What is U.S. Blood Pressure Monitoring Devices Market Size?

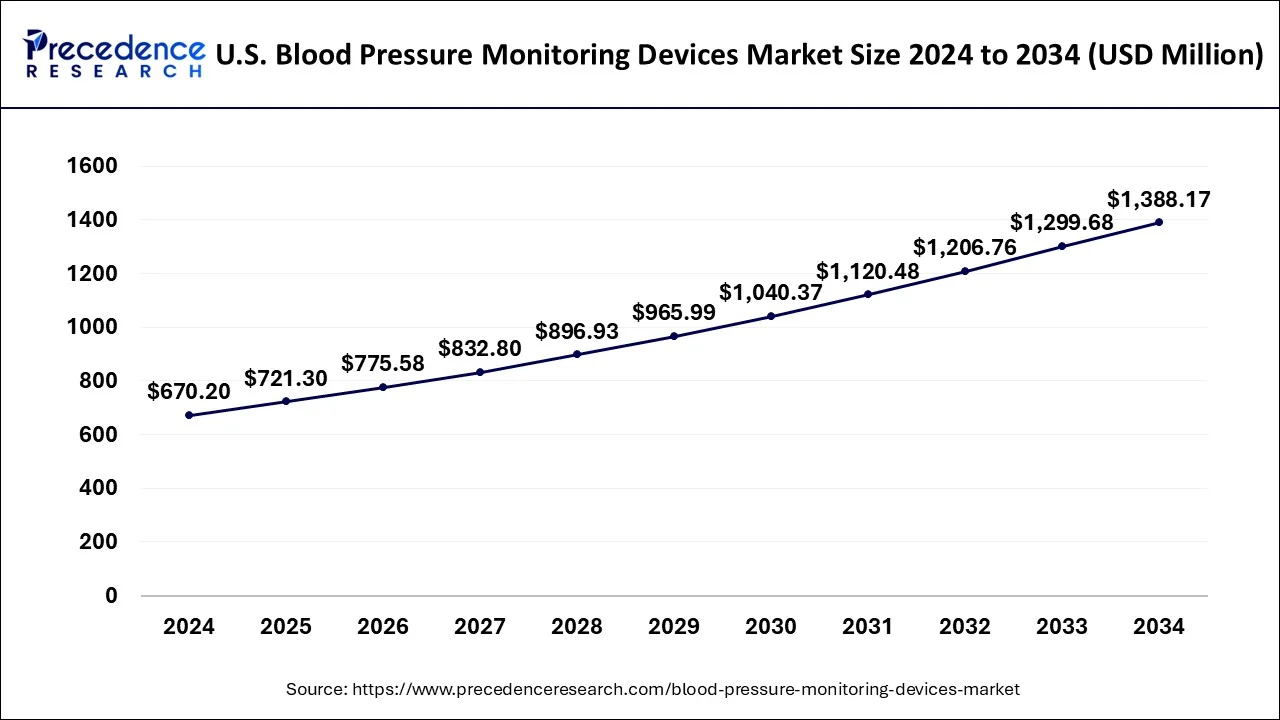

The U.S. blood pressure monitoring devices market size is valued at USD 721.30 million in 2025 and is anticipated to reach around USD 1,388.17 million by 2034, expanding at a double-digit CAGR of 7.64% from 2025 to 2034.

Market Highlights

- By product, the sphygmomanometer segment held the largest share of the market in 2024.

- By product, the ambulatory blood pressure monitor segment is expected to witness the fastest rate of expansion during the forecast period of 2025-2034.

- By end user, the hospitals segment held the largest share of the market in 2024 and the segment is observed to grow at the fastest rate during the forecast period.

- By end user, the home healthcare segment is observed to grow at the fastest CAGR during the forecast period.

Market Overview

The U.S. blood pressure monitoring devices market revolves around the development and distribution of monitoring devices that are generally to measure pulse inside the arteries using blood pressure as a parameter. To test, treat, and keep an eye on hypertension, blood pressure monitoring devices are essential. Pulse monitoring devices are incredibly accurate and assist physicians or other professionals in ensuring effective care. These incredibly accurate devices assist medical professionals in providing patients with efficient care.

U.S. Blood Pressure Monitoring Devices Market Growth Factors

- One important growth factor for the growth of the U.S. blood pressure monitoring devices market is the rising incidence of hypertension and associated cardiovascular disorders in the United States.

- Devices for measuring blood pressure are in greater demand as more people receive high blood pressure diagnoses. The ageing of the world's population is yet another important element. Since hypertension is more common among the elderly, frequent blood pressure monitoring is essential. The U.S. blood pressure monitoring devices market is expanding due to this demographic trend.

- The need for blood pressure monitors is driven by rising awareness of the value of routine medical exams and self-monitoring. Convenient and accurate solutions are sought after by health-conscious consumers.

- In addition, the industry has been stimulated by the trend toward remote patient monitoring and at-home healthcare. These gadgets are being used by patients and healthcare professionals more and more for practical and economical health management.

- Growing healthcare spending makes blood pressure monitors more accessible and affordable for a larger population, which propels the growth of the U.S. blood pressure monitoring devices market.

- As technology continues to progress, creative and user-friendly blood pressure monitoring gadgets with wireless connectivity and smartphone integration have been created, increasing their market appeal.

U.S. Blood Pressure Monitoring Devices Market Trends

- Self-monitoring is increasingly common, particularly among older adults and those with hypertension. The growth of connected blood pressure devices is being driven by their integration with smartphones, fitness trackers, and cloud platforms. Wristband and smartwatch monitors are becoming popular options instead of conventional cuffs.

- AI can assist with digital displays, allowing for accurate measurement. It removes the need for traditional sphygmomanometers in a medical environment. The introduction of sensors and wearable technology has changed the diagnostic field. This enables patients to check their blood pressure anywhere and at any moment.

- The introduction of sophisticated blood pressure monitoring devices with around-the-clock monitoring capabilities has boosted their acceptance within the U.S. population, driving growth in the U.S. blood pressure monitor market. The sector is marked by fierce rivalry, as leading firms emphasize innovation and technological progress to enhance their market position.

U.S. Blood Pressure Monitoring Devices Market Outlook:

- Industry Overview: Currently, they are shifting towards smartwatches and Bluetooth-enabled cuffs that integrate with digital health platforms and electronic health records.

- Major Investor: In May 2025, Aktiia raised an oversubscribed $42 million Series B funding round and launched its new “Hilo” brand identity.

- Startup Ecosystem: Riva Health, based in Denver, provides a mobile-based application for monitoring blood pressure.

Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2025 | USD 721.30 Million |

| U.S. Market Size in 2026 | USD 775.58 Million |

| U.S. Market Size by 2034 | USD 1,388.17 Million |

| Growth Rate from 2025 to 2034 | CAGR of 7.64% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By End User |

Market Dynamics

Drivers

Rising older population and awareness about hypertension

The likelihood of hypertension seems to rise with age. Older people are more likely to have high blood pressure because of hormonal fluctuations and altered blood vessel flexibility. As a result, the need for blood pressure monitoring devices is being driven by the demographic trend toward an older population. Elderly people's blood pressure is being monitored and managed by healthcare practitioners more often with the prescription of these devices. Further boosting the U.S. blood pressure monitoring devices market's expansion is the fact that a large number of senior citizens find home blood pressure monitoring to be more convenient.

Additionally, people are more likely to routinely check their blood pressure as they become more aware of the dangers of hypertension and how it affects their general health. Investing in personal blood pressure monitoring devices is encouraged by the focus on early identification and preventative healthcare. Furthermore, a greater number of prescriptions are being written as a result of healthcare professionals actively teaching patients about the advantages of monitoring. Device sales are fueled by this increased knowledge and health consciousness, which also improves health outcomes by enabling early intervention and lifestyle changes in reaction to rising blood pressure readings.

Restraint

The presence of high undiagnosed population

The greatest contributor to the burden of illnesses and the main cause of heart attacks is hypertension. A sizable segment of the populace received insufficient care or no diagnosis at all. As a result, they have a higher chance of morbidity and death from diseases like stroke and other CVDs that are associated with hypertension.

Healthcare professionals (HCPs) are encouraged to identify people who may have undetected hypertension as part of this effort. The new hypertension threshold, established by the American Heart Association (AHA) and the American College of Cardiology (ACC), is 130/80 mm Hg. It was 140/80 mm Hg before. Over 103 million Americans now have high blood pressure as a result of the reclassification. As a result, the large number of undiagnosed people poses a barrier to the expansion of the blood pressure monitoring device industry in the United States.

Opportunity

Rising demand for ambulatory blood pressure monitoring systems

Ambulatory blood pressure monitors are becoming more and more in demand, mainly for the diagnosis of white coats and disguised hypertension. Ambulatory blood pressure monitors are small, wrist- or arm-based devices with features that make them easier to use and more accessible. Ambulatory BP monitoring technologies allow for noninvasive blood pressure measurement. When people engage in regular activities, their blood pressure may be monitored by the use of ambulatory blood pressure monitors.

These gadgets keep an eye on how well blood pressure meds are working. The diagnosis of arterial hypertension is done at home and medical institutions like clinics using ambulatory blood pressure monitors. Advanced ambulatory blood pressure monitors are available from several companies. Thus, throughout the projected period, the U.S. blood pressure monitoring devices market will rise due to the rising demand for ambulatory BP monitoring systems.

Segment Insights

Product Insights

The sphygmomanometer segment held the largest share of the U.S. blood pressure monitoring devices market in 2024 due to its accuracy and reliability. Sphygmomanometers are known for their accuracy in measuring blood pressure. This accuracy is crucial for making informed clinical decisions and diagnosing conditions such as hypertension. This remains a staple in clinical settings such as hospitals, clinics, and healthcare offices. They provide accurate blood pressure measurements and are often used by medical professionals to assess patients' cardiovascular health.

Besides, the ambulatory blood pressure monitor segment is expected to grow at the fastest CAGR during the forecast period. Ambulatory blood pressure monitor devices offer the advantage of continuous blood pressure monitoring, providing a more comprehensive and accurate picture of a patient's blood pressure variations throughout the day and night. This helps in identifying patterns and abnormalities that may go unnoticed with intermittent measurements.

Additionally, ABPM devices are designed to be portable and non-intrusive, allowing patients to go about their daily activities while the device records blood pressure readings at regular intervals. This ambulatory nature improves patient compliance and provides a more natural representation of their blood pressure.

End User Insights

The hospitals segment held the largest market share in 2024and is expected to capture the largest market share during the forecast period. The large patient pool size is the reason for the high share. Increasingly, quick, accurate, and affordable diagnostic tools are needed to improve patient outcomes, which is why blood pressure monitoring devices are being used.

The home healthcare segment is expected to grow at the fastest rate over the projected period in the U.S. blood pressure monitoring devices market. home blood pressure monitoring devices offer convenience and accessibility, allowing individuals to monitor their blood pressure without the need for frequent visits to healthcare facilities. This is particularly beneficial for elderly individuals and those with mobility issues. Thereby, driving the segment expansion.

U.S. Blood Pressure Monitoring Devices Market: Value Chain Analysis

- R&D

The market leverages design and prototyping, strong clinical validation, and regulatory clearance by the Food and Drug Administration (FDA).

Key Players: Abbott Laboratories, Medtronic, GE Healthcare, etc. - Distribution to Hospitals, Pharmacies

Through a multi-channel approach, hospitals acquire them via direct procurement, and pharmacies distribute them directly to consumers through retail, online, and bundled chronic care programs.

Key Players: Cardinal Health, Owens & Minor, Medline Industries, etc. - Patient Support & Services

Usually, leaders are facilitating remote patient monitoring (RPM) services that transmit data to healthcare providers, user-friendly device kits with pre-paired, ready-to-use components, and secure data transmission.

Key Players: OMRON Healthcare, Accuhealth, HealthSnap, etc.

U.S. Blood Pressure Monitoring Devices Market: Company Overview

|

Company |

Headquarters |

Key Offerings |

|

Koninklijke Philips N.V. (1891)

|

Amsterdam, Netherlands. |

It facilitates the IntelliVue series, like MX300, MX400, MX550, and X3, which are versatile bedside and transport monitors that integrate different critical sign measurements, such as blood pressure. |

|

General Electric Company (1892) |

Cambridge, Massachusetts. |

It has explored the CARESCAPE series for high-acuity areas and the B-series for lower acuity patients. |

|

SunTech Medical, Inc. (1982) |

5827 S Miami Blvd, Suite 100, Morrisville, NC 27560-8394, USA. |

It usually provides devices for in-office, cardiac stress, and 24-hour ambulatory monitoring (ABPM). |

|

Welch Allyn (1915) |

Skaneateles Falls, New York, at 4341 State Street Road. |

It explored Connex ProBP Digital Blood Pressure Devices that comprise models like theProBP 3400,2400, and2000. |

|

American Diagnostic Corporation (1984) |

55 Commerce Drive, Hauppauge, NY 11788, US. |

A company offers manual aneroid sphygmomanometers,automatic digital monitors(for upper arm and wrist), andmodular critical signs stationsfor professional use. |

Recent Developments

- In July 2024, Smart Meter, the top provider of Cellular Remote Patient Monitoring (RPM)™ solutions, introduced its newest innovative product: the first cellular-enabled, multi-cuff blood pressure monitoring device specifically created for RPM and chronic care management (CCM). This innovative device is poised to revolutionize patient care by providing unmatched precision, inclusivity, and access to detailed health information for the 129 million Americans affected by a chronic condition.

- In November 2024, in a crucial move to tackle the rising AFib epidemic, OMRON Healthcare revealed that the U.S. Food and Drug Administration (FDA) has awarded the company De Novo authorization to sell new home blood pressure monitors equipped with innovative AI-driven atrial fibrillation detection. In a groundbreaking advancement for medical devices, OMRON's innovative machine learning IntelliSense™ AFib algorithm autonomously examines the Pressure Pulse Wave produced during blood pressure assessments to identify AFib, a primary contributor to strokes.

- In April 2025, Withings announced the official launch of its FDA-approved BPM VisionSearch blood pressure monitor in the United States, enhancing the accessibility of sophisticated at-home cardiovascular monitoring for consumers. The gadget, initially introduced at CES 2025, can now be purchased from the company's online shop for $149.95.

- In November 2023, the US Food and Drug Administration (FDA) authorized the Symplicity SpyralTM renal denervation (RDN) system, also referred to as the SymplicityTM blood pressure procedure, for the treatment of hypertension, according to a statement made by Medtronic plc, a pioneer in healthcare technology worldwide. Medtronic will start commercializing as soon as this permission is granted.

- In August 2023, to address health disparities and lower the risk of heart attacks and strokes in underprivileged Detroit neighbourhoods, OMRON Healthcare, a pioneer in global heart health, and EPIC Health, Detroit's healthcare system dedicated to community-focused healthcare, launched a new partnership. Program participants will have access to VitalSightTM, OMRON's first remote patient monitoring service created exclusively for people with uncontrolled Stage 2 hypertension and other high blood pressure patients.

Segments Covered in the Report

By Product

- Digital Blood Pressure Monitor

- Wrist

- Arm

- Finger

- Sphygmomanometer

- Ambulatory Blood Pressure Monitor

- Instruments & Accessories

- Blood pressure cuffs

- Reusable

- Disposable

- Others

- Blood pressure cuffs

- Transducers

- Reusable

- Disposable

By End User

- Ambulatory Surgical Centers & Clinics

- Hospitals

- Home Healthcare

Get a Sample

Get a Sample

Table Of Content

Table Of Content