What is the U.S. Endoscopes Market Size?

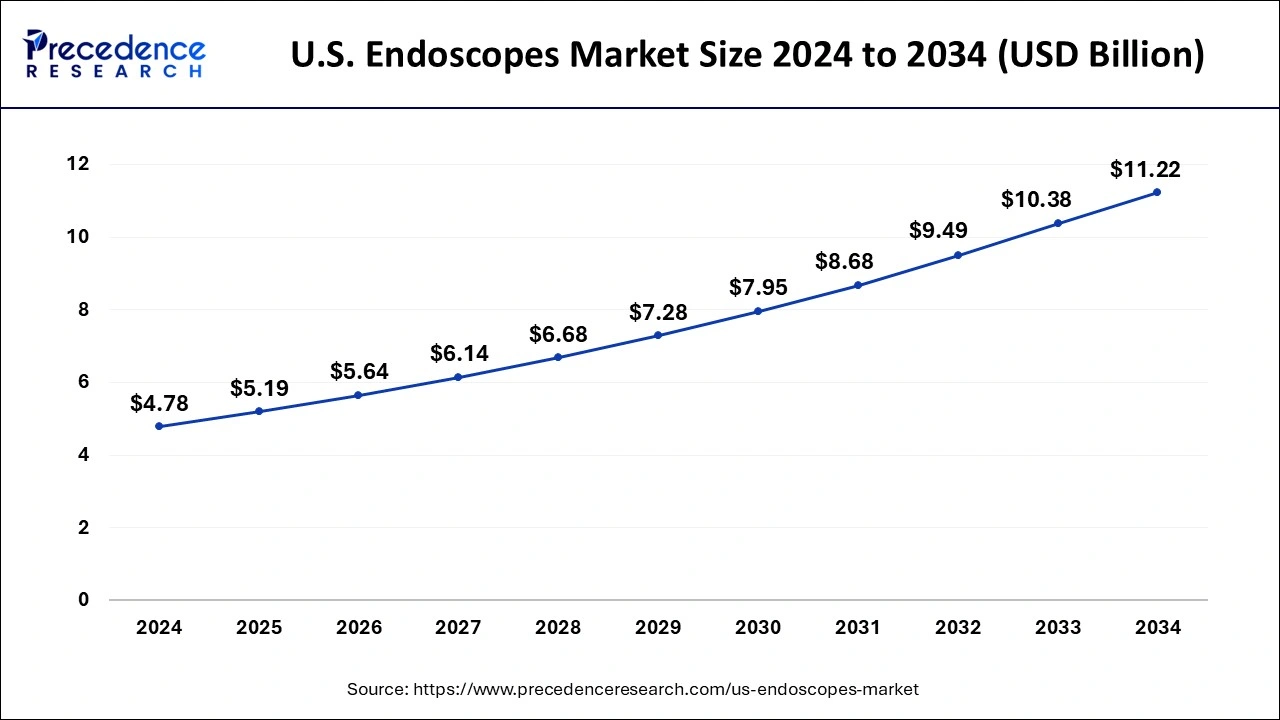

The U.S. endoscopes market size accounted for USD 5.19 billion in 2025 and is predicted to increase from USD 5.64 billion in 2026 to approximately USD 11.22 billion by 2034, expanding at a CAGR of 9.00% from 2025 to 2034.

Market Highlights

- The U.S. endoscopes market was valued at USD 4.78 billion in 2024.

- It is projected to reach USD 11.22 billion by 2034.

- The market is expected to grow at a CAGR of 9% from 2025 to 2034

- By product, the flexible endoscopes segment held the largest share of the market in 2024.

- By product, the disposable endoscopes segment is observed to witness the fastest rate of expansion during the forecast period.

- By application, the gastrointestinal (GI) endoscopy segment dominated the market with the largest share in 2024.

- By end-use, the hospitals segment held the largest share of the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 5.19 Billion

- Market Size in 2026: USD 5.64 Billion

- Forecasted Market Size by 2034: USD 11.22 Billion

- CAGR (2025-2034): 9.00%

Market Overview

The U.S. endoscopes market revolves around the production, development, and distribution of medical devices used for visual examination or surgical procedures inside the body. It is a flexible or rigid tube equipped with a light source and a camera at one end, allowing healthcare professionals to observe and diagnose conditions within various internal organs, cavities, or structures. Endoscopes are commonly employed in minimally invasive procedures, reducing the need for traditional open surgeries and minimizing patient recovery time. Endoscopy procedures offer a less invasive alternative to traditional surgical methods, leading to faster recovery times, reduced pain, and minimal scarring. The development of advanced endoscopic technologies continues to enhance the capabilities of these devices in medical diagnosis and treatment.

U.S. Endoscopes Market Growth Factors

- The main reason propelling the U.S. endoscopes market's expansion is the growing consumer demand for minimally invasive procedures (MIS), which feature smaller incisions, less discomfort, and faster wound healing.

- The market has grown as a result of the increased incidence of chronic diseases such as tumors, endometriosis, and liver cancer. This is explained by the notable increase in endoscopic usage for prompt diagnosis and efficient treatment of certain kinds of diseases.

- The demand for the product has increased greatly as a result of doctors' growing preference for rigid endoscopes because of their capacity to provide high-definition organ pictures and improve vision during surgical procedures. This has accelerated the rate of product uptake in conjunction with the increasing use of endoscopic instruments in outpatient clinics.

- To introduce novel product variations, the top producers are also concentrating on getting regulatory permissions for their goods and doing research and development (R&D) projects.

- The U.S. endoscopes market is expanding as a result of major companies' ongoing technical developments in the field of endoscopic devices.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.19 Billion |

| Market Size in 2026 | USD 5.64 Billion |

| Market Size by 2034 | USD 11.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.00% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-Use |

Market Dynamics

Drivers

Growing demand for video endoscopes

An endoscope fitted with a camera attachment is called a video endoscope, and it is used to see internal organs like the esophagus and stomach. In the realm ofmedical imaging to diagnose and treat a variety of ailments, these video endoscopes are cutting-edge technology. Players in the U.S. endoscopes market is concentrating on the development and production of sophisticated video endoscopes for use in a range of therapeutic and diagnostic applications as a result of the increasing demand for these instruments. Furthermore, companies in the global and emerging markets are attempting to capture more market share by offering end consumers next-generation solutions.

- Industry heavyweights like PENTAX and KARL STORZ have introduced very sophisticated video scopes to the market. The demand for video endoscopy systems is rising due to technological developments, better design, precise diagnosis, and consistent findings, fueling the market's expansion.

Restraint

Lack of skilled professionals

Highly skilled personnel are needed for endoscopic operations to protect patients from a variety of hazards and problems. A patient may suffer injury or receive a false diagnosis as a result of a physician examining without sufficient training. To find a target for surgery or diagnostics, the technician using the endoscopic equipment must have a comprehensive grasp of both human anatomy and the instrument itself. In addition, employees in hospitals and other healthcare facilities have to receive training on how to utilize endoscopes and comprehend the extra reprocessing procedures needed to avoid any cross-contamination. Thus, throughout the projected time, the lack of qualified and experienced endoscopic technicians is probably going to prevent the adoption of endoscopic equipment and hinder market expansion.

Opportunity

The rising acceptance of capsule endoscopy

A capsule is injected during a technique called capsule endoscopy to record a picture of the digestive system. The light source, transmitter, and tiny video camera are all contained in a throwaway, pill-sized capsule. Thousands of photos are sent to the recorder by the capsule as it moves through the digestive system. If the results of the gastroscopy and colonoscopy are negative, capsule endoscopy is advised as a third line of inquiry. In addition to standard recording devices, players are advancing capsule endoscopy through the integration of new technologies.

- For instance, the Olympus MAJ-2029 endoscopic recorder offers real-time process visibility, enhanced use, and superior clinical performance. Moreover, ENDOCAPSULE (MAJ-2027) provides an ultra-compact lens, four white LEDs, and high-resolution pictures with a broad field of vision. Because of this, the introduction of novel endoscopic capsules is anticipated to boost demand and usage for them due to the rise in gastrointestinal illnesses, which will fuel U.S. endoscopes market's expansion over the projected period.

Segments Insights

Product Insights

The market is segmented into rigid endoscopes, capsule endoscopes, robot-assisted endoscopes, flexible endoscopes, and disposable endoscopes. The flexible endoscopes segment dominated the U.S. endoscopes market in 2023. An optical device that transfers light and returns pictures to the viewer is a flexible endoscope. These devices also have transparent fibers that are bendable. Because of its benefits over competing products, the increasing number of releases, and the growing popularity of flexible endoscopes, the segment is anticipated to rise throughout the projected period.

Endoscopes are used extensively in diagnostic procedures for several chronic disorders, including inflammatory bowel disease (IBD), stomach cancer, colon cancer, respiratory infections, and respiratory cancers. As a result, there is a sharp increase in demand for flexible endoscopes due to the high frequency of these disorders.

- In 2022, there were an anticipated 26,380 new cases of stomach cancer detected in the United States; in 2023, there are expected to be 26,500 new cases identified, according to the American Cancer Society 2023 report.

On the other hand, the disposable endoscopes segment is observed to grow at the fastest rate during the forecast period. Disposable endoscopes reduce the risk of infection caused by reusable endoscopes. Reusable endoscopes require extensive cleaning, sterilization, and maintenance processes, which can be costly over time. Disposable endoscopes eliminate these ongoing expenses.

Application Insights

The market is bifurcated into arthroscopy, urology endoscopy, laparoscopy, gastrointestinal (GI) endoscopy, bronchoscopy, mediastinoscopy, gynecology endoscopy, otoscopy, laryngoscopy, and others. In 2023, the GI endoscopy segment held the largest share of the U.S. endoscopes market. The increasing incidence of gastrointestinal disorders, such as colorectal cancer, gastroesophageal reflux disease (GERD), and IBD, has contributed to the growing demand for GI endoscopy procedures.

Additionally, ongoing technological advancements, including improvements in imaging quality, the development of high-definition and ultra-high-definition endoscopes, and the incorporation of advanced imaging modalities like narrow-band imaging (NBI) and confocal laser endomicroscopy (CLE), enhance the diagnostic capabilities of GI endoscopes. Thus, this is expected to drive the U.S. endoscopes market's growth.

End-use Insights

The market is bifurcated into ambulatory surgery centers, hospitals, and others. The hospitals segment held the largest share of the U.S. endoscopes market in 2023. Endoscopes play a crucial role in minimally invasive surgeries and diagnostic procedures. Hospitals are increasingly adopting endoscopic techniques due to the benefits they offer, including reduced patient recovery times, shorter hospital stays, and lower risks of complications.

Moreover, the rising prevalence of gastrointestinal and respiratory diseases, such as colorectal cancer, GERD, and lung disorders, contributes to the demand for endoscopic procedures in hospitals. Gastrointestinal endoscopy and bronchoscopy are commonly performed in hospitals to diagnose and treat these conditions.

U.S. Endoscopes Market Companies

- Olympus Corporation

- Stryker Corporation

- Ethicon Endo-Surgery, Inc

- Boston Scientific

- Arthrex, Inc.

- ConMed

- Medtronic

- Johnson & Johnson

- Cook Medical

- Richard Wolf GmbH

Recent Developments

- In October 2023, the next-generation EVIS X1TM endoscopy system from Olympus Corporation, a global medical technology company dedicated to making people's lives healthier, safer, and more fulfilling, officially entered the market in the United States. It will be on display and available for demonstration from October 22–24 during the American College of Gastroenterology (ACG) annual meeting in Vancouver, Canada.

- In October 2023, two of the most recent breakthroughs from PENTAX Medical America Inc., a part of HOYA Group, are the i20c video endoscope series and the PENTAX Medical INSPIRATM, a top-tier 4K video processor.

- In July 2023, the 4K video processor and endoscope series obtained 510(k) approval and is being stocked for retail.

Segments Covered in the Report

By Product

- Flexible Endoscopes

- Bronchoscopes

- Laryngoscopes

- Sigmoidoscopes

- Upper Gastrointestinal Endoscopes

- Duodenoscopes

- Colonoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Others

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Urology Endoscopes

- Laparoscopes

- Arthroscopes

- Cystoscopes

- Neuroendoscopes

- Others

- Disposable Endoscopes

By Application

- Arthroscopy

- Urology Endoscopy

- Laparoscopy

- Gastrointestinal (GI) Endoscopy

- Bronchoscopy

- Mediastinoscopy

- Gynecology Endoscopy

- Otoscopy

- Laryngoscopy

- Others

By End-Use

- Ambulatory Surgery Centers

- Hospitals

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting