What is the Medical Aesthetics Market Size?

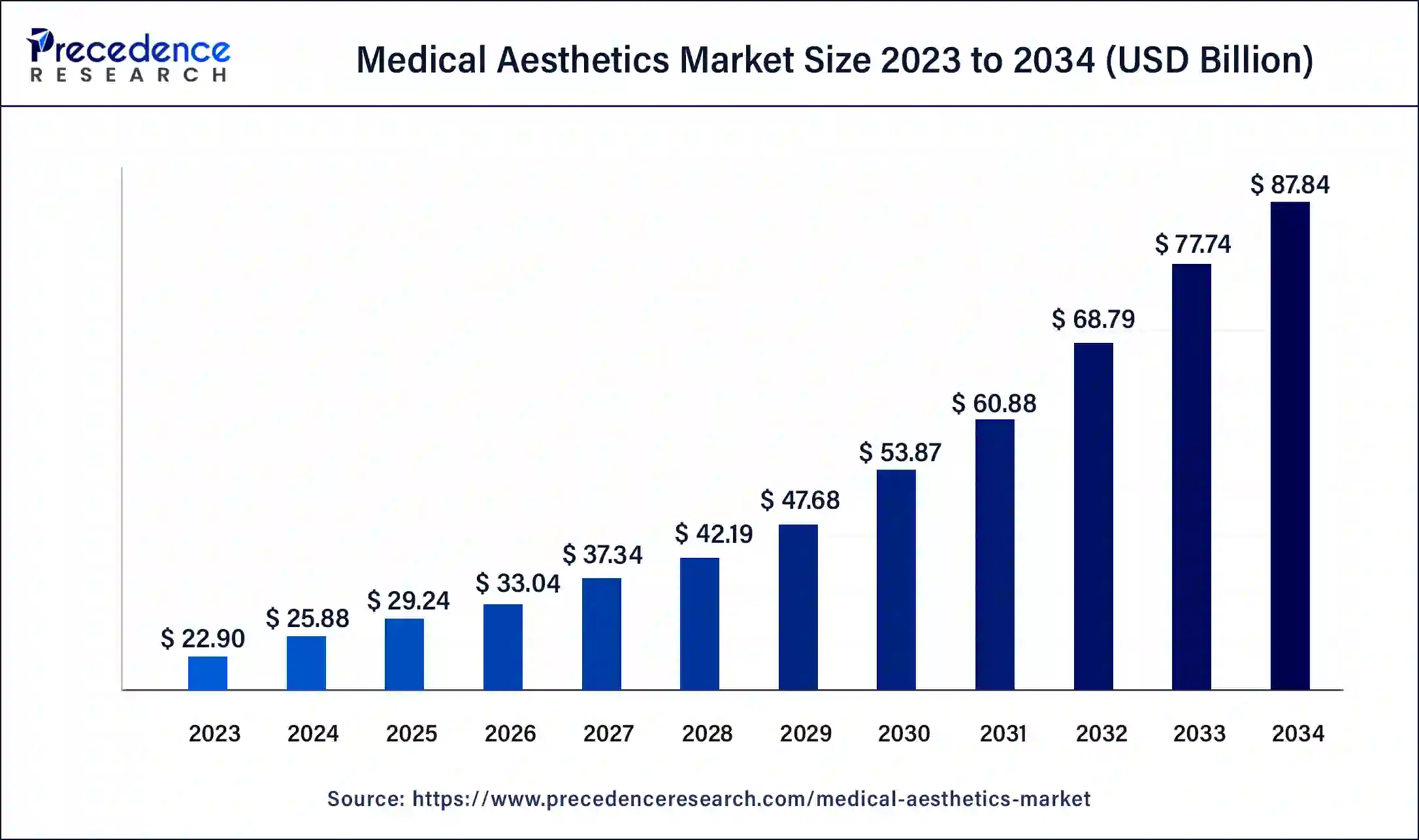

The global medical aesthetics market size is calculated at USD 29.24 billion in 2025 and is predicted to increase from USD 33.04 billion in 2026 to approximately USD 97.17 billion by 2035, expanding at a CAGR of 12.76% from 2026 to 2035.

Market Highlights

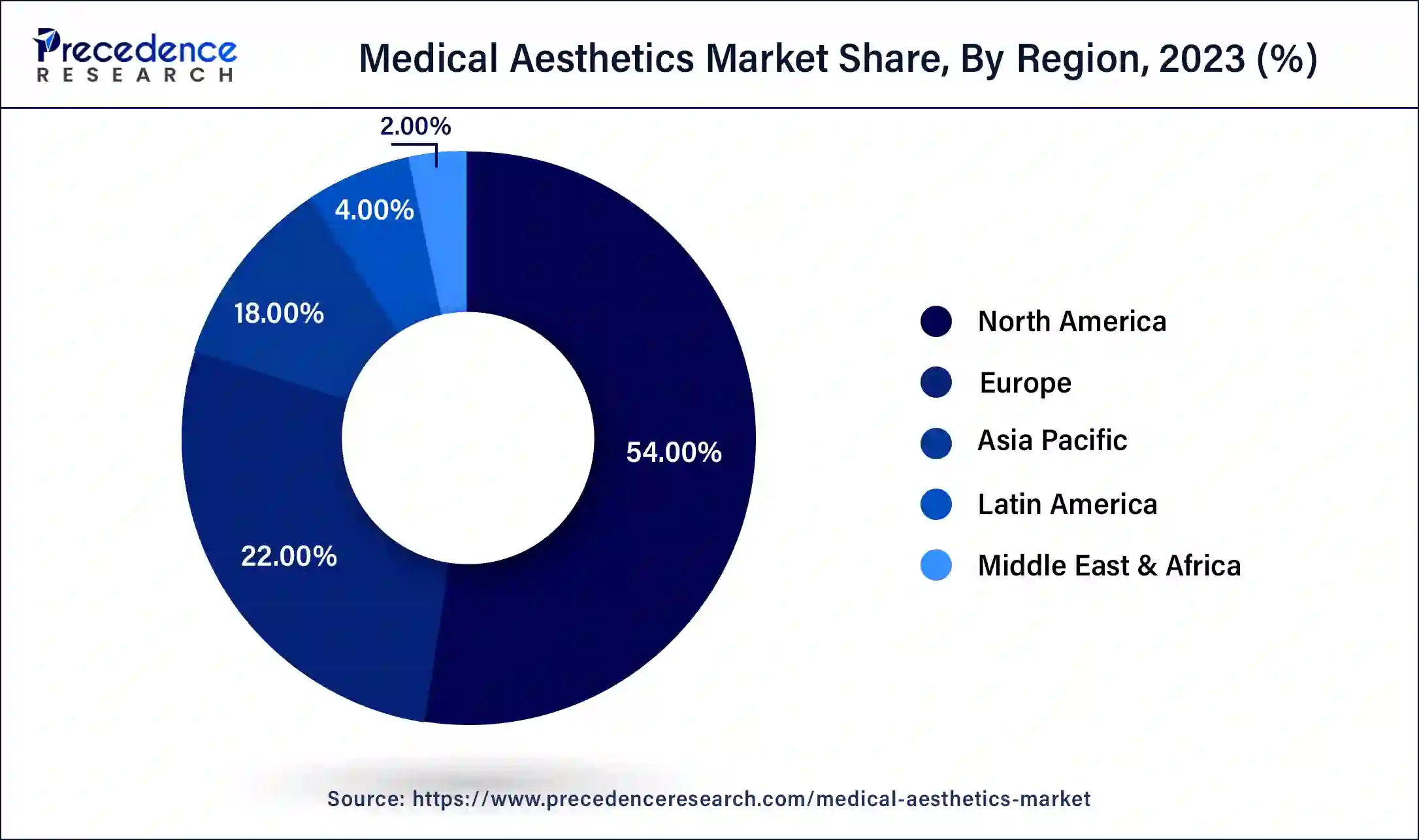

- By region, North America dominated the market in 2025.

- Asia Pacific is anticipated to expand at the fastest growth rate during the forecast period.

- By type, the non-energy-based devices segment dominated the market in 2025.

- By type, the energy-based devices segment is anticipated to expand at the fastest growth rate during the forecast period.

- By application, the skin resurfacing & tightening segment accounted for the largest market share in 2025.

- By end-user, the specialty clinics segment captured the major market share in 2025.

What is the Medical Aesthetics Market?

Beauty standards have evolved over the years. Today, people are more conscious of their beauty and appearance. Not just females; males are also into these beauty treatments. They idolize celebrities for their incredible appearance and, thus, tend to look visually appealing and achieve a picture-perfect look. All these have led to the increasing demand for medical aesthetics across the globe.

The medical aesthetics market deals with aesthetic devices and procedures. These devices deliver noninvasive and painless beauty treatments for maintaining a youthful appearance and maintenance-free skin that remains hairless and smooth without the need for waxing or shaving. These devices also help treat sunspots, wrinkles, acne, and unwanted hair. In addition, rising technological advancements and the increasing popularity of cosmetic surgeries are expected to boost the market growth in the coming years.

- In June 2024, the International Society of Aesthetic Plastic Surgery (ISAPS) unveiled the results of its annual Global Survey on Aesthetic/Cosmetic Procedures at the ISAPS World Congress in Cartagena, demonstrating an increase of 5.5% in surgical procedures, with above 15.8 million procedures performed by plastic surgeons and 19.1 non-surgical procedures. Over the last four years, the overall increase is 40%.

How is AI contributing to the Medical Aesthetics Industry?

Artificial Intelligence is transforming the world of aesthetics by means of objective assessments, extremely precise medical procedures, and personalized treatment planning. It is the one to make the evaluation of facial symmetry, provide support with decision-based insights, and simulate the outcomes. Robotics in aesthetics is the ones who increase the precision of the procedures done by laser or results in the loss of hair. Predictive modeling is the one that predicts the recovery response and the chances of complications occurring.

The patient monitoring application is the one to provide the post-care guidance by sending reminders that lead to better healing and greater satisfaction through the entire treatment process.

Market Outlook

- Industry Growth Overview: The global demand for cosmetic care and treatments is constantly increasing due to the growing preference for non-invasive methods.

- Sustainability Trends:The focus is shifting towards reusable devices and eco-friendly practices in clinics, which help to raise awareness about the environment.

- Global Expansion:The procedure is becoming more widespread in both developed and emerging markets as more people gain access to the latest treatments.

- Major Investors:Allergan Aesthetics, Galderma, Merz Pharma, Johnson & Johnson, and Cynosure Lutronic are all continuing to make significant investments in the field of aesthetics.

- Startup Ecosystem:The market now has AI-based personalization startups that present patient-centered engagement and contemporary treatment innovations as their main contribution.

Medical Aesthetics Market Trends

- The increasing demand for robot-based surgery is expected to drive the market growth.

- The rising adoption of medical aesthetics devices.

- The increasing demand for minimally invasive aesthetic treatments.

- The increasing demand for home-based aesthetic procedures.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 29.24 Billion |

| Market Size in 2026 | USD 33.04 Billion |

| Market Size by 2035 | USD 97.17 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.76% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for green products

The consumer is shifting their preference toward green skincare and regenerative products due to negligible side effects, cost-effectiveness, and providing additional benefits as well. Green or natural products are developed along with ecological standards, and they promote health benefits as well. They allow skin rejuvenation and cell regrowth naturally and reduce acne, scars, and other skin-related issues without any chemical interference or surgery requirements. Hence, consumers are adopting green regenerative skincare products. Such factors will promote their growth in the beauty and care market in forthcoming years across the globe.

Moreover, many well-established companies are collaborating with local or SMEs to boost their portfolio of beauty and skincare products, offering natural ingredients to cater to consumers' diverse needs. Green cosmetics are natural cosmetics primarily made up of plant and fruit extracts and concentrates, reducing environmental impact.

Increasing demand for non-invasive and home-based procedures

With the growing desire to enhance appearance and promote skin health, there is a heightened demand for minimally invasive aesthetic procedures. This is mainly due to the increasing awareness about the availability of non-invasive treatments and their benefits. Consumers often prefer treatments that require less downtime and offer quick results. Moreover, the demand for home-based aesthetic procedures is rising among consumers. This, in turn, boosts the adoption of home-use aesthetic devices, such as lasers, for hair removal and skin rejuvenation. In addition, the rising geriatric population worldwide and the increasing prevalence of skin problems, including acne, pigmentation, and scarring, further drive the market during the forecast period.

Restraint

High cost of devices and procedures

Various players in the market are focusing on introducing innovative devices to address the increasing demand for aesthetic procedures globally. However, the high costs of these devices can hamper the market's growth. Non-surgical cosmetic procedures are more costly due to the use of advanced aesthetic devices. In addition, the high cost of procedures such as abdominoplasty and breast augmentation and the lack of reimbursement policies covering these procedures hinder the growth of the medical aesthetics market.

Opportunity

Patient education and empowerment

In this digital era, patients are gradually taking their aesthetic choices into their own hands. They actively browse for information online to understand the intricacies of technologies and procedures. Online resource centers serve as indispensable information hubs and guide individuals through every aspect of their aesthetic journey. These platforms provide detailed insights into recovery strategies, post-treatment care, and treatment options and foster a sense of ownership across their aesthetic preferences. Moreover, technological advancements have revolutionized the medical aesthetics market, taking it to new heights. As a result, it has witnessed the development of new technologies and devices, ranging from ultrasound technologies to advanced laser systems.

- In June 2024, Allergan Aesthetics launched the A-Z of Medical Aesthetics as the first step of its campaign to improve understanding of aesthetics and empower patients over 18 years of age to make informed choices.

Medical Aesthetics Market Segmental Insights

Type Insights

The non-energy-based devices segment dominated the market with the largest share in 2025. This is mainly due to the high demand for procedures such as chemical peels, dermal fillers, and others, owing to several advantages provided by these procedures. The increased demand for non-surgical treatments to stimulate collagen, tighten skin, and reduce wrinkles further contributed to segmental growth. In addition, manufacturers are making efforts to get product approvals and introduce new products to address the growing demand for non-surgical and non-energy-based aesthetic devices, thus boosting the segment.

- For instance, in September 2022, Sientra, Inc. announced that it had received approval from the Saudi Food & Drug Authority to market its line of smooth-surface, high-strength cohesive (HSC and HSC+) silicone gel breast implants in Saudi Arabia.

The energy-based devices segment is anticipated to expand at the fastest growth rate during the forecast period, owing to the rising introduction of novel devices with advanced technologies, such as radiofrequency, ultrasound, and lasers. Energy-based devices are widely used in cosmetic treatments to remove hair and reduce wrinkles. In addition, the increasing number of laser-based aesthetic treatments propels the segment.

Application Insights

The skin resurfacing & tightening segment accounted for the largest market share in 2025. This is due to the wide availability of minimally invasive treatments for skin resurfacing, tissue tightening, and rhytids reduction. The rising patient pool undergoing several treatments for skin applications, such as sagging skin, wrinkles, fine lines, acne scars, and others, is raising the need to treat such conditions. The increasing approvals from various government agencies to launch advanced devices and the high demand for aesthetic devices for skin resurfacing procedures contribute to the growth of the segment.

The hair and tattoo removal segment is expected to grow at a high CAGR in the coming years due to the high demand for advanced technologies and increased awareness of hair removal procedures. Furthermore, the desire for smooth skin encourages individuals to undergo hair removal procedures, thereby driving the segment's growth.

End-User Insights

The specialty clinics segment captured the major share of the market in 2025. The segment growth is fueled by patients' increasing preference for specialty clinics and demand for minimally invasive procedures. In addition, the growing number of specialty clinics in numerous nations performing aesthetic processes is further enhancing the segment growth. For instance, according to the data published by PolicyBee Ltd, around 950 medical aesthetics clinics were operated in the U.K. in 2022.

The hospital segment is expected to grow at a significant rate in 2025. The segment growth is mainly attributed to the growing number of procedures, especially cosmetic and breast implant procedures, which are majorly performed in hospitals. Moreover, the easy availability and accessibility to advanced aesthetic devices encourage individuals to perform aesthetic surgeries in hospital settings under physician consultation, thus propelling the segment.

Medical Aesthetics Market Regional Insights

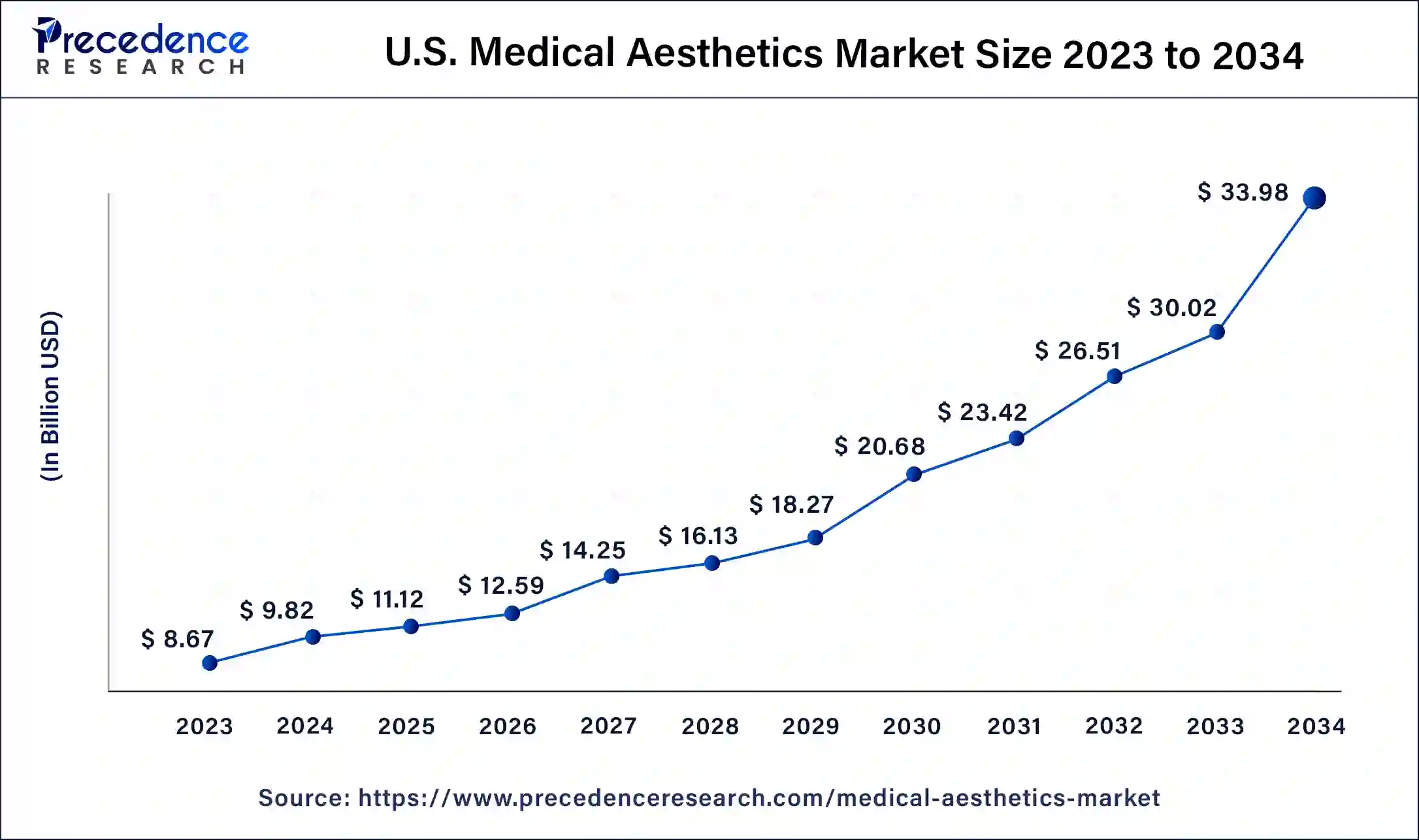

The U.S. medical aesthetics market size is calculated at USD 11.12 billion in 2025 and is projected to be worth around USD 37.64 billion by 2035, poised to grow at a CAGR of 12.97% from 2026 to 2035.

U.S. Medical Aesthetics Market Trends

The U.S. is the one that makes the regional performance go up owing to the high adoption of aesthetic procedures and the fast-paced innovation, thus new product development, technology integration, and better training programs for aesthetic practice will be the result.

North America dominated the medical aesthetics market, capturing the largest market share in 2025. The market in the region is rising because of a growing older population, advantageous reimbursements, breakthrough technologies, and the prevalence of congenital face and teeth defects. Furthermore, celebrities significantly impact the younger population, which is increasingly choosing for these procedures. The need for medical aesthetic operations has also increased. The U.S. and Canada are the major countries in the region driving the market growth. Consumers in the U.S. have increased their interest in facial aesthetic appearance. Facial injectables containing botulinum, hyaluronic acid, collagen, polymers, and particles give the skin or features a cosmetic boost.

North America is the leading market due to its high awareness, modern clinical infrastructure, and the presence of many aesthetic providers, which together drive the consumer's readiness to accept such treatments as well as technological innovations in cosmetics.

- For instance, in November 2022, Cosmetic Physician Partners Inc. launched a Network of Physician-led Medical Aesthetics Clinics across the U.S. The aim behind this launch was to provide physicians with an alternative to private equity.

Asia Pacific held the second-largest position in the market in 2025 and is expected to expand at a rapid pace in the near future. The demand for botulinum toxin treatments and dermal fillers is rising in countries such as Japan and India, along with the increased demand for facial aesthetic procedures in countries such as South Korea, China, and others, which is expected to drive the growth of the medical aesthetics market in the Asia Pacific. For instance, in September 2024, an AbbVie company, Allergan Aesthetics, announced the availability of BOTOX Cosmetic for the treatment of masseter muscle prominence (MMP) in China. BOTOX Cosmetic is the first neurotoxin approved in China for MMP and offers the established dosing, robust clinical evidence, and physician training that comes with on-label treatment.

Asia-Pacific is the region that experiences the fastest growth, thanks to the increasing demand for beauty enhancements, changing aesthetic standards, and medical tourism, all driven by the increased access to dermatology clinics and aesthetic devices.

South Korea Medical Aesthetics Market Trends

South Korea enjoys the highest technology acceptance, mainly due to beauty culture and the rising global medical tourism attractiveness, which in turn creates opportunities for local manufacturing, affordable solutions, and innovations aimed at the preferences of the young target demographic.

Advantages of Europe are day by day, establishing more and more private clinics, the high demand of the aging population and a favorable regulatory environment that supports the use of advanced injectable and skin enhancement solutions.

Germany Medical Aesthetics Market Trends

Germany is getting stronger and stronger through medical infrastructure that puts safety and efficacy first, thus providing ample room for anti-aging solutions, non-surgical rejuvenation offerings, and also the adoption of injectable-based procedures that are getting widespread.

Medical Aesthetics Market Value Chain

R&D: Measures the effectiveness in spotting new drug targets and producing compounds that yield high-value outcomes.

- Key Players: Allergan Aesthetics (an AbbVie company), Galderma, and Revance Therapeutics

Clinical Trials & Regulatory Approvals: Analyzes the processes of clinical testing and the approval routes that guarantee safety and market readiness of the product.

- Key Players: AbbVie/Allergan, Galderma, and Johnson & Johnson

Formulation & Final Dosage Preparation: Makes the production process more effective by turning active substances into high-quality final goods and maintaining the required standards.

- Key Players: Galderma and Merz Aesthetics)

Packaging & Serialization: Sets up packaging and serialization for product identification, tracking, brand protection, and security of the supply chain.

- Key Players: Amcor, Gerresheimer, and West Pharmaceutical Services

Distribution: Delivers products to hospitals and pharmacies in a way that is already quick and convenient because of logistics efficiency.

- Key players: Allergan Aesthetics, Galderma, and Merz Aesthetics

Top Companies in the Medical Aesthetics Market & Their Offerings

- Merz Pharma: Offers toxins, fillers, and energy-based devices that support the rejuvenation of the face and the contouring of the body.

- Anika Therapeutics, Inc.: Mainly concentrates on the development of orthopedic regenerative solutions using hyaluronic acid products instead of aesthetics-oriented product lines.

- Johnson & Johnson Services, Inc.: Supplies breast implants and tissue expanders through the Mentor division, which is included in the medical aesthetics category.

Other Major Companies

- AbbVie

- Lumenis

- Solta Medical

- Syneron Candela

- Alma Lasers

- Hologic

- Cutera, Inc

- El.En. S.p.A.

- Medytox, Inc.

- Fotona d.o.o

- Sisram Medical

- Cynosure

- Galderma

Recent Developments in the Medical Aesthetics Industry

- In December 2025, Aesthetics Anonymous in Columbia, MD, offers medical aesthetics with a philanthropic approach, providing discounts to military and first responders, emphasizing natural, non-invasive treatments for confidence. This service focuses on restoring confidence via natural and non-invasive procedures. (Source: financialcontent.com)

- In November 2025, SBC Medical Group Holdings is expanding in Thailand's medical tourism industry through a partnership with BLEZ ASIA, enhancing its position in aesthetic medicine and Asian market presence. This is Thailand's first medical tourism industry, is the SBC's most recent achievement. (Source: travelandtourworld.com)

- In September 2024, A J Hospital & Research Centre announced the launch of a new venture, ‘Dira Aesthetics,' in Mangaluru to fulfil the gap in aesthetic medicine. This venture will be a comprehensive unit that should take care of every aspect of aesthetics.

- In September 2024, Merz Aesthetics, the world's leading pharmaceutical company, announced the introduction of the Ultherapy PRIME platform which is the updated version of nonsurgical skin lifting treatments.

- In March 2024, Allergan Aesthetics announced its collaboration with medical aesthetics experts from around the globe to elevate discussion on ethics in aesthetics.

- In November 2023, Lumenis, an Israel-based company, unveiled its latest radiofrequency device to treat dry eye inflammation.

Medical Aesthetics Market Segments Covered in the Report

By Type

- Non-Invasive

- Dermal Fillers

- Chemical Peels

- Botulinum Toxin

- Microdermabrasion

- Others

- Invasive

- Breast Augmentation

- Tattoo Removal

- Liposuction

- Eyelid Surgery

- Hair Removal

- Tummy Tuck

- Others

By Application

- Lip Augmentation

- Acne Scars Removal

- Wrinkle Removal

- Rhinoplasty

- Others

By End User

- Hospital & Clinic

- Beauty Centers

- Home Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content