What is the Sleep Apnea Devices Market Size?

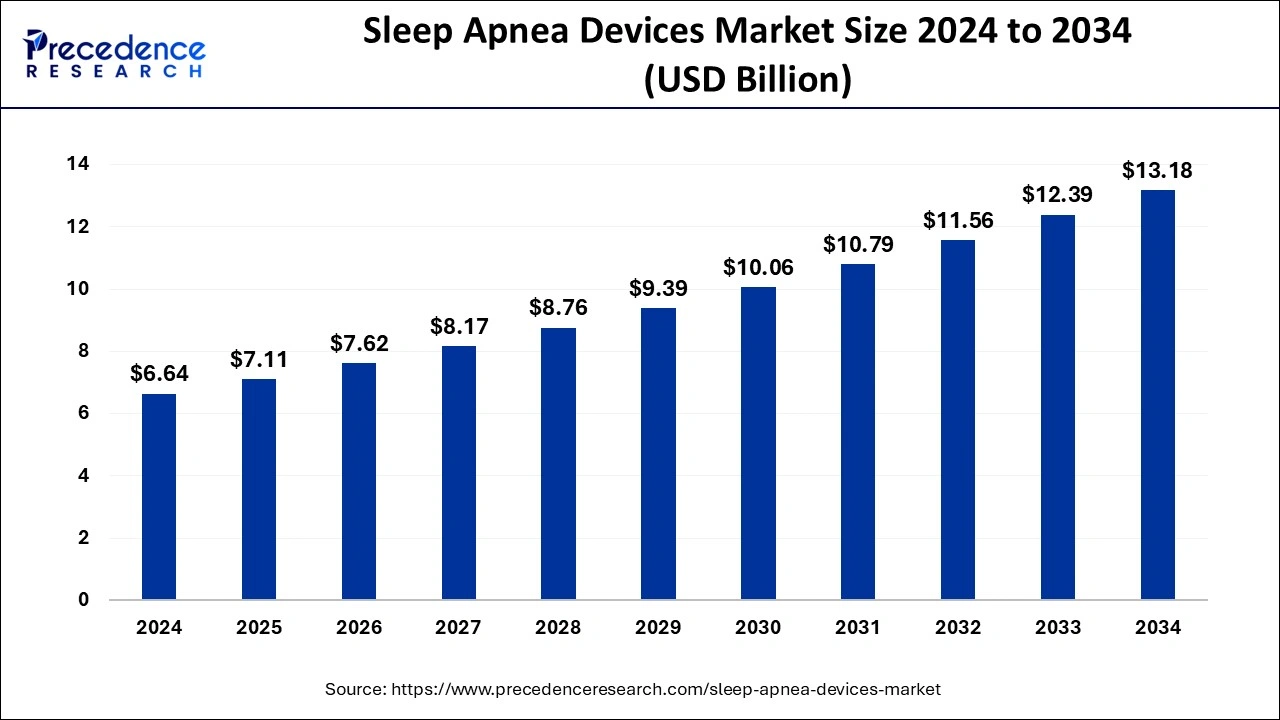

The global sleep apnea devices market size is calculated at USD 7.11 billion in 2025 and is predicted to increase from USD 7.62 billion in 2026 to approximately USD 13.18 billion by 2034, growing at a notable CAGR of 7% from 2025 to 2034. The rising prevalence of sleep apnea, the rapidly expanding medical device sector, and technological advancements boost the sleep apnea market.

Sleep Apnea Devices Market Key Takeaways

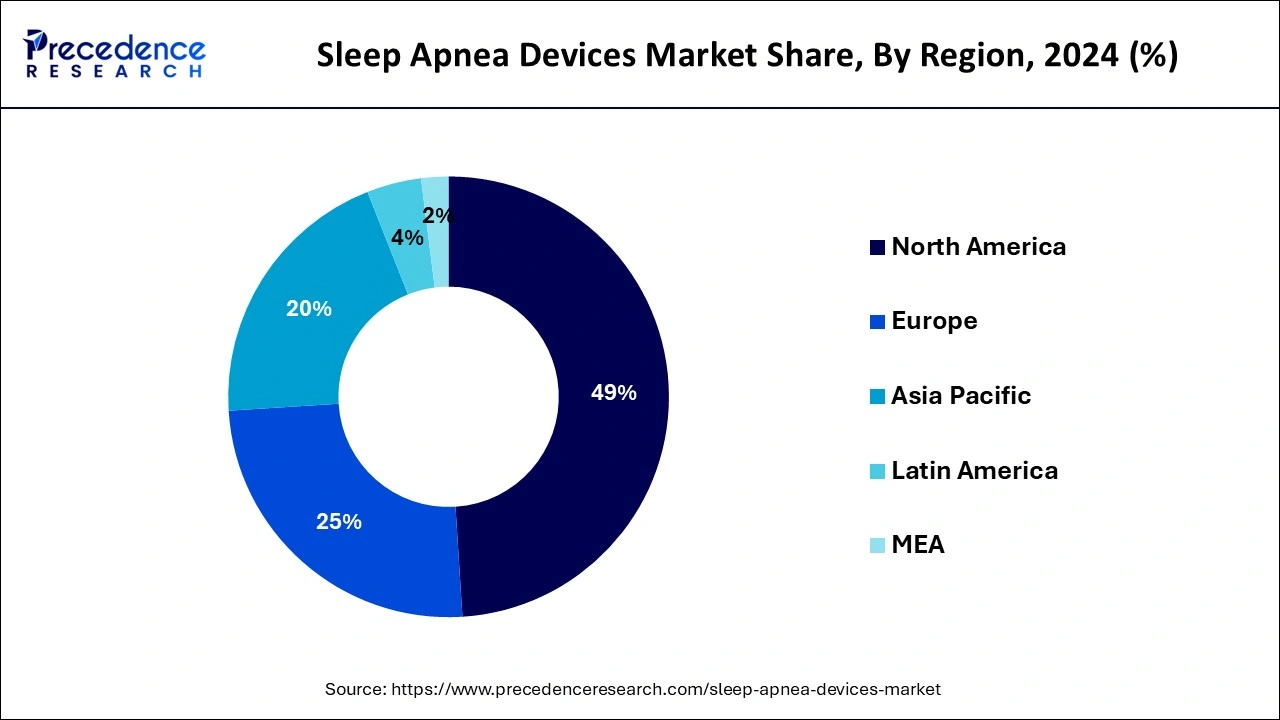

- North America led the market with the biggest market share of 49% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By Product, the therapeutic devices segment registered the maximum market share in 2024.

Sleep Apnea Devices Market Growth Factors

Several influences including an enormous pool of undiagnosed patients suffering from sleep apnea, mounting utilization of oral appliances, and technological advancements in sleep apnea devices are flourishing the growth of the global sleep apnea market.

Substantial venture capital finance, cumulative number of establishments volunteering into sleep apnea and oral appliances sector is expected to upsurge the market demand during near future. Additionally, escalating pervasiveness of obstructive sleep apnea at a worldwide level is estimated to significantly push sale of sleep apnea devices during years to come.

Global sleep apnea market is expected to record optimistic growth due to several probable advantages presented by mHealth and telemedicine in improving sleep apnea management and diagnosis. Numerous studies have stated that a foremost projecting aspect for long-term CPAP compliance is patient observance in the first few weeks of treatment. In order to advance compliance, follow-up and support throughout this period must be quick. Telemedicine provides such sort of support since extended waiting lists make it problematic to deliver this support. Many studies recommend that patients in the telemedicine group conveyed high satisfaction with their care and specifically enjoyed the suitability of a live video visit with doctor and consultant.

Integration of AI on the Sleep Apnea Devices

Artificial intelligence (AI) plays a crucial role in the medical device sector in various aspects, from designing to manufacturing. AI aids in the development of novel and more advanced sleep apnea devices with portability and automation. Integrating AI into wearable devices revolutionizes the collection and analysis of data, improving efficiency and precision. AI-enabled sensors and digital displays enable real-time monitoring of sleep patterns, facilitating healthcare professionals in effective clinical decision-making. AI and machine learning (ML) algorithms can effectively detect sleep apnea and predict its occurrence. AI can lead to the production of more cost-efficient devices. AI and ML can also aid in developing personalized sleep apnea devices and suggest measures to prevent and treat sleep apnea.

Sleep Apnea Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the increasing demand for high-quality diagnostic solutions coupled with rapid investment by government for strengthening the healthcare system across the globe.

- Major Investors: Several medical device companies and strategic investors are actively entering this market, drawn by joint ventures, R&D and product launches. Numerous market players such as Compumedics, Curative Medical, Teleflex, CareFusion Corporation, Fisher &Paykel Healthcare and some others have started investing rapidly for developing advanced sleep apnea devices for patients.

- Startup Ecosystem: Various startup companies are engaged in manufacturing high-quality medical devices. The prominent startup companies dealing in sleep apnea devices consists of ProSomnus, Nukute, Dormir Bien and some others.

Sleep Apnea Devices Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 13.18 Billion |

| Market Size in 2026 | USD 7.62 Billion |

| Market Size in 2025 | USD 7.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End-User Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Among different product segments analyzed in this report, therapeutic devices led the market in 2024 with majority of the revenue share. This development is credited to augmented disease consciousness amid patients, obtainability of technologically enhanced products, and intensifying market competition.

Further, PAP devices sub-segment is assessed to see noteworthy growth throughout assessment period. This great growth is accredited to mounting requirement for competent, superior and transportable sleep apnea devices. Moreover, existence of satisfactory insurance coverage for management of sleep apnea and other sleep disorders would supplement demand for PAP devices worldwide. Growing commonness of sleep apnea and associated co-morbidities in numerous parts of the globe is a foremost influence heightening the importance of polysomnography devices. Furthermore, intensify ingresponsiveness for sleep apnea and other sleep disorders among the populace will further add to their market growth.

End-user Insights

Different end-use sectors assessed in this research report include diagnostic devices and therapeutic devices. The assortment of devices employed in hospitals and sleep laboratories is restricted mostly to diagnostic devices including tabletop pulse oximeters, actigraphy systems, and clinical PSG devices. There is a progression in the number of sleep tests and labs accomplished with the help of a clinical polysomnography device across the world, as these tests are being assumed the standard diagnostic test for sleep apnea since long time period.

Regional Insights

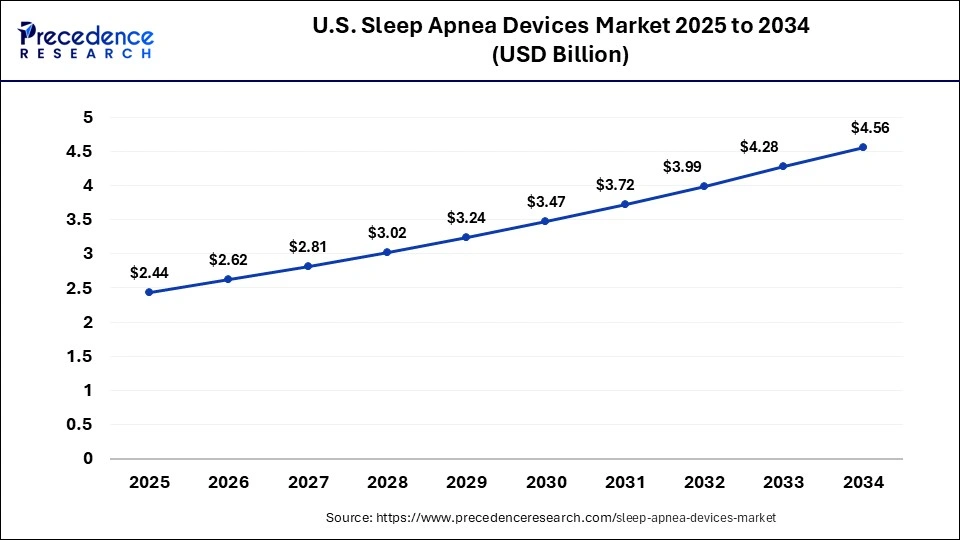

U.S. Sleep Apnea Devices Market Size and Growth 2025 To 2034

The U.S. sleep apnea devices market size was valued at USD 2.44 billion in 2025 and is expected to be worth around USD 4.56 billion by 2034, poised to grow at a CAGR of 7.18% from 2025 to 2034.

At present, geographically, North America conquers the global sleep apnea devices market and is projected to endure its stronghold in near future. This enormous growth is attributed to the great prevalence of sleep-disordered breathing and increasing aged population in this region. As per Sleep Zone, it was projected that about 22 million Americans undergo from moderate to severe sleep apnea, among them, about 3 to 7% of men and 2 to 5% of women were recognize to have had sleep apnea in the U.S in 2018.

United States:

- The presence of key players and advanced healthcare infrastructure potentiate the market. ResMed, Inc. is an American medical device company providing cloud-connectable medical devices for the treatment of sleep apnea, COPD, and other respiratory conditions. It reported a revenue of $4.7 billion in FY2024, an increase from 11%.

- The increasing healthcare spending also promotes the consumption of sleep apnea devices. In 2023, the total healthcare spending in the U.S. accounted for $4.9 trillion, an increase of 4.6% from 2022.

Nevertheless, Asia Pacific is assessed to exhibit highest CAGR during estimate period on account of snowballing occurrence of sleep apnea illnesses in this region, and deliberate agreements of international market front-runners with local companies. Additionally, huge undiagnosed pool in nations such as India, and initiatives undertaken by the government and other private administrations to promote awareness concerning sleep disorders is projected to further push the market growth in this region.

China:

- The rapidly expanding medical device sector due to increasing new product launches augments the market. In 2023, the Chinese NMPA approved a total of 69 medical devices.

- Favorable government policies and initiatives also support the development of sleep apnea devices in China. The 14th Five-Year Development Plan for the Medical Equipment Industry contemplated that by 2025, the effective local supply of medical equipment would be achieved and the performance and quality level of high-end medical equipment would be significantly improved.

India:

- The rising incidences and prevalence of sleep apnea disorder increase the demand for sleep apnea devices in India. According to the AIIMS report, around 104 million Indians or 11% of the population could be suffering from Obstructive Sleep Apnea in 2023.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The growing demand for oral therapeutic devices to treat sleeping disorders has boosted the market growth. Additionally, rapid investment by government of several countries such as Germany, Italy, France, UK and some others is expected to drive the growth of the sleep apnea devices market in this region.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The rising cases of drug addicts in several countries such as Brazil, Argentina, Venezuela and some others has increased the demand for sleeping devices, thereby driving the market expansion. Also, rapid investment by pharma companies for opening up new research and development centers is expected to boost the growth of the sleep apnea devices market in this region.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The increasing sales of pulse oximeters and positive airway pressure (PAP) devices has driven the market growth. Additionally, numerous government initiatives aimed at developing the healthcare infrastructure coupled with presence of various medical device companies is expected to drive the growth of the sleep apnea devices market in this region.

Value-Chain Analysis

Raw Material Procurement - The raw materials used in the production of sleep apnea devices includes polymers, polyester, silicone and others.

- Key Companies: Sabic, BASF SE, Dow and some others.

Production Methodology - The production of sleep apnea devices varies depending on the type, but it generally involves a combination of traditional and modern techniques.

- Key Companies: ResMed, Philips, and Fisher & Paykel Healthcare and others.

Distribution Channel - The distribution channels for sleep apnea devices include direct sales (such as through hospital tenders) and indirect sales via various retailers, including retail pharmacies, hospital pharmacies, and online pharmacies.

- Key Companies: Amazon, eBay, Alibaba, Netmeds and others.

Key Players in Sleep Apnea Devices Market & Their Offerings:

- GE Healthcare: GE HealthCare is a global medical technology and life sciences company that provides diagnostic imaging, pharmaceutical diagnostics, and patient care solutions to the healthcare industry. It is headquartered in Chicago, Illinois and offers a wide range of products and services such as imaging agents, ultrasound equipment, and AI-powered tools, with the goal of improving patient outcomes and supporting precision health.

- Philips Healthcare: Philips Healthcare is a health technology company that creates integrated solutions across diagnosis, treatment, and home care. Its main product areas include diagnostic imaging (like MRI and CT scanners), image-guided therapy, patient monitoring, sleep and respiratory care, and personal health products.

- Weinmann Medical Devices: Weinmann Medical Devices is a family-owned German company that specializes in developing and manufacturing mobile medical technology for emergency, transport, and disaster medicine. Their products include ventilators, defibrillators, and suction devices, which are used by a wide range of professionals in emergency services, hospitals, and military corps worldwide

- CadwellLaboratorie: Cadwell Laboratories is a private company based in Kennewick, WA, that develops and manufactures neurodiagnostic and electrodiagnostic (EDX) medical devices and supplies. Founded in 1979, the company produces a range of equipment for EEG, EMG, IONM, and sleep testing, serving healthcare providers and government agencies like the VA and DHA

- Compumedics: Compumedics is an Australian-based company founded in 1987 that develops diagnostic technologies for sleep, neurological, and cardiology disorders. It provides a wide range of products and software for sleep enhancement and brain diagnostics.

Sleep Apnea Devices Market Companies

- BMC Medical

- Curative Medical

- Teleflex

- CareFusion Corporation

- Fisher &Paykel Healthcare

- ResMed

- SOMNOmedics

- Invacare Corporation

- Natus Medical

Latest Announcement by Industry Leaders

- John Lopos, CEO of the National Sleep Foundation, commented that AI can expand sleep-tracking capabilities, enabling personalized information to be shared with users and empowering them to make small behavioral changes for the better.

Recent Developments

- In September 2025, Airway Management launched Nylon flexTAP. Nylon flexTAP is a 3D-printed sleep apnea device that is approved by FDA. Source: Dallas Innovates

(Source: https://dallasinnovates.com/north-texas-airway-management-launches-3d-printed-device-for-sleep-apnea/) - In August 2025, Nyxoah announced that the FDA approved sleep apnea implant. This device is designed for the patients of the U.S. region. Source: Fierce Biotech

(Source: ) - In January 2025, ResMed launched AirSense 11 in India. AirSense 11 is an positive airway pressure (CPAP) device designed for the patients suffering from sleep apnea. Source: Financial Express

- In September 2024, the U.S. Food and Drug Administration approved Apple Watch's sleep apnea detection feature. The device detects sleep apnea by identifying breathing disturbances using wrist movements.

- In August 2024, Inspire Medical Systems announced that it received the U.S. FDA for its Inspire V obstructive sleep apnea neurostimulator therapy device. The device contains a sensing function and a software-based platform for adding new features and will fully launch in 2025.

Segments Covered in the Report

By Product Type

- Diagnostic Devices

- Respiratory Polygraphs

- Actigraphs

- Polysomnography (PSG) Device

- Pulse Oximeters

- Therapeutic Devices

- Nasal Devices

- Positive Airway Pressure (PAP) Devices

- Oral Devices

- Chin Straps

By End-User

- Home Care Setting

- Sleep Laboratories & Hospitals

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content