What is the Cosmetic Oil Market Size?

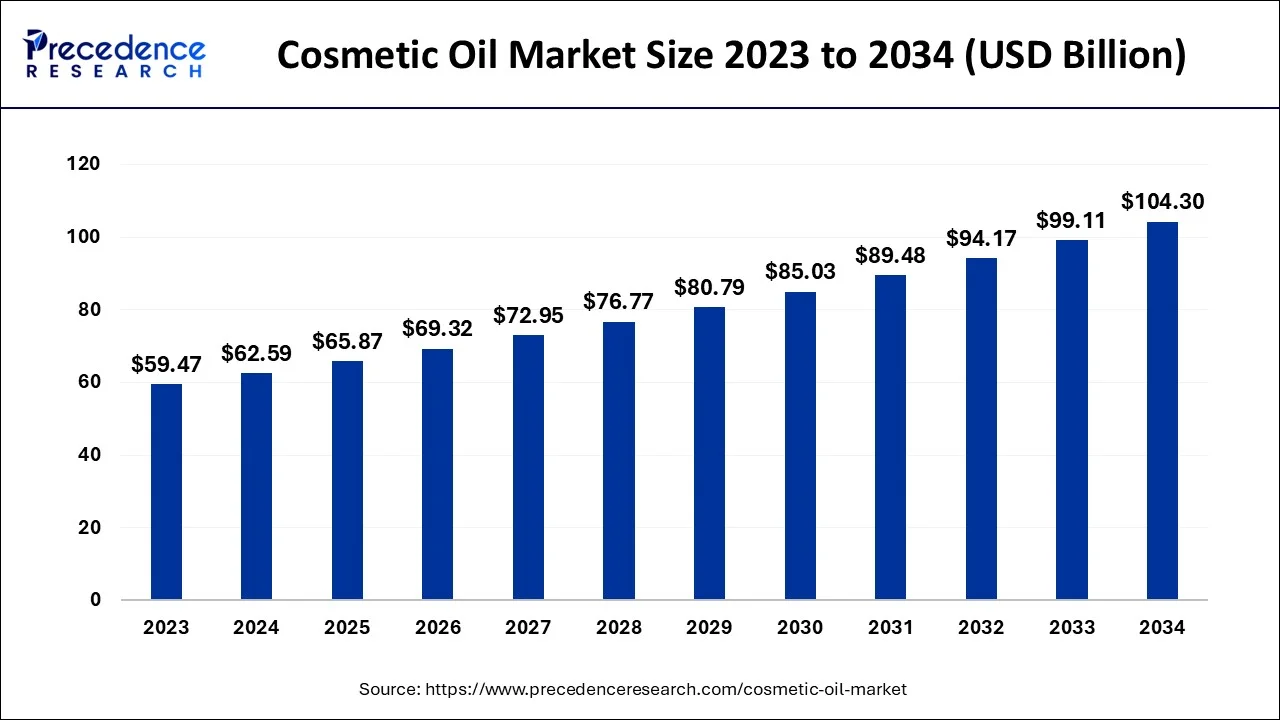

The global cosmetic oil market size is calculated at USD 65.87 billion in 2025 and is predicted to increase from USD 69.32 billion in 2026 to approximately USD 109.49 billion by 2035, expanding at a CAGR of 5.21% from 2026 to 2035.

Cosmetic Oil Market Key Takeaways

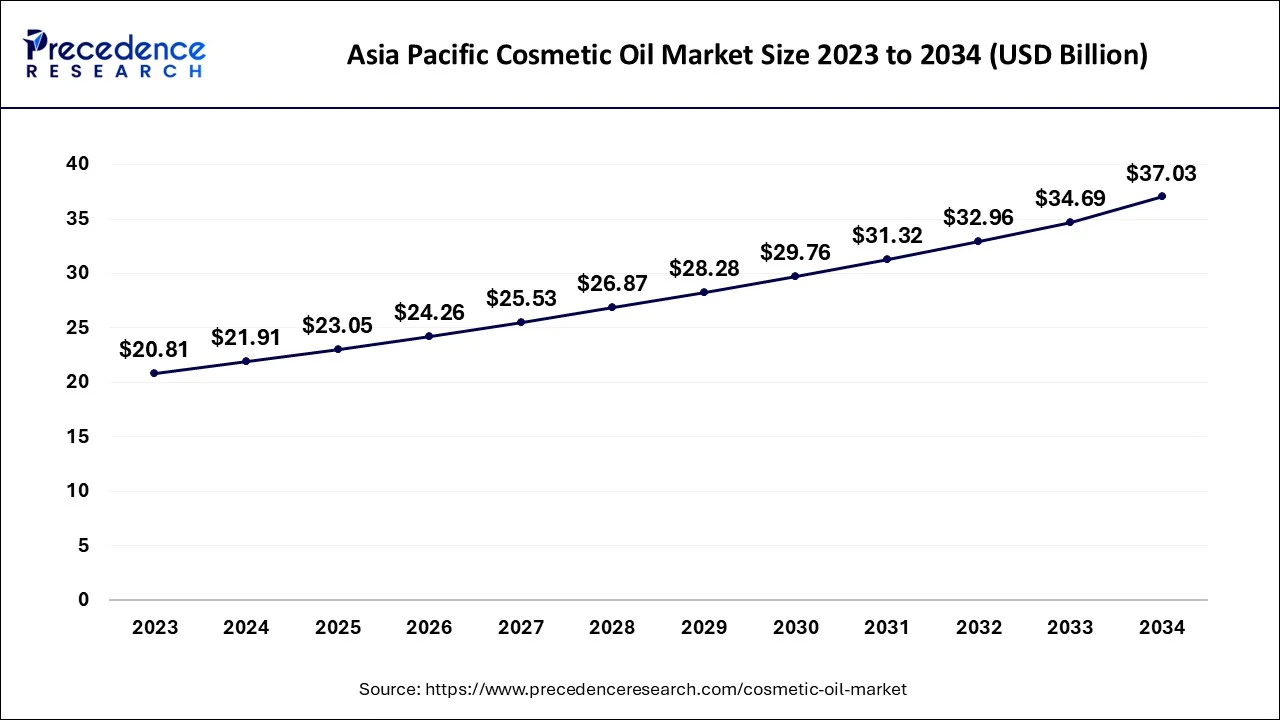

- The Asia Pacific cosmetic oil market is anticipated to expand at a CAGR of over 5.38% from 2026 to 2035.

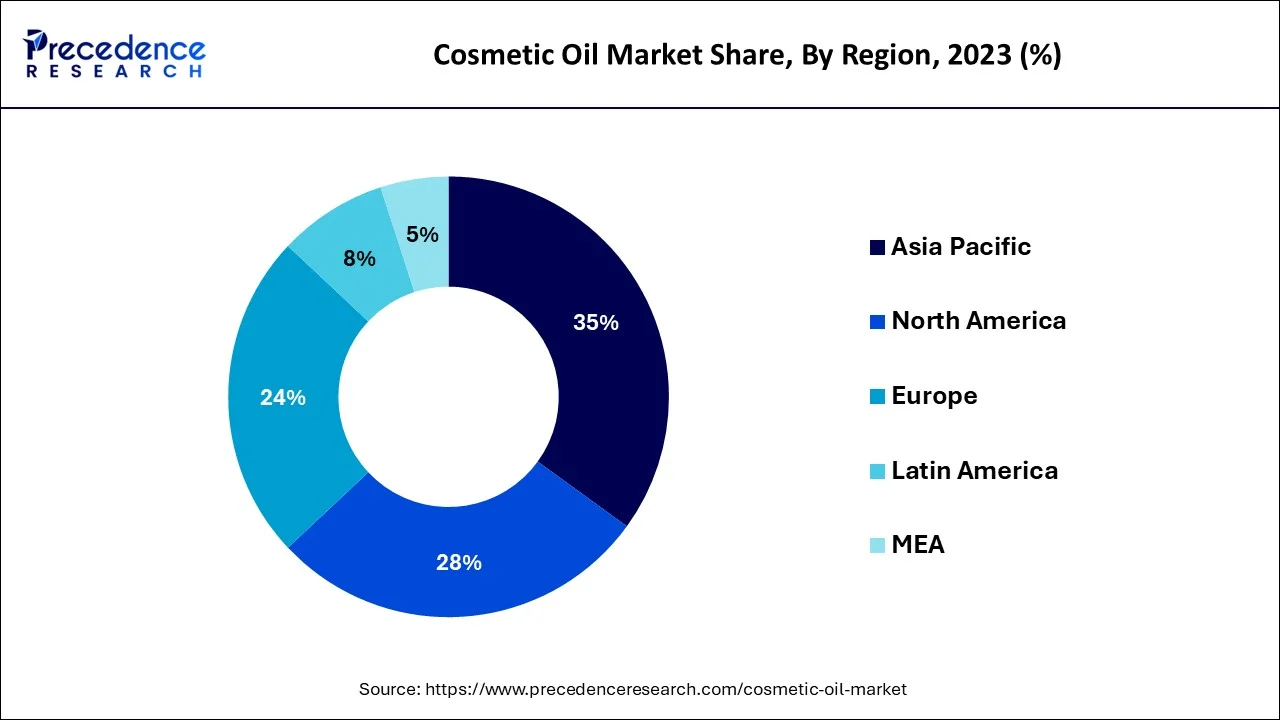

- In 2023, By geography, the North America region has accounted for the majority revenue share.

- In 2023, By source, the vegetable oil segment held the largest market share.

- In 2023, By application, the hair care segment has captured the largest market share.

Market Overview

Essential oils and carrier oils like almond and coconut oil are both used in cosmetics. In the upcoming years, demand for these oils is anticipated to be driven by a variety of qualities, including their antibacterial, moisturizing, and anti-inflammatory properties, which will subsequently support market growth. Demand is also anticipated to increase due to consumers' growing preference for organic and natural cosmetic products. In addition to lipsticks, lip balms, moisturizers, and serums, cosmetic oils are utilized in hair and skincare products such as hair, facial, and elixir oils.

Depending on the kind of skin, cosmetic oils are used for a number of purposes, including nourishing the skin and avoiding irritation and skin inflammation. At first, makers of cosmetic oils mostly targeted women, but as social media influencers proliferated and beauty awareness increased, they started to also target guys. During the projection period, it is predicted that expanding operations to other demographics would strengthen the cosmetic oil industry.

The market for cosmetic oils will see increased sales due to the rising demand for cosmetic goods as a result of people's increased awareness of outward attractiveness. Because of its inherent capacity to hydrate and nourish skin as well as to give a natural odor, cosmetic oil is utilized in cosmetic goods. During the anticipated timeframe, the expansion of men-focused beauty goods and the quick development of the gender-neutral cosmetic industry are anticipated to drive product growth.

Cosmetic Oil Market Growth Factors

Cosmetic oils provide a number of advantages, including the ability to heal sunburn, prevent dandruff, treat acne, enhance the quality of the skin, protect the skin, prevent wrinkles, and treat acne. They are also rich in antioxidants and antibacterial qualities.

- The growing natural cosmetics.

- Increasing awareness of cosmetic products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 65.87 Billion |

| Market Size by 2035 | USD 109.49 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.21% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

- Demand for natural cosmetic ingredients is growing - The growing desire for natural ingredients is driving up demand for the product. Bio-oils may replace chemical face creams and be an excellent treatment for dry skin, stretch marks, hyperpigmentation, and acne, according to recent studies. Due to growing consumer concerns about the ingredients used in cosmetics, the natural and organic cosmetics sectors are expected to experience significant growth in the years to come. By developing a variety of essential oils as well as hair and facial pressure oils, businesses like Innisfree, Farsali, Khadi, and Biotique are attempting to prosper in the cosmetic oil industry. The rise in skin issues brought on by things like pollution, hormone imbalances, genetic abnormalities, and other things are projected to boost the market need even more. Globally increasing disposable incomes will promote the expansion of the cosmetics industry, which will lead to additional growth in product demand. The cosmetic oil sector will expand as a result of the rising usage of shampoos and hair oils to treat hair loss issues.

- Internet penetration - Increased internet usage, social media marketing, and changing lifestyles are all contributing to the growth of the cosmetic oil market. Increasing marketing efforts to contact potential clients via social media platforms, for example, many companies are advertising organic and herbal oils that contain little to no toxic chemicals in them, which is an efficient approach to attracting clients. For instance, as more people have hair loss difficulties, they have started purchasing organic oils like mama earth oil, viva naturals, and others that provide a variety of oils that aid in hair development.

Key Market Challenges

- Pore blocking and contamination with toxins - Mineral oils may clog pores and increase the risk of acne and blackheads. Even the purest Mineral Oil will trap germs on the skin or use a product with extra ingredients that can clog pores, raising the possibility of breakouts. To prevent skin moisture loss, this oil creates a physical barrier on top of the skin. There are several different grades of mineral oil. Cosmetic-grade Mineral Oil, which is purer than technical grade yet has raised concerns from scientists, is used in cosmetic products. Furthermore, there is convincing evidence that Mineral Oil hydrocarbons represent the biggest threat to human health due to their absorption through the skin, food, and air.

Key Market Opportunities

- Increasing male-specific cosmetic oil opportunities - People today are more likely to use cosmetics to improve their appearance. Many issues, including hair loss, grey hair, coarse hair, and others, affect young men. With the use of the right cosmetic oil and knowledge on how to apply the right cosmetic oil to hair, all of these issues may be resolved. As a consequence, the market for cosmetic oil that caters to men's needs has a lot of space for expansion.

Source Insights

On the basis of source, the vegetable oil segment has held the largest market share in 2023. The fastest-growing segment of the market is one that may be attributed to the rising demand for vegetable oil in cosmetic applications. Due to their ability to heal and protect the skin, essential oils, avocado, almond, palm, and other types of vegetable oils are commonly used in cosmetic goods. Due to increased public awareness of its beneficial effects on the skin, vegetable oil is being utilized more commonly in cosmetics. The market share for cosmetic oils will also be encouraged by the expansion of the use of innovative vegetable oils in cosmetic goods. Vegetable oils have also received a lot of attention because of their numerous biological roles and appealing technical characteristics including simple skin absorption and remarkable spreadability.

Due to its growing use in skin and hair care products, coconut oil has the greatest market share. Due to its ability to moisturize skin, coconut oil is frequently utilized in cosmetic goods. Additionally, coconut oil cures wounds, combats acne, and treats skin diseases and infections. Additionally, the growing popularity of organic and natural certifications in cosmetics has significantly increased the demand for vegetable oils recently, driving the growth of the industry as a whole. The development of the cosmetic oil industry will be further accelerated by the increased innovation of cosmetic products using various vegetable oils.

Application Insights

On the basis of application, the hair care segment has captured the largest market share in 2023. To give the hair a shiny and smooth texture, cosmetic oil is widely used in a variety of hair care products such as hair oil, shampoos, conditioners, serums, and other hairstyle products. These oils also promote the development of hair follicles by moisturizing the scalp. Additionally, the growing significance of hair care and style in people's life has had a favorable impact on the demand for various hair care products, regardless of gender.

Regional Insights

Asia Pacific Cosmetic Oil Market Size and Growth 2026 to 2035

The Asia Pacific cosmetic oil market size is estimated at USD 23.05 billion in 2025 and is expected to be worth around USD 38.96 billion by 2035, rising at a CAGR of 5.39% from 2026 to 2035.

On the basis of geography, the North America region accounted for the majority of revenue share in 2023. Because of the increased need for inventive and multipurpose cosmetic products spurred on by changing lifestyles and busy work schedules, the market for cosmetic oils in North America is expected to grow quickly. Additionally, fresh growth potential will be created by innovation and R&D for the development of new goods, as well as the presence of large cosmetic enterprises in the area. The prevalence of early aging and hair greying, especially among young people, will cause a rise in the sale of hair care products across North America. The expansion of the cosmetic oil market over the course of the projection period will also be significantly influenced by the usage of vegetable oils in daily and personal care products.

What Makes Asia Pacific the Dominant Region in the Cosmetic Oil Market?

Over the course of the forecast period, the Asia Pacific cosmetic oil market is anticipated to expand at a CAGR of over 5.38%. The significant growth is linked to urbanization, population increase, and economic growth. Additionally, the growing production of personal care and cosmetic products in Asian nations like China and India is probably going to support market expansion in the area. More than 80% of the Asia-Pacific market for cosmetic oil is anticipated to be accounted for by China, Japan, India, and South Korea.

U.S.

The U.S. cosmetic oil market is fueled by demand for high-performance skincare and haircare oils made with botanical and specialty ingredients. Consumers prefer cruelty-free, vegan, and dermatologist-tested products. The presence of global cosmetic leaders, indie beauty brands, and digital-first marketing strategies speeds up product launches and broadens category options.

India

India is a major contributor to the Asia-Pacific cosmetic oil market because of its long-standing tradition of using oils in personal care and Ayurvedic beauty routines. Coconut, almond, castor, and herbal oils are prominent in hair and skincare products. Growing urbanization, the rise of e-commerce, and increasing demand for organic and cold-pressed cosmetic oils are fueling product innovation and boosting consumption in both mass-market and premium segments.

Why is Europe Considered a Notably Growing Area in the Market?

Europe is expected to grow at a notable rate in the cosmetic oil market. The region benefits from strict regulatory standards, high-quality manufacturing practices, and strong demand for natural and sustainable beauty solutions. Growth is driven by increasing interest in anti-aging, aromatherapy oils, and premium personal care products. European consumers prefer traceable sourcing, eco-certified ingredients, and innovative formulations in both skincare and haircare.

Germany

Germany plays a key role in the European cosmetic oil market, driven by strong demand for organic, dermatologist-tested, and eco-certified beauty oils. The country's focus on sustainability and clean formulations promotes the use of plant-based and cold-pressed oils. Additionally, Germany acts as a center for cosmetic ingredient innovation and private-label manufacturing.

Cosmetic Oil Market - Value Chain Analysis

- Extraction & Processing

Cosmetic oils are produced through methods such as cold pressing, solvent extraction, steam distillation, refining, filtration, and deodorization of plant- and seed-based oils, including argan, coconut, jojoba, almond, and essential oils. The processing aims to preserve their bioactive properties, stability, and skin compatibility.

Key Players: Croda International Plc, BASF SE, Givaudan, AAK AB. - Quality Testing & Certification

Cosmetic oils need certifications to prove purity, safety, sustainability, and compliance with regulations. Important certifications include ISO 22716 (Cosmetic GMP), COSMOS Organic/Natural certification, ECOCERT, USDA Organic, and REACH compliance for cosmetic ingredients.

Key Players: ECOCERT, COSMOS Standard, ISO (International Organization for Standardization), UL Solutions. - Distribution to End-Use Industries

Cosmetic oils are supplied to personal care and cosmetics manufacturers, skincare and haircare brands, aromatherapy producers, spa & wellness companies, and contract formulators.

Key Players: DSM-Firmenich, Vantage Specialty Chemicals, Hallstar, Oleon NV.

Cosmetic Oil Market Companies

- Vcos Cosmetics Pvt Ltd

- SOPHIM

- Bramble Berry

- Aroma Foundry

- Uncle Harry's Natural Products

- Botanic Choice

- MakingCosmetics Inc.

- A.G. Industries

- AOT Organic Products

- Marnys

Recent Developments

- In May 2022 – A brand accelerator project called Beauty Activations was launched by Symrise Cosmetic Ingredients to collaborate with North American cosmetics brands. Due to the partnership with Symrise and the Beauty Activations platform, brands will have access to detailed marketing statistics, unique formulae, and a choice of award-winning ingredients.

- In July 2024, Kérastase launched a refillable version of its Elixir Ultime hair oil, supported by the brand's first out-of-home campaign featuring Global Brand Ambassador Sydney Sweeney.

https://www.beautypackaging.com

Segments Covered in the Report

By Source

- Mineral Oil

- Vegetable Oil

By Application

- Hair Care

- Skin Care

- Lip Care

- Others

By Type

- Olive

- Almond

- Coconut

- Essential

- Others

By Industry Vertical

- Chemical and Petrochemical

- Oil and Gas

- Energy & Power

- Automotive

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting