What is the Clinical Laboratory Tests Market Size and?

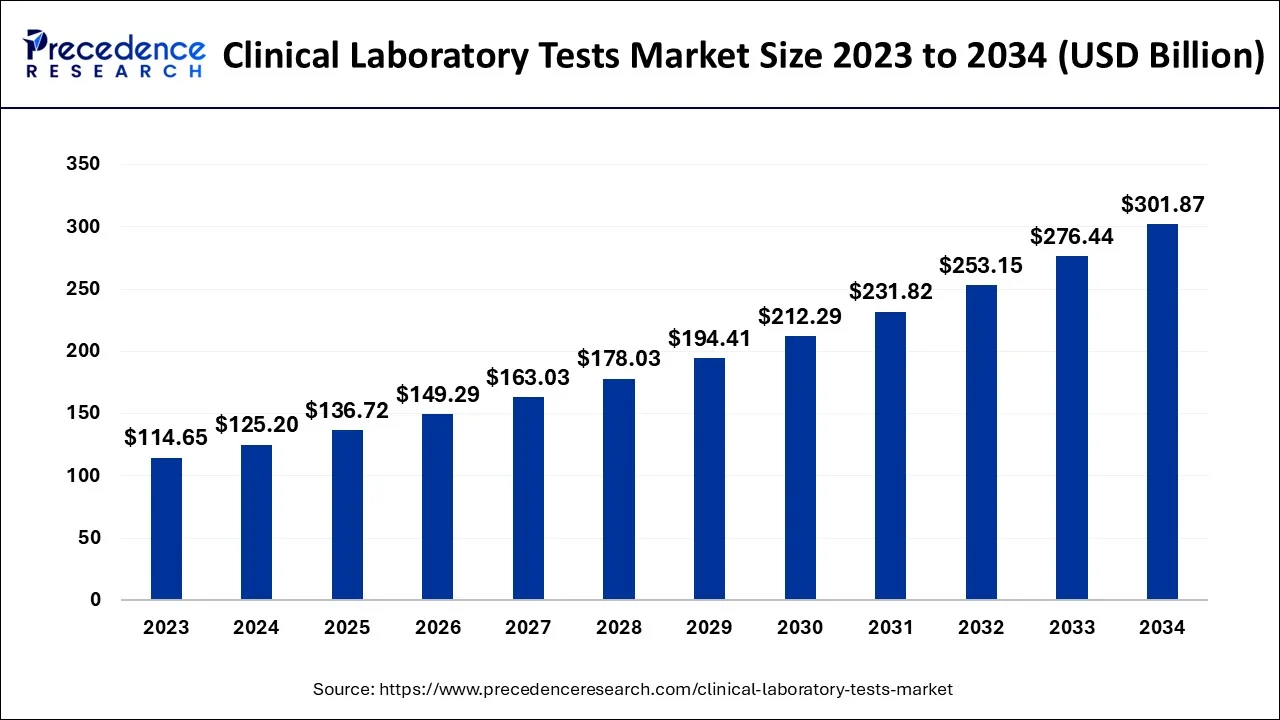

The global clinical laboratory tests market size is calculated at USD 136.72 billion in 2025 and is predicted to increase from USD 149.29 billion in 2026 to approximately USD 325.87 billion by 2035, expanding at a CAGR of 9.07% from 2026 to 2035.

Clinical Laboratory Tests Market Key Takeaways

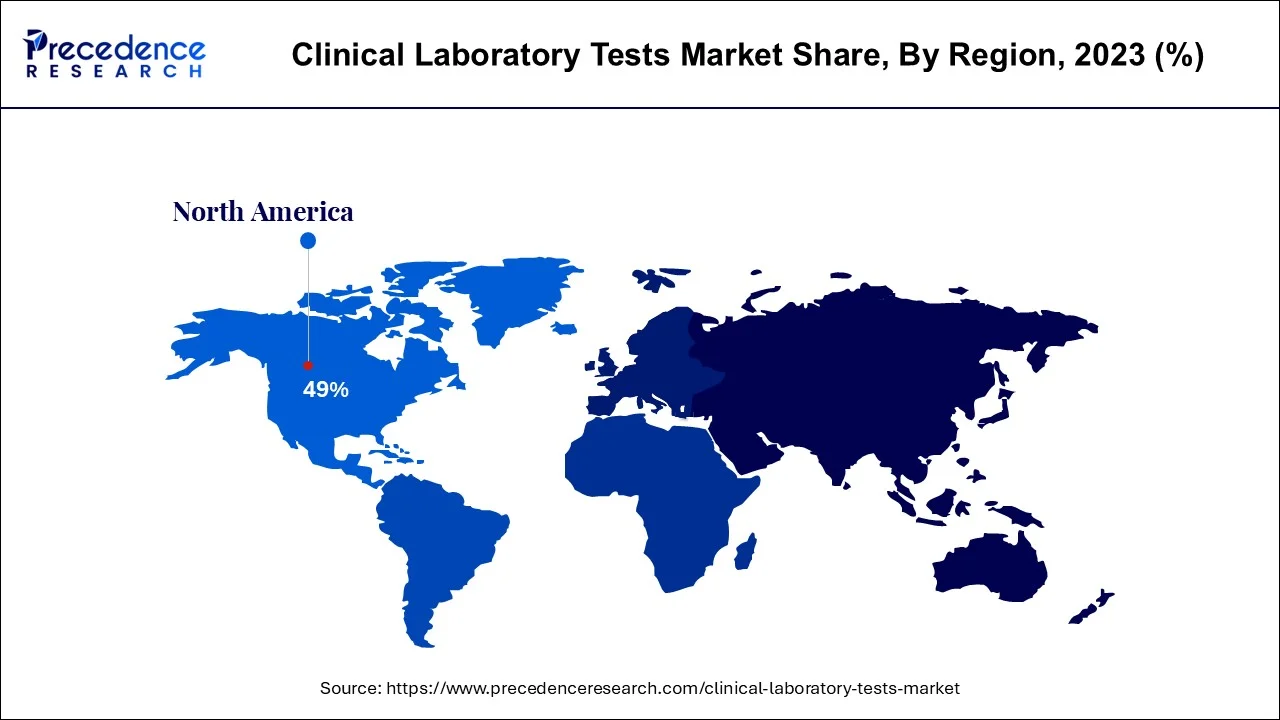

- North America Region is predicted to dominate the market between 2026 and 2035.

- Asia-Pacific is expected to expand at the fastest CAGR from 2026 to 2035.

- By Type, the HbA1c tests segment generated for the maximum market share in 2025.

- By Type, the HGB/HCT tests segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By End-use, the Primary clinic segment captured the major market share in 2025.

- By End-use, the central laboratories segment is projected to grow at a remarkable CAGR between 2026 and 2035.

Market Overview

The medical testing industry is driven by an increase in cardiovascular and other diseases, an increase in the elderly population, improvements in healthcare and medical infrastructural facilities, and an increase in public health consciousness. A recent development in this industry is the standardization of lab facilities, the improvement of lab systems, and the development of new, quick diagnostic tools. These issues are constantly being addressed by local, global, and international medical authorities and technological experts within the framework of a patient-centered strategy.

The market for clinical laboratory tests is predicted to expand because of rising investments in the creation of sophisticated laboratory testing procedures, technological advancements in clinical diagnostic equipment and tools, and a rise in patient-centered approaches to the treatment of diseases, primarily viral and chronic illnesses.

Furthermore, it is anticipated that the development of novel approaches to maximizing effectiveness and enhancing service will significantly boost the visualizations of this market. With businesses accessing as many as 100 to 150 billion samples annually, database management tools, integrated workflow management systems, and patient test records are becoming increasingly important in the healthcare sector. This market's expansion is anticipated to be fueled by the adoption and advancement of data management and informatics solutions for enabling efficient operations.

Moreover, the regulatory environment surrounding clinical laboratory tests is unclear, limiting the market growth. For example, the U.S. FDA and the European Medicines Agency (EMA) have created regulatory frameworks that rely heavily on the healthcare sector. The diagnostic industry is not subject to clear regulatory standards in developing nations such as India and China. Laboratory-developed tests that provide accurate and speedy results and internal clinical laboratories developing tests are subject to FDA regulation. Profit margins may suffer due to LDT risks, and the popularisation of recently developed tests may be delayed.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 136.72 Billion |

| Market Size in 2026 | USD 149.29 Billion |

| Market Size by 2035 | USD 325.87 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.07% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

The global market for clinical laboratory tests is driven by several factors, including the rising prevalence of conditions like cardiac diseases and neurological diseases, the aging population, the development of cutting-edge products like microarray biochips, and the increase in healthcare expenses. Furthermore, the industry is increasing due to consumer preferences for integrated analytical systems, shorter hospitalizations, and preventative health services. This results from the long waiting times for patient test results, particularly for illnesses with complicated and costly diseases.

Stand-alone research labs are anticipated to experience the fastest growth over the course of the projection period because efforts are being made to improve patient outcomes by providing diagnostic services at the retail level. The need for trustworthy diagnostic tests has been essential to high-quality patient care, and this necessity is the primary driver of the market expansion for clinical laboratory testing. Because of the increasing incidence of chronic diseases and the increasing morbidity of non-communicable diseases, the requirement has become more essential.

Restraint

Government regulations will constrain the rate of growth

The main factors restricting market growth are the strict governmental guidance and regulatory requirements on laboratory research. Country-specific regulatory organizations are in charge of ensuring the quality of clinical laboratory products.

These organizations guarantee protection from risks brought on by errors in the manufacture, design, packaging, or technology of the apparatus or accessories.

Uncertain regulatory framework

The regulatory frameworks created by organizations like the FDA and EMA in the United States are extremely important to the healthcare sector. There are no particular regulatory standards for the diagnostic business in developing countries such as India and China.

Laboratory-designed tests (LDTs) are diagnostic procedures created by internal clinical laboratories that deliver precise results quickly. Risks associated with LDT could lower profit margins and impede the marketing of newly developed tests. This factor hampers the expansion of the worldwide market for clinical laboratory tests.

Opportunity

Innovative solutions in clinical laboratory tests

Innovative approaches to increasing productivity and reducing errors are anticipated to be significant rendering drivers in this sector. With organizations handling 100 to 150 billion samples annually, interconnected document management processes, database management tools, and patient test records have grown increasingly crucial in the healthcare sector.

Market expansion is anticipated to be fueled by the establishment and growth of data management and informatics solutions to support efficient operations.

COVID-19 Impact:

The market for clinical laboratory testing services has grown because of the COVID-19 pandemic, so it is predicted that the COVID-19 outbreak will be advantageous for theclinical laboratory servicesindustry.

Rapid and widespread testing advancements have also been brought on by improvements in clinical diagnostic and screening technology, which has increased overall demand. The market is primarily driven by the rising incidence of chronic and infectious diseases and the requirement for quick and accurate disease diagnosis techniques.

Segment Insights

Type Insights

The HbA1c tests category accounted for the largest market share. As patients with fluctuating levels of HbA1c run a higher risk of developing complications from diabetes, it is predicted that the growing number of patients with diabetes and abnormal cholesterol levels will fuel segment growth. Introducing more recent laboratory tests is also anticipated to further fuel market expansion.

Over the forecast period, the HGB/HCT tests category is projected to expand at the fastest rate. The prevalence of blood-related diseases in the general population is blamed for the segment's expansion. The test is employed to identify whether polycythemia or anemia is present. The HGB/HCT test also evaluates dehydration, monitors its effects, and decides on blood transfusions. During the forecast period, market growth is anticipated to be fueled by the rising prevalence of anemia and other blood diseases and the emergence of non-invasive and technologically sophisticated products.

End-Use Insights

The primary clinic sector held the largest market share for clinical laboratory tests in 2025. Primary healthcare facilities with their research labs, physician clinics with laboratories that take samples from doctors directly, clinical research facilities, and insurance companies are examples of primary clinics. The test is easily made available to patients immediately, and the care team, doctor, and patients can rapidly obtain the results, allowing them to make clinical management decisions on the spur of the moment. They offer a smaller range of tests than hospitals or independent laboratories, and these laboratories only serve a small number of specialties, which results in a small revenue share. Despite their smaller contributions, these are anticipated to continue to support market expansion.

Over the projected timeframe, the central laboratories segment is anticipated to expand at the fastest rate. The volume of procedures and significant market penetration is credited with the company's growth. Another important factor expected to boost the market is the rising number of initiatives taken by governments to provide a variety of services, such as reimbursement for clinical laboratory tests. Many healthcare institutions are collaborating with laboratories to integrate various tests, including microbiology testing. Furthermore, a sizable portion comes from many laboratories in developing and emerging markets. Regulatory agencies are also enhancing laboratory services and simplifying the diagnosis process.

Regional Insights

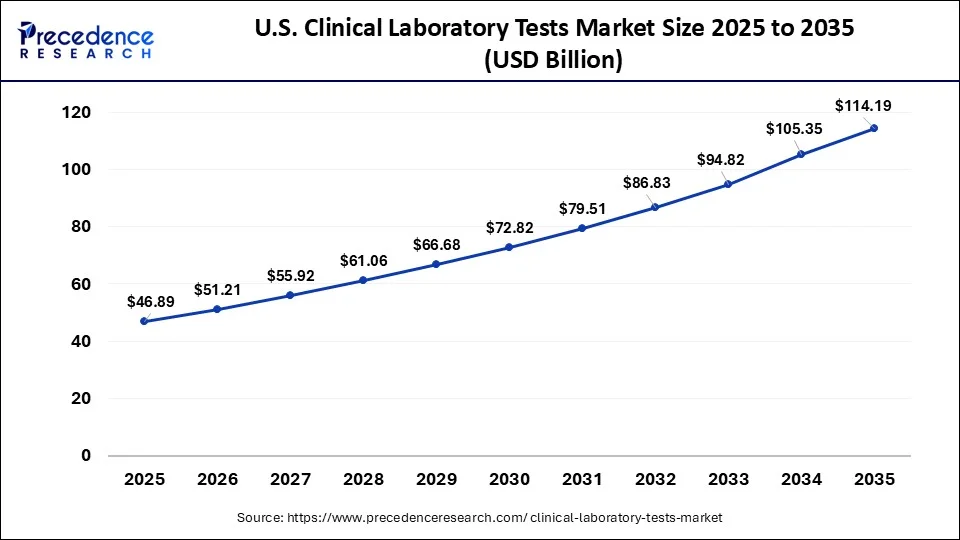

What is the U.S. Clinical Laboratory Tests Market Size?

The U.S. clinical laboratory tests market size accounted at USD 46.89 billion in 2025 and is expected to be worth around USD 114.19 billion by 2035, growing at a CAGR of 9.31% between 2026 and 2035.

North America dominates the markets for clinical laboratory tests globally. Expanding regulatory support and significant demand in clinical laboratory tests are predicted to drive the market. North America has developed economies and a restrictive regulatory framework for the approval of new tests. These tests have been authorized by the FDA in accordance with the 510(k)medical deviceregulation. To be authorized for commercialization, panel tests conducted on equipment must also pass a similar FDA clearance procedure. Health Canada regulates the Canadian authorization of these tests.

High insurance coverage and supportive regulatory measures promote regular examinations, expanding the market. Patients can more easily estimate costs because insurance firms instantly billed these tests. Medicaid will pay for urinalyses, blood tests, and screening exams. Although tests are inexpensive, local hospitals charge higher fees.

USA

The USA has seen a significant growth in the clinical laboratory test market, the growth is driven by various factors such as an aging population, increasing prevalence of chronic diseases in the country due to changing lifestyle, and advancement in diagnostic technologies, line the integration of AI and machine learning in the process and diagnosis. Emphasis on preventive healthcare and early disease detection drives the growth of the market in the country. Expansion of tests in areas such as oncology, women's health, autoimmune diseases, and neurology drives the market growth.

Regarding the worldwide industry for clinical laboratory tests, Asia-Pacific is rising the fastest.The market's primary major growth factors are sizable undeveloped opportunities in the form of unmet medical needs, broadening scientific fields, and favourable economic expansion.

Multinational players are anticipated to invest and seize the providing opportunities as the regulatory environment in high-growth regions improves. Positive developments like publicly funded healthcare raised awareness and the urge for top-notch medical care will probably expand the geographic market.

India

India is experiencing rapid growth in the clinical laboratory tests market, the growth is driven by factors such as the increasing prevalence of chronic diseases, technological advancement, and heightened health awareness in the country drives the growth of the market. Government initiatives promote preventive healthcare in the country, which also supports the growth of the market.

What are the Advancements in the Clinical Laboratory Tests Market in Europe?

Europe is expected to have significant growth in the market over the forecast years. This growth is because the region benefits from stringent regulatory frameworks that help to ensure high-quality testing standards. The European Union's In Vitro Diagnostic Regulation (IVDR) is a significant market driver as it fosters innovation while ensuring patient safety and efficacy in testing. Countries like Germany, France, and the UK are leading players.

Germany Clinical Laboratory Tests Market Trends: The country's market landscape is a mix of multinational corporations and local firms. There is also a high focus on personalized medicine and advanced diagnostics, which is driving growth.

What are the Key Trends in the Clinical Laboratory Tests Market in Latin America?

Latin America is expected to grow substantially over the forecasted years. This growth is fueled by increasing healthcare expenditure, rising awareness of preventive healthcare, and a growing population. Countries like Brazil and Mexico are leading players, witnessing rapid advancements in healthcare infrastructure, which are pivotal for market expansion. The region is also highly driven by significant investments in healthcare technology and a rising demand for diagnostic services.

India Clinical Laboratory Tests Market Trends: The country has a burgeoning private healthcare sector and features both global players and local companies, thus creating a diverse market environment that fosters innovation and accessibility in clinical testing. Expansion of health insurance coverage and supportive government initiatives are enabling broader access to diagnostic services and reducing financial barriers for patients.

How is the Middle East and Africa Growing in the Clinical Laboratory Tests Market?

The Middle East and Africa are expected to grow at a steady pace in the upcoming years. This growth is driven by increasing investments in healthcare infrastructure, government initiatives to improve healthcare access, and rising awareness of disease prevention. Countries like the UAE and South Africa are leading players in the region. The competitive landscape seems to be evolving at a steady pace, with both international and local players entering the market.

Saudi Arabia Clinical Laboratory Tests Market Trends: The country's government is seen promoting various diagnostic and screening programs in order to address the increasing incidence of chronic diseases. Expansion of private diagnostic chains, international collaborations, and gradual adoption of advanced diagnostic technologies also support market growth.

Clinical Laboratory Tests Market Companies

- Quest Diagnostics Incorporated.

- Sonic Healthcare Limited.

- Cinven

- ARUP Laboratories

- Abbott

- Clinical Reference Laboratory, Inc.

- Laboratory Corporation of America Holdings

- Synnovis Group LLP

- OPKO Health, Inc.

- UNILABS

Recent Development

- In March 2025, IQVIA Laboratories, a leading global drug discovery and development laboratory services organization, announces the launch of Site Lab Navigator, an advanced suite of solutions that automates and streamlines lab workflows for clinical trial sponsors and investigator sites.

- In September 2024, Roche announced the launch of the cobas Respiratory flex test, the first to use Roche's novel and proprietary TAGS (Temperature-Activated Generation of Signal) technology. TAGS technology, developed by Roche scientists, uses multiplex polymerase chain reaction testing, combined with colour, temperature, and data processing, to identify as many as 15 pathogens in a single PCR test.

- In January 2025, the UK Biobank announced the launch of the “world's most comprehensive study” of the human proteome. The study focuses on proteins circulating throughout the human body. Researchers involved in this endeavor hope the project will transform disease detection and lead to clinical laboratory blood tests that help diagnosticians identify illnesses earlier than with conventional diagnostics.

- March 2022 -The newest complete blood count and erythrocyte sedimentation rate hematology analyzers from Mindray were introduced for small-to-midsize laboratories.

- September 2022 -The establishment of Bionano Laboratories, a new company that combines the clinical testing services formerly provided by Lineagen with the optical genome mapping data services of Bionano, was announced by Bionano Genomics Inc. Additionally, it announced the debut of the first OGM-based test created by Bionano Laboratories (LDT).

- September 2021 -The Cobas pure integrated solutions analyzer, which has a more intelligent system adequate for several labs and hospitals working in the nation, was introduced by Roche Diagnostics' Indian division.

Segments Covered in the Report:

By Type

- Complete Blood Count

- Basic Metabolic Panel Testing

- HGB/ HCT testing

- Comprehensive Metabolic Panel Testing

- BUN Creatinine Testing

- HbA1c Testing

- Electrolytes Testing

- Liver Panel Testing

- Hepatitis

- Liver Cirrhosis

- Bone Disease

- Bile Duct Obstruction

- Liver Cancer

- Autoimmune Disorders

- Others

- Lipid Panel Testing

- Renal Panel Testing

- Cardiovascular Panel Tests

By End-Use

- Central Laboratories

- Complete Blood Count

- Basic Metabolic Panel Testing

- HGB/ HCT testing

- BUN Creatinine Testing

- HbA1c Testing

- Electrolytes Testing

- Comprehensive Metabolic Panel Testing

- Renal Panel Testing

- Liver Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- Cardiovascular Panel Tests

- Basic Metabolic Panel Testing

- HGB/ HCT testing

- Lipid Panel Testing

- BUN Creatinine Testing

- HbA1c Testing

- Electrolytes Testing

- Comprehensive Metabolic Panel Testing

- Renal Panel Testing

- Liver Panel Testing

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting