Diabetic Footwear Market Size and Growth 2025 to 2034

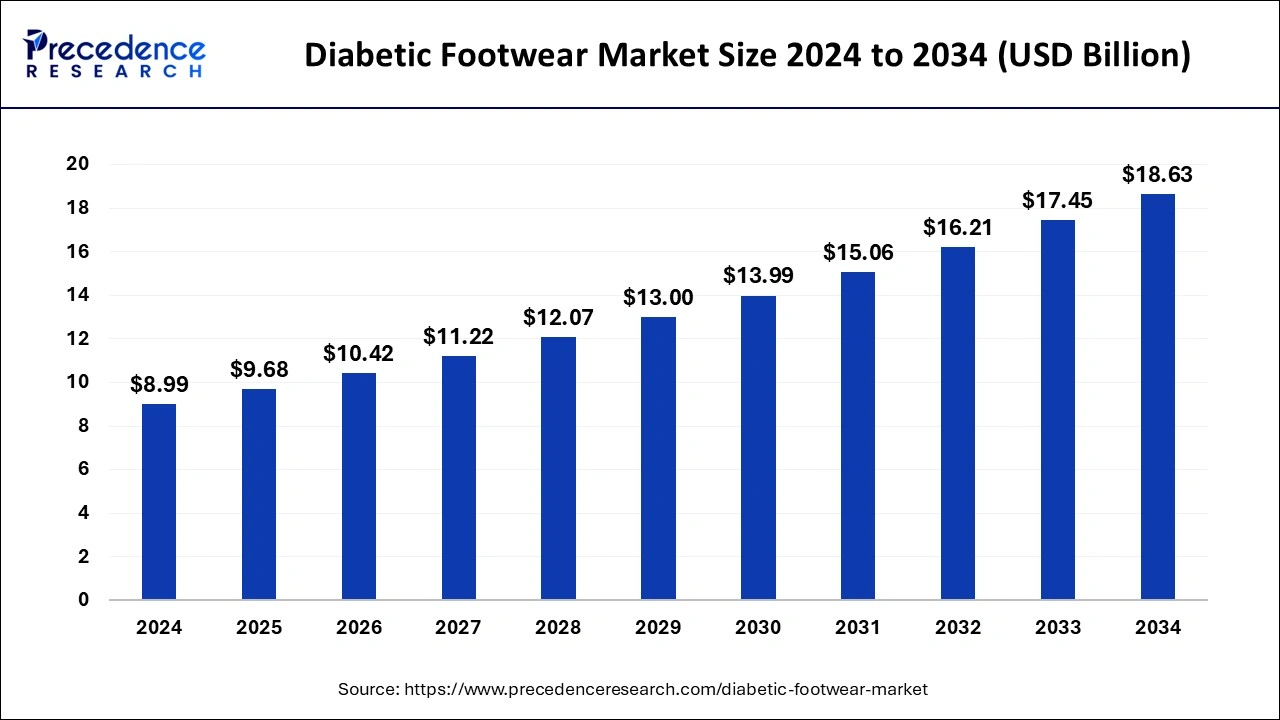

The global diabetic footwear market size was estimated at USD 8.99 billion in 2024 and is predicted to increase from USD 9.68 billion in 2025 to approximately USD 18.63 billion by 2034, expanding at a CAGR of 7.56% from 2025 to 2034.

Diabetic Footwear Market Key Takeaways

- The global diabetic footwear Market market was valued at USD 8.99 billion in 2024.

- It is projected to reach USD 18.63 billion by 2034.

- The market is expected to grow at a CAGR of 7.56% from 2025 to 2034.

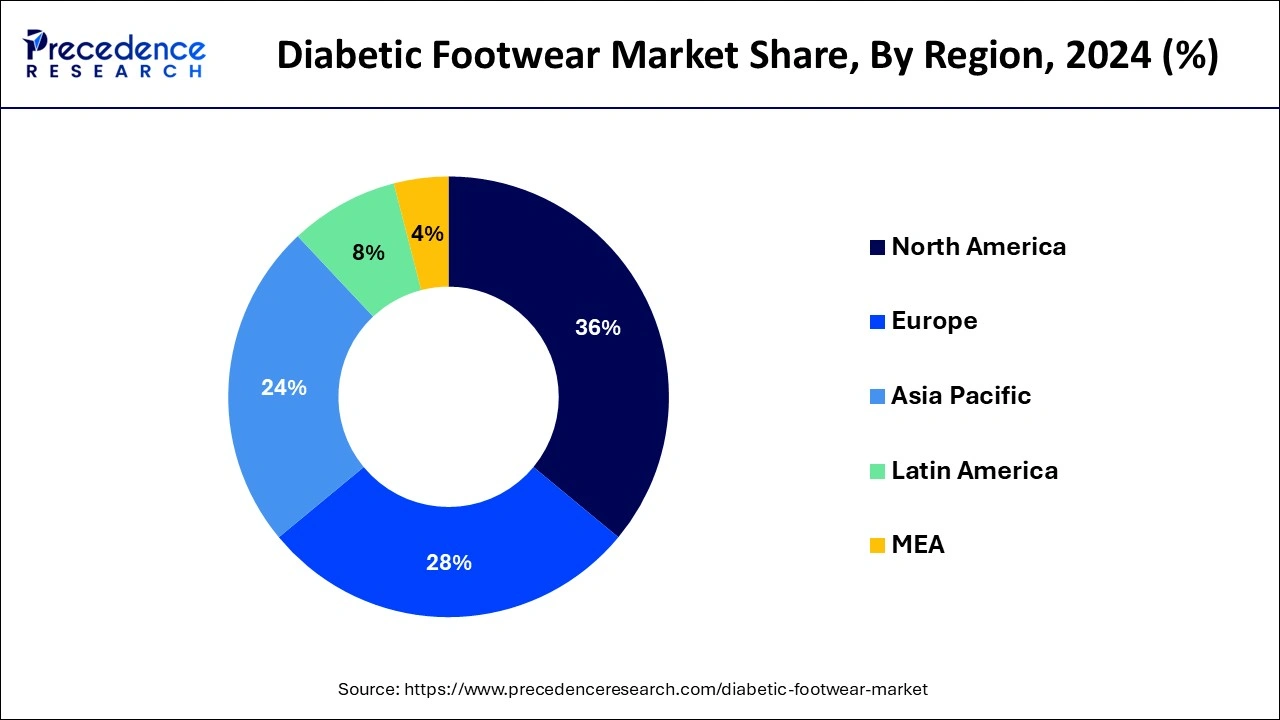

- North America led the market with the largest market share of 36% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 8.25% during the forecast period.

- By product, the shoes segment has accounted the largest market share of 37% in 2024.

- By product, the slippers segment is expected to witness a significant share during the forecast period.

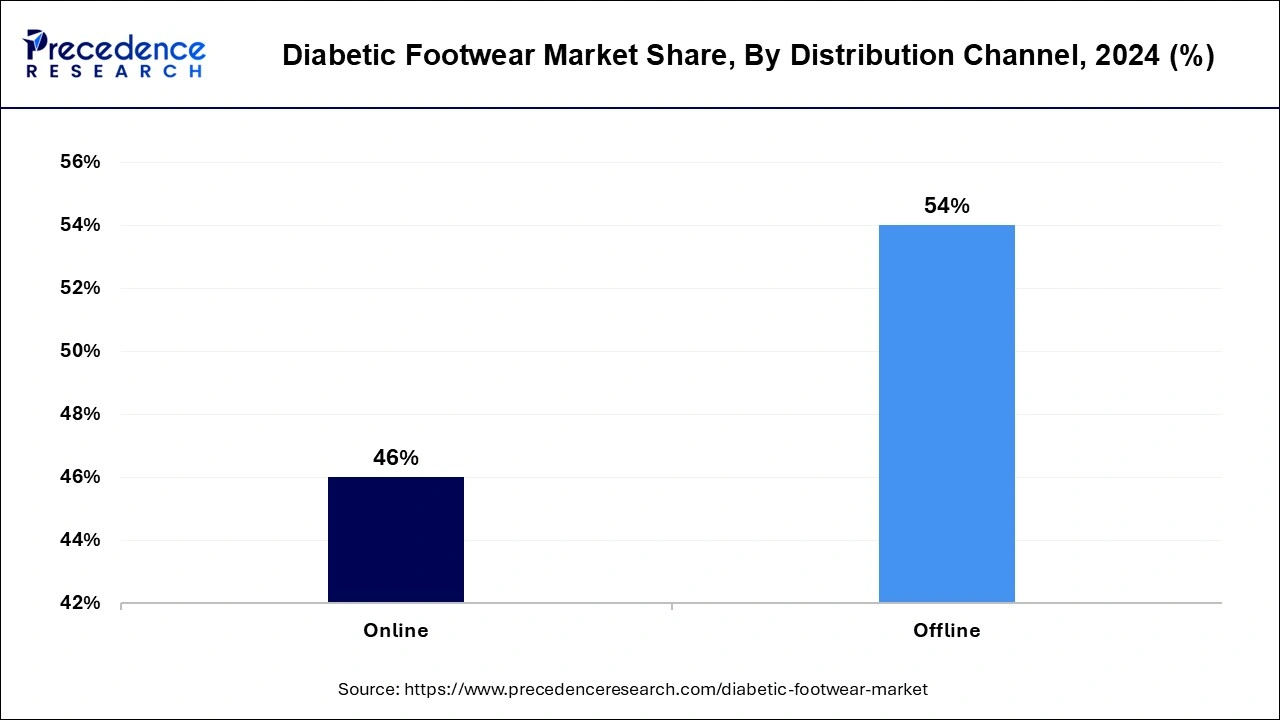

- By distribution channel, the offline segment held the largest share of 54% in 2024.

- By distribution channel, the online segment is expected to grow at a robust growth rate during the forecast period.

U.S.Diabetic Footwear Market Size and Growth 2025 to 2034

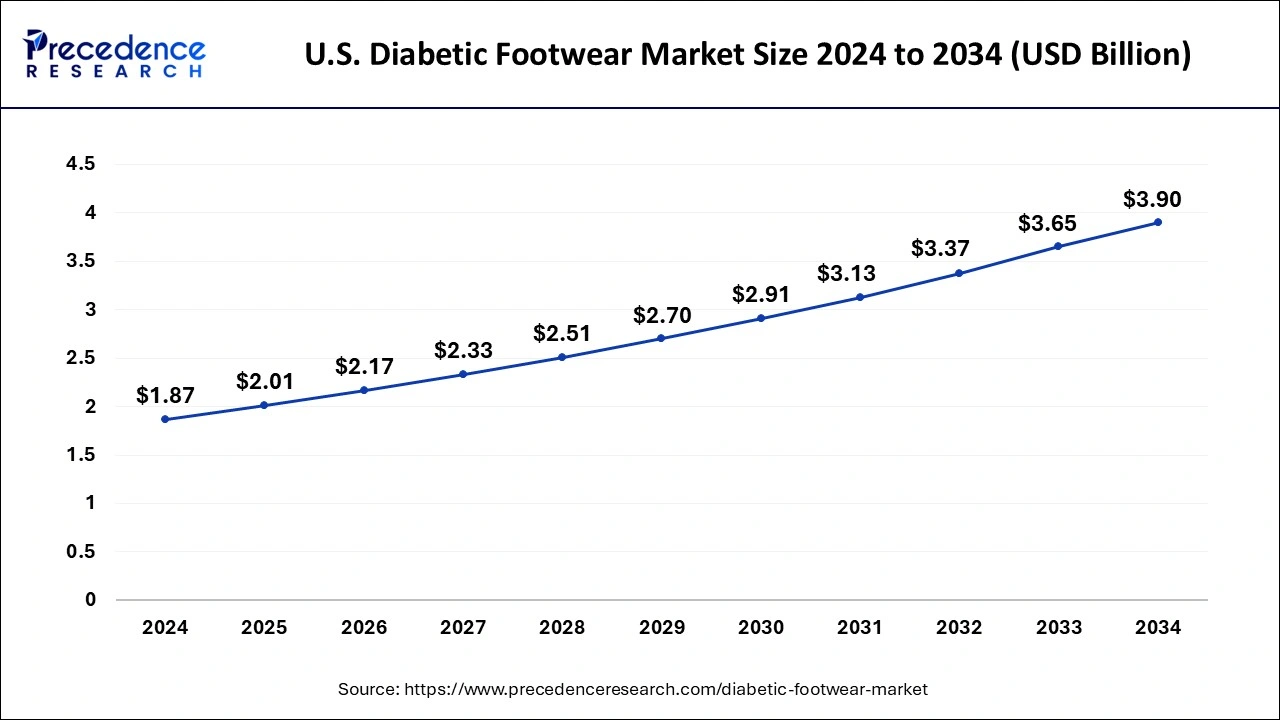

The U.S. diabetic footwear market size was estimated at USD 1.87 billion in 2024 and is predicted to be worth around USD 3.90 billion by 2034, at a CAGR of 7.63% from 2025 to 2034.

North America, in 2024, held the largest share of the diabetic footwear market. The growth of the North American region is attributed to the presence of prominent market players, the geriatric population, rising awareness regarding diabetic footwear, supportive government initiatives, rising disposable income, increasing incidence of diabetes, and increasing concerns regarding adverse effects associated with diabetic disorders. Thus, this is expected to propel market growth in the region during the forecast period.

Among all countries, the United States is the major contributor to the diabetic footwear market. The country's growth is majorly driven by the increasing availability of advanced diabetic footwear and constant innovations in the product by the market players. Additionally, the country has a large population suffering from diabetes which increases the awareness among diabetic patients regarding the health benefits of diabetic footwear. Patients with diabetes commonly suffer from foot ulcers, circulation, and others which boost the demand for diabetic footwear to avoid such foot problems.

Asia Pacific is expected to witness the fastest growth during the forecast period in the diabetic footwear market. The growth of the region is attributed to the increasing aging population, increasing incidence of diabetes, increasing disposable income, increasing demand for advanced and feet comfort footwear, and growing awareness about diabetes footwear along with its several benefits. Rising disposable income levels and increasing healthcare spending in countries like China, India, and South Korea have made diabetic footwear more affordable and accessible to a larger segment of the population. As consumers become more willing to invest in preventive healthcare measures and products that improve their quality of life, the diabetic footwear market is poised for further growth in the Asia-Pacific region.

- In April 2024, Chennai researchers unveiled to development of footwear to treat diabetic foot ulcers and reduce the risk of amputation. CLRI's patented AFO footwear for diabetes patients aids in ulcer healing, reduces amputation risk by redistributing plantar pressure, and improves gait.

Market Overview

People who suffer from diabetes may face problems with blood circulation, nerves, deformities, and immunity. Diabetic footwear is specially designed footwear that safeguards the feet of diabetic patients. The regular use of diabetic footwear may assist in healing several diabetic conditions including inadequate blood circulation in the legs and is intended to minimize the risk of skin breakdown caused by foot deformities. Diabetic footwear is often used by people suffering from foot deformities caused by diabetes. Diabetic footwear has various features including stretchable uppers, non-binding uppers, orthotic support, extra depth design for a pressure-free fit, functional soles, and others.

Diabetic footwear usually has a large toe box for ample room and comfort which are made of soft materials to reduce irritation and offer good cushioning. Diabetic footwear is exceptionally designed to protect while reducing pressure points on the feet and alleviating the risk of amputations. Companies around the world are leveraging cutting-edge technologies to manufacture customized products with enhanced comfort and safety.

Diabetic Footwear Market Growth Factors

- The rising incidence of patients suffering from diabetes along with increasing awareness regarding the benefit of diabetic footwear is anticipated to boost the global diabetic footwear market during the forecast period.

- The rapid rise in the growing geriatric population is projected to offer significant opportunities for the market's expansion.

- The rise in disposable income coupled with recent breakthroughs in footwear technology enhances product innovation and is expected to spur the demand for the diabetic footwear market.

- The rising demand for personalized and attractive diabetic footwear to reduce discomfort and provide relief from foot pain. Diabetic footwear comes with attractive designs to satisfy the latest fashion trends, especially for the female population.

- The supportive government program and initiatives regarding the prevention and treatment of diabetes increased demand for diabetic footwear during the forecast period.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.56% |

| Market Size in 2025 | USD 9.68 Billion |

| Market Size by 2034 | USD 18.63 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of diabetes

The rising prevalence of diabetes across the globe is anticipated to fuel the growth of the global diabetic footwear market during the forecast period. Diabetes is becoming a very common and lifelong disease. Foot care plays an important role for diabetics. The market has witnessed an increasing usage of diabetic footwear to relieve pain and to provide relief from flat foot pain. The diabetes population often prefers diabetic footwear to prevent foot injuries caused by foot ulcers, infections, poor, blood circulation, and amputation. Diabetic footwear is highly recommended to patients by medical professionals with health conditions including foot ulcers and chronic inflammation or infections brought on by diabetes. Due to the major market participants' aggressive investment, diabetic footwear has been developed to improve blood circulation, keep feet dry, and lower the risk of foot injuries. Consequently, the number of people with diabetes and their healthcare spending are rising dramatically, which is predicted to fuel the market for diabetic footwear.

- According to the report of the Institute for Health Metrics and Evaluation in June 2023, more than half a billion people were living with diabetes globally, it is estimated diabetes cases to rise from 529 million to 1.3 billion in the next 30 years. The latest estimates indicate that the current global prevalence rate is 6.1 percent, which makes diabetes one of the leading causes of death and disability.

Restraint

High costs

The high cost associated with diabetic footwear is anticipated to hamper the growth of the diabetic footwear market. Diabetic footwear is expensive and high cost is required for the purchase of this footwear. Along with this, the medically proven footwear solutions require heavy investments for manufacturers. In addition, less awareness of diabetic footwear among the diabetic population as well as regarding its benefits, particularly in underdeveloped countries, is restricting the expansion of the market.

Opportunity

Rising requirement for the elderly population

The increasing demand for diabetic footwear from aging population is projected to offer a lucrative opportunity for the growth of the global diabetic footwear market during the forecast period. The growing geriatric population is highly susceptible to diabetes which leads to the increasing demand for tooth diabetic footwear. Diabetic footwear comes with excellent elements such as raw material and comfort and these footwears are becoming increasingly popular among the geriatric population with diabetes. Thus, diabetic footwear assists in increasing blood circulation and nerve sensation and reduces pressure in the areas of the foot most susceptible to pain.

- According to the report published by the IHME in June 2023, Diabetes was evident in people 65 and above in every country and recorded a prevalence rate of more than 20 percent globally. The highest rate was 24.4 percent for those between ages 75-79. The rising incidence of diabetes in the geriatric population increases the demand for diabetes management and monitoring tools.

Product Insights

The shoes segment accounted for the dominating share in 2024 in the diabetic footwear market due to the rapid pace of urbanization and the rising office-going population around the world. Diabetes footwear is comfortable to wear for long hours and safeguards feet from injuries as well as alleviating the occurrence of fungal infections. The rising use of diabetic footwear is projected to accelerate the segment's growth. The rising importance of exercise, walking and running among diabetic patients is observed to create a potential growth factor for the shoes segment to grow in the upcoming period.

- In June 2022, Researchers in the Department of Mechanical Engineering at the Indian Institute of Science (IISc) collaborated with the Karnataka Institute of Endocrinology and Research (KIER), have develop a set of unique self-regulating footwear for people with diabetes. The footwear is specially-designed sandals and is 3D-printed and can be customized to an individual's foot dimensions and walking style. This increases the chances of infection and may lead to complications that require amputation in extreme cases.

On the other hand, the slippers segment is expected to witness a significant share during the forecast period in the diabetic footwear market owing to the increasing use of diabetic slippers in daily life to prevent foot ulcers and enhance blood circulation. The convenience offered by slippers as a footwear solution is observed to promote the segment's expansion. Slippers for diabetic patients is observed to offer precise acupressure for the feet, thereby the popularity of slippers as diabetic footwear is significantly growing.

Distribution Channel Insights

The offline segment held the largest share of the diabetic footwear market in 2024. Offline channels such as specialty stores, pharma outlets, and others are anticipated to remain the highly customer-preferred channels for purchasing diabetic footwear. The rapid urbanization coupled with rising disposable income in developing nations is projected to propel the growth of the segment. For instance, FitStarter is a personalized footwear recommendation tool that Aetrex, Inc. unveiled in November 2023 with the goal of assisting stores in better fitting customers' shoes, decreasing returns, and raising customer happiness. Developed in collaboration with Heeluxe, the leading provider of shoe fit testing services. FitStarter is a simple add-on for retailers using their current Albert 3D foot scanner software (Albert 2 Pro or Albert 3DFit).

On the other hand, the online segment is expected to grow at a robust growth rate during the forecast period in the diabetic footwear market. The growth of the segment is majorly driven by the rising popularity of e-commerce portals and their attractive discounts offered to the customers. E-commerce service providers such as Flipkart, Myntra, and Amazon offer various value-added services such as Cash-on-Delivery, coupon benefits, free home delivery, and others. Thereby boosting the segment's growth in the market.

Diabetic Footwear Market Companies

- Aetrex Worldwide Inc.

- Orthofeet Inc.

- DJO Global Inc.

- Dr. Zen Products Inc.

- Drew Shoe Corporation

- Podartis srl Unipersonale

- Propét USA Inc.

- Hanger Inc.

- Healer Health LLC

- Pilgrim Shoes

- Drew Shoe Corporation

- Propét USA, Inc.

- Apex Foot Health Industries LLC

- New Balance Athletic Shoe, Inc.

- SAS Shoemakers

- P.W. Minor & Son, Inc.

- Etonic Brands LLC

- Vionic Group LLC

- Columbia Sportswear Company

Recent Developments

- According to a recent study, revolutionary shoe insole technology was set to transform the prevention of diabetic foot ulcers in April 2024. This breakthrough offers hope for better foot care and a higher standard of living for diabetics. Diabetic foot ulcers are among the many consequences associated with diabetes, a chronic illness that affects millions of people worldwide. A new solution for shoe insoles has been revealed by researchers, and it is intended to precisely address the risk of diabetic foot ulcers. By combining pressure-alternating mechanisms, this invention adopts a proactive stance in contrast to traditional insoles that only offer support or cushioning.

- The first smart diabetic footwear, called "Foot Defender" powered by Sensoria smart boot, was introduced by Sensoria Health and Defender in September 2022. Sensoria Core microelectronics is integrated with the Foot Defender smart footwear. In order to track a patient's diabetic foot ulcer healing and compliance with therapy, it also includes the Sensoria patient mobile app and clinician dashboard.

Segments Covered in the Report

By Product

- Slippers

- Sandals

- Shoes

By Distribution Channel

- Offline

- Online

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting