Contactless Payment Market Size and Forecast 2025 to 2034

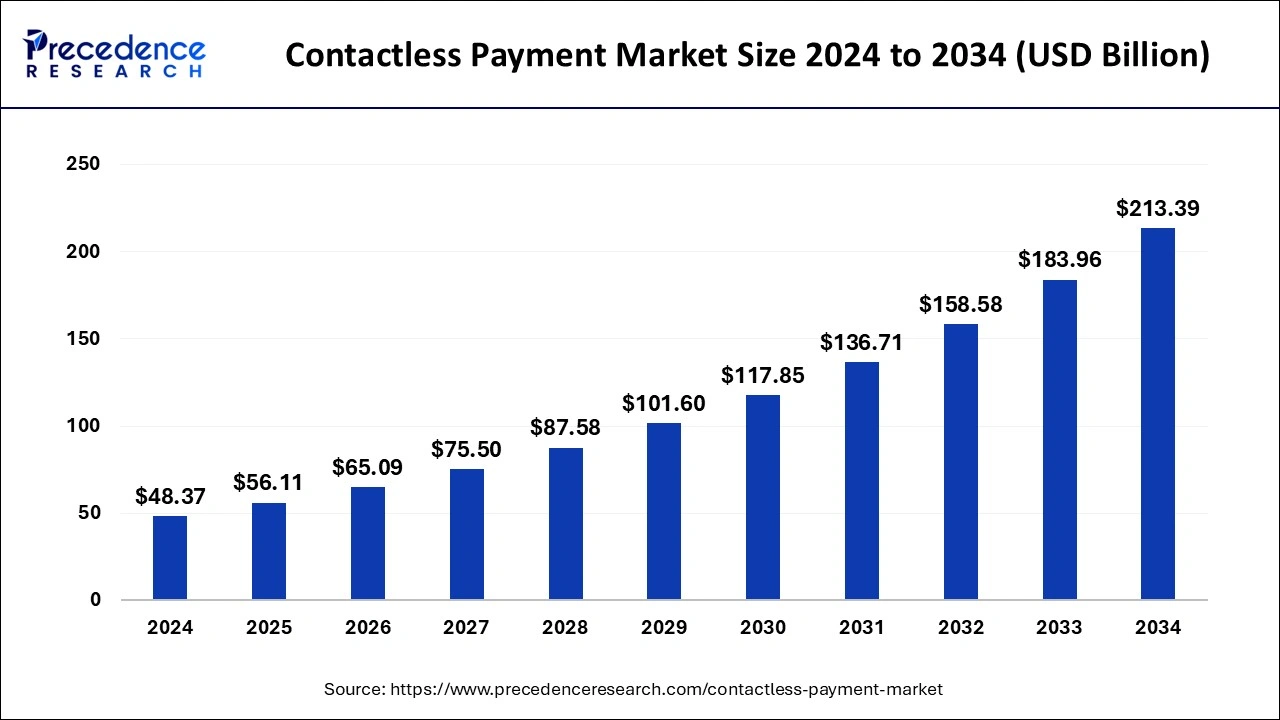

The global contactless payment market size was USD 48.37 billion in 2024, calculated at USD 56.11 billion in 2025 and is expected to reach around USD 213.39 billion by 2034, expanding at a CAGR of 16% from 2024 to 2034. The increasing adoption of mobile wallets featuring contactless payment, increasing awareness regarding the benefits of contactless payment, supportive government initiatives to promote digital payment, rising consumer preference for contactless payment as an alternative to cash, wide accessibility to high-speed internet, and rising penetration of smartphones are expected to drive the growth of the contactless payment market during the forecast period.

Contactless Payment Market Key Takeaways

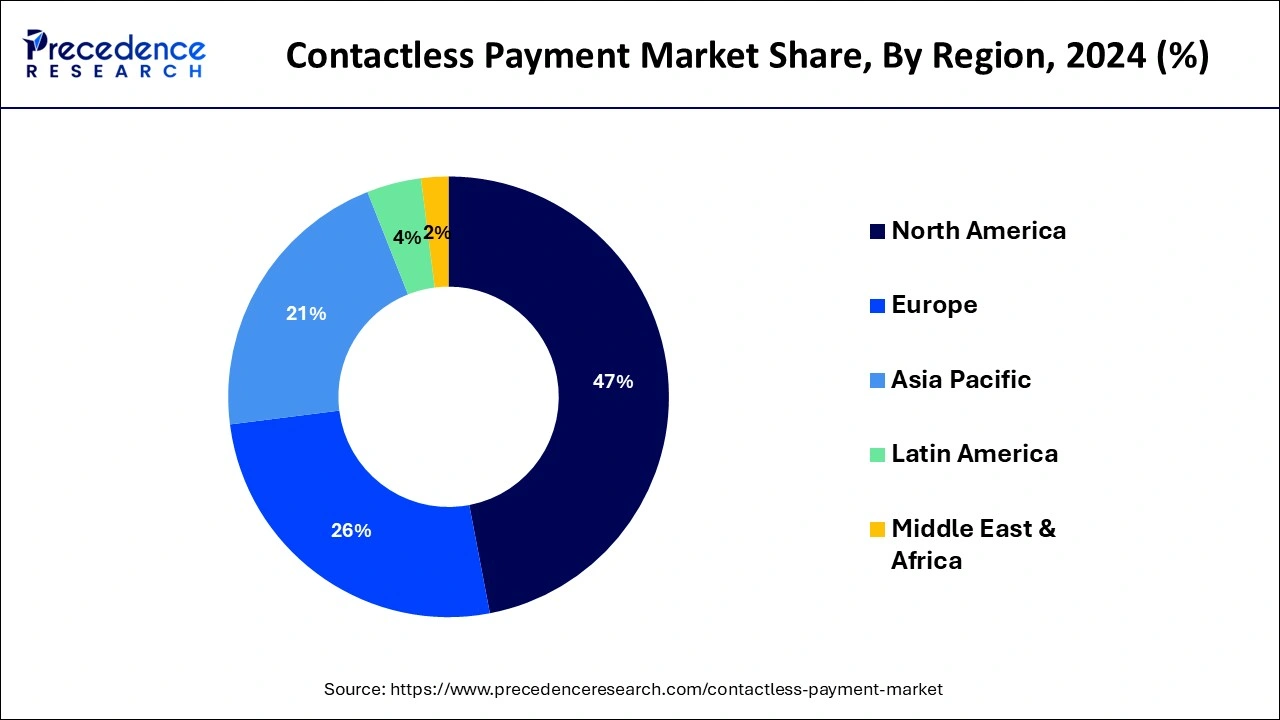

- North America led the global market with the highest market share in 2024.

- By solution, the payment terminal solution segment contributed more than 40% of revenue share in 2024.

- By application, the retail segment recorded more than 60% of revenue share in 2024.

- By device, the smartphones & wearables segment generated over 60% of revenue share in 2024.

How Does artificial intelligence (AI) Impact the Growth of the Contactless Payment Market?

In the rapidly evolving landscape of digital transactions, artificial intelligence (AI) emerges as a game-changer in transforming the contactless payment market. AI is redefining digital payment procedures by offering benefits such as enhanced productivity and efficiency, streamlined workflows, improved customer service, and advanced monitoring and issue detection. In contactless payment, AI integration plays an integral role in personalizing user experiences, enhancing security, and optimizing transaction processes. The most commonly used AI technologies in contactless payments include machine learning, natural language processing (NLP), computer vision, deep learning, data analytics, and generative AI. The major key applications of AI in contactless payment include fraud detection, risk assessment and credit scoring, personalized financial services, process automation, predictive analytics, algorithmic trading, cross-border payments, and others. AI technologies can analyze transaction patterns in real time, enhancing fraud detection by improving transaction transparency and increasing safety for both businesses and consumers. In addition, AI automates various processes within payment systems, such as transaction processing and customer service inquiry, thereby enhancing consumer satisfaction.

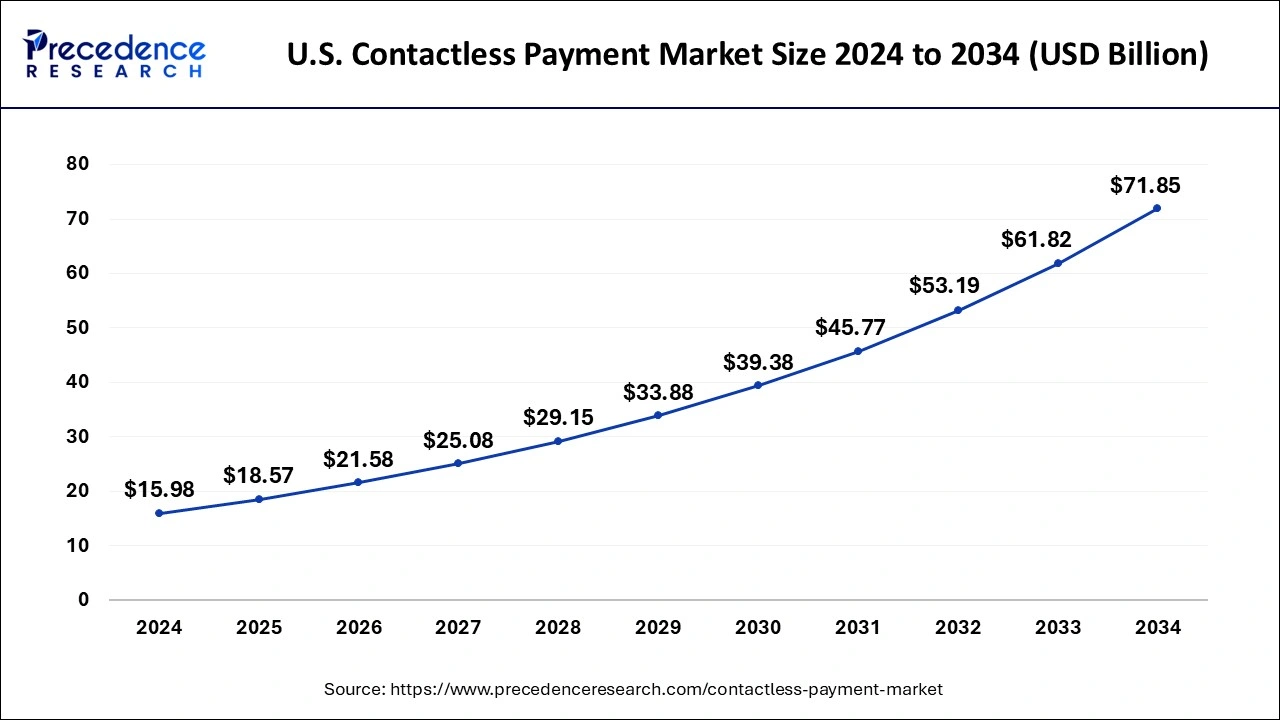

U.S. Contactless Payment Market Size and Growth 2025 to 2034

The U.S. contactless payment market size was estimated at USD 15.98 billion in 2024 and is predicted to be worth around USD 71.85 billion by 2034, at a CAGR of 16.22% from 2025 to 2034.

North America held the largest share of 47% in the contactless payment market in 2024. Contactless payment solutions offer minimal physical interactions which make them ideal for quick stops such as food and beverage stations or supermarkets. The rate of consumers for the same create a significant factor for the market to expand at a notable rate in the upcoming years. Additionally, the COVID-19 pandemic boosted the importance for safety and hygiene. Contactless payments eliminate physical contact at stores, this brings an appealing growth factor for post-pandemic world. On the other hand, the overall popularity of tap-to-pay cards and transactions in North America countries create another supplementary factor for the market to expand.

Contactless Payment MarketGrowth Factors

- The rising digitization in the banking sector is a major factor driving the market's growth.

- With the growing penetration of smartphones, there is a rapid shift toward contactless payment options, which boosts the growth of the market.

- The rising awareness about the benefits of contactless payment influences the market. Contactless payment offers a hassle-free, quick way to complete transactions without the need for credit or debit cards and cash. Contactless payment methods such as digital wallets, contactless cards, QR codes, and tap-to-pay ensure secure transactions while simplifying the payment process. This convenience attracts large numbers of consumers.

- The increasing advancements in contactless payment enhance security and make payments more user-friendly, supporting market growth.

- Escalation in the rate of modernization in digital payment and the increasing demand for higher accessibility and stress-free payment procedures further fuel market growth.

- The benefits offered by contactless payments, such as quicker checkouts and a unified experience, are favored and are anticipated to fuel the market's growth.

- Favorable government initiatives to promote contactless payment boost the market growth.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 48.37 Billion |

| Market Size by 2034 | USD 213.39 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 16% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Application, Device, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

Driver

Rapid Shift Toward Contactless Payments

With the rising digitization in the banking sector, there is a rapid shift toward contactless payments, which is expected to boost the growth of the market during the forecast period. The acceptance of contactless payment among retailers and customers is accelerating due to several factors, such as speed and convenience, seamless integration, attractive rewards and incentives, adoption of NFC cards, improved customer experience, and safety concerns. Contactless payments offer a secure, quick, and best alternative to cash and card transactions. It allows consumers to make transactions by tapping or waving their contactless-enabled cards, wearable devices, and smartphones near a payment terminal. Additionally, technologies like near-field communication (NFC) and radio-frequency identification (RFID) are increasing the safety and reliability of digital payments, supporting the growth of the market.

Restraint

Transaction Limits

The limitations to the number of transactions per day are anticipated to hamper the growth of the market. A limited number of transactions leads to the low acceptance of contactless payment among merchants and businesses. In addition, the lack of awareness of contactless payment methods and a lack of infrastructure in low-income countries are anticipated to restrain market growth. Concerns about security, data theft, and cyberattacks further limit the growth of the global contactless payment market to a certain extent.

Opportunity

Government Initiatives

Several governments around the world are encouraging the adoption of contactless payments through various policies and initiatives. For instance, the introduction of the Unified Payments Interface (UPI) and initiatives like ‘Digital India' have been pivotal in boosting the adoption of cashless payment. Various renowned banks are also making efforts to support contactless payments. The Reserve Bank of India (RBI) plays a crucial role in boosting the adoption of contactless payment across India. By increasing the per-transaction limit for contactless card payments, the RBI incentivized businesses to adopt this convenient and secure mode of payment. Moreover, the rising focus on enhancing the security of contactless payment propels the growth of the market in the coming years.

Solution Insights

In 2024, in terms of transaction value, the payment terminal solution gathered more than 40% of the total contactless payments market share. Furthermore, clients are mostly worried about safe keeping surrounding contactless payments due to frequent concern of fraud. Businesses are taking efforts to meet such concerns by offering secure payment systems that are authenticated via passcodes. The modern technological progressions have led to the innovation of novel ways of authentication including fingerprint validation for contactless payments. Further, security and fraud management market segment is anticipated to grow at a CAGR of over 20% during years to come.

Application Insights

Among different application sectors assessed in this report, in 2024, retail application segment dominated the global contactless payment market and garnered more than 60% of the market share. This growth is credited to upsurge in the number of ‘tap-and-go' transactions across the world. The tap-and-go feature prompts the check-out process and thereby making contactless payments preferable choice customers in established and evolving nations.

Moreover, contactless payments also employed in service businesses such as gas stations, movie theaters, convenience stores, and restaurants, thus heightening the payments in the retail segment.

Device Insights

Among several devices, the smartphones & wearables market segment occupied about 60% share of the total market in 2024 in terms of the transaction value. Since last few years, usage of smartphones has extremely increased in day-to-day activities. For occurrence, persons now preferably utilize smartphones to make payments at stores.

Furthermore, revolutions in wearables like payment rings and bands are projected to stimulate the market demand over the estimate period. Additionally, smart cards are anticipated to gain noteworthy share in the global market due to its easier practice than PIN-based Euro Mastercard Visa cards.

Contactless Payment Market Companies

- Verifone

- Ingenico Group SA

- Gemalto

- Visa Inc.

- Giesecke & Devrient GmbH

- Heartland Payment Systems, Inc.

- Thales Group

- Wirecard AG

- On Track Innovations Ltd.

- IDEMIA

Recent Developments:

- In August 2024, Mastercard collaborated with boAt, India's leading wearables brand, to enable contactless payments on boAt's payment-enabled smartwatches. This collaboration enables Mastercard cardholders to make convenient and secure transactions using the boat's wearable devices by offering key features such as Tap-and-Pay functionality and enhanced security.

- In September 2024, NMI, a global leader in embedded payments, partnered with INIT, a leading supplier of public transit ticketing solutions, to implement a cutting-edge payment processing solution for the San Diego Metropolitan Transit System (MTS). This collaboration showcases a new "Tap-on/Tap-off" model that enhances both convenience and security for daily commuters on MTS buses and trolleys.

- In January 2025, Mollie, a leading provider of financial services in Europe, introduced Apple's Tap to Pay on iPhone for its customers in Austria, Italy, and the U.K. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need for additional hardware.

Segments Covered in the Report

By Solution

- Security and Fraud Management

- Payment Terminal Solution

- Transaction Management

- Hosted Point-of-Sales

- Analytics

By Application

- Government

- Healthcare

- Retail

- Transportation

- Hospitality

By Device

- Point-of-Sales Terminals

- Smartphones & Wearables

- Smart Cards

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content