What is Third-party Logistics Market Size?

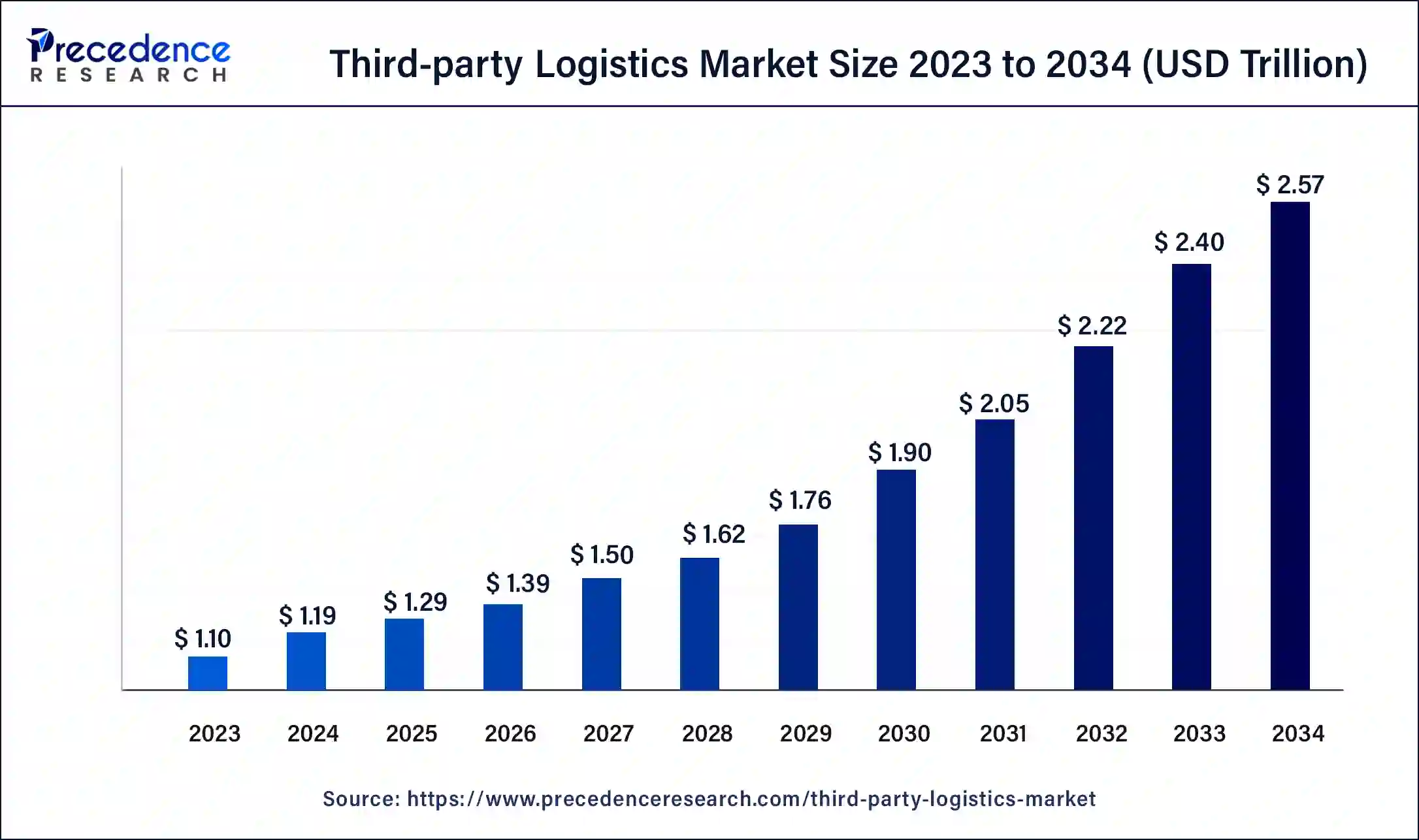

The global third-party logistics market size accounted for USD 1.29 trillion in 2025 and is predicted to reach around USD 2.57 trillion by 2034, growing at a CAGR of 8.02% from 2025 to 2034. The global third-party logistics market is observed to grow due to the expansion of e-commerce sector, as e-commerce companies continue to outsource logistics functions to third-party logistics providers.

Market Highlights

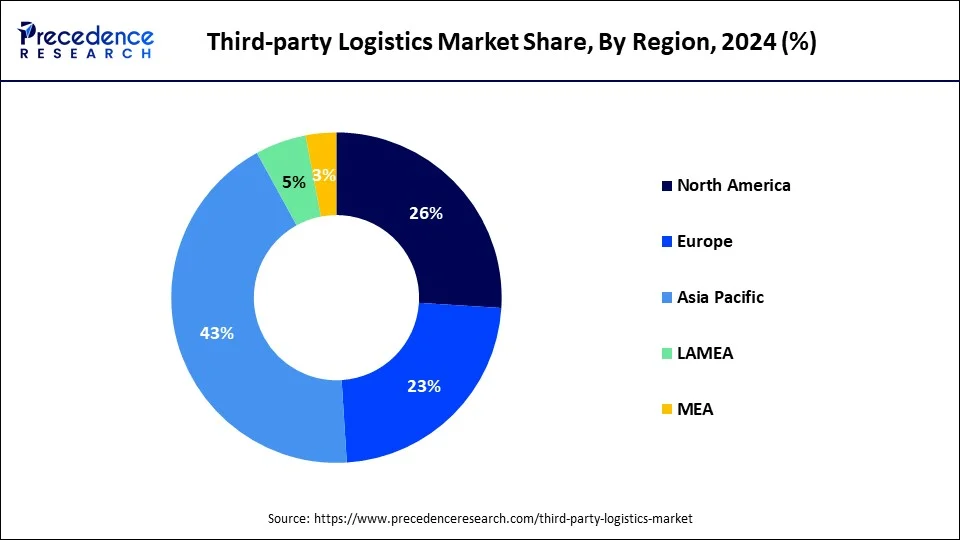

- Asia Pacific dominated the market in 2024.

- North America is anticipated to witness significant growth during the forecast period.

- By service, the domestic transportation management (DTM) segment held a large share of the market in 2024.

- By service, the international transportation management (ITM) segment is expected to grow at the fastest rate over the studied period.

- By transport, the roadways segment led the market in 2024 accounting for more than 59% market share.

- By transport, the airways segment is projected to expand rapidly in the coming years.

- By end-use, the manufacturing segment held the largest market share in 2024.

- By end-use, the automotive segment is expected to expand at the fastest growth rate during the projection period.

Market Overview: Strategic Overview of the Global Third-party Logistics Industry

Third-party logistics refers to the logistics industry where logistics companies outsource their services to third-party providers. 3PL assists businesses, particularly e-commerce businesses, in outsourcing activities related to distribution and logistics. 3PL companies offer services such as cross-docking, inventory management, product packaging, distribution, warehousing, and transportation. These services help businesses to manage and streamline their logistic operation. The market has experienced significant growth over the years and is expected to continue growing due to the rapid expansion of the e-commerce industry.

Third-party Logistics Market Growth Factors

Accelerating growth of e-commerce and retail sector along with the introduction to new technologies in logistics such as advanced driver assistance system and adaptive cruise control system are thriving the growth of third-party logistics market. The market for third-party logistics expected to seek exponential growth in the upcoming years owing to rapidly changing global supply chain structure toward more customer-centric. This also encourages most of the companies to outsource their supply chain for focusing more towards responsiveness and adaptability.

In addition, complex documentation process and customs rules and regulations have triggered more to outsource supply chain in order to focus more towards customer satisfaction and demand fulfillment. As a result, medium and small-sized companies are also leveraging third-party logistics.

Moreover, the rise of internet and e-commerce business has accelerated the growth third-party logistics. Changing customer buying behavior and expectation has greatly influence the market and brought alluring opportunities in the market area. This has significantly increased omni-channel operations coupled with rising end-user expectation in terms of cost, convenience, choice, and control also thrive the third-party logistics market growth.

Market Outlook

- Market Growth Overview: The third-party logistics market is expected to grow significantly between 2025 and 2034, driven by the rapid expansion of e-commerce, increasing outsourcing of logistics functions by businesses, and the adoption of advanced technologies for operational efficiency.

- Sustainability Trends: Sustainability trends involve green transportation solutions, energy-efficient warehousing, and sustainable packaging processes.

- Major Investors: Major investors in the market include Blackstone Group LP, Warburg Pincus, Tuscan Ventures, Brookfield, and Aditya Birla Private Equity.

- Startup Economy: The startup economy is focused on last-mile and hyperlocal delivery, warehouse automation and fulfillment, and blockchain for transparency and security.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.29 Trillion |

| Market Size in 2026 | USD 1.39 Trillion |

| Market Size by 2034 | USD 2.57 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.02% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Transport and End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Retailers increasingly focus on the implementation of Omni-Channeled distribution strategies by catering the services of 3PL providers, owing to the increased popularity of online retailing. Retailers, relying on traditional brick and mortar channels, have evolved their distribution systems to address increasing consumer demands. Using their expertise, 3PL providers assist their retail partners in promptly locating and delivering products to the consumers, irrespective of the channels.

Cloud computing has garnered significant importance in the logistics and transport business by providing access to new IT technologies and real-time data accessibilities. The remote data management service helps 3PL providers in reducing their IT and overhead costs and allows easier data management scalability. Cloud computing has the potential to solve the issues of the firms that have explored avenues to minimize costs and maximize efficiencies, owing to the light of the emergence of omnichannel distribution. Many of the 3PL providers have started adopting cloud systems due to the lack of sufficient resources for large up-front software investments. The leading cloud companies are offering the option of paying as per usage. The adoption of cloud solutions also enables simplification of the logistics processes by bonding 3PLs and carriers in a streamlined manner.

3PL providers have increasingly deployed transport management systems (TMS) over the last five years. TMS helps companies in moving freight from the origin to the destination in an efficient, reliable, and cost-effective manner.

The IT capabilities of 3PL providers have become one of the most important criteria for judgment while selecting a logistics partner. Several automotive and healthcare companies have spun off their existing internal logistics departments and turned toward 3PLs for cutting down distribution costs. Automobile manufacturers catering the services of 3PL providers have managed to reduce their operational costs, considerably. 3PL providers assist in storing, distributing, and managing the inventory levels, including other additional services such as integrating procurement, processing, warehousing, marketing, and distribution.

Drivers

Increased Focus on Core Busniess Activities

Catering the services of 3PL vendors also prevents companies taking recourse and splitting their in- house operations into several in-house sites, which may not be economical, resulting in 3PL vendors using the latest IT software and applications that enhance the distribution coverage and provide quality services to the customers. Omni-channel distribution has gained prominence over the last five years, primarily due to increased use of online marketing. 3PL providers assist their partners to promptly locate and deliver products to the consumers, irrespective of the channel, using their expertise.

Reduced cost of Shipping Through 3PL

3PL services greatly reduce the cost of shipping, especially, for companies that engage in bulk shipments on a regular basis. With the increasing freight rates, shippers are in need of opportunities to pull out costs involved in the supply chain. 3PL providers steward progression in optimizing transportation costs by prescribing effective and prompt supply chain solutions. The growth of e- commerce and entrepreneurial ventures has stoked the demand for specialized logistics and supply chain execution capabilities. Shippers benefit from contracting of 3PL services by the reduction in logistics cost, inventory cost, and fixed costs. Globalization has resulted in outsourcing of logistics functions by several companies due to their infeasibility to manage worldwide supply chain operations. Customers desire for increased services and better visibilities at same costs. Technology plays a critical role in delivering key metrics and enhancing customer experiences. 3PLs provide improved and innovative ways to optimize the effectiveness of logistics.

Restraint

Economic Downturn

Sluggish economic growths, emphasis on costs and risk containments, and inconsistent freight volumes have adversely affected the global logistics market. The recent economic tumult has critically affected the landscape of 3PL providers. Several economic factors influence the progress toward and maturity of the shipper-3PL relationships. The impact of recession on the shipper-3PL relationship has led to close scrutiny of costs along with choosing 3PL partners. Many shippers are opting for contract bids with new providers and shortening of their contract lengths to contain costs and leverage competition in the industry. Tepid economic activity has resulted in highly variable or neutral demand for outsourced logistics services. Thus, economic factors severely affect the profitability and future viability of 3PL services, negatively influencing the market growth.

Opportunity

Demand for specialized services

The demand for specialized services, such as reverse logistics and cold chain storage, is increasing among businesses. Moreover, supply chain optimization is necessary to streamline operations. Thus, businesses, especially large-scale businesses, are capitalizing on this trend and expanding their services to cater to specific needs. Additionally, the rising focus on sustainability encourages 3PL providers to develop eco-friendly logistics solutions, thereby reducing waste throughout the supply chain and enhancing customer satisfaction.

- In March 2024, EFL 3PL, a subsidiary of EFL Global, announced the launch of its warehousing facility in Bhiwandi, Mumbai, highlighting its commitment to boost its presence in India.

Segment Insights

Service Insights

The domestic transportation management (DTM) segment led the market in 2023 with the largest share. Domestic Transportation Management (DTM) held majority of market share nearly 33% in the year 2022. This is mainly attributed to the surge in cross-docking services, escalating carrier rates, and rising fuel surcharge. In addition, continuous growth in the sectors such as healthcare, retail, and steady Gross Domestic Product (GDP) growth of various countries are further escalating the growth of DTM market.

The international transportation management (ITM) segment is expected to grow at the fastest rate over the forecast period. the continuous growth in international trade expected to flourish the growth of the segment in the coming years. This is mainly influenced by the cross-border logistics activity and trade liberalization policies. Free trade agreement between several countries to promote their international trade aids to the growth of DTM market. For instance, Progressive Trans-Pacific Partnership (CPTPP) and the African Continental Free Trade Area (AfCFTA) are the recent examples of free international trade agreements.

Third-party logistics (3PL) market, by services, 2020–2022 (USD Billion)

| Service Type | 2020 | 2021 | 2022 |

| DCC/Freight forwarding | 96.38 | 104.42 | 113.47 |

| DTM | 289.19 | 311.05 | 335.55 |

| ITM | 287.21 | 309.19 | 333.83 |

| W&D | 184.60 | 197.30 | 211.61 |

| VALs | 31.62 | 34.83 | 38.47 |

End-Use Insights

The automotive segment is expected to grow at the fastest rate during the projected period. The automotive industry requires efficient logistics solutions to streamline supply chain operation. 3PL service providers help automotive businesses navigate the challenges of global trade. They play a key role in managing flow of automotive parts, thereby ensuring timely deliveries. The rapid expansion of the automotive industry is expected to boost the market.

Transport Insights

Roadways segment dominated the third-party logistics market in 2023 accounting for more 59% market share. Rising public-private partnerships coupled with increased emphasis on the logistics infrastructure are propelling the growth of the segment. In addition, the segment expected to exhibit accelerating growth owing to recent advancements in the vehicles along with supporting government regulations for roadways.

Airways segment estimated to forecast the fastest growth rate during the upcoming years. This is mainly attributed to the increasing necessity for fast and effective delivery system. These days, consumers are more focused towards services that are fast and cost-effective. However, COVID-19 outbreak in 2020 has significantly impacted the air freight business.

Third-party logistics (3PL) market, by Transport, 2020–2022 (USD Billion)

| Transport Type | 2020 | 2021 | 2022 |

| Roadway | 525.27 | 563.18 | 605.52 |

| Railway | 177.65 | 192.48 | 209.28 |

| Waterways | 139.81 | 150.83 | 163.31 |

| Airways | 46.28 | 50.31 | 54.83 |

Regional Insights

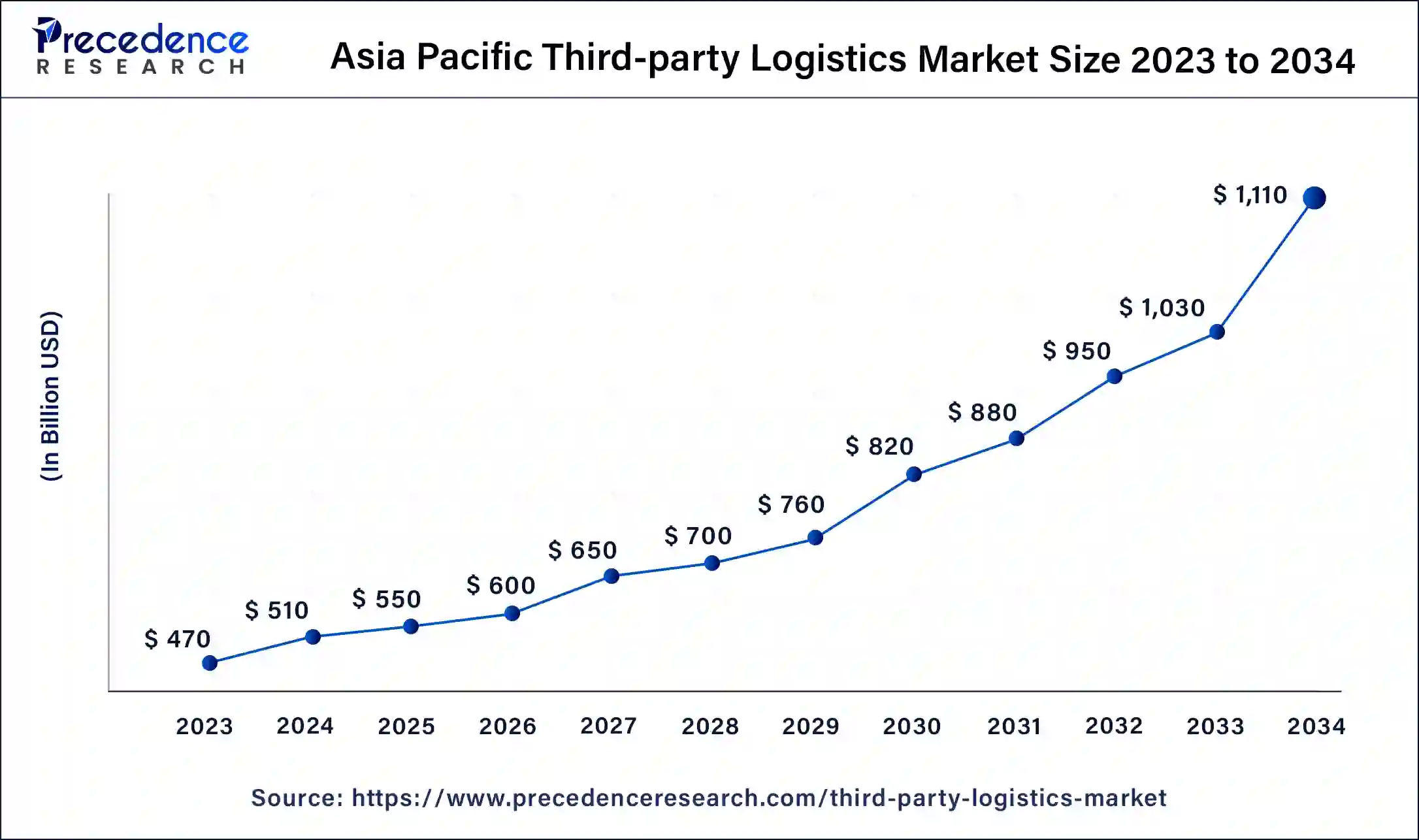

Asia Pacific Third-party Logistics Market Size and Growth 2025 to 2034

The global third-party logistics market size is valued at USD 550 billion in 2025 and is expected to be worth around USD 1,110 billion by 2034, growing at a CAGR of 9% from 2025 to 2034.

Asia Pacific dominated the market in 2024, accounting for the largest market share. The market growth in the region is attributed to the increasing trans-regional trade activities. With a rapid surge in manufacturing industries, logistics activities have been increased in the developing and underdeveloped countries. Besides this, the rising investments in developing efficient logistic solutions for supply chain management and the expansion of the e-commerce industry contributed to the regional market growth.

U.S. Third-party Logistics Market Trends

The U.S. third-party logistics market is driven by a widespread adoption of advanced automation and technological integration, including AI and robotics, to address labor shortages and boost efficiency. There is also a significant rise in demand for specialized, value-added services and a greater focus on building resilient and diversified supply chains in response to recent disruptions.

North America is anticipated to witness significant growth during the forecast period due to the increasing advancements in supply chain management solutions and the rising demand for cold storage. The presence of key players, such as XPO Logistics, Inc., C.H. Robinson Worldwide (CHRW) Inc., and UPS Supply Chain Solutions Inc, contribute to the regional market growth. Moreover, the increasing collaborations among logistic service providers to develop efficient logistic solutions drive the market in the region.

- In December 2023, Driver Logistics, a Kerala-based logistics service provider, launched its multi-client warehouse in Karnataka. It also plans to invest RS 525 crores in the coming years to expand its business.• In December 2023, Driver Logistics, a Kerala-based logistics service provider, launched its multi-client warehouse in Karnataka. It also plans to invest RS 525 crores in the coming years to expand its business.

China Third-party Logistics Market Trends

The Chinese third-party logistics market is growing due to a massive e-commerce surge and increasing industrial modernization, rapid adoption of advanced technologies, such as AI, robotics, and IoT for automation, route optimization, and enhanced supply chain transparency. There is also a significant push towards providing specialized, value-added logistic services tailored to specific industry needs, such as temperature control for pharmaceuticals.

Value Chain Analysis of the Third-party Logistics Market

- Inbound Logistics and Sourcing

This initial stage involves managing the flow of raw materials or components from suppliers to manufacturers or distribution centers.

Key Players: DHL Supply Chain and Kuehne+Nagel - Warehousing and Inventory Management

This core operational stage involves the storage of goods and managing inventory levels effectively.

Key Players: Prologis and GXO Logistics, Inc. - Value-Added Services (VALs)

This stage encompasses a variety of extra services that enhance the primary logistics function, such as kitting, custom packaging, labeling, assembly, and reverse logistics (returns management).

Key Players: XPO Logistics and UPS Supply Chain Solutions - Outbound Logistics and Transportation

This stage involves the physical movement of finished products from the warehouse or distribution center to the end customer.

Key Players: FedEx Corporation and United Parcel Service (UPS) - End-User/Customer Service

The final stage of the value chain is focused on the ultimate consumer experience and post-delivery services.

Top Companies in the Third-party Logistics Market & Their Offerings:

- Burris Logistics: Burris Logistics specializes in temperature-controlled logistics, providing warehousing, distribution, and transportation services for the food and beverage industry.

- CEVA Logistics: CEVA provides a wide range of end-to-end logistics solutions, including freight management, contract logistics, and distribution, for various sectors like automotive and e-commerce.

- C.H. Robinson Worldwide (CHRW) Inc.: CHRW is a leading global 3PL provider, known for its extensive network and expertise in freight brokerage and outsourced logistics services.

- DB Schenker Logistics: DB Schenker offers comprehensive logistics and transportation solutions globally, with a strong focus on land, air, and ocean freight. Its extensive network and multimodal services support major industries, including the automotive and industrial sectors.

- FedEx Corporation: FedEx is a global leader in transportation, e-commerce, and business services, offering comprehensive 3PL capabilities through its various divisions, including FedEx Supply Chain.

- BDP International: BDP International is a global logistics and supply chain solutions company specializing in the chemical, energy, and retail sectors. It provides complex international freight forwarding, customs clearance, and logistics services, offering expertise in handling regulated and specialized goods.

- UPS Supply Chain Solutions, Inc.: UPS Supply Chain Solutions provides a wide array of logistics services, from freight and contract logistics to repairs and reverse logistics.

- Kuehne + Nagel International AG: Kuehne + Nagel is a global transport and logistics company, known for its strong sea freight forwarding and contract logistics businesses.

- J.B. Hunt Transport Services, Inc.: J.B. Hunt is a major transportation and logistics company, primarily contributing to the 3PL market through its robust intermodal, dedicated, and truckload transportation services.

- Nippon Express Co., Ltd.: Nippon Express is a global logistics company with a strong presence in Asia, offering air freight, ocean freight, and warehousing services.

- XPO Logistics, Inc.: XPO Logistics is a leading provider of freight transportation and logistics solutions, with a strong focus on technology and automation.

Recent Developments

- In December 2023, Yusen Logistics Co. Ltd. entered into a partnership with Pickle Robot Company to introduce innovative robotics automation solutions within its warehouses, providing superior service to its customers.

- In June 2023, Honor Foods completed the acquisition of Sunny Morning Foods, a famous dairy brand based in Florida. This strategic initiative enabled Honor Foods to expand its business and improve its entire supply chain solutions.

Segments Covered in the Report

By Service

-

- Domestic Transportation Management (DTM)

- International Transportation Management (ITM)

- Dedicated Contract Carriage (DCC)/ Freight forwarding

- Value-Added Logistics Services (VALs)

- Warehousing & Distribution (W&D)

By Transport

-

- Railways

- Roadways

- Airways

- Waterways

By End-Use

-

- Retail

- Manufacturing

- Automotive

- Healthcare

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting