What is Dark Store Market Size?

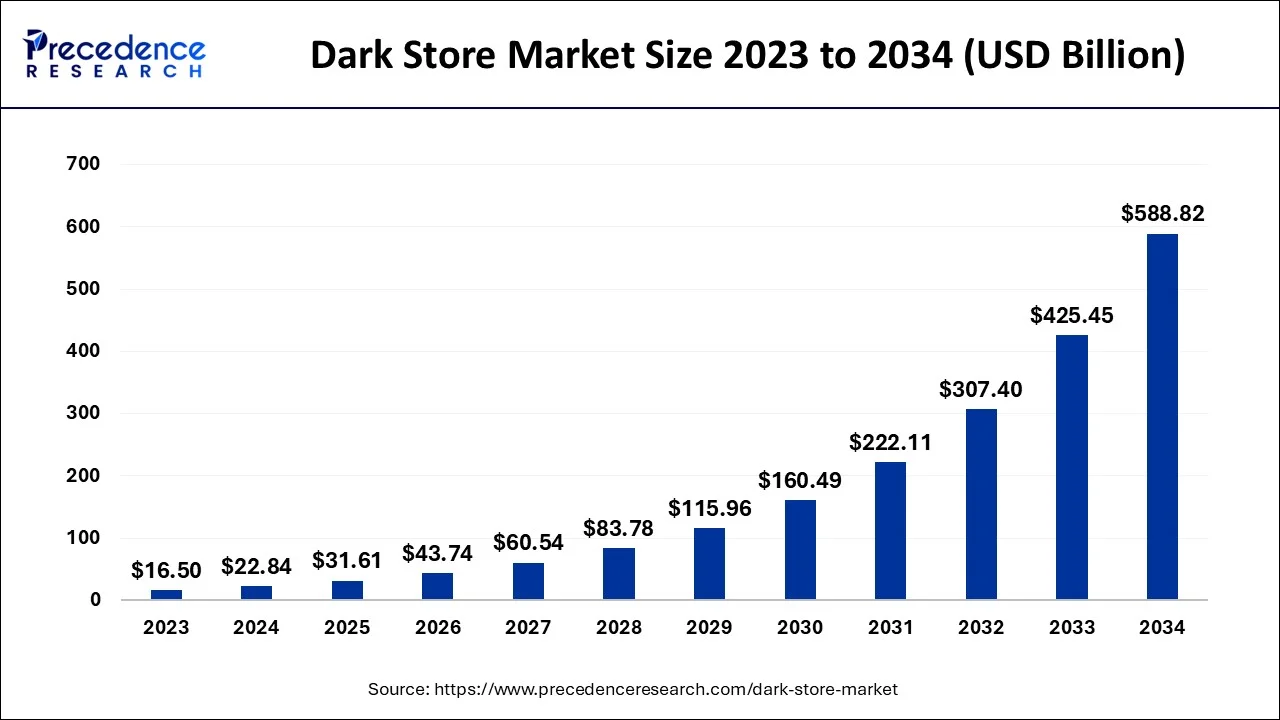

The global dark store market size accounted for USD 31.61 billion in 2025 and is anticipated to reach around USD 588.82 billion by 2034, expanding at a CAGR of 38.40% between 2025 and 2034.

Market Insights

- In terms of revenue, the market is valued at USD 31.61 billion in 2025.

- It is projected to reach USD 588.82 billion by 2034.

- The market is expected to grow at a CAGR of 38.40% from 2025 to 2034.

- North America dominated dark store market in 2024.

- By non-food product type, the pandemic segment dominated the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 31.61 Billion

- Market Size in 2026: USD 190.16 Billion

- Forecasted Market Size by 2034: USD 588.82 Billion

- CAGR (2025-2034): 38.40%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

A micro fulfillment center, with a small local store but without customers, basically dedicated to rapid online fulfillment is known as a Dark Store. The increased utilization of smartphones and easy availability of the internet boost the dark store industry. These stores mainly ship the orders directly to the convenient collection point or address specified by the customer. The Dark Stores are used for faster delivery and quick shopping. The Dark store became well-known due to the long lockdown during the COVID-19 Pandemic.

According to the collected data by Kesari Mahratta Trust, 26.1% of respondents ordered their goods frequently while the pandemic was at its worst and the lockdown was implemented, compared to 38.7% of respondents who always purchased their daily requirements from a dark store. The eCommerce saw a 43% increase between 2019-2020 almost certainly the result of the national lockdown according to U.S Census Bureau Report. The online route facilitates groceries delivery from a dark store. Order fulfillment and shipping are made simple in dark stores.

Today, a number of well-known supermarket chains across the world are experimenting with dark shops. The bulk of these stores are larger than 100,000 square feet and include specialized in-house equipment including food processing, cold press systems, slaughtering lines, etc. The typical dark stores, on the other hand, tend to be smaller in size, covering 10,000 to 20,000 square feet.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.61 Billion |

| Market Size in 2026 | USD 190.16 Billion |

| Market Size by 2034 | USD 588.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 38.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Age Group, Category,Delivery Options, Non-Food Products, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

The benefits of Dark stores involve quick and contact-free shopping, faster delivery, a larger audience, and broader reach. Along with this, there is a more extensive range of products. The dark store is the best way for improving the distribution of products and enhanced storage for many brands. Retailers will be able to start operations in new areas and countries in which they do not yet have physical operations due to this type of online business. Globally the concept of Dark stores has gone beyond the FMCG and grocery segments as per A Forbes report.

The restraints faced by the dark store market are perishability challenges. The expired products must be kept separately, the liquid must not leak and airtight containers must stay airtight at the time of delivery. The location of the dark store also plays an important role in delivery. The products must be orderly placed and easily available. Longer home delivery routes and the requirement to bring click-and-collect purchases to the shops, where additional handling expenses are also paid, result in considerably higher transportation costs.

The busy schedules of customers have led to an increase in demand for dark stores. The pandemic has led to an increase in online shopping as it is much safer. The same-day delivery requirement and new customer trends, which are more centered on the web, have encouraged firms in the industry to reinvent themselves in order to give agile and effective service, even if the majority of supermarkets still prepare orders from the shops. In addition to using autonomous carts to gather things for packers who subsequently prepare the orders for delivery, stores may also utilize robots to assemble and prepare orders.

Segments Insights

Many UK-based studies focused on the age of grocery e-commerce shoppers and 25–44-year-olds are found to be the most active group with one-third of respondents regularly engaging with e-commerce services. On the other hand, customers over 65's were the least frequent online shoppers, with just 1 in 10 respondents reporting regular e-commerce use.

In terms of value during the second quarter of 2021, online commerce accounted for 12.5% including all retail sales, according to the U.S. Census Bureau. This indicates that $12 was spent online for every $100 spent in America. Various strategies were adopted by the regional players to expand their footprints.

Products that are useful for the house include storage, batteries, home decor, and air fresheners. The growing use of rapid commerce platforms for purchasing utilities is anticipated to fuel the segment's growth. Instant grocery systems give customers instant availability and one-click access to a wider choice of items. As a consequence, customers are drawn to use these platforms frequently to buy domestic utilities due to their accessibility, which is anticipated to have a beneficial impact on the industry's growth.

A dark store strategy may also assist retailers to enhance their fulfillment strategy as the holiday shopping season draws near by continuing to offer a location where customers can pick up their purchases safely.

Age Group Insights

The global dark store is segmented into children, adults, and the elderly. According to the collected data by Kesari Mahratta Trust, it was seen that most of the respondents (42%) were between the age of 31-40 years followed by people aged above 60 years (16%) and people between 41-50 years (15.1%). Out of the total sample, 13.4% of the people were from each 18-30 years and 51-60 years. The ratio of children was minimum as access to smartphones is limited for children.

Category Insights

The global dark store is segmented into groceries, meat, and dairy. The convenient and most preferred method to buy groceries is online. The Dark store provides a wide selection of food that can be supplied at the customer's doorstep. Wide varieties of food items can be offered at a single delivery platform. This segment is differentiated on the basis of vegetarians, non-vegetarians, and Vegans. Dairy supplies are hindered due to the demand for a vegan products. The Office of National Statistics (ONS) reports that the UK's online grocery shopping share increased significantly from 5.4% in 2020 to 14.7% by February 2023.

Delivery Options Insights

The global dark store is segmented into Curbside Pickup, In-Store Pickup, and Home Delivery. Customers may conveniently pick up their orders from the curb. It often comprises of reserved parking spaces where a store representative may deliver the purchase to the consumer without asking them to get out of their car. There is typically a dedicated pickup location near the front entrance within many popular dark stores, this is in-store pickup.

Home Delivery which is rapid, easy, and contactless is advantageous to customers, especially when essential are required. We all had to reconsider our attitudes about personal safety and space as a result of the COVID-19 outbreak. Many people prefer to continue their grocery shopping online rather than standing in long ques at the supermarket. For contactless grocery purchasing, curbside pickup and delivery work perfectly.

Non-Food Products Insights

Based on non-food product type, the global dark store is segmented into body and bath products, cleansing essentials, and others. The pandemic is anticipated to support segment growth due to increased demand for cleaning products and disinfectants. Additionally, as demand for natural products like organic floor cleaners rises, customers are getting more and more aware, which is likely to enhance the market development. Quick grocery platforms provide a diverse selection of cleaning goods delivered in a few minutes; the demand is thus anticipated to increase.

Regional Insights

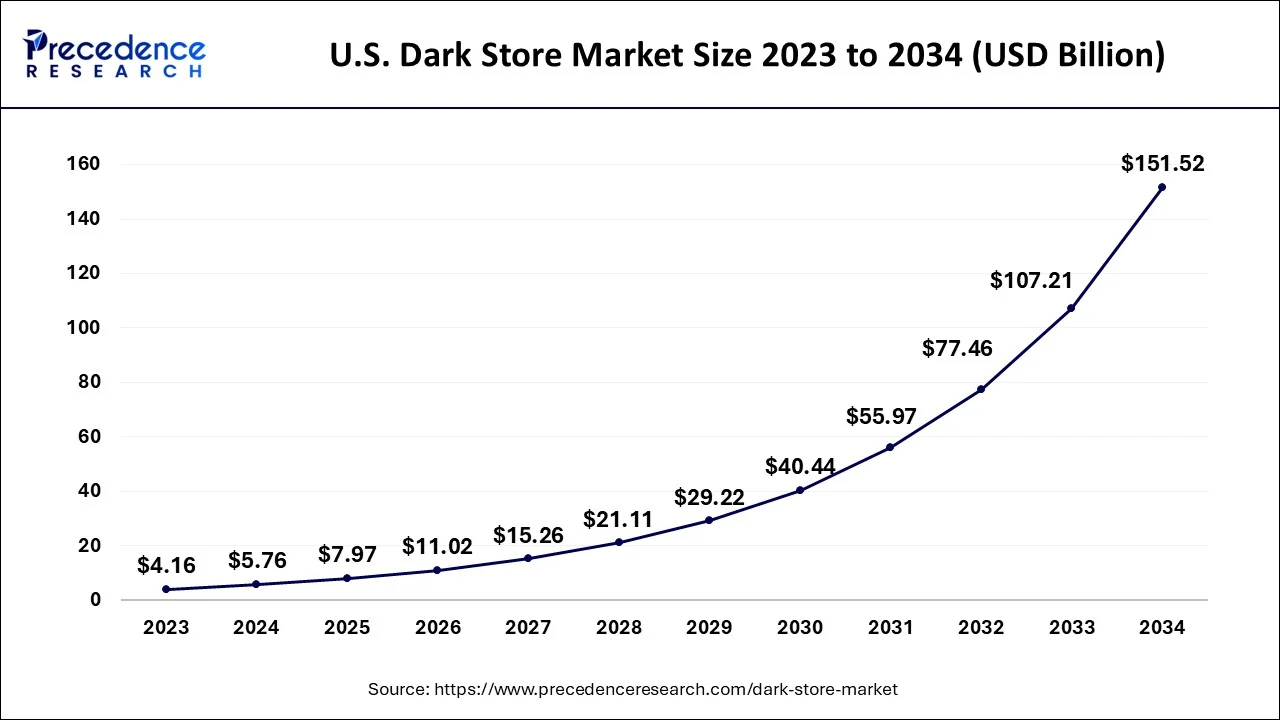

U.S. Dark Store Market Size and Growth 2025 to 2034

The U.S. dark store market size was estimated at USD 7.97 billion in 2025 and is expected to be worth around USD 151.52 billion by 2034, growing at a CAGR of 38.66% between 2025 and 2034.

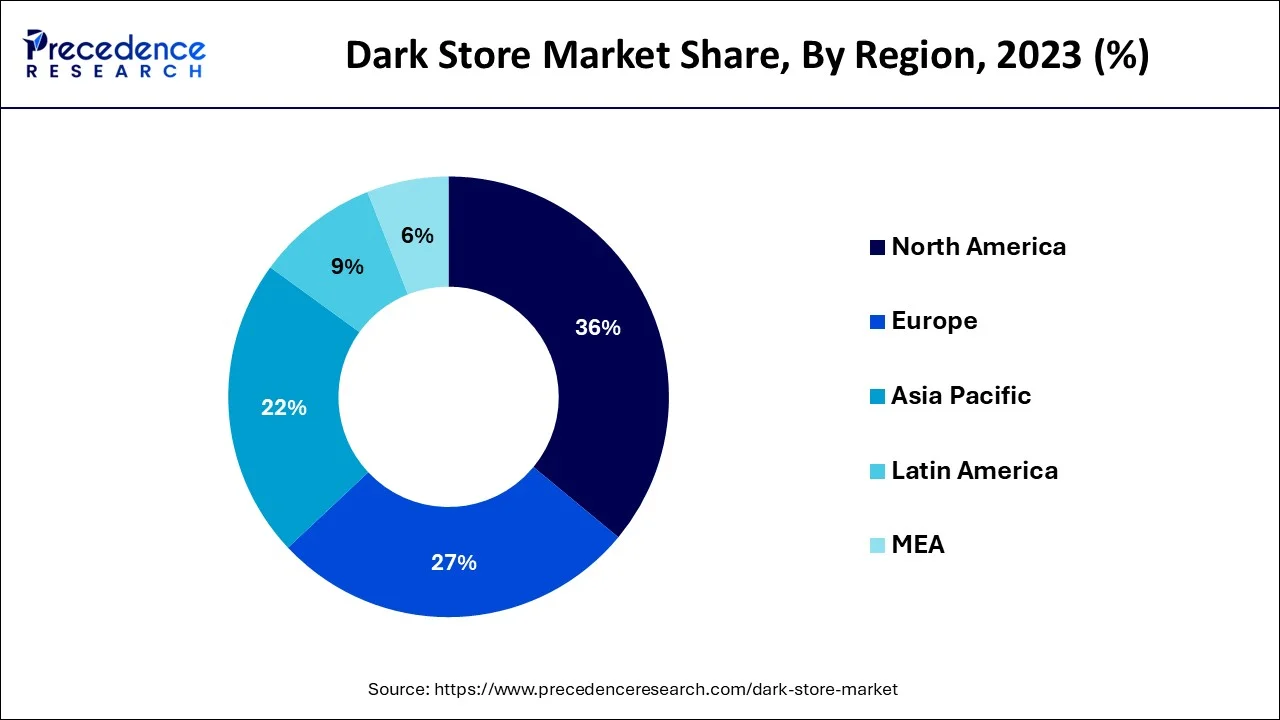

Based on region type, the global dark store is segmented into North America, Europe, Asia Pacific, and LAMEA. North America acquired the largest revenue share of over 36% in 2024. The expansion might be attributed to the increased use of platforms for supermarket delivery straight to your house. When Tesco, the largest grocery company in the UK, established its first customer-free stores in Croydon, Surrey, and Kent in 2009, the phrase "dark shop" first came into use. Tesco was shipping around 475,000 online orders each week from its 4,000 retail outlets at the time.

A 2018 Marist poll found that 56% of Americans aged 30 to 44 made more than one online purchase every month, compared to 33% of Americans aged 45 and older who had never done so. As part of its efforts to build its rapid food delivery business, Uber Technologies will extend its network of "dark stores" in Japan.

How Does Asia Pacific Influence the Dark Store Market?

Asia-Pacific region is experiencing rapid growth in the dark store market during the forecast period. This growth is driven by the surge in online shopping, increasing urbanization, and the adoption of technology. Consumers are demanding faster and more convenient delivery options, leading to a preference for online grocery shopping and same-day delivery services provided by dark stores that can efficiently handle orders. Additionally, in countries like Japan, where labor shortages pose challenges, automation plays a crucial role in improving efficiency and speeding up order fulfillment.

A notable Region in the Dark Store Market

Europe is a notable region in the dark store market. This growth is stemming from High internet penetration, and substantial investments by e-commerce companies are driving this expansion. Major players in the e-commerce sector are heavily investing in dark stores across Europe to minimize delivery times and reduce operational costs. These dark stores are often strategically located in major urban centers, optimizing delivery times and enhancing efficiency for online orders. As a result, the European dark store market is becoming a key area for growth and development, with many countries, including the U.K., Germany, and France, at the forefront of dark store adoption. Retailers in these regions are actively implementing dark store models to boost their online sales.

Key Players of the Market

To make groceries and other necessities easily accessible and quickly available on one platform, a number of market players are working to improve their current products. For instance, meal delivery services like Deliveroo and Uber Eats included groceries in August 2020.

Dark Store Market Companies

- Amazon.com, Inc.

- Swiggy

- Uber

- Ola Foods

- Supermarket Grocery Supplies Pvt Ltd.

- Walmart, Inc.

- Target Brands, Inc

- Dunzo Daily

- Instacart

- Auchan

- Wolt

- Flipkart

- Grab

Recent Development

- In April 2025, the festive season brings bustling markets and a surge in online orders, making Flipkart's launch of 100 dark stores for quick commerce a significant move. As a leader in the e-commerce sector of India, this expansion aims to meet the rising demand for faster deliveries. This initiative enables hyperlocal deliveries, reducing delivery times. Quicker deliveries enhance customer satisfaction and loyalty, as well as decentralized inventory helps manage fluctuations in demand.

- In September 2022, with the acquisition of Rosie, Instacart intensifies its technology solutions for independently owned and locally operated grocery stores.

- In September 2022, Walmart Invites Canadian Ecommerce Companies to Expand U.S. Online Marketplace.

- In August 2022, Amazon India Signs MoU with Council of Handicrafts Development Corporations (COHANDS) under the Karigar Program.

- In June 2022, Door Dash, Inc. (NYSE: DASH) announced the complete acquisition of Wolt Enterprises Oy (Wolt).

- In June 2022, NATUREPRO launches same-day delivery across India with ZFW Dark Stores. ZFW Dark store announced a partnership with personal care brand NATUREPRO to promote luxury as well as sustainable yet affordable products to the customers through same-day deliveries across India.

- In December 2020, Uber Technology, Inc. acquired Postmates, Inc. to improve the delivery of food, groceries, necessities, and other commodities.

- In August 2022, Coca-Cola and Grab Work Together to Promote Digitalization and Growth in Southeast Asia.

- The service providers are integrating smart technologies like dynamic route optimization, smart tracking, and sophisticated analytics to improve the efficiency of their delivery supply chains.

- Dark shop owners are developing technology and data models in order to deliver the most commonly purchased products in densely populated metropolitan zip areas in less than 15 minutes.

- To keep ahead of the competition, grocery delivery firms must take advantage of dark stores.

Segments Covered in the Report

By Age Group

- Children

- Adults

- Elderly

By Category

- Groceries

- Meat

- Dairy

By Delivery Options

- Curbside Pickup

- In-Store Pickup

- Home Delivery

By Non-Food Products

- Cleaning

- Essentials

- Bath & Body

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting