What is the U.S. Pharmaceutical Market Size?

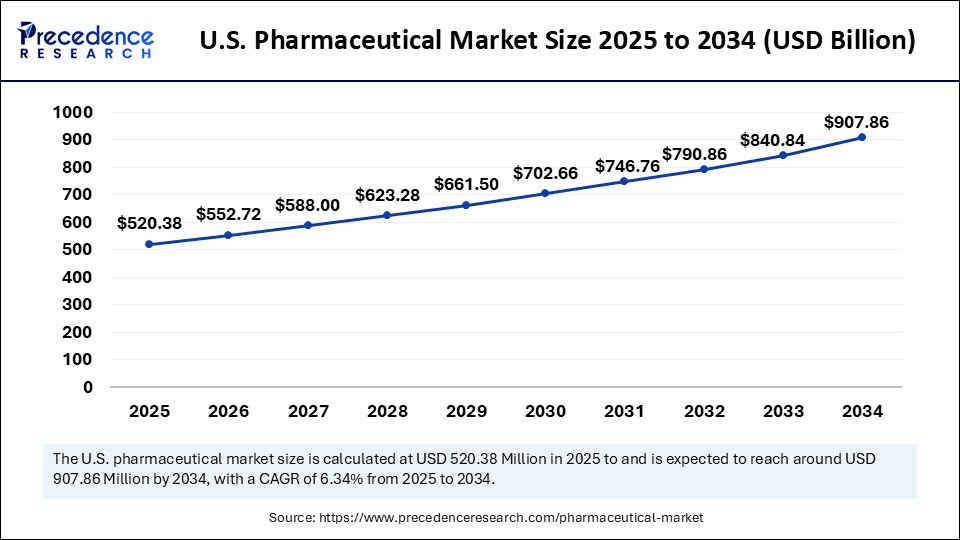

The U.S. pharmaceutical market size accounted for USD 520.38 billion in 2025 and is predicted to increase from USD 552.72 billion in 2026 to approximately USD 907.86 billion by 2034, expanding at a CAGR of 6.34% from 2025 to 2034. The market is witnessing substantial growth due to the rising demand for personalized and regenerative therapies for chronic diseases. This expansion is fueled by technological advancements, notably the integration of AI and machine learning, which accelerate R&D and drug discovery in the upcoming years.

Market Highlights

- By type, the prescription segment held the largest market share in 2024.

- By type, the over-the-counter (OTC) segment is expected to register the fastest CAGR during the foreseeable period.

- By molecule type, the conventional drugs (small molecules) segment dominated with a major market share in 2024.

- By molecule type, the biologics & biosimilars (large molecules) segment is expected to grow at a significant CAGR from 2025 to 2034.

- By product, the branded segment led with the largest market share in 2024.

- By product, the generic drug segment is expected to witness the fastest CAGR during the foreseeable period.

- By disease, the oncology segment held the largest market share in 2024.

- By disease, the obesity segment is expected to register the fastest CAGR during the foreseeable period.

- By route of administration, the oral drug administration segment held the largest market share in 2024.

- By route of administration, the parenteral segment is expected to grow at the fastest CAGR during the foreseeable period.

- By age group, the adult segment held the largest market share in 2024.

- By age group, the geriatric segment is expected to expand at the fastest CAGR during the foreseeable period.

- By distribution channel, the hospital pharmacies segment led with the largest market share in 2024.

- By distribution channel, the retail pharmacies segment is expected to witness the fastest CAGR during the foreseeable period.

What is the U.S. Pharmaceutical Market?

The U.S. pharmaceutical market focused on developing, manufacturing, and distributing drugs, biologics, and other therapeutics for treating and preventing diseases to improve overall quality of life, characterized by high innovation and regulation by the FDA. The market is fostered by a growing elderly population, a rise in chronic diseases, and significant advancements in personalized medicine, such as gene and RNA therapies, robust research and development, and expanding government support for new drug approvals.

Ket Technological Shift in the U.S. Pharmaceutical Market by AI

Artificial intelligence (AI) is playing a transformative role in the U.S. pharmaceutical market by accelerating drug discovery, optimizing clinical trials, and enhancing personalized medicine. It improves manufacturing processes by automating quality control and streamlining logistics with autonomous drones. Additionally, AI enables more accurate and compliant marketing content through automated regulatory reviews. It also optimizes drug manufacturing by providing real-time monitoring of production processes, automating quality inspections to ensure product consistency, and detecting safety risks like contamination or equipment failure.

U.S. Pharmaceutical Market Outlook

The U.S. pharmaceutical market is projected for substantial growth between 2025 and 2034, driven by the effectiveness of these therapies for complex and chronic diseases like cancer, owing to a high incidence of cancer, and advancements in targeted therapies.

The Inflation Reduction Act (IRA) is reshaping market dynamics by allowing Medicare to negotiate the prices of high-cost drugs, which is expected to negatively impact revenues for branded drug manufacturers and shift their focus from small-molecule drugs toward biologics, which have a longer period of market exclusivity.

Pharmaceutical companies are heavily investing in AI to accelerate drug discovery, optimize clinical trials, and improve manufacturing efficiency. The integration of AI and IoT is improving operational efficiency and reducing resource consumption by prompting companies to optimize their supply chains.

Venture capital and major investors are concentrating on companies developing next-generation therapies, including cell and gene therapies, and platforms that leverage AI for drug design. This is further supported by growth in outsourced services for the development and production to specialized partners.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 520.38 Billion |

| Market Size in 2026 | USD 552.72 Billion |

| Market Size by 2034 | USD 907.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.34% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Molecule Type, Product, Disease, Route of Administration, Age Group, and Distribution Channel |

Market Dynamics

Drivers

Biopharmaceutical Innovation

The primary driver of the U.S. pharmaceutical market is biopharmaceutical innovation, which focuses on developing novel and highly specialized therapies. This innovation is supported by significant investments in research and development (R&D) and advances in technology that enable the production of complex, high-value drugs for specialized conditions. There is an increasing emphasis on creating expensive, high-impact drugs for complex and rare diseases, particularly in oncology. A growing number of FDA approvals can be attributed to independent biotech firms, highlighting their importance in the innovation ecosystem.

Restraint

Pressure to Control and Reduce Drug Costs

The main restraint facing the U.S. pharmaceutical market is the mounting pressure to control and reduce drug costs. This pressure stems from government legislation as well as the entry of low-cost generics and biosimilars. This cost-containment environment directly impacts drug development, pricing strategies, and revenue for pharmaceutical companies. When patents for blockbuster drugs expire, generic and biosimilar versions quickly flood the market, leading to a sharp decline in sales for the original, more expensive branded drugs.

Opportunity

Personalized Medicine and Advanced Therapies

Future opportunities in the U.S. pharmaceutical market lie in personalized medicine and advanced therapies, which involve tailoring treatments to a patient's specific genetic and biological makeup. These therapies, including monoclonal antibodies, are a rapidly growing segment for treating complex diseases like cancer and autoimmune disorders. The integration of artificial intelligence (AI) and machine learning (ML) is becoming increasingly common in this area, helping to accelerate drug discovery and predict patient responses, leading to more efficient clinical trials.

U.S. Pharmaceutical MarketSegment Insights

Type Insights

The prescription segment led the market in 2024. This growth is driven by clinical needs, technological progress, and economic factors. Heavy investments in research and development (R&D) have led to innovative, targeted therapies, especially in biologics, oncology, and personalized medicine. In the U.S., patents and market exclusivity for new prescription drugs enable manufacturers to charge premium prices for years. These advanced drugs, often without generic alternatives, hold a significant market share.

The over-the-counter (OTC) segment is expected to grow at the fastest rate during the forecast period. This growth is driven by shifting consumer behaviors, cost-consciousness, and advancements in regulation and technology. OTC products are widely available at various retail locations, including grocery stores, drugstores, and gas stations, making them easy to purchase. Additionally, a growing preference for self-care, a wider array of available products, and the convenience of online shopping all contribute to the expansion of the OTC segment.

Molecule Type Insights

The conventional drugs (small molecules) segment led the market in 2024 due to manufacturing and administration advantages, broad applications, cost-effectiveness, and an established market presence. Small molecules usually have high oral bioavailability, allowing them to be administered as simple, patient-friendly tablets or capsules, which enhances patient adherence to treatment compared to many biologics that require injections. Their simpler manufacturing process and well-understood development pathways lead to lower production costs.

The biologics & biosimilars (large molecules) segment is expected to experience the fastest growth, mainly due to expiring patents on blockbuster drugs, increasing demand for affordable treatments, and the rising prevalence of chronic diseases. Biosimilars offer significant cost savings, enhancing access to critical therapies for patients. Innovations in manufacturing processes have improved the efficiency, scalability, and consistency of biosimilar production.

Product Insights

The branded segment led the market in 2024, mainly due to extensive research and development that resulted in innovative, high-value therapies. The widespread prevalence of chronic diseases and the demand for new, advanced treatments further strengthen this segment's market standing. The branded segment maintains its leadership by concentrating on specialized and complex therapeutic areas where it is difficult to develop generic versions, such as oncology, immunology, and treatments for rare diseases. These therapies often gain higher trust from healthcare providers and patients.

The generic drug segment is expected to grow at the fastest rate in the market. The segmental growth is attributed to the patent cliff, the mass expiration of patents on major brand-name drugs, which creates significant market opportunities for generic manufacturers to introduce more affordable alternatives. This shift is expected to save billions for the healthcare system and increase patient access to medications. Generic companies are progressing beyond simple pills to develop super generics, biosimilars, and other complex, value-added products that enhance patient compliance.

Disease Insights

The oncology segment maintained a dominant position in 2024, driven by the global increase in cancer cases, the rising aging population, and a strong demand for advanced treatments. Continued expansion in this segment is fueled by substantial R&D investments, the development of targeted therapies and personalized medicine, and a robust pipeline of oncology clinical trials. Advancements in diagnostic tools are also driving market growth, enabling earlier detection of cancer and increasing the demand for effective pharmaceutical interventions.

The obesity segment is expected to experience the fastest growth during the forecast period. This growth is primarily driven by increased public awareness of health risks associated with weight and the development of highly effective new medications. Breakthrough therapies, such as GLP-1 and GIP receptor agonists, are transforming obesity treatment and expanding the market. The demand for personalized medicine approaches to obesity management and the rising use of telehealth are also significant contributors, enhancing patient access to care and adherence to treatment.

Route of Administration Insights

The oral segment dominated the market in 2024. This is due to its convenience, cost-effectiveness, and high patient compliance. Oral administration is widely preferred for treating diseases that require long-term medication. Its large market share is supported by the ease of manufacturing and stable active pharmaceutical ingredients, making it ideal for chronic disease management and self-administration. Continuous advancements in oral drug formulations are improving bioavailability and absorption, further solidifying their market position.

The parenteral segment is expected to experience the fastest growth in the market. This is mainly due to its rapid therapeutic effects and its ability to bypass the digestive system. This makes parenteral administration a crucial option in emergencies, for patients who cannot swallow, and for drugs that are inactivated by the gastrointestinal tract. The increasing demand for biologics, vaccines, and targeted therapies, which are often administered via injection, is driving growth in the parenteral segment as precise dosing contributes to its expansion.

Government Initiatives Supporting the U.S. Pharmaceutical Market

| Initiative | Description | Key Provisions |

| Inflation Reduction Act (IRA) | Lowers drug costs for Medicare by allowing price negotiation and capping out-of-pocket costs. |

|

| Most Favored Nation (MFN) Pricing | An initiative to tie U.S. drug prices to lower prices in other developed countries. |

|

| FDA Domestic Manufacturing Initiatives | Programs to boost U.S. pharmaceutical production and reduce reliance on foreign supply chains. |

|

| FDA Regulation Modernization | Updates to the FDA's regulatory processes to encourage competition and innovation. |

|

Top Companies in the U.S. Pharmaceutical Market

| Tier | Companies | Rationale/Role | Estimated Cumulative Share |

| Tier I Major Players | Johnson & Johnson; Pfizer; Merck & Co.; AbbVie; Bristol Myers Squibb; Eli Lilly | These are large, diversified pharmaceutical and biotechnology firms with strong leading product portfolios, heavy U.S. sales, deep R&D pipelines, and considerable commercial scale across many therapeutic areas. Their U.S. operations contribute substantially to their global revenues, making them dominant in the U.S. pharma market. | 45-50% |

| Tier II Established Players | Amgen; Gilead Sciences; Regeneron; Biogen; Vertex Pharmaceuticals | These firms are major specialty / biologics / biotech players with significant U.S. presence, often focused on niche or high-value therapies. They may not have the breadth of Tier I in volume, but their high-margin products give them strong influence in the market. | 20-25% |

| Tier III Emerging / Niche / Specialty Players | Sarepta Therapeutics; Incyte; Alnylam Pharmaceuticals; Jazz Pharmaceuticals; Moderna (beyond vaccines) | These are smaller or more narrowly focused firms, often with fewer blockbuster products or with emerging pipelines. They contribute meaningfully, especially in their therapeutic niches or via novel modalities, but do not command the broader market share of the larger players. | 15-25% |

Recent Developments

- In October 2025, Genentech, part of the Roche Group, announced FDA approval for Tecentriq and Tecentriq Hybreza in combination with lurbinectedin (Zepzelca) for maintenance treatment of adult patients with extensive-stage small cell lung cancer (ES-SCLC) after first-line therapy with Tecentriq or Tecentriq Hybreza, carboplatin, and etoposide. The NCCN Guidelines now recognize this regimen as a category 2A preferred option.(Source: https://www.gene.com)

- In September 2025, the FDA approved the Novavax vaccine for COVID-19. NUVAXOVID was approved for active immunization against COVID-19 in people aged 65 and older, or those aged 12 to 64 with high-risk underlying conditions caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2).

(Source: https://www.fda.gov) - In December 2024, AbbVie completed its acquisition of Aliada Therapeutics. Aliada's lead asset, ALIA-1758, is an anti-pyroglutamate amyloid beta antibody in Phase 1 trials for Alzheimer's disease. The drug features a novel blood-brain barrier-crossing technology to improve delivery into the central nervous system.

(Source: https://news.abbvie.com)

Exclusive Analysis on the U.S. Pharmaceutical Market

The U.S. pharmaceutical market, characterized by its robust innovation pipeline and unparalleled healthcare expenditure, continues to assert its dominance as a pivotal axis in the global pharmaceutical ecosystem. Valued at over XX billion, this market is propelled by a confluence of demographic shifts, technological advancements, and evolving regulatory frameworks, collectively creating a fertile ground for sustained growth and strategic expansion.

From an investment and innovation vantage point, the proliferation of biologics, gene therapies, and precision medicine heralds a paradigm shift, unlocking unprecedented therapeutic avenues, particularly in oncology, rare diseases, and autoimmune disorders. The surge in FDA expedited approvals and breakthrough therapy designations further accelerates time-to-market, thus amplifying the commercial viability of novel entities.

Moreover, the intersection of digital health integration, encompassing AI-driven drug discovery, real-world evidence analytics, and telepharmacy, presents a transformative vector, fostering enhanced patient adherence, optimized clinical trial design, and predictive market intelligence. This confluence enhances value capture while mitigating traditional risk matrices inherent to drug development cycles.

The policy landscape, marked by incremental reforms targeting drug pricing transparency and incentivizing innovation through exclusivity extensions, signals nuanced yet tangible opportunities for both incumbent pharmaceutical giants and agile biotechs to recalibrate their market strategies. Furthermore, the demographic imperatives, chiefly the aging population and escalating chronic disease prevalence, augment sustained demand trajectories, thereby underpinning long-term market resilience.

In summary, the U.S. pharmaceutical sector embodies a high-growth frontier, driven by an amalgamation of cutting-edge scientific innovation, strategic regulatory facilitation, and digital transformation. Market participants that adeptly harness these vectors will be optimally positioned to capitalize on the expansive opportunities inherent within this dynamic and evolving landscape.

U.S. Pharmaceutical MarketSegments Covered in the Report

By Type

- Prescription

- OTC

By Molecule Type

- Biologics & Biosimilars (Large Molecules)

- Monoclonal Antibodies

- Vaccines

- Cell & Gene Therapy

- Others

- Conventional Drugs

By Product

- Branded

- Generics

By Disease

- Cardiovascular diseases

- Cancer

- Diabetes

- Infectious diseases

- Neurological disorders

- Respiratory diseases

- Autoimmune diseases

- Mental health disorders

- Gastrointestinal disorders

- Women’s health diseases

- Genetic and rare genetic diseases

- Dermatological conditions

- Obesity

- Renal diseases

- Liver conditions

- Hematological disorders

- Eye conditions

- Infertility conditions

- Endocrine disorders

- Allergies

- Others

By Route of Administration

- Oral

- Tablets

- Capsules

- Suspensions

- Other

- Topical

- Parenteral

- Intravenous

- Intramuscular

- Inhalations

- Other

By Age Group

- Children & Adolescents

- Adults

- Geriatric

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting