What is the High Potency Active Pharmaceutical Ingredients Market Size?

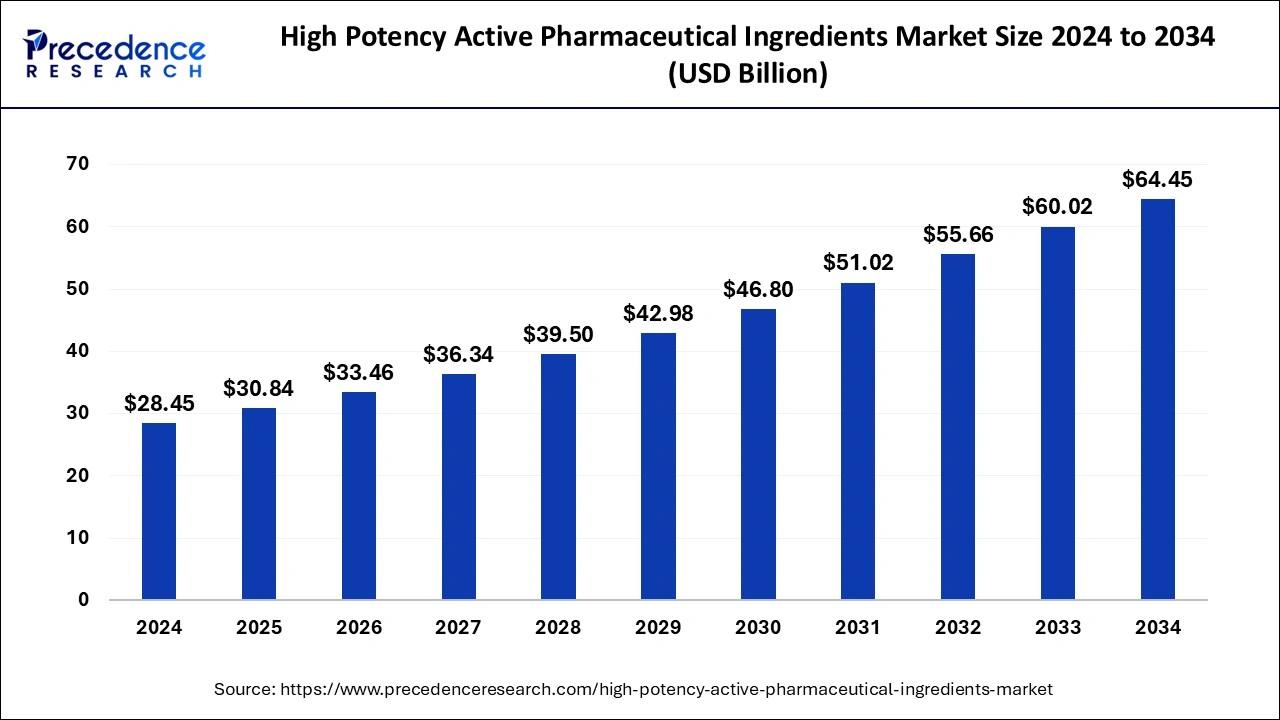

The global high potency active pharmaceutical ingredients market size is valued at USD 30.84 billion in 2025 and is predicted to increase from USD 33.46 billion in 2026 to approximately USD 68.88 billion by 2035, expanding at a CAGR of 8.37% from 2026 to 2035. The rise in demand for better therapeutics is driving the high potency active pharmaceutical ingredients market.

Market Highlights

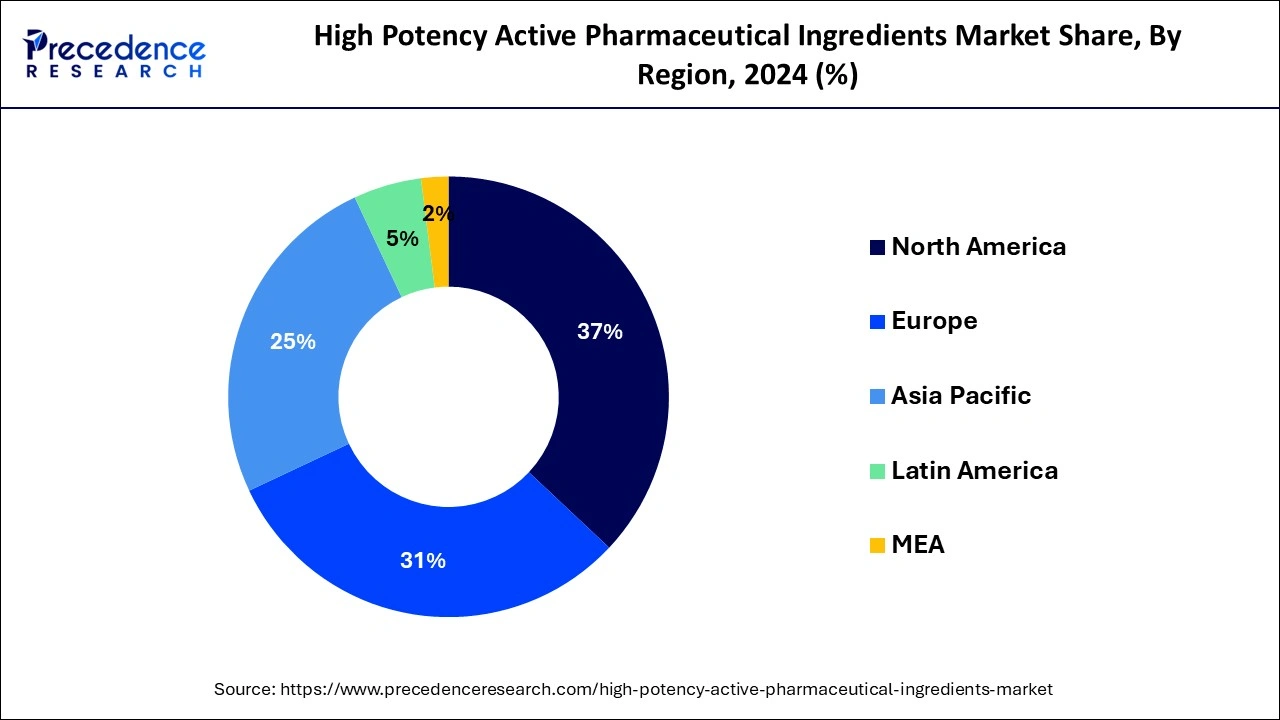

- The North America market accounted for more than 37% of the total revenue share in 2025.

- By manufacturer type, the in-house segment accounted biggest revenue share in 2025.

- By application, the oncology segment has captured a market share of around 76% in 2025.

- By drug type, innovative drugs have accounted revenue share of over 71.6% in 2025.

- By product, the synthetic segment accounted revenue share of around 70.5% in 2025.

Integration of AI in the Market

By using sophisticated algorithms and predictive analytics to find areas for resource efficiency, Artificial Intelligence-enabled modeling provides a solution. The foundation of a good HPAPI production process is efficiency. Machine learning and other AI-driven technologies provide real-time process optimization for manufacturing. AI systems find trends, spot irregularities, and recommend changes to improve production quality and efficiency by continually evaluating production data. When coupled with dynamic reinforcement learning optimization, this results in shorter cycle times, higher yields, and better-quality products. In the end, it comes down to optimizing output while upholding strict quality and regulatory requirements, which AI's adaptable skills enable.

Market Overview

The high potency active pharmaceutical ingredients (HPAPI) are more effective than conventional APIs at considerably lower dosage levels, but their handling issues are unique due to their potency. One significant reason anticipated to propel the market for highly potent active pharmaceutical ingredients is the increased incidence of cancer (HPAPIs). T The entire burden of the disease has been attributed, according to the CDC, to risk factors including lifestyle modifications like smoking, obesity, drinking alcohol, and exposure to UV radiation from the sun or tanning beds.

High Potency Active Pharmaceutical Ingredients Market Growth Factors

- Rising demand for HPAPIs: Many top pharmaceutical firms are making significant investments in R&D and HPAPI production facilities in order to strengthen their HPAPI pipelines in light of the increased demand. The increasing use of HPAPI molecules offers patients substantial potential advantages, which makes them a desirable option for pharmaceutical companies.

- Increasing focus on precision medicine and high-potency APIs: Investments allow businesses to match their portfolios with market demands as the need for tailored medical and focused remedies grows. The creation of medications with greater efficacy and fewer adverse effects may result from this strategic alignment.

- Technological advancements in high-potency API manufacturing: Rapid technical advancements in quality control systems and high-potency API production methods are being witnessed by the industry. In order to guarantee exact control over the production process of very powerful chemicals, businesses are progressively implementing automated systems and sophisticated analytical procedures.

- Rising prevalence of cancer: Strong Active Pharmaceutical Ingredients (APIs) specifically designed for oncology treatments are becoming more and more necessary as the prevalence of cancer rises worldwide. Highly powerful APIs (HPAPIs) are essential to the development of targeted cancer drugs that can eradicate malignant cells with little harm to healthy tissues.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 30.84 Billion |

| Market Size in 2026 | USD 33.46 Billion |

| Market Size by 2035 | USD 68.88 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.37% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Manufacturer Type, By Drug Type, and By Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for drugs

-

- The usage of very potent APIs in a variety of pharmacological therapies also contributes to the market's expansion. Both small and large API molecules were used in these treatments. The main ingredients in these medications are high-potency APIs. The market will expand in tandem with the increase in cancer cases to offer treatments for the condition. In recent years, precision medicine has received a lot of attention.

Increasing clinical trials

- Targeted therapies are expanding as a result of hospitals and healthcare organizations collaborating closely with pharmaceutical firms to perform clinical trials. For instance, the Human Epidermal Growth Factor Receptor 2 (HER-2) protein, which is abundant in cancer cells, is being targeted for the treatment of breast cancer. Because the protein is overexpressed in breast and stomach cancer cells, HER-2 receptor antagonists such as trastuzumab are employed. Additionally, scientists are working to create a variety of specialized products, such as Janus kinase (JAK) 3 inhibitors, selective S1P receptor modulators, inhibitors of human interleukin, and inhibitors of dihydroorotate dehydrogenase.

Challenges

- Barriers to entry - While many companies have not sought to buy existing businesses or add HPAPI capacity to their infrastructure, those with current HPAPI capabilities are actively growing their facilities. With regard to entrance obstacles, regulatory constraints, large investments, and knowledge related to APIs & HPAPI development, several manufacturers across different geographies and degrees of experience are making a sizable number of investments in HPAPI capabilities.

- Need for appropriate process designs - The majority of HPAPI and ADC medication payloads require just modest clinical and commercial production volumes. However, it is difficult to produce gram-scale GMP APIs and payloads. It is undoubtedly difficult to maintain containment control when employing flexible and compact equipment, especially glass equipment, and each process and unit operation calls for a different strategy. In order to make sure that the process scales up to the facility's capabilities and equipment, it is crucial to retain proper process designs at the developmental stage.

Opportunities

Opportunities for CMOs and CDMOs are expanding

- Comprehensive planning, the use of risk management and assessment tools, and a system to decide which compounds are suitable for manufacturing in each facility are all necessary for a comprehensive HPAPI manufacturing plant. The manufacturing of such substances exposes both the environment and people to dangers and risks.

- A growing number of strong substances require pharmaceutical producers to have the ability to produce, store and transport them safely. This demonstrates that putting into practice a successful HPAPI manufacturing strategy involves a sizable time and financial commitment. Because many of these businesses have the appropriate machinery, many sponsor companies choose to turn to CMOs and CDMOs for assistance with the research, production, and distribution of HPAPIs and their formed medicinal products.

Segment Insights

Product Insights

The synthetic category accounted for the greatest revenue share in 2025. In the upcoming years, a number of synthetic compounds are also predicted to lose their patent protection, which is likely to spur industry expansion. Since 2007, the Japanese government has encouraged the use of generic medications to lower the overall cost of healthcare and lessen the financial strain on patients.

Due to technical improvements and the high level of efficacy of these substances, the biotech segment is anticipated to grow profitably during the forecast period.

Drug Type Insights

Due to increased R&D efforts for the creation of novel pharmaceuticals and advantageous government laws, innovative drugs made up the greatest revenue share in 2025. The development of innovative APIs is being driven by the increasing emphasis on personalized and precision medicines, such as Antibody Drug Conjugates (ADCs), to treat specific patient problems, making innovation in this field a high-impact market driver.

Over the projected period, generic medication molecules are anticipated to grow at the fastest rate. Lower prices and the patent expiration of branded medications are two factors that are driving this market segment. Due to the increase in patients in emerging nations with low per capita incomes, generic medications are also increasing their market share.

Application Insights

Due to the substantial use of HPAPIs in oncology medications, the oncology segment had the greatest sales share in 2025. One significant element driving the increase in demand for HPAPIs is the rise in cancer prevalence.

As a result of glaucoma's rising incidence in both established and developing nations, the glaucoma market is expected to experience exponential expansion in the years to come. Additionally, the market for HPAPIs is anticipated to rise more quickly due to the increasing trend in the occurrence of infectious disorders with antibiotic resistance.

ManufacturerTypeInsights

The in-house sector generated the most revenue in 2025, and it is anticipated that it will continue to lead during the forecast period. To create these compounds, the businesses make significant infrastructure and development expenditures.

Further evidence that important firms are more focused on internal production than outsourcing comes from recent developments and initiatives. For instance, Novartis stated in November 2019 that it had acquired Cell for Cure, a CDMO with offices in France, in order to make molecules internally that had previously been given to Cell for Cure on a contract manufacturing basis.

Regional Insights

U.S. High Potency Active Pharmaceutical Ingredients Market Size and Growth 2026 to 2035

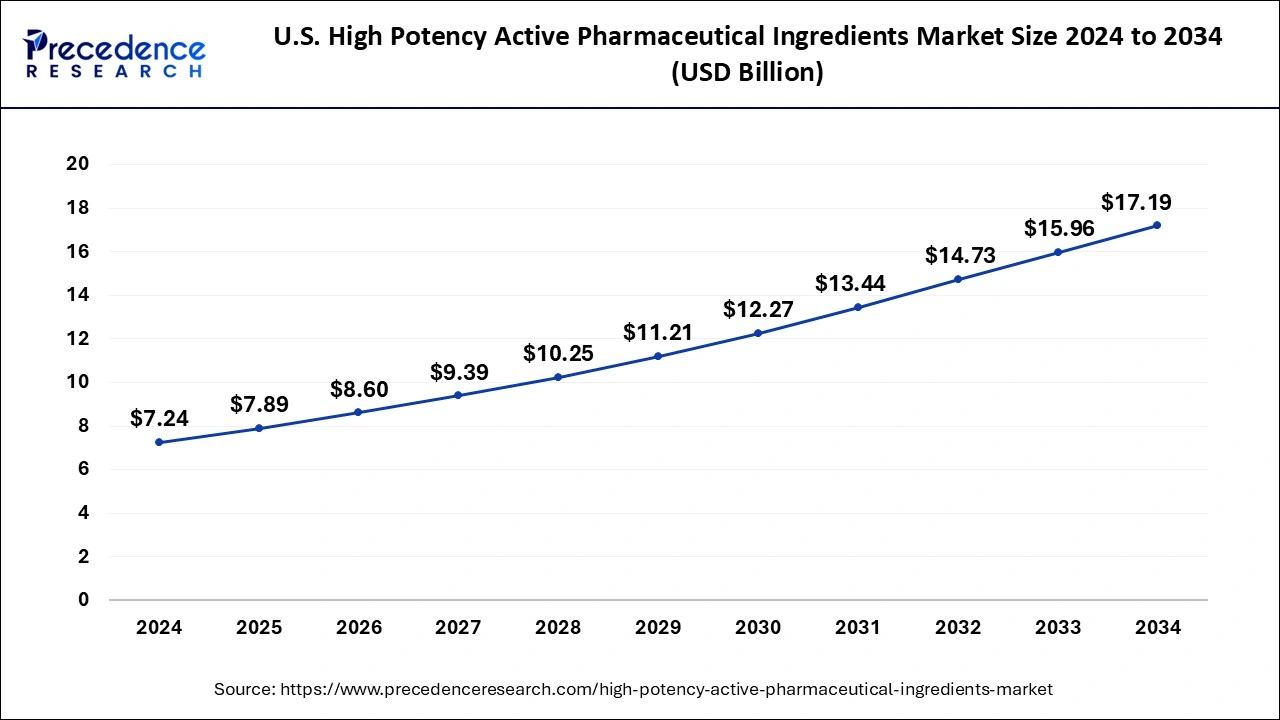

The U.S. high potency active pharmaceutical ingredients market size reached USD 7.89 billion in 2025 and is anticipated to reach around USD 18.42 billion by 2035, poised to grow at a CAGR of 8.85% from 2026 to 2035.

What Makes North America the Dominant Region in the Market?

North America is anticipated to dominate the market with revenue share of 37% in 2025. When it comes to the prevalence of diseases like cancer and neurological illnesses, the U.S. was the most impacted nation in the entire world. The region's output of HPAPIs is rising as a result of the rising prevalence of these illnesses. In several therapeutic, drug-discovery, or other research investigations pertaining to oncology and other serious conditions, HPAPIs are frequently used. As a result of the region's growing patient population relative to other nations, the demand for the same will be considerably larger in North America.

U.S. Market Analysis

The U.S. is a major contributor to the North American high potency active pharmaceutical ingredients market, owing to the rising prevalence of cancer, neurological disorders, and other chronic diseases. Increasing demand for targeted therapies, expanding oncology research, development of drug manufacturing infrastructure, and robust pharmaceutical manufacturing capabilities drive market growth. Moreover, supportive regulatory frameworks and high patient awareness regarding the use of highly potent APIs in therapeutics and clinical applications contribute to market growth.

Growing elderly population as well as the rising prevalence and incidence of infectious diseases in this region, North America is anticipated to account for a sizable portion of the market for high-potency APIs and HPAPIs. Incidence rates for chronic conditions like cancer are similarly high in the US. The Parkinson's Foundation estimates that approximately 1 million Americans have Parkinson's disease, which is more than the combined number of people with muscular dystrophy, multiple sclerosis, and amyotrophic lateral sclerosis. By 2032, this number is projected to rise to 1.2 million.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is estimated to grow at the fastest CAGR in the high potency active pharmaceutical ingredients market during the forecast period, propelled by the growing pharmaceutical industry in nations such as China and India. Advanced therapies are in high demand due to the region's large population and increased prevalence of chronic illnesses. Market expansion is also supported by government programs to improve healthcare infrastructure and attract international investment. Additionally, Asia Pacific is a desirable location for HPAPI production due to its trained labor and cost-effective manufacturing capabilities.

Over the past few decades, the Indian pharmaceutical sector has grown and now accounts for around 1.72% of the country's GDP. It is projected that the Indian pharmaceutical business will reach $65 billion by 2024 and $130 billion by 2030. The rising need for reasonably priced, high-quality medications both locally and abroad is what is causing this increase. At the moment, India ranks third globally in terms of volume and fourteenth globally in terms of value. With an 8% market share in the global API industry, India ranks third in terms of API production. India produces more than 500 distinct APIs, accounting for 57% of the APIs on the WHO prequalified list. Over the first four years, the Indian API market is expected to grow at a compound annual growth rate (CAGR) of 13.7%, which is almost 8% faster than the general API market. Many venture capitalists and investors have found the Indian API market to be profitable. An additional benefit is provided by India's strong domestic market, sophisticated chemical industry, highly qualified labor force, strict quality and manufacturing standards, and affordable prices (about 40% lower than in the West) for establishing and running a modern factory.

Europe Market Analysis

India's high potency active pharmaceutical ingredients market is expanding due to its growing pharmaceutical industry, rising demand for advanced therapies, and increasing prevalence of chronic diseases. Cost-effective manufacturing, skilled workforce, favorable government initiatives to boost healthcare infrastructure, and growing contract manufacturing opportunities attract global investment. These factors collectively drive the production and adoption of high-potency active pharmaceutical ingredients in India.

How is the Opportunistic Rise of Europe in the Market?

Europe is expected to grow at a notable rate in the upcoming period due to increasing demand for advanced therapies, a rising prevalence of chronic diseases, and a strong pharmaceutical research infrastructure. Supportive regulations, advanced manufacturing capabilities, and collaborations between biotech companies and academic institutions further drive the development, production, and adoption of high-potency active pharmaceutical ingredients in the region.

UK Market Analysis

The UK high potency active pharmaceutical ingredients market is expanding due to increasing cancer and chronic disease prevalence, rising demand for targeted therapies, and strong pharmaceutical R&D infrastructure. Supportive government policies, skilled workforce, advanced manufacturing capabilities, and active collaboration between biotech firms and research institutions are driving the development, production, and adoption of high-potency active pharmaceutical ingredients in the country.

Value Chain Analysis

- R&D: R&D in HPAPIs focuses on targeted therapies, optimizing low-dose synthesis, advanced containment, and safety protocols for highly potent biologically active drugs.

Key Players: BASF SE, Lonza Group, Boehringer Ingelheim, Cipla Limited, Dr. Reddy's Laboratories, Aurobindo Pharma, Solvay S.A - Packaging and Serialization : HPAPI packaging uses specialized containment for safety and product integrity, while serialization ensures regulatory-compliant traceability across the pharmaceutical supply chain.

Key Players: Gerresheimer AG, West Pharmaceutical Services, Schott AG, Catalent, AptarGroup, Huber Group, Amcor Limited. - Distribution to Hospitals, Pharmacies : HPAPI distribution requires secure, GMP-compliant supply chains with controlled storage, strict containment, and regulatory adherence to ensure safety and product integrity.

Key Players: UPS Healthcare, DHL Supply Chain, FedEx Custom Critical, Marken (Thermo Fisher), PCI Pharma Services, Recipharm, Catalent.

Top Companies Operating in the Market & Their Offerings

- BASF SE – Provides high-potency active pharmaceutical ingredients and custom synthesis services, focusing on oncology and specialty therapies, with advanced containment, safety protocols, and large-scale manufacturing capabilities.

- CordenPharma – Offers development, manufacturing, and packaging of HPAPIs, including oncology and cytotoxic drugs, with expertise in formulation, containment, and regulatory compliance for global pharmaceutical clients.

- Dr. Reddy's Laboratories Ltd. – Manufactures HPAPIs for oncology and specialty treatments, providing contract development and production services with adherence to GMP standards and strict safety protocols.

- CARBOGEN AMCIS AG – Specializes in custom development and manufacturing of HPAPIs and cytotoxic compounds, including drug substances and intermediates, supporting pharmaceutical R&D and commercial production globally.

- Pfizer, Inc. – Develops and produces high-potency APIs for targeted therapies, particularly in oncology, leveraging advanced manufacturing, containment technologies, and global distribution for therapeutic applications.

High Potency Active Pharmaceutical Ingredients Market Companies

- Sun Pharmaceutical Industries, Ltd.

- Teva Pharmaceutical Industries Ltd.

- Albany Molecular Research, Inc.

- Sanofi S.A.

- Merck & Co., Inc.

- Novartis AG

Recent Developments

- In April 2025, Penpulimab-kcqx was approved by the FDA for treating relapsed nasopharyngeal carcinoma, following multiple fast-track designations to accelerate its development and review.(Source: https://www.fda.gov)

- In January 2025, the FDA granted accelerated approval to sunvozertinib (Zegfrovy) for treating metastatic non-small cell lung cancer (NSCLC) patients with EGFR exon 20 insertions.(Source: https://www.fda.gov)

Segments Covered in the Report

By Product

- Synthetic

- Biotech

By Manufacturer Type

- In-house

- Outsourced

By Drug Type

- Innovative

- Generic

By Application

- Oncology

- Hormonal Disorders

- Glaucoma

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting