Artificial Intelligence Engineering Market Size and Forecast 2025 to 2034

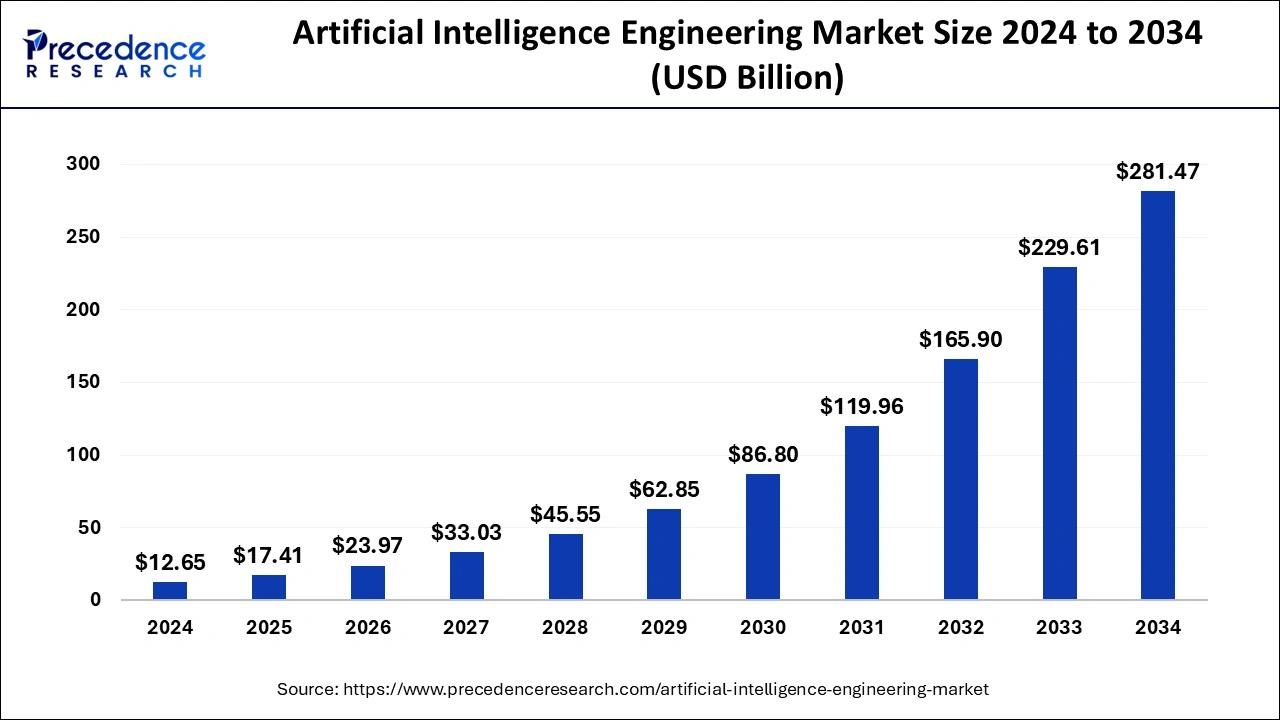

The global artificial intelligence engineering market size was estimated at USD 12.65 billion in 2024 and is predicted to increase from USD 17.41 billion in 2025 to approximately USD 281.47 billion by 2034, expanding at a CAGR of 36.37% from 2025 to 2034.

Artificial Intelligence Engineering MarketKey Takeaways

- In terms of revenue, the global artificial intelligence engineering market was valued at USD 12.65 billion in 2024.

- It is projected to reach USD 281.47 billion by 2034.

- The market is expected to grow at a CAGR of 36.37% from 2025 to 2034.

- North America held the largest share of the market in 2024.

- Asia Pacific is forecasted to be the fastest-growing regional market.

- By solution, the services segment held the largest market share of the artificial intelligence engineering market.

- By solution, the software segment is expected to witness significant growth over the forecast period.

- By technology, the machine learning segment dominated the market in 2024.

- By technology, the deep learning segment is expected to witness significant growth over the forecast period.

- By deployment mode, the cloud segment is expected to dominate the market over the forecasted period.

- By deployment, the on-premise segment is expected to witness significant growth during the forecast period.

- By vertical, the IT & telecom segment held the largest share of the market in 2024.

- By vertical, the automotive and transportation segment is expected to witness significant growth during the forecast period.

Market Overview

The artificial intelligence engineering market refers to the sector focused on the development, implementation, and utilization of artificial intelligence (AI) technologies within various industries and applications. This market encompasses a wide range of activities, including the design, creation, and deployment of AI algorithms, models, and systems tailored to specific business needs and objectives. In the artificial intelligence engineering market, professionals leverage machine learning, natural language processing, computer vision, robotics, and other AI techniques to build intelligent systems capable of performing tasks traditionally requiring human intelligence.

These systems can automate processes, analyze vast amounts of data, make predictions, and interact with users in human-like ways. The artificial intelligence engineering market is experiencing robust growth driven by several key factors. These include increasing demand for AI-powered solutions across industries, technological advancements in AI technologies like machine learning and natural language processing, the proliferation of big data, and the rise of cloud computing. Additionally, increased investment in the AI sector and the availability of scalable AI platforms have further fueled market growth. Overall, these factors are empowering organizations to enhance operational efficiency, extract valuable insights from data, and drive innovation across various sectors.

Artificial Intelligence Engineering Market Data and Statistics

- In February 2022, the International Federation of Robotics, a Germany-based non-profit organization, reported that UK factories would have 23,000 industrial robots operating in 2021, marking a 6% increase from the previous year. Moreover, new robot sales surged by 8% to reach 2,205 units in 2020.

- In 2021, according to Eurostat, a Luxembourg-based statistical office of the European Union, In December 2021, a survey conducted by O'Reilly Media Inc., a US-based learning company, revealed that out of 2,834 global respondents, 90% stated that their organizations currently utilize cloud-based applications. Moreover, looking ahead, 48% of the respondents plan to migrate over half of their applications to the cloud within the next year, with 20% aiming for a complete migration to cloud-based solutions. This elevated use of cloud-based applications is a significant driver propelling the growth of the artificial intelligence (AI) engineering market.

Artificial Intelligence Engineering Market Growth Factors

- The increasing recognition of the value of artificial intelligence engineering in improving the quality and quantity of sales leads. As businesses aim to enhance their lead generation processes, the demand for sophisticated artificial intelligence engineering solutions has surged.

- Another significant factor contributing to market growth is the rising number of small and medium-sized enterprises (SMEs) globally. SMEs are increasingly realizing the importance of artificial intelligence engineering in gaining a competitive edge, understanding customer behaviors, and making informed business decisions. The accessibility and affordability of artificial intelligence engineering solutions have made them more appealing to a broader range of businesses, fostering market expansion.

- The market is benefiting from the growing emphasis on business transformation and customer engagement efforts. Companies, especially in the BFSI, FinTech, and B2B tech sectors, are turning to artificial intelligence engineering to streamline lead management, mitigate risks, and drive business expansion. As organizations prioritize digital transformation, the demand for advanced artificial intelligence engineering tools and platforms continues to grow, propelling the market forward.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 36.37% |

| Market Size in 2025 | USD 17.41 Billion |

| Market Size by 2034 | USD 281.47 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution, By Technology, By Deployment Mode, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rapid adoption of automation

The rapid adoption of automation is anticipated to be a key driver in propelling the growth of the artificial intelligence (AI) engineering market in the foreseeable future. Automation, in this context, refers to the utilization of technology to design, manufacture, and distribute goods and services with minimal human intervention. In the AI engineering sector, automation plays a crucial role in accelerating development processes, enhancing productivity, and streamlining procedures. One of the primary ways automation contributes to the growth of the AI engineering market is by expediting the development and deployment of AI systems.

Automation tools and platforms enable engineers and developers to automate repetitive tasks such as data preprocessing, model training, and deployment, thereby reducing the time and effort required for AI development projects. This accelerated development process allows organizations to bring AI-powered solutions to market more quickly, gaining a competitive edge in their respective industries.

Moreover, automation enhances productivity by enabling AI systems to handle complex tasks and workflows autonomously. With the integration of automation technologies, AI systems can analyze vast amounts of data, identify patterns, and make informed decisions without human intervention. This capability not only increases operational efficiency but also enables organizations to leverage AI-driven insights to optimize processes, improve decision-making, and drive innovation across various sectors.

Furthermore, automation streamlines procedures by minimizing manual errors and optimizing resource utilization. By automating routine tasks and workflows, organizations can reduce human error rates, ensure consistency in processes, and allocate human resources to more strategic and value-added activities. This streamlined approach to AI engineering enhances operational efficiency, reduces costs, and accelerates time-to-market for AI-powered products and services. therefore, the broad adoption of automation in the AI engineering sector signifies a shift towards more efficient, scalable, and intelligent systems. By leveraging automation technologies, organizations can harness the full potential of artificial intelligence to drive digital transformation, innovation, and sustainable growth in today's dynamic business landscape.

Restraint

Limited skilled AI professionals

The scarcity of AI professionals poses a significant restraint to the continued expansion of the artificial intelligence (AI) market. As businesses across various industries increasingly integrate AI technologies into their operations, there is a growing demand for skilled professionals capable of developing, implementing, and maintaining these advanced systems. However, the supply of qualified AI talent is not keeping pace with the rising demand, leading to a shortage of skilled professionals in the field.

This shortage not only hampers the growth potential of AI-driven industries but also presents obstacles for small and medium-sized enterprises (SMEs) seeking to leverage AI technologies. SMEs, often lacking the resources and expertise to navigate the complexities of AI implementation, may struggle to adapt to the rapid changes and innovations in AI systems. Additionally, the limited availability of AI professionals and the challenges faced by SMEs in adopting AI solutions collectively hinder the broader expansion of the global AI market in the foreseeable future. Addressing this talent shortage and providing support for SMEs to embrace AI technologies will be crucial for sustaining and accelerating the growth of the AI industry worldwide.

Opportunity

Rapid advancements in specialized AI chips

Future opportunities in artificial intelligence engineering are driven by rapid advancements in specialized AI chips, which enable efficient processing of large volumes of real-time data and deliver accurate results. Enterprises are increasingly exploring innovative and cost-effective hardware solutions that can enhance the performance of AI algorithms, enabling them to tackle complex business problems more effectively. AI accelerators, specifically designed for efficient processing of AI workloads like neural networks, play a crucial role in this landscape. These high-performance parallel computation machines significantly reduce the time required to train and execute AI models, and they can handle specialized AI-based tasks that traditional Central Processing Units (CPUs) cannot. Additionally, the increase in private investment for research and development (R&D) of AI, driven by the growing demand for AI solutions in business operations and decision-making, is expected to further contribute to the growth of market revenue. This trend underscores the immense potential for continued innovation and advancement in theof artificial intelligence engineering.

Solution Insights

The services segment held the largest market share, driven by several factors including the ease of doing business and the increasing demand for intelligent AI solutions in decision-making and automating manual tasks. AI engineering plays a crucial role in modifying existing algorithms or creating hybrid algorithms to address specific problems, which further boosts its demand and supports the growth of the services segment in the market. As businesses seek to optimize their operations and gain insights from data, the demand for AI engineering services is expected to continue growing, driving further expansion of the services segment in the AI market.

The software segment is anticipated to make a substantial growth in the AI engineering market share throughout the forecast period, driven by the increasing adoption of artificial intelligence across various industries necessitates advanced software solutions to develop, deploy, and manage AI-driven applications and systems. Moreover, the evolution of AI algorithms and frameworks requires sophisticated software tools for training, testing, and optimizing models. Additionally, as organizations prioritize digital transformation initiatives, there is a growing demand for AI software platforms that offer scalability, flexibility, and interoperability.

Furthermore, advancements in machine learning algorithms and natural language processing techniques are driving the need for specialized software solutions tailored to specific AI engineering tasks. Collectively, these factors are expected to propel the growth of the software sector within the AI engineering market, consolidating its significant contribution to overall market share in the foreseeable future.

Technology Insights

The machine learning segment has emerged as the dominating segment in terms of market share within the AI engineering landscape. This growth can be attributed to several key factors driving the adoption of machine learning (ML) algorithms across industries. Firstly, the increasing demand for big data analysis has spurred significant advancements in ML algorithms, especially in the domain of unsupervised learning. This approach allows AI algorithms to discern patterns within datasets without the need for predefined labels or classifications, making it particularly valuable for product-based companies in developing robust recommendation systems.

Moreover, supervised learning, another key aspect of machine learning, trains models using historical datasets to make accurate predictions and forecasts. This supervised learning technique finds extensive application in diverse domains such as sales forecasting, supply chain optimization, and customer retention strategies. The widespread adoption of both supervised and unsupervised learning methodologies underscores the dominance of the machine learning segment in the AI engineering market, signifying its pivotal role in driving innovation and business outcomes through data-driven insights.

On the other hand, deep learning is anticipated to experience significant growth within the AI engineering market as the deep learning algorithms have demonstrated remarkable capabilities in processing vast amounts of complex data across various domains, including image and speech recognition, natural language processing, and autonomous systems. The increasing availability of large datasets and the advancement of computational resources have further facilitated the training and deployment of deep learning models, enabling organizations to extract valuable insights and drive innovation in their respective fields.

Moreover, deep learning techniques, such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), have shown superior performance in handling unstructured data and extracting high-level features, making them invaluable tools for tasks like image classification, language translation, and predictive analytics. As industries increasingly seek to leverage AI-driven solutions to enhance decision-making processes, optimize operations, and improve customer experiences, the demand for deep learning technologies is poised to grow exponentially.

Deployment Mode Insights

The cloud segment secured the largest market share in the artificial intelligence engineering market. This dominance is primarily due to the advantages offered by cloud solutions, such as eliminating firewall restrictions that could impede users' access in on-premise solutions. Cloud-based software as a service (SaaS) solutions also eliminate maintenance and overhead costs, providing a cost-effective and scalable alternative. Cloud object storage services contribute to virtually unlimited storage capacity, overcoming scalability and storage volume limitations associated with locally placed hardware.

The on-premise segment is projected to experience a significant CAGR over the forecast period. This growth is attributed to the security and privacy benefits provided by on-premise solutions in the field of artificial intelligence engineering. Additionally, on-premise solutions leverage edge analytics, which reduces bandwidth requirements. Integrating these solutions with on-premise deployment ensures higher speed and increased reliability in delivering results. The on-premise deployment model appeals to organizations seeking enhanced control over their data and security measures.

Vertical Insights

The IT & telecom segment held the largest share of the artificial intelligence engineering market, the growth is attributed to the profound impact of the pandemic, which accelerated the digital transformation initiatives of businesses worldwide. With the imperative to adapt to remote work environments and ensure seamless connectivity, organizations across the IT and telecommunications sector swiftly migrated their operations to cloud-based platforms. This transition enabled them to facilitate remote collaboration, enhance scalability, and improve operational efficiency.

Hence, the transformative impact of the pandemic, coupled with the growing demand for cloud-based solutions and advanced technologies, has propelled the IT & telecommunications segment to the forefront of the market. As businesses continue to embrace digitalization and prioritize agile, scalable IT infrastructure, the segment is expected to sustain its growth trajectory and drive innovation across the AI engineering landscape.

The automotive and transportation segment will witness significant growth within the AI engineering market. The growth is driven by the development and deployment of autonomous vehicles representing a pivotal area of innovation, where AI technologies enable self-driving vehicles to perceive their environment and make real-time decisions. Additionally, the proliferation of connected vehicle technologies enhances safety and traffic optimization through AI-driven solutions.

Moreover, the integration of AI-powered advanced driver assistance systems (ADAS) is becoming increasingly prevalent in modern vehicles, enhancing driver safety and reducing accidents. Furthermore, AI-driven predictive maintenance solutions are revolutionizing vehicle maintenance practices, reducing downtime and optimizing fleet operations. The rise of smart mobility solutions and personalized driving experiences further underscores the transformative potential of the industry. As the sector continues to embrace digitalization and innovation, AI engineering solutions will play a pivotal role in shaping the future of mobility and transportation.

Regional Insights

North America emerged as the dominant region in the artificial intelligence engineering market. The gradual transition of leading companies and brands in North America towards digitalization is fostering the automation of business operations and related activities. Consequently, this surge in digital transformation is driving a heightened demand for products engineered using artificial intelligence (AI). The presence of international technology giants such as Google and Amazon, coupled with the emergence of new AI software startups like Cruise Automation, Palantir Technologies, and Tempus Labs in the US, is further fueling the demand for AI engineering solutions in North America.

According to the US Bureau of Labor Statistics, the demand for AI jobs and experts is projected to surge by over 30% by the end of 2030. Therefore, it is anticipated that the North American AI engineering market will experience substantial expansion over the forecast period.

Asia-Pacific is expected to experience the most rapid growth over the forecast period, driven by the increasing adoption of AI technology in countries like China, Japan, and India. The region benefits from its large population, extensive use of mobile and internet technologies, and a thriving manufacturing sector. As these countries embrace AI solutions across various industries, including manufacturing, healthcare, finance, and retail, the demand for AI engineering services and products is expected to soar in the Asia-Pacific region. This trend underscores the region's potential to emerge as a key hub for AI innovation and development in the coming years.

Artificial Intelligence Engineering Market Companies

- Google LLC (United States)

- IBM Corporation (United States)

- Amazon Web Services, Inc. (United States)

- Cisco Systems Inc. (United States)

- Nvidia Corporation (United States)

- Microsoft Corporation (United States)

- Siemens AG (Germany)

- Oracle Corporation (United States)

- SAP SE (Germany)

- Alibaba Cloud (China)

Recent Developments

- In June 2023, Accenture bolstered its engineering capabilities by acquiring Nextira, an AWS Premier Partner. Nextira's expertise in delivering cloud solutions and predictive analytics, powered by AWS, complements Accenture Cloud First's offerings, enabling clients to access a broader range of cloud tools and capabilities.

- In April 2023, Deloitte introduced a new practice focused on Generative AI and Foundation Models to help clients harness AI for increased productivity and innovation. Leveraging top-quality services and industry expertise, Deloitte aims to assist enterprise leaders in developing effective strategies and applications powered by Generative AI.

- In March 2023, Amazon and IIT Bombay launched the Amazon IIT-Bombay AI-ML Initiative. This initiative, hosted by the IIT Bombay Department of Computer Science and Engineering, aims to advance research and scholarship in AI and ML, with a focus on speech, language, and multimodal AI domains. Through financial support and community events, the initiative seeks to drive innovation in these fields.

Segments Covered in the Report

By Solution

- Hardware

- Software

- Services

By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Computer Vision

By Deployment Mode

- Cloud

- On-Premises

By Vertical

- Healthcare

- Automotive and Transportation

- Agriculture

- Information Technology (IT) & telecom

- Business Management

- Other End-Users

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting