What is the Contract Lifecycle Management Software Market Size?

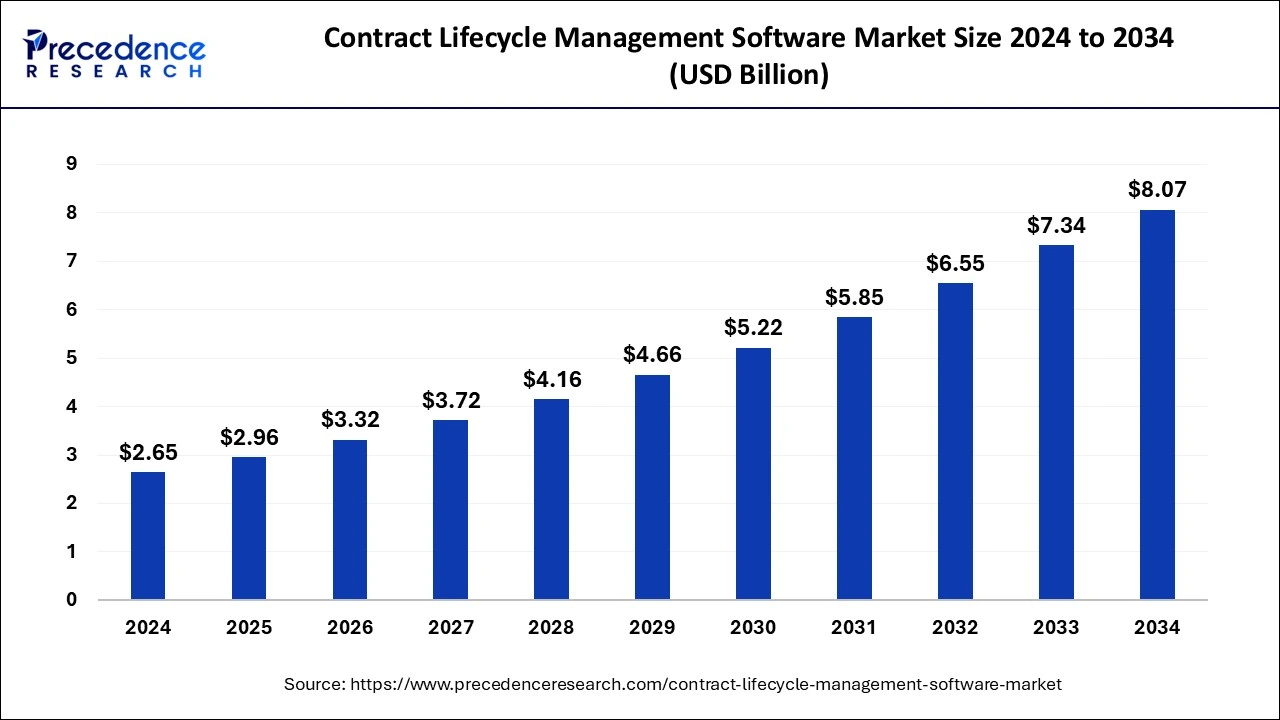

The global contract lifecycle management software market size accounted for USD 2.96 billion in 2025 and is anticipated to reach around USD 8.84 billion by 2035, expanding at a CAGR of 11.56% from 2026 to 2035.

Contract Lifecycle Management Software Market Key Takeaways

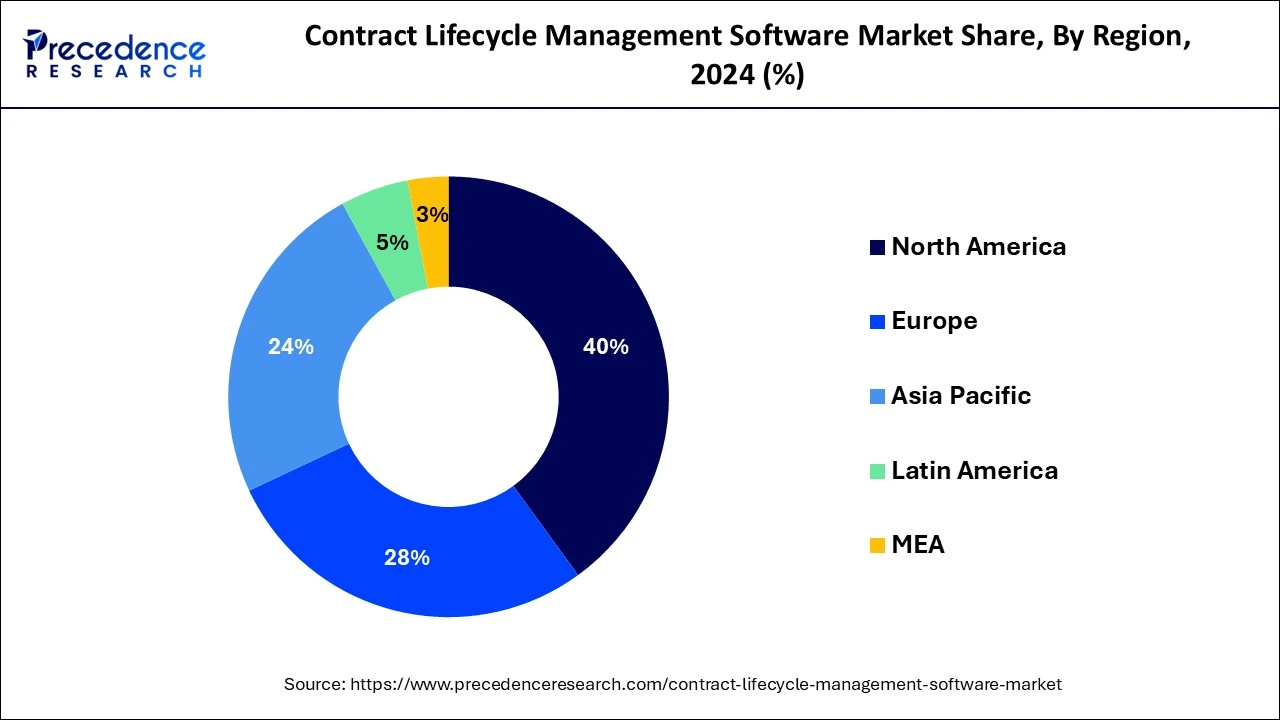

- North America hdominated the global market with the largest market share of 40% in 2024%.

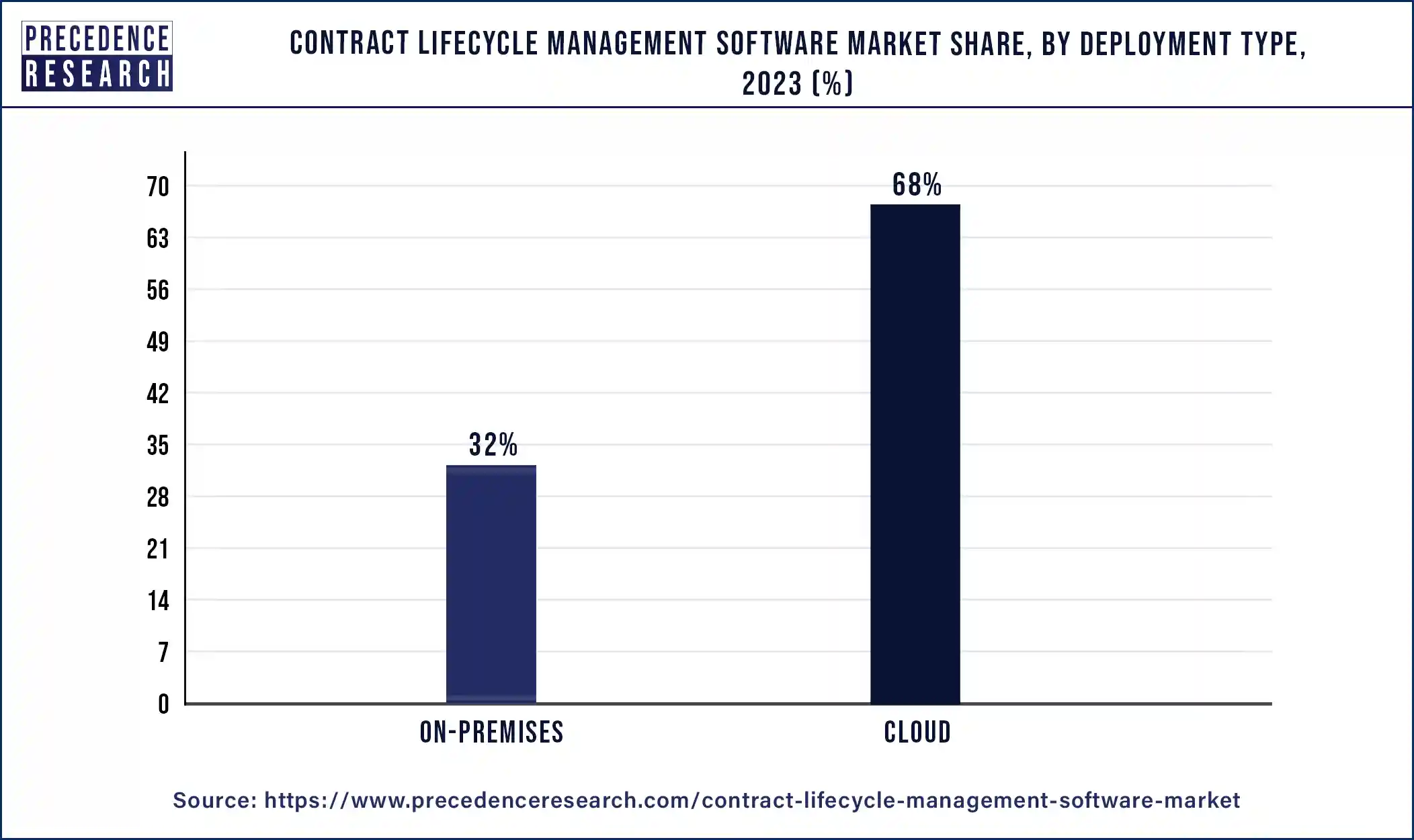

- By deployment model, the cloud-based segment contributed the highest market share in 2024.

Market Overview

Nearly 25% of the market for contracts is devoted to contract lifecycle management. Every part of a contract is managed and tracked for compliance, performance, and other success criteria using agreement lifecycle management. A contract is managed through each stage of its lifecycle via a contract lifecycle management solution. Due to the rising adoptive parents of cloud-based agreement management solutions, enterprise agreement lifecycle management applications, contract automation systems, and cloud-based agreement revision control applications, among many others, the demand for service agreement lifecycle management remedies is anticipated to experience a significant increase during the forecast period.

All procedures connected to a contractual agreement's life cycle are included in contract lifecycle management. Keeping organized throughout the whole contract lifecycle is made possible by regulations, audits, and analyses of contracts. Additionally, effective document management systems and responsibility and risk and compliance solutions assist any firm to save time and money. With the growing demand for cloud-based contractual lifecycle management systems for better security, limitless data storage, and accessibility to this data stored from wherever the market for contractual lifecycle management is gradually expanding. Additionally, the suppliers of contract lifecycle management offer a range of business services such as legally binding contract administration, contractual analytics, and CLM technology that enable users to streamline the procedure and meet client expectations.

Contract Lifecycle Management Software Market Growth Factors

One of the main causes influencing the adoption of CLM technology to reduce risks, create a stronger framework for compliance management, and improve customer experience is the growing complexity of corporate operations. Furthermore, self-service contract writing, management of templates and pre-approved alternate provisions, and real-time cooperation for a quicker contract turnaround are all benefits of cloud-based CLM software, which is rapidly gaining popularity in small and medium-sized businesses. To facilitate and manage contract talks, secure attachments, and emails and lower compliance risk through automated contract approval processes, it also provides configuration management and comparison capabilities.

In addition, the integration of artificial intelligence (AI), IoT, computer vision, and voice control capabilities offer high efficiency and accuracy while removing the risks connected to contract expiration. This is expected to present attractive growth prospects to major market players within the industry, especially given the growing emphasis of many organizations on large-scale cooperation to handle frequent changes in their industries.

Market Outlook

- Industry Growth Overview: The contract lifecycle management (CLM) market continues to grow steadily, as organizations are looking at increasing volumes of contracts and complexities with regulatory compliance across the globe. Companies desire to have better visibility into their contracts, reduce risk, and create operational efficiencies from their contracts.

- Sustainability Trends: Organizations are deploying contract lifecycle management software to decrease the amount of paper used by providing the ability to digitally approve contracts and provide for the inclusion of Environmental, Social, and Governance (ESG) clauses, thereby supporting sustainability efforts in addition to creating improved transparency and audit readiness.

- Global Expansion: Multinational corporations use CLM solutions to manage contracts in multiple jurisdictions, manage multiple languages for compliance purposes, and adhere to jurisdiction-specific regulations via a centrally located cloud-based contractual governance system.

- Startup Ecosystem: Innovative start-ups are developing AI-driven clause intelligence, predictive risk scores, and no-code CLM solutions; thereby creating a highly competitive environment and driving innovation in both the mid-market and enterprise sectors.

Contract Lifecycle Management Software Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 11.56% |

| Market Size in 2025 | USD 2.96 Billion |

| Market Size in 2026 | USD 3.32 Billion |

| Market Size by 2035 | USD 8.84 Billion |

| Base Year | 2024 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Type, Organization Size, Business Function, and Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

- Need to streamline processes promoting the use of CLM technology - To obtain similar agreements from the collection for reference purposes, attorneys can use CLM software. These contracts can be viewed digitally in formats including PowerPoint, Microsoft Word, and Excel. This expedites the evaluation procedure and makes it possible for businesses to find systemic faults. Additionally, this software enhances the effectiveness and transparency of organizational control and reporting procedures, enabling businesses to enforce compliance with regulatory authority's requirements.

- Cloud-based CLM computer's growth - Moreover, as cloud-based CLM software becomes more prevalent, interest in this solution is increasing across all industry sectors since it offers a user-friendly interface, seamless communication with well-known CLM solutions, dynamic system clearances, and significantly lower total costs. Additionally, it helps companies reduce infrastructure expenditures related to contract management.

- Increased transparency of the contract for the parties - The necessity for a coordinated partnership in managing projects and partnerships has become more critical as a result of greater globalization since it improves contractual visibility for all parties. To comply with the quick changes in their sectors, businesses are developing extensive alliances, which are anticipated to drive the CLM industry.

Key Market challenges

Any company can have its reputation damaged by CLM errors - There are numerous options available in the present day for contract management software. Of course, there isn't a "one size fits all" CLM option for every agency or company. Customers, business associates, and appropriate authorities all want businesses to handle contracts carefully and responsibly. Institutions like government entities are now held to a stricter standard than ever before whenever it comes to agreements. Any business or organization can have its reputation damaged by even minor CLM mistakes. Contract performance must be monitored over time since contracts may perform poorly or get stale. Any CLM process should provide specialized contractual reporting based on predetermined criteria. You and your organization might benefit from being able to generate contract reports depending on factors like transaction fees, business regions, or even the durations of renewal terms.

Key Market Opportunities

Automate structured and planned processes - large companies are increasingly utilizing contractual lifecycle management because it allows them to manage planned and specified processes. Additionally, it appears that major organizations engage in more collaborations and other operations annually than do small and medium-sized companies. The implementation model predicts that the market for on-premise agreement lifecycle management might well grow rapidly through 2033 due to the inherent advantages of the model, including the ability to handle everything internally, control placed above a white safety and backup systems, delivered an exceptional adherence, and avoid yearly advertising costs.

Segment Insights

Component Insights

For reference, CLM software enables lawyers to locate similar contracts in the library that may be visually viewed in Microsoft Word, PowerPoint, and Excel formats. This shortens the evaluation process and makes it possible for businesses to find systemic flaws. This software enables firms to enforce compliance with laws put in place by governmental bodies and also delivers transparency and efficiency in reporting procedures and management controls. The need for this solution is also being fueled by the development of cloud-based CLM technology across a variety of industries since it offers a user-friendly interface, seamless interaction with well-known CLM systems, supports dynamic process approvals, and substantially lowers total costs.

Additionally, it aids businesses in minimizing infrastructure expenditures associated with contract administration. Rapid globalization has made it imperative to take a collective approach when managing projects & joint ventures since it improves contract visibility for all parties involved. Because of this, businesses are starting extensive collaborations to deal with ongoing changes in their industries, which is anticipated to have a favorable impact on the CLM market.

Deployment Type Insights

In 2025, the cloud-based market category held the most market share. The license and subscription sector will continue to rule the worldwide contractual lifecycle management software industry in 2023 based on CLM offerings.

The small and medium-sized segment is anticipated to hold the largest market share depending on enterprise size. In terms of region, North America controlled most of the share of the market in 2025.

Organization Size Insights

Small and medium-sized businesses are defined as those with fewer than 1,000 employees. These businesses must maximize production while minimizing costs because they have a tight budget to manage their contracts. To optimize their agreements, these businesses need a solution that is both affordable and effective. Compared to huge corporations, SMEs manage a smaller number of contracts. As a result, there is a dearth of aggressive contract management because contracts can be delayed with little to no cost. SMEs can supervise the contracts manually and save money on software expenditures if there are only a few contracts.

The number of new agreements will increase over time, while the conditions of current contracts will change or they will close out. And this is the point at which the risks connected to an SME's contracts begin to quickly increase. For small and medium-sized businesses, the use of contract management solutions is anticipated to increase managing risk, reduce administrative costs, lower the cost of complying, and produce positive business outcomes.

Vertical Insights

Hospitals manage a huge number of contracts, each of which is subject to a different set of compliance requirements and performance criteria. Hospitals that employ smart contract management systems streamline their processes, saving time and reducing the possibility of missing any crucial tasks. Software for managing contracts has significantly advanced technologically over the years. In terms of patient personal confidentiality and security, the most recent contract administration software on the market complies fully with HIPAA as well as other international regulations. This is encouraging hospitals to use contract management systems.

One of the primary areas for cutting healthcare expenses is the efficient handling of important contract agreements, patient information, and databases with minimal human labor. Furthermore, it is more crucial than ever for healthcare businesses to handle their contracts and papers efficiently and productive efficient and productive manner due to unforeseen costs associated with errors & denials, fines related to data breaches, and lawsuits.

Regional Insights

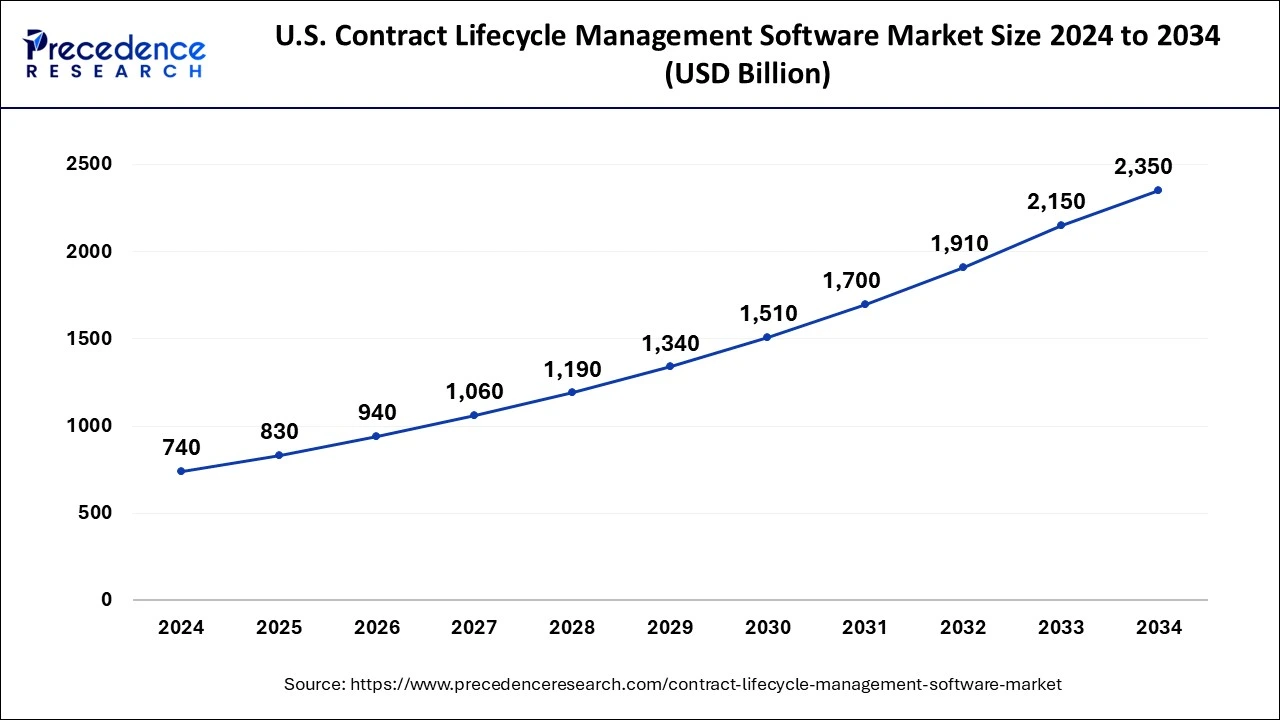

What is the U.S. Contract Lifecycle Management Software Market Size?

The U.S. contract lifecycle management software market size surpassed USD 830 million in 2025 and is expected to be worth around USD 2,577 million by 2035, growing at a CAGR of 12% from 2026 to 2035.

In 2025, the market for contract management software is mostly driven by North America in 2025. One of the main factors influencing the expansion of the North American market is the existence of prominent players in the region, including Coupa, Apttus, Docusign, Icertis, Zycus, etc. Players in the contractual management system industry in this area make significant R&D investments. For instance, Coupa invested almost 62 million USD, or 23.7% of its annual revenue, in research & development in 2018. Additionally, the BFSI, IT, and healthcare sectors in North America are well established, which gives a big opportunity for such providers of contract management solutions.

Organizations in North America are required to keep a systematic record of their contracts. These firms can increase the openness of their construction contracts by putting in place clear policies and employing simple technologies. Additionally, supportive laws like the Healthcare Insurance Protection & Accounting Act (HIPAA) encourage the use of contractual software solutions in the area.

Europe: Regulation-Driven Adoption of CLM

The European market is reaping the benefits of significant data protection legislation, and there is a significant need for compliance automation and the complexities of cross-border trading. GDPR-compliant contract management and audit-ready workflows are very high on the enterprise's list of priorities. Germany is the fastest-growing country as a result of digitising manufacturing and a concentration on legal-tech-related companies.

Latin America: Digital Transformation Impacting CLM Adoption

The increasing digitisation of enterprises, improvement of cloud infrastructure, and growing legal standardisation are causing a significant increase in CLM adoption across Latin America, with a particular emphasis on larger corporates and financial institutions. Brazil is the fastest-growing country due to increased SaaS adoption and changes to corporate governance.

Middle East & Africa (MEA): Enterprise Modernisation Fuelling Demand

There is a rapidly increasing demand for CLM across the MEA region, driven largely by smart government initiatives, government infrastructure projects, and enterprise modernisation efforts, where a strong preference for cloud-based solutions exists. The United Arab Emirates is the fastest-growing country due to the digitization of law, multinational presence, and a high level of investment in the enterprise software ecosystem.

Value Chain Analysis of the Contract Lifecycle Management Software Market

- Platform Development & Core CLM Architecture: The platform development and core CLM Architecture stage focuses upon creating scalable CLM solutions for contract creation, version control, clause libraries, AI-based risk evaluation, and compliance tracking.

Key Players: Icertis, SAP, Oracle, and Agiloft. - Integration, Customization & Deployment Services: The Integration, customization, and deployment services stage of CLM solutions is integrated with ERP, CRM, procurement, and legal systems, thus providing complete end-to-end visibility.

Key Players: DocuSign, Coupa Software, and Conga. - Post-Implementation Support, Analytics & Optimization: The post-implementation support, analytics and optimization stage provides continuous value by using performance analytics, creating contract intelligence dashboards, providing information about current regulations, and optimizing processes.

Key Players: Ironclad, Sirion, and Evisort.

Contract Lifecycle Management Software Market Companies

- Agiloft Inc.

- Apttus

- ASC Networks Inc.

- Aurigo

- BravoSolution SPA,

- CLM Matrix

- CobbleStone Software

- Concord

- Conga

- Contracked BV,

- Contract Logix, LLC

- Corcentric LLC

- Coupa Software Inc.

- Determine (Corcentric, LLC)

- DocuSign, Inc.

- ESM Solutions Corporation,

- GEP

- Great Minds Software, Inc.

- IBM Corporation

- Icertis, Inc.

- I Contracts, Inc.

- Infor

- Information Services Group, Inc.

- Infosys Limited

- Ivalua Inc.

- Jaggaer

- Koch Industries, Inc.

- Model N, Inc.

- Newgen Software Technologies Limited

- Optimus BT, Inc.

- Oracle Corporation,

- SAP SE

- SecureDocs, Inc.

- SpringCM

- Symfact AG,

- Synertrade (Econocom Group)

- Trackado

- Ultria

- Wolters Kluwer N.V.

- Zycus Infotech Private Limited

Recent Developments

- Coupa finalized the acquisition of Exari, one of the top contract management companies, in May 2019. The capabilities of Coupa's contracts management solution were improved by this acquisition. Coupa's contractual management services now include features for contract authoring, collaboration, and research, among other improved capabilities.

- DocuSign Gen, a contract extension management solution that DocuSign & SpringCM jointly created in September 2018, enables Salesforce customers to simplify, automate, and expedite the production of agreements like sales contracts, quotations, and nondisclosure contracts.

- One of the top CLM, cloud-based documentation creation software suppliers, SpringCM, was bought by DocuSign in Sept 2018. The company's range of contract management solutions was strengthened by the purchase.

- Microsoft and Icertis worked together in June 2019 to improve the blockchain-based contractual products. Using the Icertis Blockchain Framework, it is possible to track contractual obligations and needs. By integrating the Microsoft Azure Diamond Workspace for the ICM platforms, this relationship will assist Icertis in extending blockchain technology to contractual administration.

- Volkswagen, a German automaker, collaborated with Minespider & Icertis to develop a blockchain trial in April 2019 to follow the lead production process for its batteries from the place of origin to the manufacturing. Through this agreement, Icertis' blockchain technology would assist Volkswagen in documenting supply chain agreements to vetting outside vendors.

Segments Covered in the Report

By Component

- Software

- Services

- Consulting

- Implementation

- Support and Maintenance

By Deployment Type

- On-Premises

- Cloud

By Organization Size

- SMEs

- Large Enterprises

By Business Function

- Legal

- Sales

- Procurement

- Operations

- Others (IT, HR, and Finance)

By Vertical

- Government

- Retail and eCommerce

- Healthcare and Life Sciences

- Banking, Financial Services, and Insurance (BFSI)

- Transportation and Logistics

- Telecom and IT

- Manufacturing

- Others (Media and Entertainment, Energy and Utilities, and Education)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting