What is the Home Medical Equipment Market Size?

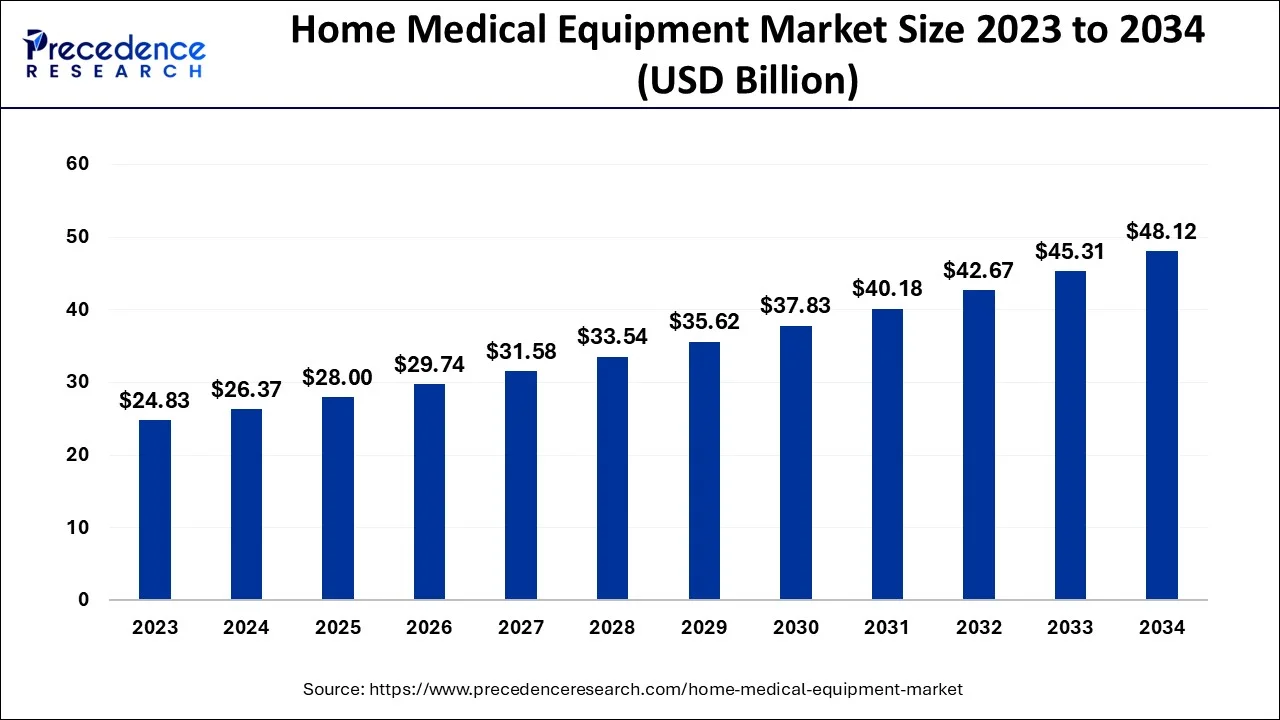

The global home medical equipment market size is calculated at USD 28.00 billion in 2025 and is predicted to increase from USD 29.74 billion in 2026 to approximately USD 50.82 billion by 2035, expanding at a CAGR of 6.14% from 2026 to 2035.

Home Medical Equipment Market Key Takeaways

- By equipment, the therapeutic equipment segment has captured 44% revenue share in 2025.

- By distribution channel, the retail pharmacy segment has hit 46% market share in 2025.

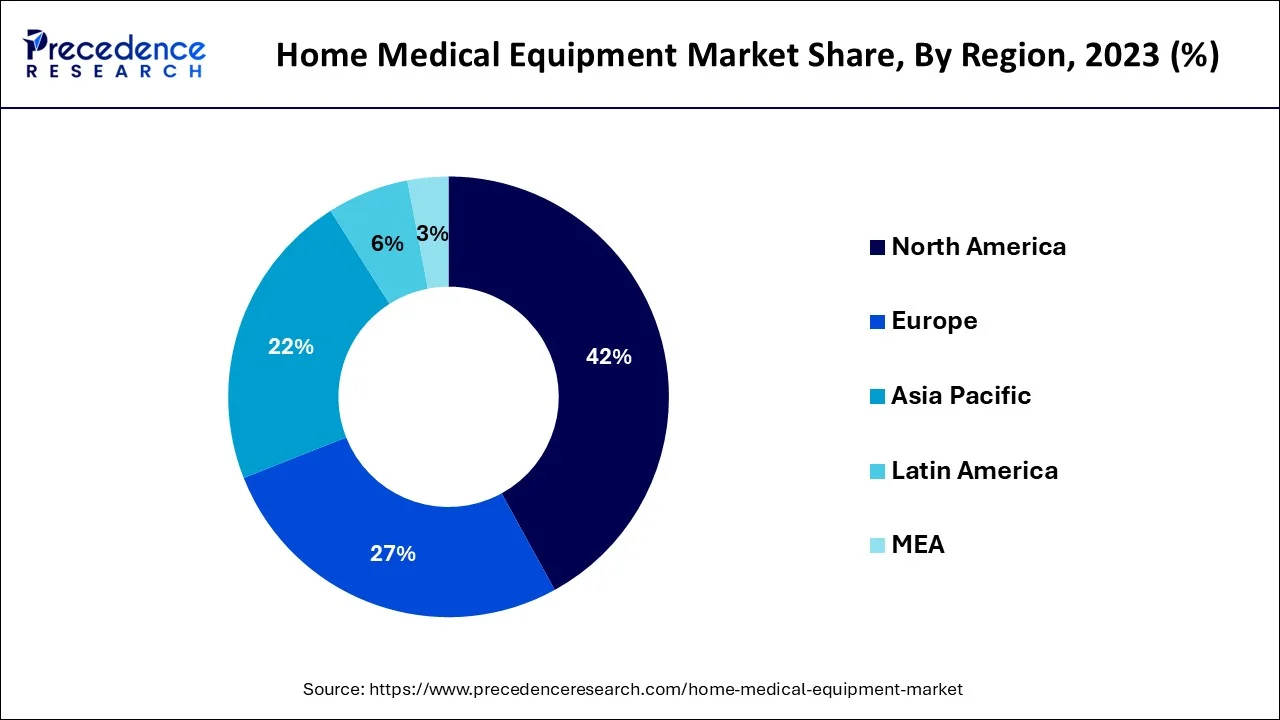

- North America dominated the market with a 42% revenue share in 2025.

- Asia-Pacific is expected to grow at a CAGR of 8% from 2026 to 2035.

What is Home Medical Equipment?

The global home medical equipment market is primarily spurred by the rising burden of chronic illnesses and the growing geriatric population across the globe. According to the International Diabetes Federation, the global diabetic population is estimated to reach 700 million by 2045. As per the WHO, around 262 million people were suffering from asthma and over 65 million people were suffering from COPD in 2019. The rising cases of cancer are another major factor that drives the market significantly as cancer survivors need to be regularly monitored. Furthermore, the global geriatric population is estimated to reach around 2 billion by 2050, as per the United Nations. Old-age people are the major demand drivers of home medical equipment. The convenience associated with acquiring treatment at home is a major factor that drives the demand for the home medical equipment market across the globe.

The rising prevalence of hospital-acquired infections and raising awareness about it is fueling the demand for home medical equipment across the globe. According to the WHO, around 7% of hospitalized patients in developed nations and 10% of patients in developing nations have the chance of getting infected with hospital-acquired infections. Moreover, in high-income countries, around 30% of ICU patients get affected by at least one hospital-acquired infection. Therefore, the rising awareness among people regarding hospital-acquired infection encourages them to acquire treatment at home, which in turn fuels the growth of the global home medical equipment market. Furthermore, the rising popularity of self-health management is positively impacting the market growth. Various organizations like the World Health Organization (WHO), the Center's Chronic Disease Self-Management Program (CDSMP), the National Council of Aging (NCOA), and the Global Self-Care Federation (GSCF) promote self-health management amongst the population by providing appropriate guidelines and assistance.

The recent outbreak of the COVID-19 pandemic positively impacted the home medical equipment market in 2020. The demand for home healthcare services increased as people were restricted to stay in their homes and the fear of getting infected by the COVID-19 disease compelled the people to adopt healthcare services at home that boosting the demand for home medical equipment.

How is AI contributing to the Home Medical Equipment Industry?

AI allows early health warning with wearables and sensors through remote monitoring. It customizes the care plans, enhances medication adherence via smart notifications, automates daily routine, proactive interventions. It also improves patient interaction and minimizes unnecessary hospital stays with continuous data-driven insights.

Market Outlook

- Industry Growth Overview: The market is expanding vigorously due to the rise in demand for remote patient monitoring solutions by the aging population.

- Trends in Sustainability: The manufacturers' focus on the use of durable devices, energy functions, and recycling of electronic medical waste.

- Global Expansion: This is a strategy where companies are going global to meet the increasing healthcare demands of the emerging global markets.

- Major investors: BlackRock, Medtronic, Cardinal Health, Siemens Healthineers, and CVS Health Corporation are major investors.

- Startup Ecosystem: Startups are based on wearables, digital health platforms, and portable diagnostic home-care technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.00 Billion |

| Market Size in 2026 | USD 29.74 Billion |

| Market Size by 2035 | USD 50.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.14% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Equipment Type, Distribution Channel, End Users, and Geography |

Market Dynamics

The growth of technology for self-health management, aimed to relieve financial strains on traditional healthcare systems, has increased the consumption of home medical equipment. People with chronic conditions utilize home medical equipment to get help managing their health, control their own health, and help others with healthcare. Chronic disorders such as high blood pressure and osteoporosis, which require lifetime medical care, are most suitable for cost-effective home healthcare solutions. These medical care solutions, on the other hand, must be both safe and convenient. In these situations, home medical equipment is the best alternative, and it is driving the industry.

Individuals dealing with a chronic condition, recuperating from surgery, or being treated for an infection may find that in-home care is a better alternative than hospitalization. As a result of these circumstances, there has been a continuous increase in the demand for home medical equipment over hospital or other healthcare organization medical services. Increased demand for home medical devices is driven by rising treatment and procedure expenses in hospitals and clinics.

This industry is growing in prominence, particularly in industrialized nations such as the United States and Europe. For example, respiratory therapy (RT) is a home care service that assesses and treats breathing illnesses such as asthma, bronchitis, and chronic obstructive pulmonary disease (COPD). In emerging nations like India and China, the industry is still in its infancy, but it is predicted to represent the future of the home medical equipment business. Due to a huge target audience and the growing senior population, developing destinations might serve as potential centers for producers of home medical equipment.

To get high-quality diagnosis and treatment, using home medical devices need specialized knowledge. There has been evidence of a dearth of expertise on how to operate medical equipment in a homecare setting, which might be a major stumbling block to market growth. Even though the global frequency of chronic illnesses is rising, there is a significant disparity between the availability of knowledge and the number of patients. As a result, professionals handling and coordinating medical equipment in homecare settings are in greater demand. The lack of competence in accessing medical equipment according to standards, on the other hand, might stifle the growth of home medical equipment.

Covid-19 Impact

The COVID-19 pandemic has had a favorable influence on the home medical equipment market. Since the outbreak of the pandemic increased, the need for home medical equipment such as life-supporting and life-sustaining devices. During the COVID-19 pandemic, the disruptions in traditional production, supply, and distribution systems resulted in significant medical supply shortages. As a result, government authorities are taking steps to address the interruption of the medical equipment supply chain.

For example, the United States Food and Drug Administration (USFDA) announced in 2020 that it is monitoring the medical device supply chain and is working closely with manufacturers to analyze the potential of interruptions in order to fulfill the increased demand for medical equipment for patients. In addition, in response to the COVID-19 pandemic, the Pan American Health Organization (PAHO) has produced a list of priority medical devices, which includes a continuous positive airway pressure (CPAP) machine, a vital monitor, and a pulse oximeter. Furthermore, the World Health Organization (WHO) issued a list of priority medical devices for managing cardiovascular diseases and diabetes in June 2021 to assist governments worldwide in growing the medical equipment available to enhance healthcare. During the current pandemic, such initiatives are driving the use of medical equipment at home.

Segment Insights

Equipment Type Insights

Based on the equipment type, the therapeutic equipment segment dominated the global home medical equipment market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is mainly due to the rising prevalence of chronic respiratory diseases and increased demand for oxygen delivery equipment in the home healthcare setting. The rising disposable income, rising healthcare expenditure, and demand for quality and convenient healthcare services are fueling the growth of this segment.

On the other hand, patient monitoring equipment is estimated to be the most opportunistic segment during the forecast period. The need for continuous monitoring of the health and mental conditions of the patient is rising. The rising prevalence of cardiovascular disorders, sleep disorders, and diabetes is a significant contributor to the growth of patient monitoring equipment. The most widely used patient monitoring equipment at home includes blood pressure monitors, diabetes monitors, heart rate monitors, and Holter monitors.

Distribution Channel Insights

Based on the distribution channel, the retail medical stores segment dominated the global home medical equipment market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributable to the increased penetration and higher preferences for retail medical stores across the globe. Retail medical stores are the traditional and the most popular channels that supply home medical equipment.

On the other hand, online retailers are expected to be the fastest-growing segment during the forecast period. The rising adoption of the internet and growing penetration of online retail stores are fueling the growth of this segment. Moreover, the easy payments, home delivery, and easy return and replacements offered by online retailers are expected to foster the growth of this segment during the forecast period.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In March 2020, Invacare Corporation introduced AVIVA FX Power Wheelchair, a new brand of power wheelchairs that provides mobility solutions at home.

The various developmental strategies like new product launches, collaborations, acquisitions, and mergers foster market growth and offer lucrative growth opportunities to the market players.

Regional Insights

What is the U.S. Home Medical Equipment Market Size?

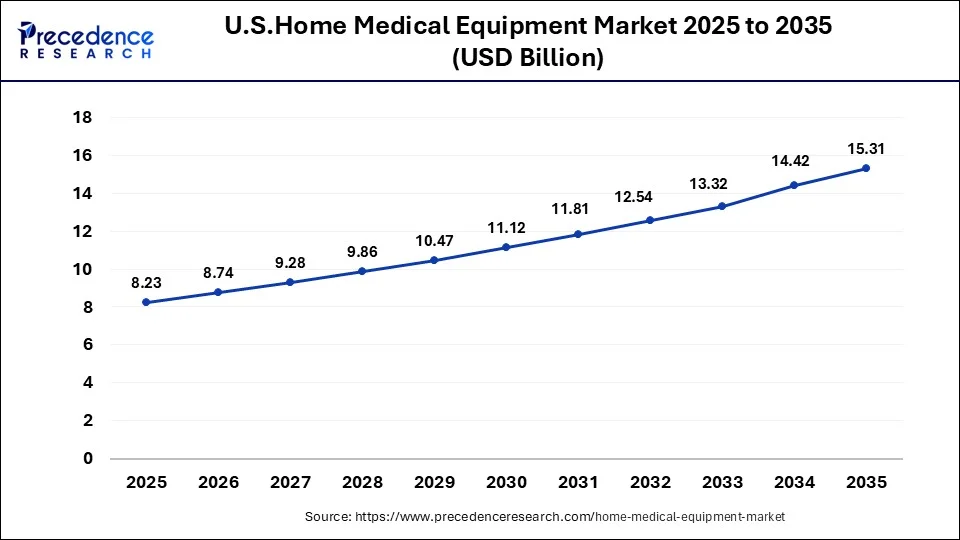

The U.S. home medical equipment market size is evaluated at USD 9.28 billion in 2025 and is predicted to be worth around USD 15.31 billion by 2035, rising at a CAGR of 6.40% from 2026 to 2035.

Based on region, North America dominated the global home medical equipment market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America is characterized by increased healthcare expenditure, high disposable income, a rapidly rising geriatric population, and an increasing prevalence of various chronic diseases among the population. All these factors are the significant market drivers of the North American home medical equipment market. Furthermore, the increased awareness regarding hospital-acquired infection in developed markets like the US and Canada is fueling the demand for home healthcare services, which augmented the demand for home medical equipment.

What Makes Asia Pacific the Most Opportunistic Region in the Market?

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. The Asia Pacific is home to around 4.4 billion people and the rising prevalence of chronic diseases, growing cases of road traffic accidents, and rising geriatric population in this region are the prominent factors that can be held responsible for the growth of home medical equipment in the upcoming future. According to the WHO, around 80% of geriatric people will be living in low and middle-income countries. Furthermore, the rising government investments in the development of healthcare infrastructure are improving the access to healthcare services, which is expected to have a positive impact on the market in the forthcoming years.

China leads the large-scale adoption of home healthcare services, driven by rising demand for connected healthcare devices among urban seniors. In India, urban areas are seeing rapid growth, supported by private providers and start-ups that facilitate the distribution of telehealth-enabled home devices. However, rural markets are expanding gradually due to increasing government investments to establish new healthcare facilities.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) offers immense opportunities in the home medical equipment market. These opportunities arise from the rising healthcare investments, growing urban affluence, and expanding private healthcare infrastructure. Governments are implementing reforms and supporting initiatives that encourage the adoption of home-based care, creating demand for advanced medical devices such as oxygen concentrators, dialysis machines, and remote monitoring equipment. Additionally, the region's medical tourism and high-income populations are driving demand for premium, technology-enabled home healthcare solutions, making it an attractive market for both international and regional device providers.

In the UAE and Saudi Arabia, high per-capita healthcare expenditure and extensive hospital upgrades are driving rapid adoption of connected home medical devices and hospital-at-home pilot programs. Qatar and Bahrain are also quickly embracing premium durable medical equipment (DME) as part of their national health strategies and medical tourism initiatives. South Africa serves as a regional hub, with well-established home-health agencies and private insurance coverage enabling broad access to DME across the country.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise in the home medical equipment market, driven by increase in the number of people with chronic diseases and the growth of private healthcare networks, which provide home-care services. There is a rising demand for affordable and user-friendly home medical devices such as glucometers, portable oxygen units, and home infusion pumps, particularly among middle-class households. Both public health systems and private insurers are introducing pilot programs for remote monitoring and home-based therapy, aiming to reduce hospital congestion and minimize patients' travel time.

Brazil leads the Latin American home medical equipment market due to its large urban populations and rapidly growing home-care industry, which create strong demand for durable medical equipment (DME) and remote healthcare solutions. The country's well-established local manufacturing capabilities and partnerships between healthcare providers and device distributors ensure widespread availability and affordability of home medical devices. Additionally, robust private healthcare networks and insurance coverage further support adoption, making Brazil the most developed market in the region.

Value Chain Analysis of the Home Medical Equipment Market

- R&D: Formulations obtained as a result of research and initial stages of testing on experiments.

Key Players: Pfizer, Roche, Novartis, Merck & Co., Johnson & Johnson - Clinical Trials and Regulatory Approvals: Through the Human studies, safety, dosage, and efficacy are evaluated, and the organization is permitted to proceed with its marketing approval by the relevant health authority.

Key Players: IQVIA, ICON plc, Parexel, Labcorp, Syneos Health - Formulation and Final Dosage Preparation: APIs were turned into stable and usable, continuously dosed finished products such as tablets, capsules, and liquids.

Key Players: Sun Pharma, Dr. Reddy's Laboratories, Cipla, Lupin - Packaging and Serialization: Final products that are packed with distinct identifiers that aid traceability, prevention of counterfeits, and inventory management.

Key Players: Amcor, Gerresheimer AG, West Pharmaceutical Services - Distribution to Home Medical Equipment, Pharmacies: Distribution deals with storage, warehousing, and delivery of equipment to the patient-friendly dispensing locations.

Key Players: McKesson, AmerisourceBergen (Cencora), Cardinal Health, Medline Industries

Home Medical Equipment Market Companies

- Abbott: Abbott supplies home diagnostics and trackers, such as FreeStyle Libre, and allows patients to monitor glucose levels continuously and provide self-management.

- B. Braun SE: B. Braun SE provides infusion therapy solutions, IV products, and tubing that are used in safe and reliable delivery of clinical care in the home.

- Baxter: Baxter offers chronic and acute care of patients by supplying home dialysis systems as well as intravenous therapy products.

Other Major Key Players

- BD

- General Electric

- Hill-Rom Services, Inc.

- Medtronic

- Smith & Nephew

- Invacare Corporation

- Johnson & Johnson

Recent Developments

- In August 2025, Nonin Medical introduces the Nonin Health platform, a cloud-based system for DME/HME providers, sleep dentists, and labs. The platform addresses logistical challenges in delivering efficient care to over 1.5 million Americans needing supplemental oxygen and managing sleep disorders.

(Source: https://respiratory-therapy.com ) - In June 2025, Cardinal Health launched the Kendall DL™ Multi System in the U.S., a single-patient use monitoring cable and lead wire that continuously monitors cardiac activity, blood oxygen levels, and temperature. Designed for patient transport, it enhances clinician workflows, ensures reliable patient care, and maximizes hospital value. (Source: https://www.prnewswire.com )

- In March 2022, Dozee's contactless remote patient monitoring solutions to transform assisted living for patients announced a partnership with Priaashraya Healthcare Pvt. Ltd. The sensor in this device monitors the parameters and the readings are available in the mobile phone app.

- In March 2022, the second-largest hospital chain Manipal Hospitals in India, Bangalore, plans to provide digital patient monitoring technologies once a patient is released from the hospital following a significant intervention, like surgery.

- In May 2021, Medtronic acquired the CE certification for the improved capability of their InPen smart insulin pen, which allows for multiple daily doses (MDI). The CE certification allows the sensor to work with either the MiniMed 780G insulin pump system or the InPen, or it may be used as a stand-alone continuous glucose monitor (CGM).

- In July 2021, Belluscura (BELL) announced that its X-PLO2RTM portable oxygen concentrator portfolio has inked its third distribution agreement and first with a durable medical equipment supplier. There are several storefronts in several states as well as an online store for durable medical equipment (DME). Meanwhile, the third distributor has placed its first order for the X-PLO2RTM portable oxygen concentrator, with delivery due in less than 90 days.

- In June 2020, Armstrong Medical out the FD140i, a second-generation dual treatment flow driver with a smoother transition from CPAP to HFOT.

- In March 2020, Invacare Corporation introduced a new line of power wheelchairs, including the Invacare AVIVA FX Power Wheelchair, to help patients with mobility issues at home.

- In August 2019, OxyGo LLC announced the release of its new Bluetooth-enabled POC with six flow settings. OxyGo NEXT is a revolutionary wireless connectivity platform that uses Bluetooth technology to help healthcare practitioners enhance patient outcomes.

- In October 2018, Resmed announced the CPAP mask-Airlift f30i for Hospitals and Respiratory Care Physicians in the United States.

Segments Covered in The Report

By Equipment Type

- Therapeutic Equipment

- Respiratory Therapy Equipment

- Dialysis Equipment

- Intravenous Equipment

- Other Therapeutic Equipment

- Patient Monitoring Equipment

- Conventional Monitors

- Telemedicine Patient Monitoring Equipment

- Mobility Assist & Support Equipment

- Mobility Assist Equipment

- Medical Furniture

- Bathroom Safety Equipment

By Distribution Channel

- Retail Medical Stores

- Hospital Pharmacies

- Online Retailers

By End Users

- Hospitals

- Home Care Settings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content