What is Elevator And Escalator Market Size?

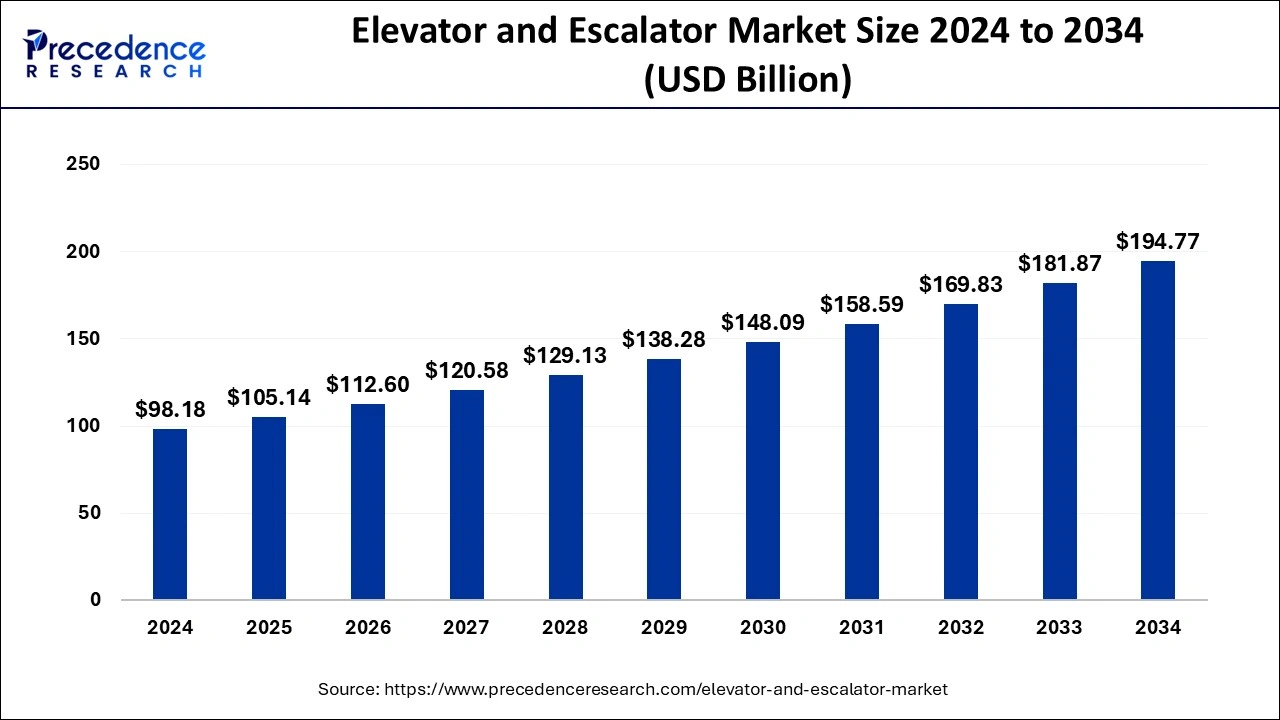

The global elevator and escalator market size is estimated at USD 105.14 billion in 2025 and is anticipated to reach around USD 194.77 billion by 2034, expanding at a CAGR of 7.09% from 2025 to 2034. The rising development of high-rise buildings and commercial complexes in developed and emerging countries contributes to the growth of the elevator and escalator market.

Market Highlights

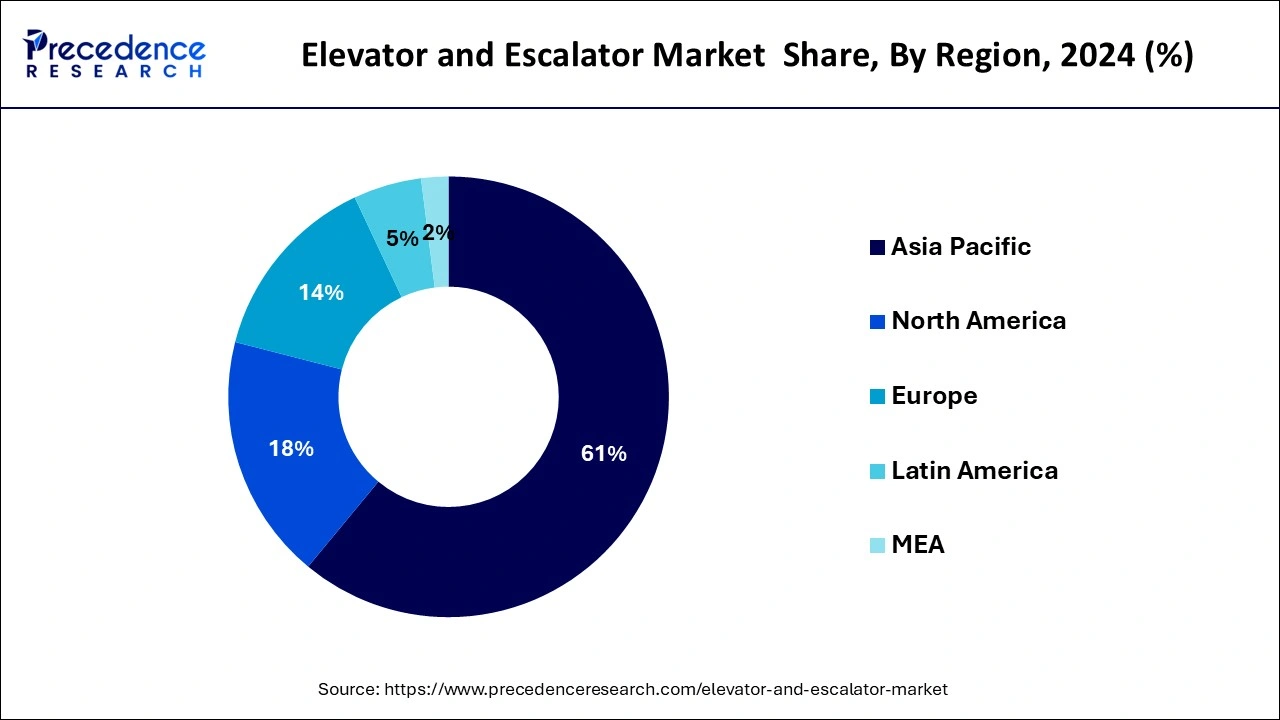

- Asia Pacific led the market with the biggest market share of 61% in 2024.

- Europe is estimated to expand at the fastest CAGR during the forecast period.

- By Product, the escalators segment is expected to grow at a notable CAGR during the forecast period.

- By Business, the equipment segment registered the maximum market share in 2024.

How is Innovation Impacting the Market?

The incorporation ofartificial intelligence has changed the way elevators and escalators operate by improving their mechanical functions. As elevators and escalators have become smarter and more intelligent, AI helps operators resolve problems better and manage the traffic flow. It analyzes data from elevator and escalator systems to predict when maintenance is required. AI also detects faults in these systems and resolves them as early as possible, reducing downtime and improving reliability.

Elevator and Escalator Market Growth Factors

- Urbanization and government investments in high-rise infrastructure are propelling the demand for elevators and escalators worldwide.

- Expansion of public infrastructure projects of several types, such as airports, metro stations, and shopping complexes, promotes ongoing adoption.

- Growing construction in residential, commercial, and healthcare sectors heightens reliance on vertical transport solutions.

- Tourism development allows installing them in heritage sites, landmarks, and public areas to enhance accessibility.

- Technological advances in areas such as smart elevator-cum-energy-efficient systems further the long-term market opportunities.

Market Outlook

- Industry Growth Offerings-Industry growth in the market is driven by rising urbanization, high-rise construction, and modernization of aging infrastructure. Companies offer smart, energy-efficient, IoT-enabled mobility systems, along with installation, predictive maintenance, and modernization services to enhance safety, performance, and efficiency.

- Global Expansion- Global expansion of the market is fueled by rapid urban development, large-scale infrastructure projects, and growing demand in emerging economies. Companies are widening their international presence through strategic partnerships, smart mobility technologies, and tailored solutions for residential, commercial, and transit applications.

- Startup ecosystem- Startups in the market are focusing on IoT-based monitoring, predictive maintenance, AI-driven safety systems, and energy-efficient designs. They collaborate with builders and tech firms to offer smarter, cost-effective mobility solutions and improve uptime, performance, and user experience.

MarketScope

| Report Highlights | Details |

| Market Size in 2025 | USD 105.14 Billion |

| Market Size in 2026 | USD 112.60 Billion |

| Market Size by 2034 | USD 194.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.09% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By Business, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Depending on the product, the global elevator & escalator market is classified into elevators, escalators, & moving walkways. The escalators segment is anticipated to be the fastest-growing segment in the market. This is accredited to the increasing demand from the commercial infrastructures comprising shopping malls, commercial parks, and several others.

Furthermore, the escalating aerospace infrastructure development is resulting in the rise in demand for escalators and moving walkways. Moreover, the demand for elevators is projected to experience stable growth as a result of their high saturation in the market.

Business Insights

Based on the business, the global elevator & escalator market is categorized into new equipment, maintenance, and modernization. Among these, the new equipment segment has considerably contributed to the growth of the market revenue and is anticipated to remain dominant during the forecast period. This is attributed to the changing demographics, rise in urbanization, and rise in construction activities. Further, maintenance and modernization of the existing equipment is projected to showcase substantial growth over the projection period.

Application Insights

Depending on the application, the global elevator & escalator market is characterized into residential, commercial, and industrial. Escalators and elevators have a high penetration in the commercial centers, for example, malls, retail centers, and co-working places. The rising shift towards flexible design, safety, and eco-efficiency is driving the commercial segment. However, the upsurge in self-employment has led to the demand for multiple co-work places over the past few years. Hence, evolving investments in office space are further anticipated to contribute to the growth of the escalator and elevator market.

In addition, the industrial segment is contributing to the elevator & escalator market growth because of the increasing demand for freight transport needs across various verticals. Furthermore, increasing residential construction activities are further projected to propel market demand.

Regional Insights

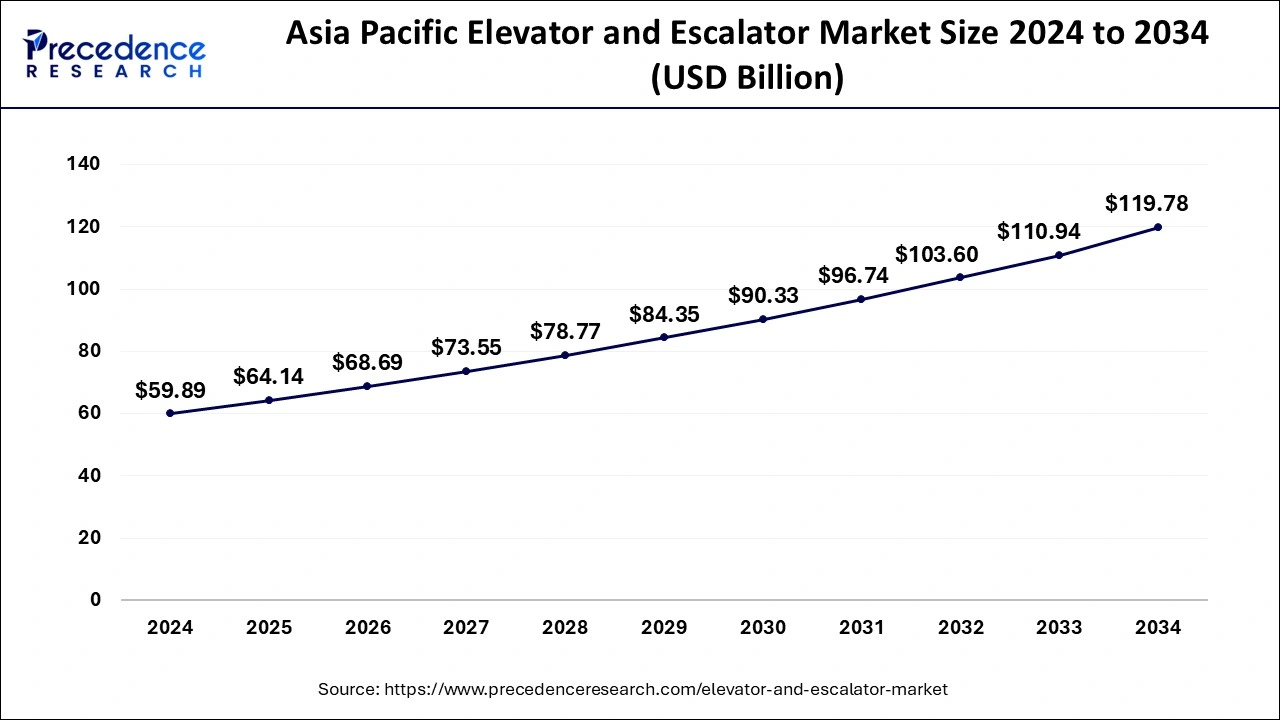

Asia Pacific Elevator and Escalator Market Size and Growth 2025 to 2034

The Asia Pacific elevator and escalator market size is evaluated at USD 64.14 billion in 2025 and is predicted to be worth around USD 119.78 billion by 2034, rising at a CAGR of 7.18% from 2025 to 2034.

The Asia Pacific region is projected to grow at a significant growth rate in the global elevators and escalators market over the projection period. The growth of this regional market is accredited owing to improvements and advancements in the construction industry. Furthermore, the region is anticipated to continue with its regional pre-eminence over the forecast timeframe. In addition, the Asia Pacific region is a manufacturing hub. The growing number of a high rise in building infrastructure and the growth of smart cities is expected to further boost the industry growth in the region over the prediction period.

IoT Integration Elevates Europe's Role in Global Vertical Mobility Growth

Europe region is expected to have a significant revenue share in the elevators and escalators market. The vendors in the region are implementing IoT in the elevators and escalators since it reduces operating costs significantly. Additionally, IoT integration in elevators and escalators also upsurges the service efficiency as it diminishes the downtime effectively. Such factors are anticipated to drive the elevators and escalators market growth across the world over the forecast period.

China's Vertical Mobility Boom: Urban Growth driving Elevator and Escalator Demand

China's market is expanding due to rapid urbanization, large-scale infrastructure development, and increasing construction of high-rise residential and commercial buildings. Aging equipment in older structures is also driving strong demand for modernization and replacement. Government investment in smart cities and public transportation, along with rising safety standards and technological upgrades like energy-efficient systems, further support sustained market growth.

Rising Upwards: UK Elevator and Escalator Market Enters a Modernization Era

The UK market is expanding due to ongoing urban redevelopment, increasing construction of commercial complexes, and the refurbishment of aging infrastructure. Growing demand for accessibility solutions in public spaces, strict safety regulations, and the modernization of outdated systems also contribute to market growth. Additionally, the shift toward energy-efficient, smart, and digitally connected mobility solutions supports wider adoption across residential, commercial, and public infrastructure projects.

North America Ascends: Smart Infrastructure Powering Vertical Transport Growth

North America's market is growing due to continuous urban development, rising demand for high-rise commercial and residential structures, and the modernization of aging vertical transport systems. Strict safety regulations and a strong focus on upgrading outdated equipment also fuel investments. Additionally, the adoption of smart, energy-efficient, and digitally connected systems, along with increasing infrastructure renovation projects, supports steady market expansion across the region.

U.S. on the Rise: High-Rise Construction and Upgrades Fuel Elevator Market Surge

The U.S. market is increasing due to steady growth in high-rise residential, commercial, and mixed-use construction. Significant replacement needs for aging equipment in older buildings also drive strong demand. Strict safety regulations, modernization requirements, and the push for energy-efficient, smart mobility systems further support market expansion. Additionally, ongoing investments in airports, hospitals, and public infrastructure contribute to the sustained adoption of advanced vertical transportation solutions.

Value chain analysis

- Raw materials sourcing: In this stage, value chain analysis refers to the procedures related to sourcing, acquisition, and inventorying of raw materials comprising metals and electronic components at the lowest possible cost and with the desired quality for the final product.

Key Players: Otis, Schindler, KONE

- Component fabrication and machining: This includes analyzing the production processes and levels at which raw materials are converted into finished elevator and escalator components, focusing on areas such as efficiency, cost, and quality control.

Key Players: Otis, KONE, Schindler, and ThyssenKrupp

- Testing and Certification: At this stage, value chain analysis examines the testing standards and certification processes of elevator and escalator component systems to assure their safety, reliability, and conformity to industry standards.

Key Players: TÜV SÜD and TÜV NORD

- Maintenance and After-Sales Service: This involves scrutiny of the activities providing support to the customer after the sale, including preventative maintenance, repair, and technical help, to guarantee product durability and customer satisfaction.

Key Players: Otis, KONE, Schindler, and TK Elevator

- Product Lifecycle Management for Elevator and Escalator: This stage of value chain analysis takes into account the whole life cycle of the product-from design and development up to end-of-life

Key Players: TK Elevator, Mitsubishi Electric, and Hitachi

Industry Leader Announcement

- In March 2023, Hyundai Elevator Co. joined a South Korean government-led team to bid for smart city projects in Indonesia. Jo Jae-cheon, CEO of Hyundai Elevator, stated that the company has been developing non-contact elevator buttons using infrared sensors and open API services that allow various functions like calling an elevator with a smartphone or providing customized information on signage inside an elevator.

Top Vendors and their Offerings

- Otis Elevator Company: Otis offers elevators, escalators, and moving walkways with advanced IoT, predictive maintenance, and energy-efficient technologies. Its portfolio includes installation, modernization, and service solutions tailored for residential towers, commercial buildings, airports, and large infrastructure projects.

- Fujitec: Fujitec provides elevators, escalators, and moving walkways featuring smart controls, safety enhancements, and smooth-ride technology. The company focuses on installation, modernization, and maintenance services for commercial complexes, residential buildings, and transportation hubs worldwide.

- Hitachi Ltd.: Hitachi delivers high-speed elevators, escalators, and intelligent vertical mobility systems with energy-saving features and advanced traffic management. It offers installation, modernization, remote monitoring, and maintenance services for commercial skyscrapers, residential projects, and public infrastructure.

- KONE Corporation: KONE offers eco-efficient elevators, escalators, and smart building mobility solutions integrated with IoT and cloud analytics. Its offerings include installation, modernization, and predictive maintenance for offices, residential buildings, malls, and transit facilities.

- Schindler Group: Schindler provides elevators, escalators, and moving walkways supported by IoT-based monitoring, efficient traffic flow systems, and sustainable designs. The company specializes in installation, modernization, and maintenance for commercial buildings, residential towers, and major transportation environments.

Recent Developments

- In August 2025, Rocket Lab boosts US investments to expand semiconductor manufacturing capacity and supply chain security for space-grade solar cells and electro-optical sensors, supported by $23.9 million Trump Administration award. (Source: https://rocketlabcorp.com)

- In May 2025, Malaysian semiconductor company SMD Semiconductor opened a new R&D Innovation Hub in Wales, aiming to collaborate with UK companies on designing next-generation semiconductor chips. (Source: https://businessnewswales.com)

Segments Covered in the Report

By Product

- Elevators

- Moving Walkways

- Escalators

By Business

- Maintenance

- New Equipment

- Modernization

By Application

- Industrial

- Residential

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting