What is the Deep Brain Stimulation Devices Market Size?

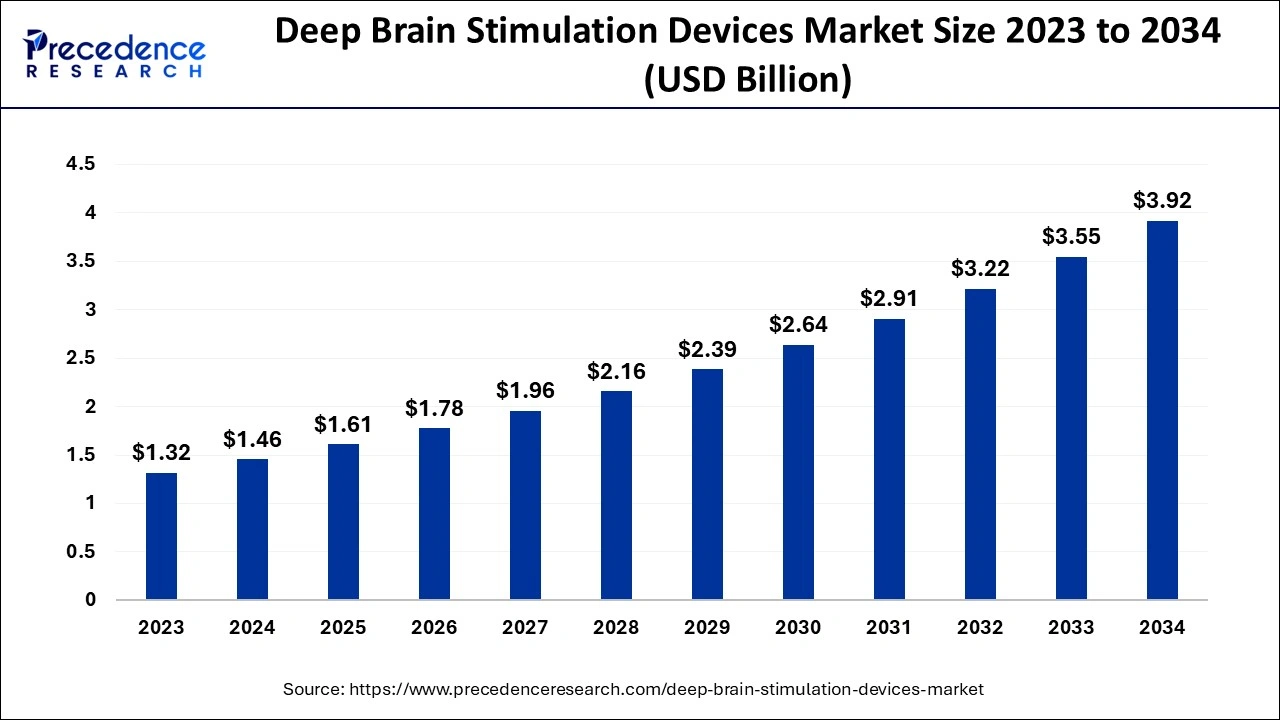

The global deep brain stimulation devices market size is valued at USD 1.61 billion in 2025 and is predicted to increase from USD 1.78 billion in 2026 to approximately USD 4.26 billion by 2035, expanding at a CAGR of 10.22% from 2026 to 2035.

Deep Brain Stimulation Devices Market Key Takeaways

- The North America region has captured a market share of around 52% in 2025.

- By product, the dual-channel segment held a market share of around 58.2% in 2025.

- By application, the Parkinson's disease segment has dominated the market in 2025 with a revenue share of around 65.4%.

- By end-use, the hospital's segment accounted for 52.8% of the total market share in 2025.

Market Overview

A surgical method called deep brain stimulation involves implanting a device that sends electrical signals to the parts of the brain in charge of controlling movement. A DBS system is made up of three components that are implanted within the body of a patient: a lead, an extension, and a neurostimulator. The lead links the pacemaker device to the brain to synchronize electrical pulses. DBS devises aid in lowering the stiffness and tremor symptoms brought on by a number of neurological conditions, including Parkinson's disease, dystonia, or essential tremor. People can reduce their drug dosage after deep brain stimulation surgery, perhaps removing any negative effects.

Due to the rising occurrence of neurological illnesses, the deep brain stimulation systems market is anticipated to develop profitably throughout the forecasted period. One of the key reasons driving market expansion is the rising prevalence of Parkinson's disease across a number of continents. For example, the Parkinson's Foundation estimates that over 10 million individuals worldwide suffer from Parkinson's disease. Demand for DBS devices will also increase due to the increased prevalence of essential tremors and dystonia. As a result, the aforementioned factor will considerably boost the growth of the deep brain stimulation devices market during the course of the forecast year.

Additionally, neurological problems are more common in adults over the age of 65. Therefore, the incidence of neurological illnesses would be significantly stimulated by the rising rate of the senior population, expanding the market. Another important element driving the use of DBS procedures and consequently boosting market growth is the population's increased awareness of a variety of neurological conditions.

Deep Brain Stimulation Devices Market Growth Factors

During the ongoing coronavirus epidemic, telehealth and eHealth applications are becoming more and more popular for frequently monitoring PD patients. The global market for deep brain stimulation devices for Parkinson's disease is growing as a result of favorable reimbursement policies in healthcare institutions. However, implanted pulse generators for DBS devices require technical breakthroughs. Therefore, businesses in the Parkinson's disease market for deep brain stimulation devices should invest more in R&D to maximize battery life, along with patient-related factors like patient compliance with nightly device cut-off or IPG recharging dependability. For medical technology businesses to acquire a competitive edge in the worldwide deep brain stimulation devices market for Parkinson's disease, device-specific aspects including parameter delivery, lead configuration choice, implantation site, and cautious electrode material selection are critical.

Companies that make deep brain stimulation devices for Parkinson's disease are working harder to sell their products internationally. Other businesses involved in the DBS (deep brain stimulation) sector have products, but they are still in the clinical development stage and are not yet commercially accessible. Businesses are eager to release novel goods that are simple for patients and doctors to use. These businesses seek to increase the gadgets' portability, affordability, efficiency, and effectiveness.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.61 Billion |

| Market Size by 2035 | USD 4.26 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.22% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Drivers

The rising desire for less invasive operations among the general public

- The rising desire for less invasive operations among the general public is one of the most important factors propelling the market for deep brain stimulators. DBS is a minimally invasive targeted procedure primarily used to treat dystonia, Parkinson's disease, and essential tremor movement disorders. Compared to conventional surgical methods, minimally invasive treatments provide a number of advantages, including shorter recovery times, smaller incisions, less discomfort, and decreased scarring. Therefore, these operations are highly sought-after due to a variety of patient advantages.

- In addition, there are some instances when less intrusive surgery shows a greater accuracy rate compared to conventional surgical techniques. Additionally, these techniques only need microscopic incisions big enough to introduce cameras and thin tubing. Due to the aforementioned advantages, there is a rising demand for such surgical treatments, which is driving market expansion.

Growth in the market will be affected by the unprecedented growth in the geriatric population

- One of the key factors boosting the market growth for deep brain stimulation devices is the rising senior population. At this age, people are more susceptible to chronic illnesses. Some of the most prevalent illnesses that can affect elderly persons are neurological disorders. Neuropathy, Parkinson's disease, Alzheimer's disease, dystonia, and other neurological conditions that commonly afflict elderly individuals include these.

- According to the National Institutes of Health (NIH), 617 million individuals, or 8.5% of the world's population, are 65 and older. Therefore, the market for DBS systems would see significant development during the period of 2018 to 2026 due to the expanding elderly population and increased frequency of neurological illnesses.

Key Market Challenges

- Concerns regarding side effects - Market expansion is anticipated to be hindered by worries about side effects including allergic response and tingling or prickling of the skin. Also anticipated to provide a barrier to the market for deep brain stimulation devices is the availability of alternative treatment alternatives such as pharmacological therapy and surgery.

Key Market Opportunities

The increasing geriatric population is propelling the market growth

- The main drivers of the market's expansion are the rapidly aging population, which is raising the risk and prevalence of neurological disorders, the rising demand for the devices due to the growing acceptance of minimally invasive procedures, and the availability of advanced deep brain stimulation devices. As a result of advancements in technology, deep brain stimulation technologies are predicted to become more widespread.

Deep Brain Stimulation Devices Market Segment Insights

Product Insights

The market is divided into single-channel and dual-channel deep brain stimulation devices depending on the product. With a market share of 58.2% in 2023, the dual-channel sector is in the lead due to its greater use in surgical operations. One of the safest and most efficient tools used in surgical operations is dual channels. As a result, the increased frequency of debilitating neurological disorders, the rise in PD surgery, and the number of hospitals utilizing dual-channel DBS devices are all contributing to the segment's growth. Additionally, new product introductions and technology developments are fueling category growth. For instance, the U.S. FDA granted clearance for the additional indication of Parkinson's disease to Abbott's Infinity DBS system in January 2020. This method will enable the targeting of the internal Globus Pallidus (GPi), a particular region of the brain linked to the symptoms of Parkinson's disease.

From 2026 to 2035, the single-channel deep brain stimulation device market is anticipated to expand at the greatest compound annual growth rate (CAGR), or 10.6%. Healthcare experts feel that single-channel DBS devices are more popular because neurologists like them since they provide more programming choices. The Parkinson's Foundation claims that older people are more likely to have neurological disorders. For instance, the World Ageing 2019 study estimates that there were around 703 million individuals worldwide who were 65 or older in 2019. Thus, it is projected that the segment would rise as a result of the ageing population, patients' rising knowledge of neurological illnesses, and healthcare professionals' choice.

Application Insights

The market is divided into segments for pain management, essential tremor, epilepsy, depression, obsessive-compulsive disorders (OCD), Parkinson's disease, dystonia, and others based on the applications they are used for. Due to the rising number of deep brain stimulation therapies that have been approved by the U.S. FDA and the high incidence of Parkinson's disease (PD) in the world, the Parkinson's disease segment is expected to dominate the market in 2021 with a share of 65.4%. The Verses deep brain stimulation device system for the treatment of Parkinson's disease was approved by the U.S. FDA in December 2017 for use by Boston Scientific Corporation. The Parkinson's Foundation estimates that 60,000 Americans are given PD diagnoses each year. In the upcoming years, this is predicted to fuel the segment's expansion.

From 2026 to 2035, the epilepsy category is anticipated to experience the greatest compound annual growth rate (CAGR), at 16.4%. In the upcoming years, it is anticipated that rising consumer knowledge of cutting-edge epilepsy treatment alternatives will combine with expanding healthcare infrastructure to further accelerate category expansion. The World Health Organization (WHO) estimates that 50 million individuals worldwide have epilepsy, making it one of the most prevalent neurological conditions. Due to the poor therapeutic response of medications in treating seizures and the low success rates of procedures, DBS is utilized in epilepsy. This will fuel sector growth even further.

End-Use Insights

With a share of 52.8% in the end-use sector in 2024, hospitals led the total market growth. The rise in Parkinson's disease and essential tremor prevalence as well as the rise in DBS procedures conducted in hospitals are the key causes of this market segment's expansion. During the projected period, it is also anticipated that the availability of technologically improved DBS devices along with attractive reimbursement policies would further propel the hospital market. For an instance, Medtronic provides thorough services to establish and maintain coverage as well as payment for a range of DBS devices.

In addition, hospitals are currently improving technologically, and sophisticated gadgets are widely utilized in hospitals to deliver better care. These tools assist produce better, quicker, and more accurate outcomes in addition to streamlining treatment methods. Most neurological problems, including Parkinson's disease, are identified and managed by qualified neurologists who work in specialized facilities and utilize cutting-edge technology.

From 2026 to 2035, theAmbulatory Surgical Centers (ASC) category is anticipated to see the greatest compound annual growth rate (CAGR), at 10.3%. This is because the procedures are less expensive than in hospitals, and patients have easier access to care and wait less time than in hospitals and neurology clinics. Additionally, research by Advancing Surgical Care found that 92% of patients were happy with the medical attention and service they received at ASCs, which helped the segment thrive. Additionally, because the surgical techniques used at ASCs are sophisticated and less invasive, the majority of neurosurgeries may now be completed there.

Deep Brain Stimulation Devices Market Value Chain Analysis

- Device Processing

DBS devices are created through processes such as electrode fabrication, neurostimulator design, pulse generator programming, device miniaturization, and integration with wireless and rechargeable systems to treat neurological disorders.

Key players: Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, PINS Medical Co. Ltd - Quality Testing and Certification

DBS devices need certifications for medical safety, electromagnetic compatibility, biocompatibility, and regulatory approval. These include ISO 13485, FDA premarket approval (PMA), CE marking for medical devices, and IEC 60601 compliance.

Key players: FDA (U.S. Food and Drug Administration), ISO (International Organization for Standardization), CE Marking, UL Solutions. - Distribution to Industrial Users

DBS devices are supplied to hospitals, neurology clinics, specialized surgical centers, and medical device distributors that serve patients with Parkinson's disease, epilepsy, dystonia, and other movement disorders.

Key players: Medtronic plc, Abbott Laboratories, Boston Scientific Corporation.

Top Companies in the Deep Brain Stimulation Devices Market & Their Offerings:

- Medtronic plc

Medtronic is a global leader in deep brain stimulation (DBS) devices, providing implantable systems for movement disorders such as Parkinson's disease, essential tremor, and dystonia. Its devices include both rechargeable and non-rechargeable neurostimulators with advanced programming and MRI-compatible features. - Abbott Laboratories

Abbott offers DBS solutions through its Infinity™ DBS platform, focusing on precise therapy for neurological disorders. Its devices support patient-specific programming, wireless monitoring, and integration with digital health platforms to optimize treatment results. - Boston Scientific Corporation

Boston Scientific provides DBS systems with directional leads and advanced neurostimulators. Its solutions aim for better symptom control, energy efficiency, and flexibility in treating movement disorders, supported by comprehensive clinician training and programming software. - NeuroPace, Inc.

NeuroPace develops implantable neurostimulation devices targeting neurological disorders, with applications in managing movement disorders. The company emphasizes responsive and closed-loop stimulation technologies to enhance effectiveness and improve patient outcomes. - SceneRay Co., Ltd.

SceneRay specializes in neurostimulation devices, including DBS systems for Parkinson's disease and dystonia. The company creates affordable, locally produced DBS solutions aimed at expanding in the Asian markets with competitive prices and adherence to regulations.

Deep Brain Stimulation Devices Market Companies

- Abbott (St. Jude Medical)

- Medtronic

- Boston Scientific Corporation

- Aleva Neurotherapeutics S.A.

- Nexstim

- LivaNova PLC

- Neuropace Inc.

Recent Developments

-

In March 2025, Newronika is preparing for the commercial launch of its AlphaDBS™ system in select European markets, following CE Mark approval in March 2025. The company has not yet released the product for commercial use.

https://parkinsonsnewstoday.com -

In March 2025, the Medtronic BrainSense™ Adaptive DBS system was approved by the FDA as the first DBS technology that automatically adjusts stimulation therapy based on real-time brain signals. This innovation aims to personalize treatment for patients with Parkinson's disease.

https://www.news-medical.net

Deep Brain Stimulation DevicesMarket Segment Covered in Report

By Product

- Single Channel

- Dual Channel

By Application

- Pain Management

- Epilepsy

- Essential Tremor

- Obsessive-Compulsive Disorder (OCD)

- Depression

- Dystonia

- Parkinson’s Disease

- Others

By End-Use

- Hospitals

- Neurology Clinics

- Ambulatory Surgical Centers

- Research Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content