Diabetic Kidney Disease Market Size and Forecast 2025 to 2034

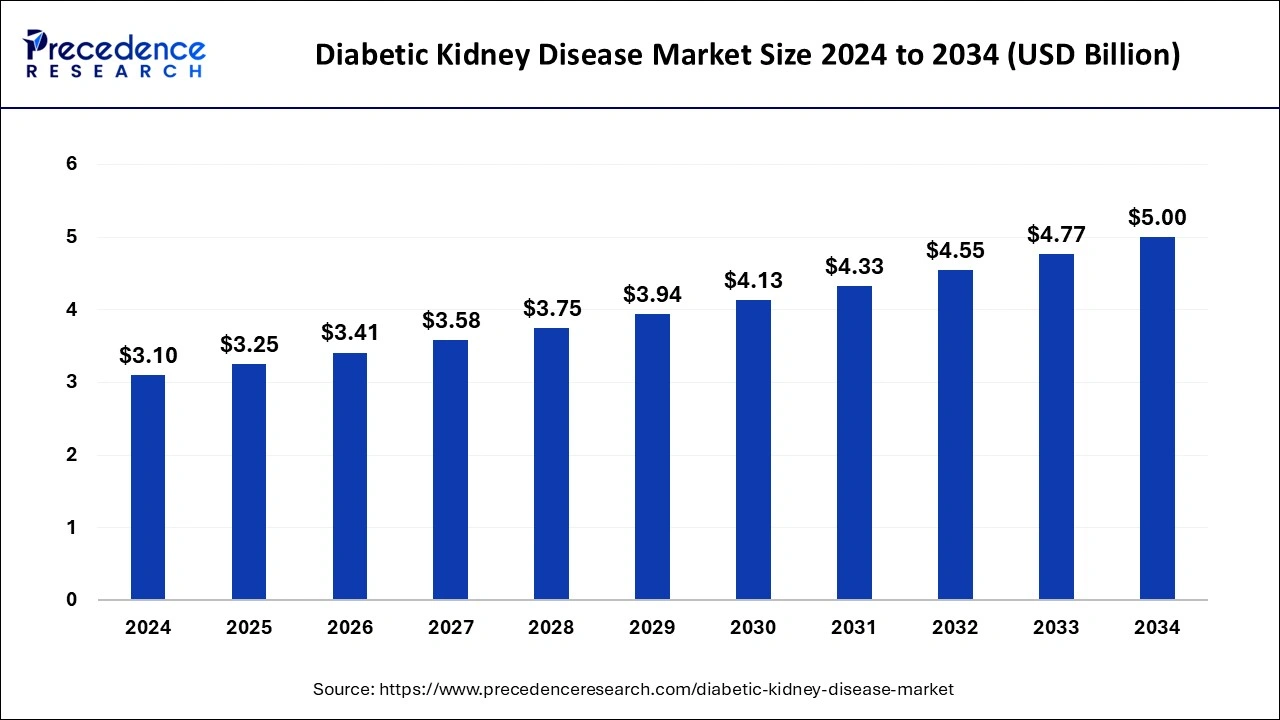

The global diabetic kidney disease market size was estimated at USD 3.10 billion in 2024 and is anticipated to reach around USD 5 billion by 2034, expanding at a CAGR of 4.90% from 2025 to 2034. The increasing prevalence of diabetes is a key factor driving the growth of the market. Furthermore, ongoing advancements in therapeutics and the rising development of new therapies fuel the growth of the diabetic kidney disease market in the coming years.

Diabetic Kidney Disease Market Key Takeaways

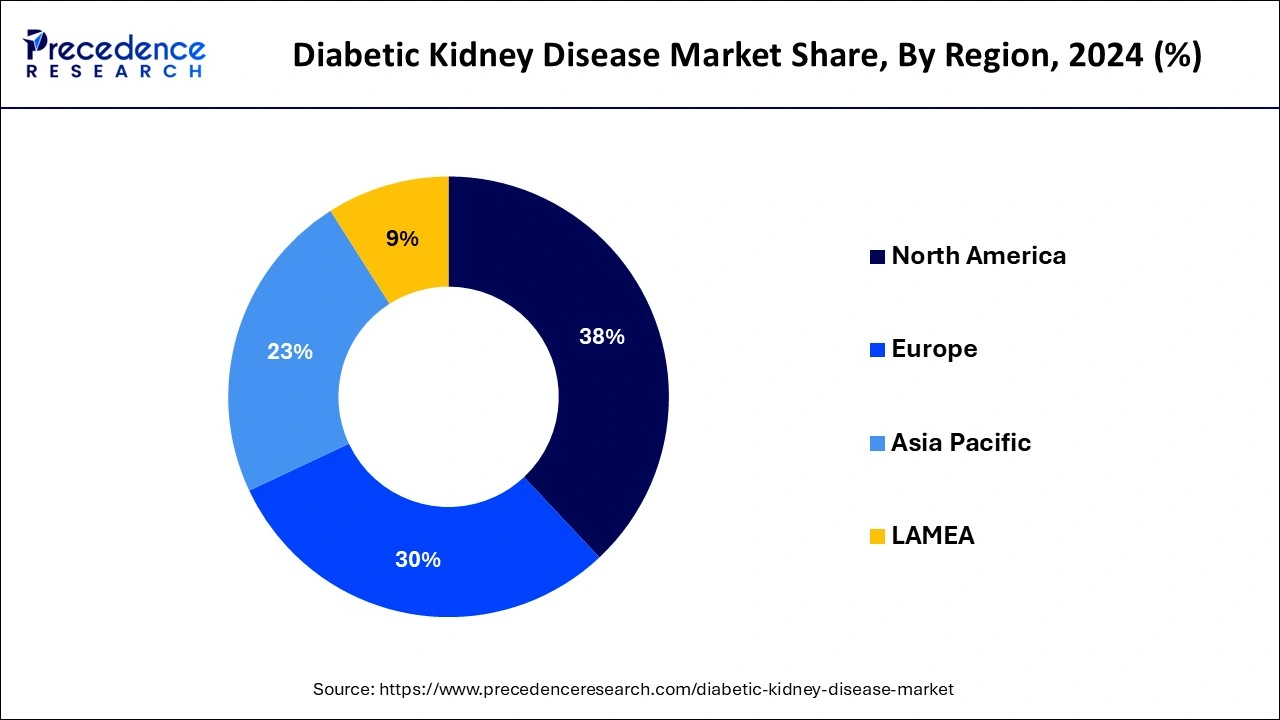

- North America contributed the biggest market share of 38% in 2024.

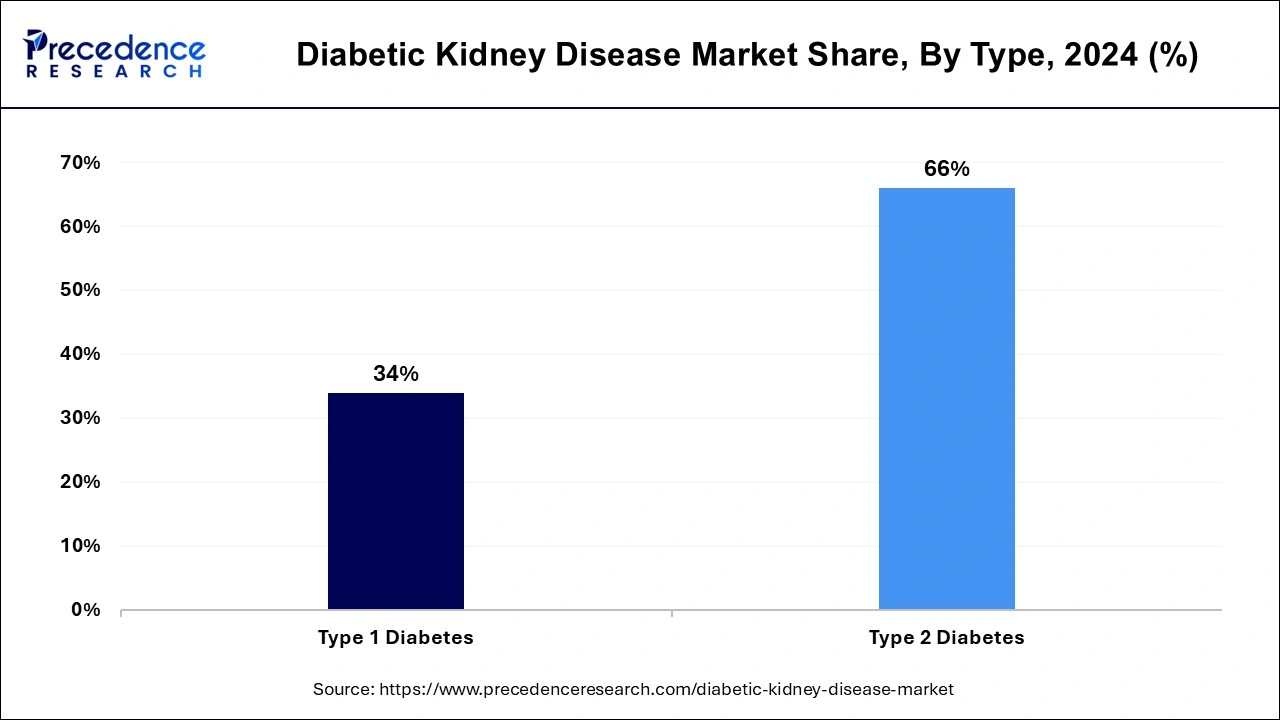

- By type, the type 2 segment has held the biggest market share of 66% in 2024.

- By treatment, the angiotensin-converting enzyme (ACE) Inhibitors segment accounted for the major market share in 2024.

- By distribution channels, the retail pharmacy and drug store segment contributed the highest market share in 2024.

Role of AI in Diabetic Kidney Disease Management

Artificial intelligence (AI) technologies help optimize diabetic kidney disease management. AI algorithms are improving the efficiency and precision of diagnostic and imaging tools, detecting diabetic kidney diseases at an early stage. AI-driven ultrasound technologies facilitate efficient monitoring of structural changes and renal blood flow in real time. Furthermore, AI analyzes patient data and responses, enabling healthcare professionals to develop personalized treatment plans.

U.S. Diabetic Kidney Disease Market Size and Growth 2025 to 2034

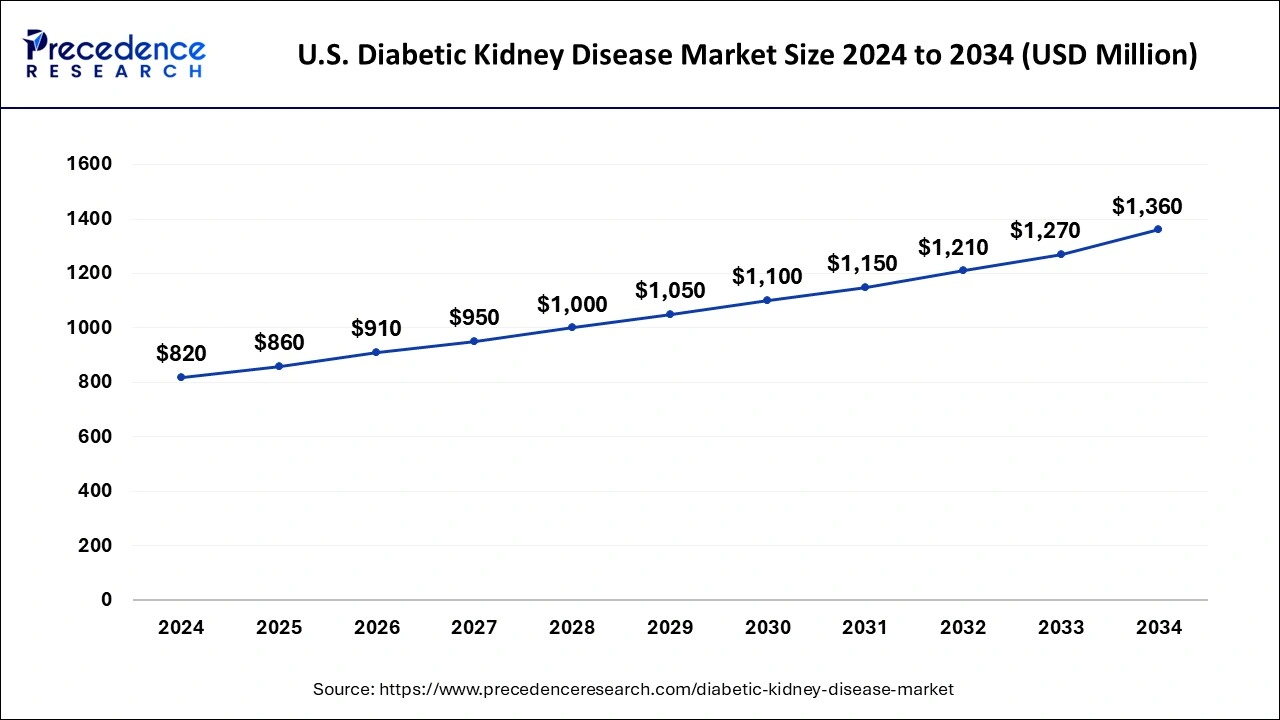

The U.S. diabetic kidney disease market size was evaluated at USD 820 million in 2024 and is predicted to be worth around USD 1360 million by 2034, rising at a CAGR of 5.18% from 2025 to 2034.

The United States, Canada, and Mexico are the major nations covered in the global kidney disease market report. Other significant countries include Germany, France, the United Kingdom, the Netherlands, Belgium, Switzerland, Italy, Russia, Spain, and Turkey, as well as the rest of Europe, Japan, China, South Korea, India, Malaysia, Singapore, Thailand, Australia, Indonesia, and the Philippines as well as the rest of Asia-Pacific (APAC), Saudi Arabia, the United Arab Emirates, South Africa, Egypt, and Israel as well as the rest of Middle East and Africa (MEA).

Due to rising government and pharmaceutical organization efforts to raise awareness of kidney disease as well as the existence of generic manufacturers, Europe has experienced the highest increase in the market worldwide.

As technology for treating renal disorders develops and pharmaceutical companies ramp up their efforts to create new formulations, North America now controls the market.

The study's regional section also lists specific market-impacting elements and domestic market regulation changes that affect the market's present and future trends. When giving prediction analysis of the country data, it also takes into account the presence and accessibility of international brands as well as the difficulties they encounter due to solid or weak competition from domestic and local brands, the influence of domestic tariffs, and trade routes.

Market Overview

Kidney illness brought on by diabetes accounts for a significant portion of all diseases worldwide. The prevalence of obesity and diabetes is rising worldwide, fueling the market for diabetic nephropathy to proliferate. Genetics, blood sugar management, and blood pressure are a few other risk factors that can aid in the development of kidney disease in diabetes patients. Rising demand for diagnostic tests, including urine, blood, and kidney biopsy, as well as imaging tests like CT scans and MRI, are other factors driving market expansion.

Strict regulatory regulations, prolonged medication approval processes, and a shortage of comprehensive therapeutic management for diabetic nephropathy are all impeding the growth of the diabetic nephropathy market. Additionally, the high cost of imaging devices and the accuracy and dependability of a diagnostic test for the diagnosis of diabetic nephropathy restrict market expansion. Nevertheless, improvements in healthcare infrastructure in developing nations can generate a massive opportunity for market expansion and significantly boost market growth throughout the forecast period. Additionally, the market is growing due to the robust growth of the medical device sector and the accessibility of cutting-edge diagnostic tools.

Growth Factors

- With the growing prevalence of diabetes worldwide, the number of cases of diabetic nephropathy is rising significantly, which boosts the growth of the market.

- There is a high awareness about early disease detection and prevention. This, in turn, boosts the demand for diagnostic tests, including urine, blood, and kidney biopsy, as well as imaging tests like CT scans and MRI, driving market growth.

- The growing geriatric population contributes to market expansion since older people are more susceptible to chronic diseases like diabetes.

- Rising research and development activities to develop new therapeutic approaches further contribute to market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.25 Billion |

| Market Size by 2034 | USD 5 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.90% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Treatment, By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Driver

With the growing geriatric population across the globe, there is a significant rise in the number of cases of chronic conditions such as diabetes and hypertension. If these conditions are not managed for a prolonged period, they narrow or stifle blood vessels, which reduces blood flow in the kidney, leading to diabetic kidney disease (DKD). Growing awareness about the benefits of early detection of DKD further drives the market growth. Advancements in screening methods have made early detection and intervention possible. As awareness regarding early disease detection and prevention continues to grow, patients and healthcare systems alike must prioritize early screening and management to mitigate adverse outcomes associated with DKD.

Restraint

Despite advancements in DKD therapeutics, there are several factors that hinder market growth. Many treatment options, particularly advanced therapies and medications, are expensive, and not everyone can afford them. This limits access to advanced treatments for many patients and further exacerbates the condition. Furthermore, limited access to nephrologists and the lack of availability of advanced treatments, especially in underdeveloped areas, hinder the growth of the market.

Opportunity

There is a significant opportunity for innovation in the treatment of DKD. Ongoing research and development efforts are exploring new drugs, gene therapies, and regenerative medicines, which will provide more effective treatment options for patients suffering from this disease. Moreover, telemedicine presents a promising avenue for enhancing patient monitoring and engagement. By utilizing telehealth technologies, healthcare providers can improve treatment adherence, provide timely interventions, and facilitate better management of DKD. As these new methods and technologies continue to evolve, they hold the potential to transform the landscape of DKD treatment and improve patient outcomes significantly.

Type Insights

The market is divided into Type 1 Diabetes and Type 2 Diabetes. During the projected period, the type 2 segment has held the biggest market share of 66% in 2024. Due to the widespread occurrence of diabetic nephropathy (DN) in type 2 diabetic people aged 20 and older.

Distribution Channel Insights

The retail pharmacy and drug store segment contributed the highest revenue in the diabetic kidney disease market in 2024. During the forecast period, the online provider segment is anticipated to see the highest CAGR, owing to the rise in the population suffering from diabetes and the geriatric population.

Treatment Insights

Based on treatment, Angiotensin Receptor Blockers (ARBs), angiotensin-Converting Enzyme (ACE) Inhibitors, Antioxidant Inflammation Modulators, Calcium Channel Blockers, and Others are the market segments. The Angiotensin-Converting Enzyme (ACE) Inhibitors sector has the largest market share. This is due to the safety and effectiveness of particular diabetic nephropathy-related symptoms.

Diabetic Kidney Disease Market Companies

- AstraZeneca (UK.)

- Pfizer Inc (US.)

- Allergan,Inc (Ireland)

- Bristol-Myers Squibb Company (US.)

- Endo International plc (Ireland)

- Dr. Reddy's Laboratories Ltd (India)

- Sun Pharmaceutical Industries Ltd (India)

- Teva Pharmaceutical Industries Ltd (Israel)

- Novartis AG (Switzerland)

- Mylan NV (US.)

- CiplaInc (India)

- Lupin (India)

- Aurobindo Pharma (India)

- Sanofi (France)

- Fresenius SE & Co. KGaA (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Abbott (US.)

Recent Developments

- In January 2024, Sun Pharmaceutical Industries and Bayer entered into a partnership to market and distribute a second brand of Finerenone , a medicine meant to treat chronic kidney disease associated with Type-2 diabetes, in India.

- In March 2023, Novartis announced that it had submitted a marketing authorization application (MAA) to the European Medicines Agency (EMA) for the renoprotective effects of sevelamer carbonate, a phosphate binder, for the treatment of diabetic nephropathy.

Segment Covered in the Report

By Type

- Type 1 Diabetes

- Type 2 Diabetes

By Treatment

- Angiotensin Receptor Blockers (ARBs)

- Angiotensin-Converting Enzyme (ACE) Inhibitors

- Antioxidant Inflammation Modulator

- Calcium Channel Blockers

- Others

By Distribution Channel

- Online Pharmacy

- Hospital Pharmacy

- Retail Pharmacy

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting