What is Proximity Payment Market Size?

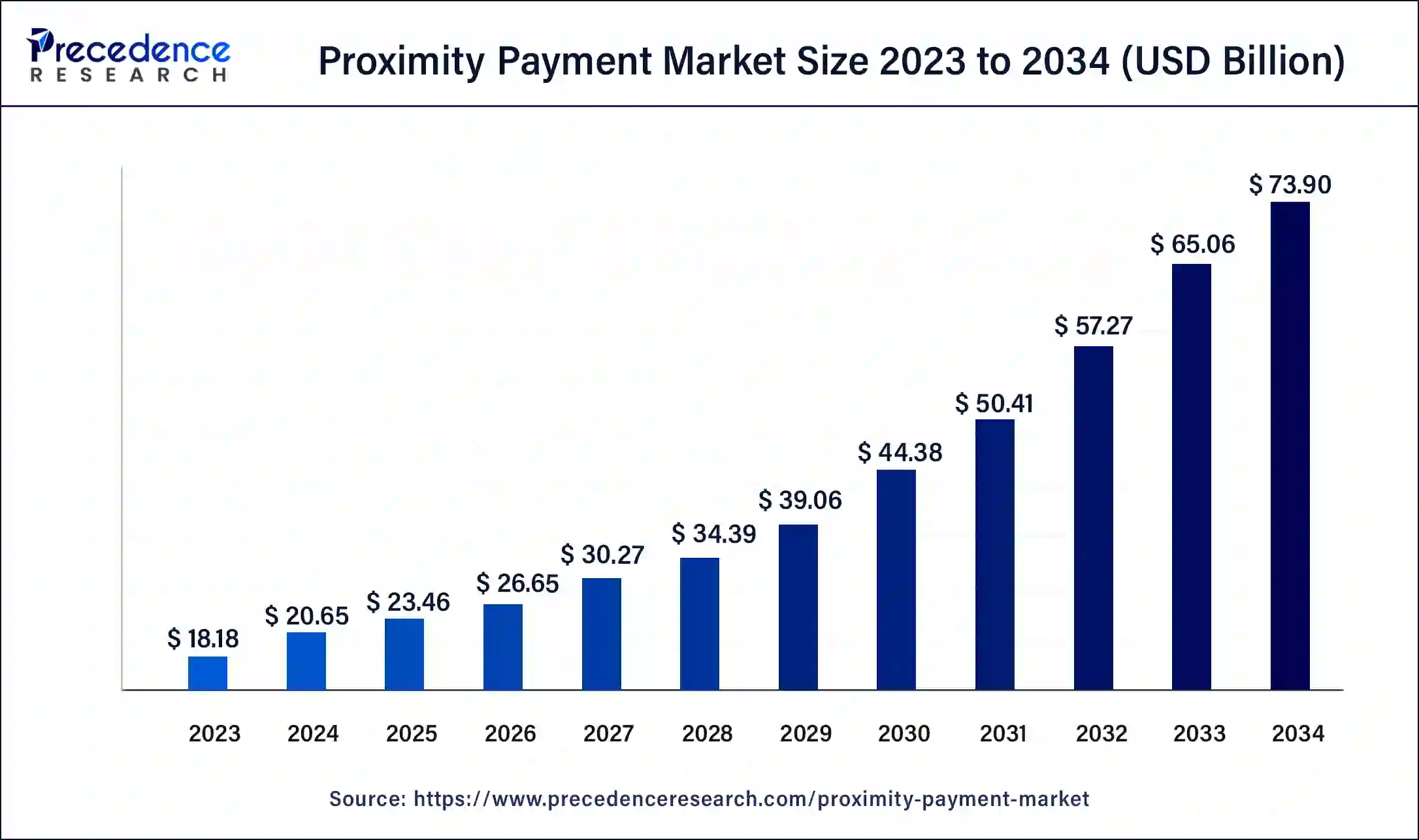

The global proximity payment market size is estimated at USD 23.46 billion in 2025 and is predicted to increase from USD 26.65 billion in 2026 to approximately USD 82.04 billion by 2035, expanding at a CAGR of 13.34% from 2026 to 2035

Market Highlights

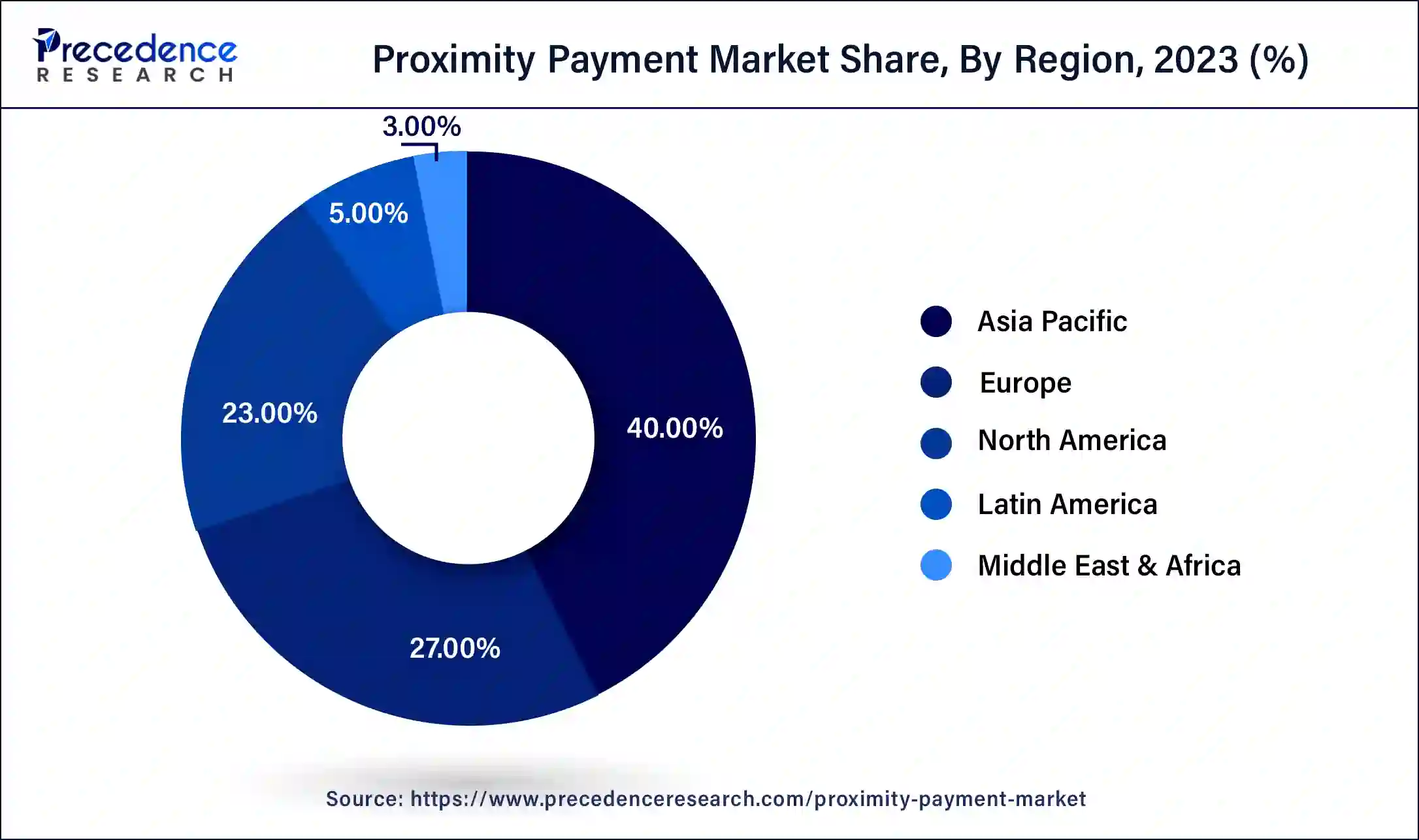

- Asia Pacific led the global market with the highest market share of 40% in 2025.

- By offering, the solution segment has held the largest market share in 2025.

- By application, the grocery store segment captured the biggest revenue share in 2025.

Proximity Payment Market Growth Factors

The major benefits that is provided by the proximity payment systems include flexibility of payment devices, reduced transaction time, Real-time transaction processing and increase in convenience. All these factors are expected to drive the growth of the market. Moreover, the massive adoptions of proximity payments among the merchants and the surge in the usage of the Smartphone that facilitate the proximity payments are some of the attributes that contributes significantly towards the market growth. For instance, On 24th June 2021, FIS, a financial technology pioneer, announced that USALLIANCE Financial, based in Rye, New York, has chosen the FIS Payments One platform to streamline and modernize its credit and debit card digital payment options for its members. Payments from the FIS One platform combines credit and debit card processing, loyalty, fraud protection, and card manufacturing into a single programmed. This will help USALLIANCE Financial to benefits form the robust capabilities of FIS' Payments One to streamline and modernize its portfolio of card offerings.

The surge in the faster connectivity has motivated the customers and the merchants to execute proximity payments and this factor drive the growth of the market. The developing countries offer wide range of opportunities for the market growth owing to the growth of middle class segment, rise in literacy level, rapid urbanization and others. Furthermore, the Government initiative to promote the digital payments in order to eliminate the money laundering activities is expected to boost the growth of the proximity payment market.

The increasing payment efficiency and the customer convenience with reducing operational cost are some of the factors that drive the market growth. The adoption of proximity payments will reduce the paper based transaction and hence it is considered as a good green initiative. Additionally, with the rapid urbanization the smartphones have become an essential commodity in the life of an individual and thus this increased penetration of smartphones in the lives of the customers has fueled the growth of the proximity payment market.

In the post-pandemic era, the contactless payments have become one of the primary factors contributing significantly towards the market growth. Furthermore, the Government across the globe is promoting the digital payments and encouraging banks to build robust payment gateways to secure the proximity payments and this will positively contribute towards the growth of the proximity payment market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.46 Billion |

| Market Size in 2026 | USD 26.65 Billion |

| Market Size by 2035 | USD 82.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.34% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Application, and Regions |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

Penetration of smartphones

A significant driving factor for the proximity payment market is the growing adoption of smartphones and their potential applications in every sector. Smartphones offer a secure payment method by providing mobile wallets that act as a digital platform to store payment cards and help with proximity transactions. The growing availability of global connections is also secured by expanding networks like 5G and the expansion of internet services via satellite, which provide internet connections even in remote and underserved areas. Applications like Google Pay and Apple Pay enable contactless payments and are key contributors to the market's growth.

Restraint

Concerns over secure payment

Despite several benefits, the proximity payment market faces challenges like security concerns regarding making transactions with precision and transparency. Consumers are worried about potential fraud activities, data leaks, and misuse of identity that may be conducted by contactless systems for payment. Such fear of losing sensitive financial data and the chances of facing illegal account access by hackers are creating a barrier to the market's growth.

Opportunity

Emerging technologies like NFC and biometric systems

The significant opportunity that the proximity market holds is advancements in payment technologies like mobile wallets, authentication using biometric systems, and near-field communication. These innovations are ideal for security enhancement and efficient transactions, which help gain the traction of a maximum consumer base from different regions. According to the European Central Bank, to maintain consumer trust and expand the cashless economy, security features should be robust and highly secured.

Segment Insights

Offering Analysis

TheProximity Payment Market is divided into Solution and Service. The solution segment in the offerings will hold the largest market share in 2025 accounting for more than three fourth of the total share and is expected to dominate the market during the forecast period. Owing to the data breaches in the proximity payments, robust infrastructure should be built that provides a safe payment infrastructure and therefore this segment is continuously under research and development to produce the safe environment for the payment and this factor is expected to contribute positively towards the growth of the proximity market.

The service segment is also projected to grow at fastest rate of 14.8% CAGR during the forecast period owing to the increased penetration of the mobile phone in the lives of the customers and the convenience with which the proximity payments are carried on.

Application Analysis

TheProximity Payment Market is divided Grocery Stores, Bars & Restaurants, Drug Stores, Entertainment Centers and Others. In this segment, the grocery store is estimated to hold the largest share accounting for more than one third of the global proximity payments. The availability of payment infrastructure at different places facilitates the proximity payments. For instance, On 6th October 2021, Paypal introduced PayPal QR Codes as Inflight Payment Option offering customers buy snacks, drinks, and other inflight purchases while on board by just scanning a QR code – with or without Wi-Fi. Therefore, the use of proximity payment systems provides hassle free contactless payments to its users. This robust payment infrastructure has huge opportunities to grow in the upcoming years owing to the benefits it provides.The bars and restaurants are anticipated to grow significantly in the upcoming years owing to convenience with which the payment are carries out.

Regional Insights

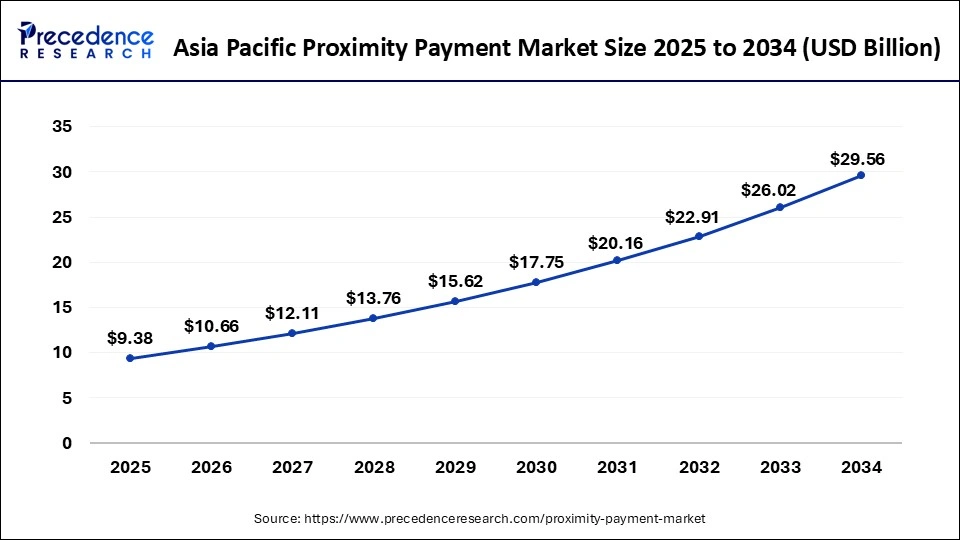

Asia Pacific Proximity Payment Market Size and Growth 2026 to 2035

The Asia Pacific proximity payment market size is estimated at USD 9.38 billion in 2025 and is predicted to be worth around USD 32.81 billion by 2035, at a CAGR of 13.34% from 2026 to 2035.

Asia Pacific region is expected to dominate the proximity payment during the forecast period owing to presence of developing nation such as India, China, South Korea, Japan and Australia. These countries provide a stable ecosystem that fosters the growth of the proximity payment market. In India, the act of demonetization has opened up huge opportunities for the digital payments. According to Visa Inc. in India the proximity payments accounts to more than 25% of the total transaction happening in the country. For instance, on 25thAugust 2021, Against all obstacles, CCAvenue, a prominent digital payment platform, functions admirably and regularly. Despite the challenging regulatory climate and dynamic nature of the industry, it continues to succeed in its business endeavours. CCAvenue was honoured with the 'Best Technology Solution for Enterprise Risk Management' award at the Innovation & Technology Awards 2021, which were co-hosted by Inkspell and Global Trends Forum. Also, countries like Australia are evolving at a faster rate in terms of adopting proximity payments. According to Visa Inc. 79% of the total transaction took place electronically leaving only 21% transaction to be carried out by cash.

Europe on the other hand is dominating the proximity payment market owing to the increased awareness among the users regarding the benefits of proximity payments and the Government policies that favors the implementation of hassle free and safe proximity payment systems.For instance, on 24th June 2021 Visa Inc., the world's largest digital payments company, has announced the signing of a definitive agreement to buy Tink, Visa will pay a total financial consideration of 1.8 billion Euros, which includes cash and retention incentives.

Proximity Payment Market Companies

- ACI Worldwide Inc.

- Alphabet Inc.

- Apple Inc.

- FIS

- IDEMIA

- Ingenico

- Mastercard

- PayPal Holdings Inc.

- Square Inc.

- Visa Inc.

Recent Developments

- In August 2024, Mastercard launched an innovative loyalty application program that offers a contactless payment method to increase consumer engagement of consumers. Samsung Pay is gaining traction in the proximity payment market, as it provides a contactless transactional experience.

- In April 2024, leading companies IDEMIA, Telefonica, and Quside formed an alliance to develop a quantum-safe solution designed for IoT devices. This collaboration is highly fruitful and will support finding new standards for security and resilience in the IoT ecosystem.

Segments Covered in the Report

By Offering

- Solution

- Hardware

- Software

- Service

By Application

- Grocery Stores

- Bars & Restaurants

- Drug Stores

- Entertainment Centers

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting