Containerboard Market Size and Forecast 2025 to 2034

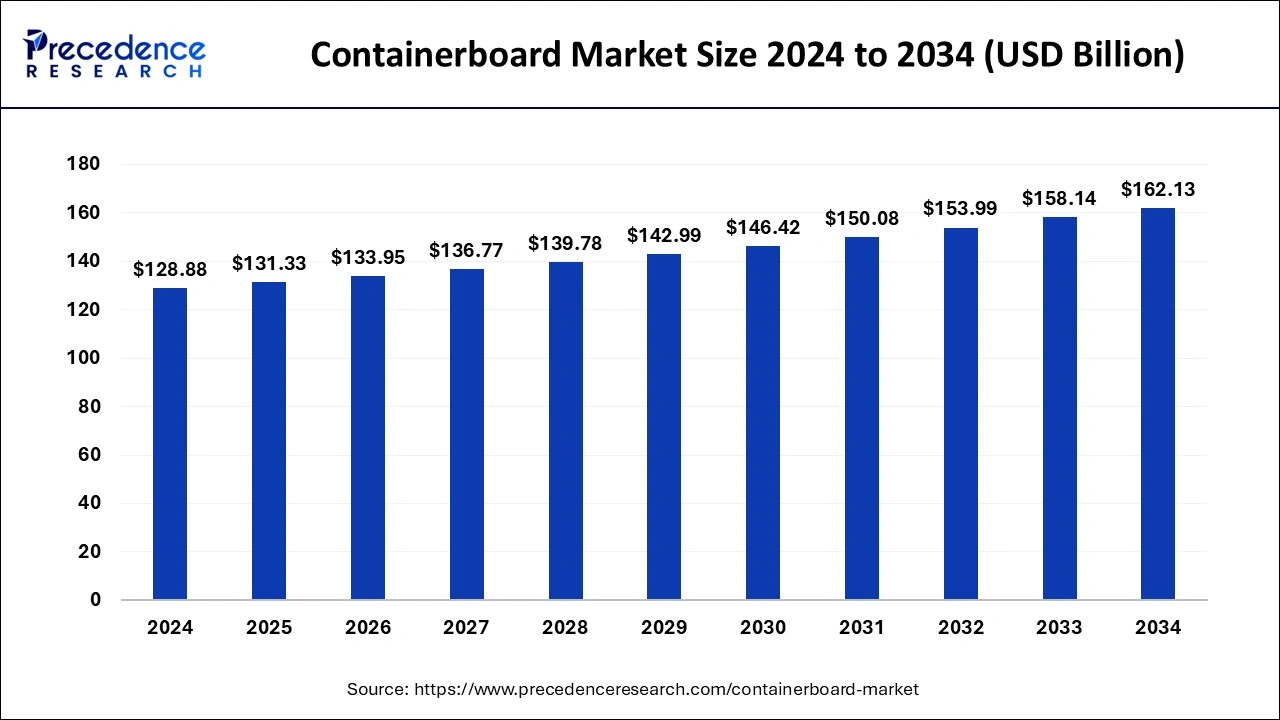

The global containerboard market size was calculated at USD 128.88 billion in 2024 and is predicted to increase from USD 131.33 billion in 2025 to approximately USD 162.13 billion by 2034, expanding at a CAGR of 2.32% from 2025 to 2034.

Containerboard Market Key Takeaways

- In terms of revenue, the containerboard market is valued at USD 131.33 billion in 2025.

- It is projected to reach USD 162.13 billion by 2034.

- The containerboard market is expected to grow at a CAGR of 2.32% from 2025 to 2034.

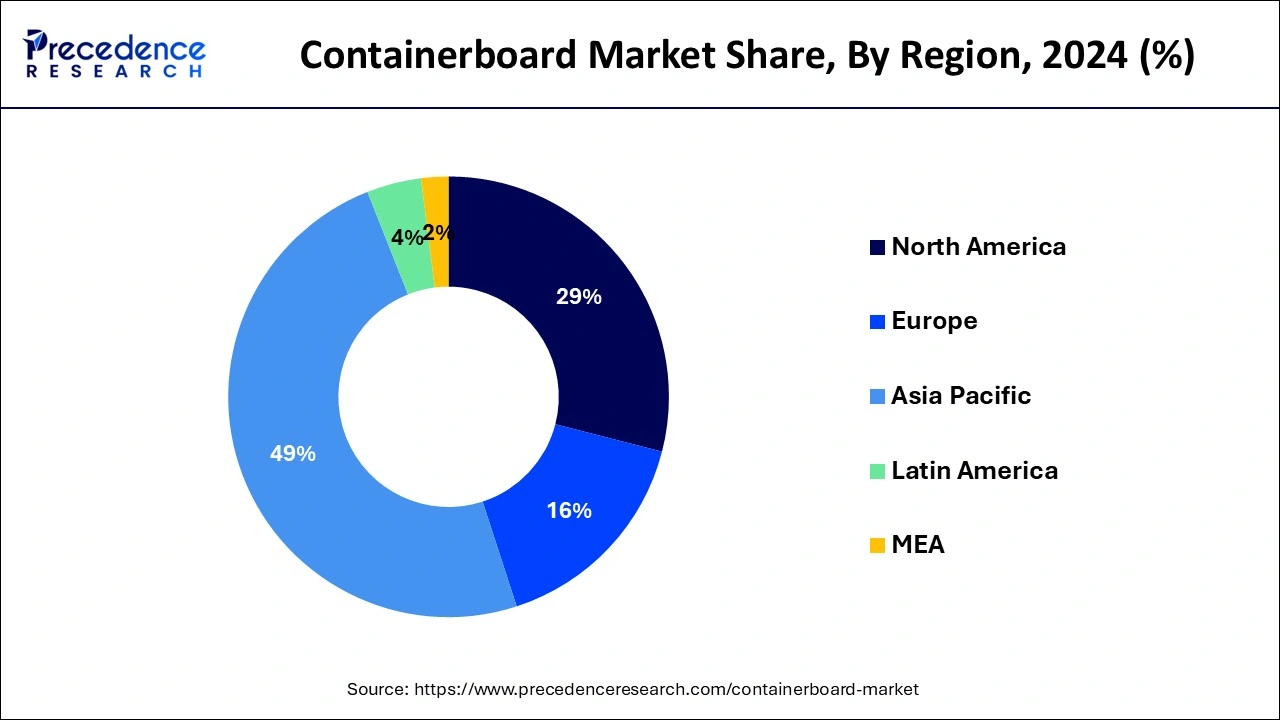

- Asia Pacific contributed more than 46% of market share in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

- By end-use, the food & beverage segment has held the largest market share of 32% in 2024.

- By end-use, the personal care & cosmetics segment is anticipated to grow at a remarkable CAGR of 3.9% between 2025 and 2034.

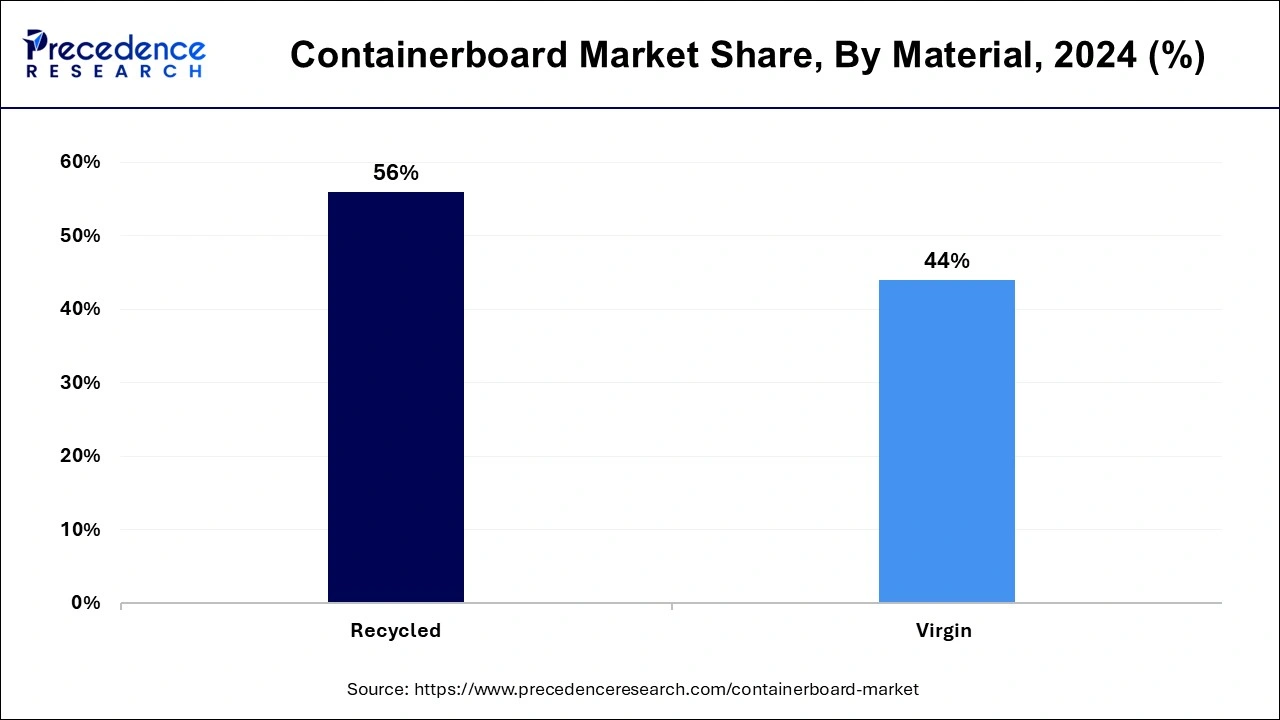

- By material, the recycled segment generated over 56.45% of the market share in 2024.

- By material, the virgin segment is expected to expand at the fastest CAGR over the projected period.

Asia Pacific Containerboard MarketSize and Growth 2025 to 2034

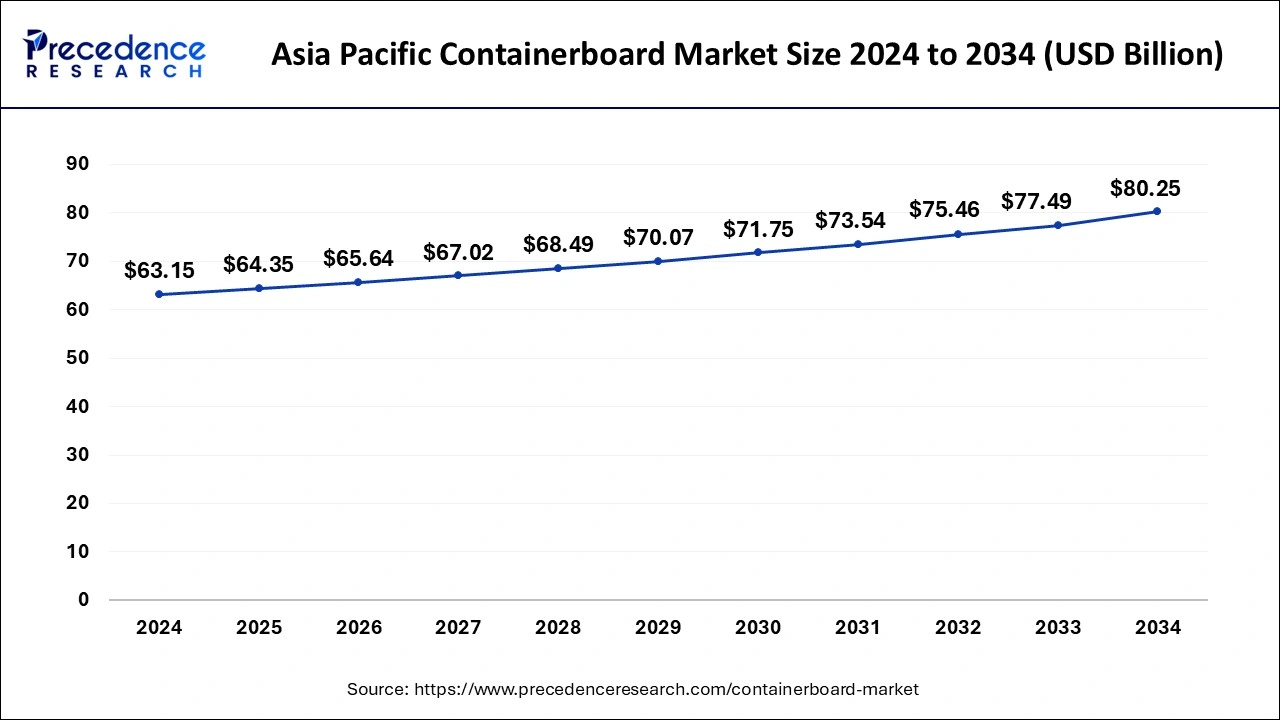

The Asia Pacific containerboard market size was exhibited at USD 63.15 billion in 2024 and is projected to be worth around USD 80.25 billion by 2034, growing at a CAGR of 2.43% from 2025 to 2034.

Asia Pacific held a dominating share of 46% in the containerboard market due to a combination of factors. Asia Pacific commands a significant share in the containerboard market due to robust industrialization, expanding e-commerce, and increasing consumer demand for packaged goods. Rapid economic growth in countries like China and India has propelled the manufacturing and packaging sectors, driving the need for containerboard. Additionally, the flourishing e-commerce landscape in the region boosts demand for reliable packaging materials. Asia-Pacific's dominance in the containerboard market is further sustained by a burgeoning middle class with rising purchasing power, fueling the consumption of packaged products.

China is a major contributor to the containerboard market. The large production capacity of containerboard helps in the market growth. The growing urbanization and growth in the e-commerce industry increase demand for containerboard. The growing middle-class population increases demand for packaged goods, fueling demand for containerboard drives the market growth. The presence of key players like Shanying International, Nine Dragons Paper, and Lee & Man Paper supports the overall growth of the market.

North America is poised for rapid growth in the containerboard market due to robust construction activities, driven by a surge in infrastructure projects and residential development. The region is experiencing increased demand for sustainable and energy-efficient building solutions, fostering innovation in materials and construction practices. Favorable economic conditions, government initiatives, and a growing focus on modernizing existing structures contribute to the optimistic outlook. With a dynamic market landscape and a heightened emphasis on resilient and eco-friendly construction, North America is positioned for significant expansion in the building materials sector.

On the other hand, Europe is experiencing substantial growth in the containerboard market due to several factors. Increased e-commerce activities, a surge in sustainable packaging demands driven by environmental awareness, and stringent regulations promoting recyclability contribute to the market expansion. Additionally, technological advancements and innovations in manufacturing processes enhance efficiency and product quality. The region's commitment to sustainable practices and the rising need for customized packaging solutions further fuel the growth of the containerboard market in Europe.

Market Overview

Containerboard is a type of paperboard specifically designed for the production of corrugated fiberboard, a crucial material in the packaging industry. Composed of multiple layers, the containerboard typically consists of an inner corrugated medium sandwiched between two flat linerboards. The corrugated medium provides strength and rigidity, while the linerboards offer a smooth surface for printing and additional structural support. Containerboard's unique composition makes it ideal for manufacturing corrugated boxes and packaging materials, widely used for shipping and storing goods.

Its versatility and durability make containerboard a key component in the packaging supply chain, providing a cost-effective and environmentally friendly solution for various industries that rely on efficient and protective packaging solutions.

Containerboard Market Growth Factors

- The surge in e-commerce has significantly boosted the demand for containerboard as online shopping becomes more prevalent. The need for durable and sustainable packaging materials is on the rise, driving the expansion of the containerboard market to meet these evolving consumer demands.

- Global trade expansion, marked by increased movement of goods across borders, is a key contributor to the growing demand for containerboard. This essential material ensures the secure packaging and protection of products during transit, aligning with the dynamics of a globalized trade environment.

- Environmental sustainability is playing a pivotal role in shaping consumer preferences towards eco-friendly packaging solutions. Containerboard, known for its recyclability and biodegradability, is gaining favor as businesses strive to align with sustainability goals and provide environmentally responsible packaging options.

- Continual technological advancements in manufacturing processes have enhanced the efficiency and quality of containerboard production. Manufacturers are leveraging advanced technologies to meet the rising demand for diverse and customized packaging solutions, fostering growth in the containerboard market.

- The trend of increasing urbanization, particularly in developing nations, is driving higher consumption of packaged goods. As urban populations grow, there is a corresponding uptick in demand for packaging materials like containerboard to cater to the needs of densely populated and consumer-oriented markets.

- Stringent regulations related to packaging materials and waste management are compelling industries to adopt sustainable and compliant solutions. Containerboard, meeting these regulatory standards and offering recyclability, is gaining traction as businesses aim to comply with environmental regulations, thereby contributing to the market's sustained growth.

Major Key Trends in Containerboard Market

- E-commerce Growth Boosting Demand: The increase in online shopping creates a need for robust, lightweight, and recyclable packaging, making containerboard an ideal choice for shipping boxes and protective packaging solutions.

- Emphasis on Sustainability and Recyclability:Environmental issues and regulations are compelling manufacturers to create recyclable containerboard products, aligning with global sustainability objectives and minimizing ecological impact.

- Innovation in Lightweight Materials: Progress in manufacturing techniques is resulting in the development of lightweight containerboard, which lowers transportation expenses and environmental footprint while ensuring strength and durability.

- Adoption of Advanced Technologies:The implementation of technologies such as nanotechnology and smart packaging improves containerboard characteristics, providing enhanced strength, durability, and interactive features for greater consumer engagement.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 131.33 Billion |

| Market Size by 2034 | USD 162.13 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use and Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Global packaging consumption

- The World Packaging Organization reports that global packaging consumption is expected to grow at an annual rate of 5.6%, boosting the demand for containerboard in packaging applications.

The rise in global packaging consumption is a key driver propelling the demand for the containerboard market. As consumer preferences shift toward more packaged goods globally, there is a significant increase in the use of containerboard. This is evident in the expected annual growth rate of 5.6% in global packaging consumption. Containerboard, with its resilient and versatile packaging capabilities, is becoming increasingly favored by industries seeking reliable solutions to protect products during transportation. With the increasing demand for packaged goods, industries are turning to containerboard for its versatile and reliable packaging capabilities.

Containerboard's ability to safeguard products during transit, coupled with its sustainability features, positions it as a preferred choice in meeting the heightened requirements of a packaging-intensive global market. The burgeoning demand for containerboard is intricately linked to the escalating need for effective and sustainable packaging solutions in response to the expanding landscape of global packaging consumption.

Restraint

Digitalization impact on paper usage

The increasing trend toward digitalization poses a restraint on the market demand for the containerboard industry. As more aspects of communication and documentation transition to digital platforms, there is a consequential decrease in the demand for traditional paper usage. Businesses and consumers alike are adopting digital alternatives for various purposes, such as online advertising, electronic communication, and document storage. This shift in preference towards digital mediums diminishes the demand for printed materials and, consequently, impacts the requirement for containerboard in packaging applications.

The containerboard market faces the challenge of adapting to changing consumer habits influenced by digitalization. While packaging remains crucial, especially for e-commerce, the overall reduction in traditional paper usage due to the rise of digital platforms can hinder the growth of the containerboard market. Industry players must navigate this trend by exploring innovations, emphasizing the sustainability of paper-based packaging, and diversifying product offerings to remain resilient in the evolving market landscape.

Opportunity

Rising middle-class consumers

The growing number of middle-class consumers worldwide is opening doors for the containerboard market. As more people join the middle-income group, their increased purchasing power leads to a rise in buying packaged goods. This surge in consumer demand, particularly in emerging markets, provides a prime opportunity for the containerboard industry to cater to the packaging requirements of a growing middle-class population.

The Containerboard industry can capitalize on this opportunity by offering packaging solutions that align with the preferences of middle-class consumers, such as aesthetically pleasing and functional packaging. Additionally, the demand for packaged goods extends beyond basic necessities, encompassing a variety of consumer products, further driving the need for innovative and versatile packaging materials like containerboard to meet the evolving demands of this expanding demographic.

End-use Insights

The food & beverage segment had the highest market share of 32% in 2024. In the containerboard market, the food and beverage segment refers to the utilization of containerboard in packaging materials for the food and beverage industry. This includes corrugated boxes and cartons designed to safeguard and transport food products. A notable trend in this segment is the increasing demand for sustainable and eco-friendly packaging solutions, aligning with consumer preferences. Containerboard, with its recyclable and biodegradable properties, meets these demands, making it a popular choice for environmentally conscious food and beverage manufacturers aiming for sustainable packaging practices.

The personal care & cosmetics segment is anticipated to expand at a significant CAGR of 3.9% during the projected period. The personal care and cosmetics segment in the containerboard market refers to the packaging of beauty and grooming products. This includes items like skincare, haircare, and cosmetic products. A notable trend in this segment involves the increasing demand for sustainable and aesthetically pleasing packaging. Manufacturers are adopting eco-friendly containerboard options and incorporating innovative designs to enhance the visual appeal of personal care and cosmetic products. This aligns with consumer preferences for environmentally conscious choices and visually attractive packaging in the beauty and grooming industry.

Material Insights

The recycled segment held a 56.45% revenue share in 2024. In the containerboard market, the recycled segment refers to containerboard products manufactured using recovered paper fibers. This sustainable approach aims to reduce environmental impact by utilizing recycled content in packaging. A notable trend in the recycled segment involves an increasing preference for eco-friendly packaging solutions. Businesses are opting for recycled containerboard to align with sustainability goals and respond to growing consumer awareness. This trend reflects a broader industry shift towards incorporating recycled materials, contributing to the environmentally responsible evolution of the containerboard market.

The virgin segment is anticipated to expand fastest over the projected period. In the containerboard market, the virgin segment refers to containerboard produced using entirely new and unused paper fibers. This segment emphasizes high-quality packaging materials, offering enhanced strength and printability. Current trends in the virgin segment include a focus on sustainability through responsible sourcing of raw materials and eco-friendly production processes. As consumer preferences shift towards environmentally conscious products, containerboard manufacturers in the virgin segment are increasingly adopting practices that align with sustainability goals, contributing to the overall evolution of the containerboard market.

Containerboard Market Companies

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- Nine Dragons Paper Holdings Limited

- Georgia-Pacific LLC

- Oji Holdings Corporation

- Lee & Man Paper Manufacturing Ltd.

- Packaging Corporation of America

- Svenska Cellulosa AB (SCA)

- Rengo Co., Ltd.

- Pratt Industries, Inc.

- Siam Cement Group Packaging (SCGP)

- KapStone Paper and Packaging Corporation

Recent Developments

- In July 2024, PG Paper formed a partnership with Opal to launch the Opal containerboard range to the UK market. The new range consists of a lighter and unique shade of virgin kraft liner board with a smooth & bright surface. It is ideal for high-quality professional printing with testliner grade and 100% recycled fluting. The fluting and recycled testliner are manufactured at Botany Mill in the outer Sydney area and KLB at Maryvale Mill in South East Australia.

- In February 2025, Mondi and Zwiesel developed containerboard packaging for glassware. The outer layer of the pack is made up of 190g uncoated containerboard paper and embossed with silver foil accents & Zwiesel Glas logo. The pack is produced at the Mondi Grunburg corrugated solutions plant, and the packaging is created for Zwiesel Glas' handmade collection.

- In May 2024, Mondi invested 200 million euros in an Italian recycled containerboard mill. The mill is capable of producing 420000 tonnes of recycled containerboard for packaging. The mill lowers greenhouse gas emissions by strengthening the supply chain and lowering transport distance. The investments aims to build stakeholder partnerships, economic development, and job opportunities.

- In April 2024, Saudi Arabia's MEPCO approves $ 475 mln for the construction of a new phase of the containerboard project. The PM5 construction consists of 450000 tonnes of production capacity of containerboard. The project is expected to be completed in 2027 fourth quarter and production will begin same time.

- In May 2025, Smurfit Westrock announced the closure of its containerboard facility in Forney, Texas, leading to 200 job losses. This move is part of a wider strategy to adjust operational capacities and manage costs. Nonetheless, the company continues to invest in renewable energy projects in Texas, indicating a commitment to sustainable practices.

- In December 2024, International Paper saw a 62% increase in stock value following Andrew Silvernail's appointment as CEO. The company revealed the closure of five box plants and a pulp mill to enhance operational efficiency. Furthermore, acquiring DS Smith is anticipated to substantially boost EBITDA, indicating a significant shift in strategy and growth prospects.

- In June 2024, UK-based packaging firm Mondi launched ProVantage SmartKraft Brown and White, cutting-edge containerboard grades that blend fresh and recycled fibers. The upper layer delivers strength and print-quality, while the lower layer comprises entirely recycled fiber, fulfilling diverse packaging requirements without sacrificing quality or sustainability.

- In August 2021, SCGP (Siam Cement Group Packaging) successfully acquired a 75% stake in Intan Group, a leading corrugated container manufacturer in Indonesia. This strategic move aimed to strengthen SCGP's presence in the ASEAN market, providing a comprehensive range of manufacturing, supply chain, and packaging development services from upstream to downstream.

- In January 2021, Mondi, a global packaging and paper company, acquired a substantial 90.38% stake in Olmuksan International Paper Ambalaj Sanayi ve Ticaret A.Ş from International Paper. With a total consideration of USD 74.9 million, this acquisition positions Mondi to achieve operational improvements and exploit paper integration opportunities, leveraging its expertise and global portfolio of virgin and recycled paper products.

Segments Covered in the Report

By End-use

- Food & Beverage

- Personal Care & Cosmetics

- Industrial

- Others

By Material

- Virgin

- Recycled

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting