What is the Regenerative Agriculture Market Size?

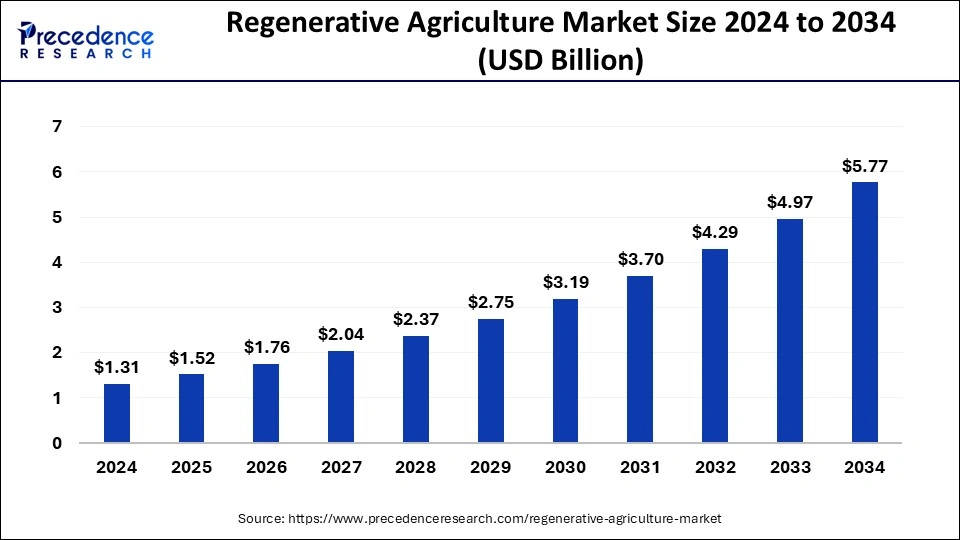

The global regenerative agriculture market size is calculated at USD 1.52 billion in 2025 and is predicted to increase from USD 1.76 billion in 2026 to approximately USD 5.77 billion by 2034, expanding at a CAGR of 15.97% from 2025 to 2034.

Regenerative Agriculture Market Key Takeaways

- In terms of revenue, the market is valued at $1.52billion in 2025.

- It is projected to reach $ 5.77 billion by 2034.

- The market is expected to grow at a CAGR of 15.97% from 2025 to 2034.

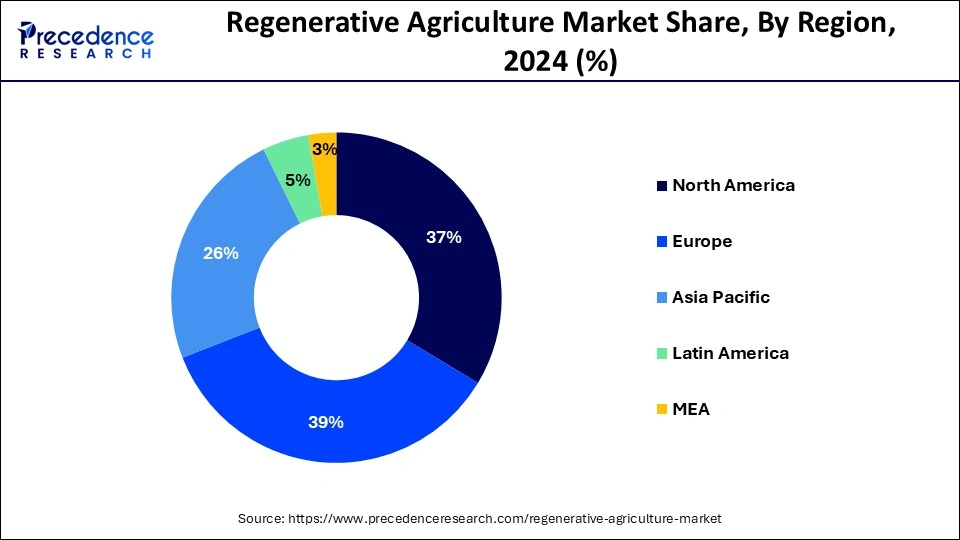

- North America dominated the global market with the largest market share of 37% in 2024.

- By Practice, the agroforestry segment held the highest market share of 21% in 2024.

- By Application, the biodiversity segment had the highest revenue share in 2024.

Market Overview

Regenerative agriculture combines a set of agricultural practices whose main objective is to enhance soil quality naturally. Regenerative agriculture also refers to restoring the fertility of exhausted or diseased soils. The global regenerative agriculture market is majorly driven by the growing uptake of regenerative agricultural practices, and rising awareness regarding environmental impacts of conventional farming techniques. Regenerative agriculture has emerged as a sustainable alternative that prioritizes biodiversity, soil health, and ecosystem resilience. The regenerative agriculture market tends to have a lucrative opportunity owing to the increasing demand for sustainable food production systems.

- In December 2022, the Rockefeller Foundation announced a grant of $11 million for respective organizations that promote Indigenous as well as regenerative agriculture. Several trends driving the regenerative agriculture market growth include corporate funding for regenerative farming practices, rising consumer requirement for sustainable and healthy food, technological advancements, and government incentives & policies. Increased knowledge-sharing initiatives and collaboration among stakeholders in the regenerative agriculture domain propel the adoption of regenerative techniques and promote sustainable agriculture practices across the globe.

- In March 2023, PepsiCo announced an investment of $216 million in long-term strategic partnership agreements with 3 of the well-known farmer-facing organizations – Soil and Water Outcomes Fund (SWOF), Practical Farmers of Iowa (PFI), and the IL Corn Growers Association (ICGA). These long-term strategic partnership agreements are aimed at driving the adoption of regenerative agriculture practices across the US.

Unilever, General Mills, Nestle, and PepsiCo pledged notable support for regenerative agriculture practices, which involve the avoidance of synthetic pesticides and fertilizers. As of September 2022, out of 900 million arable acres in the United States, around 1.5% is farmed regeneratively. Thus, there exists a vast scope for regenerative agriculture in the US. As per a new report, Soil Wealth, investments in regenerative agriculture-related projects are surprisingly high. As of July 2019, the report suggested that were around 70 investment strategies with assets under management of more than $47.5 billion across the United States.

A meta-review conducted by the Consultative Group on International Agricultural Research (CGIAR) in 2021 concluded that by maintaining biodiversity in agricultural lands, regenerative agriculture practices are able to create additional critical ecosystem services.

Regenerative Agriculture Market Outlook

Industry Growth Overview:

Between 2024 and 2034, the regenerative agriculture market is set to experience accelerated growth, driven by the convergence of climate policy, corporate sustainability commitments, and increasing consumer demand for environmentally responsible products. Governments are incentivizing carbon farming and soil restoration, while food giants are integrating regenerative sourcing into their long-term procurement strategies. Farmers are also shifting from yield maximization to resilient agricultural systems that enhance soil health, water retention, and biodiversity, positioning regenerative agriculture as a cornerstone of the sustainable food economy by the decade's end.

Sustainability Trends:

Sustainability is the core mission of regenerative agriculture, aimed at reversing degradation while maintaining productivity through practices like cover cropping, rotational grazing, and compost application, which are improving soil carbon composition and microbial diversity. Leading companies such as Danone, Nestlé, and General Mills are purchasing from regenerative farms, reporting verified improvements in soil health and emissions reduction, while the growing adoption of carbon-positive agricultural practices aligns with the global carbon credit market, offering farmers a new revenue stream.

Global Expansion:

Regenerative agriculture is expanding globally through collaborations between corporations, research institutions, and local farming cooperatives, with companies like Cargill and General Mills regenerating millions of acres in the U.S. Midwest under the USDA Climate-Smart Commodities Program. In Europe, the EU Green Deal and Common Agricultural Policy (CAP) are driving adoption by funding soil health practices, while in Latin America, agroforestry and mixed cropping are being used to restore degraded pasturelands, led by initiatives from Grounded South Africa and regional NGOs.

Major Investors:

Major investors in the market include impact investors like Regenerate Capital, large financial institutions such as Rabobank through its Carbon Bank, and venture capital firms like Indigo Ag with its Terraton Initiative. These investors contribute by funding projects focused on soil health, carbon capture, and land restoration, helping scale regenerative practices while also driving innovations in agri-tech, carbon markets, and environmental impact measurement.

Startup Ecosystem:

The start-up ecosystem in regenerative agriculture is rapidly evolving, with a strong focus on integrating agritech, sustainability, and data science, as companies like Continuum Ag, CIBO Technologies, and Biome Makers use AI, satellite imagery, and soil genomics to develop accessible soil health and carbon storage solutions. Additionally, Soil Capital Ltd. is helping European farmers generate and sell carbon credits and ecosystem services through digital reporting, while biological input startups like Pivot Bio and Trace Genomics are pioneering microbial solutions to boost yields without disrupting the ecological balance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.52 Billion |

| Market Size in 2026 | USD 1.76 Billion |

| Market Size by 2034 | USD 5.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.97% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Practice and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

In July 2023, as part of a multi-year partnership with ALUS, General Mills, Inc. announced an investment of $2.3 million for supporting farmers and boosting regenerative agriculture in Canada. ALUS, a national charitable organization offers resources, expertise, and financial support to 35 communities in 6 provinces in Canada.

McCain Foods announced that by 2030, all potatoes bought by the company will be grown with regenerative agriculture techniques. The Regenerative Soils Program by BioSafe Systems follows the regenerative agriculture model, where soil health is improved using sustainable farming practices. This program is cost-effective and provides disease protection from pre-plant to harvest. Such regenerative soil programs are helpful in the production of tomatoes.

In order to enhance various regenerative agriculture techniques, respective companies can consider collaborations, partnerships, acquisitions & mergers, and joint ventures. Furthermore, continuously evolving regenerative agricultural technology can make the existing agricultural technology obsolete very soon. This may intensify the competition among the crucial market players in the coming years.

Since the count of regenerative agriculture solution providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is relatively high as compared to the bargaining power of buyers. Due to promising profit margins, the threat of new entrants in the regenerative agriculture market is moderate as of now.

Our regenerative agriculture market report includes an in-depth analysis of the current market situation. This report covers crucial key factors such as the competitive landscape, the latest trends, regional analysis, and key players. The analytical research on the impact of the pandemic of COVID-19 helps in realizing the effects on the demand and supply side. The segmental analysis offers a distinct view of particular practices involved in regenerative agriculture.

The Dire State of Soil Degradation Rapidly Accelerates Transition to Regenerative Agriculture

Summary of Report: The accelerating global crisis of soil degradation is one of the key drivers of the growing regenerative agriculture market. Over 60% of agricultural soils in the EU, and 40% in the UK are in severe degradation - due to too much tillage and too many chemicals associated with intensive farming practices. Degradation means less productivity and more risk of drought/flooding. Regenerative agriculture repairs soil ecology, builds soil fertility, increases biodiversity, increases water retention, and sequesters carbon. Farmers who adopted regenerative agriculture also report improved quality of crops, decreased input price and more resilience to climate shock, and food security is an ongoing sustainable solution.

Practice Insights:

Based on practice, the global regenerative agriculture market is segmented into agroecology, aquaculture, biochar & terra preta, agroforestry, no-till & pasture cropping, holistically managed grazing, silvopasture, and other practices. The agroforestry segment held the highest market share in 2024. The aquaculture segment is expected to hold a significant market share during the forecast period.

Regenerative agroforestry, a sustainable and resilient agricultural practice is considered to have the potential to deal with the climate issue. Regenerative agroforestry enhances food security for the rising population while reducing climate change, enabling economically viable production, and safeguarding biodiversity. This method is a nature-based and cost-effective practice that can be adopted across various parts of the world.

Application Insights

Based on application, the global regenerative agriculture market is segmented into soil & crop management, biodiversity, operations management, and other applications. The biodiversity segment had the highest revenue share in 2024. The biodiversity segment is expected to dominate the market during the study period.

Numerous regenerative agricultural practices such as planting cover crops, no-tillage, and planting buffer strips help in enhancing biodiversity. A few other advantages of biodiversity include a clean and safe water supply, nutrient recovery, protection of the soil, the provision of fertilizer, and a greater variety of wildlife.

Regional Insights

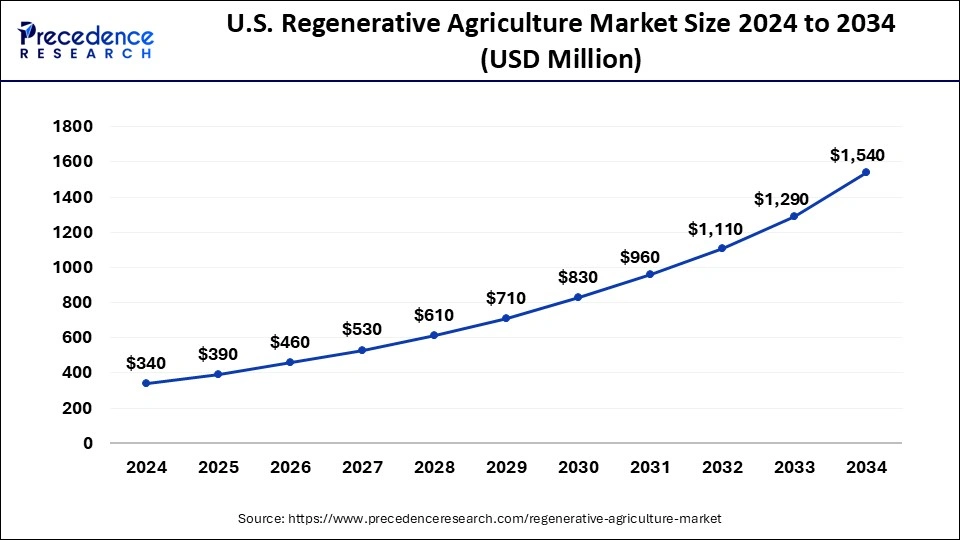

U.S. Regenerative Agriculture Market Size and Growth 2025 to 2034

The U.S. regenerative agriculture market size accounted for USD 390 million in 2025 and is expected to be worth around USD 1,540 million by 2034, growing at a CAGR of 15.97% from 2025 to 2034.

The regenerative agriculture market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. In 2022, the North American region held the largest revenue share in the regenerative agriculture market. In 2024, the United States held the highest share followed by Canada and Mexico in North America. North America is one of the most developed continents owing to the presence of countries with favorable agriculture policies and an inclination towards regenerative agriculture.

Grupo Bimbo and CIMMYT partnership has planned to enhance regenerative agricultural practices for maize and wheat in Mexico. Grupo Bimbo has set a goal that 200,000 hectares of wheat should be cultivated with regenerative agriculture practices by 2030. Grupo Bimbo also aims that 100% of key wheat ingredients must be produced with regenerative agriculture solutions by 2050.

In Mexico, the production volume of wheat is forecast to rise by 0.1 million metric tons in the coming years. The production volume of wheat in Mexico is predicted to amount to about 3.22 million metric tons in 2031. The production of maize in Mexico is predicted to increase continuously by 1.7 million metric tons during the next years. The production of maize in Mexico is expected to amount to around 29.52 million metric tons in 2031. The partnership between Grupo Bimbo and CIMMYT, and the high production of wheat and maize are anticipated to create promising opportunities for the regenerative agriculture market in the near future.

What Potentiates the Growth of the European Regenerative Agriculture Market?

The European regenerative agriculture market is segmented into France, Germany, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is expected to hold the highest share of the European regenerative agriculture market during the study period. The European Agroforestry Federation (EURAF) promotes the growth of trees across farms and any kind of silvopastoral throughout various environmental regions of Europe. The European Agroforestry Federation has over 500 members from 20 European nations. The presence of such agroforestry federations is supporting the market growth in the region.

Organic farming methods that involve lesser use of pesticides and store more carbon in the soil are considered to be more popular. Experts suggest that the regenerative farming shift can decrease UK climate emissions. In November 2021, General Mills started its 1st regenerative agriculture project in Europe to help farmers who provide milk for Häagen-Dazs ice cream.

How Big is the Role of Asia Pacific in the Regenerative Agriculture Market?

The regenerative agriculture market in the Asia Pacific (APAC) region is segmented into China, India, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. In 2022, China dominated the Asia Pacific (APAC) regenerative agriculture market followed by Japan and India.

Asia Pacific is expected to experience significant growth in the market, as governments prioritize soil health and climate adaptation within national agricultural strategies. The region's high population of smallholder farmers and the vulnerability of supply chains to climate change are driving the adoption of scalable regenerative methods, with commodity sourcing programs for tea, rice, and sugar opening up market access and financing for farmers, while blended finance models supported by regional investors and development agencies help de-risk large-scale transitions.

India is poised to become the fastest-growing regenerative agriculture market in Asia Pacific, driven by its large base of smallholder farmers and a national focus on soil restoration. Government initiatives like the National Mission for Sustainable Agriculture and Paramparagat Krishi Vikas Yojana are promoting low-input, climate-resistant farming practices across millions of hectares, and the country's policy-friendly environment, innovation, and resource intensity make it a key catalyst for the region's regenerative agriculture growth.

What Factors Boost the Growth of the Market in Latin America?

Latin America, Middle East, and African (LAMEA) regenerative agriculture market is segmented into South Africa, Saudi Arabia, Brazil, North Africa, Argentina, and the Rest of LAMEA. The Latin American region is estimated to hold a considerable share of the regenerative agriculture market during the forecast period. In 2022, Brazil held the largest market share in the LAMEA regenerative agriculture market. Owing to the low literacy rate, civil war, and unfavorable economic conditions in a few African countries, the regenerative agriculture market in the African region is expected to grow at a slower rate.

Regenerative Agriculture Market – Value Chain Analysis

- Soil Preparation and Input Sourcing

The foundation of regenerative agriculture begins with natural soil enrichment, emphasizing organic inputs, such as compost, cover crops, biofertilizers, and microbial inoculants, rather than synthetic chemicals.

Key Players: Soil Capital Ltd, Pivot Bio, Symborg, Novozymes, Biome Makers - Farm Management and Cultivation Practices

This stage involves adopting regenerative techniques, such as crop rotation, minimal tillage, agroforestry, and holistic grazing, to restore ecosystem function, increase soil carbon, and improve biodiversity.

Key Players: Continuum Ag, RegenAG, Grounded South Africa, Regeneration Canada, White Oak Pastures - Data, Monitoring, and Certification

Advanced data analytics and soil monitoring platforms are used to measure soil health, carbon sequestration, and biodiversity gains. Certification programs validate regenerative outcomes and enable the issuance of carbon credits.

Key Players: CIBO Technologies, Indigo Ag, Soil Capital Ltd, Land to Market, SCS Global Services - Crop Processing and Supply Chain Integration

Regeneratively grown crops are processed into food, fiber, or raw materials for downstream industries, integrating sustainability metrics across the agricultural supply chain.

Key Players: Cargill, Inc., Danone SA, General Mills Inc., Nestlé S.A., Alter Eco Americas, Inc. - Consumer Products and Market Distribution

Consumer-facing brands market finished goods derived from regenerative sourcing, including packaged foods, beverages, and personal care products, highlighting traceability and environmental stewardship.

Key Players: Alter Eco Americas, Inc., Danone SA, Nestlé S.A., General Mills Inc., EcoFarm - Policy Support and Financial Incentives

Public agencies, NGOs, and sustainability finance institutions play a key role in funding, subsidies, and incentive programs for farmers transitioning to regenerative systems.

Key Players:Food and Agriculture Organization (FAO), International Fund for Agricultural Development (IFAD), World Bank, Rodale Institute, EIT Food

Regenerative Agriculture Market Companies

- Alter Eco Americas, Inc. — A pioneer in sustainable food sourcing, Alter Eco champions regenerative organic farming practices for cacao, quinoa, and sugar to restore soil health and biodiversity.

- Bluebird Grain Farms — Specializes in organically grown, regenerative grains like heritage wheat and emmer, promoting soil regeneration and carbon sequestration through whole-farm systems.

- Cargill, Inc. — Integrates regenerative agriculture practices across its global supply chains, investing in soil health, carbon reduction, and farmer resilience programs worldwide.

- CIBO Technologies — Provides advanced regenerative agriculture analytics through its carbon credit and soil impact platform, enabling farmers and corporations to quantify and monetize sustainability outcomes.

- Continuum Ag — Focused on soil health consulting and data-driven regenerative management, Continuum Ag helps farmers adopt profitable, sustainable practices through its TopSoil Tool.

- Danone SA — A global food leader driving regenerative agriculture in its dairy and plant-based supply chains, emphasizing soil fertility, biodiversity, and farmer livelihoods.

- EcoFarm — An agricultural network promoting education and collaboration on ecological and regenerative farming practices across North America.

- General Mills Inc. — Actively scales regenerative agriculture across millions of acres, partnering with farmers to restore ecosystems and reduce agricultural emissions in its key supply chains.

- Grounded South Africa — Develops regenerative value chains for smallholder farmers, transforming degraded land into sustainable agricultural ecosystems with market linkages.

- Nestlé S.A. — Implements regenerative agriculture programs across commodities like coffee, dairy, and cocoa to achieve net-zero emissions and strengthen farmer resilience.

Other Major Companies

- RegenAG

- Regeneration Canada

- Soil Capital Ltd.

- White Oak Pastures

Recent Developments:

- In May 2025, The PepsiCo Foundation has initiated a new programme called VivaOliva, aimed at assisting smallholder olive oil farmers in Jaén, Spain, in adopting regenerative agricultural practices. With a funding commitment of €300,000, the initiative seeks to enhance the sustainability and profitability of olive oil production.

- In April 2025, Bayer is launched its first tranche of carbon credits from thousands of Indian rice farmers adopting regenerative practices like direct seeded rice (DSR) farming. The company is working with Gold Standard, a leading registry in the voluntary carbon market, to validate, certify, and issue up to 2,50,000 tons of carbon dioxide equivalent (CO2e) credits.

- In October 2023, General Mills, Walmart and Sam's Club announced a collaboration to help accelerate the adoption of regenerative agriculture on 600,000 acres in the U.S. by 2030. Jon Nudi, Group President, North America Retail at General Mills stated , “Through this partnership, we will work hand-in-hand with Walmart and Sam's Club to help regenerate the acres of land in the key regions where we source ingredients for our shared business. We are excited by the opportunity to bring our products to Walmart shelves more sustainably, with the help of our merchants and farmer partners.”

- In September 2021, Nestlé announced to invest CHF 1.2 billion ($1.31 billion) for the next 5 years to support regenerative agriculture across the company's supply chain. Leveraging the broad network of research and development (R&D) experts, Nestlé is developing higher-yielding cocoa and coffee varieties with lower environmental impact. The company is also assessing unique solutions to decrease emissions across the dairy supply chain. For advancing regenerative farming practices, Nestlé decided to work with its food system partners, which include a vast network of 150,000 suppliers and over 500,000 farmers.

- In May 2022,global consumer goods company Unilever, global asset management and insurance company AXA, and alternative asset management group Tikehau Capital reported that they signed a Memorandum of Understanding (MoU). This Memorandum of Understanding outlines a plan to create an impact fund for scaling and accelerating the regenerative agriculture transition. These 3 companies plan to invest €100 million each and combine a unique set of financial expertise to drive the structural change.

Segments Covered in the Report:

By Practice

- Agroecology

- Aquaculture

- Biochar & Terra Preta

- Agroforestry

- No-till & Pasture Cropping

- Holistically Managed Grazing

- Silvopasture

- Others Practices

By Application

- Soil & Crop Management

- Nitrogen Fixation

- Water Retention

- Nutrient Cycle

- Biodiversity

- Operations Management

- Carbon Sequestration

- Ecosystem Services

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting