected to drive the growth of the prostate cancer diagnostics market during the forecast period.

- In May 2023, Health Canada had approved Illuccix. Illuccix is a radioactive diagnostic agent indicated for PET (positron emission tomography) imaging of PSMA-positive lesions in patients with prostate cancer.

The interstitial cell carcinoma segment is estimated to exhibit a significant growth rate during the forecast period. The increasing cases of testicular tumors due to the growing prevalence of obesity has increased the demand for prostate cancer diagnostics, thereby driving the market growth. Also, the rising application of PSA tests and transrectal ultrasonography (TRUS) for detecting interstitial cell carcinoma in the prostate gland is likely to boost market growth to some extent. Moreover, the growing demand for non-invasive imaging systems to diagnose interstitial cell carcinoma is expected to propel the growth of the prostate cancer diagnostics market during the forecast period.

- In February 2024, Cleveland Clinic launched a non-invasive imaging system. This non-invasive imaging system is effective for diagnosing interstitial cell carcinoma among men.

End-Use Insights

The outpatient facilities segment held a dominant share of the market in 2024. The rising number of clinics that allow doctor consultations related to prostate cancer has driven the market growth. Also, the availability of prostate cancer diagnostics tools in outpatient facilities is likely to boost the market growth to some extent. Moreover, the advantages of outpatient facilities, such as flexibility, low cost, convenience, patient satisfaction, and some others, are expected to boost the growth of the prostate cancer diagnostics market during the forecast period.

- In April 2022, Mount Sinai Health System launched a mobile prostate cancer screening unit. This prostate cancer screening unit is inaugurated in New York City with the aim of supporting prostate health among the black community.

The hospitals segment is expected to grow at a significant CAGR during the forecast period. The rise in the number of cancer hospitals across the world has boosted the market growth. Also, the growing emphasis by the governments of several countries on developing medical facilities associated with prostate cancer diagnostics and treatment is likely to boost market growth to some extent. Moreover, several hospitals are integrating prostate cancer diagnostics tests and engaged in clinical trials to help patients suffering from prostate cancer, thereby driving the growth of the prostate cancer diagnostics market during the forecast period.

- In April 2024, Norwalk Hospital announced the launch of a new clinical trial. This clinical trial is launched for diagnosing unfavorable intermediate-risk prostate cancer in men.

Prostate Cancer Diagnostics Market Companies

- MDx Health

- Myriad Genetics, Inc.

- Abbott Laboratories

- F. Hoffman-La Roche AG

- Bayer AG

- Siemens Healthcare GmbH

- OPKO Health, Inc.

- Genomic Health.

- Pfizer Inc.

- Humasis

- Hologic Inc.

- DiaSorin S.p.A

- Beckman Coulter, Inc.

- Metamark Genetics, Inc

- Proteomedix

Recent Developments

- In May 2024, Cortechs.ai launched OnQ Prostate. OnQ Prostate is approved by the FDA post-processing software that helps in the detection of prostate cancer.

- In February 2024, DiaCarta collaborated with OncoAssure. This collaboration is done to commercialize OncoAssure's excellent prostate test that is designed for identifying patients with a low risk of prostate cancer recurrence.

- In September 2023, Nanostics launched ClarityDX. ClarityDX is a prostate test that helps in screening prostate cancer cases in men aged 45-70 years.

- In July 2023, Quest Diagnostics announced a collaboration with Envision Sciences. This collaboration is aimed at launching a novel prostate cancer biomarker test for identifying and differentiating potentially aggressive cases of prostate cancer in men.

- In July 2023, Blue Earth Diagnostics POSLUMA. POSLUMA is a radio-hybrid (rh) Prostate-Specific Membrane Antigen (PSMA)-targeted PET imaging test that finds application in the detection of prostate cancer.

Segments Covered in the Report

By Test Type

- Preliminary Tests

- PSA Tests

- Free PSA Test

- Total PSA Test

- Other Preliminary Tests

- Confirmatory Tests

- Pca3 Test

- Trans-Rectal Ultrasound

- Biopsy Test

By Type

- Adenocarcinoma

- Interstitial Cell Carcinoma

- Other

By End-Use

- Hospitals

- Home Care

- Outpatient Facilities

- Research & Manufacturing

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting