What is the Pharmaceutical Capsule Filling Machines Market Size?

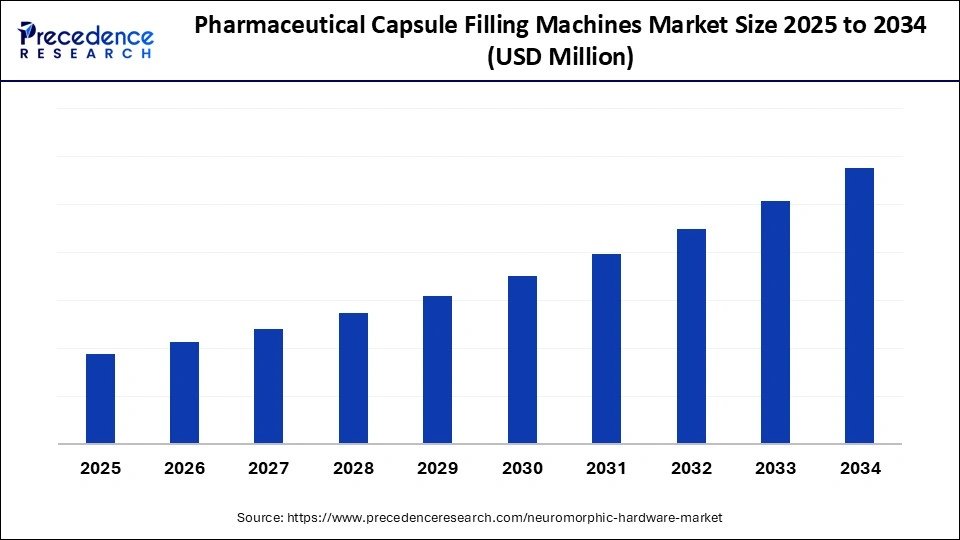

The global pharmaceutical capsule filling machines market is expanding as manufacturers adopt AI-enabled monitoring, modular designs, and continuous manufacturing to enhance productivity and quality.The market is driven by rising demand for precision drug delivery, growth in generics, and increasing adoption of automated production technologies.

Pharmaceutical Capsule Filling Machines Market Key Takeaways

- Asia Pacific dominated the global pharmaceutical capsule filling machines market with largest market share of 40% in 2024.

- North America is anticipated to witness significant growth during the forecasted years.

- By machine type, the fully automatic capsule filling machines segment captured the biggest market share of 55% in 2024.

- By machine type, the semi-automatic capsule filling machines segment is anticipated to show considerable growth over the forecast period.

- By dosage/fill type, the powder filling machines segment contributed the highest market share of 50% in 2024.

- By dosage/fill type, the liquid/oil-based filling machines segment is anticipated to show considerable growth over the forecast period.

- By capsule type, the hard gelatin capsules segment held the maximum market share of 60% in 2024.

- By capsule type, the HPMC (Hydroxypropyl Methylcellulose) capsules segment is anticipated to show considerable growth over the forecast period.

- By output capacity, the large-scale (above 70,000 capsules/hour) segment accounted for the significant market share of 45% in 2024.

- By output capacity, the medium-scale segment is anticipated to show considerable growth over the forecast period.

- By end-use industry, the pharmaceutical manufacturing companies segment generated the major market share of 65% in 2024.

- By end-use industry, the nutraceutical and dietary supplement companies segment is anticipated to show considerable growth over the forecast period.

Market Overview

The pharmaceutical capsule filling machines market includes sophisticated machines that are used to fill hard and soft capsules with pharmaceutical powders, pellets, granules, or liquids, and the machines are core in the manufacture of modern drugs. These machines are necessary in matters of offering quality dosage, high performance, and prevention of contamination, and mass production, which makes them invaluable in the pharmaceutical, nutraceutical, and biotechnology industries. The growth in the market was encouraged by the increased use of solid oral dosage forms, the growing need for cost-effective generics, and the growing popularity of dietary supplements.

This demand is further increased by an aging population, with the elderly population tending to take numerous medications and supplements that are taken in the long term to manage their health. Moreover, the capsule filling machines are increasingly becoming cost-effective and efficient due to technological innovations into faster speed automation, greater accuracy of fillers, and integration of intelligent control systems. In addition, increased health awareness and demand for nutraceuticals and functional foods are compelling manufacturers to embrace new technology for filling the capsules to boost productivity and retain the quality of the product.

How is AI Integration Impacting the Pharmaceutical Capsule Filling Machines Market?

The pharmaceutical capsule filling machines market is in the stage of revolution with artificial intelligence that will make the process of manufacturing more automated, efficient, and accurate. With the advent of AI, manufacturers get the opportunity to maximize their processes, reduce costs, and ensure a consistent quality of their products through predictive analytics, machine learning, and real-time surveillance. In addition, the capsule weight, uniformity, as well as sealing can be monitored in real-time and controlled with AI-type quality control, which guarantees a significant rise in the level of compliance with the high regulatory standards.

Industry 4.0 projects are also supported by AI since it assists in linking the capsule filling machines with other production processes and giving a complete and smart production ecosystem. The machines that the AI can adapt to the new demands with ease, hence, flexible production lines can be implemented in the nutraceutical and pharmaceutical industries, where high-quality, plant-based, and specialized formulations can be found in the increase.

What Factors Are Fueling the Rapid Expansion of the Pharmaceutical Capsule Filling Machines Market?

- Rising Demand of Pharmaceuticals and Nutraceuticals: The rate of chronic illnesses has been on the rise, along with the increasing belief in good health and fitness is fuelling the surge in the demand for drugs and dietary supplements. This growth necessitates effective capsule manufacturing mechanisms, and this forces the pharmaceutical firms to seek the services of modern capsule filling machines that are accurate, quick, and of international standard.

- Technological Improvement: The manufacture of capsules has seen some innovations that include high-speed automation, extreme dosing precision, and the application of intelligent monitoring systems, all of which are considered to be a revolution in the production of capsules. These enhancements are more effective in the operations and reduce labor and human error.

- Growing Need for Clean, Vegan, and Plant-Based Capsules: The demand for clean and vegan health products and plants is creating the necessity of specialized, clean and vegan, and plant-based capsule filling solutions. The trend is the use of machines with gelatin-free and natural formulations by the manufacturers, and this is due to an increase in consumer preferences and opportunities in the nutraceutical and herbal supplements markets.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Dosage/Fill Type, Capsule Type, Output Capacity, End-Use Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Herbal and Nutraceutical Supplements

One of the biggest market drivers of the pharmaceutical capsule filling machines is the increasing levels of consumer interest in herbal supplements, vitamins, and nutraceuticals. With a general shift towards health awareness in the world, there has been a general shift towards plant, organic, and natural supplements for promoting overall wellness, prophylaxis, and fitness. This growing market is in the area of herbal extracts, probiotics, dietary supplements, and sports nutrition products such as protein and performance-enhancing capsules.

Modern capsule filling machines are flexible, which enables companies to offer a variety of products that are adapted to the changing consumer trends. Due to the current upward trend in the nutraceutical and dietary supplement market worldwide, capsule filling equipment is emerging as a vital support to the large-scale production of high-quality supplements.

Stringent Regulatory Requirements for Pharmaceutical Manufacturing

The global regulations as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Good Manufacturing Practices (GMP) standards, are very strict about the process of drug production, to guarantee the safety and consistency of the product and its quality to the patients. Such regulations require a lot of accuracy, control of contamination, and records during the manufacturing process. The incorporation of such technologies helps pharmaceutical companies to increase the efficiency of operations as well as protect regulatory approval and market access.

Restraint

High Initial Investment Costs and Maintenance Costs

A significant limitation in the pharmaceutical capsule filling machines market is the high startup cost and maintenance expenses of having sophisticated equipment. Capsule fillers are very capital-intensive machines that are not affordable to small and medium-sized pharmaceutical companies. These machines incur huge start-up costs, and they also come with several other costs that are incurred to maintain them, hire qualified personnel, and meet the high standards of regulatory requirements. Additionally, the regular upgrades and technological progress require additional capital investment, straining budget-conscious companies.

Opportunity

Rising Demand for Personalized Medicine and Customized Formulations

The growing trend towards personalized medicine and customized drug preparations is a large opportunity for the pharmaceutical capsule filling machines market. As healthcare is increasingly being driven into more personalized approaches to treatment, pharmaceutical companies are increasingly pressing the need to design more adaptable and more customized capsule-filling technologies capable of facilitating small-scale production. The growing popularity of vegan and plant-based variants of capsules in the nutraceutical market has made manufacturers respond with the creation of tools to be able to utilize the capsule production.

Segments Insights

Machine Type Insights

Why did Fully Automatic Machines Lead the Pharmaceutical Capsule Filling Machines Market in 2024?

The fully automatic capsule filling machines segment led the market in 2024. The large-scale pharmaceutical manufacturers have a strong preference towards these machines because they are very efficient, precise, and capable of facilitating continuous production with minimal human intervention. Fully automatic systems have implemented advanced capabilities like in-process weight control, automated feed of capsules, and connection with the upstream and downstream packaging lines, and meet the high standards of the regulatory environment. Also, these machines help in cutting down labor expenses, reducing chances of contamination, and enabling uniform quality of products. As the number of investments in smart manufacturing, IoT-driven operations, and automated quality checks continues to rise, fully automatic capsule fillers will occupy a leading position in the market.

The semi-automatic capsule filling machines segment is expected to grow at a significant CAGR over the forecast period. Small and medium-sized enterprises (SMEs) prefer these machines because of are cost-effective, easier to operate, and flexible when it comes to smaller batch production. Semi-automatic systems make use of some manual control, like loading capsules or filling a powder, to enable the manufacturer to have a low level of control over the production process and to gain the advantages of moderate automation. The increasing demand for generics, nutraceuticals, and specialty medicines drives SMEs to use these machines instead of the expensive, fully automatic systems. Semi-automatic machinery is also suitable for research and development or pilot-scale production, where low volumes and frequent changeovers are the norm.

Dosage/Fill Type Insights

Why did Powder Filling Capture the Largest Revenue Share in the Pharmaceutical Capsule Filling Machines Market in 2024?

The powder filling machines segment led the market in 2024. The powder filling machine ensures consistency in each dose, thus minimizing wastage and contamination at the same time. These machines can be used with several varieties of powder formulations, such as fine powder, granules, and blends, which is a plus in their diversification in carrying out various therapeutic procedures. The importance of the segment is also motivated by the need to have cost-effective and scalable manufacturing solutions. Additionally, innovation, including servo-controlled dosing, in-process weight control, and dust containment systems, has improved on efficiency and precision of powder filling machines. With pharmaceutical firms still placing emphasis on the solid oral dose forms, the powder filling segment will have a dominant role in the market.

The liquid/oil-based filling machines segment is expected to grow substantially in the pharmaceutical capsule filling machines market. The increasing demand for liquid-filled soft capsules, multi-component formulations, and combination therapies that enhance bioavailability and patient compliance is fueling this trend. Liquid and combination filling machines enable the exact amount of oils, semi-solids, and suspensions to be accurately dosed into the capsules with minimal leakage and preservation of the product. Growth is also driven by technological development in machine technology, such as automated capsule handling, vacuum dosing, and temperature-controlled systems, which accommodate sensitive formulations. The growth of the segment is also boosted by the regulatory focus on dosage exactness and the growing popularity of personalized medicine that demands customized and effective liquid and mix capsule filling technology.

Capsule Type Insights

Why did Hard Gelatin Capsules Lead the Pharmaceutical Capsule Filling Machines Market in 2024?

The hard gelatin capsules segment led the market while holding a 60% share in 2024. They are also highly favored because of their simplicity in manufacture, low cost, and the ability to blend with a wide variety of powders, granules, and pellets. Hard gelatin capsules can provide accurate dosing, outstanding stability, as well as predictable release characteristics, which are suitable for prescription medication, generic, and nutraceutical products. Also, the high-speed and fully automatic capsule filling machines have improved production efficiency, quality control, and scalability even further, in the case of hard gelatin capsules. As the need for solid oral dosage forms continues to rise, the hard gelatin capsule market is projected to maintain its leadership in the market and still enjoy the benefits of automated filling, expanding the size of capsules, and optimization of forms.

The HPMC (Hydroxypropyl Methylcellulose) capsules segment is expected to grow at a significant CAGR over the forecast period. The growing popularity of vegan and vegetarian-favorite products and the growing concern about health and sustainability are contributing to the demand for plant-based alternatives to standard gelatin capsules. The stability, safety, and release properties of HPMC and other plant-based capsules remain similar to meet the needs of religious, dietary, and ethical reasons. Naturals are also popular in the segment, which is becoming popular in nutraceuticals, herbal supplements, and functional foods, where natural ingredients are highly appreciated. The technologies of capsule filling, the ability to correspond with automated devices, and the multi-component preparations are also contributing to the market.

Output Capacity Insights

Why did the Large-Scale (>70,000 Capsules/Hr) Segment Hold the Largest Share in the Pharmaceutical Capsule Filling Machines Market in 2024?

The large-scale (above 70,000 capsules/hour) segment held a 45% share in the market in 2024. The large pharmaceutical companies and the contract manufacturing organizations mostly use these machines to cater to the high demand for prescription drugs, generics, and nutraceuticals. Moreover, such machines promote the use of continuous high-speed production, and less labor is needed, as well as lowering the costs of operation. Their efficiency, reliability, as well as suitability to different formulations have also been enhanced by technological advancements. As the world pharmaceutical market deals with large-volume manufacturing, that of generic drugs, as well as high-demand health supplements, large-scale capsule filling machines are still a favorable option, as they provide manufacturers with the scalability, accuracy, and efficiency required to compete in a very competitive environment.

The medium-scale segment is projected to record significant growth during the forecast period, and this is based on the growing demand of small and medium-sized pharmaceutical and nutraceutical manufacturers. The machines can produce 25,000-70,000 capsules per hour, offering the optimal efficiency and cost-effectiveness for an average number of batches. They are especially applicable to generics, dietary supplements, as well as specialty formulations where flexibility is highly essential. Medium-scale systems are commonly characterized by partial automation, user user-friendly interface, and the ability to accept various powder, liquid, or combination fillings, which is essential for a pilot-scale production or a commercial system with moderate output requirements. The number of SMEs venturing into the segment also helps the growth of the segment since the demand for cheap healthcare and nutraceutical products is growing worldwide.

End-Use Industry Insights

Why do Pharmaceutical Manufacturers Dominate the Pharmaceutical Capsule Filling Machines Market?

The pharmaceutical manufacturing companies segment led the market while holding a 65% share in 2024. Automation, dosage, and regulatory compliance are the key factors that pharmaceutical firms consider; thus, fully automated and high-volume capsule-filling machines are the most desirable. The rising generic medications, specialty pharmaceuticals, and regular high-quality dosage forms contribute to this segment's domination. Capsule filling technology with in-process weight checks, servo-controlled dosing, and combining with downstream packaging systems has also made production efficient. Moreover, the increased investments in smart manufacturing and Industry 4.0 solutions allow the pharmaceutical manufacturers to increase the scale of their operations without compromising the quality level.

The nutraceutical and dietary supplements segment is expected to grow at a significant CAGR over the forecast period, due to the increasing awareness of consumers on health and wellness. The industry covers vitamins, minerals, herbal extracts, probiotics, and other dietary supplements, which are being produced more and more as capsules, to provide convenience, bioavailability, and accuracy of dosages. Nutraceutical companies are using medium and small-scale capsule-filling machines to fill the varied and increasing market need, as well as targeting the plant-based or HPMC capsules to serve vegetarian or vegan customers. Improvements in technology in the filling of capsules by automated technology, which also allows the use of powder, liquids, as well as combination formulations, are facilitating the efficient production without compromising the product safety and quality.

Regions Insights

Why did Asia Pacific Hold the Largest Share of the Pharmaceutical Capsule Filling Machines Market in 2024?

Asia Pacific led the global market with the highest share of 40% in 2024, because of its fast-growing pharmaceutical and nutraceutical industries. China, India, and Japan are leading the pack, and they are supported by the growing generic drugs production, the growing demand for healthcare services, and the powerful efforts of governments to empower local pharmaceutical markets. The launch of dietary supplements, herbal medicines, and plant-based capsules is also experiencing a boom in the region, especially in such markets as China, South Korea, and India, where the traditional medicine and wellness trends are very influential.

The pharmaceutical capsule filling machines market in the Asia Pacific has strong potential of growth potential with the influence of China. Being among the biggest manufacturers of generic drugs and exporters in the world, China suffers a huge requirement for rapid and effective capsule-filling technologies. The pharmaceutical industry is also receiving a boost through government-supported healthcare reforms and programs to cover more people with insurance, which is boosting the domestic demand for medicines and supplements. Furthermore, the trend of digitalization, automation, and smart manufacturing in China is enhancing the use of the next-generation capsule filling machine that goes well beyond international regulations.

Why is North America Expected to Witness Significant Growth in the Pharmaceutical Capsule Filling Machines Market?

North America is estimated to grow significantly during the forecast period. Its well-developed healthcare infrastructure, high rate of automation, and strength of the pharmaceutical manufacturing industry are the sources of power. The drug and nutraceutical companies in the area are also leveraging the modernized capsule filling machines to enhance productivity, maintain regulatory requirements, and adhere to the growing requirement of precise medicines and nutritional supplements. Capsule filling innovation is very high because there is a good investment in research and development, which has been facilitated by favorable government programs.

The United States has the biggest share and is the driver of growth in the market of the region. The ongoing improvement of healthcare technology and the implementation of Industry 4.0 procedures, such as the introduction of AI and robots, are changing the work of capsule filling in all manufacturing plants in the U.S. The increasing demand for personalized medicines and an emerging trend in the consumption of nutraceuticals, which include herbal supplements and sports nutrition, is further increasing its adoption. The large capital investment, coupled with the effective partnership between pharmaceutical, research, and machine producers, guarantees the U.S. lead in the innovation of capsule filling technologies.

Pharmaceutical Capsule Filling Machines Market Companies

- Bosch Packaging Technology (Syntegon Technology GmbH)

- IMA Pharma

- ACG Worldwide

- Capsugel (Lonza Group)

- MG2 S.r.l.

- Harro Höfliger Verpackungsmaschinen GmbH

- Zhejiang Fuchang Machinery Co., Ltd.

- Shanghai Develop Machinery Co., Ltd.

- Anchor Mark Pvt. Ltd.

- Sejong Pharmatech Co., Ltd.

- Schaefer Technologies, Inc.

- Riva GmbH

- Qualicaps (Mitsui Group)

- Beijing Hanlin Hangyu Technology Development Inc.

- Pharma Technology Inc.

Recent Developments

- In September 2025, Finetech introduced an improved NJP-1200 capsule filling machine. The system facilitated a mixture of soft capsules and granules with a production of up to 55,000 capsules in an hour. (Source: https://www.accessnewswire.com)

- In November 2023, ACG presented an idea of an AF330 capsule filling machine at CPHI and PMEC India. The model was focused on efficiency and compactness, as well as IIoT-enabled capabilities to meet current pharmaceutical production. (Source: https://www.pharmiweb.com)

- In July 2023, Syntegon released the GKF Capsylon 6005 capsule filling machine, which is used in nutraceuticals. The system had a record production of 360,000 capsules per hour, which was twice as effective as the old system.(Source: https://www.syntegon.com)

Segment Covered in the Market

By Machine Type

- Manual Capsule Filling Machines

- Semi-Automatic Capsule Filling Machines

- Fully Automatic Capsule Filling Machines

By Dosage/Fill Type

- Powder Filling Machines

- Granule Filling Machines

- Pellet Filling Machines

- Liquid/Oil-Based Filling Machines

- Combination Filling Machines (Powder + Pellets, Liquid + Powder)

By Capsule Type

- Hard Gelatin Capsules

- Soft Gelatin Capsules

- HPMC (Hydroxypropyl Methylcellulose) Capsules

- Others (Starch-Based, Pullulan)

By Output Capacity

- Small Scale (Up to 25,000 Capsules/Hour)

- Medium Scale (25,000–70,000 Capsules/Hour)

- Large Scale (Above 70,000 Capsules/Hour)

By End-Use Industry

- Pharmaceutical Manufacturing Companies

- Nutraceutical and Dietary Supplement Companies

- Research and Development Laboratories

- Contract Manufacturing Organizations (CMOs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting