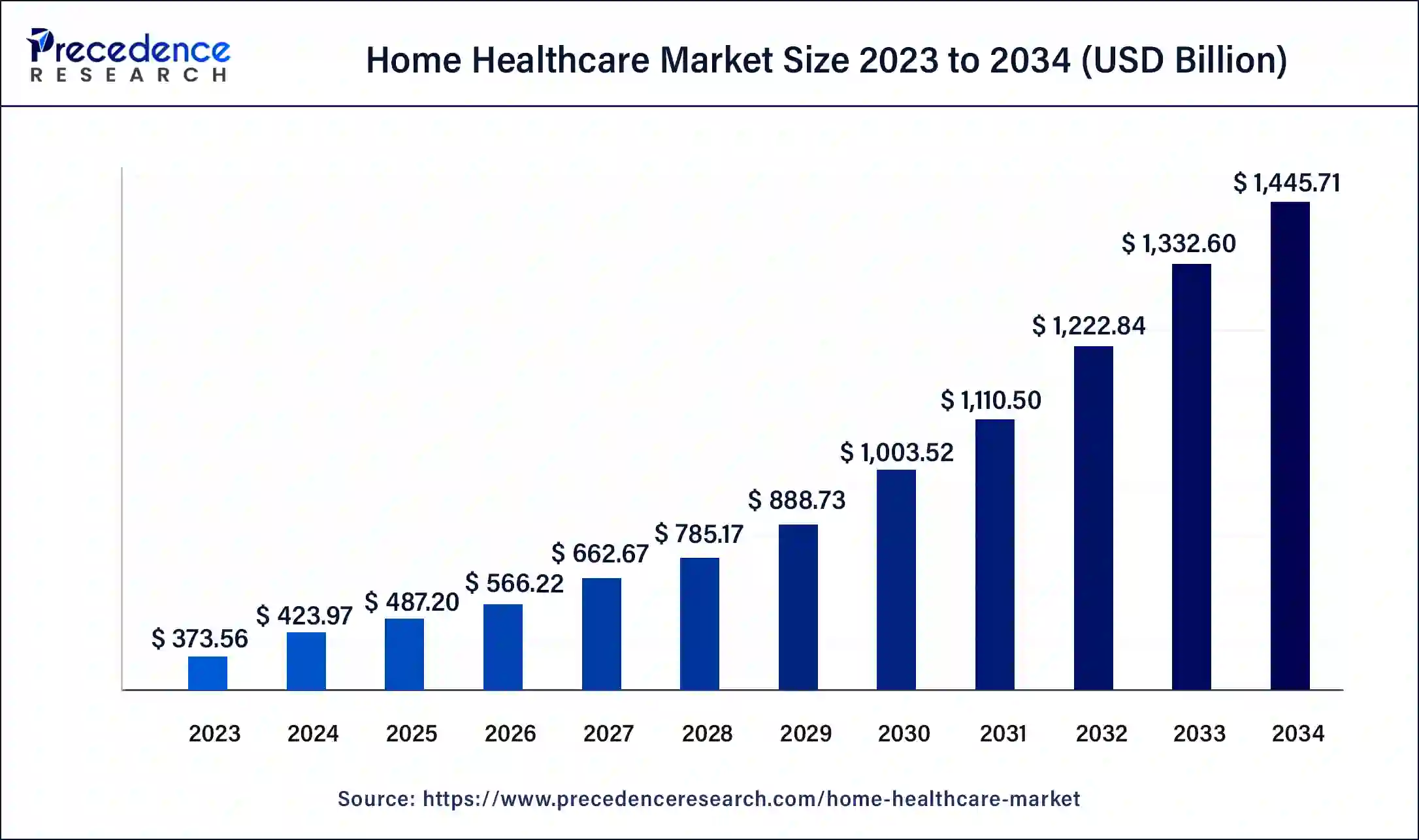

Home Healthcare Market Size and Forecast 2024 to 2034

The global home healthcare market size accounted for USD 423.97 billion in 2024 and is expected to be worth around USD 1,445.71 billion by 2034, at a CAGR of 13.05% from 2024 to 2034. The North America home healthcare market size reached USD 188.98 billion in 2023.

Home Healthcare Market Key Takeaways

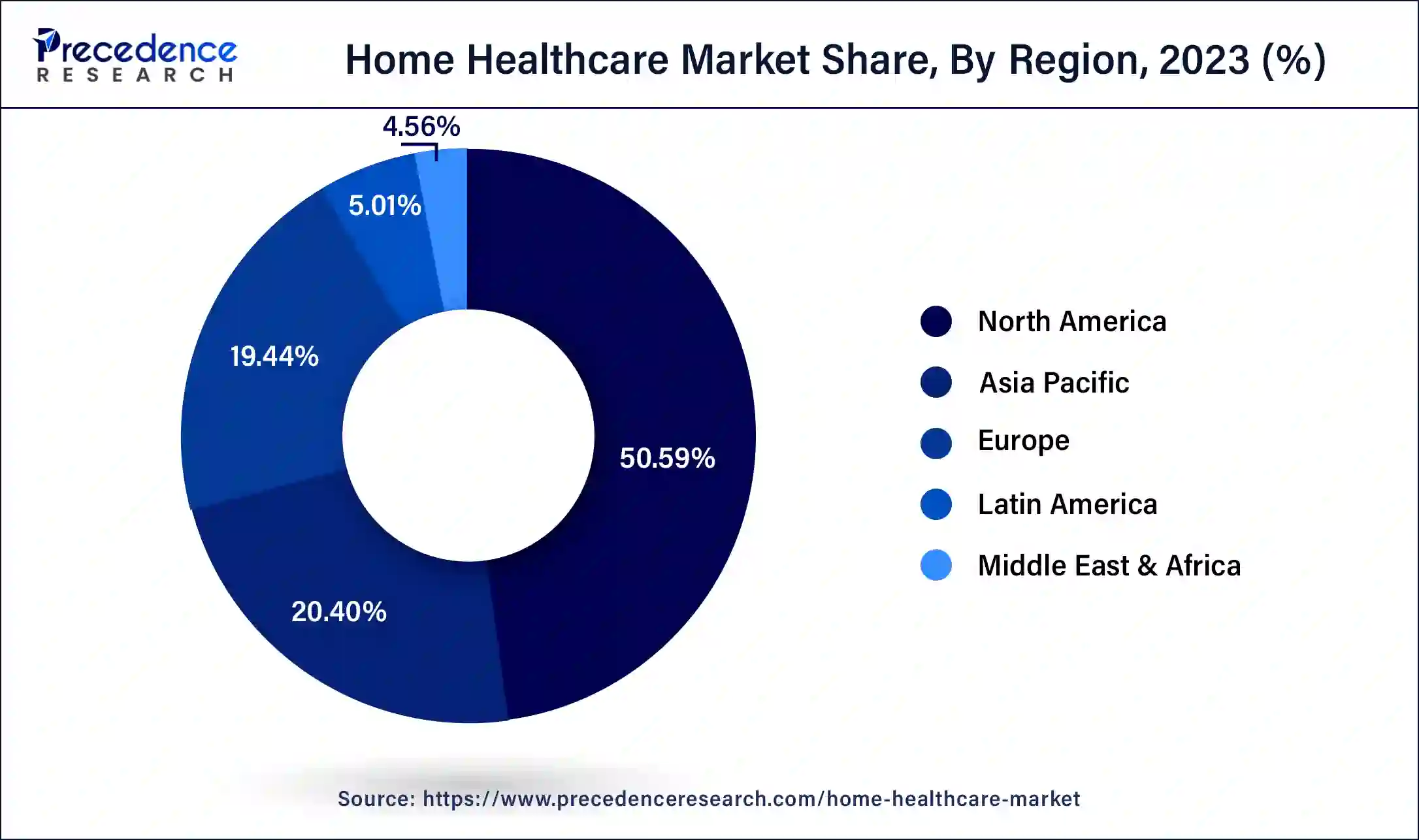

- North America led the global market with the highest market share of 50.59% in 2023.

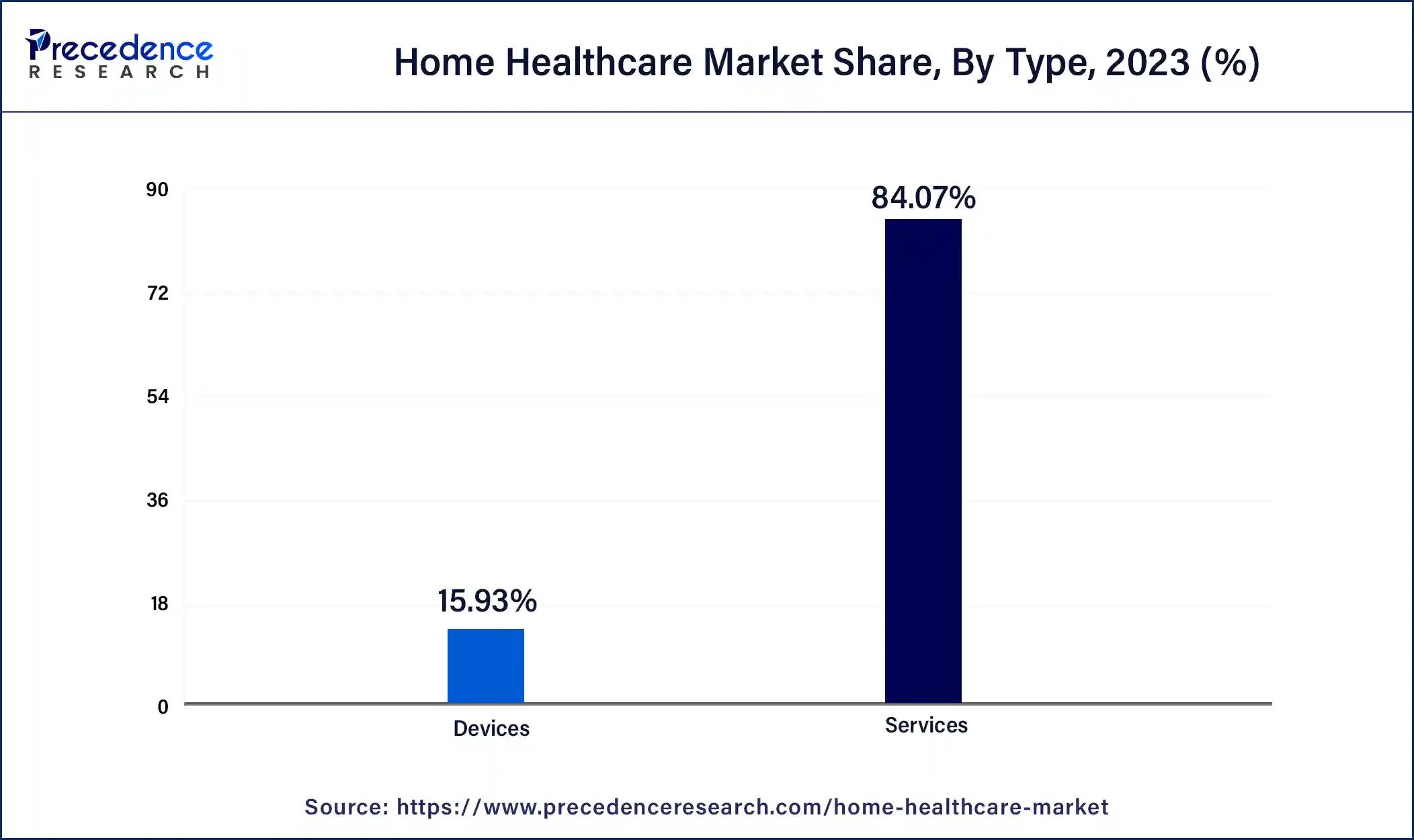

- By type, the services segment registered a maximum market share of 84.07% in 2023.

- By device, the home mobility assist devices segment captured the biggest revenue share of 40.26% in 2023.

- By service, the rehabilitation segment has held the largest market share of 44.12% in 2023.

How is AI Revolutionizing the Home Healthcare Market?

Artificial intelligence (AI) is redefining the various aspects of the healthcare sector. It helps enhance patient care through remote monitoring. AI-powered medical devices continuously monitor patients' health conditions and transfer this data to healthcare providers. AI's analytical capabilities allow healthcare providers to respond quickly by analyzing patient data and detecting changes in patients' condition. This further helps in timely intervention and reduces hospital readmissions. In addition, AI could make it much easier for caregivers, providers, and patients to manage complex home care plans. By coordinating caregiver activities and automatically scheduling doctor's appointments, AI can streamline care management.

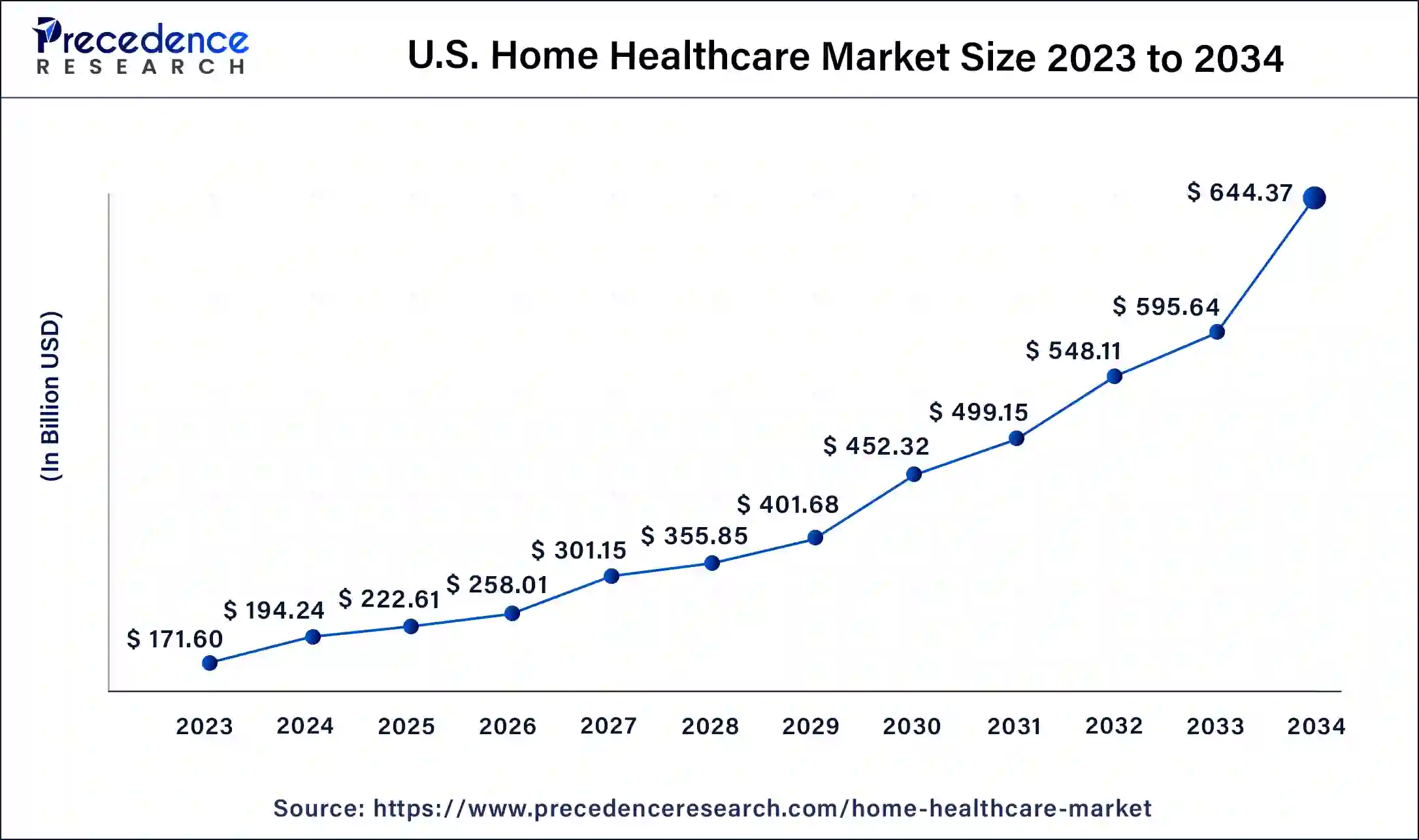

U.S. Home Healthcare Market Size and Growth 2024 to 2034

The U.S. home healthcare market size was estimated at USD 171.60 billion in 2023 and is predicted to be worth around USD 644.37 billion by 2034, at a CAGR of 12.74% from 2024 to 2034.

North America held the largest share of 50.59% share in 2023 in the home healthcare market. Over the past few years, the home healthcare market in North America has grown significantly, and this trend is anticipated to continue. This market includes a broad range of goods and services meant to help people receive medical attention and support in the comfort of their own homes. Skilled nursing care, physical therapy, occupational therapy, speech therapy, medical social services, and personal care support are all included in home healthcare services. Licensed healthcare providers or certified caregivers frequently offer these services. Patients have greater access to home healthcare services since they are frequently partially reimbursed by government healthcare programs like Medicare and Medicaid.

United States Home Healthcare Market Trends:

The United States is a major contributor to the home healthcare market. The high disposable incomes and growing preference for home-based care help in the market growth. The growing conditions like respiratory disorders, diabetes, and cardiovascular disease in aged people increase the demand for home healthcare. The well-developed healthcare system offers specialized home healthcare services. The favorable government policies, like Medicare & Medicaid, support home healthcare. Additionally, growing technological advancements like remote patient monitoring and telehealth drive the overall growth of the market.

Asia Pacific also expected to grow at the fastest CAGR during forecast period. A number of factors, including an aging population, an increase in the frequency of chronic diseases, growing healthcare expenses, and technological improvements, have contributed to the tremendous rise that the home healthcare industry has been seeing in the Asia Pacific area. A vast array of medical and non-medical services, such as nursing care, physical therapy, occupational therapy, medical equipment rental, and home infusion therapy, are included in the category of home healthcare services. These services are given to patients in their homes. In the Asia-Pacific region, the prevalence of chronic illnesses like diabetes, heart disease, and respiratory conditions is rising. By giving patients in-home lifestyle assistance, medication management, and ongoing monitoring, home healthcare plays a critical role in managing chronic illnesses.

Home Healthcare Market Overview

Home healthcare refers to a variety of medical services that can be provided in the comfort of a patients' own home to treat a sickness or accident. A patient's options for receiving home health care services are virtually endless. Care can range from nursing to specialized medical treatments, such as laboratory workups, depending on the individual patient's circumstance. The treatment plan and any treatments that the patient may require at home will be determined by the doctor. The duration of home healthcare can be short-term to long-term, depending on the health of the patient.

There are different types of home healthcare services available:

- Personal care & companionship services usually include non-medical care apart from routine medical care such as senior care, assistive care, home health aide services. In such cases, the patient may or may not be suffering from any severe ailment(s).

- Private duty nursing care is usually long-term nursing services for patients suffering from an injury, disability, or chronic illness.

- Apart from these, home healthcare services can be short-term with a designated physician assigned to help a patient recover from an injury or illness.

Home healthcare may or may not be prescribed by the doctor. In cases where it is prescribed by the doctor, these services are generally covered by the insurance company.

Devices such as blood pressure monitoring devices, glucose monitoring devices, and other therapeutic & diagnostic devices are also classified under home healthcare. The scope of the home healthcare market covers devices as well as services.

The rising percentage of geriatric patients across the world especially in developed countries like Germany, France, Japan, and the United States is considered as one major driving factor which promotes the growth of the home healthcare market.

According to WHO, it is estimated that between 2015 to 2050, the population above 60 years will approximately double from 12% to 22% across the globe. As per the study, it is also observed that each elder patient suffered from at least two or more major chronic disorders which further fuels the growth of the market. In addition, the rising demand for advanced healthcare services followed by high acceptance from the end-users is considered a significant influence for the market growth.

The unhealthy aging of individuals will bring a huge opportunity for the healthcare services market. Recently, the rising penetrations of technology in the field of healthcare services followed by the delivery system are seen as a encouraging factor for the growth of the market. Rising investment in the upcoming technology followed by penetration of Artificial intelligence in healthcare is one of the major factors which will bring huge opportunities within the forecast period.

Developing countries with a mass population like India, China, Indonesia, Brazil, and others still need a good amount of time to develop and adapt themselves in the field of healthcare to become equivalent to developed countries. According to WHO, Counties like India lack the geriatric population and still need 20 more years to reach nearer to France.

Market Scope

| Report Highlights | Details |

| Growth Rate from 2024 to 2034 | CAGR of 13.05% |

| Market Size in 2023 | USD 373.56 Billion |

| Market Size in 2024 | USD 423.97 Billion |

| Market Size by 2034 | USD 1,445.71 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Device, and By Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Home Healthcare Market Dynamics

Drivers

The rising aging population & nuclear homes drive the need for home healthcare

Almost every country in the globe is seeing an increase in the number of older people and the proportion of them in their population. In 2019, the world's population of people aged 65 and up totaled 703 million. In 2050, the number of elderly people is expected to increase to 1.5 billion. The proportion of the world's population aged 65 and up went from 6% in 1990 to 9% in 2019. By 2050, that percentage is expected to climb to 16%, implying that one in every six individuals on the planet would be 65 or older.

Eastern and South-Eastern Asia, as well as Latin America and the Caribbean, have the fastest-aging populations. In Eastern and South-Eastern Asia, the percentage of people aged 65 and up about doubled from 6% in 1990 to 11% in 2019, and in Latin America and the Caribbean, the percentage of people aged 65 and up about doubled from 5% in 1990 to 9% in 2019. In four regions, Northern Africa and Western Asia, Central and Southern Asia, Latin America and the Caribbean, and Eastern and South-Eastern Asia, the proportion of older people are expected to treble between 2019 and 2050.

In the years 2015-2020, a 65-year-old person should expect to live a further 17 years on average over the world. That figure will have risen to 19 years by 2045-2050. In all countries, life expectancy at 65 is expected to rise between 2015 and 2020 and 2045-2050. Women presently outlive males by 4.8 years, but this disparity is likely to close over the next three decades.

The level of population aging appears to be dependent on age patterns of output and consumption, according to indicators that combine both demographic and economic data. The economic old-age dependency ratio, which combines measured levels of consumption and output by age, reveals that population aging has the largest influence on nations or areas with large numbers of older people and high levels of old-age consumption, such as Europe and Northern America, as well as Australia and New Zealand.

Increasing healthcare costs to drive the demand for affordable home health treatments

Healthcare costs are increasing all around the world due to advancements in technology, the complexity of procedures, multiple illnesses in patients, changing government policies, high insurance premiums, and limited coverages. For instance, healthcare costs have risen dramatically in the US over the past several decades. The American Medical Association (AMA) identified three key factors driving healthcare costs, viz., population growth, population aging, and rising prices. Besides these, disease prevalence or incidence of medical service utilization are other vital factors fueling healthcare costs as well.

As the population grows older and lives longer, healthcare becomes more expensive. As a result, rising service expenses, particularly inpatient hospital care, accounted for half of the growth in healthcare spending. Additionally, population increase (23%) and population aging are the two most important elements driving up such spending (12%).

Average yearly rates for family coverage for those with employer-provided healthcare increased by 37% from USD 15,545 in 2015 to USD 21,342 in 2020 for those with employer-provided healthcare. Meanwhile, from 2015 to 2020, average unsubsidized family premiums for the Affordable Care Act (ACA) increased by 97%, from USD 8,724 to USD 17,244.

Increased insurance prices are simply one part of the equation. Americans are spending more money out of pocket than they have in the past. High-deductible health plans (HDHPs), which impose out-of-pocket fees of up to USD 14,000 per family, have increased the cost of healthcare significantly. Employer payments to HDHPs help to offset the higher deductible, and according to one study from 2018, HDHP members paid 20% of their total premium, whereas PPO participants paid up to 27%.

Medicare and Medicaid, for example, have increased total demand for medical services, resulting in higher pricing. Increases in the cost of medical treatment have been directly correlated with increases in the incidence of chronic illnesses such as diabetes and heart disease, particularly among seniors.

Restraints

Lack of Skilled Nursing Professionals

There has been a shortage of nursing staff which leads to limitation of growth of home healthcare market in developing countries like India. This shortage is primarily due to the insufficient number of qualified nurses available to meet the increasing demand for home-based healthcare services. According to an estimate India's health workforce density is high than WHO recommended threshold of 44.5 skilled health workers per 10,000 people. However, despite the relatively high overall workforce density, there remains an imbalance in the distribution of healthcare professionals. Skilled nursing professionals are often concentrated in urban areas, leaving rural and remote regions underserved. In home healthcare, face to face interaction is low between doctor and nurse. Nurses often take on a more autonomous role, including conducting patient assessments and sharing their findings with the patient's primary care physician. This reduced direct supervision impairs the need for highly skilled and autonomous nurses in the home healthcare setting.

Moreover, In India, there is no coverage of insurances companies for home healthcare treatments for generic and chronic conditions which is hindrance to the growth of the home healthcare market in India. Insurance companies typically focus on post-hospitalization treatments, while many patients require ongoing care at home. This financial barrier can deter patients from seeking home-based healthcare services, limiting the market's expansion.

Opportunity

The home healthcare sector has a significant opportunity for remote patient monitoring, or RPM. RPM uses technology to gather and send health information from patients' homes to medical professionals, which has several benefits. RPM makes it possible for patients to have continuous monitoring for chronic illnesses, which improves early problem detection and intervention and, in the end, improves patient outcomes and disease management. Additionally, it lowers ER visits and hospital readmissions, which saves a lot of money. In addition, RPM makes healthcare more accessible to underserved or remote locations, supports individualized treatment based on real-time data, promotes patient involvement, and ultimately turns out to be cost-effective. In order to effectively benefit of this potential, home health care providers require technological and personnel training investments, work with device manufacturers, and guarantee compliance with data privacy laws. Therefore, Adopting RPM leads several opportunities for market growth and development in healthcare delivery by enabling providers to provide better patient care, lower costs, and increase accessibility to healthcare services.

Type Insights

The services segment held the largest share of 84.07% in 2023 in the home healthcare market. A variety of services that are offered to patients in their homes to meet their medical needs are included in the home healthcare market. This market's service sector usually consists of a range of healthcare services that are provided by qualified experts to patients in their homes. Assistance with activities of daily living (ADLs) like clothing, grooming, meal preparation, and light cleaning is given by home health aides (HHAs) or personal care assistants. This entails the provision of expert nursing care by licensed practical nurses (LPNs) or registered nurses (RNs) in order to monitor vital signs, manage complicated medical problems, give medicine, treat wounds, and instruct patients and their families in health condition management.

How did the service segment dominate the home healthcare market?

The service segment dominated the home healthcare market in 2024. The aging population and growing chronic disease prevalence increase demand for home care services. The growing consumer preference for home care helps in the market growth. The growing demand for various services like respiratory therapy, rehabilitation, and hospice drives market growth. The growing technological advancements in remote monitoring and telehealth increase demand for various services. The rise in virtual care and growing demand for services like advanced therapies and personal care drive the overall growth of the market.

Rehabilitative treatments are offered by physical therapists (PTs) to patients who are recuperating from surgery, injuries, or illnesses. By using exercises, manual treatment, and other methods, they assist patients in achieving greater strength, endurance, mobility, and balance. Occupational therapists (OTs) assist patients in regaining or acquiring the skills necessary for doing everyday tasks including getting dressed, cooking, and using the restroom.

Device Insights

The Home Mobility Assist Devices segment held the largest share of 40.26% in 2023 in the home healthcare market. When it comes to helping people who have mobility issues as a result of age, accident, or disability, home mobility assist devices are essential to the home healthcare industry. These technologies give users the ability to carry out daily tasks and move around their houses safely, which improves independence and quality of life. People with restricted or no walking abilities can move around with the use of manual and electric wheelchairs. Those who can walk but need assistance can benefit from the stability and support provided by these devices. Canes aid in stability and balance, especially for people who require little assistance. With the use of these assistive gadgets, people with mobility impairments can safely climb stairs and descend hills.

Why did the home mobility assist devices segment lead the home healthcare market?

The home mobility assist devices led the home healthcare market in 2024. The growing age-related conditions like neurological disorders, arthritis, and osteoporosis increase demand for home mobility assist devices. The growing demand for disability rates and the growing preference for home-based care help in the market growth. The growing technological advancements in mobility devices like mobility lifts & powered wheelchairs drive market growth. Additionally, growing demand for home healthcare in the aged population increases demand for home mobility assist devices, contributing to the overall growth of the market.

The aging population and the rise in the number of disabled individuals are driving up demand for home mobility assistance products. Modern technological innovations like ergonomic designs and lightweight materials are making these gadgets more comfortable and easier to use. As more people look for ways to receive care in the comfort and safety of their own homes, the COVID-19 epidemic has also hastened the development of home healthcare solutions, including mobility aid devices. Sensors and networking capabilities are being added by manufacturers to mobility devices in order to improve user safety and offer remote monitoring. Personalized solutions that address the unique requirements and preferences of individual consumers are becoming more and more popular.

Home Healthcare Market, By Device, 2020-2023 (USD Billion)

| By Device | 2020 | 2021 | 2022 | 2023 |

| Diagnostic & Monitoring Devices | 12,638.8 | 14,368.0 | 16,403.2 | 18,794.6 |

| Therapeutic Devices | 12,518.5 | 13,778.2 | 15,186.2 | 16,761.8 |

| Home Mobility Assist Devices | 19,053.7 | 20,602.0 | 22,238.5 | 23,965.3 |

Service Insights

The rehabilitation held the largest share of 44.12% in 2023 in the home healthcare market. In home healthcare, the term "rehabilitation" refers to a variety of therapeutic approaches intended to improve or restore a patient's functional, cognitive, or physical capacities after a disease, surgery, or injury. The need for rehabilitation services in home healthcare is expanding due to an aging population and an increase in the prevalence of chronic illnesses and disabilities. Rehabilitative services allow patients to reach their recovery objectives while retaining their independence, as most patients choose to receive care in the comfort of their own homes. A broad range of rehabilitation treatments, including physical therapy, occupational therapy, speech therapy, and cognitive rehabilitation, are being offered by home healthcare firms.

Which service segment dominated the home healthcare market in 2024?

The rehabilitation segment dominated the home healthcare market in 2024. The growing disabilities and chronic diseases increase demand for rehabilitation services. The growing demand for convenience and the shift towards value-based care help in the growth of the market. The growing demand for increasing independence in daily living, improving functional mobility, and lowering the hospital readmission process fuels demand for rehabilitation. The ongoing technological advancements, like remote monitoring technologies and digital health solutions, fuel demand for rehabilitation programs, supporting the overall market growth.

Technological innovations like wearables, telemedicine platforms, and remote monitoring systems are making it easier to provide rehabilitative services in home healthcare. Through the use of virtual sessions, remote patient monitoring, and plan modifications, tele-rehabilitation improves patient outcomes and increases access to therapy. A multidisciplinary team of medical specialists, including physical therapists, occupational therapists, speech-language pathologists, nurses, and social workers, are frequently involved in rehabilitation in home healthcare. Throughout the rehabilitation process, therapists collaborate closely with patients and their families to create individualized treatment plans that encourage motivation, empowerment, and involvement. When compared to inpatient or outpatient care, home-based rehabilitation can be more affordable since it saves money on hospital stays, transportation costs, and facility-based services.

Home Healthcare Market, By Service, 2020-2023 (USD Billion)

| By Services | 2020 | 2021 | 2022 | 2023 |

| Rehabilitation | 109,827.8 | 118,814.4 | 128,382.9 | 138,558.7 |

| Telehealth | 16,600.1 | 25,123.7 | 35,992.5 | 50,859.5 |

| Respiratory Therapy | 33,077.7 | 37,868.8 | 41,270.1 | 45,447.4 |

| Infusion Therapy | 14,687.9 | 17,200.3 | 19,171.6 | 21,589.3 |

| Unskilled Homecare | 46,466.1 | 51,485.0 | 54,213.8 | 57,579.5 |

Home Healthcare Market Companies

Manufacturers: -

- McKesson Medical-Surgical Inc.

- Fresenius Medical Care

- Becton, Dickinson And Company

- Arkray, Inc.

- Medline Industries, Inc.

- 3M Healthcare

- Baxter International Inc.

- Medtronic PLC

- Braun Melsungen AG

- ConvaTec Group PLC

- Molnlycke Health Care

- Acelity L.P.

- Hollister Inc.

- Others

Service Providers: -

- Sunrise Carlisle, LP

- Extendicare, Inc.

- Brookdale Senior Living, Inc.

- Home Health Services Ltd.

- Care UK Limited

- Kindred Healthcare, Inc.

- Genesis Healthcare Corp.

- Sompo Holdings, Inc.

- Home Instead Senior Care, Inc.

- Others

Recent Developments

- In July 2024, Allied Insurance Company and Star Health expanded their services to include home healthcare services across more than 50 Indian cities. This initiative focuses on ensuring expedited and convenient claims settlement and delivering healthcare solutions directly to customers' homes.

- In April 2024, the U.S. Food and Drug Administration (FDA) announced the launch of a new initiative, Home as a Health Care Hub. The aim behind this initiative was to help reimagine the home environment as an integral part of the healthcare system and to advance health equity for all people in the U.S.

- In May 2024, LG Electronics announced the launch of a new venture, Primefocus Health, which will develop a provider-facing healthcare-delivery platform that leverages technologies and therapies to aid in remote patient monitoring and give patients access to new therapies through technology applications. It also allows patients to track progress, communicate with patients, and collect patient data.

Segments Covered in the Report

By Type

- Device

- Services

By Device

- Diagnostic & Monitoring Devices

- Therapeutic Devices

- Home Mobility Assist Devices

By Services

- Rehabilitation

- Telehealth

- Respiratory Therapy

- Infusion Therapy

- Unskilled Homecare

By Regional Outlook

- North America

- US.

- Canada

- Europe

- UK.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East and Africa

- GCC

- North Africa

- South Africa

- Rest of MEA

Get a Sample

Get a Sample

Table Of Content

Table Of Content