Home Sleep Apnea Testing Devices Market Size and Foprecast 2025 to 2034

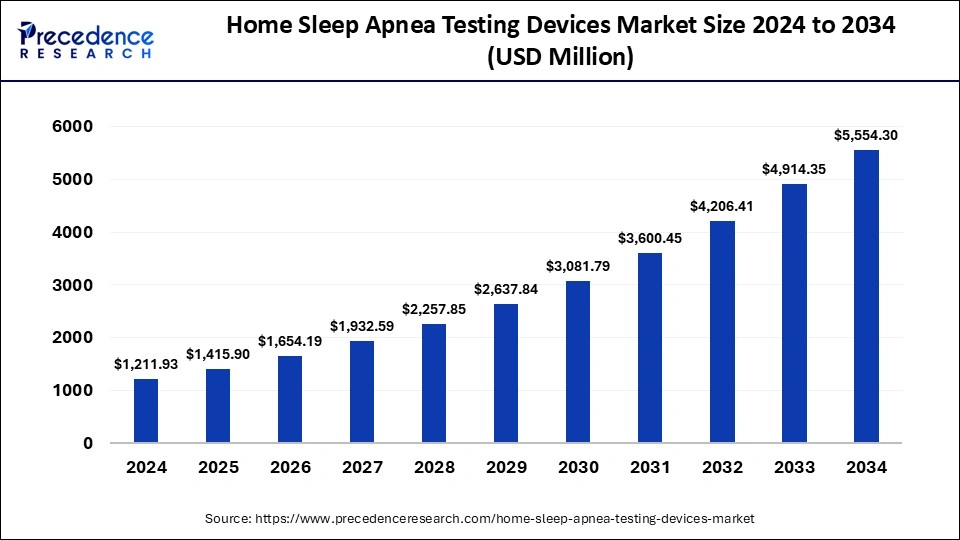

The global home sleep apnea testing devices market size was estimated at USD 1,211.93 million in 2024 and is predicted to increase from USD 1,415.90 million in 2025 to approximately USD 5,554.30 million by 2034, expanding at a CAGR of 16.44% from 2025 to 2034. The rising prevalence of chronic conditions such as heart disease among patients with sleep disorders is driving the demand for the home sleep apnea test devices market.

Home Sleep Apnea Testing Devices Market Key Takeaways

- The global home sleep apnea testing devices market was valued at USD 1,211.93 billion in 2024.

- It is projected to reach USD 5,554.30 billion by 2034.

- The market is expected to grow at a CAGR of 16.44% from 2025 to 2034.

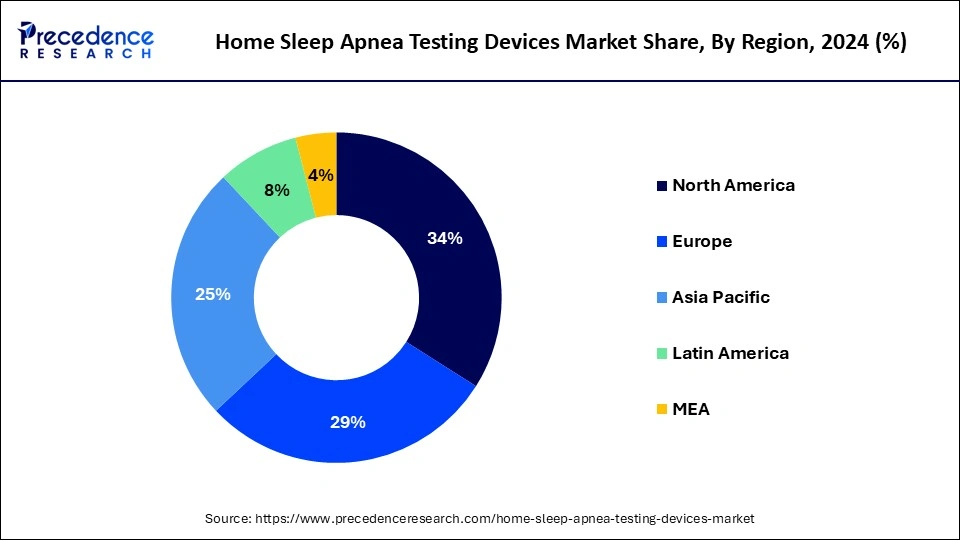

- North America has held a major revenue share of 34% in 2024.

- Asia Pacific is projected to experience the fastest growth in the market during the forecast period.

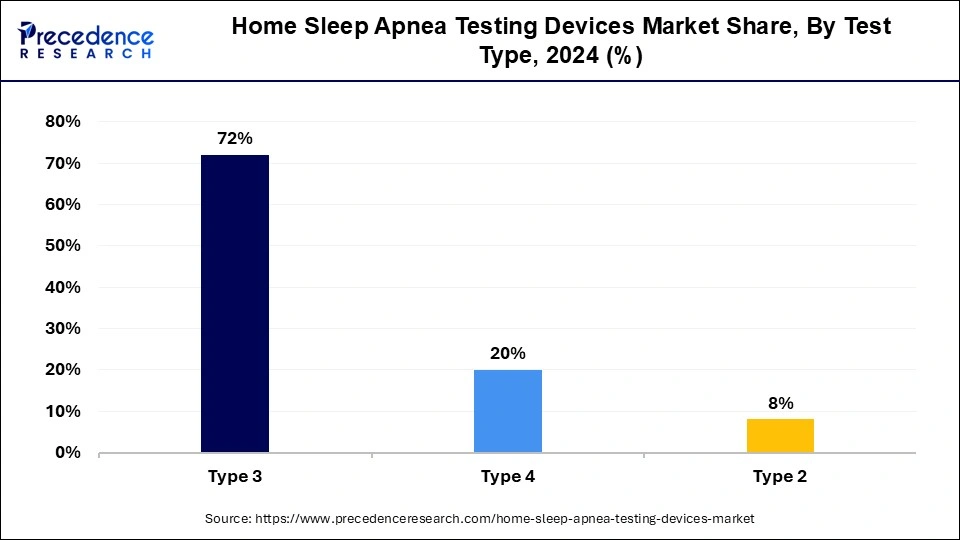

- By type, the type 3 segment dominated the market with the largest revenue share of 72% in 2024.

- By type, the type 4 segment is expected to witness the fastest growth in the market during the forecast period.

U.S. Home Sleep Apnea Testing Devices Market Size and Growth 2025 to 2034

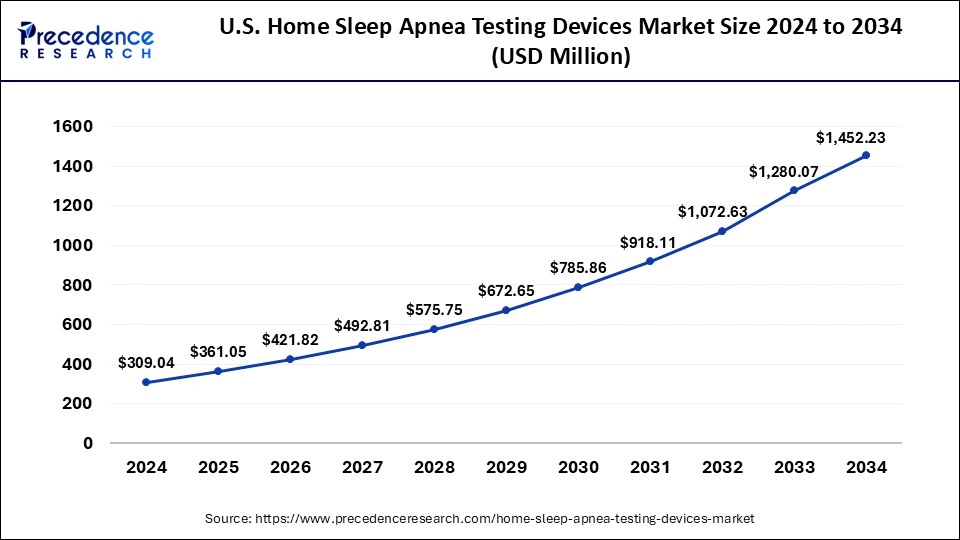

The U.S. home sleep apnea testing devices market size was calculated at USD 309.04 million in 2024 and is projected to attain around USD 1,452.23 million by 2034, poised to grow at a CAGR of 16.74% from 2025 to 2034.

North America dominated the global home sleep apnea test devices market in 2024. North America plays a significant role in the global market for home sleep apnea test devices, with major contributions from the United States and Canada. The region benefits from a robust economy, technological advancements, and a strong consumer base with high purchasing power. The substantial growth in North America is attributed to its developed healthcare infrastructure. The United States and Canada host many leading companies in the home sleep apnea test devices market with their advanced healthcare systems.

- In the U.S., Acurable plans to launch the FDA-cleared version of its device adapted to target the specific needs of the U.S. healthcare system. This follows the company's recent $12 million Series A funding round.

Asia Pacific is projected to experience the fastest growth in the home sleep apnea test devices market during the forecast period. This growth is being driven by countries such as China, Japan, India, and South Korea. This growth is supported by a large population, rising disposable incomes, and increasing urbanization, which can collectively boost the demand for the home sleep apnea test devices market and related services.

The home sleep apnea test devices market in India may expand or contract due to various factors, including macroeconomic conditions, population demographics, disease incidence rates, and geopolitical factors. Disruptions in the market can occur due to sudden and unexpected changes in these factors, as well as changes in clinical practices that influence the diagnosis and treatment of patients, as part of ongoing efforts to improve medical practices in general.

- In November 2022, HealthNet Global announced that it recently launched an eCommerce website devoted to leading patients to the supplies that will best treat their Obstructive Sleep Apnea (OSA). According to the company's statement, the launch of the eCommerce website comes in line with the comprehensive sleep solution program “Good Nidra” that was launched by the health-tech company earlier this year.

Market Overview

Sleep apnea is a sleep disorder that can lead to severe health issues such as hypertension, diabetes, stroke, cardiomyopathy, heart failure, and heart attacks. Untreated sleep apnea causes repeated breathing interruptions during sleep, resulting in loud snoring and daytime fatigue, even after a full night's rest. While it can affect anyone, it is most common in older, overweight men. However, it also affects people of all ages, including infants and children, particularly those over 50 and those who are overweight.

Common physical characteristics in patients with obstructive sleep apnea include excessive weight, a large neck, and structural abnormalities that narrow the upper airway, such as nasal obstruction, a low-hanging soft palate, enlarged tonsils, or a small jaw with an overbite. Sleep apnea is typically caused by a blockage of the airway when the soft tissue at the back of the throat collapses during sleep. Diagnosis involves sleep tests such as an overnight sleep study called a polysomnogram (PSG) or a home sleep test (HST).

Home Sleep Apnea Testing Devices Market Growth Factors

- Strong economic growth and conditions of an individual can lead to market expansion.

- Government regulations and policies are expected to fuel the growth of the home sleep apnea test devices market over the forecast period.

- Consumer preferences and emerging trends will help the market to grow shortly.

- Growing consumer demands for sustainable and eco-friendly products can lead to the home sleep apnea test devices market expansion.

- Undergoing digital transformation in the home sleep apnea test devices market is expected to propel its growth in the upcoming years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1,211.93 Million |

| Market Size by 2034 | USD 5,554.30 Million |

| Growth Rate from 2025 to 2034 | CAGR of 16.44% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for home sleep apnea testing

In the home sleep apnea test devices market, the demand for home sleep apnea testing remains high, as it provides physicians with comprehensive information about a patient's breathing patterns. However, recent regulations from regional regulatory bodies for manufacturing sleep apnea devices have made it more challenging for new home sleep apnea testing manufacturers to enter the market.

Various home sleep apnea testing devices equipped with advanced sensors and detectors are available and are driving the home sleep apnea test devices market. These diagnostic tools often measure heart rate and oxygen levels, and their diverse applications are expanding the market for home sleep apnea testing. Typically, these devices can diagnose obstructive sleep apnea and hence contribute significantly to the home sleep apnea test devices market.

- In May 2023, the Acurable Eye U.S. market decided to launch a sleep apnea testing device. Acurable's AcuPebble device aims to replace the current gold standard for sleep apnea diagnosis in the UK and is preparing for a commercial launch in the US.

Restraint

High initial investment and market fragmentation

In the home sleep apnea test devices market, the high initial investment required for the development and installation of these devices, especially for large-scale projects, can be a significant barrier to market growth. Additionally, companies must continuously innovate and adapt to changing preferences in order to retain and attract customers.

The home sleep apnea test devices market is fragmented, with many companies offering similar products and services. This makes it challenging to stand out and gain market share in such a competitive environment. Meeting the changing expectations of customers in terms of product quality, service, and experience is also a challenge.

Opportunity

The rising adoption of advanced sleep apnea devices

The shift in patient preferences from traditional sleep apnea devices to technologically advanced options is driving the growth of the sleep apnea devices market. Many patients now prefer mandibular advancement devices (MAD) over continuous positive airway pressure (CPAP) for treating obstructive sleep apnea. This change in preference is due to the discomfort and complications often associated with CPAP. The adoption of CPAP has significantly decreased in recent years with the introduction of alternatives like oral appliances. These factors are expected to have a positive impact on the global home sleep apnea test devices market during the forecast period.

- In February 2024, Samsung Electronics announced that the sleep apnea feature1 on the Samsung Health Monitor app2 has received De Novo authorization from the U.S. Food and Drug Administration (FDA). This feature, which detects signs of sleep apnea using a compatible Samsung Galaxy Watch and phone, was the first of its kind to be authorized by the FDA following previous approval by Korea's Ministry of Food and Drug Safety, announced last October in Korea.

Test Type Insights

The type 3 segment dominated the home sleep apnea test devices market in 2024. Type 3 devices are more cost-effective compared to polysomnography (PSG) devices, offering high effectiveness and efficiency in diagnosing obstructive sleep apnea. Furthermore, Type 3 devices have multiple functions, including detecting ECG or heart rate, oxygen saturation, and channels of respiratory movement and airflow. The increased production of Type 3 devices is subsequently driving market growth.

The home sleep apnea test devices market is expected to see the fastest growth in the type 4 segment. Type 4 devices, also known as portable cardio-respiratory monitors or home sleep apnea tests (HSAT), are used for screening obstructive sleep apnea (OSA) or aiding in diagnosing OSA in patients with a high pretest probability of moderate to severe OSA. Various HSAT devices have been developed for clinical use. One notable Type 4 HSAT device, developed in Japan, is widely used and highly popular. While some data indicate the usefulness of the Apnomonitor for OSA screening, the clinical utility of its latest version, the Apnomonitor Mini, has not been verified.

- In January 2024, The Food and Drug Administration (FDA) granted 510(k) clearance to BresoDX1 to aid in the diagnosis of moderate to severe sleep apnea in an at-home setting. BresoDX1 is designed to record a patient's physiological signals during sleep using a sensor and a pulse oximeter. The sensor is placed on the neck over the trachea, and the pulse oximeter is placed on the finger. These two diagnostic inputs record the patient's tracheal breathing sounds and movements, neck and body position, oxygen saturation, and heart rate during sleep.

Home Sleep Apnea Testing Devices Market Companies

- Fisher & Paykel Healthcare

- ImThera Medical, Inc.

- Natus Medical, Inc.

- Somnetics International, Inc.

- Braebon Medical Corporation

- BMC Medical Co., Ltd.

- Teleflex, Inc.

- Weinmann Medical Devices GmbH & Co., KG.

- Philips Respironics

- CareFusion Corp.

- Compumedics Limited

- and Nihon Kohden.

Recent Developments

- In February 2023, Philips Respironics introduced the release of its new domestic sleep screening tool, the Philips DreamMapper Pro. The DreamMapper Pro is a software platform that may be used to tune and control sleep apnea remedies.

- In March 2023, SomnoMed introduced the release of its new domestic sleep screening tool, the SomnoMed AXG300. The AXG300 is a wi-fi device that can be used to diagnose sleep apnea and loud night breathing.

- In April 2023, Welch Allyn introduced the release of its new domestic sleep screening tool, the Welch Allyn SleepCheck Pro. The SleepCheck Pro is a fingertip pulse oximeter that may be used to screen blood oxygen degrees all through sleep.

- In November 2022, ResMed and Alphabet's life science offshoot Verily announced the formation of Primasun, an end-to-end solution to help employers and healthcare providers identify populations at risk for complex sleep disorders.

- In October 2022, Airway Management, manufacturer of the most globally researched custom oral appliances, announced the launch of flexTAP, a premium lab-made oral appliance designed to treat patients with snoring and mild to moderate obstructive sleep apnea.

Segments Covered in the Report

By Test Type

- Type 2

- Type 3

- Type 4

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting