What is the U.S. Brain Computer Interface Market Size?

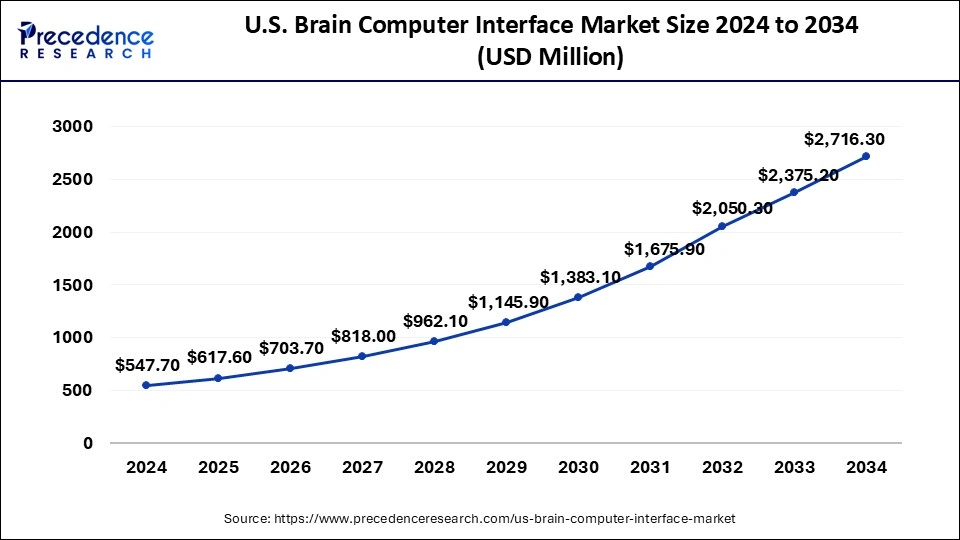

The U.S. brain computer interface market size is calculated at USD 617.60 million in 2025 and is predicted to increase from USD 703.70 million in 2026 to approximately USD 2,716.30 million by 2034, expanding at a CAGR of 17.90% from 2025 to 2034.

Market Highlights

- In terms of revenue, the U.S. brain computer interface market was valued at USD 547.70 million in 2024.

- It is projected to reach USD 2,716.30 million by 2034.

- The market is expected to grow at a CAGR of 17.90% from 2025 to 2034.

- By product, the non-invasive brain computer interface segment held the largest market share in 2024.

- By application, the healthcare segment held the dominating share of the market in 2024.

- By component, the software segment dominated the U.S. brain computer interface market in 2024.

- By end user, the medical segment dominated the market in 2024 and is expected to sustain the growth during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 617.60 Million

- Market Size in 2026: USD 703.70 Million

- Forecasted Market Size by 2034: USD 2,716.30 Million

- CAGR (2025-2034): 17.90%

Market Overview

A brain computer interface (BCI), also known as a brain machine interface (BMI) or direct neural interface (DNI), is a technology that establishes a direct communication pathway between the brain and an external device, such as a computer or a robotic system. The primary goal of BCIs is to enable the direct A brain computer interface (BCI), also known as a brain machine interface (BMI) or direct neural interface (DNI), is a technology that establishes a direct communication pathway between the brain and an external device, such as a computer or a robotic system. BCIs operate by recording, interpreting, and translating neural signals into actionable commands or data. These neural signals can be acquired through various methods, including electroencephalography (EEG), intracortical electrodes, electrocorticography (ECoG), and functional magnetic resonance imaging (fMRI), among others.

The primary goal of BCIs is to enable the direct transmission of information between the brain and an external device without relying on the traditional neuromuscular pathways, such as peripheral nerves and muscles. These technologies have diverse applications ranging from assisting individuals with disabilities and enhancing human-computer interaction to enabling control of external devices through direct neural commands. BCIs have shown promise in helping people with paralysis regain communication and control over their environment by translating their thoughts into commands that can operate assistive devices or communication systems.

U.S. Brain Computer Interface Market Growth Factors

- One of the main reasons driving the market's growth is the geriatric population in the U.S., which is also contributing to the development of neurological illnesses, including epilepsy, Alzheimer's, and Parkinson's diseases.

- The exponential growth of BCI technologies and increasing integration of the same in various industries is a significant aspect of the market's growth.

- Within the healthcare industry, the growth of the U.S. brain computer interface market is supported by the growing emphasis on leveraging BCI technologies to operate virtual reality (VR) applications and Internet of Things (IoT) devices.

- BCI technology is increasingly gaining popularity in smart home applications and activities like opening and closing doors and windows and managing the television or music system because of its high accuracy, dependability, and enhanced security monitoring.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 617.60 Million |

| Market Size in 2026 | USD 703.70 Million |

| Market Size by 2034 | USD 2,716.30 Million |

| Growth Rate from 2025 to 2034 | CAGR of 17.90% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Component, and End User |

Market Dynamics

Drivers

Rising prevalence of neurodegenerative disorders

The rising cases of related neurodegenerative conditions among the growing American senior population globally form a major consumer base for the U.S. brain computer interface market. The region has been experiencing a growth in the percentage of diagnoses every year. Parkinson's is the second-most common neurodegenerative condition after Alzheimer's. According to the Parkinson's Foundation, 1 million people are suffering from Parkinson's Disease (P.D.) in the U.S., and it is expected to reach 1.2 million by 2030.

An increase in the requirements for neuroprosthetics

Through the use of a hardware-software interface known as brain computer interface, computers or external devices may be controlled only by mental activity. The main goal of BCI research is to apply communication skills to severely disabled individuals who are immobilized by neurological neuromuscular dysfunctions, such as stroke, spinal cord injury, or brain stem damage. This also fuels the expansion of the U.S. brain computer interface market. An application called 'cognitive monitoring' uses real-time brain signal decoding (RBSD) to gather data on the cognitive condition of users. By employing automated RBSD, a BCI is created that offers a unique information modality for technological techniques based only on brain activity. The user can communicate with these devices or operate the connected computer system by giving voluntary, controlled commands using BCI.

Restraint

High cost

The cost of therapy increased as a result of newly developed, highly advanced technologies that were introduced to the market and improved the effectiveness and efficiency of treatments for degenerative conditions by improving connections between the brain and external devices. Due to the high cost of the therapy, this could negatively impact the U.S. brain computer interface market, which would lower demand and slow market development. The general public is unable to profit from the enhanced methods of treating the illness.

Opportunity

Rising gaming sector

The U.S. brain computer interface market has found applications in a growing variety of gaming industries to improve the attraction and interaction of video games. With the elimination of conventional controls, neurogaming offers a revolutionary gaming paradigm that greatly improves both the overall gaming experience and the financial possibilities for game firms. In addition, there is a growing trend in the mobile and virtual gaming sectors for the incorporation of BCI technology into V.R. headsets. Additionally, this technology creates a plethora of opportunities for mind-controlled gadgets, which are expected to fuel the U.S. brain computer interface market's expansion throughout the analysis period.

One prominent example is Emotiv, Inc., which has created video games using Neurogaming, a non-intrusive BCI technique that reads users' emotions and modifies music and graphic components appropriately.

Segments Insights

Product Insights

The non-invasive brain computer interface segment held the largest share of the U.S. brain computer interface market in 2024. Owing to the technology's broad application and the rise in neurological illnesses, the non-invasive brain-computer interface industry is seen to have a dominant market share. It is anticipated that the prevalence of BCI technology will rise with the creation of non-invasive brain-computer interface devices based on EEG. Further anticipated to support the market's growth is an increase in the number of approvals.

Application Insights

Technological progress is paving the way for a new era in the healthcare field with the arrival of brain-computer interfaces BCI. The BCI is a brain-computer interface that connects with external factors instantly, providing cutting-edge solutions for different medical issues and disabilities. In recent decades, BCI has gained significant interest and importance, revolutionizing the medical device industry with its numerous potential applications. It represents the quickest expanding area in contemporary computing, with BCI research typically focused on aiding, improving, or rehabilitating human cognitive or sensory-motor capabilities, especially in situations where effective treatment alternatives are presently unavailable.

- In May 2023, Elon Musk's neurotech venture Neuralink announced that the Food and Drug Administration had given the company permission to carry out its first in-person clinical investigation. The Link, a brain implant being developed by Neuralink, is intended to assist those suffering from severe paralysis in controlling external devices only through neural impulses.

Component Insights

The U.S. brain computer interface market is bifurcated into hardware and software. The software segment held the largest share of the market in 2024. BCI systems generate large amounts of neural data that require sophisticated signal processing and analysis. Software plays a crucial role in extracting meaningful information from neural signals, reducing noise, and enhancing the overall performance of BCIs. In addition, BCI software often includes communication protocols and middleware that enable seamless integration with external devices, such as robotic systems, computers, or prosthetic limbs. This ensures effective communication between the BCI and the target application. Thereby driving the market growth.

End User Insights

The medical segment held the largest share of the U.S. brain computer interface market in 2023 and is observed to sustain the position during the forecast period due to its use in helping people with disabilities. Patients with conditions including Parkinson's, epilepsy, paralysis, and Alzheimer's can walk about and do tasks more independently because of BCI technology. These activities include using a wheelchair, prosthetic limbs, and other devices.

U.S. Brain Computer Interface Market Companies

- NeuroSky

- Natus Medical Incorporated

- Integra Lifesciences

- Emotiv

- Cortech Solutions

- Cadwell Industries

- Advanced Brain Monitoring, Inc

- Mind Technologies, Inc

- Compumedics, Ltd

- Cas Medical Systems

Recent Developments

- In September 2024, Neurable Inc., a prominent figure in neurotechnology focusing on AI-driven tools, alongside the luxury audio brand Master & Dynamic, unveiled the MW75 Neuro, intelligent headphones that incorporate Neurable's brain-computer interface (BCI) technology to assist users in gaining profound insights into their cognitive well-being, tackling burnout, and improving everyday performance. The first of their kind, these BCI-enabled consumer headphones are poised to transform our interaction with daily technology by enabling users to manage their health and wellness using the power of their thoughts.

- In September 2024, Synchron recently revealed that a patient in the United States, who had been implanted with the Synchron brain-computer interface (BCI), successfully utilized the Amazon Alexa virtual assistant technology, marking the initial demonstration of the BCI with this system. As stated by the company, the Synchron BCI is inserted into the blood vessel located on the motor cortex's surface in the brain through the jugular vein via an endovascular procedure.

- In August 2024, a novel brain-computer interface created at UC Davis Health converts brain signals into speech with an accuracy of up to 97%, the most precise system of its kind. The scientists placed sensors in the brain of a man who had significant speech difficulties caused by amyotrophic lateral sclerosis (ALS). The man successfully conveyed his planned speech shortly after starting the system.

- In April 2023, through a joint fund named the EP-GB Investment Limited Partnership, Seiko Epson Corporation and its subsidiary Epson X Investment Corporation made investments in Neurable, Inc., a startup firm. Brain wave ("electroencephalography / EEG") activity is used by Boston-based Neurable, a University of Michigan spinout started by Dr. Ramses Alcaide and Adam Molnar, to create brain-computer interface1 (BCI) technology.

- In May 2023, a leading provider of high data-rate brain-computer interfaces (BCI), Paradromics Inc., announced that Prime Movers Lab is leading a $33 million Series A financing round. Green Sands Equity, Dolby Family Ventures, and Westcott Investment Group are further investors. The additional money will support Paradromics in starting the Connexus Direct Data Interface (DDI) first-in-human clinical study. Along with the investment, Paradromics also revealed that the Connexus DDI "Breakthrough Device Designation"—which provides an accelerated review process for innovative medical devices with the potential to treat illnesses that might be permanently crippling—had been awarded by the U.S. Food and Drug Administration.

Segments Covered in the Report

By Product

- Invasive Brain Computer Interface

- Partially Invasive Brain Computer Interface

- Non-Invasive Brain Computer Interface

By Application

- Healthcare

- Entertainment & Gaming

- Communication & Control

- Smart Home Control

- Brain Function Repair

- Disabilities Restoration

By Component

- Hardware

- Software

By End User

- Military

- Medical

- Manufacturing

- Research Center

- Others (Gaming and Communication)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting