What is the Voluntary Carbon Credit Trading Market Size?

The global voluntary carbon credit trading market is witnessing rapid growth as companies purchase and trade certified credits to meet climate targets, drive sustainability, and fund emission-reduction projects.The voluntary carbon credit trading market has emerged as a pivotal mechanism in global climate action, enabling businesses and individuals to offset their carbon emissions beyond regulatory requirements. By purchasing credits tied to verified carbon reduction or removal projects, participants actively contribute to sustainability and corporate responsibility goals. Unlike compliance-driven schemes, this market thrives on voluntary commitments, reflecting both ethical considerations and strategic business positioning.

Voluntary Carbon Credit Trading Market Key Takeaways

- North America dominated the voluntary carbon credit trading market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By credit type, the avoidance & reduction Credits segment held the largest market share in 2024.

- By credit type, removal credits are expected to grow at a remarkable CAGR between 2025 and 2034.

- By project category type, the forestry & land use segment led the market in 2024.

- By project category type, carbon capture, utilization & storage are expected to grow at a remarkable CAGR between 2025 and 2034.

- By trading platform type, the over-the-counter segments captured the biggest market share in 2024.

- By trading platform type, blockchain & digital registries are expected to grow at a remarkable CAGR between 2025 and 2034.

- By buyer type, the corporations segment contributed the highest market share in 2024.

- By buyer type, institutional Investors are expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user industry, the energy & utilities segment held the maximum market share in 2024.

- By end-user industry, IT & Technology is expected to grow at a remarkable CAGR between 2025 and 2034.

- By verification standard type, the verified carbon standard segment generated the major market share in 2024.

- By verification standard type, the gold Standard is expected to grow at a remarkable CAGR between 2025 and 2034.

What is the Voluntary Carbon Credit Trading Market?

The voluntary carbon credit trading market refers to the ecosystem where businesses, investors, and individuals purchase and trade carbon credits outside of regulatory or compliance schemes. These credits are generated through projects that reduce, avoid, or remove greenhouse gas emissions, such as renewable energy, reforestation, carbon capture, and sustainable agriculture initiatives. Unlike compliance markets, participation is voluntary, often driven by corporate sustainability commitments, net-zero pledges, and investor pressure for ESG integration. Trading platforms, brokers, and registries facilitate transactions, while standards organizations verify project credibility. The market is expanding rapidly due to corporate climate action, growing investor demand for transparent ESG reporting, and global momentum toward carbon neutrality, with strong emphasis on digital registries and blockchain-based platforms.

The market is characterized by rapid expansion, diverse participants, and evolving standards of verification and accountability. Ranging from forestry and renewable energy to advanced carbon capture projects, carbon credits represent measurable reductions with tangible global impact. Demand is being shaped not only by sustainability-driven enterprises but also by investors seeking ESG-aligned portfolios. Yet, transparency, scalability, and trust in certification frameworks remain critical to its long-term success. As stakeholders embrace digital platforms and blockchain for traceability, the market is transitioning from niche initiatives to a global trading ecosystem.

How AI Impacted the Voluntary Carbon Credit Trading Market

Artificial intelligence has transformed the voluntary carbon credit market by enhancing accuracy, scalability, and trust in measurement and verification. AI-driven satellite imagery and machine learning algorithms enable precise monitoring of carbon sequestration in forests, wetlands, and soil projects. Predictive analytics help forecast supply-demand dynamics, improving pricing models and liquidity in trading platforms. Smart contracts powered by AI enhance transaction transparency, reducing risks of fraud and double-counting. Furthermore, AI-driven insights empower corporates to align credits with their unique sustainability trajectories. In effect, AI is the invisible enabler, bridging credibility and scalability in a market built on trust.

Market Key Trends

- Expansion of digital marketplaces integrating blockchain for traceable and tamper-proof carbon credit transactions.

- Rising demand for nature-based solutions, especially reforestation and soil regeneration projects.

- Corporate net-zero and science-based target initiatives are driving large-scale participation.

- Integration of AI and IoT for high-resolution monitoring of carbon sequestration projects.

- Emergence of tokenized carbon credits, enabling fractional ownership and democratized access.

- Regional diversification, with developing economies increasingly hosting large-scale projects.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

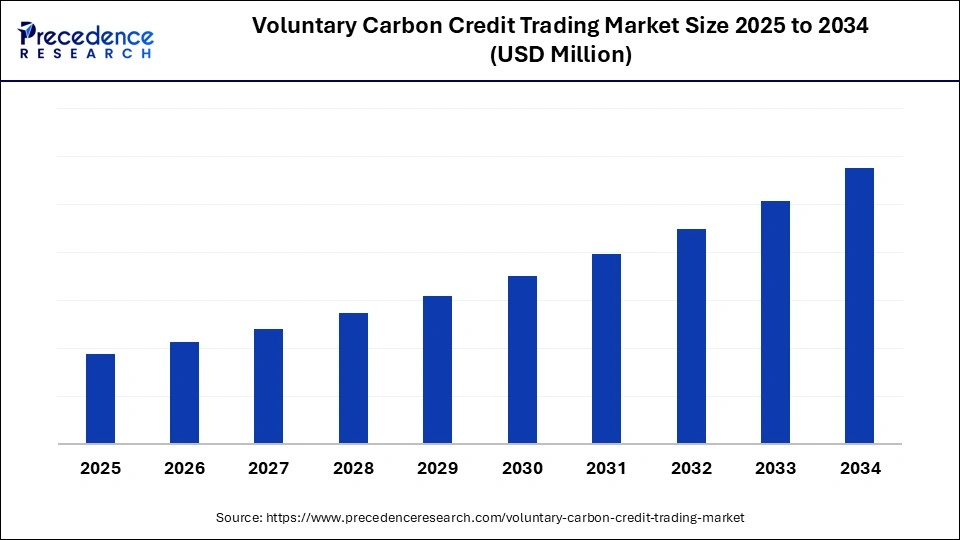

| Forecast Period | 2025 to 2034 |

| Segments Covered | Credit Type, Project Category, Trading Platform, Buyer Type, End-Use Industry, Verification Standard, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The voluntary carbon credit trading market is fueled by the global urgency to combat climate change and reduce greenhouse gas emissions. Corporations are increasingly pledging net-zero targets, creating consistent demand for credible offset solutions. Investors and stakeholders are pressuring companies to align with ESG frameworks, further amplifying adoption. Consumers, too, are rewarding climate-conscious brands, pushing businesses to showcase tangible sustainability actions. Technological advances in AI, blockchain, and satellite monitoring are strengthening trust and transparency in carbon credit verification. Together, these factors are driving steady growth and institutional confidence in the market.

Restraints

Despite strong momentum, the voluntary carbon credit trading market faces critical challenges that could hinder its expansion. The lack of universal standards for credit validation leads to inconsistencies and market fragmentation. Many credits face criticism for quality concerns, raising fears of greenwashing and reputational damage. High project implementation and verification costs create barriers for smaller players. Volatility in demand, driven by fluctuating corporate priorities and economic cycles, also adds uncertainty. Moreover, questions around the long-term permanence of carbon sequestration make some investors hesitant to commit fully.

Opportunities

Amid challenges, the market is ripe with opportunities for innovation and expansion. The rise of urban forestry, regenerative agriculture, and community-based projects offers diverse pathways for credit generation. Emerging technologies like direct air capture and biochar open new avenues for scalable carbon removal. Blockchain-enabled trading platforms can democratize access, offering fractional credits and global liquidity. SMEs and regional businesses are increasingly looking at voluntary credits as cost-effective tools to meet sustainability goals. Cross-border alliances and integrated global marketplaces promise to unify fragmented systems, making the voluntary carbon credit market a cornerstone of the global climate economy.

Segmental Insights

Credit Type Insights

Why Are Avoidance & Reduction Credits Dominating the Voluntary Carbon Credit Trading Market?

Avoidance and reduction credits continue to dominate the voluntary carbon market because they offer immediate solutions to mitigate emissions. These credits typically arise from renewable energy, energy efficiency, and deforestation prevention projects, which have gained widespread acceptance. Corporations prefer them due to their scalability and relatively lower costs compared to removal-based projects. Their familiarity with ESG reporting frameworks also strengths their global demand. Many multinationals use avoidance credits as their first step in sustainability journeys, before transitioning to more permanent solutions. The dominance of these credits reflects their practicality and ease of integration into existing corporate climate strategies.

The strength of the avoidance of reduction credits lies in their proven impact across multiple sectors. By replacing fossil-based systems with renewables or halting deforestation, these credits address both present and future emissions. They are also better suited to developing regions where renewable infrastructure and land preservation projects generate both climate and socio-economic benefits. The relatively lower verification complexity further drives corporate adoption. With governments and NGOs supporting deforestation reduction projects, these credits enjoy legitimacy and long-term relevance. Thus, avoidance and reduction credits remain the backbone of voluntary carbon markets, reinforcing both climate action and developmental goals.

Removal credits are rapidly emerging as the fastest-growing segment, largely due to their ability to provide permanent carbon sequestration. Unlike avoidance credits, removal projects actively extract carbon from the atmosphere through reforestation, soil carbon storage, and advanced technologies like direct air capture. This tangible removal resonates strongly with investors seeking higher credibility. Demand is particularly strong among corporations aiming for robust net-zero strategies, where offset permanence is vital. Although more expensive, removal credits are increasingly viewed as premium investments for long-term climate impact. Their accelerated growth reflects shifting market sentiment toward durability and accountability.

The adoption of removal credits is also fueled by technological breakthroughs. Direct air capture facilities and biochar initiatives have transitioned from pilot phases to scalable solutions. These credits align perfectly with scientific recommendations that emphasize not just emission reductions but also carbon drawdown. As climate scrutiny intensifies, companies willing to pay a premium for integrity and permanence are flocking toward removal solutions. Emerging verification tools backed by AI and satellite monitoring further strengthen trust in removal projects. Consequently, removal credits are charting a rapid growth trajectory and are poised to redefine market hierarchies in the coming decade.

Project Category Insights

Why Forestry and Land Use Are Dominating the Voluntary Carbon Credit Trading Market?

Forestry and land use projects dominate the market, reflecting the deep link between natural ecosystems and climate stability. Reforestation, afforestation, and avoided deforestation projects generate large volumes of credits while offering co-benefits such as biodiversity preservation. These projects attract corporations seeking to align climate actions with community and environmental impact. Their scalability across tropical regions ensures a steady credit supply to global buyers. Multinationals favor these credits because they simultaneously strengthen ESG performance and brand reputation. Thus, forestry and land use projects remain the cornerstone of voluntary carbon markets.

The dominance of forestry-based projects also stems from their high visibility and storytelling potential. A company supporting rainforest protection or reforestation can clearly communicate its impact, making such credits attractive for marketing and CSR narratives. Local communities benefit from employment and sustainable land practices, strengthening the appeal of such initiatives. With international support from coalitions and NGOs, forestry projects enjoy strong policy backing. Their relatively lower technological barriers make them accessible across developing nations. This combination of ecological, social, and corporate benefits ensures their continued dominance.

CCUS projects represent the fastest-growing category, owing to their ability to combine innovation with measurable impact. By capturing CO? emissions at the source and either storing or converting them, these projects provide immediate, verifiable reductions. Industries with high emissions, such as cement and steel, are increasingly investing in CCUS credits. Corporations see these credits as technologically advanced and highly credible, aligning with long-term decarbonization goals. Their growth trajectory reflects a strong appetite for innovation-driven solutions. This trend positions CCUS as a future-defining pillar of voluntary carbon credit markets.

The scalability of CCUS is further driving investor attention. With government-backed pilot programs evolving into commercial ventures, credit issuance from CCUS is expanding rapidly. Unlike forestry projects, CCUS solutions directly tackle industrial emissions that are otherwise hard to abate. These credits also enjoy a premium valuation due to their perceived permanence and scientific rigor. Multinationals in heavy industries are actively adopting CCUS credits to offset unavoidable emissions. As industrial decarbonization accelerates, CCUS projects are set to witness exponential adoption across global markets.

Trading Platform Insights

Why Over-the-Counter Trading Is Dominating the Voluntary Carbon Credit Trading Market?

The over-the-counter (OTC) model dominates trading in voluntary carbon markets due to its flexibility and direct engagement. Corporations prefer OTC deals as they allow for customization of project type, volume, and price. Bilateral agreements also build stronger trust between buyers and project developers. The absence of complex intermediaries ensures greater control over transaction terms. Large multinational corporations rely heavily on OTC purchases to secure credits that align with their specific ESG narratives. Thus, OTC remains the preferred trading mechanism in this fragmented yet expanding market.

Another reason for OTC dominance is its capacity to support long-term partnerships. Many firms directly finance forestry, renewable, or community projects through OTC agreements, locking in a multi-year credit supply. This ensures cost predictability and project stability. It also provides developers with assured funding, accelerating project execution. Although digital platforms are on the rise, OTC transactions maintain the lion's share due to corporate preference for personalization and reliability. In essence, OTC trading embodies flexibility, trust, and sustained engagement in the carbon credit ecosystem.

Blockchain and digital registers are the fastest-growing trading platforms, transforming how credits are validated and exchanged. By providing transparent, tamper-proof records, these platforms address long-standing concerns about double-counting and credit legitimacy. Blockchain-enabled tokens allow for fractional ownership, broadening access to smaller buyers. The digital model also accelerates transaction speed, making credit trading more efficient and global. As trust becomes paramount, blockchain systems are increasingly viewed as the future of voluntary carbon markets. Their adoption is growing rapidly among tech-savvy corporations and institutional players alike.

The scalability of digital registers is reshaping global participation. With platforms enabling cross-border trading in real time, geographic barriers are rapidly dissolving. Smaller companies and individuals can now participate without needing large capital commitments. Integration of AI andInternet of Things with blockchain further enhances project monitoring and reporting accuracy. Such platforms also promote liquidity by standardizing credits into easily tradable digital assets. Collectively, these innovations are accelerating the rise of blockchain as the new backbone of carbon credit trading.

Buyer Type Insights

Why Are Corporations Dominating the Voluntary Carbon Credit Trading Market?

Corporations dominate the buyer landscape, as they are under immense pressure to decarbonize and align with sustainability commitments. From Fortune 500 companies to emerging startups, businesses are integrating voluntary carbon credits into their ESG strategies. Many firms use credits as transitional tools while working to reduce direct emissions. Their scale of purchase dwarfs that of other buyer groups, reinforcing their dominance. Brand reputation, regulatory anticipation, and shareholder activism all converge to drive corporate participation. Thus, corporations remain the anchor customers of voluntary carbon trading markets.

Corporate dominance is also fueled by cross-sector participation. Energy, aviation, consumer goods, and technology companies all feature heavily as top buyers. These credits enable firms to showcase accountability to both investors and consumers. Additionally, corporations often purchase in bulk, which sustains the financial viability of many carbon projects. Their involvement creates ripple effects, encouraging supply chain partners to follow suit. Therefore, corporate buyers will continue to shape the market's demand trajectory.

Institutional investors are the fastest-growing buyer group, drawn by the dual promise of sustainability and financial returns. Funds, banks, and asset managers are increasingly allocating capital to carbon projects and trading platforms. The rise of green investment funds has amplified their participation in voluntary credit markets. Unlike corporations, institutional investors focus on both credit credibility and market liquidity. Their involvement is accelerating the professionalization of the carbon trading ecosystem. This growing influence positions them as key drivers of future market maturity.

Institutional interest is further strengthened by the integration of carbon credits into financial instruments. Products such as carbon-linked ETFs and green bonds are creating new opportunities for investment diversification. The pursuit of climate-positive portfolios is aligning strongly with investor mandates. Additionally, institutional backing provides long-term stability to project developers. By injecting significant capital, investors are broadening the scope and scale of projects. As this trend intensifies, institutional investors are poised to rival corporations in market influence.

End-Use Industry Insights

How Energy and Utilities Are Dominating the Voluntary Carbon Credit Trading Market?

The energy and utilities sector dominates demand, given its status as one of the largest global emitters. Companies in power generation, oil, and natural gas lean heavily on carbon credits to offset their unavoidable emissions. Voluntary credits serve as a bridge as these industries transition toward renewables and greener technologies. Heavy public scrutiny further accelerates adoption within this sector. Utilities also favor long-term credit contracts to ensure consistent ESG reporting. Consequently, energy and utilities remain the dominant end-use sector in voluntary carbon trading.

The IT and technology sector is the fastest-growing adopter of carbon credits, driven by surging data center energy use and supply chain emissions. Tech giants are pledging ambitious carbon neutrality targets, often extending commitments to their vendors. The rapid expansion of cloud computing and AI has intensified the sector's carbon footprint, necessitating offset solutions. Technology firms also embrace blockchain-based platforms, making their participation more agile. Their focus on brand equity and customer trust accelerates credit adoption.

Verification Standard Insights

Why Verified Carbon Standard Dominating the Voluntary Carbon Credit Trading Market?

The verified Carbon standard dominates as the most widely recognized certification for voluntary credits. Its rigorous methodologies provide credibility and trust to both buyers and sellers. The broad range of project types under VCS ensures accessibility for diverse participants. Corporations rely heavily on VCS-backed credits to satisfy ESG and disclosure requirements. The widespread acceptance of VCS reinforces the dominance across regions. By ensuring transparency and accountability, VCS serves as the gold benchmark in carbon credit verification.

The gold standard is rapidly emerging as the fastest-growing verification framework, prized for its emphasis on sustainable development co-benefits. Beyond carbon mitigation, it prioritizes community upliftment, health, and biodiversity outcomes. Buyers seeking high-impact, socially responsible offsets gravitate toward gold standard credits. The framework aligns strongly with the UN Sustainable Development Goals, making it particularly attractive to investors and NGOs. Although it is more niche compared to VCS, its demand is growing rapidly among impact-driven organizations. The gold standard is carving a reputation as the premium choice for holistic climate action.

Regional Insights

How is North America an Epicenter of Carbon Market Leadership?

North America dominates the voluntary carbon credit trading market, driven by corporate sustainability commitments and advanced financial infrastructure. The U.S. is home to several large-scale carbon marketplaces, with companies like tech giants and Fortune 500 firms actively investing in offsets to meet ambitious net-zero goals. Demand is bolstered by consumer activism and investor pressure, forcing corporations to go beyond compliance frameworks. High innovation in AI, blockchain, and fintech solutions further strengthens market transparency and scalability. Nature-based projects across Canada and the U.S. Midwest play a central role in providing credible, high-quality offsets. Together, these forces cement North America's leading position.

However, challenges remain in balancing voluntary ambitions with regulatory oversight. The absence of a unified federal carbon policy in the U.S. leaves much of the momentum in the hands of corporations and private platforms. Critics also highlight risks of over-reliance on credits instead of actual emission reductions. Nevertheless, North America's financial depth, technological edge, and corporate activism provide it with a robust foundation. As the market matures, North America will likely set the standards for best practices, verification, and global replicability in voluntary carbon credit trading.

How Is Asia Pacific the Fastest-Growing Fastest Growing in the Voluntary Carbon Credit Trading Market?

Asia Pacific represents the most dynamic growth story in voluntary carbon trading, underpinned by large-scale renewable projects, reforestation initiatives, and surging corporate participation. Countries like India, China, and Indonesia are becoming hubs for supply-side credits, while fast-industrializing economies are also spurring demand. Regional governments are promoting voluntary carbon markets to complement national climate goals, creating fertile ground for cross-border trading. Low-cost project development, coupled with high sequestration potential, makes the Asia Pacific a natural leader in credit generation. As more companies embrace ESG strategies, demand for local credits is expanding rapidly.

It plays a critical role in shaping growth, not only as a demand center but also as a global rule-setter. The EU's climate regulations and corporate net-zero mandates have positioned Europe as a major buyer of voluntary credits, particularly nature-based solutions from developing regions. Asia Pacific and Europe together represent a symbiotic relationship: Asia produces while Europe consumes and regulates. As collaboration deepens, these two regions are poised to drive the next phase of scaling voluntary carbon trading. Their combined dynamism ensures that the market is both inclusive and globally relevant.

Voluntary Carbon Credit Trading Market Companies

- Verra

- Gold Standard Foundation

- Climate Action Reserve

- American Carbon Registry

- South Pole Group

- ClimatePartner

- EcoAct (an Atos company)

- 3Degrees Group

- Natural Capital Partners

- Emergent Forest Finance Accelerator

- Carbon Credit Capital

- Carbon Trade Exchange

- Sylvera

- Pachama

- AirCarbon Exchange

- XPansiv CBL (Carbonplace)

- Climate Impact X

- Compensate

- NativeEnergy

- Moss Earth

Recent Developments

- In September 2025, Gujarat-based renewable energy developer and operator KPI Green Energy on Thursday announced the listing of its maiden green bond worth ?670 crore on the National Stock Exchange of India. In a company statement, the move was described as a major milestone for sustainable finance in India's renewable sector. The five-year instrument carries an annual coupon rate of 8.50%, structured with a quarterly amortisation schedule. To enhance credit security, the bond benefits from a 65% partial guarantee by GuarantCo, a member of the Private Infrastructure Development Group (PIDG). GuarantCo itself is backed by the governments of the United Kingdom, Switzerland, Australia, Sweden, the Netherlands, Canada, and France, further underscoring global confidence in the initiative.(Source: https://economictimes.indiatimes.com)

Segments Covered in the Report

By Credit Type

- Avoidance & Reduction Credits

- Renewable energy credits

- Energy efficiency credits

- Methane capture & flaring

- Industrial emission reduction credits

- Removal Credits

- Reforestation & afforestation

- Soil carbon sequestration

- Biochar projects

- Direct Air Capture (DAC) credits

- Blue carbon (mangroves, seagrasses)

By Project Category

- Forestry & Land Use

- Renewable Energy Projects

- Agricultural Projects

- Industrial & Waste Management Projects

- Carbon Capture, Utilization & Storage (CCUS)

- Marine & Coastal Projects

- Others

By Trading Platform

- Exchange-based trading

- Over-the-counter (OTC) trading

- Blockchain & digital registries

By Buyer Type

- Corporations (energy, manufacturing, tech, finance)

- Institutional Investors

- SMEs

- Individuals/Consumers

By End-Use Industry

- Energy & Utilities

- Manufacturing & Heavy Industry

- Transportation & Logistics

- Financial Services & Trading Firms

- Consumer Goods & Retail

- IT & Technology

- Agriculture & Forestry

- Others

By Verification Standard

- Verified Carbon Standard (VCS, Verra)

- Gold Standard

- Climate Action Reserve (CAR)

- American Carbon Registry (ACR)

- Global Carbon Council (GCC)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting