What is the In-vehicle Payment Services Market Size?

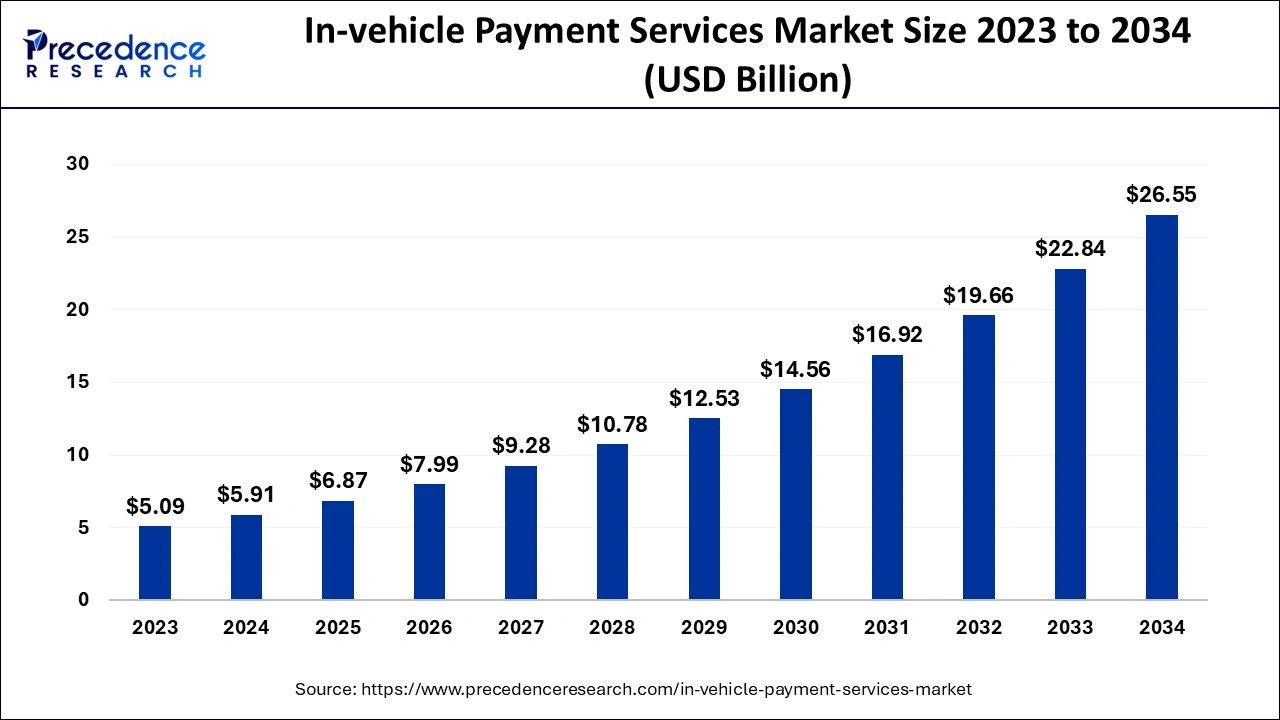

The global in-vehicle payment services market size is accounted at USD 6.87 billion in 2025 and predicted to increase from USD 7.99 billion in 2026 to approximately USD 29.91 billion by 2035, representing a CAGR of 15.85% from 2026 to 2035.

In-vehicle Payment Services Market Key Takeaways

- By mode of the payment, the debit card and credit card segment hit market share of over 54% in 2025.

- By application, the food and coffee segment has accounted market share of around 29% in 2025.

- By vehicle, the light duty vehicle has hit highest revenue share of about 74% in 2025.

- The app/e-wallet segment is expected to witness growth at a CAGR of 15% from 2026 to 2035.

- The parking segment is growing at a CAGR of 16% from 2026 to 2035.

- The Asia Pacific region is expanding growth at a CAGR of 15% from 2026 to 2035.

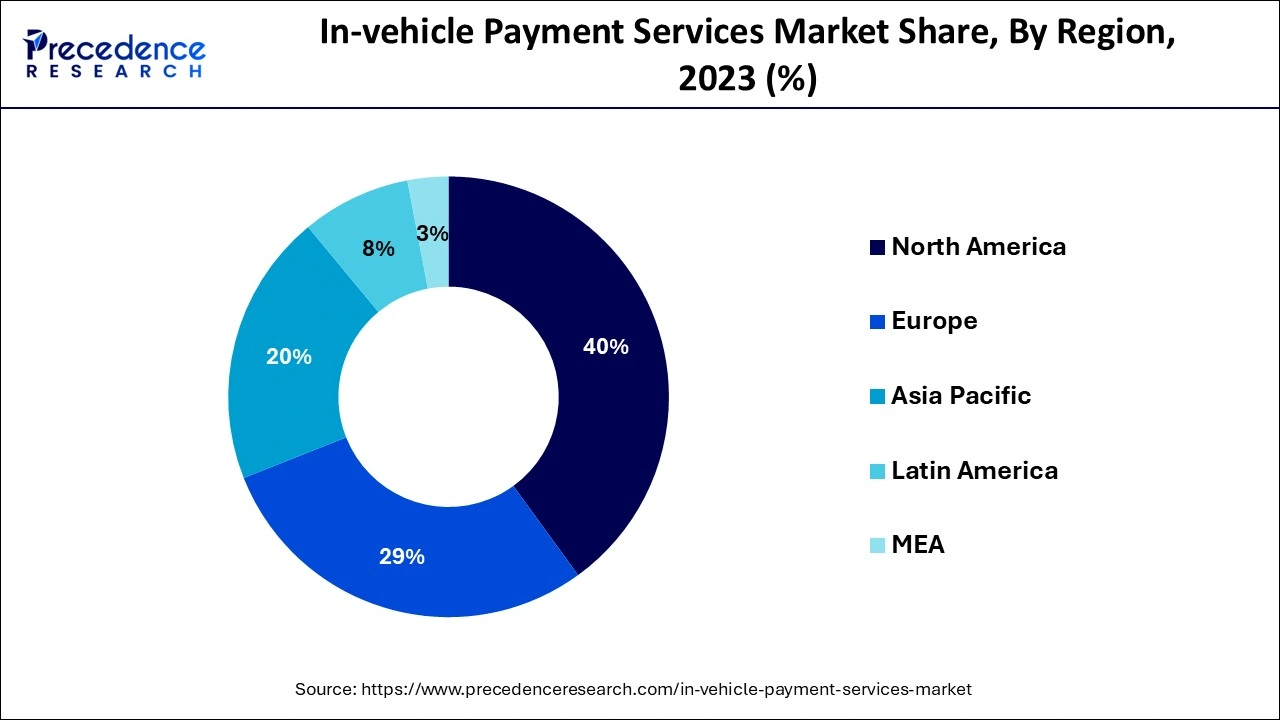

- North American region accounted 40% revenue share in 2025.

What are the In-Vehicle Payment Services?

The demand for the in-vehicle payment services is expected to grow in the coming years as it is helpful in ordering and making payments for foods and beverages as well as groceries and gasoline for the drivers without having to come out of the call and it is also helpful in making payments for the parking as well as the tolls. Increased use of IoT technology in the vehicles by the manufacturers will be driving the market growth in the coming years.

Constant research and development in the manufacturing of the cars has led to an integration of advanced and better solutions in terms of infotainment which have provided such features and these features are expected to drive the market growth in the forecast period. These payment processes are provided by different people across the globe like PayPal, visa MasterCard as they have partnered with the vehicle manufacturers. Partnership between MasterCard and General Motors was beneficial in developing these solutions in the year 2017. Similar collaborations with different payment providers with the manufacturers will drive the market growth during the forecast period. Major car manufacturers like Honda, Volkswagen and Ford have incorporated the in-vehicle payment solution. There's a growing demand for these built-in systems in the automobiles which are expected to drive the market growth in the coming years. In order to improve the road safety for the drivers as well as the passengers the market for in vehicle payment services is expected to grow well during the forecast period.

During the COVID-19 pandemic the demand for in vehicle payment services had affected to a great extent. Disrupted supply chains had negatively impacted the manufacturing processes of the major companies. add the manufacturing activities had come to a standstill during the pandemic the companies incurred losses. Due to the various restrictions that were imposed by the governments and social distancing policies laid down by the government during the pandemic had negatively impacted the market. However, as this service is helpful in providing contactless payments there was an increased preference for this payment method even during the pandemic.

In-vehicle Payment Services Growth Factors

Increase in the demand for the driver support systems in the vehicles is expected to drive the market growth in the coming years. There is a growing demand for the in-vehicle payment services and it is adopted by major manufacturers. As the service is extremely beneficial for the drivers as it is helpful in making instant purchases and provides the benefits of easy parking without making use of any card payments or the use of any other device the market is expected to grow well in the coming years. As the service comes with the voice enabled controls it has a greater potential for driving the market growth in the coming years as it does not compromise with any of the safety norms of driving on the roads.

The advancements in the technology is used in the automobiles have led to the introduction of self-driven cars with the facilities of connectivity and this is expected to be an extremely beneficial technology we shall drive the market growth in the coming years. Due to an increased adoption of this facility in the hospitality and travel segments which helps by providing many benefits the market is expected to grow well. As the time required for the various activities is reduced to a great extent and the service is extremely convenient the market will grow well. As the service is extremely beneficial in increasing the speed of the transaction of money for the service is taken by the person and it is also beneficial as it has application in many different purchases The market is expected to grow well.

Increased connectivity in the vehicles and the use of high-speed Internet especially at the fuel stations bill generate more revenue for this market. Availability of Internet add the all boots and fuel stations as well as the parking lots will be instrumental in the growth of the market in the coming years period increased use of the smartphones and lesser time needed for making the payments has created more demand for the payment devices of the variable type. And they shall accelerate the market growth in the coming years. As the developing and the developed nations are increasing the amount of investments made in order to help the growth of the automobile industry the market for these services is also expected to grow. Increased number of initiatives taken by the government to promote digital payment options across the developed as well as the developing economies will lead to a growth in the market in the coming years.

During the pandemic the demand for these services had gained importance due to the feature ofcontactless payment. Major manufacturers like Honda, Mercedes, General Motors are concentrating on providing connected vehicles. Increased traffic congestions and the longer queues at the parking spaces, gas stations as well as the toll booths are some of the factors that will lead to the growth of the market in the coming years. There is a growing popularity of this service due to various benefits provided. There has been an increase in the development of the infrastructure required for the service and should boost the growth of the market in the coming years.

Market Outlook

- Industry Growth Overview:

The in-vehicle payment services market is experiencing significant growth, driven by increasing user demand for hassle-free, time-saving transactions for daily services such as fueling, parking, and drive-through purchases without leaving their vehicles. - Global Expansion:

The market is experiencing significant global expansion, driven by the incorporation of robust infotainment systems, IoT (Internet of Things) sensors, and 5G connectivity allows real-time data exchange, seamless transaction processing in the vehicle ecosystem. North America is the fastest-growing market due to robust connected car infrastructure and high digital payment acceptance. - Major investors:

Major investors in in-vehicle payment services are generally a combination of large automotive original equipment manufacturers (OEMs), economic services providers, and technology companies that invest in or partner to develop these systems. It includes BMW AG, Daimler AG, Ford Motor Company, Hyundai Motor Company, and Tesla, Inc.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.87 Billion |

| Market Size in 2026 | USD 7.99 Billion |

| Market Size by 2035 | USD 29.91 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 15.85% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Mode of Payment, Offering, Vehicle Type, Application, and Geography |

Mode of Payment Insights

Depending upon the mode of payment, the debit card and credit card segment is expected to have the largest market share in 2023. The debit cards as well as the credit cards are used largely in the developed as well as the developing economies as it happens to be the most popular mode for payment. This payment mode is preferred by most of the consumers for the contact list as well as the contact payments. There is an increased preference for the cordless as well as card transactions at the point of sales it is expected to contribute to the growth of the market in the coming years. The debit card and the credit card payment method is preferred by the various people belonging to different age groups as it is extremely convenient to use.

Application Insights

On the basis of application, the demand for the in-vehicle payment services is expected to have the largest market share for the food and coffee segment. Large amount of revenue is generated through the sales of food and coffee as compared to any other purchases in the past period it is expected to hold a dominant position as these products are consumed on a large scale especially on the travels made for offices or the workplaces. Increased traffic congestion has led to a shortage of time especially when a person has to reach the office. In order to limit the time period required for waiting when buying food the demand for in vehicle payment services is expected to grow. This method of payment is extremely convenient as it helps in saving the time period there is a growing popularity for the usage of in-vehicle payment services in the developing as well as the developed nations.

Apart from the amount of revenue generated through the sales of coffee and fool a good amount of revenue will also be generated through the payments made for parking lots. The segment is expected to grow with a compound annual growth rate of 15% during the forecast period. Due to an increased sales of the commercial vehicles as well as the passenger vehicles the demand for parking is expected to grow. Growing population and increased sales of automobiles has created limited space for parking. A large number of commercial vehicles are sold in many Asia Pacific regions. The in-vehicle payment services are used in the Asia Pacific regions for the parking spaces as they are helpful in reducing the amount of time required for staying in the long queues.

Regional Insights

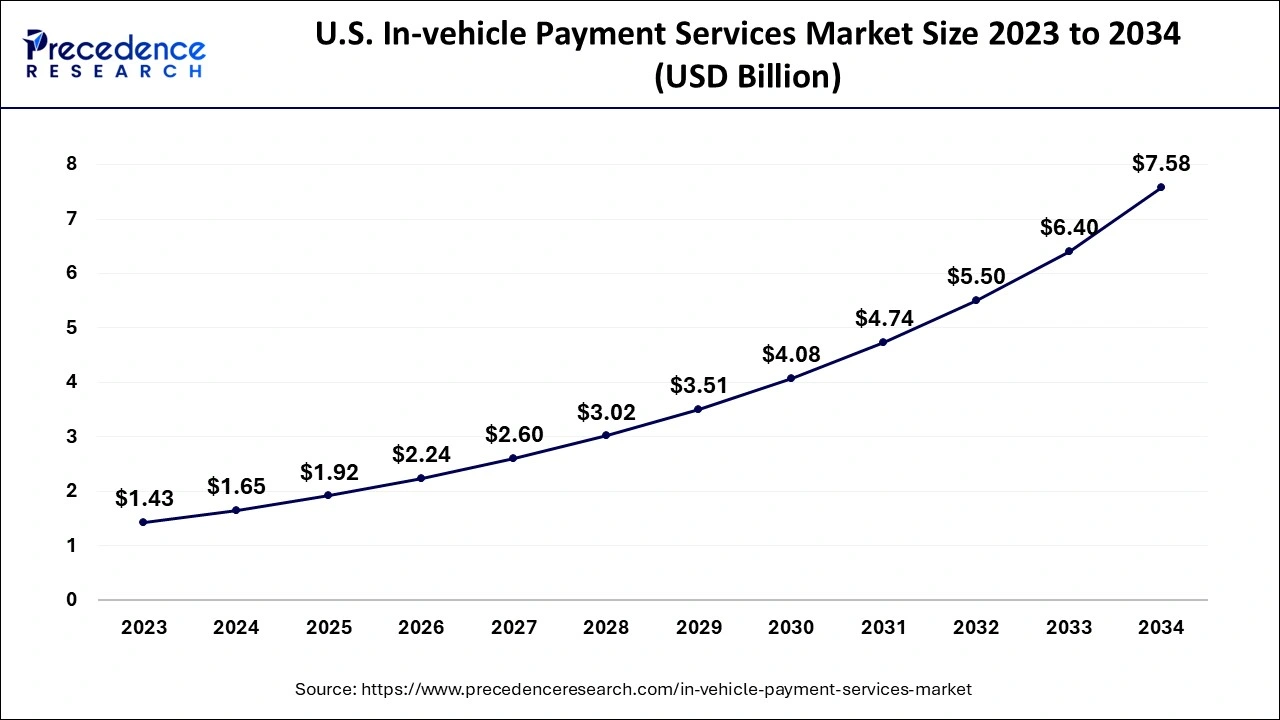

U.S. In-vehicle Payment Services Market Size and Growth 2026 to 2035

The U.S. in-vehicle payment services market size is evaluated at USD 1.92 billion in 2025 and is predicted to be worth around USD 8.57 billion by 2035, rising at a CAGR of 16.14% from 2026 to 2035.

North American region has dominated the market in the past and it is expected to have the largest market share in 2025. Due to the growth in the adoption of connected cars the demand for these services are expected to grow in the coming years. As the population in the Asia Pacific region is expected to grow the demand will continue to grow in this region. There has also been an increase in the disposable income of the people staying in these regions. Constant research and development activities have provided advanced technology and innovative products for making the payments and these shall play an instrumental role in the growth of the market in the coming years.

The North American region is expected to have a larger adoption of in vehicle payment services during the forecast period as the government in these regions are increasing the amounts invested in the infrastructure of the road as well as the telecom industry. Increased investments in these two sectors will be helpful in increasing the connectivity and communication in the car. It will be able to establish the automotive market in a positive manner. Major companies across the globe are increasing their focus on partnerships as they shall be instrumental in improving the market presence and the product portfolio of these companies.

U.S. In-vehicle Payment Services Market Trends

The U.S. has a significant number of advanced vehicles on the road, which is a precondition for in-vehicle payment systems to function efficiently. There is a strong consumer preference for convenient and effective contactless transactions, a trend faster by the pandemic and supported by the present digital payment penetration in the U.S., which drives the growth of the market.

Asia Pacific: Increasing government programs

Asia Pacific is the fastest-growing market with massive EV acceptance, increasing digital payment infrastructure, high development, tech-savvy young consumers seeking convenience, and strategic spending by automakers and fintechs, making a perfect storm for digital, in-car transactions. Strong existing digital payment ecosystems simply transition into connected cars, with app-based payments increasing rapidly, which contributes to the growth of the market.

India In-vehicle Payment Services Market Trends

In India, extensive acceptance and government mandate of the NETC FASTag system for electronic toll collection has been a significant catalyst. The number of connected vehicles on Indian roads is increasing. Indian consumers, specifically the increasing middle class, are progressively demanding efficient, convenient, and contactless services, which drives the growth of the market.

Europe: Strategic partnerships

Europe is significantly growing in the market as increasing partnerships among the automotive Original Equipment Manufacturers (OEMs), economic technology organizations, and payment service providers are increasing the advancement and deployment of novel in-vehicle payment solutions, which contribute to the growth of the market.

The UK In-vehicle Payment Services Market Trends

UK consumers have a strong existing preference for cashless and contactless transactions. The high adoption of electric vehicles requires seamless, integrated payment services for public charging stations. The UK has a strong fintech sector and a supportive government framework, including Open Banking initiatives and Strong Customer Authentication (SCA) rules, which foster secure and novel payment services.

Value Chain Analysis – In-vehicle Payment Services Market

- Raw Material Sourcing:

In-vehicle payment services include sourcing hardware components for connectivity and data processing, like embedded telematics units, sensors (such as RFID or Bluetooth Low Energy), infotainment systems, and secure microchips.

Key Players: Apple and Google - Vehicle Assembly and Integration:

Vehicle assembly and integration in in-vehicle payment services is the process of seamlessly integrating the required hardware and software components for payment functionality in the vehicle's existing systems during the industrial or retrofitting stages.

Key Players: Payment Networks and Specialized Providers/Infrastructure - Retail Sales and Financing:

In-vehicle payment services relate to retail sales and financing by offering a seamless platform for drivers to purchase goods and solutions directly from their vehicle and access associated credit options at the point of sale.

Key Players:Automakers and Tech Giants

Top Companies in the In-vehicle Payment Services Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

ZF Friedrichshafen AG |

Germany |

Integrated system solutions across driveline |

ZF provides inclusive product and software services for established vehicle manufacturers and novel emerging transport and mobility service providers. |

|

|

United States |

Continuous innovation and massive user data access. |

German regulator ends probe into Google's in-car services after the company agrees to modify automotive services and maps platform. |

|

Amazon |

United States |

Significant technological innovation and strong customer loyalty |

Amazon to deploy 1,000 electric delivery vans with Vision-Assisted Package Retrieval by early 2025. |

|

Visa |

United States |

Strong financial performance and innovation in digital payments |

In December 2025, Finance partnered with Visa and cloud-based banking platform Pismo to introduce New Zealand's first open-loop fleet payment solution. |

|

MasterCard |

United States |

Strong brand value and efficient business model |

Mastercard is pioneering a future where consumer-grade simplicity is the norm for B2B payments. |

In-vehicle Payment Services Market Companies

- ZF Friedrichshafen AG

- Amazon

- Visa

- MasterCard

- PayPal

- BMW AG

- Daimler AG

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Jaguar Land Rover Automotive PLC

- Volkswagen AG

Key Market Developments

- Volkswagens business of the payments was acquired by JP Morgan in the year 2021. JPMorgan aims at improving the in-vehicle payment service provided by the organization by investing in the company.

- A partnership agreement was signed between visa and Daimler as the organizations aimed at providing biometric solutions for the in-vehicle payments market.

Segments covered in the report

By Mode of Payment

- App/e-wallet

- Credit/Debit card

- NFC

- QR Code/RFID

By Offering

- Solution

- Service

- Professional

- Managed

By Vehicle Type

- Light Duty Vehicle

- Heavy Duty Vehicle

By Application

- Shopping

- Food/Coffee

- Parking

- Gas/charging stations

- Toll Collection

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting