What is the U.S. Medical Aesthetic Devices Market Size?

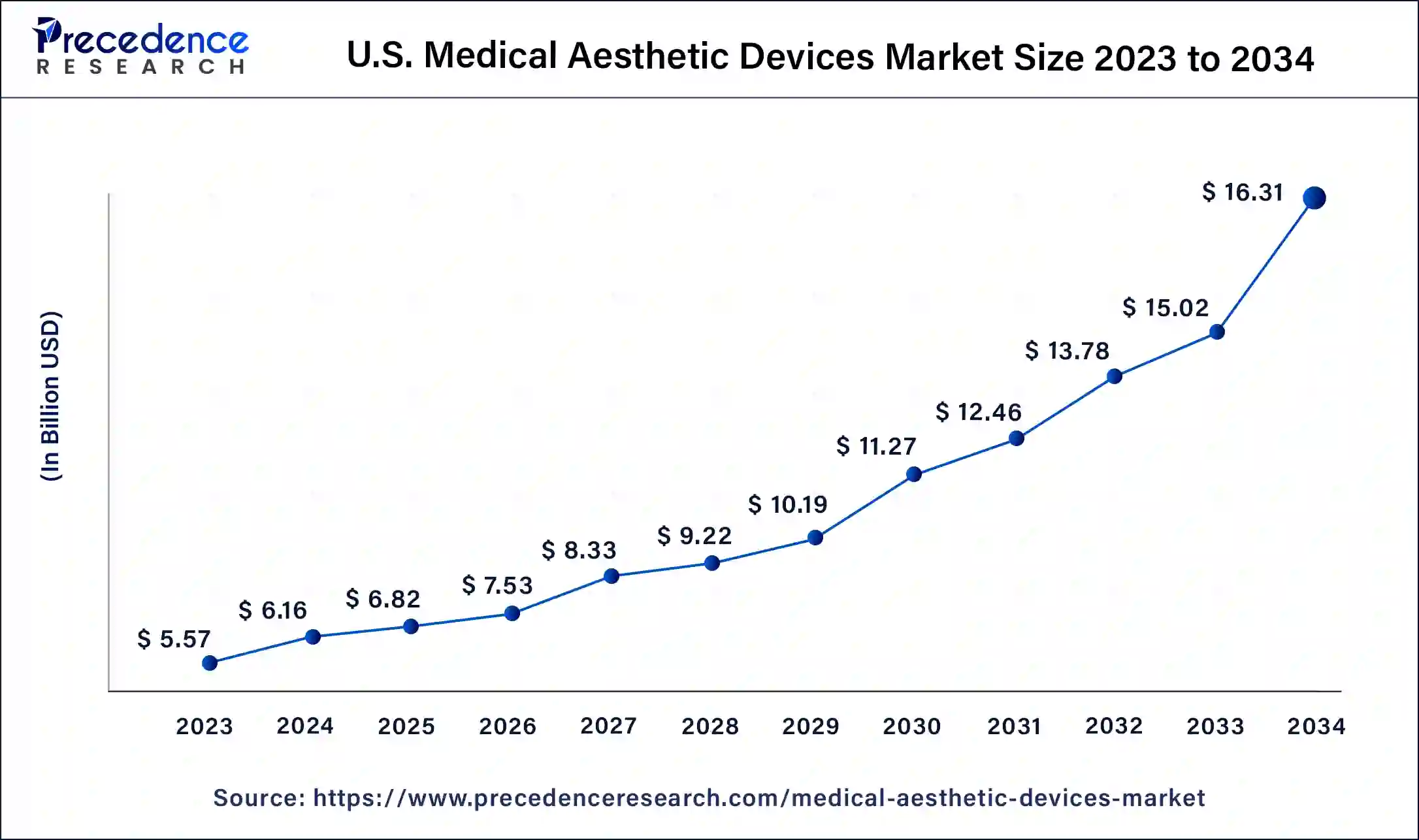

The U.S. medical aesthetic devices market size is calculated at USD 6.82 billion in 2025 and is predicted to increase from USD 7.53 billion in 2026 to approximately USD 17.57 billion by 2035, expanding at a CAGR of 9.93% from 2026 to 2035.

Key Takeaways

- On the basis of type of device, the non-energy-based aesthetic device segment accounted for 79.40% of revenue share in 2025.

- On the basis of application, the skin resurfacing and tightening segment held the highest market share in 2025.

- On the basis of end-user, the hospitals and clinics segment accounted for the biggest market share in 2025.

What are Medical Aesthetic Devices in the U.S.?

Medical Aesthetic Devices are used to overcome flaws in a person's physical appearance. The American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) estimates that in the United States in 2021, 1.4 million surgical and non-surgical operations were carried out. The top 5 cosmetic surgical procedure in the United States includes Facelift surgeries, Liposuction, Breast Augmentation, Nose reshaping, and eyelid surgery. The demand for aesthetic treatment in developing countries is growing due to the urge to look young and fit.

The aesthetic method such as liposuction, nose reshaping, and Botox injection are gaining consumer attention. Skin-tightening and non-invasive fat technologies have recently established out a new niche in the medical aesthetics market. The key factors enhancing the growth of the U.S. Aesthetic Medical Device market are a surge in the prevalence of facial deformities and congenital teeth, enhancement in demand for non-invasive surgeries, an increase in the number of cosmetic surgeries, and advancement in aesthetic devices.

How is AI contributing to the U.S. Medical Aesthetic Devices Industry?

The use of artificial intelligence in U.S. medical aesthetic devices is a significant factor that enhances the accuracy, safety, and personalization of the devices. AI assists in the area of diagnostics, treatment planning, and even post-care monitoring. It evaluates the facial structure of the patient, forecasts the patient's reactions, and permits the use of robotic-assisted procedures accompanied by a personalized simulation for outcome visualization.

AI has also automated the workflow by providing automated scheduling and aftercare tools, thereby making the practitioner training through advanced simulation less strenuous and more effective. With these benefits, the patient's displeasure is reduced, the risks are lowered, and the total clinical efficiency across aesthetic procedures is maximized.

Market Outlook

- Industry Growth Overview: The market moves up with the help of more people being aware of aesthetic treatment, the development of new technologies, and the attraction of the less disruptive beauty solutions.

- Sustainability Trends: The fashion and cosmetics industry is gradually adopting environmentally-friendly practices such as the use of eco-friendly materials, energy-efficient production processes, and responsible disposal of products at the end of their life cycle.

- Global Expansion: The U.S. firms are making their way into the global market by forming partnerships, providing area-specific products, and conducting research and development that is the driving force behind the expansion of aesthetic technology.

- Major Investors: The financial support of AbbVie, Johnson & Johnson, Venrock, and New Enterprise Associates rides on the promotion of growth through their strategic funding, which makes it possible for the innovative aesthetic developments to take place.

- Startup Ecosystem: The novice companies of the day are giving importance to the combination of smart devices, making enhancements in safety, and providing innovative solutions to be the future of the medical aesthetic treatment experiences.

US Medical Aesthetic Devices Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.82 Billion |

| Market Size in 2026 | USD 7.53 Billion |

| Market Size by 2035 | USD 17.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.93% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type of Device, By Application, By End User |

Market Dynamics

Drivers

The rising prevalence of obesity, increased awareness of cosmetic treatments, expanding use of minimally invasive devices, and technical developments in devices are some factors that are fueling the market's growth.

The rise in the choice of minimally invasive and non-invasive cosmetic surgeries

- Compared to standard surgical treatments, minimally invasive/nonsurgical methods provide a variety of benefits, such as quicker recovery times and less pain and scarring. For instance, according to the American Society of Plastic Surgeons, Plastic Surgery Statistics Report 2020, there were 6.8 million reconstructive procedures, 13.2 million cosmetic minimally invasive procedures, and 2.3 million cosmetic surgical procedures performed in the United States in 2020.

High Awareness of cosmetic operations and rising obesity rates

- A person's appearance can be improved without surgery using medical aesthetic devices. These goods, which also use the name "cosmetic surgery devices," include a wide range of things including laser hair removal equipment, microdermabrasion equipment, photo rejuvenation systems, cellulite reduction equipment, body contouring equipment, breast implants, and others. Although the geriatric population is mostly driving the need for aesthetic operations, younger people are also favoring the usage of aesthetic procedures, which is driving the demand for aesthetic equipment.

- WHO estimates that the prevalence of obesity has risen since 1975 and that roughly 30% of people worldwide are obese. A primary underlying cause of obesity, illness, and disability is sedentary behavior. All developed and emerging nations have high levels of physical inactivity.

Restraints

High cost and side effects of the aesthetic surgery device

- The risk of potential side effects comes along with technological innovation in various cosmetic procedures. A few commonly occurring side effects in patients undergoing breast augmentation or facelift includes hematoma. Another side effect that occurs after a tummy tuck or body fat reduction is seroma, which appears in 15-30% of patients. Despite several therapeutic and aesthetic applications of botox, the expense and side effects are expected to hinder the market growth.

Opportunities

Accessibility to technologically advanced and user-friendly products

- Non-invasive fat-freezing body contouring system has led to technologically improved products. The market for medical aesthetic devices will be boosted by rising investments in research and development for the launch of new products. For instance, Cynosure introduced the Elite iQ platform in the US, European, and Australian markets in June 2020 for laser hair removal and skin rejuvenation applications.

The breast implants sub-segment is Expected to show rapid grow in the implants segment of the market

- The International Society of Aesthetic Plastic Surgery Report 2020 states that 371,997 breast augmentation operations were performed in the US in 2016. The market is anticipated to grow at a modest rate over the projected period as a result of its prevalence among celebrities and anyone seeking to enhance their outer appearance.

Segment Insights

Type Insights

The devices segment dominated the market in 2025, accounting for the largest market share. The increasing demand for non-invasive aesthetic surgeries significantly boosted the demand for medical aesthetic devices. Laser and radiofrequency devices are increasingly used in aesthetic procedures to remove hair, tighten skin, reduce wrinkles, and stimulate collagen production, which further promotes skin rejuvenation. The increasing investments in R&D to develop sophisticated aesthetic devices further contributed to the segment's growth. Moreover, the increased number of laser-based aesthetic procedures performed in the last few years bolstered the segment.

The aesthetic implants segment is anticipated to expand at the fastest growth rate during the forecast period due to the rising demand for body contouring procedures. Aesthetic implants, including buttocks and breast implants, are widely used in body contouring procedures to enhance the specific part of the body. Moreover, the increasing popularity of breast augmentation surgery fuels the segment. For instance,

- In 2021, about 365,000 breast augmentation procedures were performed in the US, up 44% from 2021.

Application Insights

The non-surgical segment led the market in 2025 and is expected to continue its dominance throughout the projection period due to the increasing number of non-surgical aesthetic procedures performed in the US. The segment growth is attributed to the easy availability and accessibility of non-surgical procedures in medical spas and beauty centers. Non-surgical aesthetic procedures often require less time than surgical procedures, appealing individuals seeking aesthetic enhancement. Moreover, the growing awareness about the benefits of non-surgical procedures is expected to boost the segment.

End-User Insights

The hospitals and clinics segment held a large share of the market in 2025 due to the availability of advanced aesthetic devices in hospital settings. The easy accessibility to these devices and the availability of skilled professionals encourage individuals to perform aesthetic surgeries in hospital settings under physician consultation. Moreover, the rapid expansion of derma clinics contributed to the segmental growth.

Country-Level Analysis

The U.S medical aesthetics market is experiencing significant growth, driven by evolving consumer preferences and advancements in technology. Individuals are now increasingly seeking non-invasive procedures that offer minimal downtime and natural-looking results. This shift highlights the growing popularity of treatments such as injectables, laser therapies, and skin rejuvenation techniques. Moreover, the rise of social media platforms such as Instagram and TikTok has increased accessibility even more, allowing people to explore various options and share their experiences.

Regulatory bodies in the region are increasingly focusing on ensuring safety and efficacy, which has led to the introduction of new guidelines and standards. This evolving framework helps to foster innovation while also maintaining consumer trust.

Value Chain Analysis

- R&D: clinical needs identification and proposal of initial device ideas are the basis for new and improved medical device innovation.

Key Players: AbbVie (Allergan Aesthetics), Galderma, Cynosure, and Candela Medical. - Clinical Trials and Regulatory Approvals: Subjecting the product to thorough testing and, at the same time, presenting safety and effectiveness to authorities results in official market clearance.

Key Players: Avania, NAMSA, IQVIA, and Parexel - Formulation and Final Dosage Preparation: market-ready medical devices with proper configurations and quality control checks are produced from raw materials and components.

Key players: AbbVie (Allergan Aesthetics) (for injectables like Juvéderm and Botox), Merz Aesthetics, and Galderma - Packaging and Serialization: Finished medical devices are packed for shipment, and tracking measures are put in place, ensuring both supply chain transparency and compliance with regulatory traceability.

Key Players: AbbVie (Allergan Aesthetics) (for injectables like Juvéderm and Botox), Merz Aesthetics, and Galderma - Distribution to Hospitals, Pharmacies of U.S. Medical Aesthetic Devices: A continuous network of hospitals, clinics, and pharmacies is the route for the supply of medical devices from manufacturing plants.

Key Players: Johnson & Johnson Services, Inc. (Mentor), Bausch Health - Product Design and Innovation:This stage focuses on developing advanced, safe, and effective devices, integrating AI, software, and imaging to improve clinical outcomes.

Key Players: Cynosure, Allegran, AbbVie - Manufacturing Process: This stage deals with transforming designs into regulatory-compliant products, emphasizing precision components, sterile injectables, and energy systems with rigorous quality checks.

Key Players: Cutera, Revance, Galderma

U.S. Medical Aesthetic Devices MarketCompanies

- Cynosure: Hefty laser and light-based aesthetic systems for hair removal, skin rejuvenation, body contouring, and tattoo removal are delivered by Cynosure to the aesthetic application and clinical practices, which are the master-nature of it all.

- Alma Lasers: The clinic must-have treatments that include skin rejuvenation, hair removal, and effective body contouring, offering the versatile platforms of the Alma Lasers that employ the skills of laser, radiofrequency, and ultrasound technologies.

- Lumenis Inc.: The company not only produces but also provides energy-based solutions that include IPL and CO2 lasers for skin resurfacing, hair removal, and draining of targeted vascular lesions.

Other Major Key Players

- Bausch Health Companies Inc. (Solta Medical Inc.)

- Abbvie

- Lumenis Ltd.

- Dentsply Sirona, Inc.

- Dentsply Sirona, Inc.

- PhotoMedex, Inc.

- Straumann

Recent Developments

- In August 2025, Cynosure Lutronic announces FDA clearance for its XERF™ system. The system is an innovative radiofrequency technology for skin tightening in medical aesthetics. (Source: https://www.businesswire.com )

- In May 2025, at the NAIMA event, CEO Joe Querishi unveiled affordable prices for a new device in collaboration with Aesthetics Depot. He highlighted FIVE key features to inform potential buyers, aiming to enhance profitability and client retention amid the gathering of reporters and press. (Source: https://fox59.com )

- In October 2025,Allergan (U.S.) announced a strategic partnership with a leading telehealth platform to enhance patient access to aesthetic consultations. This is likely to expand the company's customer base by integrating digital solutions into traditional aesthetic practices, thus aligning with the growing trend of telemedicine. Such initiatives may not only improve patient engagement but also streamline service delivery, reflecting a broader shift towards digital transformation in the industry. (Source: prnewswire.com)

- In September 2025, Revance Therapeutics (U.S.) launched a new marketing campaign aimed at educating consumers about the benefits of its innovative DaxibotulinumtoxinA product. This campaign is significant as it seeks to differentiate Revance's offerings in a crowded market, potentially increasing brand loyalty and consumer trust. By focusing on education, Revance may enhance its competitive edge, appealing to a more informed consumer base that values transparency and efficacy. (Source: revance.com)

- In June 2022,Cynosure launches the PicoSure Pro device, a next-generation aesthetic laser device. PicoSure Pro is the first and only 755nm picosecond laser that has received FDA clearance. It uses pressure rather than heat to deliver energy in a trillionth of a second, offering all skin types safe and effective treatments for hyperpigmentation and skin rejuvenation.

- In November 2021, an agreement was signed between NanoPass Technologies and Aesthetic Management Partners (AMP) to commercialize NanoPass's MicronJet 600 intradermal delivery device in the United States.

- In May 2021, Soliton, a medical device firm, is acquired by Allergen Aesthetics. Due to the acquisition, Allergan have access to Soliton's RESONIC rapid acoustic pulse (RAP) technology. RESONIC got the US Food and Drug Administration's 510(k) certification. It is a non-invasive gadget designed to temporarily improve cellulite appearance.

- In March 2021, Longer-lasting neuromodulator drug candidate DaxibotulinumtoxinA for Injection (DAXI), a Botulinum Toxin Type A formulated with a novel peptide excipient or combined treatment of glabellar, dynamic forehead, and lateral canthal lines was introduced by Revance Therapeutics, Inc.

- In August 2020, NuEra Tight with FocalRF technology has been invented by Lumenis Ltd., the leading energy-based medical device business for cosmetic, surgical, and ophthalmic purposes.

Segments Covered in the Report

By Type

- Devices

- Energy-based Aesthetic Device

- Laser-based Aesthetic Device

- Radiofrequency (RF)-based Aesthetic Device

- Light-based Aesthetic Device

- Ultrasound Aesthetic Device

- Non-energy-based Aesthetic Device

- Botulinum Toxin

- Dermal Fillers and Aesthetic Threads

- Microdermabrasion

- Others

- Aesthetic Implants

- Facial Implants

- Breast Implants

- Others

By Application

- Surgical

- Non-surgical

By End-user

- Hospitals and Clinics

- Medical Spas and Beauty Centers

Get a Sample

Get a Sample

Table Of Content

Table Of Content