What is the Disposable Syringes Market Size?

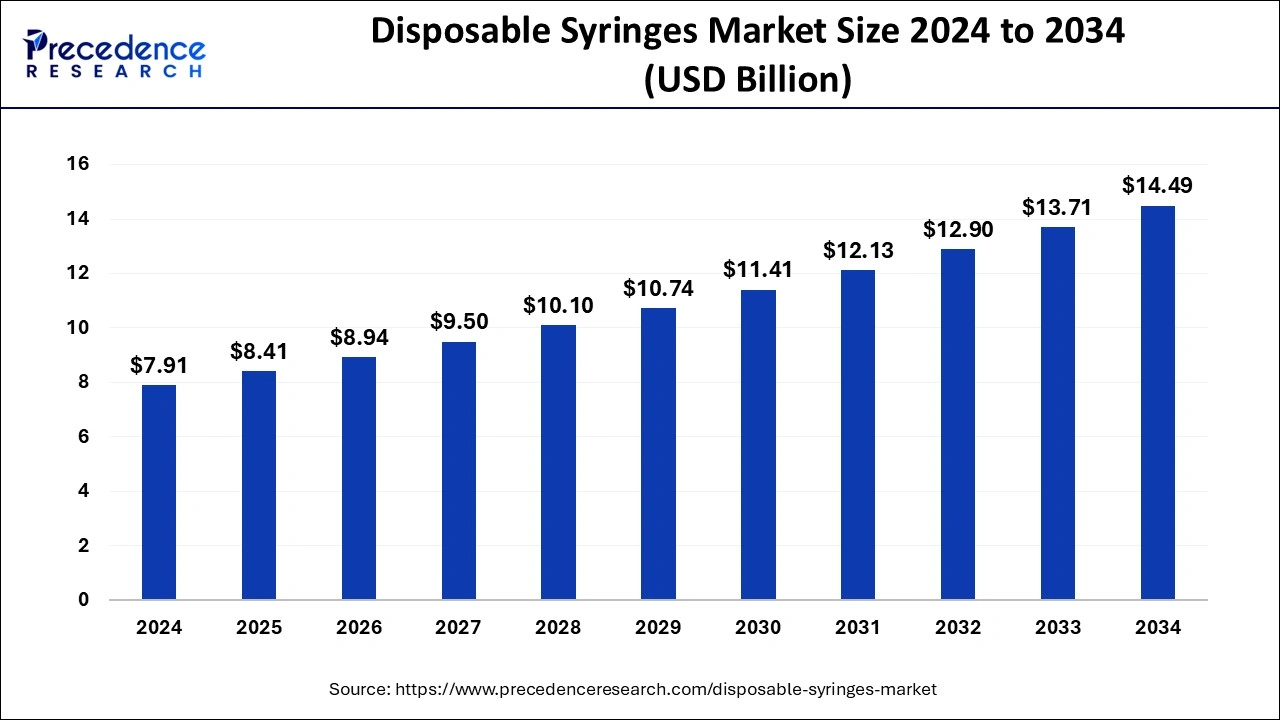

The global disposable syringes market is calculated at USD 8.41 billion in 2025 and is predicted to increase from USD 8.94 billion in 2026 to approximately USD 14.49 billion by 2034, expanding at a CAGR of 6.30% from 2025 to 2034. The rapidly expanding healthcare sector, the rising prevalence of chronic disorders, and the increasing number of laboratory tests drive the disposable syringes market.

Disposable Syringes Market Key Takeaways

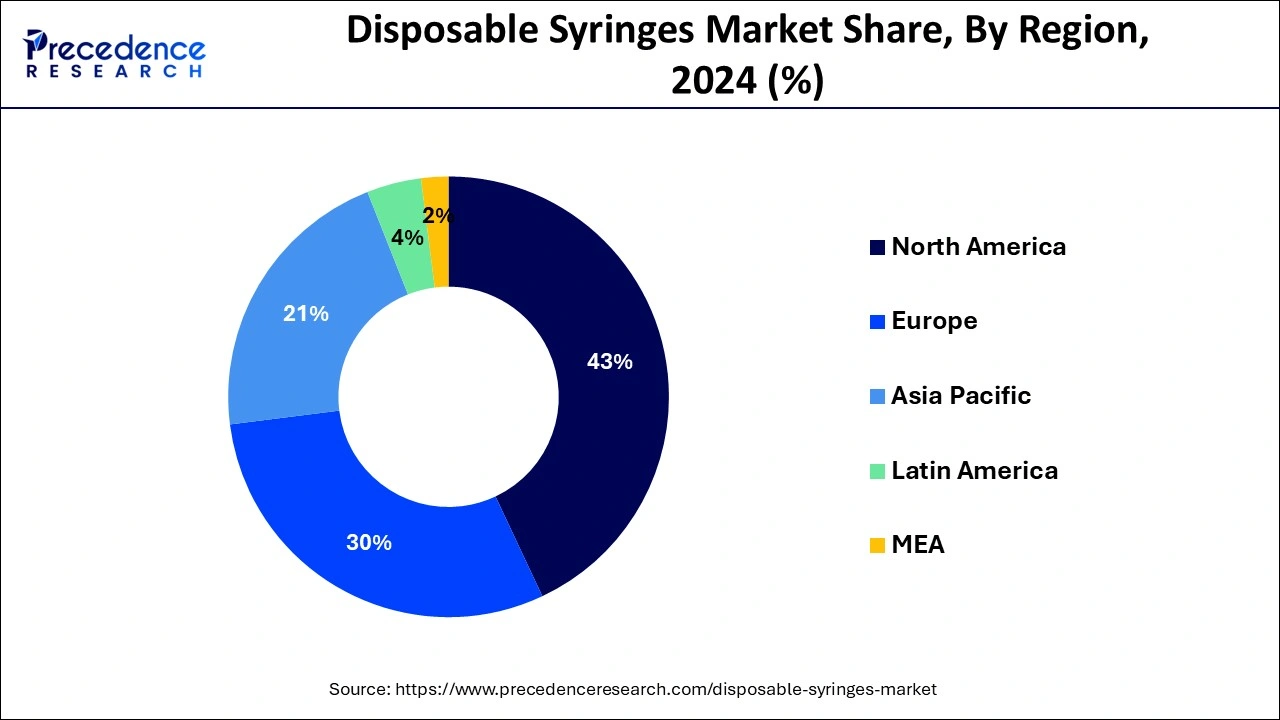

- North America led the global market with the highest market share of 43% in 2024.

- By Type, the safety syringe segment has held the largest market share in 2024.

- By Application, the therapeutic injections segment led the market with the largest market share in 2024.

How AI is Powering the Disposable Syringes Market?

Artificial intelligence (AI) transforms the manufacturing process of disposable syringes. It facilitates bulk manufacturing of syringes, improving efficiency and reproducibility. AI can introduce automation in manufacturing, minimizing human intervention and reducing the overall cost of production. AI-enabled predictive analytics helps to predict defects and errors during manufacturing, enabling manufacturers to make timely decisions. Additionally, AI can be used to design syringes of different textures and shapes, depending on requirements. AI can also help to detect the properties and quality of the final product, fostering an easier regulatory process. Furthermore, AI and Machine Learning can improve the supply chain distribution of disposable syringes to different parts of the world, owing to the increasing demand.

Key Market Insights

As a substitute for the glass hypodermic needles, disposable plastic syringes have been launched. These are used in all the healthcare services across the globe to provide medicines to uncountable patients following this breakthrough. Syringes are accessible in bulks and are among other items, can be used to administer medications via intravenous, intramuscular or intradermal routes. Disposal of them can have impact on the environment which is a major concern. This is ill-suited to demand for supportable growth, but healthcare organization is growing worldwide in response to the growing demand for decent medical care and the rise in chronic diseases, drug administration is becoming increasingly prevalent. In any healthcare environment, it is a actual simple operation, and disposable syringes are an integral part. Dealings like the latest COVID-19 epidemic make investing in the future more profitable for the market for disposable syringes.

The growth of the global demand for disposable syringes is motivated by an increase in the incidence of needle stick injuries, increased healthcare spending worldwide, supportive government policies, and a rise in chronic conditions and infectious diseases. However, costly disposable syringes for protection and access to various distribution modes inhibit the growth of the market. On the other hand, in developed countries, the rise in untapped capacity generates new prospects in the coming years.

Crucial factors accountable for Market Growth Factors

- Increasing number of patients at risk of developing stroke

- Increasing patient awareness

- Increased health care expenditure

- Large pool of geriatric population

Future of Global Disposable Syringes Market

Key companies like Baxter International and Fresenius Kabi AG are aiming towards profitable development by accepting strategies like mergers and acquisitions, weighty investments in the industrial facilities that is expected to fuel the worldwide market growth in near future. This tendency is likely to continue and will enhance growth of the aiming industry in forecast time frame. Also, stringent government regulations regarding usage of secure and engineered devices in medical sector will flourish target market growth over the forecast time frame.

Market Outlook

- Industry Growth Overview- The disposable syringes market is growing steadily due to rising vaccination programs, increasing healthcare infrastructure, and a focus on infection control. Innovations in safety and prefilled syringes, along with growing chronic disease management, are further driving industry expansion.

- Global Expansion- Global expansion of the market is driven by rising healthcare demand, vaccination initiatives, and growing medical procedures worldwide. Companies are increasing production capacities, entering emerging markets, and forming strategic partnerships to strengthen their international presence.

- Startup Ecosystem- The startup ecosystem in the market is growing, focusing on innovative designs like safety and auto-disable syringes. Startups are leveraging advanced materials, smart injection technologies, and sustainable manufacturing to meet rising healthcare and vaccination demands globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 8.94 Billion |

| Market Size in 2025 | USD 8.41 billion |

| Market Size by 2034 | USD 14.49 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Type Insights

The Safety Syringe Segment Is Predicted to Lead the Product Segment of the Disposable Syringes Market Revenue

On the basis of type safety, the syringe division was dominant with a significant share in 2024. The growth of the safety syringe is owing to the benefits that safety bulbs offer outruns their duration of existence even at low cost over disposables, which further shifts the preference toward safety syringes.

How did safety syringes dominate the disposable syringes market in 2024?

The safety syringes segment dominated the disposable syringes market in 2024. The growing demand for preventing the spread of hepatitis and HIV increases the adoption of safety syringes. The rising awareness about risks associated with needlesticks helps in the market growth. The growing demand for healthcare & patient safety, and technological advancements like self-deactivating syringes & retractable needles, drive the overall growth of the market.

ApplicationInsights

Therapeutics Segment Is Likely to Take over the Application Segment of Disposable Syringes Market Revenue

On the basis of application the global market is segregated into therapeuticsand immunization applications. The therapeutics application segment is anticipated to hold share in the global market in the near future. Immunization application segment will grow at moderate CAGR in the next 10 years.

Which application segment dominated the disposable syringes market in 2024?

The therapeutics segment dominated the disposable syringes market in 2024. The growing chronic diseases, like cardiovascular disease, cancer, diabetes, and arthritis, increase demand for therapeutics to treat conditions. The growing trend of self-injectors and home healthcare helps in the market growth. The rising vaccination programs globally and the growing development of prefilled syringes drive the overall market growth.

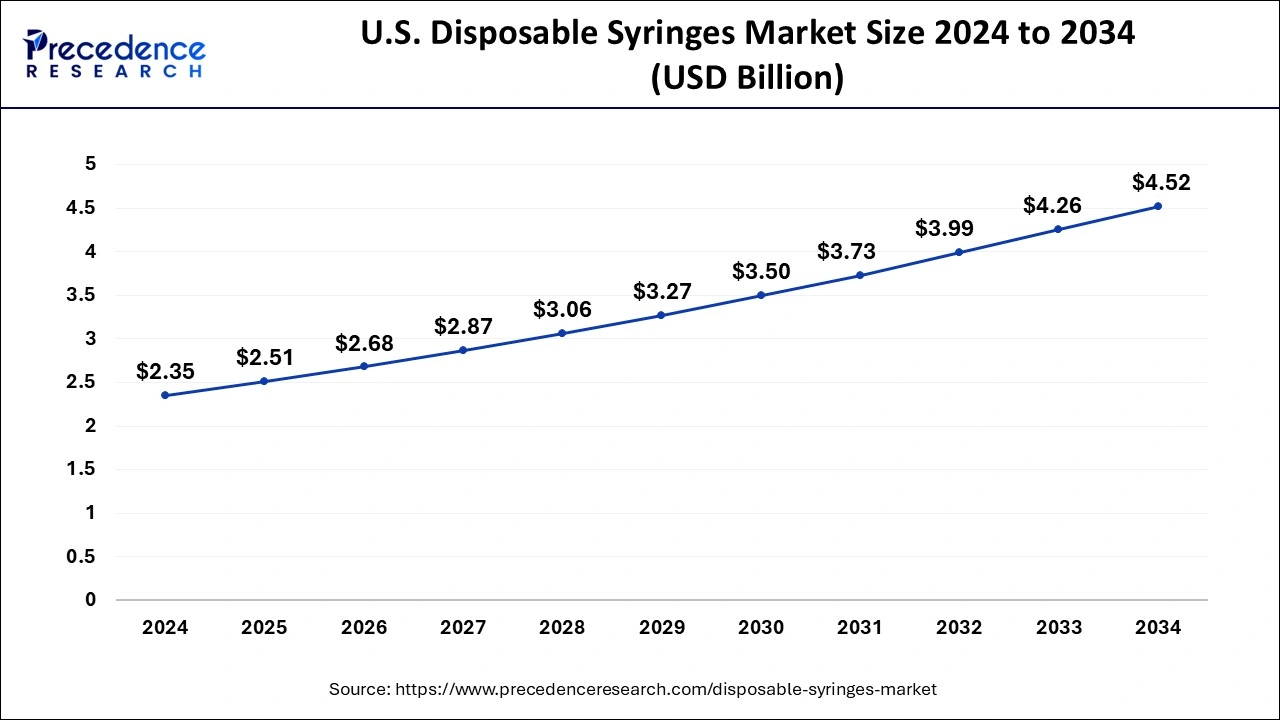

U.S. Disposable Syringes Market Size and Growth 2025 to 2034

The U.S. disposable syringes market size is estimated at USD 2.51 billion in 2025 and is predicted to be worth around USD 4.52 billion by 2034, at a CAGR of 6.8% from 2025 to 2034.

The study report delivers prospects and trends of disposable syringes products across different geographical regions counting Europe, North America, Latin America, Asia-Pacific, Middle East, and Africa. However, regionally, the disposable syringes market is dominated by North America due to high incidence of diseases and growing preference for injectable drugs. Also, disposable syringe producers are also investing by launching new products in the countries U.S. and Canada. Availability of advanced healthcare infrastructure, presence of key market players, and government initiatives are among the major factors to fuel growth of the target industry in the North America. Europe constitute a share more than 30% of the global in 2024. Presence of key operating players in the countries of the region is expected to help the development of the Europe market in the coming years of the forecast period. Asia Pacific disposable syringesmarket is anticipated to grow at significant CAGR over the forecast period.

- In January 2024, BD (Becton, Dickinson and Company) invested over $10 million in its U.S. manufacturing network, aiming to enhance critical medical devices, including disposable syringes, needles, and IV catheters. The company also expanded production at its facilities in Connecticut and Nebraska, and plans to invest an additional $30 million in 2025 for further IV catheter manufacturing expansion in Utah. This expansion is projected to increase domestic production capacity by 40-50% by the end of 2025.

How did the United States lead the disposable syringes market?

The United States led the disposable syringes market in 2024. The strong presence of the healthcare system, like hospitals & clinics, increases demand for disposable syringes. The growing prevalence of chronic diseases like cancer, diabetes, and cardiovascular disease helps in the market growth. The growing vaccination programs, like vaccination during COVID-19, and the increasing development of advanced syringes, are increasing the adoption of disposable syringes.

The stricter regulations for manufacturing syringes and growing preference for safety fuel demand for disposable syringes. The growing distribution & production of disposable syringes and the strong presence of the pharmaceutical industry support the overall market growth.

United States Disposable Syringes Market Trends

- The increasing number of laboratory tests in the U.S. potentiates market growth. It is estimated that more than 14 billion clinical laboratory tests are performed in the U.S. annually, increasing the demand for disposable syringes.

- The U.S. is the largest exporter of syringes globally. It exported approximately 4.6 billion units of syringes globally worth $105 billion in 2023

Asia Pacific as a Growing Developer of Disposable Syringes

Asia Pacific is anticipated to witness significant growth in the market due to growth in healthcare spending, rising healthcare investments, and growing urbanization. Asian countries like China, India, Japan, and South Korea are increasing their manufacturing capabilities. The increased prevalence of chronic disease, the growing geriatric population, and surgical procedures have increased demand for injectable medications and vaccines in Asia. The increased awareness about infection control and regulatory safety protocols is contributing gin the market growth. Government and pharmaceutical companies are investing heavily in the development of disposable medical products, including disposable syringes. Additionally, the adoption of advanced technologies in syringe design and safety features is expected to boost market areas.

- In March 2024, Hindustan Syringes and Medical Devices (HMD) launched the Dispojekt single-use syringes with a safety needle to strengthen India's position in becoming a global powerhouse in medical devices.

Role of disposable syringes in the Asia Pacific

Asia Pacific experiences the fastest growth in the market during the forecast period. The growing investment in healthcare infrastructure and the growing demand for reliable injection solutions increase the adoption of disposable syringes. The aging population and growing age-related conditions like chronic disease help in the market growth.

The growing urbanization and strong government support for the use of disposable medical supplies fuel the adoption of disposable syringes. The strong investment in vaccination programs and growing chronic diseases like cancer & diabetes drive the overall market growth.

China Expands with Healthcare Growth and Safety Initiatives

China's market is growing due to rising healthcare infrastructure, increasing vaccination programs, and expanding medical procedures across hospitals and clinics. The demand for safe, sterile, and single-use syringes is driven by infection control measures and government initiatives promoting immunization. Additionally, the growth of the pharmaceutical industry and rising awareness about healthcare safety among the population are further fueling market expansion in the country.

Europe Grows Amid Rising Safety and Healthcare Demand

Europe's market is expanding due to increasing demand for safe and sterile medical devices in hospitals, clinics, and vaccination programs. Rising awareness of infection control, stringent regulatory standards, and government-led immunization initiatives are driving adoption. Additionally, growth in chronic disease management, expanding healthcare infrastructure, and the introduction of innovative syringe designs, such as auto-disable and safety syringes, are further supporting market growth across the region.

UK: Focuses on Innovation and Safety

The UK disposable syringes market is expanding due to increasing demand from hospitals, clinics, and vaccination programs, especially amid heightened focus on infection control and patient safety. Government immunization initiatives, rising prevalence of chronic diseases, and growing healthcare infrastructure are driving adoption. Additionally, innovations in syringe design, including safety and auto-disable features, are boosting efficiency and reducing medical waste, further supporting market growth in the country.

Value Chain Analysis

Serialization

- Disposable syringes are sterilized during production to ensure safety for end users.

- Common sterilization methods include gamma radiation and ethylene oxide (EO) gas.

- Unlike reusable equipment, which is often sterilized by autoclaving, single-use syringes rely on radiation or chemical sterilization.

- Sterilization is completed before the syringes are packaged and sealed for distribution.

Distribution to Hospitals, Pharmacies

- Disposable syringes are supplied to hospitals and pharmacies via manufacturers, wholesalers, and distributors.

- The distribution process ensures a consistent and reliable supply of these medical devices.

- Syringes are produced from raw materials like polypropylene, assembled with needles, and packaged.

- Finished products are then shipped to healthcare providers for clinical and medical use.

Patient Support and Services

- Patient support for disposable syringes emphasizes safe usage and proper disposal, particularly for home self-injection.

- Services include educational resources on correct syringe handling and injection techniques.

- Psychological support is provided for patients managing chronic conditions or experiencing needle anxiety.

- These programs aim to improve patient confidence, adherence, and overall treatment outcomes.

Top Vendors and their Offerings

- Fresenius Kabi AG- Offers a range of disposable syringes and infusion systems, including safety syringes, prefilled syringes, and sterile injection devices for hospitals and clinical use.

- Baxter International Inc.- Provides sterile, single-use syringes, including safety and prefilled options, mainly for intravenous therapies, vaccines, and hospital applications.

- Terumo Corporation- Manufactures high-quality disposable syringes, safety syringes, and insulin pens, focusing on precision, safety, and reliability.

- B. Braun Melsungen AG (Basun Medical)- Offers a wide range of disposable syringes, including safety syringes, insulin syringes, and prefilled systems for medical and clinical applications.

- Novo Nordisk (Novartis Nordisk)- Provides insulin pens and prefilled disposable syringes specifically designed for diabetes management, ensuring accuracy, convenience, and patient safety.

Latest Announcement by Industry Leaders

- Eric Borin, President of BD Medication Delivery Solutions, commented on the expansion of domestic syringe production that, the company can support additional syringe demand to help ensure continuity of patient care. He also said that the company has always served the healthcare system's needs for essential high-quality medical products and it produced an additional 2 billion syringes and needles during the pandemic.

Recent Developments

- In January 2025, HLB Life Sciences announced that it had received the U.S. Food and Drug Administration pre-market approval (510k) for its Sofject disposable syringe. The clearance allows the company to export human-use syringes to the U.S. via Allison Medical.

- In January 2025, BD (Becton, Dickinson and Company) unveiled its BD Neopak™ XtraFlow™ Glass Prefillable Syringe at Pharmapack 2025.

- In January 2025, the BD Medical - Pharmaceutical Systems team attended the Pharmapack 2025 event to show how their BD Neopak™ Glass Prefillable Syringe and BD UltraSafe Plus™ Passive Needle Guard are meeting the needs of biologic drug delivery.

- In October 2024, Gerresheimer presented its silicone oil-free prefillable syringe systems for ophthalmic applications at CPHI Worldwide 2024.

- In March 2024, Hindustan Syringes and Medical Devices launched Dispojekt single-use syringes with safety needle to reduce the prevalence of accidental needle-stick injuries. The new product launch will also strengthen India's position in becoming a global powerhouse in medical devices.

Segments Covered in the Report

By Type

- Conventional Syringes

- Safety Syringes

- Retractable Safety Syringes

- Non-retractable Safety Syringes

By Application

- Immunization Injections

- Therapeutic Injections

By End User

- Hospitals

- Diagnostic Laboratories

- Blood Banks

- Pharmaceutical Industry (B2B) (Prefilled Syringes)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content