What is the Endoscopes Market Size?

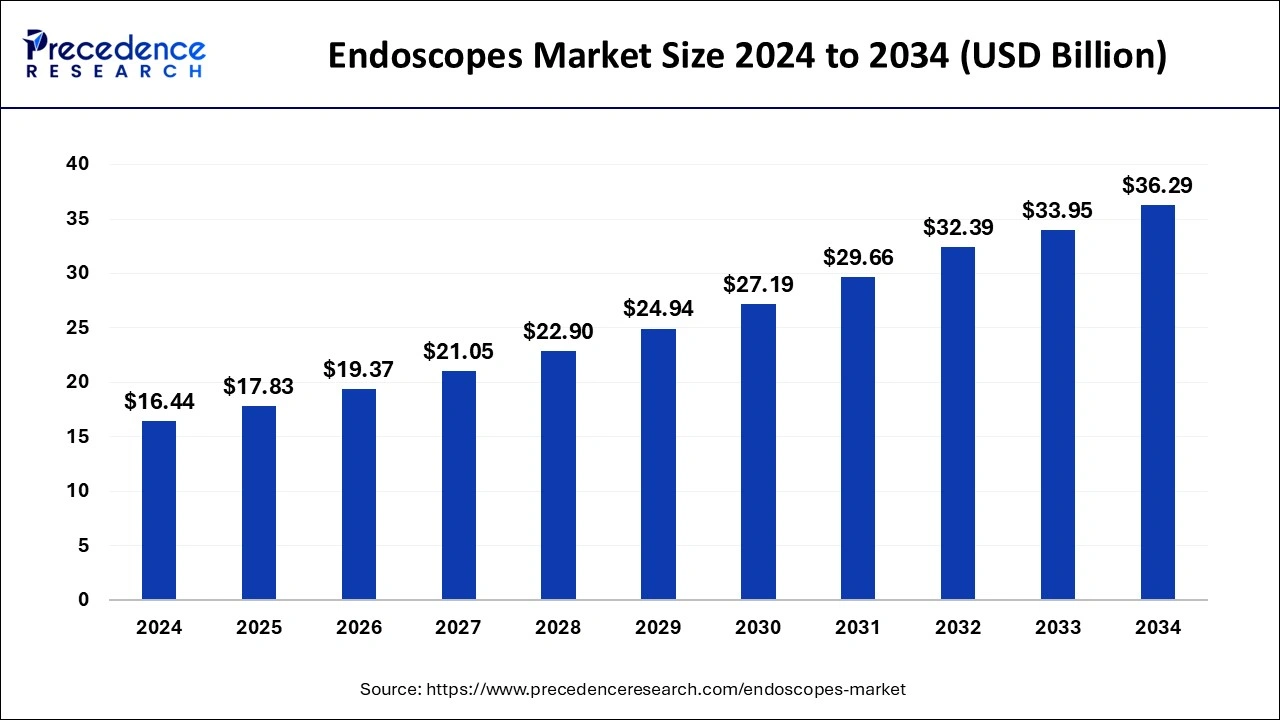

The global endoscopes market size was estimated at USD 17.83 billion in 2025 and is anticipated to reach around USD 36.29 billion by 2034, expanding at a CAGR of 8.39% from 2025 to 2034. The growth of the endoscopes market is driven by the rising demand for minimally invasive surgery. Endoscopes allow physicians to observe the inside of the body without performing major surgery.

Market Highlights

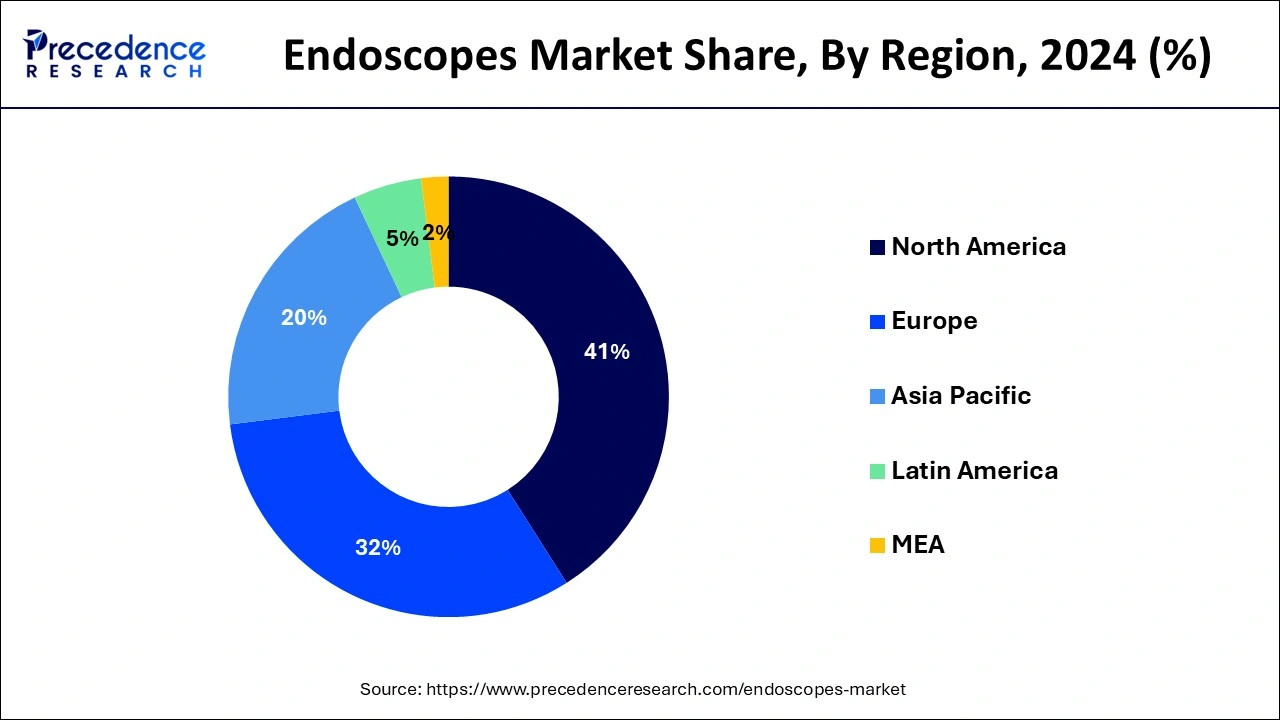

- North America led the global market with the highest market share of 41% in 2024.

- By Product, the flexible endoscopes segment contributed more than 47% of revenue share in 2024.

- By Application, the GI endoscopy segment had the largest market share of 51% in 2024.

- By End-user, the hospitals segment contributed more than 48.1% of revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 17.83 Billion

- Market Size in 2026: USD 19.37 Billion

- Forecasted Market Size by 2034: USD 36.29 Billion

- CAGR (2025-2034): 8.39%

- Largest Market in 2024: North America

How does Artificial Intelligence (AI) impact the Endoscopes Market?

Artificial intelligence (AI) has a profound impact on the overall healthcare sector. AI technologies have proven instrumental in revolutionizing healthcare delivery. With AI technologies, thorough evaluation and enhanced imaging and diagnostic are possible, which enhances the accuracy of endoscopy procedures. AI-driven endoscopes allow early detection, improve accuracy and precision, and transparency that helps medical professionals make informed decisions. Moreover, AI streamlines workflows in endoscopic procedures, reducing the burden on healthcare professionals and increasing efficiency.

Market Overview

Endoscopy and related devices have gained immense traction in the past few years. Endoscopes are widely used for diagnostic and therapeutic procedures. At present, HD format and HD+ technologies are making endoscopes highly reliable and effective. Further, better-quality designs have made flexible GI endoscopes easy to use, and smaller instrumentation has permitted more dedicated devices. Since the previous decade, the demand for flexible endoscopes has increased, mostly due to patients' inclination towards minimally invasive procedures.

Commonly, endoscopic processes are low-risk actions and are covered under health insurance policies. An upsurge in the number of aged populations with high risk of orthopedic, gastrointestinal, and ophthalmic diseases and cancer is driving the growth of the endoscopes market across the world. As per statistics by the World Health Organization (WHO), between 2000 and 2050, the proportion of the world's population aged 60 years and above will be twice from around 11% to 22%. This elderly population is the leading end user of bariatric surgeries, colonoscopy procedures, knee-hip implants, and gastrointestinal endoscopy, among others.

Inside View: Endoscope Market Illuminating Minimally Invasive Care

Market Outlook

- Industry Overview: The industry comprises established medical-device OEMs, specialist endoscopy firms, component suppliers, optics, sensors, LEDs, flexible polymers, contract manufacturers, distributors, clinical service organisations, and reprocessing/sterilisation providers. Competitive dynamics are shaped by technology differentiation, imaging quality, ergonomics, disposables, scale advantages in manufacturing and distribution, and service networks for maintenance and training. Regulatory scrutiny around infection control and device validation is high, prompting investment in clinical evidence and reprocessing validation. Consolidation and partnerships between imaging/software innovators and device manufacturers, or between large OEMs and agile startups, are common strategies to accelerate feature breadth and clinical adoption.

- Sustainability Trend: Sustainability debates in endoscopy center on balancing patient safety with environmental impact. Single-use scopes can reduce reprocessing resource consumption energy, water, and chemicals and lower cross-contamination risk but increase medical waste. Reusable scopes require intensive sterilization and lifecycle management; thus sustainability efforts aim to reduce energy and chemical use in reprocessing, extend device life through reconditioning and service programs, and develop recyclable or lower-impact materials for disposables.

- Circular approaches validated remanufacturing, take-back schemes for high-value components, and packaging reduction are gaining traction. Hospitals increasingly assess total environmental impact alongside clinical outcomes when choosing between reusable and disposable options.

- Major Investment Themes: Investors are favouring innovations that improve diagnostic yield, lower infection risk, and optimize economics. Key themes include single-use endoscope platforms for specific applications; AI and computer-vision tools for real-time lesion detection, characterization, and reporting; higher-resolution imaging and advanced modalities fluorescence, narrow band, spectral imaging; miniaturized sensor and illumination technologies enabling smaller-calibre scopes; and therapeutic extensions such as endoscopic suturing and submucosal dissection tools.

- Investment also flows into validated reprocessing automation, novel sterilization chemistries, and services that reduce total cost of ownership training, remote diagnostics, uptime guarantees. Strategic corporate investments often pair clinical evidence generation with distribution channels to accelerate adoption.

- Sustainable Ecosystems and Startups: A vibrant ecosystem links academic centres, clinical champions, MedTech incubators, and startups solving targeted problems low-cost single-use scopes for outreach programs, AI lesion detection tuned to specific anatomies, compact video processors for low-resource settings, and eco-friendly disposable materials.

- Successful startups focus on regulatory-minded product design, early clinical validation through pilot sites, and partnerships with larger OEMs or distributors for scale. Public-private collaboration training programs, shared clinical testbeds, and sustainability pilots that measure both clinical outcomes and environmental metrics helps promising solutions cross the adoption chasm.

Endoscopes MarketGrowth Factors

- The growing awareness about the early detection and prevention of diseases boosts the growth of the market.

- The increasing demand for minimally invasive and painless surgical procedures contributes to market expansion.

- The rising prevalence of chronic diseases, such as cardiovascular diseases (CVDs) and cancer, is likely to fuel the growth of the market during the forecast period.

- The rising demand for advanced diagnostic technologies that can visualize internal structures in detail contributes to market growth.

- Favorable reimbursement policies covering endoscopic procedures positively impact the market.

- The rising approvals for new endoscopes by regulatory bodies and health organizations are expected to drive the growth of the market.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 17.83 Billion |

| Market Size in 2026 | USD 19.37 Billion |

| Market Size by 2034 | USD 36.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.39% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, Region |

Market Dynamics

Drivers

Increasing Prevalence of Gastrointestinal Diseases

The increasing number of cases of gastrointestinal diseases, such as constipation, dyspepsia, and inflammatory bowel disorder (IBD), leads to a high demand for endoscopic procedures. The need for effective diagnostic solutions increases as these conditions become more common. However, endoscopes are essential to manage these conditions because they can analyze the GI tract in detail.

Expanding Healthcare Facilities

The rapid expansion of healthcare facilities, especially in emerging countries, drives the growth of the endoscopes market. Governments of various nations are also investing in improving healthcare facilities in underserved areas. This, in turn, boosts the demand for medical devices, including endoscopes. Furthermore, with the rising consumer disposable incomes in emerging countries, healthcare expenditure is increasing, contributing to market expansion.

Restraint

High Costs

The costs associated with endoscopy procedures are high and require a certain healthcare infrastructure in place. This cost includes procurement and maintenance of endoscopes and related equipment, as well as staff training. This makes endoscopic procedures costlier. In emerging countries, the healthcare infrastructure is still developing, which adds further pressure. Purchasing advanced endoscopic equipment is challenging for small healthcare organizations due to budget constraints, limiting the market's growth.

Opportunity

Technological Advancements

Rising advancements in endoscopic technology create immense opportunities in the market. Innovations like HD imaging and 3D visualization enhance the efficacy and accuracy of endoscopy procedures. Over the past years, technological advancements have made endoscopes more operative in performing procedures. Advancements in technology have paved the way for the development of robotic-assisted endoscopy. Such developments enhance precision and improve patient outcomes.

Segments Insights

Product Insights

Different types of product segments assessed in this report include flexible endoscopes, capsule endoscopes, robot assisted endoscopes, rigid endoscopes, disposable endoscopes and others.

Among all, flexible endoscopes gathered highest market revenue 47% in 2024 due to growing inclination on account of improved safety, ergonomics, and effectiveness over rigid endoscopes.

Application Insights

Among different applications evaluated in this report, GI endoscopy accounted for major market revenue of around 51% in 2024. Intensifying burden of GI diseases, plus mounting geriatric populace is motivating GI endoscopy demand worldwide. GI tumors are the second prevalent reason of cancer-associated deaths across the globe. Thus, less risk of surgical site infection (SSI), technical developments and low cost offered by surgeries than others are some of the considerable factors driving the progress of this segment in the global endoscopes market.

End-user Insights

Different end-users of endoscope products include ambulatory surgical centers or clinics, hospitals, and other. Other segment involves mobile endoscopy facilities, diagnostic centers, and office endoscopy services.

Among these, hospitals appeared as the prevalent end-user in 2024 and garnered a market share of 48.1%, due to extensive implementation of endoscopes and an upturn in the amount of surgeries accomplished in hospitals. Further, cumulative private and government subsidy and upward trend among patients and physicians to execute endoscopic processes in a hospital-based environment are driving the growth.

Regional Insights

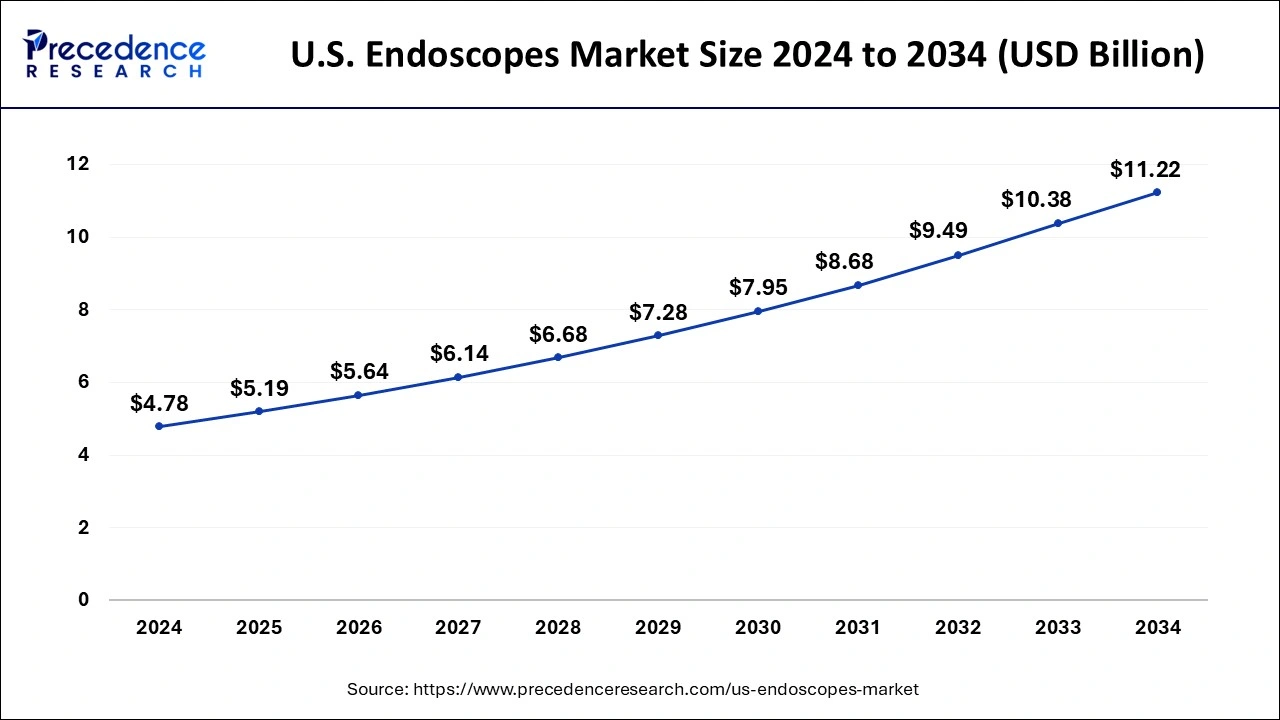

U.S. Endoscopes Market Size and Growth 2025 to 2034

The U.S. endoscopes market size was evaluated at USD 5.19 billion in 2025 and is predicted to be worth around USD 11.22 billion by 2034, rising at a CAGR of 9% from 2025 to 2034.

North America gathered major revenue chunk in 2024 of over 41% with of the total endoscopy devices market is projected to uphold this drift throughout the assessment period. This progress credited is upsurge infrequency of chronic diseases plus augmenting elderly population, great acceptance rate of technically cutting-edge endoscopy devices, and great responsiveness concerning the paybacks of endoscopy interventions. Additionally, intensification in measures for preventive healthcare, occurrence of highly sophisticated healthcare organization, and encouraging reimbursement setting is further pushing the market growth in this region.

India, Brazil, Russia, China, and South Africa are amongst the fastest-growing nations across the world. The World Economic Forum evaluates these emergent markets will occupy about one-third of the global healthcare spending in 2020. Now, numerous endoscopy equipment makers are setting up their plants in the Middle East, Asia Pacific, and Latin America. Leading companies like KARL STORZ and Stryker have already set up their R&D and manufacturing facilities in these nations. Furthermore, market maturity in established regions like North America and Europe, will further push endoscopy equipment manufacturers to emphasis on evolving nations during years to come.

Can Latin America Scale Endoscopy Services Without Breaking the Budget?

Latin America presents a mixed landscape: larger economies Brazil, Mexico, Argentina, Colombia have established tertiary hospitals and specialist networks able to adopt mid-to-high-end endoscopy systems, while many regions remain underserved due to limited infrastructure and trained personnel. Cost sensitivity favors reuse and long-life instrumentation in major centres, but remote or rural areas could benefit from targeted use of affordable single-use scopes or mobile endoscopy units that reduce the need for local reprocessing.

Local distributor relationships, service availability, and workforce training are decisive factors in adoption. Strategic investments in training programs, regional sterilization hubs, and scalable single-use pilots could expand access while managing costs.

Will Portable, Durable Solutions Bridge the Endoscopy Gap in Middle East Africa?

Middle East & Africa show a spectrum from advanced urban medical centres in wealthier Gulf and North African countries where high-end imaging and therapeutic endoscopes see early adoption to resource-constrained sub-Saharan regions where limited sterilization, intermittent power, and scarcity of trained endoscopists restrict procedure volumes.

Opportunities include portable, battery-tolerant processors, ruggedized low-cost scopes for outreach clinics, tele-mentoring to extend specialist reach, and regional service hubs that support maintenance and reprocessing. Successful deployment hinges on reliable servicing, supply-chain stability for consumables, and financing models leasing, managed service agreements that lower upfront barriers for hospitals and clinics.

Market Value Chain Analysis

- Raw Material Sourcing: Critical materials include high-performance imaging sensors (CMOS), precision glass and polymer optics, flexible medical-grade thermoplastic elastomers for insertion tubes, biocompatible polymers for distal tips, LED or laser light sources, miniaturized electronics and PCBs, and sterilization-compatible adhesives and seals. Suppliers must meet stringent quality, traceability, and regulatory requirements biocompatibility, lot traceability.

- Technological Advancements: Technological progress includes higher-resolution imaging HD/4K and beyond, enhanced optical modalities narrow band, fluorescence, multispectral imaging, AI-driven real-time detection and quantification of lesions, and miniaturized sensor and light sources enabling ultra-thin scopes. Single-use manufacturing techniques are improving quality while lowering costs for select indications. Robotic and articulating endoscopic platforms expand therapeutic precision and reach.

Endoscopes Market Companies

- Karl Storz (The company is crucial for integrating digital information and video content within the OR, improving surgical efficiency, and expanding the capabilities of minimally invasive surgery.)

- Richard Wolf GmbH (Richard Wolf is important for developing high-quality, durable, and ergonomically designed instruments that can be used across multiple disciplines.)

- Hoya Corporation (A global technology and med-tech company with importance spanning healthcare and information technology.)

- ConMed (A medical technology company specializing in surgical devices and equipment for minimally invasive procedures across orthopedics, general surgery, gynecology, and gastroenterology.)

Recent Developments

- In August 2024, KARL STORZ United States partnered with FUJIFILM Healthcare Americas Corporation (Fujifilm) to provide comprehensive solutions for endoscopists and surgeons. This partnership aims to transform endoscopy by combining Fujifilm's industry-leading flexible gastrointestinal (GI) endoscopes with OR integration solutions from KARL STORZ.

- In July 2024, FUJIFILM India opened a new endoscopy center in Mumbai. This center is FUJIFILM's second-largest unit, equipped with repair tools and technology that aim to reduce service turnaround times.

- In March 2024, Olympus and NTT announced the start of their first demonstration experiment of a cloud endoscopy system. The companies aim to create a reference model for a cloud endoscopy system that will enable real-time image processing of endoscopes on the cloud.

Segments Covered in the Report

This research study comprises comprehensive assessment of the marketplace revenue with the help of prevalent quantitative and qualitative acumens, and forecasts of the market. This report presents breakdown of market into major and niche segments. Furthermore, this research study gauges market revenue growth and its drift at global, regional, and country from 2025 to 2034. This report includes market division and its revenue assessment by categorizing it depending on product, application, end-user and region as follows:

By Product

- Flexible Endoscopes

- Bronchoscopes

- Laryngoscopes

- Sigmoidoscopes

- Upper Gastrointestinal Endoscopes

- Duodenoscopes

- Colonoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Other

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Urology Endoscopes

- Laparoscopes

- Arthroscopes

- Cystoscopes

- Neuroendoscopes

- Other

- Disposable Endoscopes

By Application

- Arthroscopy

- Urology Endoscopy

- Laparoscopy

- Gastrointestinal (GI) Endoscopy

- Bronchoscopy

- Mediastinoscopy

- Gynecology Endoscopy

- Otoscopy

- Laryngoscopy

- Other Applications

By End-Use

- Ambulatory Surgery Centers

- Hospitals

- Other

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting