List of Contents

What is the Disposable Endoscopes Market Size?

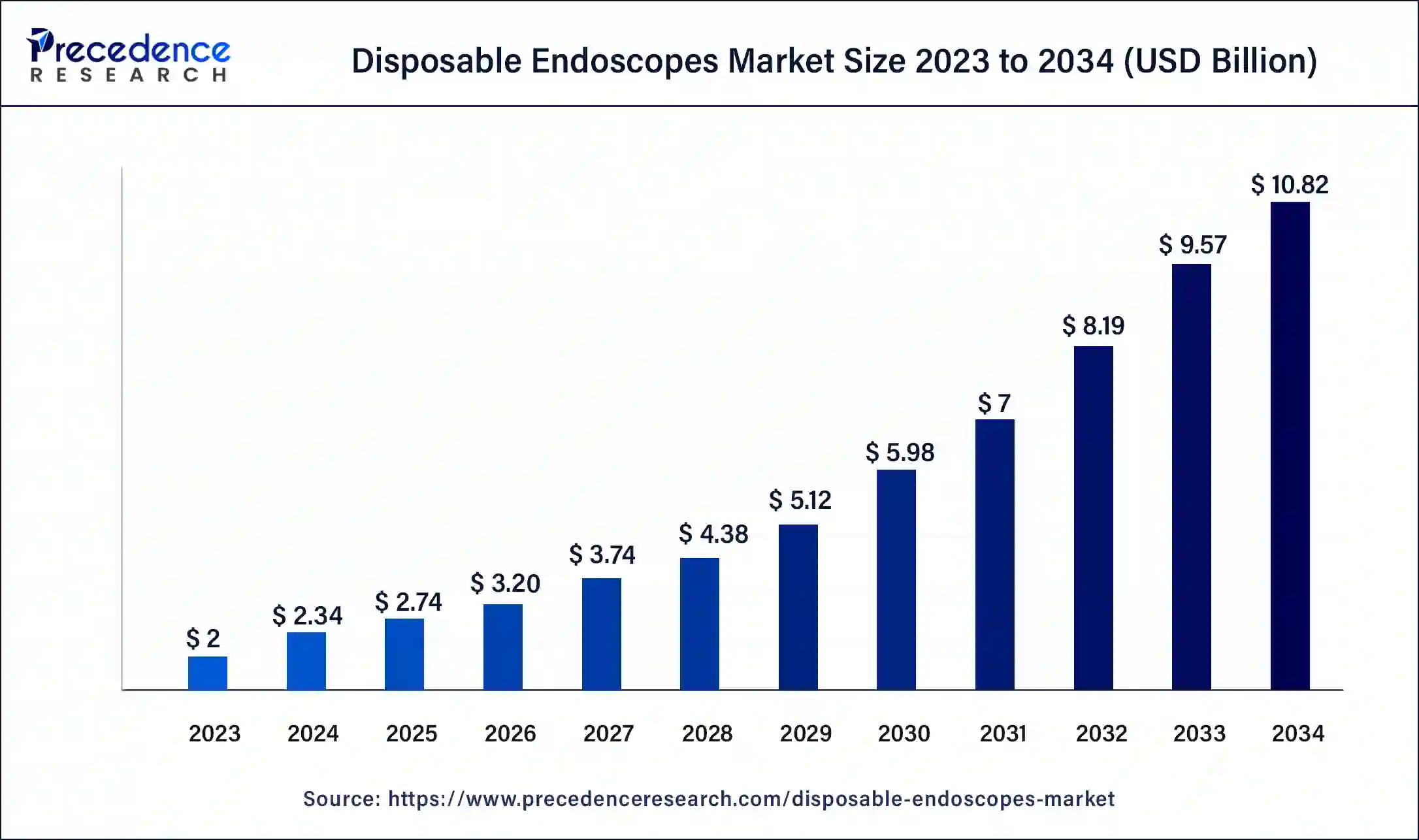

The global disposable endoscopes market size is valued at USD 2.74 billion in 2025 and is predicted to increase from USD 3.2 billion in 2026 to approximately USD 10.82 billion by 2034, expanding at a CAGR of 16.55% from 2025 to 2034.

Disposable Endoscopes Market Key Takeaways

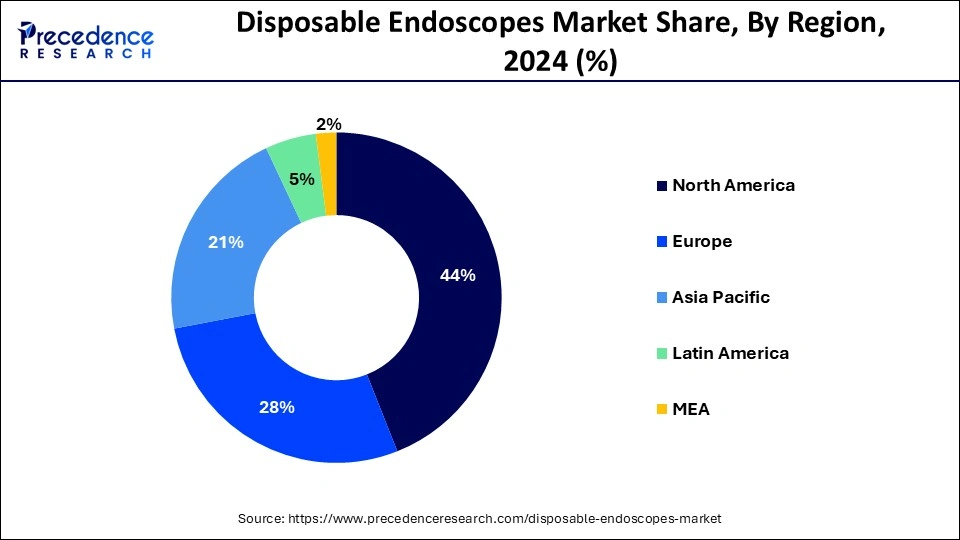

- North America contributed more than 44% of revenue share in 2024.

- Europe is estimated to expand the fastest CAGR between 2025 and 2034.

- By Application, the bronchoscopy segment has held the largest market share of 32% in 2024.

- By Application, the urologic segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By End-user, the hospital segment generated over 49% of revenue share in 2024.

Disposable Endoscopes Market Growth Factors

Continuous growth of disposable endoscopes market is primarily driven by growing hospital investments in endoscopy facilities, rising demand for endoscopy owing to the rising prevalence of target diseases, and technological advancements in endoscopy. Different advantages proposed by this type of endoscopes including low cost of maintenance, cleaning, and storage of the single-use endoscopes are boosting the product demand. Moreover, the escalating apprehension of regulatory bodies for patient protection has facilitated in refining the excellence of disposable endoscopes thereby decreasing the amount of infections. This scenario has witnessed advantageous for industry growth. Also, the increasing prevalence of target diseases is also anticipated to drive product demand.

Rising incidences of Hospital-acquired Infections (HAI) owing to the usage of contaminated endoscopes is one of the most fundamental factors attributed to the growth of the market. Furthermore, additional influence that will propel the sale of disposable endoscope is swelling sanctions from regulatory authorites. Such as, the FDA has just permitted to novel disposable endoscopes proposing sterile endoscopy treatment manufactured by Invendo medical company acquired by Ambu. Conversely, more prices of disposable endoscopes will hinder the disposable endoscopes market growth in upcoming years to certain level.

Sleep Apnea Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the growing number of diagnostics centres across the world coupled with rapid investment by healthcare companies for opening up new production centers.

- Major Investors: Several market players and strategic investors are actively entering this market, drawn by collaborations, R&D and product launches. Numerous disposable endoscope brands such as Olympus, Ambu A/S, Boston Scientific, Covidien, and some others have started investing rapidly for developing high-quality endoscopic solutions to cater the needs of the patients.

- Startup Ecosystem: Numerous startup companies are engaged in developing high-quality medical equipment. The prominent startup companies dealing in disposable endoscopes consists of GI-View, EndoSemio, Zsquare and some others.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 2.74 Billion |

| Market Size in 2026 | USD 3.2 Billion |

| Market Size by 2034 | USD 10.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.55% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End User, Application, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Application Insights

The global disposable endoscopes market, by application, is categorized into GI endoscopy, proctoscopy, bronchoscopy, urologic endoscopy, arthroscopy, others. Among these, the bronchoscopy application is likely to dominate the market with revenue share of 32% in 2024, due to factors, such as a surge in the number of infections associated with bronchoscopes and high availability of devices. Further, the bronchoscopy application is expected to showcase exponential growth due to the increased respiratory infections across the globe.With the help of disposable endoscopes, the effective treatment for respiratory diseases will increase the segment growth during the projection period.

In addition, the technological advancement in the urologic endoscopy segment is anticipated to drive the segment growth over the forecast period. Likewise, the rise in research & development activities by vendors for product line development is also boosting the segment growth. In addition, the growing contamination owing to the in appropriate washing of reusable devices is also heightening the product demand. Moreover, the increasing prevalence of chronic diseases such as cancer, post ureteroscopy infections, and advances in ureteroscopes are the factors responsible for segment growth.

End-user Insights

Depending on end-user the global disposable endoscopes market is categorized into hospitals, diagnostic centers, and clinics. Among these, the hospital segment is expected to hold the maximum revenue share of 49% of the total market in 2024. Factors such as rising awareness, higher cleaning costs, and increasing reprocessing failures are resulting in the adoption of disposable endoscopes in hospitals. Moreover, due to contaminated equipment, the growing prevalence of hospital-acquired infections is anticipated to drive the segment growth. An inclination for disposable endoscopes is high regarding the reprocessed endoscopes in the hospitals. In addition, the technological advancements incorporated within the disposable endoscopes proposing accurate diagnosis will upsurge its adoption in hospitals enhancing the segmental growth.

The rising demand for low-cost endoscopy procedures and increasing the prevalence of chronic diseases such as cancer are other significant factors enlightening the product demand. Also, the growing demand for single-use endoscopes due to their low maintenance cost and higher reprocessing costs are augmenting its demand and shifting the preference of healthcare experts for the usage of disposable ones. On the other hand, medical waste generated by these devices is a threat to the environment, which may hinder the demand in the near future.

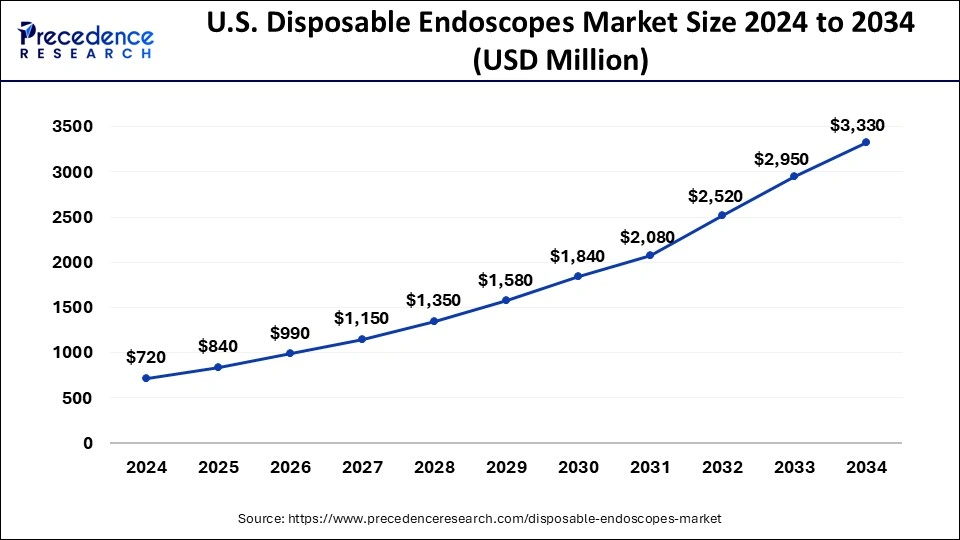

U.S. Disposable Endoscopes Market Size and Growth 2025 To 2034

The U.S. disposable endoscopes market size is calculated at USD 840 million in 2025 and is predicted to increase from USD 990 million in 2026 to approximately USD 3,330 million by 2034, expanding at a CAGR of 16.65% from 2025 to 2034.

In 2024, North America accounted for the largest revenue chunk 44% and the region is anticipated to continue its dominance over the projection period as the region is extremely active towards the adoption of innovative products. Furthermore, increased incidence of chronic diseases and the incidence of a massive target population base is the key parameter augmenting demand for disposable endoscopes in the region. Growing awareness about cost-efficient disposable endoscopes and high per capita healthcare expenditure are the other factors responsible for the growth of the North America disposable endoscopes market.

However, the European region is projected to be the second fastest-growing market for disposable endoscopes. The rising awareness regarding the benefits of disposable endoscopes is leading to greater adoption among healthcare professionals in the Europe region. The Asia Pacific region is expected to witness the fastest growth in the global disposable endoscopes market over the forecast period. Growing nosocomial infections, a rising number of product approvals, and a lack of proper reprocessing procedures are pouring the regional growth. In Latin America, and the Middle East and Africa, the need for disposable endoscopes is anticipated to remain moderate during the projection period. This is because of the economic prices of disposable endoscopy.

Why Asia Pacific held a significant share of the industry?

Asia Pacific held a significant share of the market. The rising cases of urological disorders in numerous countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Also, numerous government initiatives aimed at modernizing the public hospitals coupled with presence of several healthcare companies is expected to drive the growth of the disposable endoscopes market.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The growing demand for disposable endoscopes for numerous applications such as GI endoscopy and bronchoscopy has driven the market growth. Additionally, rise in number of healthcare startups along with surging consumer interest towards regular health-checkups is expected to boost the growth of the disposable endoscopes market.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The rising cases of gastrointestinal cancer in numerous countries such as UAE, South Africa, Saudi Arabia and some others has driven the market expansion. Also, rapid investment by government for strengthening the healthcare sector is expected to accelerate the growth of the disposable endoscopes market.

Value-Chain Analysis

Raw Material Procurement: The raw materials used in the production of disposable endoscopes includes polyurethane elastomers, nylon, silicone rubber and others.

- Key Companies: BASF SE, Covestro AG, Huntsman Corporation and some others.

Production Methodology: The production of disposable endoscopes involves using low-cost materials and mass production techniques, such as injection molding and automated assembly, to create single-use devices.

- Key Companies: Covidien, EndoChoice, Fujifilm Holdings Corporation and others.

Distribution Channel: The distribution channels for disposable endoscopes primarily include direct sales to hospitals and large clinics, and an increasing use of online platforms for smaller clinics and diagnostic centers.

- Key Companies: Amazon, Alibaba, Netmeds and others.

Disposable Endoscopes Market Companies

- Olympus: Olympus is a Japanese company primarily known today as a global medical technology company specializing in endoscopes, surgical devices, and diagnostic equipment. Its focus is on developing and commercializing solutions for healthcare professionals for improvinh patient outcomes in areas such as endotherapy, surgery, and respiratory care.

- Boston Scientific: Boston Scientific is a global medical technology company headquartered in Marlborough, Massachusetts, that designs, manufactures, and markets a wide range of medical devices used in interventional medicine. Its products are used to diagnose and treat conditions in areas such as cardiovascular, respiratory, digestive, oncological, neurological, and urological diseases.

- Ambu A/S: Ambu A/S is a Danish medical technology company that develops and manufactures single-use medical devices for endoscopy, anesthesia, and patient monitoring. This company was founded in 1937 and is a market leader in single-use endoscopy, offering solutions for pulmonology, gastroenterology, urology, and ENT.

- Covidien: Covidien is an Irish-headquartered healthcare products company that manufactured medical devices and supplies before being acquired by Medtronic in 2015. This company provides a wide range of products such as surgical instruments, patient monitoring, and respiratory and nursing care products.

- EndoChoice: EndoChoice was a medical technology company founded in 2008 that specialized in manufacturing and distributing endoscopic imaging systems, devices, infection control products, and pathology services for diagnosing and treating gastrointestinal (GI) conditions. This company provided a wide range of devices, diagnostics, and services for GI specialists, with a focus on improving the diagnosis and treatment of GI diseases.

- Fujifilm Holdings Corporation: Fujifilm Holdings Corporation is a Japanese multinational conglomerate with a diverse portfolio that includes healthcare, materials, and imaging solutions. The company operates two main business groups, FUJIFILM Corporation and FUJIFILM Business Innovation Corporation.

Recent Developments

- In April 2025, Medtronic partnered with Dragonfly Endoscopy. This partnership is done for launching a disposable endoscope in the U.S. Source: News Medtronic

- In March 2025, Olympus launched Retentia HemoClip. Retentia HemoClip is a new hemostasis clip designed to help meet the needs of GI endoscopists. Source: PR Newswire

- In January 2025, Precision Optics launched Unity Imaging Platform. Unity Imaging Platform is a disposable endoscope solution designed for the healthcare sector. Source: GlobeNewswire

Segments Covered in the Report

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in every sub-segment from 2020 to 2032. This research study analyzes market thoroughly by classifying global disposable endoscopes market report on the basis of different parameters including application, end users, and region:

By Application

- GI Endoscopy

- Bronchoscopy

- Proctoscopy

- Urologic Endoscopy

- Arthroscopy

- Others

By End-user

- Diagnostic centers

- Hospitals

- Clinics

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client