Syringes Market Size and Forecast 2025 to 2034

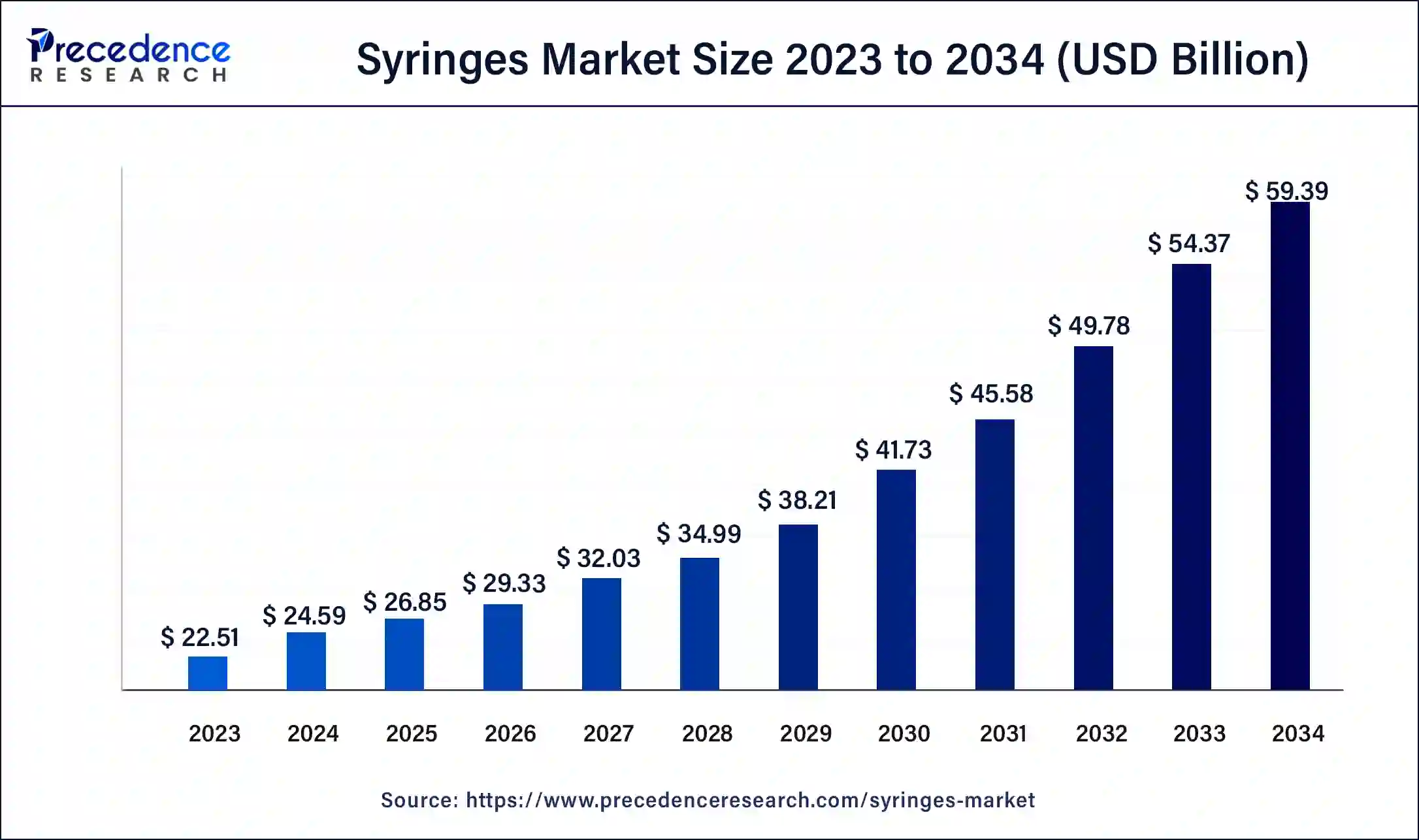

The global syringes market size was estimated at USD 24.59 billion in 2024 and is predicted to increase from USD 26.85 billion in 2025 to approximately USD 59.39 billion by 2034, expanding at a CAGR of 9.22% from 2025 to 2034. The rising prevalence of chronic diseases and the need for effective drug delivery methods are the key drivers of the syringes market

Syringes Market Key Takeaways

- In terms of revenue, the global syringes market was valued at USD 24.59 billion in 2024.

- It is projected to reach USD 59.39 billion by 2034.

- The market is expected to grow at a CAGR of 9.22% from 2025 to 2034.

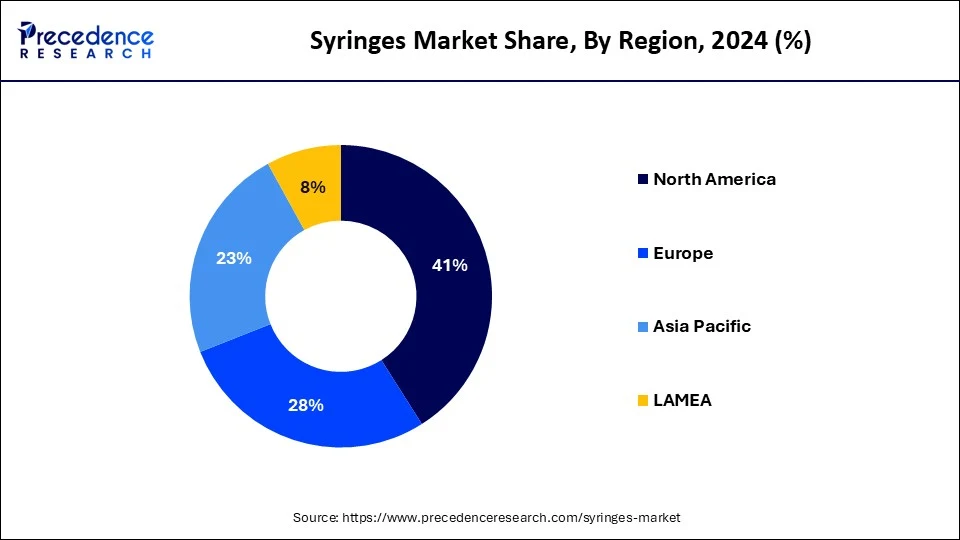

- North America dominated the syringes market with the largest market share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest rate in the market over the forecast period.

- By usability, the disposable syringes segment dominated the market in 2024.

- By usability, the sterilizable/reusable segment is expected to grow at the fastest rate in the market over the forecast period.

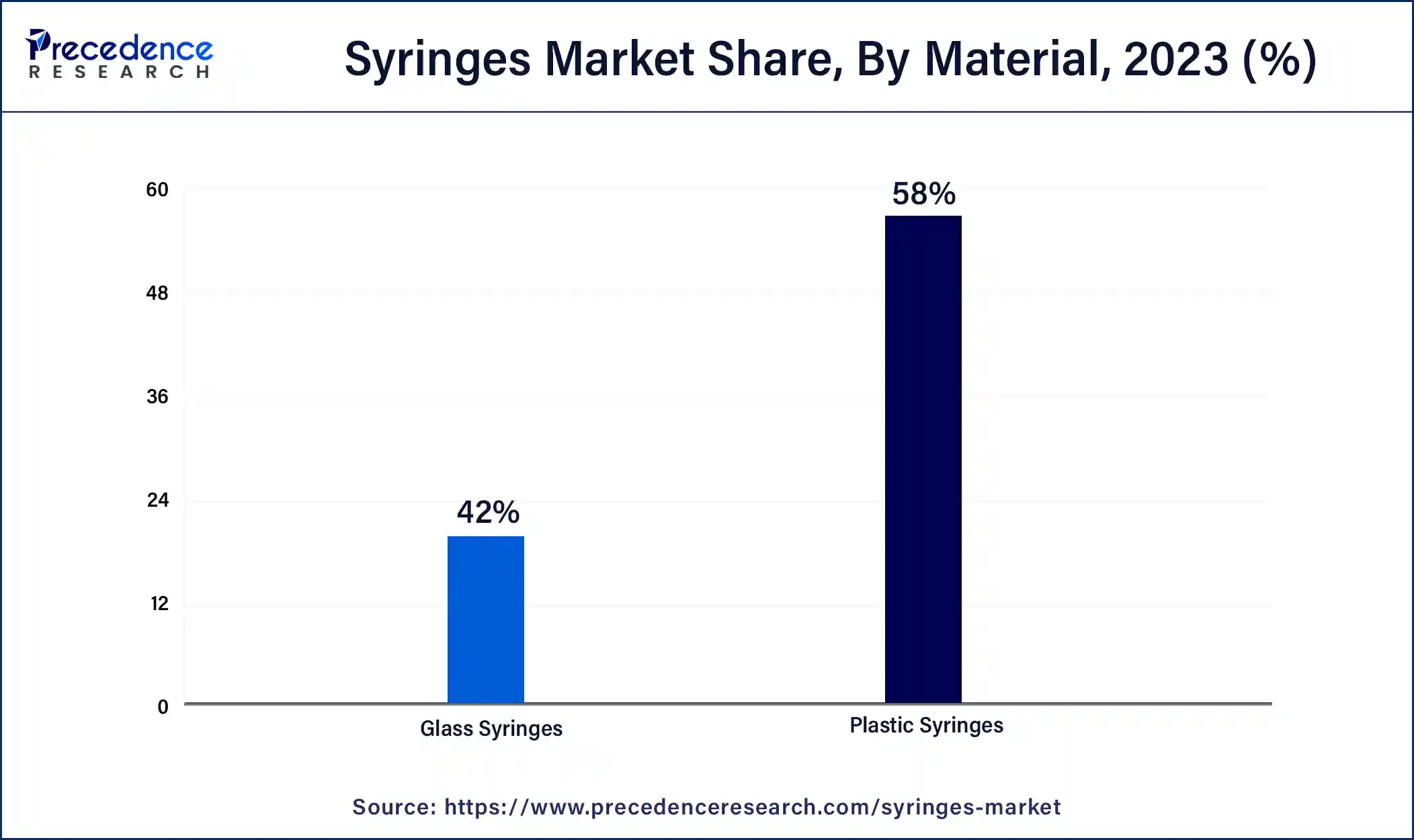

- By material, the plastic syringe segment contributed the biggest market share of 58% in 2024.

- By material, the glass syringes segment is expected to show the fastest growth in the market over the forecast period.

- By type, the specialized syringes segment dominated the global market in 2024.

- By type, the general syringes segment is anticipated to grow at the fastest rate in the market during the projected period.

U.S. Syringes Market Size and Growth 2025 to 2034

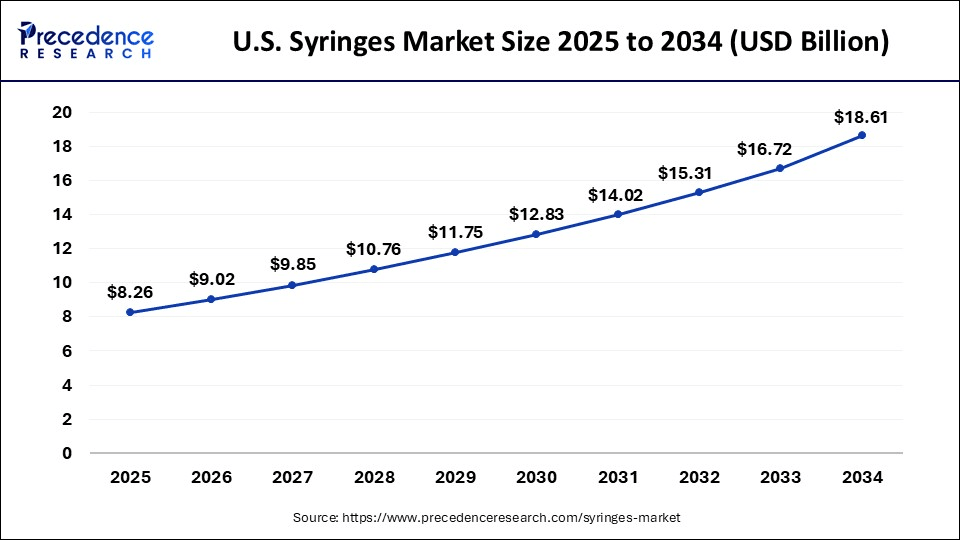

The U.S. syringes market size was valued at USD 7.56 billion in 2024 and is expected to be worth around USD 18.61 billion by 2034, rising at a CAGR of 9.43% from 2025 to 2034.

North America dominated the syringes market in 2023. In North America, the market is propelled by the increasing prevalence of chronic conditions, heightened vaccination campaigns, and innovations in medical technology. Additionally, the push towards disposable medical supplies designed to reduce infection risks during hospital procedures contributes to market growth.

The United States holds a substantial market share, positioning it as a key player in the syringe industry. The rise in syringe sales across the country can be linked to a surge in chronic and infectious diseases, the growing use of self-administered medications, and the presence of leading syringe manufacturers. The expansion of markets like prefilled syringes, home healthcare, and insulin syringes further supports this upward trend.

- In March 2024, Schott Pharma announced the building of a $371M syringe factory. The North Carolina plant is part of the company's effort to triple its U.S. supply of glass and polymer syringes used in GLP-1 therapies by 2030.

Asia Pacific is expected to grow at the fastest rate in the syringes market over the forecast period. Several factors are poised to drive the syringes market in Asia Pacific, including improving economic conditions, rising purchasing power, increased awareness of the benefits of prefilled syringes, and a substantial patient population with chronic conditions.

India, one of the world's fastest-growing economies with a population exceeding 1.38 billion, is emerging as a key market for disposable syringes. What Contributes to the growth are government initiatives to vaccinate all newborns, a strong presence of syringe manufacturers, and growing awareness of current trends in the syringes market.

- In September 2022, Terumo India, the Indian arm of Terumo, a global leader in medical technology, announced the launch of FineGlide, a Sterile Pen Needle for patients requiring regular insulin injections or other self-medication. Designed to be compatible with the most commonly available pen devices in India, Fineglide raises the bar for patient comfort and, thereby, drug compliance.

Market Overview

A syringe is a medical tool designed for extracting fluids from or injecting fluids into the body. They come in a variety of forms, including general-purpose syringes, specialized types (such as insulin and tuberculin syringes), and disposable varieties (including conventional, prefilled, and safe syringes). The World Health Organization's mandatory recommendation to switch to disposable syringes has significantly driven the growth of the syringe market by promoting safer injection practices. Syringes are favored for their efficiency in parenteral drug administration, reducing drug waste, extending the product lifespan, and offering precise dosing, all of which contribute to the increasing demand in the market.

How is AI technology Impacts Syringes Manufacturing?

The integration of artificial intelligence (AI) into healthcare devices brings about enhanced efficiency, precision, and patient safety. AI's role in healthcare is multifaceted, encompassing areas such as diagnostics, treatment planning, patient monitoring, and medical devices. In the context of the syringes market, AI is driving advancements in manufacturing, usage, and post-market surveillance, thereby ensuring higher standards of quality and safety.

- In April 2023, MIT researchers introduced a revolutionary tiny molecular ‘syringe' designed to deliver proteins directly into human cells, developed using AI and DeepMind's AlphaFold program. Initial tests in vitro and in mice have yielded highly encouraging results that suggest potential future applications as programmable protein delivery systems for improved dosing accuracy.

Syringes Market Growth Factors

- Developments in syringe materials along with needle technology enhance the usability and safety of syringes, which can drive the syringes market growth.

- Rising awareness about the importance of safe injection practices is fueling market growth during the forecast period.

- The increasing need for vaccination & immunization is expected to boost the syringes market growth further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 59.39 Billion |

| Market Size in 2025 | USD 26.85 Billion |

| Market Size in 2024 | USD 24.59 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Usability, Material, Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for advanced syringes

The syringes market outlook is being positively impacted by the introduction of innovative advancements aimed at improving both safety and functionality. Moreover, the rising inclination towards home-based healthcare and the growing popularity of biologics are driving market expansion. Another significant factor contributing to market growth is the increasing demand for single-use syringes for anesthetic administration, fueled by the higher number of individuals undergoing surgical procedures.

- In March 2024, Hindustan Syringes and Medical Devices (HMD), one of the leading manufacturers of disposable and auto-disable syringes, announced the launch of Dispojekt, an indigenous single-use safety syringe to reduce instances of needle stick injuries. A needle stick injury (NSI) is an accidental skin-penetrating stab wound from a hollow-bore needle containing another person's blood or body fluid.

Restraint

Limited reimbursement policies

Challenges in reimbursement policies for syringes could hinder their broader acceptance, as healthcare providers might struggle financially to integrate the syringes market products into their practices without adequate reimbursement support. Additionally, despite the presence of safety features in syringes, concerns about needlestick injuries continue among healthcare professionals. Hence, the demand for further safety measures could impact the preference for alternative injection methods.

Opportunity

Innovations in pre-filled syringes

The global syringes market is being driven by significant advancements in prefilled syringes. Companies specializing in pre-filled syringes are now offering innovative features, including automatic needle shielding and retractable needles. Also, some manufacturers are introducing dual and multi-chambered syringes designed for lyophilized medications. Furthermore, leading pharmaceutical firms, such as Pfizer with its XYNTHA and Takeda Pharmaceutical Company with Prolia, have begun using these dual/multi-chambered syringes for their lyophilized drugs. Despite the variety of pre-filled syringe designs currently available, experts in the industry point out that many therapeutic fields remain underexplored, which suggests the potential for continued growth in the pre-filled syringes market throughout the forecast period.

- In May 2023, Schott Pharma announced that it launched pre-fillable syringes made from advanced polymers for delivering deep-cold drugs. These deep-cold drugs are stored and transported on dry ice at temperatures reaching -100°C. Schott designed the syringes from an advanced, pharmaceutical-grade polymer, delivered in a standardized nest and tub configuration. This ensures compatibility on major fill-finish lines to simplify the filling process.

Usability Insights

The disposable syringes segment dominated the syringes market in 2024. The substantial market potential for disposable syringes is driven by the broad availability of affordable, sterilized, and ready-to-use single-use syringes. Growing concerns over disease transmission linked to reusable syringes have increased the demand for disposable options, especially within the healthcare sector. Moreover, the easy access to raw materials for producing disposable syringes enhances their appeal and makes them a preferred choice for widespread adoption.

The sterilizable/reusable segment is expected to grow at the fastest rate in the syringes market over the forecast period. These syringes are employed for aspirating fluids intended for laboratory analysis, such as bacteriological or biochemical tests. Their reusability makes them a cost-effective option, particularly beneficial to managing chronic conditions. These attributes contribute significantly to the growing global utilization of these syringes.

Material Insights

The plastic syringe segment led the syringes market in 2024. Thegrowing demand for disposablesyringes and affordable syringes, coupled with the increasing use of plastic syringes in vaccination campaigns, is driving the expansion of the plastic market. Additionally, the benefits of plastic syringes, including their high impact resistance and ease of use, further support their extensive adoption.

- In May 2024, Medline Industries and Jiangsu Shenli Medical Production initiated recalls for plastic syringes, adding to the list of recent safety problems concerning syringes made in China and distributed in the U.S.

The glass syringes segment is expected to show the fastest growth in the syringes market over the forecast period. This can be attributed to their durability, resistance to chemicals, and accurate delivery capabilities. Unlike their plastic counterparts, glass syringes do not react with the medications they hold, which makes them particularly suitable for administering highly sensitive or reactive drugs, including biologics and specific vaccines. Their application is especially prevalent in the pharmaceutical and biotechnology sectors, where preserving the integrity of the substance is important.

Type Insights

The specialized syringes segment dominated the global syringes market in 2024. Specialized syringes play a critical role in advancing drug delivery systems and addressing innovations in pharmaceuticals, biotechnology, and personalized medicine. There is a growing demand for syringes that can manage complex drug formulations and high-viscosity substances or require precise dosage control.

- In September 2022, BD (Becton, Dickinson, and Company) introduced a next-generation glass pre-fillable syringe (PFS) that sets a new standard in performance for vaccine PFS with new and tightened specifications for processability, cosmetics, contamination, and integrity. The new BD Effivax Glass Prefillable Syringe was designed in collaboration with pharmaceutical companies to meet the complex and evolving needs of vaccine manufacturing.

The general syringes segment is anticipated to grow at the fastest rate in the syringes market during the projected period. Designed for various applications such as medication administration, fluid transfer, and sample collection, these syringes are experiencing consistent growth. This trend is fueled by rising healthcare spending and the growing incidence of chronic diseases. Additionally, market dynamics are shaped by strict regulations governing the production and use of syringes.

Syringes Market Companies

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton Dickinson and Company

- Cardinal Health Inc.

- Gerresheimer AG

- Hindustan Syringes & Medical Devices Ltd.

- Nipro Corporation

- Pfizer Inc.

- Retractable Technologies Inc.

- Schott AG

- Smiths Group plc

- Terumo Corporation

- Thomas Scientific LLC

Recent Developments

- In May 2024, Gerresheimer, one of the healthcare and pharmaceutical packaging companies based in Germany, expanded its Queretaro capacity of ready-to-fill (RTF) syringes in Mexico.

- In March 2024, SCHOTT Pharma built its first U.S. facility to manufacture pre-fillable polymer syringes required to meet the need for deep-cold storage and transportation of mRNA medications.

- In March 2024, Hindustan Syringes and Medical Devices (HMD), one of the leading providers of auto-disable and disposable syringes, launched Dispojekt, an indigenous single-use safety syringe to minimize instances of needle stick injuries.

Segments Covered in the Report

By Usability

- Disposable Syringes

- Reusable Syringes

By Material

- Glass Syringes

- Plastic Syringes

By Type

- General Syringes

- Specialized Syringes

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting