What is the Sleep Monitoring Devices Market Size?

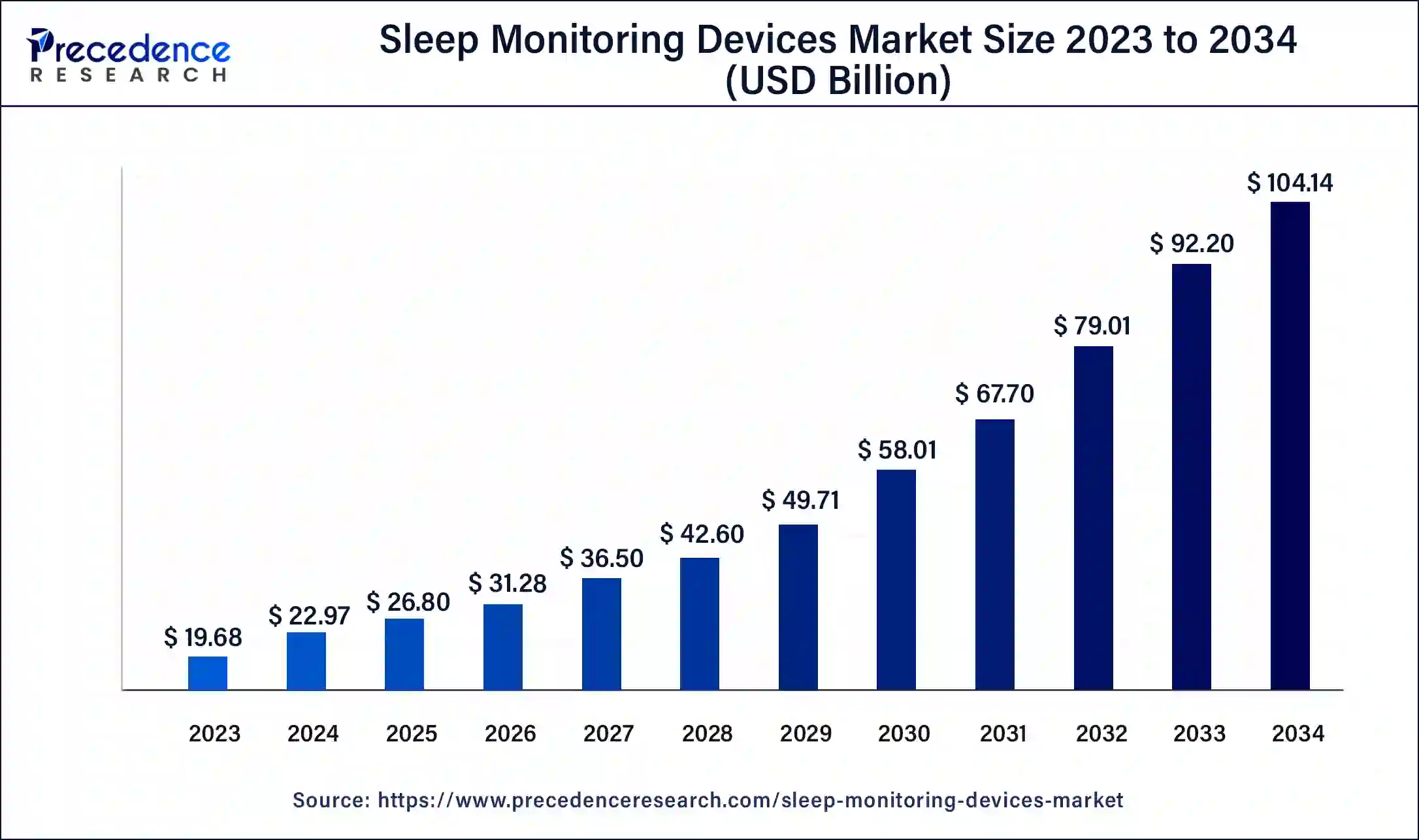

The global sleep monitoring devices market size is calculated at USD 26.80 billion in 2025 and is predicted to increase from USD 31.28 billion in 2026 to approximately USD 104.14 billion by 2034, growing at a CAGR of 16.32% from 2025 to 2034.

Sleep Monitoring Devices Market Key Takeaways

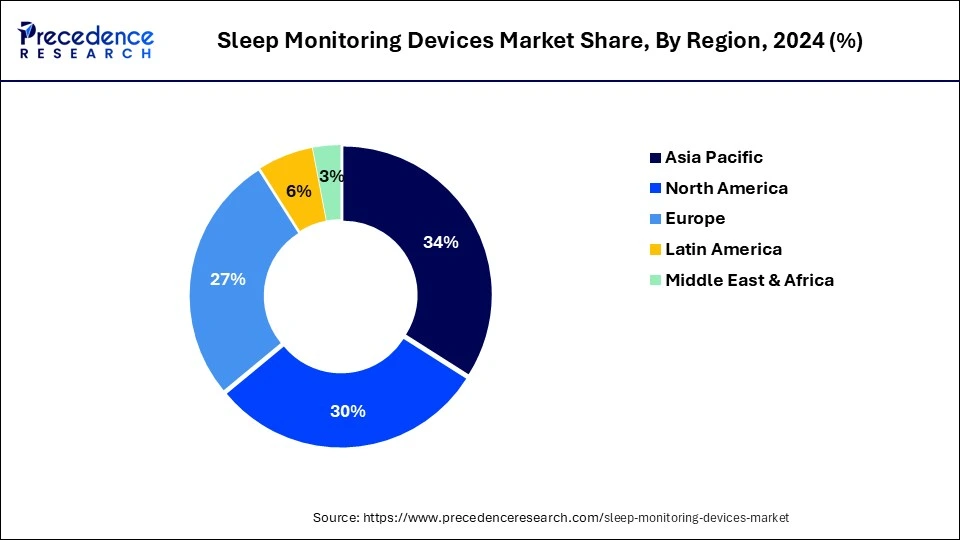

- Asia-Pacific contributed more than 35% of the revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By component, the hardware segment has held the largest market share of 61% in 2024.

- By component, the software & solutions segment is anticipated to grow at a remarkable CAGR of 17.4% between 2025 and 2034.

- By operating system, the android segment generated over 72% of the revenue share in 2024.

- By operating system, the IOS segment is expected to expand at the fastest CAGR over the projected period.

The Future of Rest: Innovative Sleep Monitoring Solutions

Sleep monitoring devices are innovative tools designed to observe and assess an individual's sleep patterns. These devices, which include wearables, smart mattresses, and associated apps, employ sensors to gather data on aspects such as movement, heart rate, and breathing during sleep. By utilizing sophisticated algorithms, these devices offer users comprehensive insights into their sleep duration, cycles, and overall quality, often accompanied by personalized recommendations to enhance sleep habits based on the collected data.

The increasing awareness of the crucial role sleep plays in overall health has driven the popularity of these devices. Users can leverage the information provided to recognize patterns, identify sleep disturbances, and make informed lifestyle adjustments for improved sleep quality. Advancements in artificial intelligence and machine learning further enhance the accuracy and sophistication of these analyses, positioning sleep monitoring devices as integral components in the proactive management of individual health.

Sleep Monitoring Devices Market Growth Factors

- Increased Awareness: Growing awareness about the importance of sleep for health and well-being is propelling the demand for sleep monitoring devices.

- Technological Advancements: Continuous innovations in sensor technologies and data analytics are enhancing the capabilities of sleep monitoring devices, attracting more users.

- Rising Health Consciousness: The global focus on health and wellness is driving individuals to seek tools like sleep monitors to optimize their sleep routines.

- Prevalence of Sleep Disorders: The increasing incidence of sleep disorders is fostering the adoption of sleep monitoring devices for early detection and management.

- Integration with Smart Homes: Sleep monitors' compatibility with smart home systems is making them more accessible and convenient for users.

- Personalized Health Management: The trend towards personalized health solutions is boosting the demand for devices that offer tailored insights into sleep habits.

- Remote Patient Monitoring: Sleep monitoring devices are becoming integral in remote patient monitoring, enabling healthcare professionals to track sleep patterns outside clinical settings.

- Stress and Lifestyle Management: The role of sleep in stress reduction and overall lifestyle management is fueling the use of sleep monitoring devices.

- Fitness and Performance Optimization: Athletes and fitness enthusiasts use sleep monitors to optimize recovery and enhance overall performance.

- Corporate Wellness Programs: Companies are incorporating sleep monitoring devices into wellness programs to promote employee health and productivity.

- Market Competitiveness: Increasing competition among device manufacturers is driving the development of more advanced and feature-rich sleep monitors.

- Consumer Education Initiatives: Educational campaigns about the benefits of monitoring sleep are increasing consumer understanding and adoption of these devices.

- Wearable Technology Trends: The broader trend of wearable technologies is influencing the popularity of sleep monitoring devices that can be easily incorporated into daily routines.

- Aging Population: The aging population, with a higher prevalence of sleep-related issues, is contributing to the expanding market for sleep monitoring devices.

- Telemedicine Integration: Sleep monitoring devices are being integrated into telemedicine platforms, providing remote healthcare professionals with valuable sleep data.

- Health Insurance Incentives: Some health insurance programs offer incentives for using sleep monitoring devices, encouraging their adoption among policyholders.

- Global Pandemic Impact: The COVID-19 pandemic has heightened awareness of the importance of sleep, leading to increased interest in sleep monitoring devices.

- Continuous Product Upgrades: Manufacturers regularly introduce updates and new features, encouraging existing users to upgrade and attracting new customers.

- Affordability and Accessibility: As sleep monitoring devices become more affordable and widely available, their market penetration is increasing.

- Research and Development Investments: Ongoing investments in research and development are driving the evolution of sleep monitoring devices, ensuring continuous market growth.

- In 2022 the Huawei Technologies Co., Ltd. made a revenue of $92.3 B.

Sleep Monitoring Devices Market Outlook: The Growth Path

- Industry Growth Overview: The growing sleep disorders, technological advancements, and health awareness are driving the industrial growth in the market.

- Major Investors: Private equity firms, venture capital firms, and other strategic investors are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is focusing on the development of comfortable, clinically validated, and non-invasive home-use technologies.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 16.32% |

| Market Size in 2025 | USD 26.80 Billion |

| Market Size in 2026 | USD 31.28 Billion |

| Market Size by 2034 | USD 104.14 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Operating System, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Technological advancements and the prevalence of sleep disorders

The surge in demand for sleep monitoring devices is fueled by both technological advancements and a growing prevalence of sleep disorders. Continuous improvements in sensor technologies, wearables, and data analytics have equipped these devices with advanced features, offering users more accurate and personalized insights into their sleep patterns. This aligns with consumer preferences for sophisticated solutions that contribute to effective sleep management, driving the market forward.

Simultaneously, the increasing occurrence of sleep disorders, such as insomnia and sleep apnea, has heightened awareness regarding the significance of monitoring and addressing sleep health. As more individuals seek tools for early detection and management of sleep-related issues, Sleep monitoring devices have become crucial. This confluence of technological progress and a rising need for sleep-related health solutions establishes sleep monitoring devices as indispensable contributors to the pursuit of improved sleep and overall well-being.

Restraint

Privacy concerns and user compliance

Privacy concerns and user compliance pose significant restraints to the market demand for sleep monitoring devices. The collection of sensitive health data during sleep monitoring raises apprehensions about privacy among users. Fear of potential data breaches or unauthorized access to personal health information can deter individuals from adopting these devices, especially in an era of heightened awareness about data security.

Additionally, user compliance is crucial for the effective functioning of sleep monitoring devices. Consistent and prolonged usage is necessary to gather meaningful data for accurate insights into sleep patterns. However, factors such as discomfort, inconvenience, or a lack of understanding about the importance of continuous monitoring may hinder users from consistently using these devices. Overcoming these challenges requires addressing privacy concerns through robust data protection measures and designing devices with user-friendly features to enhance compliance and encourage widespread adoption of sleep monitoring technology.

Opportunity

Corporate wellness programs and wearable technology

Corporate wellness programs and wearable technology trends are creating significant opportunities in the sleep monitoring devices market. Employers are increasingly recognizing the impact of employee well-being on productivity and are incorporating sleep monitoring devices into corporate wellness programs. This integration allows employees to monitor and manage their sleep health, fostering a more comprehensive approach to workplace wellness. The workplace emphasis on sleep contributes to increased adoption, driving demand for devices that seamlessly fit into individuals' daily routines.

Simultaneously, the wearable technology trends, where consumers are embracing smart and stylish wearables, provide a favorable environment for sleep monitoring devices. The convergence of fashion and functionality in wearable technology attracts users looking for devices that not only deliver accurate sleep insights but also align with their personal style preferences. By tapping into these trends, sleep monitoring devices can position themselves as not just health tools but as lifestyle accessories, expanding their market presence and attracting a broader consumer base.

Component Insights

In 2023, the hardware segment had the highest market share of 61% on the basis of the component. In the sleep monitoring devices market, the hardware segment encompasses the physical components of monitoring devices, including sensors, wearables, and processing units. Hardware trends focus on miniaturization for increased wearability, improved sensor accuracy for precise data collection, and extended battery life for uninterrupted monitoring.

Innovations in lightweight materials and compact designs contribute to user comfort, while integration with smart home ecosystems remains a key trend. The hardware segment's evolution reflects a commitment to enhancing user experience and overall device effectiveness in monitoring and improving sleep quality.

The software & solutions segment is anticipated to expand at a significant CAGR of 17.4% during the projected period. In the sleep monitoring devices market, the software and solutions segment encompass the digital components that facilitate data analysis, interpretation, and user engagement. This includes sleep tracking algorithms, mobile applications, and cloud-based platforms. Trends in this segment focus on enhancing user experience through user-friendly interfaces, personalized insights, and real-time feedback. Advanced analytics, artificial intelligence, and machine learning are increasingly integrated to provide more accurate sleep pattern analyses and actionable recommendations, reflecting the industry's commitment to delivering comprehensive and sophisticated solutions for improved sleep health.

Operating System Insights

According to the operating system, the android segment has held a 72% revenue share in 2023. In the sleep monitoring devices market, the Android segment refers to devices compatible with the Android operating system. The Android segment is witnessing a growing trend with the development of user-friendly sleep monitoring apps and wearables. Manufacturers are leveraging the flexibility of the android OS to create seamless integrations with smartphones and tablets, enhancing user convenience. The android segment in sleep monitoring devices caters to a wide user base, offering diverse options for tracking and improving sleep patterns through accessible and customizable applications.

The IOS segment is anticipated to expand fastest over the projected period. In the sleep monitoring devices market, the iOS segment specifically caters to users of Apple's operating system. As iOS devices, including iPhones and Apple Watches, gain popularity, sleep monitoring apps compatible with iOS have become prevalent. The trend involves the seamless integration of sleep tracking features into Apple's Health app, offering users comprehensive insights into their sleep patterns. The user-friendly interface, coupled with continuous updates and improvements in sleep tracking algorithms, positions iOS as a significant player in the evolving landscape of sleep monitoring technology.

Regional Insights

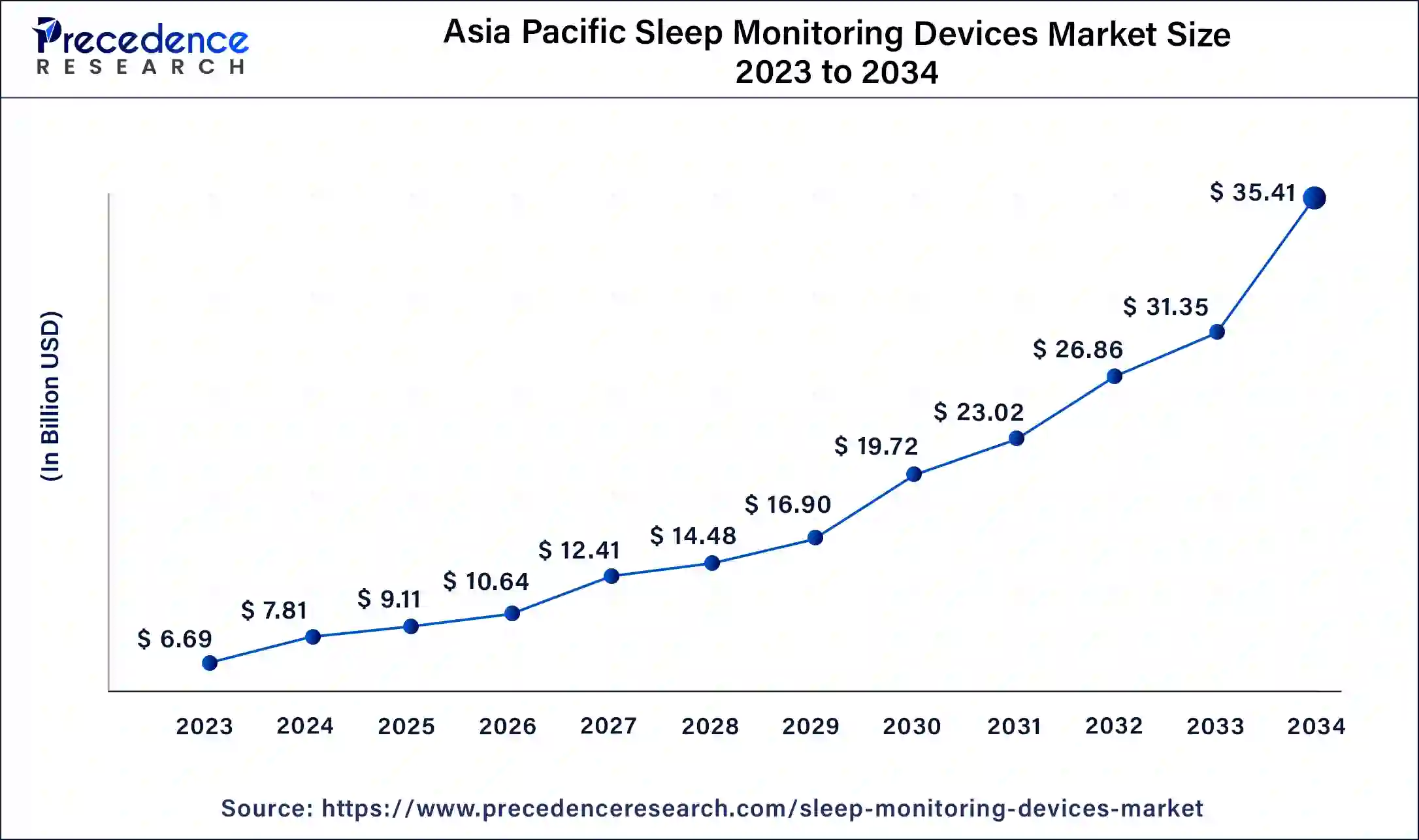

Asia Pacific Sleep Monitoring Devices Market Size and Growth 2025 to 2034

The Asia Pacific sleep monitoring devices market size is valued at USD 9.11 billion in 2025 and is expected to be worth around USD 35.41 billion by 2034, growing at a CAGR of 17% from 2025 to 2034.

Asia-Pacific has held the largest revenue share 35% in 2024. Asia-Pacific holds a major share in the sleep monitoring devices market due to a combination of factors. The region's large population, rising awareness ofhealth and wellness, and increasing prevalence of sleep disorders contribute to high market demand. Additionally, technological advancements, particularly in countries like Japan and South Korea, drive the adoption of innovative sleep monitoring solutions. The growing middle-class population's disposable income and a proactive approach towards personal health further fuel the market's expansion in the Asia-Pacific region.

North America is estimated to observe the fastest expansion. North America holds a major share in the sleep monitoring devices market due to factors like a robust healthcare infrastructure, high awareness of health and wellness, and substantial investments in technological advancements. The region's aging population, prevalence of sleep disorders, and a proactive approach towards preventive healthcare contribute to the demand. Additionally, the presence of key market players and a tech-savvy consumer base further propels North America's dominance, making it a hub for the adoption and innovation of sleep monitoring devices.

Awareness: The Growth Factor of China

The growing sleep health awareness in China is increasing the use of sleep monitoring devices. The growing sleep disorders due to stress, sedentary lifestyles, and an aging population are also increasing this demand. Additionally, the companies are contributing to their advancement by developing advanced wearable devices to track sleep patterns, attracting the population.

U.S. Sleep Crisis Drives the Demand for Devices

The growing incidence of sleep disorders like insomnia and obstructive sleep apnea in the U.S is increasing the demand for sleep monitoring devices. The presence of wearable and non-wearable devices is also increasing their use at home, where industries are integrating AI technologies to develop personalized devices. Additionally, the growing awareness is also increasing their use.

Tech Innovations Lead Europe

Europe is expected to grow significantly in the sleep monitoring devices market during the forecast period, due to growing technological innovations. The companies are developing various wearable, non-wearable devices and software solutions for sleep monitoring. At the same time, the growing sleep disorders and health awareness are increasing their use, promoting the market growth.

Growing Adoption Accelerates the UK

The growing adoption of wearable sleep monitoring devices is driving the UK market. The growing awareness is increasing their demand as well, where sensor-based wearable devices and software solutions are also being developed. Moreover, the health systems are also promoting their use for at-home sleep monitoring.

Value Chain Analysis

- R&D

The R&D for sleep monitoring devices focuses on the integration of advanced multimodal sensors with sophisticated AI technologies.

Key players: Apple Inc., Garmin Ltd., ResMed Inc. - Clinical Trials and Regulatory Approvals

The clinical trial and regulatory approval of sleep monitoring devices require accuracy and safety validations.

Key players: Philips Healthcare, ResMed Inc., Dreem - Patient Support and Services

Educational services, personalized behavioral coaching programs, therapeutic programs, and online platforms for connecting patients and physicians are provided in the patient support and services of sleep monitoring devices.

Key players: Withings, Philips Healthcare, ResMed Inc.

The Sleep Monitoring Devices Market Masters: Key Players' Offering

- Garmin Ltd.: Venu, Index Sleep Monitor, and Epix Pro are provided by the company.

- Withings (Nokia Health): Products like Sleep Analyzer and ScanWatch are provided by the company.

- Apple Inc. The company provided products such as, Apple Watch Series.

- Oura Health Ltd.: The Oura Ring is offered by the company.

- Eight Sleep Inc.: The company is offering Smart Mattress Systems.

Sleep Monitoring Devices Market Players

- ResMed Inc.

- Fitbit, Inc. (Now part of Google)

- Philips Healthcare

- Sleep Number Corporation

- Xiaomi Corporation

- Emfit Ltd.

- Beddit (Acquired by Apple Inc.)

- Dreem

- Sleepace

- Huami Corporation

Recent Developments

- In September 2022, Sleepme Inc., the parent company of ChiliSleep, unveiled groundbreaking technology called Hiber-AI and a non-wearable sleep tracker as part of the sleepme+ membership. Hiber-AI is a first-of-its-kind technology that collects, analyzes, and responds to sleep data in real-time, offering an innovative approach to sleep tracking and management.

- In May 2022, Huawei Vietnam launched three new smartwatches—Huawei Watch GT3 Pro, Watch Fit 2, and Watch Kids 4 Pro. These advanced smartwatches feature a range of functionalities, including health alerts, early sleep alerts, medication reminders, and insights into positive mood and exercise volume. This release reflects Huawei's ongoing commitment to providing comprehensive health and wellness features in their wearable technology products.

Segments Covered in the Report

By Component

- Hardware

- Software & Solutions

By Operating System

- Android

- IOS

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content