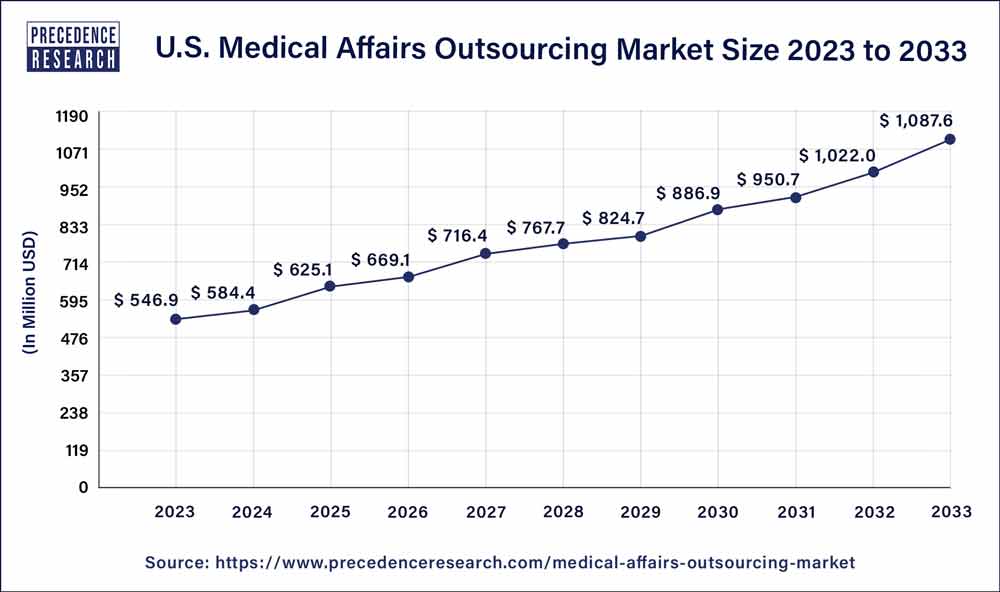

The U.S. medical affairs outsourcing market size was exhibited at USD 546.9 million in 2023 and is projected to touch USD 1,087.6 million by 2033, registering a CAGR of 7.1% from 2024 to 2033.

Key Takeaway

- By Industry, the pharmaceutical segment was valued at USD 289.1 in 2023, with a market share of 52.86%.

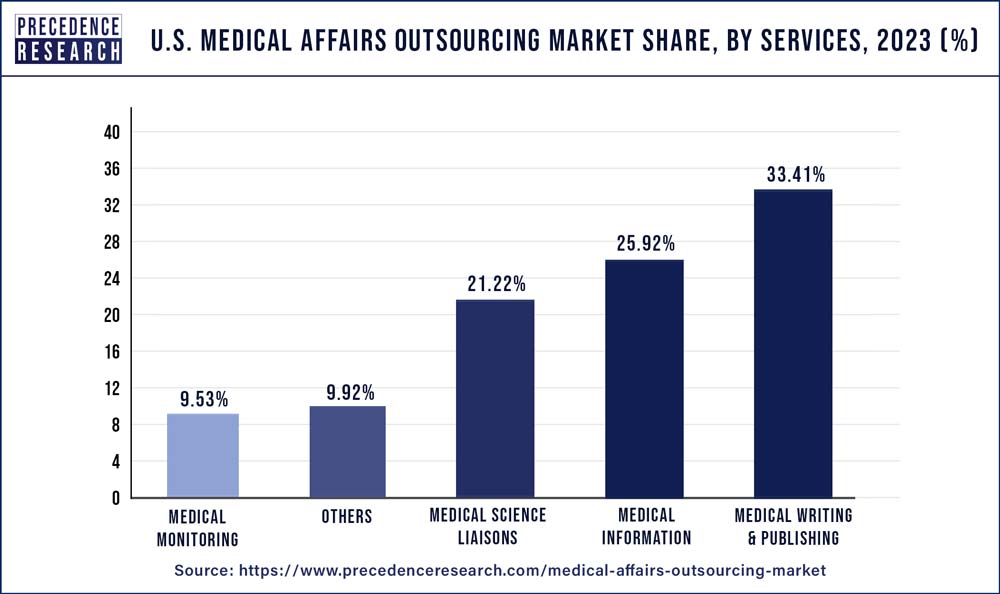

- By Services, the medical writing & publishing segment was valued at USD 182.7 in 2023, with a market share of 33.41%.

U.S. Medical Affairs Outsourcing Market Overview

Medical affairs is the department inside a pharmaceutical or medical device organization that informs healthcare professionals with reliable information. By using a technique called medical affairs outsourcing, patients, healthcare providers (HCPs), and governmental organizations may get deep knowledge of patient data as well as healthcare regulations and practices. The process of discovering and developing new drugs requires both money and time. It can take more than 10 to 15 years to complete the process from early discovery or design to development and regulatory approval. To ensure the quality and effectiveness of a drug substance, several testing services are needed. In order to cut costs and time, pharmaceutical and biotechnology companies choose to outsource their services to contract research organizations (CROs), which is predicted to accelerate the market's growth. The World Health Organization published statistics in 2019 showing an increase in the yearly number of clinical trials registered, from 3,344 in 2004 to 54,894 in 2018. The product's efficiency and safety for human consumption is monitored by the outsourcing companies.

U.S. Medical Affairs Outsourcing Market Trends

- AI is positively impacting the healthcare industry by offering predictive analytics for patient results, resource usage, and effective treatment. Outsourcing marketers are significantly dependent on AI to analyze huge datasets and retrieve actionable insights. AI algorithms can predict the readmission possibility of patients to find out patterns in treatment. AI can also be leveraged to offer personalized treatment and increase the results of treatment.

- The increasing outsourcing for revenue cycle management is primarily the most outsourced function in the healthcare sector. The RCM holds many financial-related tasks in the healthcare sector, including patient registration, verification of insurance to claim submission, payments, and collections.

A significant driver for the market also includes simplified billing and claim processes. The healthcare providers are majorly looking for managing complex insurance claims, on-time payment, and dealing with canceled visits. Owing to its benefits, several healthcare providers are expected to adopt RCM outsourcing, which enhances cash flow, minimizes accounts receivable days, and reduces the possibility of claim denials. - Remote patient monitoring is another driver for the U.S. medical affairs outsourcing market as it provides convenience to track patients from remote areas. It offers round-the-clock monitoring without the over-hustle of nursing staff and offers expertise in handling RPM devices along with EHR systems. It allows us to analyze huge datasets concerning a patient's medical history, current treatment, medication, and its results.

U.S. Medical Affairs Outsourcing Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 546.9 million |

| Market Size by 2033 | USD 1,087.6 million |

| Growth Rate from 2024 to 2033 | CAGR of 7.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered |

|

U.S. Medical Affairs Outsourcing Market Dynamics

Driver:

Increase in the number of clinical trials

- Pharmaceutical and medical device companies outsource medical affairs services to Contract Research Organizations (CROs) to reduce operational costs, reduce regulatory compliance risk, and avoid process delays. The major factors that have driven the growth of the medical affairs outsourcing market are an increase in the number of clinical trials, a surge in the need for medical affairs services to be outsourced, and an increase in R&D expenditures.

Increased prevalence of both communicable and non-communicable disorders

- The increase in the number of communicable and non-communicable diseases has risked the number of clinical trials being undertaken, which is boosting the demand for novel pharmaceutical and medical equipment, which further enhances the demand for medical affairs outsourcing services on a larger scale

Technological advancement

- Along with this, an increase in healthcare expenditure and technological advancement also helps to enhances the market growth of medical affairs outsourcing. Due to a chronic shortage of medical affairs specialists, North American biopharmaceutical and medical device companies have outsourced some responsibilities to individuals with considerable expertise in the industry.

Restraints:

An expensive investment in clinical trials and drug development

- In contrast, the rising expense of clinical trials and drug development hinders the growth of the market. According to a recent report by Cutting Edge Information in the US, outsourcing regulatory and medical affairs has increased. The top 50 pharmaceutical firms have also boosted their expenditures on regulatory and medical affairs. The market is expanding as more end-to-end service providers approach the medical affair service industry to take advantage of possibilities driven by the increased need for low-cost medication research and manufacture. Additionally, new product introductions and innovative medication delivery systems are expected to fuel a global need for pharmaceutical medical affairs outsourcing.

Opportunities:

Decreased access to healthcare professionals & institutions

- Medical Scientific Liaisons (MSLs) and other medical affairs professionals no longer visit HCPs and institutions. Face-to-face communication, including the sharing of scientific knowledge and the collecting of insights, which are two of the main duties of MSLs, deteriorated as a result of COVID-19. As a result, the medical affairs outsourcing market enhanced.

Advancement in R&D

- Due to the numerous small and large pharmaceutical and biotechnology companies in the U.S. in addition to the strong healthcare industry, the country is anticipated to become a lucrative market. In the forthcoming years, increased research and development in the U.S. for innovative medications, vaccines, and medical devices will continue to encourage market growth.

- Data Breach and Security Risks are some of the challenges faced by outsourcing companies.

COVID-19 Impact

Nearly every industry has been negatively impacted by the worldwide pandemic, and it is expected that industrial growth would be affected over the projected period. Many regulatory and outsourcing teams are under pressure as a result of COVID-19. It has, however, also had a favorable effect on the bio/pharmaceutical outsourcing sector, as rising R&D activity demand is simultaneously driving up the need for medical affairs services. Due to the increasing demand, many CROs are concentrating on their outsourcing as well as other business operations. Medical IoT devices that reside with patients at home are increasingly used to enhance outpatient therapy, lower the number of follow-up visits, and even use these devices in an emergency. The expansion of the medical affairs outsourcing market is anticipated to be accelerated by the introduction of competitive pricing and value-based pricing models.

Services Insights

Based on Services, the U.S. medical affairs outsourcing market is segmented into medical science liaisons, medical writing & publishing, medical information, and medical monitoring. The medical science liaisons (MSLs) market is estimated to grow at the fastest pace throughout the projected period due to the growing demand for professional medical writing, publication, and service supply from small, mid-sized, and major healthcare organizations.

Medical Science Liaisons are doctorate- and advanced-degree-holding healthcare professionals who act as regional extensions of medical affairs departments. They connect with stakeholders and healthcare experts and respond to their clinical queries about drugs, technologies, and the disorders they treat.

U.S. Medical Affairs Outsourcing Market Revenue, ByServices, 2020 - 2023 (USD Million)

| ByServices | 2020 | 2021 | 2022 | 2023 |

| Medical Writing & Publishing | 141.5 | 154.4 | 169.8 | 182.7 |

| Medical Monitoring | 40.6 | 44.2 | 48.6 | 52.1 |

| Medical Science Liaisons | 90.9 | 98.9 | 108.3 | 116.0 |

| Medical Information | 113.8 | 122.7 | 133.4 | 141.8 |

| Others | 45.6 | 48.5 | 51.9 | 54.2 |

Industry Insights

Based on Industry, the U.S. medical affairs outsourcing market is segmented into pharmaceutical, biopharmaceutical, and medical devices. The medical devices are further segmented into therapeutic medical devices and diagnostic medical devices Therapeutic medical devices include any equipment, apparatus, appliance, or other items that are meant to be used by humans for a therapeutic purpose. A reagent, calibrator, control material, kit, specimen receptacle, software, instrument, apparatus, equipment, or system that is used alone or in combination with other diagnostic items for in vitro application is known as an in vitro diagnostic medical device (IVD). In 2023, the pharmaceutical industry held the larger market share. The demand for medical affairs providers has risen as a result of numerous patent expirations, for the development of new patent drafts in the US. The requirement for medical affairs outsourcing services in the market is anticipated to increase as a result of the biopharma industry's increased focus on the basic operations associated with drug development. The pandemic is expected to have a long-term impact on the pharmaceutical business, which has been facing poor growth, delayed medication approvals, and insufficient pharma manufacturing supply chain.

U.S. Medical Affairs Outsourcing Market Revenue, ByIndustry, 2020 - 2023 (USD Million)

| ByIndustry | 2020 | 2021 | 2022 | 2023 |

| Pharmaceutical | 227.9 | 247.3 | 270.3 | 289.1 |

| Biopharmaceutical | 57.7 | 62.8 | 68.8 | 73.8 |

| Medical Devices | 146.8 | 158.7 | 172.8 | 184.0 |

Recent Developments

- In March 2025, a leading firm, SCIENTURE, introduced its strategic agreement and commercial operation leadership with Syneos Health, which is popular for its leading contract sales. The collaboration is aiming to strengthen Scienture LLC's capacities to expand its market reach using the expertise of Syneos Health to outsource sales solutions.

- In September 2022, Penumbra Security, Inc. was acquired by SGS to expand its footprints and cybersecurity capabilities in the U.S.

- In June 2022, Pharmaceutical Product Development, LLC established a customary practice for Positioning the Patient in Drug Trials.

- In April 2022, Hawaii the most recent U.S. state regulate the presence of PFAS in some consumer goods. On December 31, 2024, the use of PFAS in particular types of food packaging will be banned.

- In December 2019, Celegence Holdings LLC has made a substantial strategic investment in Soterius, Inc., a supplier of outsourced services, collaboration tools, and data assets in the drug safety and medical affairs area, as part of Soterius' Series A funding round.

- In November 2019, Soterius has introduced virtual means of Medical Science Liaisons (MSLs) to facilitate the exchange of information which has been proven to be an effective way to reach a wider audience and enhance the optimum use of limited valuable MSL resources.

U.S. Medical Affairs Outsourcing Market Companies

- Pharmaceutical Product Development, LLC

- IQVIA Holdings Inc

- SGS SA

- ZEINCRO Group

- Pfizer Inc

- The Medical Affairs Company

- ICON plc

- Ashfield Healthcare Communications

- Syneos Health Inc

- Wuxi Clinical Development, Inc

Segments Covered in the Report

By Services

- Medical Science Liaisons (MSLs)

- Medical Writing & Publishing

- Medical Monitoring

- Medical Information

- Others

By Industry

- Pharmaceutical

- Biopharmaceutical

- Medical Devices

- Therapeutic Medical devices

- Diagnostic medical devices

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting