Debt Settlement Market Size and Forecast 2025 to 2034

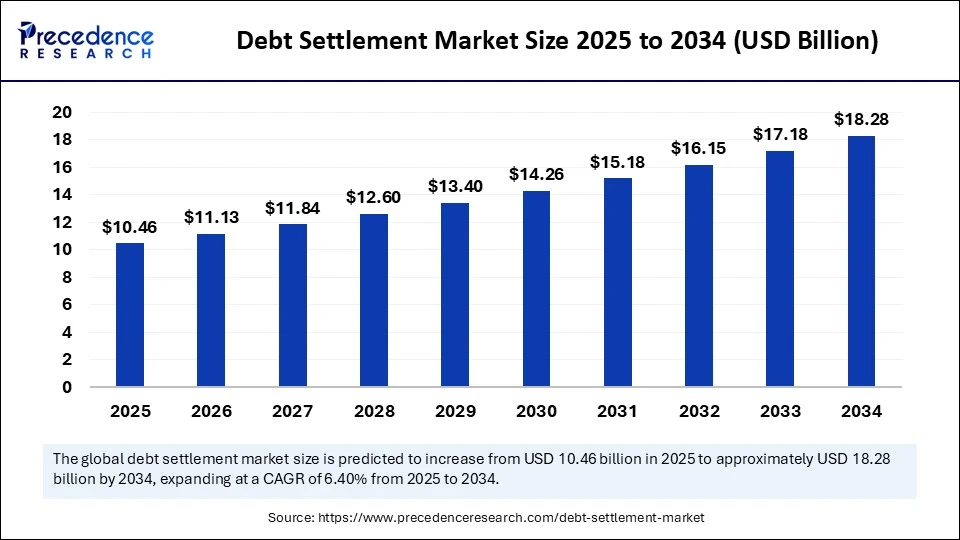

The global debt settlement market size accounted for USD 9.83 billion in 2024 and is predicted to increase from USD 10.46 billion in 2025 to approximately USD 18.28 billion by 2034, expanding at a CAGR of 6.40% from 2025 to 2034. The increased consumer debt levels, including credit card debt, personal loans, student loans, and medical loans, are driving the global debt settlement market. The rising living costs contribute to increased need for debt settlement for household loans, fueling the market growth.

Debt Settlement Market Key Takeaways

- In terms of revenue, the global debt settlement market was valued at USD 9.83 billion in 2024.

- It is projected to reach USD 18.28 billion by 2034.

- The market is expected to grow at a CAGR of 6.40% from 2025 to 2034

- North America dominated the global debt settlement market with the largest revenue in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 20245 to 2034.

- By type, the credit card debt settlement segment held the major market share in 2024.

- By type, the personal loan debt settlement segment will grow at a CAGR between 2025 and 2034.

- By service type, the debt negotiation segment held the major market share in 2024.

- By service type, the debt counselling segment will grow at a CAGR between 2025 and 2034.

- By end-user, the individual consumers segment held the major market share in 2024.

- By end-user, the small and medium enterprises (SMEs) segment will grow at a CAGR between 2025 and 2034.

- By distribution channel, the offline/traditional channels segment contributed the biggest market revenue in 2024.

- By distribution channel, the online/digital platforms segment is expected to expand at a significant compound annual growth rate (CAGR) between 2025 and 2034.

How is AI Impacting on Debt Settlement Solution?

Artificial Intelligence is playing a transformative role in the debt settlement solution industry by providing automated debt negotiation, speeding settlements, reducing the need for intervention, and providing personalized solutions. Debt settlement is a critical firm, requires specialized experts to provide deep awareness and benefit education to the clients. However, the growing integration of AI in debt settlement firms is making it convenient for both settlement officers and customers. AI-enabled data analytics helps to identify trends, optimal settlement strategies, and patterns, to enhance accurate and quick decision-making abilities. AI in process standardization is the emerging trend to perform high-value and complex tasks. Debt settlement companies are driving focus, leveraging AI with their settlement solutions to provide 24/7 support and guidelines and enhance overall consumer experiences.

- In April 2025, the credit-building platform used by over a million Americans, Kikoff, launched AI Debt Negotiation, a voice AI agent that can negotiate debt on behalf of consumers. The software is expected to provide smarter and stress-free ways to tackle debts to consumers.

(Source: https://www.businesswire.com)

Market Overview

The global debt settlement market is rising significantly due to increased consumer debt levels, financial awareness, and demand for debt relief services. The market has witnessed major growth in personal loans, credit card debts, medical loans, educational loans, and business loans. The highest demand for debt relief is for credit card debts in the market. The government initiatives and regulations for transparency and consumer protection are bringing several enhancements in service providers, including law firms, debt settlement companies, and financial advisors.

The global debt settlement market is transforming growth in emerging countries. The economic crises in developing countries are leading to the financial burden on citizens, driving demand for comprehensive loans and debts like household debts, educational loans, and business loans, and fueling the need for debt settlement services.According to a major novel report commissioned by the late Pope Francis, emerging countries require a fresh new round of debt relief for urgently needed prevention money in health and education.

(Source: https://www.theguardian.com)

- In June 2025, Ghana will provide approval of a $2.8 billion debt restructuring deal with 25 creditor nations, including France and China, adding disbursements under the IMF bailout programme to alleviate this country's worst economic crisis in decades.

What is the Potential Impact of U.S. Tariffs on the Debt Settlement Market?

The U.S. tariffs have had significant impacts in mid-2025, including economic, industry, and debt settlement implications. Tariffs have disrupted international trade and investment flows, leading to challenges for businesses in several countries. The tariffs have majorly impacted the emerging market, creating debt challenges and economic vulnerability. Consumers are seeking to prioritize essential expenses over debt repayments, challenging the debt settlement companies. The tariffs can also create credit score issues, which can play in favor of rising demand for debt settlement services. The uncertainty created by U.S. tariffs has caused businesses and individuals to secure financing, creating debt problems.

What are the Key Trends of the Debt Settlement Market?

- Growth in Consumer Debt: The increased consumer debt is driving demand for advanced debt settlement services. The individuals' struggle to manage their debt obligations requires debt settlement services.

- Economic Uncertainty: The economic downturns, job losses, and income instability are challenging businesses and individuals to meet their debt obligations, driving demand for debt settlement services.

- Growing Awareness and Education: The rising awareness and education about debt settlement services and their benefits are contributing to increased adoption of the services.

- Technological Advancements:The technological advancements, like digital platforms and AI-enabled debt negotiation tools, are helping to enhance the effectiveness and efficiency of services.

- Government Initiatives and Regulations: The government worldwide is implementing regulations for the protection of consumers and promoting debt settlement practices, contributing to the market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.28 Billion |

| Market Size in 2025 | USD 10.46 Billion |

| Market Size in 2024 | USD 9.83 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Service Type, End-user, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Regulatory Reforms

The government worldwide has implemented several regulatory reforms to enhance consumer protection and transparency. Regulatory bodies are mandating clear and concise communication from debt settlement campaigns to enhance transparency. Several regulatory reforms, including Electronic Trading Platforms (ETPs), Variation Margin for OTC Derivatives, and legal Entity Identifiers (LEI), are ensuring efficiency, reducing risk from non-centrally cleared derivatives, and enabling aggregation of risks.The regulatory debt collection practices, including the Fair Debt Collection Practices Act (FDCPA) in the U.S., are protecting consumers from unfair tactics and harassment from debt collectors.

Additionally, the Reserve Bank of India and other regulations are improving efficiency, resilience, and transparency for consumer debts.

- In January 2025, the consumers who were harmed by the Bogus Debt Relief Scheme called ‘ACRO Services' received more than $5 million in refunds from the FTC (Federal Trade Commission)

(Source: https://www.ftc.gov)

Restraint

Ethical Concerns

Ethical concerns like consumer protection, fairness and transparency, debt forgiveness, credit score impact, and unscrupulous practices are the major risks for the market growth. Some companies create distrust among consumers by promising unrealistic processes. Charging fees and delays in results or potential outcomes cause vulnerability across consumers. The lack of transparency and communication leads to consumer distrust and harm. Additionally, unqualified counsellors in debt settlement companies are inadequate in their results, with poor outcomes.

Opportunity

Strategic Collaborations of Debt Settlement Companies with Financial Institutions

The ongoing partnerships with financial institutions are helping to improve the credibility and trust of companies. The debt settlement companies are focusing on collaborating with banks, credit unions, and fintech firms to not only streamline communication and the negotiation process between companies and creditors but also to enhance credibility, provide better outcomes, and meet with required regularity. The collaboration enables debt settlement companies to access a larger consumer base. The collaboration can enhance credit rehabilitation tools and improve client outcomes by providing effective debt settlement solutions. Companies are partnering with financial institutions to enhance revenue streams.

Type Insights

Which Type Segment Dominated the Debt Settlement Market in 2024?

In 2024, the credit card debt settlement segment dominated the market due to a large increase in consumers with credit cards. Consumers' preference for credit cards with high-interest rates makes it challenging to pay off the debts. Debt settlement solution providers help to negotiate with credit card issuers and narrow outstanding balances. The increased use of credit cards, consumer debt levels, and financial distress are driving demand for debt settlement services.

The personal loan debt settlement segment is seen to grow at the fastest rate during the forecast period due to increased consumer personal loan levels. Debt settlement services negotiate to reduce the amount owed on a personal loan. The debt settlement services are crucial to prevent serious consequences like lawsuits, property loss, or credit score loss. The growing financial instability, job losses, and growing taxes are contributing to increased personal loans.

Service Type Insights

How the Debt Negotiation Segment Dominated the Debt Settlement Market?

The debt negotiation segment dominated the debt settlement market in 2024, due to increased consumer debt levels and demand for debt negotiations. The demand for debt negotiation services to negotiate with creditors is high, driven by the need to reduce the amount owed on credit cards and medical bills. Consumers with multiple debts require debt negotiation services to prevent bankruptcy and reduce financial loss. The debt negotiation services combine multiple loans into a single loan with a lower interest rate, making consumer easier for consumers to repay and preventing major financial stress.

By service type, the debt counselling segment is expected to grow fastest over the forecast period, due to increased debt levels among businesses and individuals. The demand for debt counseling services has increased to manage debt, create structured and simple repayment plans, and negotiate with creditors. The awareness about debt management services is a factor contributing to the growing demand for debt solving services.

End-user Insights

What Made Individual Consumers Segment Lead the Debt Settlement Market in 2024?

The individual consumers segment led the market in 2024, due to increased individual consumer debt levels. Individuals are facing various financial challenges, leading to the need for personal loans like credit card balances, medical bills, and educational loans. The demand for debt relief services increased among individual consumers to prevent serious issues like bankruptcy and manage their debt. The growing awareness of debt management services is are significant offering by debt settlement companies and credit counseling agencies is fostering the segment.

The small and medium enterprises (SMEs) segment is the second-largest segment, leading the market, due to rising demand for debt settlement solutions in the small and medium enterprises (SMEs). These enterprises are highly reliant on bank loans compared to the large enterprises that depend on internal funds or cash. The growing geopolitical issues, economic instability, and growing digitalization have increased the financial crisis in small and medium enterprises (SMEs), particularly in emerging countries, contributing to increased debts and driving demand for sophisticated debt settlement services.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Debt Settlement Market in 2024?

In 2024, the offline/traditional channels segment dominated the market, growth driven by highly complex debt cases. The demand for personalized services drives consumer surge for offline/traditional channels like phone, email, and in-person consultation. Consumers still prefer to trust offline channels to avoid the risk of financial fraud. The offline/traditional channels are crucial for consultation, where face-to-face negotiation and consulting are needed.

The online/digital platforms segment is expected to lead the market over the forecast period, due to rising consumer shift towards more convenient, accessible, and cost-effective services. The digitalization in all sectors is also contributing to the segment's growth. Online channels, including websites, portals, and virtual consultations, are gaining popularity in the debt settlement industry. The adoption of online/digital platform-based debt settlement services is high among tech-savvy consumers.

Regional Insights

North America Debt Settlement Market Trends

North America dominated the global debt settlement market, driven by large consumer debt levels, a strong settlement industry, and robust regulatory frameworks in the region. North America has a high consumer level of debt, including student loans, mortgages, and credit card loans. The well-established regulations, like the Fair Debt Collection Practices Act and Telemarketing Sales Rule, are enhancing transparency in the debt settlement companies. Well-established debt settlement industry of North America is making access sot a wide range of services available to consumers in the region.

The U.S. is a major player in the regional market, driving growth due to high consumer debt levels and economic uncertainty. The U.S. has a large consumer base with high reliance on credit cards and personal loans. The large consumer debt levels have increased demand for debt relief services in the country. Additionally, a strong industry and the existence of robust regulatory bodies are contributing to the market growth.

- In June 2025, the leading AI-enabled debt resolution platform, Relief, secured a novel round for growth capital in the U.S., which was led by National Debt Relief. The capital is created to unveil a partnership between two companies, accelerate Relief's ability to provide consumer digital access to trust, and a high-impact debt resolution solution.

(Source: https://www.businesswire.com)

Asia Pacific Debt Settlement Market Trends

Asia Pacific is the fastest-growing region in the global market, witnessing significant growth due to increased consumer demand and emerging companies like China, India, and Japan, and raising awareness about financial conditions. Asia Pacific has a large volume of middle-class population, driving demand for financial services like debt settlement solutions. Growing digitalization my regulatory changes, and demand for personalized financial services are contributing to the market growth.

China is a major player in the regional market, growth driven by rapid developments, digitalization, and government initiatives. China's role as a bilateral creditor for developing countries in Asia plays a vital role in market growth. China is a major participant in collective debt-relief bodies, influencing the market outlook for various countries. The growing focus on Chinese companies to provide state-led lending and commercial, rational debt relief approaches is transforming the market.

India is a significant player in the regional market, facing several challenges and growth initiatives like growing interest rates, economic uncertainty, and government initiatives in reducing debt and focusing on fiscal consolidation. The uneven economic recovery from the pandemic has influenced various sectors in the country, has fueled the debt level, and need for sophisticated debt settlement services.

Indian Government Policies for Loan Settlements

- Pradhan Mantri Mudra Yojana (PMMY)

- Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTFMS)

- Credit Linked Capital Subsidy Scheme (CLCSS)

- Pradhan Mantri Awas Yojana (PMAY)

- Central Sector Interest Subsidy Scheme (CSISS)

Europe Debt Settlement Market Trends

Europe is a significant player in the global market, witnessing transformative growth due to rising consumer debt levels, regulations, and a well-established financial industry. The European Union has implemented several regulations, like the Consumer Credit Directive, to enhance consumer protection and after debt settlement practices. The European market has witnessed significant growth in demand for debt consolidation. The importance of credit counselling and the digitalization of debt settlement services is further contributing to the market growth.

Germany is a significant player in the regional market, witnessing growth due to rising consumer reliance on digital debt relief solutions, credit cards, and strict regulations for consumer protection. The household debt level is high in Germany. Growing consumer demand for personalized financial planning tools and services is contributing to the market growth.

Debt Settlement Market Companies

- Freedom Debt Relief

- CuraDebt

- Pacific Debt Inc.

- New Era Debt Solutions

- Accredited Debt Relief

- National Debt Relief

- American Financial Solutions

- Beyond Finance

- CreditAdjusters

- Consolidated Credit Counseling Services

- Alliance Credit Counseling

- DMB Financial LLC

Best Debt Settlement Companies are Consumer Reviews

- Freedom Debt Relief: Consumers have highlighted the company as the most trusted.

- National Debt Relief: Best for credit card balances

- Accredited Debt Relief: Best company for flexibility and communication

- CuraDebt: Best for tax and business debt relief

- Pacific Debt Relief: Best for personal support

(Source: https://www.stltoday.com)

Recent Developments

- In June 2025, the late Pope Francis appointed a commission to release a novel report urging requirements to address global debt, which impacted sustainable development and climate across various countries. The Jubilee Commission, with a group of 30 experts, including Nobel laureate and U.S. economist Joseph Stiglitz and Martin Guzman, authored this report.

(Source: https://news.mongabay.com)

- In May 2025, New Era Debt Solutions expanded its debt relief program to respond to the financial challenges caused by rising inflation. The initiatives are aiming to help American consumers who are grappling with increased living costs and mounting unsecured debts, like credit card balances and personal loans.

(Source: https://www.cbs42.com)

- In March 2025, the Australian government will release the 2025-26 federal budget for tax cuts, cost-of-living relief, and support for homes, students, and business debt. Australia aims to ease financial pressures by addressing economic changes, including slow economic growth and housing affordability.

(Source: https://timesofindia.indiatimes.com)

Segment Covered in the Report

By Type

- Credit Card Debt Settlement

- Mortgage Debt Settlement

- Student Loan Debt Settlement

- Medical Debt Settlement

- Personal Loan Debt Settlement

- Others

By Service Type

- Debt Negotiation Services

- Debt Counseling Services

- Debt Management Plans

- Legal Assistance for Debt Settlement

- Others

By End-user

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Distribution Channel

- Online/Digital Platforms

- Offline/Traditional Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting