Reverse Logistics Market Size and Forecast 2025 to 2034

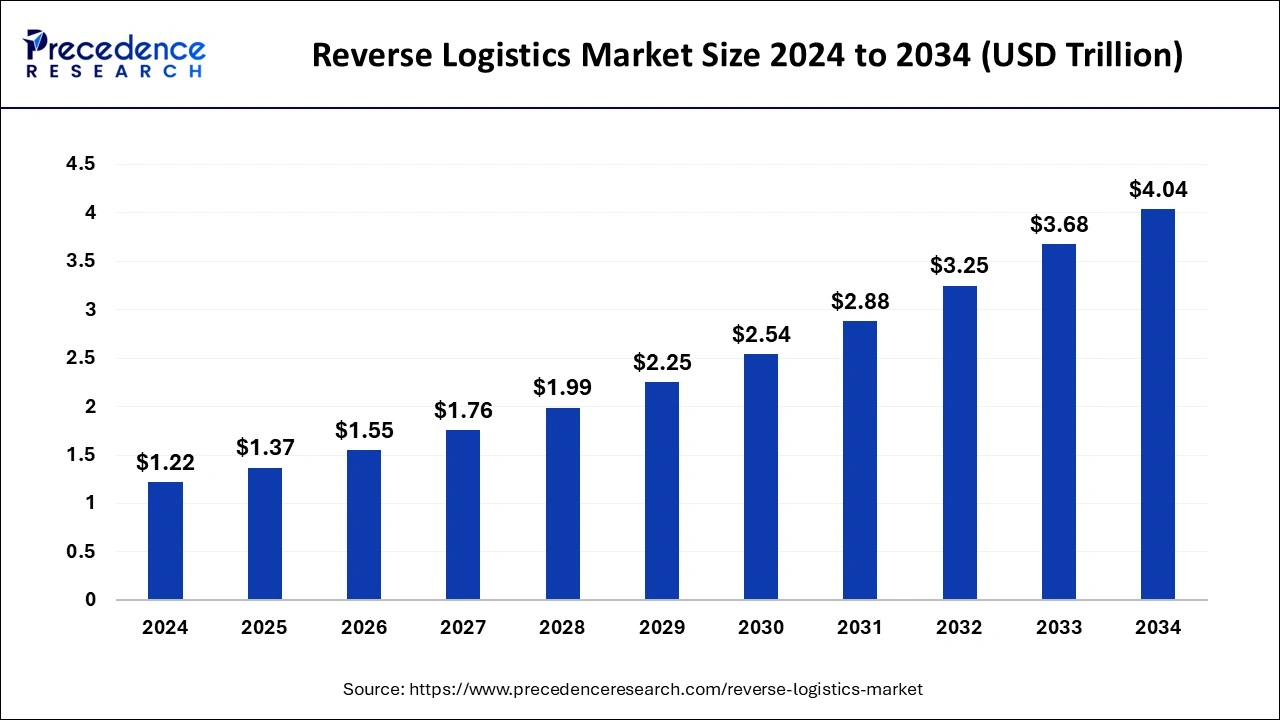

The global reverse logistics market size accounted for USD 1.22 trillion in 2024, and is expected to reach around USD 4.04 trillion by 2034, expanding at a CAGR of 12.72% from 2025 to 2034.

Reverse Logistics Market Key Takeaways

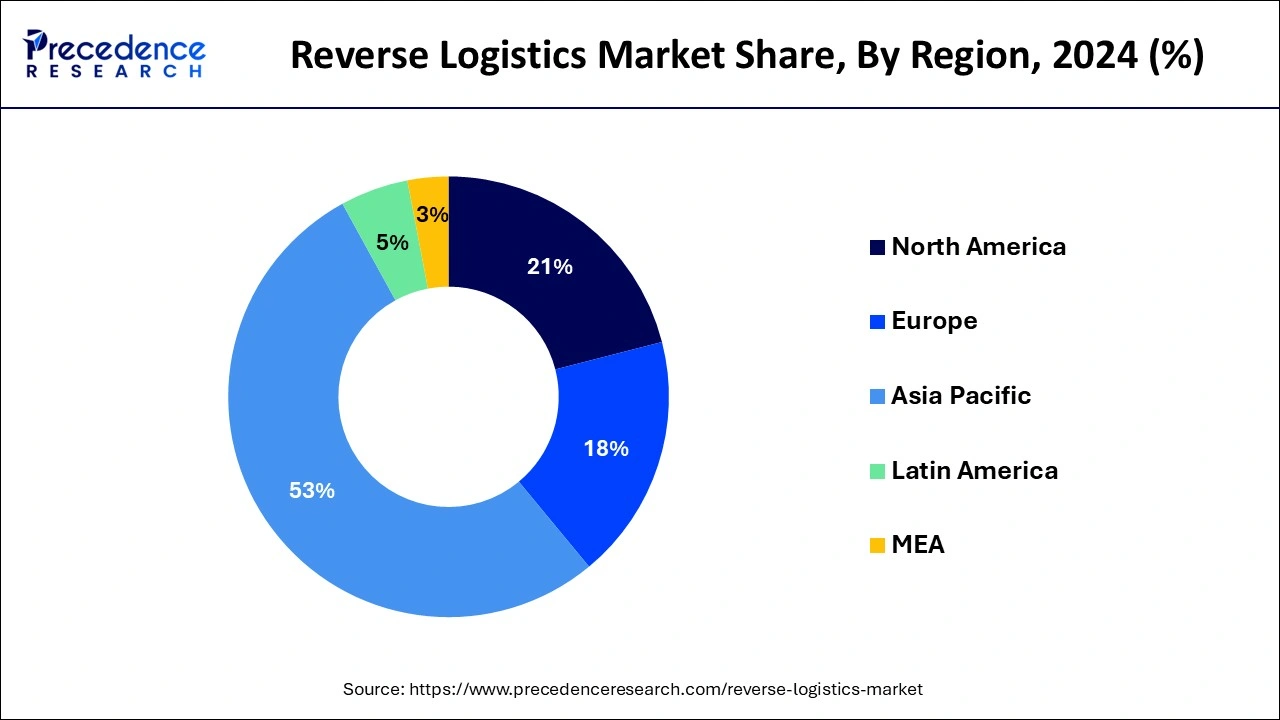

- Asia Pacific market has generated more than 53% of revenue share in 2024.

- The Middle East and Africa are expected to expand at the highest CAGR of 13% between 2025 and 2034.

- By End User, the e-commerce segment has contributed more than 56% of revenue share in 2024 and is predicted to grow at the quickest CAGR between 2025 and 2034.

- By End User, the automotive segment is anticipated to experience the second-highest CAGR of 13% between 2025 and 2034.

- By Software, the repairable returns segment is expected to expand for the fastest CAGR of 6% between 2024 and 2033.

Asia Pacific Reverse Logistics Market Size and Growth 2025 to 2034

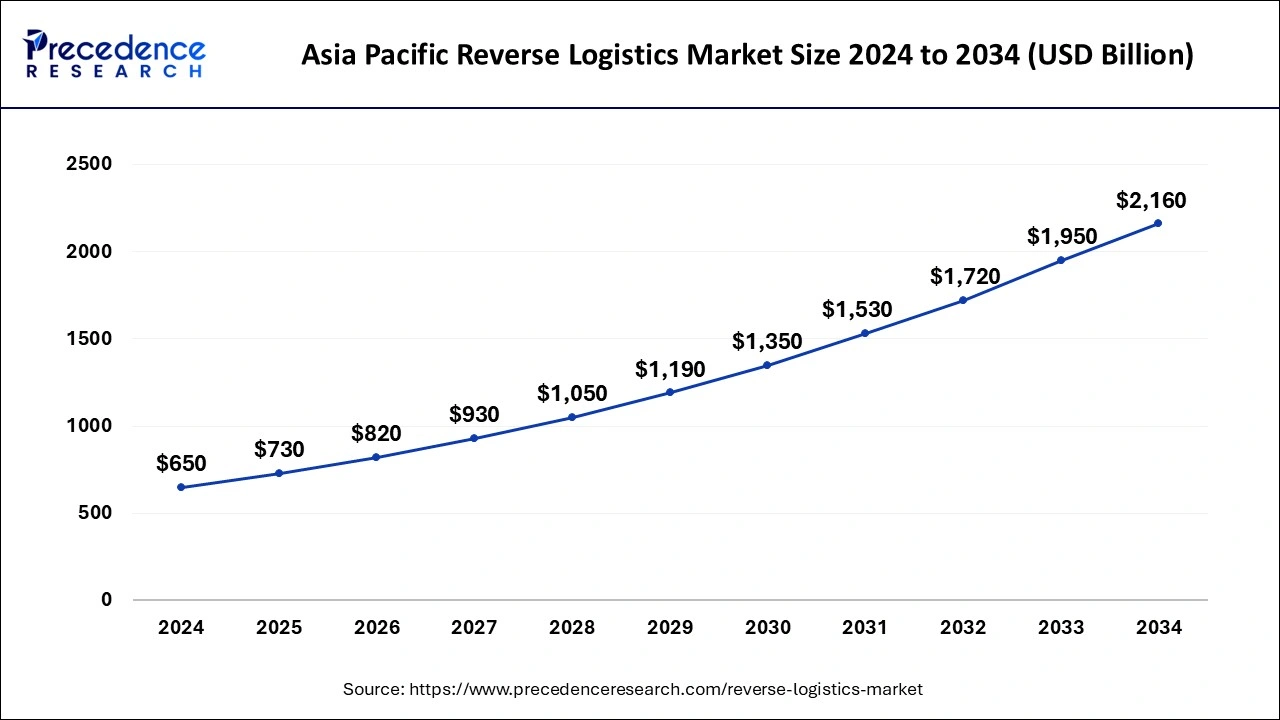

The Asia Pacific reverse logistics market size was estimated at USD 640 billion in 2024 and is predicted to be worth around USD 2160 billion by 2034, at a CAGR of 12.76% from 2025 to 2034.

Over 53% of global income was generated in Asia Pacific in 2024, and it is expected to grow at the quickest CAGR between 2025 and 2034. Growing returns from the area as a result of increased e-commerce utilization are anticipated to support market expansion. In addition, the expansion of the market is anticipated to be fueled by the expansion of manufacturing sectors in emerging nations throughout the region and the rising demand for reverse logistics for electric cars. As a result of the aforementioned reasons, Asia Pacific uses reverse logistics frequently, which increases income production.

China is the leading country when it comes to the Asia Pacific reverse logistics space, propelled by its enormous e-commerce sector, fast rate of urbanization, and broad pressures on environmental sustainability. In 2024, China continued to lead the charge of circular economy practices, with many major enterprises placing greater emphasis on returns management and waste reduction strategies. China's large manufacturing sector and complex supply chain networks also give rise to opportunities, especially within the electronics, automotive, and retail industries. These factors position China as the key player in reverse logistics within the region.

The Middle East and Africa are expected to have the second-highest CAGR, at 13% from 2025 to 2034. Growing possibilities in the area and numerous investments in the e-commerce sector are both credited with driving the market's expansion. The area is also receiving significant investment for transportation centers, which supports market expansion. The aforementioned elements make the area much simpler to enter than other marketplaces, especially when combined with an increase in discretionary income. Market participants can anticipate a broad range of opportunities from Europe and Central and South America to grow their operations and attract more customers.

The UAE is one of the foremost countries in the Middle East and Africa for reverse logistics. The UAE offers logistics infrastructures such as the Jebel Ali Port and Al Maktoum International Airport, in advancing logistics capabilities in the UAE. The logistics infrastructure led to UAE-based DP World announcing growth in 2024 despite regional and geopolitical challenges, further retaining its place in the importance of reverse logistics. The strategic partnerships with firms such as Amazon strengthen its logistics network.

- In May 2024, the Department of Commerce's Census Bureau said that the estimated U.S. retail e-commerce sales for the first quarter of 2024, excluding price adjustments and adjusted for seasonal variation, came in at $289.2 billion, up 2.1 percent (±0.7%) over the previous quarter. Estimates for total retail sales in the first quarter of 2024 were made, and they came in at $1,820.0 billion, down 0.1 percent (±0.4%)* from the same period in 2023. The projection for e-commerce in the first quarter of 2024 climbed by 8.6 percent (±1.1%) compared to the same time in 2023, while total retail sales increased by 1.5 percent (±0.5%). In the first quarter of 2024, 15.9% of total revenues came from e-commerce.

Market Overview

Reverse logistics entails transporting goods from their final location and getting returned goods or materials for appropriate disposal. Reverse logistics is generally understood to be the process of repurposing goods due to repair, damage, restocking, and surplus inventory.

Reverse logistics involves a number of activities, such as product returns, warranty repairs, and recycling, that require careful planning and coordination to ensure that products are handled efficiently and effectively. The process is complex and requires collaboration among various stakeholders, including manufacturers, retailers, logistics providers, and customers.

Reverse Logistics Market Growth Factor

Over the forecast period, the global market is anticipated to be driven by the growing usage of reverse logistics by numerous companies in order to efficiently handle the return of goods from customers to businesses or makers.

In the upcoming years, market development is expected to be fueled by rising environmental awareness as well as increasing knowledge of reverse logistics' advantages. The market suffered as a result of the COVID-19 epidemic. Due to the total disruption of supply lines worldwide caused by the COVID-19 pandemic to uphold the regulatory standards set by the government, a substantial drop has been seen.

The growth of e-commerce has led to a corresponding increase in the volume of returns, with customers expecting easy and hassle-free return policies. Reverse logistics helps manage this process, ensuring returned products are efficiently and effectively processed.

Reverse logistics is the process by which commodities or products move backward from their ultimate location, or the place of end-user or end-consumer, to the location of their beginning or production. It relates to every action that could be taken to repurpose goods or materials that have been returned. Reverse logistics involves a number of processes, including product development, remanufacturing, refurbishment (the resale of a product after repair or proof that it is in excellent shape), and disposal.

The reverse logistics market has been growing rapidly in recent years due to the increasing focus on sustainability and environmental responsibility. Companies are recognizing the importance of managing their supply chains in a more efficient and sustainable manner, and reverse logistics plays a critical role in achieving these goals.

- The global demand for time-effective distribution and return services for the transportation of products in forward and reverse logistics is driven by the expansion of the e-commerce and logistics sectors.

- Emerging countries in the Asia Pacific and South America are rapidly industrializing and developing their production sectors, which is fueling the market's expansion.

- The industry's top players continuously engage in the development of supply chain management procedures, which is fostering a favorable outlook for the market globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.37 Trillion |

| Market Size by 2034 | USD 4.04 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 12.72% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By End User, and By Software |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Growth of the E-commerce industry, reverse logistics driven by technology, and IoT devices

The worldwide transportation and e-commerce industries have grown considerably over the past few years as a result of the rise in networking solutions. Global demand for time-effective shipment and return services for product transportation in forward and backward logistics is driven by the growth of the e-commerce and logistics sectors. Reverse logistics services and solutions have been developed and adopted by the top retail, e-commerce, and third-party logistics businesses over the past few years due to the unprecedented development of online purchasing.

As a consequence, these businesses have been able to profit from this tendency. Reverse logistics services have been widely adopted across the e-commerce sector as the returns procedure has grown to be a critical component of the retail consumer experience. The primary reason propelling the development of the reverse logistics market over the projection period is the rising usage of reverse logistics services to enhance the client experience.

The development of technical trends and the adoption of cutting-edge technologies in the FMCG, pharmaceutical, and other sectors have transformed the global reverse logistics market. Reverse logistics operations are increasingly utilizing Internet of Things (IoT) solutions, which give clients and freight firms immediate Internet access to the business network. Along with other recently introduced technologies, the reverse logistics market is also witnessing the advancement of cutting-edge technologies like artificial intelligence (Al), machine learning, radio-frequency identification (RFID), and Bluetooth. Additionally, the digitalization of international supply networks lowers waste and inefficiency, encouraging the use of loT-enabled devices in reverse logistics services. Therefore, the growth of the reverse logistics market is stimulated by the rise in technological advancements.

Key Market Challenges

Process uncertainty in reverse logistics

The reliability, competence, and honesty of logistics service providers are completely dependent upon the producer and merchants. In this case, the production or retailing business has no direct control over its activities because it relies on the logistics service provider. Additionally, the manufacturer is unable to monitor warehouse activities, which presents a serious danger to the standard of the final product. Furthermore, outsourcing to a third-party reverse logistics (3PL) business would probably lead to a confidentiality violation, exposing client personal data or disseminating information that is financially delicate. Therefore, it is expected that the absence of producer control over reverse transportation services will restrain the market's expansion.

Process uncertainty is a significant challenge in reverse logistics. Reverse logistics involves the handling of used or returned products, which can be difficult to predict in terms of quantity and quality. The uncertainty associated with the quality and quantity of returned products can make it challenging for businesses to effectively plan and manage reverse logistics processes.

Key Market Opportunities

Blockchain technology's advent

Blockchain allows improved tracking and openness throughout the entire product lifetime, from the makers' acquisition of raw materials to the product's ultimate disposal. Market players in the logistics sector have begun evaluating and implementing blockchain technology to improve backward logistics operations. For instance, Walmart Canada automates the creation of bills using blockchain technology, doing away with time-consuming freight bill checks. Blockchain technology also makes it easier to monitor refunds and spot issues with high return rates. A possible chance to grow the reverse logistics industry is the creation of more sophisticated blockchain technology for use in those services.

The advent of blockchain technology presents an opportunity for the reverse logistics market to improve its operations and overcome challenges related to process uncertainty and data transparency. Blockchain technology can enable greater visibility and traceability in reverse logistics processes, providing a more accurate and transparent record of product movements and transactions. This can help reduce the risk of fraud, increase efficiency, and improve customer trust.

For instance, blockchain technology can be used to track the movement of products in reverse logistics processes, from the point of return to their final disposition, such as resale or disposal. This can provide greater visibility into the location and condition of products, and ensure that they are handled and processed in an appropriate and efficient manner. Additionally, blockchain technology can enable the creation of smart contracts, which can automate certain aspects of the reverse logistics process, such as payments, reducing the need for intermediaries and streamlining operations.

Industry Use Insights

The market was led by the e-commerce sector, which had a revenue share of over 56% in 2024 and is anticipated to grow at the quickest CAGR between 2024 and 2033. Due to users' growing propensity for online purchasing as well as its rising utilization and adoption, the e-commerce sector has seen a substantial uptick. Reverse logistics is crucial to the e-commerce sector because it supports the replacement and resale of goods as well as transit activities, all of which promote market expansion. Reverse logistics is widely used in the e-commerce sector as a result of the aforementioned reasons, which help to increase income production.

On the premise of sales, the automobile sector is anticipated to experience the second-highest CAGR of 13% from 2025 to 2034. Due to various goals, such as governmental policies regarding ecological and environmental worries, reverse logistics holds a significant position in the car industry and thus contributes to market development. Therefore, over the course of the forecast term, the automotive sector is anticipated to expand profitably.

Reverse Type Insights

During the projection period, the sector of repairable returns is anticipated to account for the largest market share while expanding at a GAGR of 6%. The growth of companies' worldwide market boundaries has been aided by the rise in domestic and international interconnectivity. Similar to land, sea, and air transit systems, connectivity solutions offer distribution and return services that are quick and flexible. The widespread use of digital devices in people's daily lives around the globe is driving the demand for quick repair and overhaul services for goods shipped with flaws, damage, or other problems. Recently, the government implemented new rules regarding cars with defects that must be fixed or replaced, and consumers have the right to ask for a reimbursement or price decrease. Reverse logistics is being driven by consumer-friendly government policies that hold producers accountable for faulty goods and give customers the right to a substitute.

The section dealing with recalls will have the second-largest percentage. A possibly dangerous product is returned to the manufacturer using the recall process, a form of return. Manufacturers have adopted recall policies as a result of increased government laws and guidelines that forbid the selling of defective goods to customers. Reverse logistics services give producers the ability to fix product flaws and defects and stop accidents brought on by defective products, which promotes the expansion of this market sector. The market's growth is also aided by the extension of governmental programs. In order to lessen the damaging effects of the defective product on the brand's image, the makers are also putting forth a recall strategy. These refunds help the business avoid end-user or client harm.

Reverse Logistics Market Companies

- DB SCHENKER (Deutsche Bahn AG)

- Deutsche Post AG

- FedEx Corporation

- Kintetsu World Express, Inc.

- United Parcel Service, Inc.

- Yusen Logistics Co., Ltd.

- RLG Systems AG

- Core Logistic Private Limited

- Safexpress Pvt. Ltd.

Recent Developments

- In January 2025, DHL Supply Chain acquired reverse logistics leader, Inmar Supply Chain Solutions. With the acquisition, DHL Supply Chain expands its reverse logistics solutions, becoming the largest provider of returns processing in North America.

- In June 2024, On-demand junk removal company LoadUp launched a division dedicated to helping eCommerce furniture retailers generate additional revenue from each customer interaction, including in traditional areas of loss in return logistics. Greg Workmon, CEO of LoadUp, stated in the release, “With rising costs in the furniture supply chain, retailers are rethinking their reverse logistics strategy.”

- In August 2024, LSPedia, a SaaS solution leader in global product traceability, announced a strategic partnership with Pharma Logistics, the industry leader in pharmaceutical reverse distribution. This collaboration aims to transform the pharmaceutical supply chain by offering turnkey compliance, unprecedented data visibility, and robust supply chain efficiency.

- In June 2023, UPS launched an innovative reverse logistics solution targeting the healthcare industry. The new service aims to efficiently handle medical equipment returns and refurbishments by leveraging UPS's existing logistics network.

Segments Covered in the Report

By End User

- E-commerce

- Retail

- Automotive

- Consumer Electronics

- Pharmaceutical

By Software

- Recalls

- Commercial Returns

- Repairable Returns

- End-of-use Returns

- End-of-life Returns

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting