What is the Flexible Endoscopes Market Size?

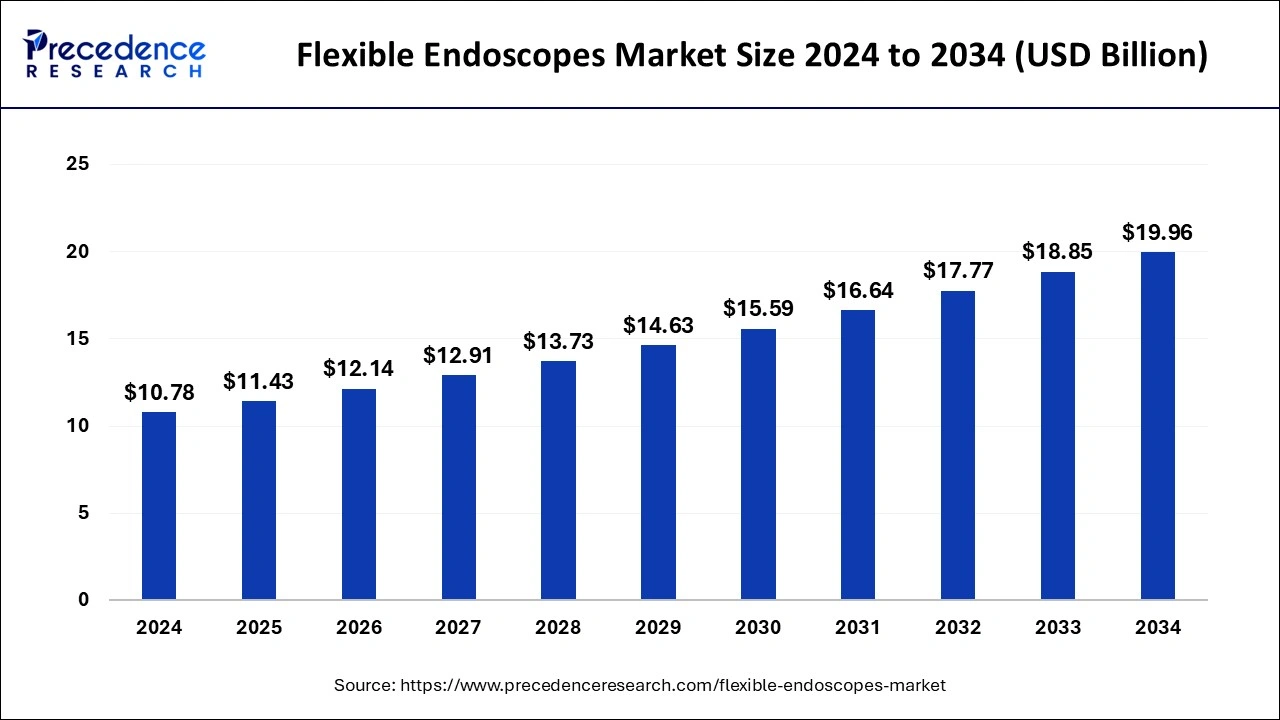

The global flexible endoscopes market size was estimated at USD 11.43 billion in 2025 and is predicted to increase from USD 12.14billion in 2026 to approximately USD 21.05 billion by 2035, expanding at a CAGR of 6.30% from 2026 to 2035.

Flexible Endoscopes Market Key Takeaways

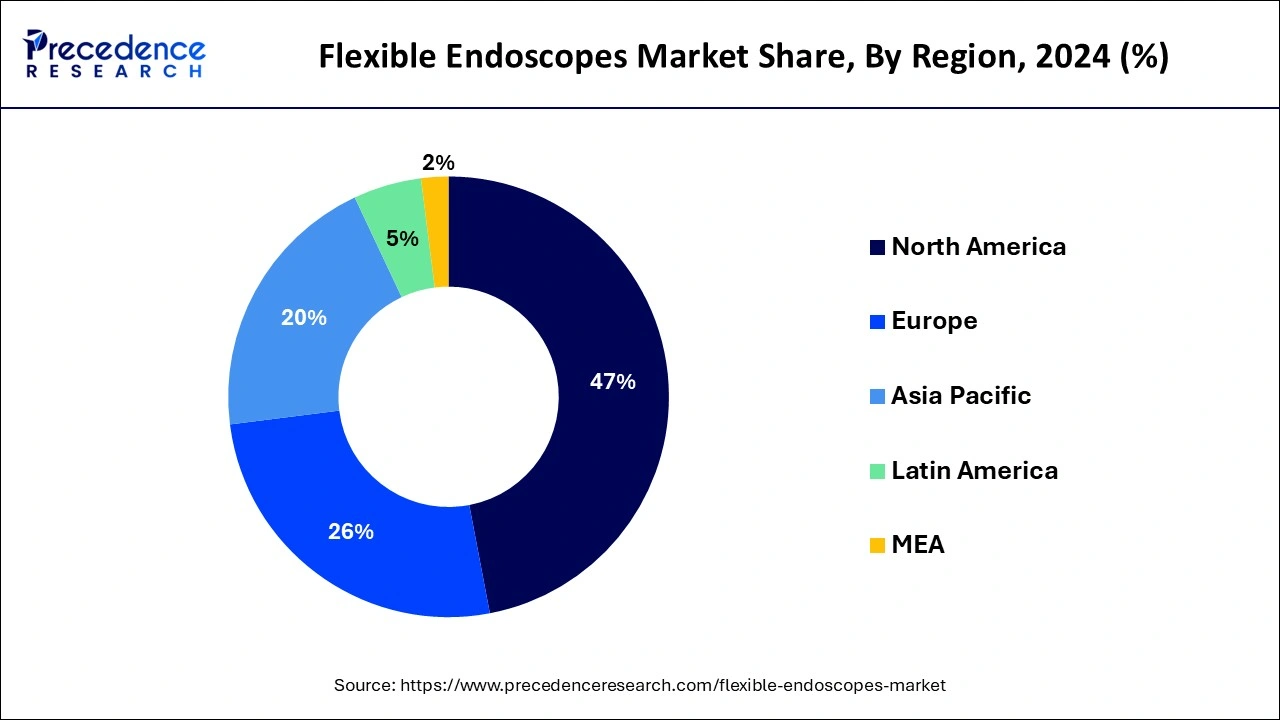

- North America has held the highest revenue share of 47% in 2025.

- Asia-Pacific region is expected to expand at the fastest CAGR during the forecast period.

- By Type, the colonoscopes segment captured 24% of revenue share in 2025.

- By Type, the neuroendoscopes segment is anticipated to grow at a notable CAGR of 6.8% between 2026 to 2035.

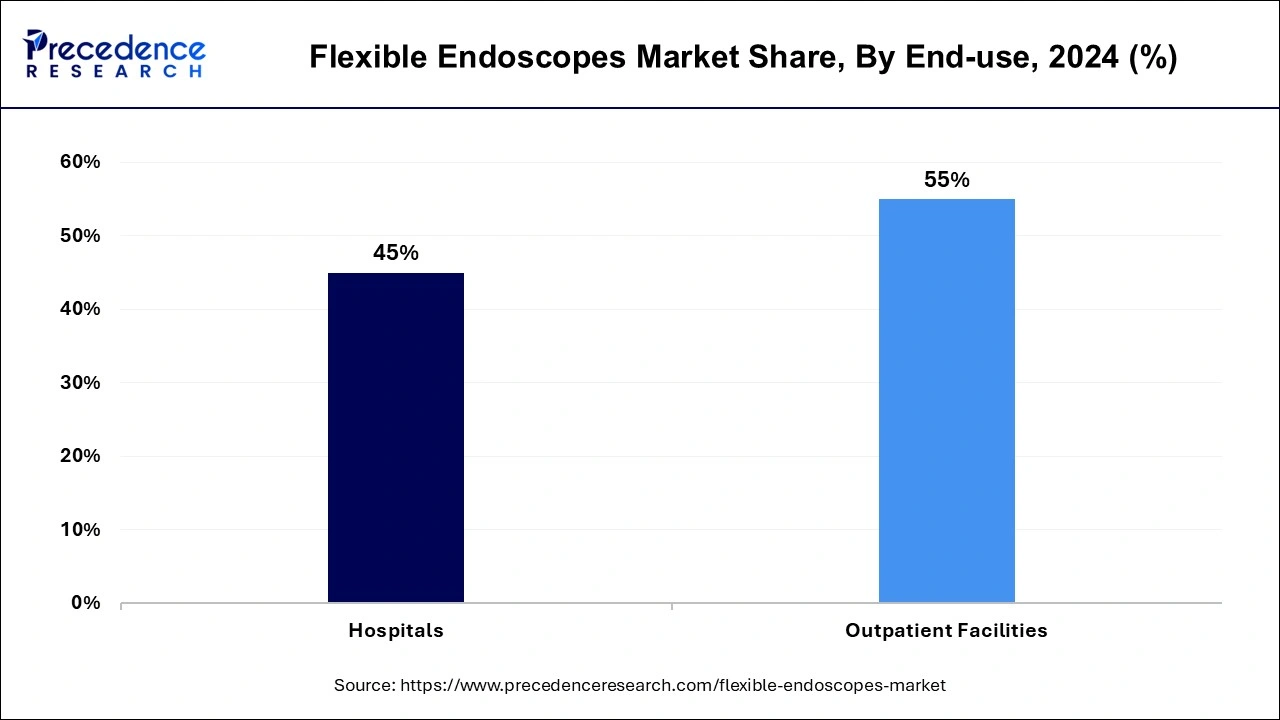

- By End-use, the outpatient facilities segment contributed more than 55% of revenue share in 2025.

- By End-use, the hospitals segment is expected to expand at the fastest CAGR over the projected period.

What is the Flexible Endoscope?

- The flexible endoscopes market encompasses the medical devices used for non-invasive visual examination and diagnostic procedures within the body's cavities and organs. These instruments, featuring flexible, slender, and maneuverable shafts with integrated cameras and lighting, are employed to investigate and diagnose various medical conditions, often through minimally invasive techniques.

- The market is characterized by ongoing technological advancements aimed at enhancing image quality, flexibility, and usability, with applications spanning gastroenterology, pulmonology, urology, and other medical specialties to improve patient diagnosis and treatment outcomes.

How is AI contributing to the Flexible Endoscopes Industry?

AI enhances versatile endoscopy as it serves as a real-time clinical assistant in the process. CAD systems are used in non-invasive scanning of image frames, detecting polyp lesions that are bleeding and early cancers. CADx applications can distinguish between benign and malignant growths in tissues and determine the depth of invasion immediately. AI monitors bowel preparation and the documentation of blind spot withdrawal.

Flexible Endoscopes Market Growth Factors

The flexible endoscopes market is a vital component of modern healthcare, providing minimally invasive and precise diagnostic and therapeutic solutions. These instruments, characterized by their flexible, slender shafts equipped with cameras and illumination, enable visual examinations of body cavities and organs.

The flexible endoscopes market is propelled by several key factors, including technological advancements, the increasing prevalence of chronic diseases, and the growing preference for less invasive medical procedures.

The industry continually witnesses innovations in flexible endoscope design, resulting in improved image quality, enhanced maneuverability, and increased usability. These advancements, such as superior optics and more compact instruments, contribute significantly to market growth.

The escalating incidence of chronic diseases, particularly gastrointestinal disorders and respiratory conditions is a primary driver of the demand for flexible endoscopes. These devices play a pivotal role in early diagnosis, ongoing monitoring, and treatment.

The global demographic shift towards an aging population is associated with an increased susceptibility to age-related health issues. This demographic trend further fuels the demand for flexible endoscopes, given their less invasive nature and the desire for timely interventions. Patients are increasingly inclined towards minimally invasive procedures, which has led to a gradual shift away from traditional surgical methods. Flexible endoscopes offer reduced recovery times, fewer complications, and enhanced patient comfort, making them a preferred choice.

The industry grapples with the critical challenge of maintaining stringent infection control measures during endoscopy procedures. Ensuring the proper cleaning and disinfection of reusable endoscopes to prevent cross-contamination remains a paramount concern. The initial capital investment and ongoing maintenance costs associated with flexible endoscopes can be substantial. This can limit their accessibility in resource-constrained healthcare settings and impact market penetration. Compliance with complex and evolving regulatory frameworks is a key challenge for industry players. Ensuring that products meet stringent safety and quality standards can slow down product development and market entry.

Emerging markets with expanding healthcare infrastructure present significant growth opportunities for flexible endoscope manufacturers. These regions offer a burgeoning patient population and a growing demand for advanced medical technologies. The integration of flexible endoscopes with telemedicine platforms holds the potential to enhance remote consultations and provide expert guidance, expanding the reach and utility of these devices. The development of cost-effective, disposable flexible endoscopes could address infection control concerns while reducing long-term costs for healthcare facilities, creating a lucrative avenue for innovation.

Market Outlook

- Industry Growth Overview: Minimally invasive procedures, ageing population, and high definition imaging maintain industry growth.

- Global Expansion: Europe, especially Germany, focuses on compliance, high-tech integration set up healthcare infrastructure.

- Major investors: Olympus Corporation, Karl Storz, Boston Scientific, Fujifilm, Stryker, Medtronic, and Ambu are heavy investors.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.30% |

| Market Size in 2025 | USD 11.43 Billion |

| Market Size by 2035 | USD 21.05 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Offering and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of chronic diseases and patient preference for minimally invasive procedures

The increasing prevalence of chronic diseases, including gastrointestinal disorders, respiratory conditions, and various forms of cancer, stands as a primary catalyst for the growing market demand for flexible endoscopes. These medical devices hold a crucial role in the diagnosis, ongoing monitoring, and treatment of chronic health conditions, making them indispensable tools in modern healthcare. As the patient population requiring frequent endoscopic procedures for early detection and intervention continues to expand, flexible endoscopes have evolved into indispensable tools for healthcare providers. Their capacity to deliver minimally invasive solutions, resulting in shorter recovery times and reduced patient discomfort, perfectly aligns with the patient-centric approach to care, further accelerating their adoption and fostering market growth in response to the mounting burden of chronic diseases.

The market demand for flexible endoscopes is strongly influenced by patient preferences for minimally invasive procedures. An increasing awareness of the advantages, including shorter recovery periods, reduced discomfort, and fewer complications, has led patients to favor minimally invasive techniques. Flexible endoscopes empower healthcare providers to conduct a diverse array of diagnostic and therapeutic procedures with minimal trauma, perfectly aligning with patients' desires for less invasive interventions. This rising demand signifies a fundamental transformation in healthcare, prioritizing procedures that enhance patient comfort and overall satisfaction. Consequently, it propels the adoption and growth of flexible endoscopic technologies within the market.

Restraints

Infection control and disposable device adoption

Infection control presents a significant restraint on the market demand for flexible endoscopes. Ensuring the proper cleaning and disinfection of reusable endoscopes is critical to prevent healthcare-associated infections. Instances of lapses in infection control can erode patient and healthcare provider confidence in the safety of these procedures.

Moreover, the rigorous protocols and resource-intensive processes required for effective infection control can increase operational costs for healthcare facilities. As a result, concerns related to infection control can limit the adoption of flexible endoscopes and hinder their broader use in medical settings, impacting market demand.

Moreover, Disposable device adoption poses a restraint on the market demand for flexible endoscopes. The increasing preference for disposable endoscopes due to infection control concerns has led to a shift away from traditional reusable devices. This shift can limit market growth for manufacturers of reusable endoscopes, as healthcare facilities increasingly opt for single-use alternatives. While disposable devices offer advantages in terms of infection control, they can lead to reduced revenue for traditional flexible endoscope manufacturers, creating a challenge for sustaining market demand and profitability in this evolving landscape.

Opportunities

Technological advancements and telemedicine integration

Technological advancements serve as a robust driver of market demand in the flexible endoscopes market. Continuous innovation, such as enhanced optics, miniaturization, and improved maneuverability, significantly enhances the capabilities of these devices. These advancements result in superior image quality, increased diagnostic accuracy, and greater patient comfort. Additionally, innovations such as smaller and more agile instruments enable healthcare providers to perform a wider range of procedures with greater ease and precision. As healthcare evolves to prioritize advanced and less invasive techniques, the adoption of technologically advanced flexible endoscopes is propelled, ensuring their continued relevance and market growth.

Moreover, telemedicine integration significantly boosts market demand for flexible endoscopes. The incorporation of flexible endoscopes into telemedicine platforms enhances remote consultations, enabling healthcare providers to offer expert guidance and conduct examinations in real-time, even in remote or underserved areas. This expansion of the technology's reach improves access to minimally invasive diagnostic and therapeutic procedures, driving up demand for flexible endoscopes. Telemedicine also streamlines patient care, reduces the need for in-person visits, and supports early diagnosis and intervention, aligning perfectly with the growing patient-centric healthcare approach, thus fueling market growth for flexible endoscopy technologies.

Segment Insights

Type Insights

According to the type, the colonoscopes segment held a 24% revenue share in 2025. A colonoscope is a type of flexible endoscope specifically designed for the examination and visualization of the colon (large intestine). It features a long, flexible, and slender tube equipped with a camera and lighting, allowing healthcare providers to inspect the inner lining of the colon for signs of abnormalities, such as polyps or cancer.

In the flexible endoscopes market, the colonoscope segment is experiencing notable trends, including advancements in optics and imaging technology, which enhance the quality of colonoscopy procedures. Moreover, the rising prevalence of colorectal diseases and a growing emphasis on early detection and prevention are driving the demand for colonoscopes as essential tools for gastroenterologists and colorectal surgeons.

The neuroendoscopes segment is anticipated to expand at a significantly CAGR of 6.8% during the projected period. Neuroendoscopes are a specialized type of flexible endoscope designed for minimally invasive procedures within the brain and central nervous system. These instruments feature slender, flexible shafts equipped with high-resolution cameras and illumination, enabling neurosurgeons to visualize and treat conditions like tumors and hydrocephalus.

In the flexible endoscopes market, a notable trend is the continuous improvement in neuroendoscope technology. Advancements such as high-definition imaging, better maneuverability, and integration with navigation systems enhance precision and safety during neurosurgical procedures. This trend reflects the broader industry shift towards enhancing the capabilities of flexible endoscopes for specialized medical applications.

End-use Insights

Based on the End-use, outpatient facilities segment is anticipated to hold the largest market share of 55% in 2025. Outpatient facilities, also known as ambulatory care centers or day surgery centers, provide medical services to patients who do not require an overnight hospital stay. These facilities have become a key end-use segment in the flexible endoscopes market due to their cost-effectiveness and patient convenience. Recent trends in the market indicate a growing preference for performing endoscopic procedures in outpatient settings. This shift is driven by advancements in technology that enable quicker and less invasive procedures, reducing recovery times.

Additionally, the COVID-19 pandemic has accelerated the adoption of outpatient endoscopy, as it minimizes patient exposure and conserves hospital resources. The trend towards outpatient endoscopy is expected to continue as healthcare systems prioritize efficiency and patient-centric care.

On the other hand, the Hospitals segment is projected to grow at the fastest rate over the projected period. Hospitals are key end-users of flexible endoscopes, employing these medical devices for a wide range of diagnostic and therapeutic procedures. The trends in the flexible endoscopes market within hospitals include a growing emphasis on minimally invasive techniques, which align with patients' preferences for reduced discomfort and faster recovery times. Hospitals are also investing in training programs to equip healthcare professionals with the necessary skills to perform endoscopic procedures effectively.

Furthermore, the integration of flexible endoscopes with telemedicine platforms is gaining traction, enabling remote consultations and expert guidance, which enhances the reach and utility of these devices within hospital settings.

Regional Insights

What is the U.S. Flexible Endoscopes Market Size?

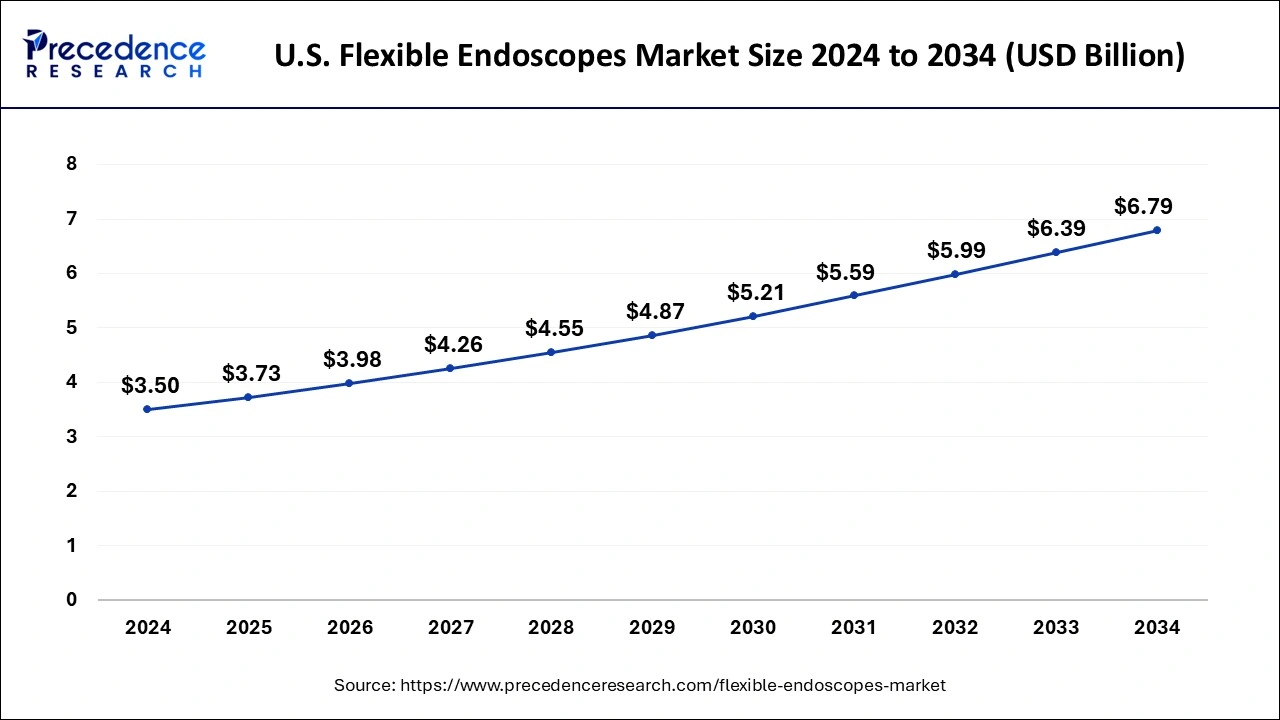

The U.S. flexible endoscopes market size reached USD 3.73 billion in 2025 and is anticipated to be worth around USD 7.19 billion by 2035, poised to grow at a CAGR of 6.78% from 2026 to 2035.

North America has held the largest revenue share of 47% in 2025. In North America, the flexibleendoscopes market is marked by several notable trends. The region exhibits a strong demand for advanced medical technologies, driven by a growing prevalence of chronic diseases, such as gastrointestinal disorders and respiratory conditions. Technological advancements in endoscope design, including improved optics and maneuverability, continue to shape the market. Additionally, the adoption of telemedicine and the integration of flexible endoscopes into remote healthcare platforms are on the rise, enabling enhanced access to specialized care. Regulatory compliance and infection control measures are also key considerations influencing market dynamics in North America.

The United States remains the leader in the North American flexible endoscopes market, driven by a highly developed healthcare infrastructure and strong demand for minimally invasive procedures. Chronic diseases, including gastrointestinal diseases and colorectal cancer, are increasing the use of flexible endoscopes for early diagnosis. AI is expected to be increasingly integrated into flexible endoscopes in 2024 and 2025, and disposable endoscopes are expected to shift considerably within the integrated market due to infection control.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the flexible endoscopes market is experiencing significant trends. The expanding healthcare infrastructure, particularly in countries like China and India, is fostering the adoption of flexible endoscopic procedures. Rising healthcare awareness and the prevalence of chronic diseases are driving demand. Additionally, technological advancements in endoscope design are gaining traction. The growing aging population in the region, prone to age-related health issues, is increasing the need for diagnostic and therapeutic endoscopy. Overall, the Asia-Pacific region is emerging as a dynamic market for flexible endoscopes, with a focus on enhancing healthcare accessibility and quality.

China is rapidly progressing in the Asia Pacific flexible endoscopes market with government investment in healthcare, increasing rates of gastrointestinal diseases, and improving policy measures for access to minimally invasive procedures. Concurrently, domestic companies are teaming with international companies to invest correctly in new technologies. AI and robotics-assisted endoscopy technologies are accelerating within flexible endoscopes, which indicates China's commitment to healthcare advancement and further emphasis on innovation in the medical devices industry.

What Are the Driving Factors of The Flexible Endoscopes Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is a highly developed, adaptable endoscopy market with well-developed healthcare frameworks and centralized cancer screening campaigns. The frequent upkeep of high-definition imaging sustainable platforms and well-organized reimbursement policies assists in maintaining consistent demand.

Germany Flexible Endoscopes Market Trends

Germany focuses on the traceability of regulatory compliance and infection control in the endoscopy services. Tough reprocessing regulations promote the single-use and reusable systems in mixed fleets. Hospital changes concentrate procurement, hastening upgrades. Metropolis hubs are enlarging tele endoscopy by using portable towers linked with specialist hubs.

Value Chain Analysis of the Flexible Endoscopes Market

- R&D: Innovation through core research to produce variousiated flexible endoscopy therapeutic and diagnostic value propositions.

Key players: Olympus Corporation, FUJIFILM Holdings Corporation, Karl Storz SE & Co. KG - Clinical Trials and Regulatory Approvals: Safety, efficacy validation, and obtaining legal requirements allowing market access in a compliant manner across the world.

Key players: Stryker Corporation, Boston Scientific Corporation, Medtronic plc - Flexible Endoscope Distribution: Flexible Logistics Management of high-value instruments, providing care to doctors safely.

Key players: Olympus Corporation, Boston Scientific Corporation

Flexible Endoscopes Market Companies

- Olympus Corporation: Pioneers with high-resolution gastroscopes and colonoscopes with Narrow Band Imaging that improve clinical accuracy and reliability in lesion detection.

- Fujifilm Holdings Corporation: Offers Eluxeo technology, which combines Multi light technology and CADEYE AI to support more visualization and diagnostic confidence in real time.

- Karl Storz SE & Co. KG: Offers Silver Scope versatile endoscopes to the IMAGE1 S platform that provides modular high definition imaging solutions.

Other Major Key Players

- Hoya Corporation (PENTAX Medical)

- Stryker Corporation

- Medtronic plc

- Richard Wolf GmbH

- Smith & Nephew plc

- Arthrex, Inc.

- Ambu A/S

- B. Braun Melsungen AG

- Boston Scientific Corporation

- CONMED Corporation

- EndoChoice Holdings, Inc. (A subsidiary of Boston Scientific)

- HOYA Corporation (PENTAX Medical)

Recent Developments

- In May 2025, Olympus Corp. launched the ScopeLocker Air endoscope drying cabinet, enhancing drying options for healthcare facilities. This product, from Capsa Healthcare, ensures compliance with guidelines for endoscope drying and storage, crucial for reprocessing.

(Source: https://www.prnewswire.com ) - In March 2025, the FDA approved Nanosonics' automated CORIS device, an automated system that cleans the intricate inner channels of flexible endoscopes, tackling biofilm buildup that manual cleaning misses. This is crucial as biofilm can harbor resistant pathogens linked to hospital-acquired infections during reprocessing. (Source: https://www.fiercebiotech.com )

- In March 2025, Creo Medical Group plc, a medical device company specializing in surgical endoscopy, launched its SpydrBlade Flex technology in the UK and Europe, with St Mark's Hospital in NW London becoming its first commercial customer. The SpydrBlade Flex is a multi-modal endoscopic device designed for precision in lower gastrointestinal colorectal resections.

- In May 2024, Vivo Surgical launched the ENLYT flexible endoscope at the global health conference "Promoting Healthier Connections with the World" at Duke University in the U.S.

- In January 2024, EndoSound Inc., a pioneering medical technology company dedicated to advancing patient care, announced it had received 510(k) clearance from the FDA for its EndoSound Vision SystemTM (EVSTM). The EVS is a novel endoscopic ultrasound (EUS) device that attaches to upper gastrointestinal endoscopes, seamlessly integrating into any endoscopy center's existing ecosystem.

- In May 2024, Galvanize today announced that it received U.S. Food and Drug Administration 510(k) regulatory clearance for the INUMI Flex endoscopic needle for use with the Aliya PEF System for soft tissue ablation. The INUMI Flex needle expands the Aliya Pulsed Electric Field ablation portfolio, enabling minimally invasive endoscopic delivery to complement the previously cleared percutaneous Needle.

Segments Covered in the Report

By Offering

- Laparoscopes

- Arthroscopes

- Ureteroscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscope

- Bronchoscopes

- Hysteroscopes

- Laryngoscopes

- Sinuscopes

- Otoscopes

- Sigmoidoscopes

- Pharyngoscopes

- Others

By End Use

- Hospitals

- Outpatient Facilities

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting