What is the Duodenoscope Market Size?

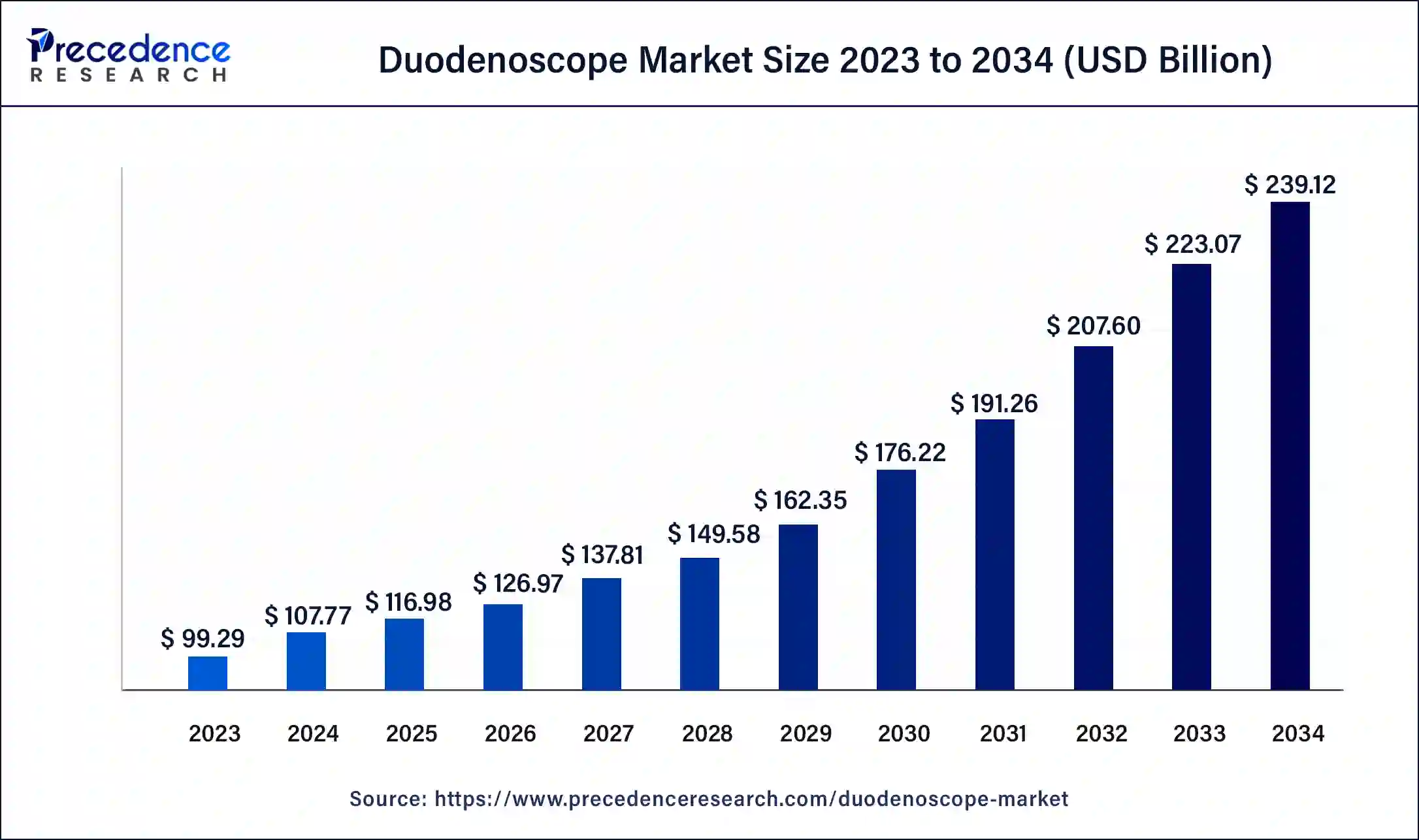

The global duodenoscope market size is calculated at USD 116.98 billion in 2025 and is predicted to increase from USD 126.97 billion in 2026 to approximately USD 254.78 billion by 2035, expanding at a CAGR of 8.09% from 2026 to 2035.

Duodenoscope Market Key Takeaways

- North America region generated the highest revenue share in 2025.

- By Product Type, the flexible video duodenoscope segment is expected to capture a maximum market share between 2026 to 2035.

- By Application, the diagnosis segment recorded the largest revenue share in 2025.

Duodenoscopes at the Forefront: Advancing Diagnosis and Treatment of Complex GI and Pancreatic Disorders

Duodenoscopes are flexible, hollow, lighted tubes that help doctors to view the top of a patient's duodenum or intestine. Doctors use duodenoscopes for endoscopic retrograde cholangiopancreatography (ERCP) procedures. This device supports doctors in diagnosing and treating severe life-threatening diseases like cancer and gallstones in the bile ducts and pancreas. As per the U.S. Food and Drug Administration, Americans undergo over 500,000 ERCP procedures every year using duodenoscopes.

Duodenoscopes are helpful in diagnosing infection, tumors, trauma, and cancer of the bile ducts. This device is also useful in the treatment of Chronic pancreatitis, Acute pancreatitis (inflammation of the pancreas), Pancreatic pseudocysts (fluid-filled sac in the abdomen), and cancers of the pancreas.

Duodenoscope is a more complex instrument when compared with other endoscopes. Cleaning and disinfecting a duodenoscope is a bit tough. The duodenoscopes market is expanding considerably owing to the rising prevalence of numerous gastrointestinal conditions such as bile duct and pancreatic cancer tumors. Additionally, growing research and development (R&D), technological advancements to recognize the risk factors related to the transmission of infectious agents, and increasing awareness is driving the duodenoscope market growth during the review period.

Our duodenoscope report aims to give an overview of the market with exhaustive market segmentation by product type, application, and end-user. The duodenoscope market is estimated to experience remarkable growth during the study period. This report provides crucial data & statistics relevant to the market considering the leading players, market trends, and key opportunities.

Duodenoscope Market Growth Factors

- Increasing adoption of duodenoscopes in hospitals and clinics for effective diagnosis and treatment of respective disorders and diseases fuels the market growth.

- The increasing number of clinical trials and R&D activities boost the market.

Duodenoscope Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 116.98 Billion |

| Market Size in 2026 | USD 126.97 Billion |

| Market Size by 2035 | USD 254.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.09% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing incidences of chronic diseases

The rising prevalence of pancreatic cancer, bile duct cancer, stomach cancer, and gastrointestinal disorders are expected to drive the market during the forecast period. Duodenoscopes are used to detect the risk factors and causes of the disease. Moreover, rising technological advancements to make duodenoscope more efficient for medical practices and the rising research and development activities boost the market growth.

Restraint

Regulatory challenges

Stringent regulations for manufacturing duodenoscopes hinder the market. Manufacturers must follow regulatory standards to ensure the product is safe for use. Furthermore, lengthy product approval process and the availability of cost-effective alternatives can hamper the market.

Opportunity

Rising acceptance of ERCP procedure

The rising need for endoscopic retrograde cholangiopancreatography (ERCP) procedure propels the market. ERCP procedure is widely used to diagnose and treat gallstones, acute pancreatitis, and pancreatic duct injuries. The increasing prevalence of GI disorders and the growing demand for flexible video duodenoscopes propel the market growth during the forecast period.

- In April 2024, Fujifilm introduced Tracmotion, the red dot award-winning Endoscopic Submucosal Dissection (ESD) device, at Endocon 2024 in Delhi.

COVID-19 Impact:

The pandemic of COVID-19 has impacted the duodenoscope market considerably. The adverse impact was majorly because of the reduction in endoscopy procedures during the initial stages of the pandemic. Since transport was largely affected in many parts of the world, the export of various essential components needed for the duodenoscope was severely impacted. Thus, the supply side of the duodenoscope market was hampered considerably owing to numerous limitations.

Among the endoscopy procedures, duodenoscopes involved a high risk of nosocomial infections. While single-use duodenoscopes had a certain utility for COVID-19-positive patients, there were availability and cost-related constraints across many countries of the world. During the COVID-19 pandemic period, ERCPs volumes reduced notably by 57% as compared to the pre-pandemic period. Such a decrease in the ERCPs volumes had a remarkable impact on the growth of the duodenoscope market.

Segmennt Insights

Product Type Insights

Based on product type, the global duodenoscope market is bifurcated into Flexible Video Dueodenoscopes and Flexible Non-Video Dueodenoscopes. The Flexible Video Dueodenoscopes segment is expected to hold a significant market share during the forecast period.

Earlier used duodenoscopes included flexible non-video (fibre) duodenoscopes. During the initial stage, fiber duodenoscopes were used the most. But now, the use of non-video duodenoscopes is declining and they can even become obsolete very soon.

Flexible video duodenoscopes include a flexible insertion tube that features video recording functionality. This flexible insertion tube uses a charge-coupled device for displaying magnified images on the video screen. Now, the flexible video duodenoscope segment is dominating with a higher market share. Olympus Corporation is one of the leading players in the duodenoscopes market followed by Fujifilm Holding, Karl Storz, and Pentax.

Application Insights

The global duodenoscope market is segmented into diagnosis and treatment. The diagnosis segment had the highest revenue share in 2023. The diagnosis segment is expected to dominate the market during the study period.

A duodenoscope is useful for diagnosis as well as treatment of numerous conditions of the biliary tree and pancreas, including stones, ductal obstructions, and malignancy.

A diagnostic duodenoscope (JF-140R, Olympus) with a working channel of 3.2 mm and an outer diameter of 11 mm can be used for children aged 1–3 years. A therapeutic duodenoscope having a 4.2 mm working channel can be used for ERCP among elder children.

End User Insights

The hospital segment dominated the market in 2023. The growth of the segment is attributed to the rising usage of duodenoscopes to perform endoscopic retrograde cholangiopancreatography (ERCP), a life-saving procedure used to detect and treat conditions in the bile ducts and pancreas. Moreover, the easy availability of advanced diagnostic solutions in hospitals contributed to the segmental growth.

Regional Insights

What Made North America the Dominant Region in the Market?

In 2023, North America region held the largest revenue share in the duodenoscope market. North America is the most developed continent owing to the presence of nations with favorable healthcare policies, high spending capacity, and early adoption of the latest medical technologies. In the United States, the per-procedure cost of a disposable duodenoscope varies from $797 to $1,547. This cost is for centers that perform at the 75th percentile of ERCP procedure volume.

U.S. Duodenoscope Market Analysis

The U.S. dominates the North American market. The U.S. market is growing due to the high volume of ERCP procedures, advanced healthcare infrastructure, and early adoption of innovative endoscopic technologies. The strong presence of leading manufacturers, the increasing prevalence of pancreatic and bile duct disorders, and strict regulatory oversight that improves device safety further support market leadership.

In 2023, health research expenditures in the private sector in Canada reached about $1,354.56 million. This was a significant rise from the amount of $1,276.01 million spent during 2021. A remarkable rise in health expenditure enhances the scope for new duodenoscope in the North American region.

What Potentiates the Duodenoscope Market in Asia Pacific?

In the Asia Pacific (APAC) region, pancreatic cancer is considered to be one of the most aggressive types of cancer. In India, pancreatic cancer is the 11th most prevalent kind of cancer. In 2019, the count of pancreatic cancer cases in China was around 114,964, and the incidence was found to be 5.78/100,000. Owing to such a count of pancreatic cancer cases, the need for duodenoscopes is anticipated to rise drastically in the Asia Pacific (APAC) region in the coming years.

The market in Asia Pacific is also potentiated by increasing healthcare infrastructure development, rising demand for minimally invasive procedures, and a growing prevalence of gastrointestinal diseases, particularly in countries like China and India. Government investments in healthcare, along with advancements in medical technology, are enhancing the adoption of duodenoscopes in hospitals and specialized clinics.

India Duodenoscope Market Analysis

India's market is expected to grow at the fastest rate due to the rising prevalence of gastrointestinal, pancreatic, and bile duct disorders, coupled with increasing awareness of early diagnosis. The rapid expansion of healthcare infrastructure, the growing number of endoscopy centers, improved access to advanced medical technologies, and rising healthcare expenditure further drive market growth during the forecast period.

What are the Major Factors Driving the Market in the Middle East and Africa?

Various Gulf countries such as Kuwait, Bahrain, Qatar, Oman, the United Arab Emirates (UAE), and the Kingdom of Saudi Arabia (KSA) have well-developed infrastructure required for duodenoscopes. The duodenoscope market in the Middle East region is anticipated to grow promisingly during the study period.

Due to low literacy, civil war, and uncertainty in some African countries, the adoption of duodenoscopes in the African region is expected to take place at a comparatively slow rate. The awareness about the benefits of duodenoscope is increasing in the Latin America region. The duodenoscope market in the Latin America region is expected to grow gradually.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate in the duodenoscope market due to the rising prevalence of gastrointestinal, pancreatic, and bile duct disorders. Increasing adoption of minimally invasive ERCP procedures, advanced healthcare infrastructure, and a strong focus on patient safety support growth. Favorable reimbursement policies, continuous technological advancements, and stringent regulatory standards further drive steady market expansion during the forecast period.

UK Duodenoscope Market Analysis

The market in the UK is growing due to the increasing prevalence of gastrointestinal, pancreatic, and bile duct disorders and the rising adoption of minimally invasive ERCP procedures. Strong NHS infrastructure, improved infection control guidelines, and growing use of advanced duodenoscope technologies support market expansion. Additionally, rising awareness, early diagnosis initiatives, and continued investments in endoscopy services further drive steady growth during the forecast period.

Value Chain Analysis

- Clinical Trials

Clinical trials focus on reducing contamination in reusable duodenoscopes and assessing the safety and efficacy of single-use duodenoscopes for ERCP.

Key players: Boston Scientific, PENTAX Medical, Ambu A/S, SonoScape, Fujifilm, Medtronic. - Regulatory Approvals

In the U.S., the FDA regulates duodenoscopes, encouraging the use of disposable components to reduce infection risks and ensure patient safety.

Key players: Cook Medical, Olympus Corporation, Karl Storz, Pentax Medical, Medtronic, Hoya Corporation. - Patient Support and Services

Duodenoscope patient support focuses on infection prevention, safety education, and guidance from healthcare providers, regulators, and device manufacturers.

Key players: Fujifilm, Boston Scientific, Ambu A/S, Pentax Medical, Olympus Corporation, and Medtronic.

Duodenoscope Market Companies:

- PENTAX Medical Company: Provides advanced duodenoscopes and endoscopic imaging solutions for ERCP procedures, focusing on patient safety, high-resolution visualization, and improved diagnostic and therapeutic outcomes.

- SonoScape: Manufactures flexible duodenoscopes and endoscopic devices with integrated imaging technology, targeting hospitals and clinics for gastrointestinal and pancreatic diagnostic and therapeutic procedures.

- Ambu A/S: Offers single-use and reusable duodenoscopes designed to reduce infection risk, enhance patient safety, and deliver reliable performance for ERCP and other endoscopic procedures.

- Boston Scientific Corporation: Supplies a comprehensive portfolio of duodenoscopes and endoscopic solutions for minimally invasive procedures, emphasizing innovation, high-quality imaging, and patient safety in gastrointestinal interventions.

Other Major Key Players

- Fujifilm Holdings Corporation

- KARL STORZ GmbH & Co. KG.

- Olympus Corporation

Recent Developments

- In September 2022, researchers at Harvard Medical School developed long, flexible GRIN lenses to produce bendable endoscopic imaging probes. These lenses can be used to perform fluorescence microscopy approaches to image deep into tissues.

- In August 2024, PENTAX Medical (part of HOYA Group) gained FDA approval for a duodenoscope featuring advanced sterilization technology, enhancing safety for ERCP procedures.

(Source: pentaxmedical.com) - In April 2024, Fujifilm introduced Tracmotion, its award-winning Endoscopic Submucosal Dissection (ESD) device, at Endocon 2024 in Delhi, highlighting innovations in endoscopic procedures.

(Source: fujifilm.com)

Segments Covered in the Report:

By Product Type

- Flexible Video Dueodenoscopes

- Flexible Non- Video Dueodenoscopes

By Application

- Diagnosis

- Treatment

By End User

- Hospitals

- Pediatric Centers

- Clinics

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting